Findependent Review 2024 – Pros & Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Findependent is a recent Robo-Advisor. They only started in 2021. But they have some interesting characteristics already. They have been growing fast since their creation.

Findependent aims to provide a simple service for everyone to invest in and to make that service affordable.

This review will cover all there is to know about Findependent and its pros and cons. By the end of this review, you should know whether to use Findependent.

| Management fee | 0.44% |

|---|---|

| Product Costs | 0.16% |

| Investing strategy | Passive |

| Investing products | ETFs |

| Minimum investment | 500 CHF |

| Currency conversion | Unknown |

| Customization | Good |

| Sustainable | ESG ETFs |

| Languages | German, French, and English |

| Custody bank | Hypothekarbank Lenzburg |

| Users | 7’000 |

| Established | 2021 |

| Headquarters | Lenzburg, Aargau, Switzerland |

Findependent

Findependent is a very affordable Robo-advisor with a focus on sustainable investments. Invest your money easily! Get 20CHF in your account with code PoorSwiss.

- Excellent fees

Findependent started offering its services in 2021. So, they are a very recent addition to the Robo-advisors. They are a Swiss Robo-advisor founded by a previous employee of Neon, Matthias Bryner.

Findependent aims to provide a simple service that is available to many people so they can invest their money in the stock market in the long term. They want a simple digital solution like Neon does for the banking system.

In addition, they want to provide an affordable service, so the fees are very fair.

While new, they had already attracted more than 600 customers in September 2021 and are seeing excellent growth. In December 2021, they even reached 2000 customers! As of October 2023, they had reached 7000 customers, which is quite impressive. They want to turn a profit in the next four years.

They also secured a 1.2 million CHF financing round in July 2022, which is great news for the startup.

To open an account with Findependent, you will need at least 500 CHF. 500 CHF is an excellent minimum, the lowest among Swiss Robo-Advisor. And below 2000 CHF, your account will be cheaper (details later on).

Only Swiss residents at least 18 can open an account with Findependent. On top of that, they must only be liable for taxes in Switzerland.

Onboarding can be done entirely from the application, which is available in French, German, and English—remarkable for being available in all major languages.

Investing Strategy

Findependent has a relatively standard investing strategy, using index ETFs for each portfolio.

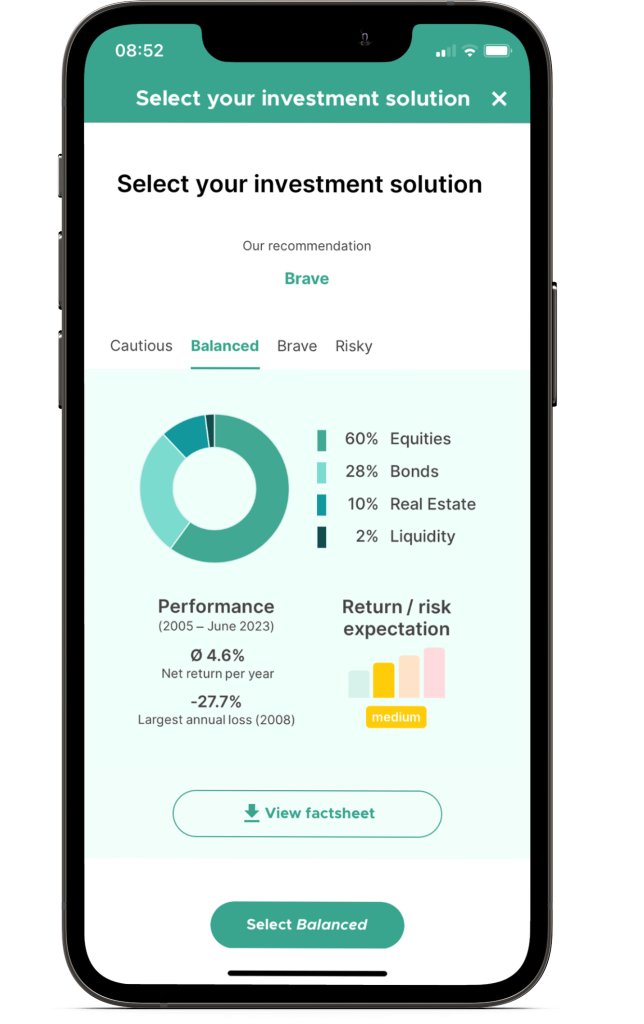

They have four different strategies available for their customers:

