Interview of Patrik Schär – CEO of Selma Finance, Robo-Advisor

| Updated: |(Disclosure: Some of the links below may be affiliate links)

I had the opportunity of interviewing Patrik Schär, the CEO of Selma Finance. For those of you that do not know, Selma Finance (Selma) is a Swiss-Finnish Robo-Advisor company. It is a young company. Patrik founded it, with three other people, in 2016.

I have not yet talked about Robo-Advisors on this blog. However, they are getting more and more popular. The idea is that you can get smaller fees by automating most tasks, hence the Robo-name. And it is much simpler than investing by yourself. It provides a good entry point into the investment. And Selma is a great option for those that would choose that route!

First, Selma Finance is different from a bank in that it is almost entirely automated. It has lower fees than a bank. It gives you a personal investment assistant that can assist you all the time. Another cool thing with Selma Robo-Advisor is that they follow passive investing philosophy, reducing the fees and following the market performance.

But enough from me, Patrik Schär, the CEO, will tell you everything there is to know about Selma!

1. What can you tell us about yourself?

I’m Patrik, I grew up on a Swiss mountain called Rigi and used to be a banker for a bit more than 10 years before I jumped over to the bright side. Now I’m a founder of Selma where we aim to help you the different aspects of your finances and to provide an alternative to the evil guys ;)

2. What were your experiences working in the financial industry as a private banker in Switzerland?

Just recently a friend reminded me that I never even left my desk without putting my suit jacket on. I guess I was damn serious about my job and the rituals and jargon that came with it. Looking back I think I learned a few things that got me thinking:

- The whole industry looks so complex from the outside a lot of things really aren’t. Some de-mystifying, transparency and openness is urgently needed instead of hiding large fees behind jargon loaded glossy brochures.

- Some people earn a LOT of money and clearly, not everybody is worth it. Why would we be willing to pay that much for things that aren’t worth it?

- 90% of the job is to get people’s wealth structure right (that’s what the really rich bankers do) and to align your finances with your life, goals, and situation. It’s not about if you should buy Roche or UBS shares today. The guy that tells you which company shares to buy might have less a clue than yourself.

- Wealthy people are not really happier, so to only aim for wealth in your life is pointless.

3. What is Selma Finance?

Invest easily with Selma: a great way to invest in the stock market without the hassle of doing it yourself.

- Beginner-Friendly

- Degressive Fees

Shortly put, Selma offers more than the classical service of a robo advisor. We create a fully individual investment plan while keeping your plan always in balance with the financial markets and your financial life

A robo-advisor can be defined as an online investment service that offers 5-10 low-cost portfolios and uses algorithms to trade your investments for you. A private banker creates an individual setup for you and manages your wealth, offers personalized support and accompanies you through difficult financial life decisions. This is usually quite expensive.

We strongly believe that in order to digitize private banking, we can not simply offer portfolios and bank accounts online, we have to digitize the whole experience!

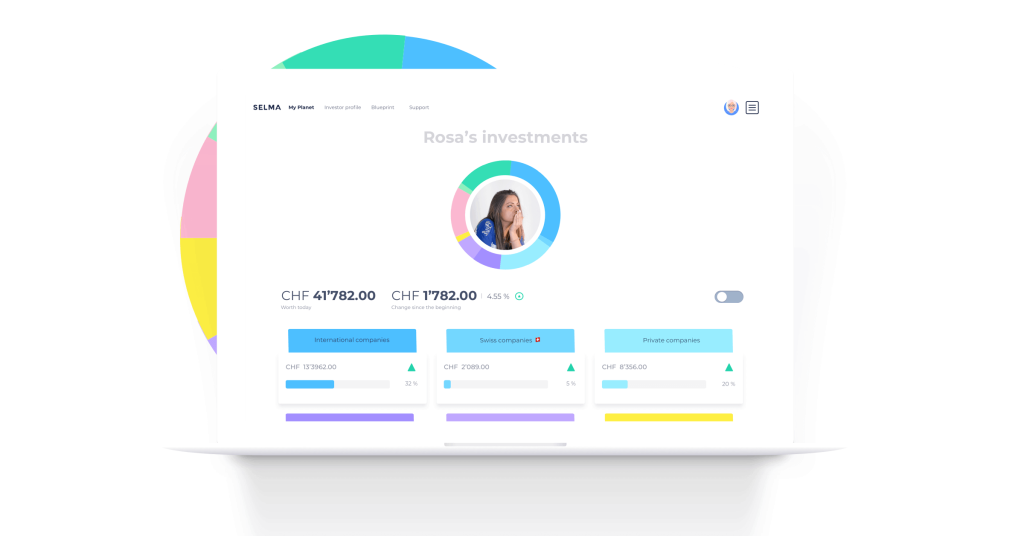

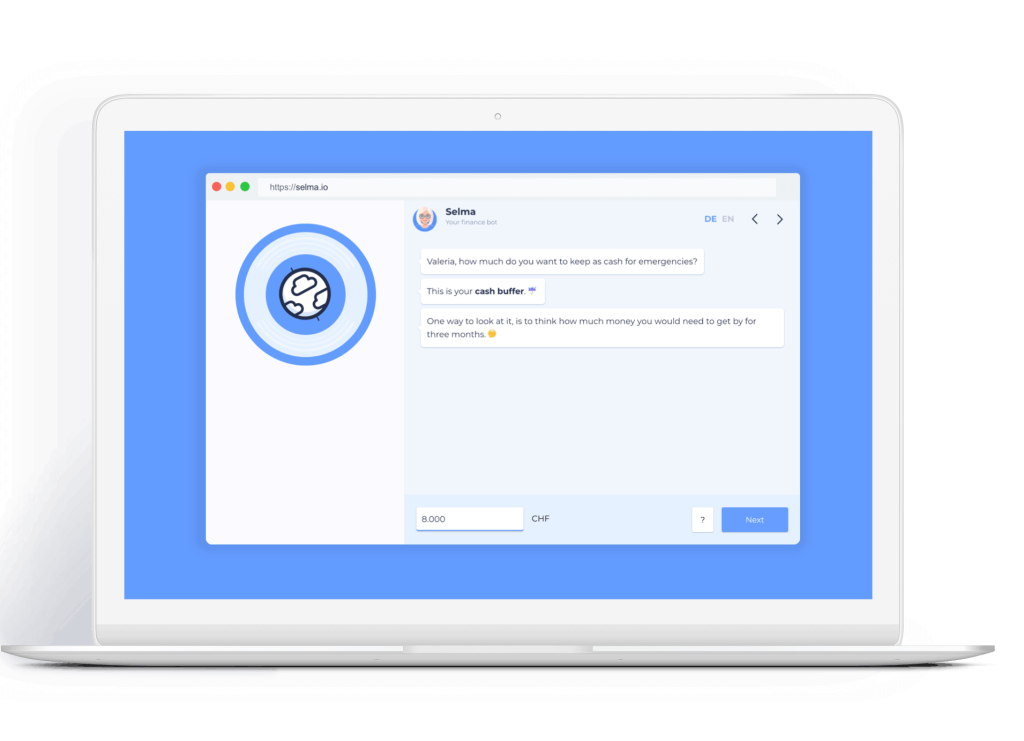

Selma is your friendly investment assistant – she gets to know you through a chat (which would otherwise be a boring form) and then recommends a setup for you that fits with your financial life.

Once you open an account with our partner Saxo Bank (Switzerland) via the Selma app, you can also directly start investing there. Selma automatically takes over and manages your money. We do follow a passive investing approach. But we still make sure to look for over and undervaluations in markets in order to actively manage risks of your investments.

Over time Selma communicates with you as your banker would – checks in if you have more savings, makes sure you opt for less risk when you enter a time in your life with more spendings, etc.

At Selma, we also advocate transparency in the financial sector. It is difficult to communicate all details of financial products. But we try. We have also built a strong “Selma Contributor Community” (lively Facebook group + engaged email list) of people who pitch in their ideas, give feedback on early features and shape the whole service together with us.

Simply put: Most Swiss people do not invest or invest the wrong – because nobody helps them to do it right. And that’s where blogs like yours and our service come in.

4. How is the investment portfolio decided? Is it customized to every customer?

Yes, Selma Finance customizes portfolios to every customer instead of offering a choice of 3-5 “kind of fitting” portfolios.

To come up with the portfolio, Selma looks at three different aspects.

- Your current financial situation such as your income, current investments, etc.