- Careful: 40% in stocks, 48% in bonds, 10% in real estate, 2% in cash

- Balanced: 60% in stocks, 28% in bonds, 10% in real estate, 2% in cash

- Brave: 80% in stocks, 8% in bonds, 10% in real estate, 2% in cash

- Risk-Taker: 98% in stocks, 2% in cash

These are good strategies. It would be slightly better to choose the bonds and real estate allocation. For instance, I prefer a proper 80/20 portfolio rather than an 80/8 plus some real estate. But I do not believe this will make a very significant difference. The 98% stocks portfolio does not have a real estate allocation, which is excellent.

I wish we could go to 99% stocks. Ideally, we would like 100% stocks, but no Robo-advisor currently allows this because they need some cash to pay the fees. But 98% in stocks is already excellent.

When you open an account, they will ask you the usual questions to guess your risk capacity. With this information, they will propose one of the four portfolios. But you can choose yourself if you disagree with their recommendations.

For these portfolios, Findependent uses 9 Exchange Traded Funds (ETFs). All the ETFs they use are physically replicating ETFs, which is great. And Findependent is very transparent and shares the exact ETFs they are using for each of their portfolios

As an example, we can look at the composition of the 98% stocks portfolio:

- 29.4% iShares Core SPI (TER 0.10%)

- 9.8% UBS SPI Mid(TER 0.25%)

- 30.4% iShares MSCI USA ESG (TER 0.07%)

- 12.7% iShares MSCI Europe ESG (TER 0.12%)

- 4.9% iShares MSCI Japan ESG (TER 0.15%)

- 10.8% iShares MSCI Emerging Markets ESG (TER 0.18%)

While it could be simpler, this portfolio is quite solid. The allocations make sense, and they are using relatively cheap ETFs. In total, the TER of this portfolio is about 0.12%, which is very reasonable.

However, you may have seen that they force you into ESG ETFs. ESG stands for Environmental, Social, and Governance. An ESG ETF is one of the ways to invest sustainably. They are not bad ETFs at all. If you want to invest sustainably, Findependent is excellent.

However, I wish Findependent would give their users the choice of investing in ESG ETFs. These ETFs are biased against some companies, and we do not know whether this will perform better.

On average, sustainable ETFs are more expensive than the standard ETFs. So, for me, a Robo-Advisor should let its customers choose whether they want to use them. It is still important to mention that the ETFs chosen by Findependent are fairly priced. So, this is an affordable way to invest sustainably.

Now, Findependent also lets you create a custom strategy, and you can choose the ETFs you want there. More about that in the next section.

Also, this portfolio has a strong bias towards Switzerland, with almost 40% invested in Swiss Stocks. This is too much home bias for most people, and I wish we could configure that.

Interestingly, you will only have access to 5 ETFs if you have less than 2000 CHF in your account. In that case, you will not have emerging markets, such as Japanese and medium-cap Swiss companies, in your portfolio.

Findependent executes stock operations once a day. So, your money will be invested once and possibly rebalanced once a day if needed.