- The financial outlook such as your investment goals, future needs and saving potential.

- Your relationship with risk.

All of this information gets pulled together through a charming chat with Selma when you sign up.

5. Could you give an example of a Selma portfolio?

The typical portfolio at Selma invests very broadly across the globe to spread your risk into different companies, loans etc.

To do this cost-efficiently for small amounts (you can start with as low as CHF 2’000), we mainly use ETFs that let you invest in entire stock markets (such as the S&P 500 or the SMI) efficiently and with low costs.

To see how your individual setup would look like, you simply have a chat with Selma.

6. Is it entirely automated?

Almost! The biggest part of the work is automated. But of course, some aspects are still in the automation work-in-progress.

Creating the individual investment portfolios is automated and also the account opening process is completely digitized. This saves a lot of time for you and us!

Other parts of our processes (trading, etc.) are still an interdependence of humans and machines. Both have their strong suit, and we’re trying to optimize it as much as possible.

Every client has – of course – the chance to reach out to a friendly support crew. And in case your financial situation is quite difficult, we automatically reach out and offer personal checkups. Also if you are already well-versed in investments and simply use Selma because you like to not spend time on doing it yourself, we are happy to together adjust your portfolio to specific preferences (no bonds, please!).

7. What are the fees for Selma customers?

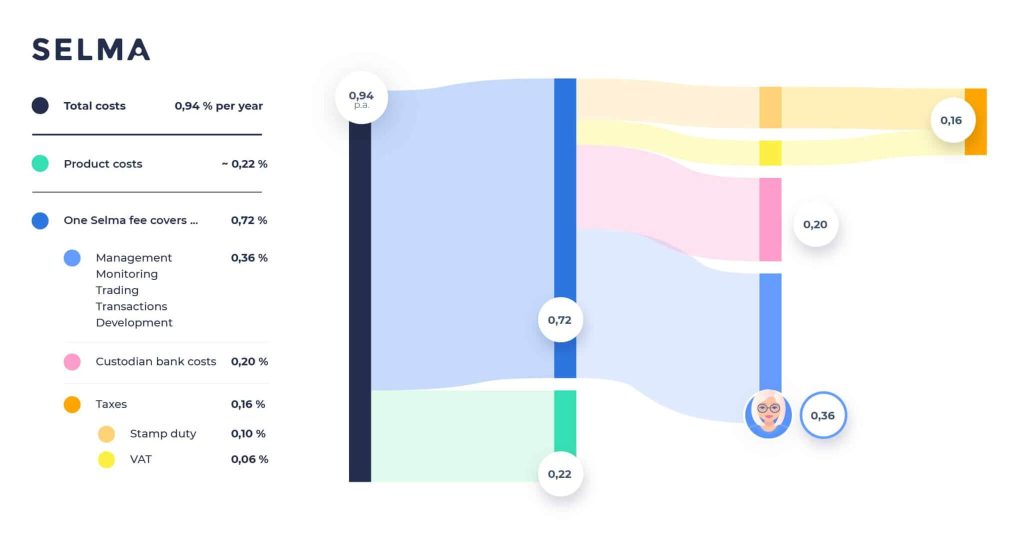

Selma comes with one all-in fee of 0.68% of your investment sum per year.

Only the investment product costs of approximately 0.22% per year are not included in the service fee. And the fees are going down with large portfolios. For instance, if you invest 150’000 CHF, your fees will go down to 0.47%!

Example: If you invested 10’000 CHF with Selma, your fee would be 6 CHF per month. So basically, you get a private banker for the price of one beer per month :)

8. What do these fees pay?

The fee covers all costs that always appear out of nowhere when you start to invest. Bank & depot fees, transaction costs, the generation of a tax statement. But then, of course, these fees also include Selma’s services:

- Constant monitoring of markets

- Automatic adjustments of your investments

- Live chat support

- Market updates

This is an explanatory infographic of where the fees go.

9. Who is Selma Finance best for?

Selma Finance is for everyone who knows that it is not smart to keep all their savings on their bank.

For people who have this “nagging feeling” in the back of their head. But who do not feel confident, interested, fascinated enough (or simply don’t have time) to get started with investing and handling their wealth on their own.

Our clients start at the age of 18, our oldest client is over 75 years old. And recently we even started opening children accounts for parents who want to use Selma as a university fund for their children.

10. What are the advantages and disadvantages of DIY investing compared to Selma?

Advantages of DIY

- Can be cheaper (when you don’t trade too much)

- You know exactly what your money does

- You can influence every investment decision, timing etc. and include and exclude all your favorite companies as pleased.

Disadvantages of DIY

- Investment of your own time

- Need to research on your own and monitor your investments consistently

- You need to be conscious of the costs of trading and tax effects

- We all tend to be gamblers, DIY needs a well-planned strategy and you need to stick to it

11. Do you have any tips for DIYs investors from your perspective?

Here are some tips:

- Plan your strategy carefully and stick to it no matter what, emotions do not pay off

- Review your strategy when big things in your life change

- Plan for the long term and lean back

- Invest regularly to smoothen your purchase prices

- Look at trading costs and hidden costs closely. They do add up to big sums over time

- Diversify: Never put all the eggs in one basket.

Mr. The Poor Swiss: Thanks a lot to Patrik Schär for answering my questions and Carina Wetzlhütter for helping make it happen.

Invest easily with Selma: a great way to invest in the stock market without the hassle of doing it yourself.

- Beginner-Friendly

- Degressive Fees

After learning about Selma Finance and after Patrik’s answers to my questions, I think it is a great company. As Patrik says, DIY investing is not for everybody. And standard banks are charging too much money and do not provide customized investment portfolios. For people that do not want to invest themselves but still want to invest, Selma is a great way to get started into the investing world!

To learn more about Selma, read my Review of Selma.

Have you ever heard of Selma Finance? What do you think of robo-advisor services?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Robo-Advisors

- More articles about Investing

- Swiss Robo-Advisors 2024: Invest without any hassle

- FlowBank Review 2024 – Pros and Cons

- Investart Review 2024 – Pros and Cons

Thanks for this interesting article. This looks like a really interesting way to invest I did not know before in detail.

I’ve done some research after reading this article and found a very interesting Swiss alternative: True Wealth. Has anyone compared these products? In my eyes it is quite a lot cheaper (almost half of the fees with 0.5% plus product cots) – and this is a huge difference when you think in long term investing for example because of compound interests. The True Wealth product looks also a bit more trustworthy in my eyes. Also they offer a “real” Swiss bank as custodian bank as an alternative (Basellandschaftliche Kantonalbank) – I know Saxo bank is also a Swiss bank, but after shortly looking into their terms, I’m a bit scared (for example they do also not follow Swiss bank secrecy at all).

Would be really interesting to read if somebody has looked into both products and could comment.

Hi Weng,

I heard of True Wealth as well, I never used it.

It seems cheaper indeed, although now by half. True Wealth minimum is 0.5 + 0.15 = 0.65% while Selma is at 0.94%.

I honestly do not know how they compare. They both seem to offer similar products. True Wealth has a much higher minimum of 8500 CHF though. On the other hand, anyone serious about investing should be able to save that amount. From what I have looked, the only thing I did not like with True Wealth is that they allocate a lot to Emerging Markets, Pacific and Japan. I would feel more comfortable with more U.S. But that is just personal taste.

I would also be interested in hearing reviews from people who actually used one of the two services.

Why don’t you also conduct an interview with the CEO of True Wealth? That could help and be of interest to us readers of your blog.

Hi Roy,

That is a very good idea! I will put that on my list and contact True Wealth to see if that is possible :)

Thanks for the suggestion! I am always open to ideas for my blog :)

Hi MPS, you might be interested in this review on True Wealth (not paid by them) I just finished, answers some of your q’s relating to portfolio allocation: true wealth review 2019

Hi InvestingHero,

Thanks for sharing, this is very interesting :)

Good luck with your blog and your investing!

Thanks for the great interview :)!

You’re welcome Niklas, I’m glad you like it!

What I don’t like is that there are fixed costs, even if it’s not making any money, right? I wouldn’t mind paying a fee based on profits.

Hi Nuno,

That would be great indeed. But I do not think this will ever happen. They cannot predict the stock market either. That means that the performance is mainly depending on the performance of the stock market. If they had a fee only on profit, this fee would be higher than it was now and this would make it worse. The entire finance industry for money management is based on fixed costs in a percentage of your managed money.

Thanks for stopping by :)