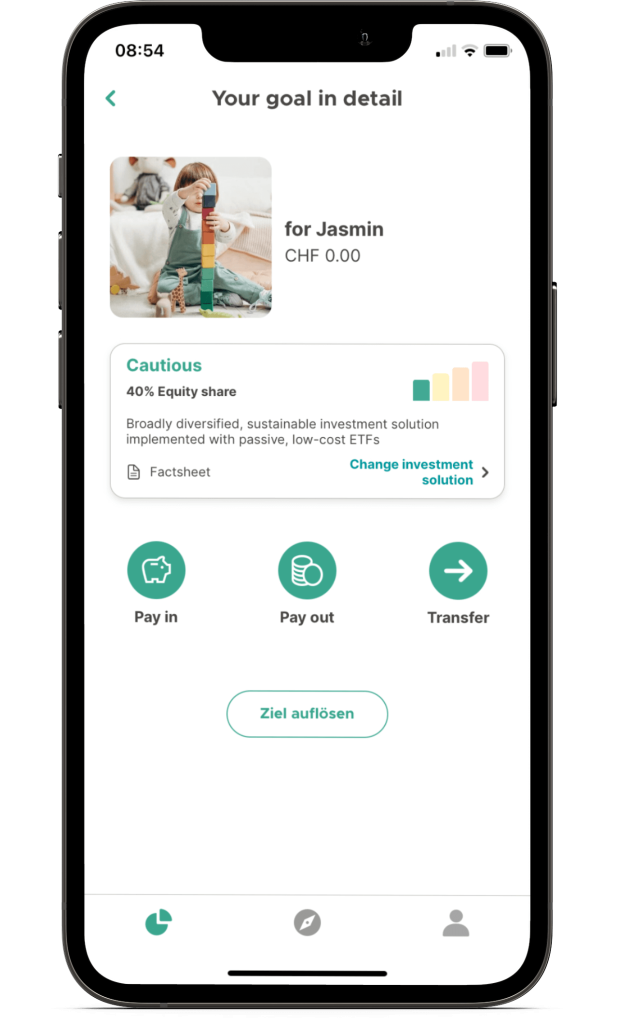

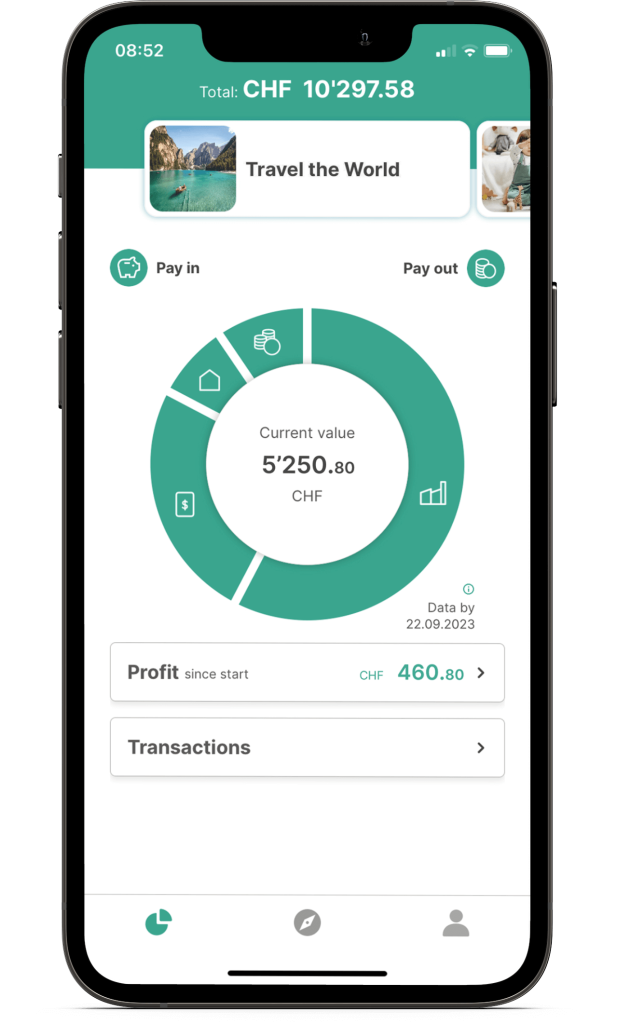

With Findependent, you can have several portfolios. This can be very useful if you invest towards different goals and you have to have them separated.

You can also create portfolios for your children. This is a great feature that few services have in Switzerland. Once your children are 18, you can transfer the portfolio for free to their Findependent account.

Custom Portfolio

The second option with Findependent is to create a custom portfolio. You have considerable freedom to make exactly what you want. Of course, you need to know a little about what you are doing to have a well-diversified portfolio for the long term.

To create your custom portfolio, you can choose about 30 ETFs. They have an excellent choice with standard ETFs, ESG ETFs, and SRI ETFs. These ETFs are all European ETFs and are generally low-cost.

Each ETF has a maximum weight, so you have some limits. But these limits make sense. For instance, you cannot invest more than 50% in the SPI index, making sense for diversification. On the other hand, you can invest 100% in VWRL, a world ETF.

It is important to note that custom portfolios are only available starting from 5000 CHF. Below that, you will have to use Findependent portfolios.

Overall, I like their concepts of custom portfolios. It allows ETF investing easily.

Deposits and withdrawals

When you want to start investing, you must fund your account.

As mentioned, you will need 500 CHF in your account to start. And below 2000 CHF, you will only have access to a subset of ETFs, but you will have lower fees.

You can only deposit money in CHF, like with most Robo-advisors. And you need to deposit money from an account in your name for security reasons.

The principle for withdrawals is the same: you can withdraw money at any time but only to an account in your name.

Findependent Fees

I say this in every review: investing fees are very important. If you are a long-term investor, you need to minimize fees. This is especially true if you are a passive index investor, where fees are the best lever at your disposal to increase your returns in the long term.

With that said, we will delve into Findependent’s fees.

Findependent charges a 0.44% fee on your assets, billed quarterly. So, if you have 10’000 CHF with them, you will pay 44 CHF per year. Starting In June 2023, the fees are reduced if you have more money:

- From 50’000 CHF: 0.42%

- From 150’000 CHF: 0.39%

- From: 250’000 CHF: 0.37%

- From 500’000 CHF: 0.35%

- From 1’000’000 CHF: 0.33%

This tiered system is excellent! Over time, you can reduce your fees significantly as your portfolio grows.

On top of that, several fees are not included:

- The ETF costs between 0.12% and 0.23% per year.

- The foreign currency exchange fee of 0.50% per conversion. This expensive fee can weigh quickly on your total costs.

- The stock exchange fees of about 0.015% for each transaction.

- The stamp duties of 0.15% on foreign securities and 0.075% on Swiss securities.

The most aggressive portfolio will be chargeda 0.56% fee per year based on your assets. The other fees will depend on how much you invest. This base fee is outstanding. If you have an extensive portfolio, you can reduce these fees by up to 0.11%!

Depending on what you invest, these fees can quickly add up. Each investment (and withdrawal) on the aggressive portfolio will add up to about 0.38%. These are not negligible fees, but management fees are much more important than one-time costs in the long term. And some costs will also arise when rebalancing hits.

Interestingly, the 0.44% fee will be free below 2000 CHF. This free investment option can be great for testing Findependent without paying high fees. If you a small to medium account, this 2000 CHF managed for free can make a significant difference. However, if you have a large account, it will not much of a difference.

Is it safe?

If you want to invest money online, ensuring it is safe first is essential.

Looking at regulations, we can see that Findependent is well-regulated in Switzerland. On top of that, they are a member of The Financial Services Standards Association (VQF) and the Industry Organisation for Independent Asset Managers (BOVV). These are important compliance organizations that ensure that financial advisors are doing a proper job with your money.

Findependent is depositing your money and shares at Hypothekarbank Lenzburg (HBL), the same bank Neon uses. With that, deposit protection will guarantee your liquidity up to 100’000 CHF. And your shares are deposited in your name. So, in case of either Findependent or HBL bankruptcy, you should be able to recover your shares.

Unfortunately, Findependent does not share much information about technical security on its website. I wish they would communicate more about that.

At this point, Findependent does not support a second factor of authentication (2FA), but this is something they are planning to support.

However, one great thing about their security is that you can only deposit money into an account in your name, which improves security.

So, overall, I would say Findependent is as safe as other Swiss Robo-advisors. I wish they shared more information on their website about technical security.

Findependent reputation

It is essential to look at one service’s reputation before considering using it.

Out of 41 reviews on Google, Findependent got five stars out of 5 stars review. This is a great score, even for such a young company. People seem happy about the fees and the service’s ease of use.

However, we must mention that most people share their referral code there. But it is good to see that there are no bad reviews.

Findependent has only four reviews on Trustpilot, so it is not an excellent data source. They also have 4.8 out of 5 stars on the Apple Store out of more than 200 reviews.

Overall, Findependent has an excellent reputation among its users.

Alternatives to Findependent

When considering an investment service, you must check how it compares with other alternatives.

Findependent vs True Wealth

TrueWealth is an excellent Swiss Robo-advisor with very affordable prices, making it the best Robo-advisor for serious investors.

- Very customizable

True Wealth is another very affordable Robo-advisor. Both Robo-advisors use Exchange Traded Funds (ETFs) for investing.

True Wealth has a 0.50% management fee against 0.44% for Findependent. On top of that, you will pay the product costs of the ETFs, which should be pretty similar on both sides.

This makes Findependent cheaper than True Wealth. Both Robo-advisors have a degressive pricing system, but in most cases, Findependent will be cheaper.

On the ease-of-use side, Findependent is likely slightly easier to use than True Wealth. However, True Wealth has more customization options. And with True Wealth, you can easily choose whether you want sustainable options.

You can start using Findependent with 500 CHF only. The minimum to start using True Wealth is much higher, at 8000 CHF.

Overall, if you want the cheapest option, you should use Findependent. True Wealth is an excellent alternative if you want more customization or a more established service.

You can read my True Wealth review for more details.

Findependent vs Selma

Invest easily with Selma: a great way to invest in the stock market without the hassle of doing it yourself.

- Beginner-Friendly

- Degressive Fees

Selma is a very simple Robo-advisor. Their philosophy is to make investing as simple as possible. Both Selma and Findependent use ETFs to invest. With Selma, you can choose between sustainable and standard investments.

Selma charges a 0.68% management fee. In addition, you will pay standard costs for the ETFs, like for Findependent.

Since Findependent has only a 0.44% management fee, it is significantly cheaper than Selma.

Selma will likely be slightly easier to use than Findependent, but not by a large margin.

Overall, Findependent will be a cheaper option than Selma. Unless you want something even simpler, the fees are sufficiently cheaper to make Findependent better than Selma.

FAQ

What is the minimum deposit for Findependent?

You need to have at least 500 CHF in your account.

How many portfolios can you have with Findependent?

You can have as many portfolios as you want, but there is a minimum for each portfolio to be invested.

Can you have a custom portfolio with Findependent?

Yes, you can have a custom portfolio, by choosing between ETFs. But you will need at least 5000 CHF to enable this option.

Can you invest sustainably with Findependent?

Yes. By default, every investment solution is using sustainable ETFs only. If you opt for a custom investment solution, you can opt out of sustainable investing.

How much fees do you pay at Findependent?

The base management fee is 0.44% per year. This fee gets lower as you increase your invested portfolio. And you need to pay product costs on top of that management fee.

Who is Findependent good for?

Findependent is good as a Robo-advisor if you want to invest with low fees in sustainable ETFs.

Who is Findependent not good for?

Findependent is not great if you do not want to invest by default in ESG ETFs. It is also not great if you only want to use services used by many customers.

Findependent Summary

Findependent is a recent Swiss robo-advisor, from 2021. Their goal is to provide a simple service to many investors.

Product Brand: Findependent

4.5

Findependent Pros

Let's summarize the main advantages of Findependent:

- Good management and custody fees;

- Very transparent about their fees;

- Tiered pricing;

- Acceptable fees;

- Custom portfolios;

- Can start investing with as low as 500 CHF;

- Management and custody fees are waived below 2000 CHF;

- Can only withdraw money to an account in your name;

- Properly regulated;

- Available in German, English and French;

Findependent Cons

Let's summarize the main disadvantages of Findependent:

- Very new platform;

- Only available on mobile: no web app;

- Strong bias towards Swiss stocks in default portfolios;

- Very new service;

- No information about technical security on their website;

Conclusion

Findependent is a very affordable Robo-advisor with a focus on sustainable investments. Invest your money easily! Get 20CHF in your account with code PoorSwiss.

- Excellent fees

Overall, Findependent is a very interesting Robo-Advisor. They have an excellent investing strategy and very fair fees. It is also great to get started since they have a very low minimum of 500 CHF (2000 CHF for access to all ETFs).

The default portfolios all invest in ESG ETFs. If you want more freedom, you can create custom ETF portfolios where you can choose each ETF directly.

And their very affordable management fee of 0.44% makes Findependent an excellent option for investing sustainably or in a custom ETF portfolio.

The only downside of Findependent is their young age. But they already have more than 7000 users. The feedback from these users is excellent. So, it looks like a good choice to start investing with a Robo-advisor.

I need to mention that I am not investing in Robo-Advisors. Instead, I am investing directly with a broker account, which is much cheaper and allows me much more customization. But not everybody wants to invest the time to invest themselves, and that’s where Robo-advisors are interesting.

If you want to know more, you can read my article about Swiss Robo-advisors.

What about you? What do you think about Findependent?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Robo-Advisors

- More articles about Investing

- FlowBank Review 2024 – Pros and Cons

- Interview of Richard Toolen – CEO of Investart

- Selma vs True Wealth 2024 – Best Swiss Robo Advisor?

Great article, thanks. I think another interesting fact is that their management fees don‘t have a maximum, so they can grow quite large with a bigger portfolio.

Philip

That’s a good point, but Robo-advisors never have caps on their management fees. Brokers often have a cap on their custody fees, but brokers will always be cheaper than Robo-advisors when used properly.

That‘s an interesting fact I was not aware about. Thanks for sharing.

Hi, I’ve been using Findependent since August 2021 and I’m quite satisfied – I wanted sustainable ETFs and Findependent has these by default. Account opening was pretty quick and simple and the app is really straightforward and easy to use. The team behind it also makes a good impression. It takes a few days before money actually is invested from the moment you send it to your account, so it’s not really made for reacting quickly to market fluctuations (although not sure any roboadvisers are really suited for that). But so far so good. They give codes that allow increasing the amount of your portfolio managed for free from 2000 to 3000CHF for life – here’s one if you’re opening an account: UOBZO2

Cheers

Hi Philippe,

Thanks for sharing your experience, this is very important.

To my knowledge, no Swiss Robo-advisor is good for reacting quickly. And they should not be! investors should not react to short-term events.

Hi there,

to ay I got an update for the Findependent App. You can now set up your portfolio manually too. Also with that comes to possibility to choose between non ESG, ESG or even SRI funds.

Maybe you take another shot of findependent?

Kind regards

ei8ht

Hi ei8ht

Thanks for the information, I will have to take a look at this and update my article. But it seems that their website is not entirely up to date regarding these changes.

Once it is updated, I will try to update the article once I get some time.

Hi, why you don’t want to have a portion of the investment allocation in Real Estate?

Do you just don’t like that it’s a forced thing, or you don’t like that allocation as a whole?

Thank you.

Hi Alessandro,

I am not a huge believer in real estate that’s correct. But my point is more about being forced into it rather than have a choice.

For me, real estate can be a good investment, but more if you do it yourself rather than through an ETF or index fund. The difference in returns between an ETF real estate or physical real estate are big.

Also, in a world ETF, you will have some real estate as well.

But, having 10% real estate is not bad in itself :)