How To Buy an ETF on DEGIRO

| Updated: |(Disclosure: Some of the links below may be affiliate links)

This article shows how to buy an Exchange Traded Fund (ETF) on DEGIRO. The process will be the same regardless of the ETF you want to buy.

DEGIRO is a great broker for European investors. They have very low fees and are very easy to use.

We will also see how to deposit money into your account. You will need cash in your account before you can buy an ETF.

And remember: Investing involves the risk of loss. Always do your research before you invest and know why you invest and what you invest in.

Deposit money into your DEGIRO account

This article assumes you already have an account with DEGIRO. If not, you can open a DEGIRO account very quickly.

The first thing you need to do is deposit money into your account. You can go to the next section if you have already done that.

You have two ways to deposit money in your DEGIRO account: SOFORT and Bank Transfer.

SOFORT is an instant deposit to your DEGIRO account. It supports many ways of transferring money. However, it will cost you 1.25 CHF per transfer. So you should generally avoid doing that to save money. But if you transfer large amounts of money, this is fine since this is a small fee. And you have the advantage of having the money right now.

The most used way to deposit money into your account is to transfer money from your bank account. A bank transfer is entirely free. So this is generally the way to go. You can only transfer money from the bank account you used to create your account. You cannot transfer money from another bank account.

Just make a bank transfer to the DEGIRO IBAN account. DEGIRO will use your bank account as the reference and match it to your account. Processing the money in your account should only take a few days. And you will see the funds appear on your dashboard.

Once you have the money in your account, you can purchase the ETF (or any other shares) from your account.

The basics

I assume that you are using CHF as your base currency. But, if you are not using CHF, this will not change anything since currency conversions are automatic. On DEGIRO, you do not have to convert currencies manually. You can directly buy something in other currencies, and DEGIRO will do the conversion for you. You can also opt for manual conversions. But this is more expensive.

As you will see, it is easy to buy something with DEGIRO. There are two primary portals: The web interface and the mobile application. I cover both in this article. We will start with the web interface.

Keep in mind that buying ETFs is generally not free with DEGIRO. If you want to know more about DEGIRO fees, you should read my review of DEGIRO.

In this example, I am buying the VT ETF. Unfortunately, since this article came out, DEGIRO stopped offering access to U.S. ETFs. But this example will work with any ETF, such as a VUSA. It is that easy! And you can even follow the same technique if you want to buy a stock.

Buy ETF Using the DEGIRO web interface

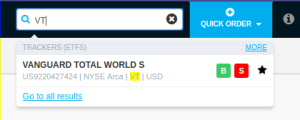

The first thing you need to do is to log in to your account. Then, you have to find the ETF. There are several ways to do that. If you have never bought it, you can search for it in the search box. You can use the ticker (VUSA, for instance) or the name to search for it.

Then, you can click on the name to go to the ETF page. If you already have this ETF, you can go to your portfolio page and click on the ETF name.

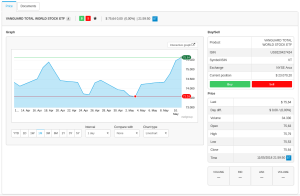

It should now bring you to the ETF page:

On this page, you have all the current information about the ETF. On the left, you get the graph of the ETF price. And on the right, you get the current price information. You can also see your current position in this ETF.

In this view, the market is not open. So the last information about volume, bid, and ask is empty. It is not a problem. You can, of course, place an order outside of trading hours. The exchange will execute your order as soon as possible. You probably noticed the big Buy and Sell buttons. Just press the Buy button to buy new shares.

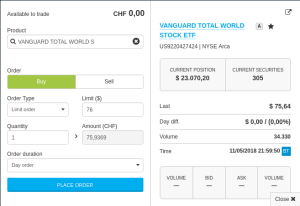

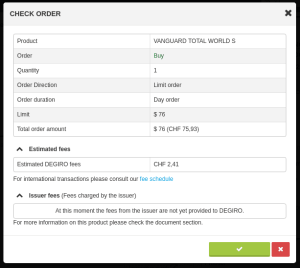

Again, on the right, you get all the current information about your position and the price. On the left is the configuration of your order. Here, I have specified that I wanted to buy one share at a maximum of 76 USD. Be aware that it will not let you trade if you do not have enough funds.

Be careful to have some extra money when trading in foreign currency. If the exchange rate changes enough, you may not have enough currency for the trade!

You have got quite a few options for stock market order types:

- Limit Order. You set a maximum to buy or a minimum to sell a share. The exchange will only execute the order if your maximum or minimum is met. It is the default option.

- Market Order. The order will be executed at the current best possible price. You should be careful with this order type. It is especially true with less liquid products.

- Stop Loss Order. The exchange will fill the market order once the share reaches the loss price. The sell order is then executed at the best possible price. In some cases, it could be sold well below the loss price.

- Stop Limit Order. A limit order is filled in the market when the share reaches the loss price. It gives you better control than a stop-loss order. But if the market goes too quickly below your limit order, you may be unable to sell.

I recommend you use limit orders in general. You will avoid surprises. Do not try to time the market using the “smart” limit. You can also use a market order if you trade only with a high-volume ETF. It should not make a big difference.

And you can also choose the duration of your order:

- Day order. The order will be valid until executed or until the end of the day, or until the market closes.

- GTC (Good Till Cancel) Order. The order will be valid for as long as possible. It depends on the market. European markets allow orders lasting up to one year, while the U.S. market allows orders up to 90 days.

For pure passive investors like us, day orders are more than enough as a tool. For instance, I invest once a month, regardless of the market. You should not try to make something too complicated.

Ok, we can go back to the matter at hand. I am using a Limit order that is only valid for one day. You can confirm the order with Place Order.

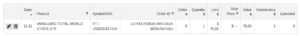

You can still cancel the action. You should always check twice before placing an order. Once you are sure of your choice, press the green button. The order will now appear on your Orders page:

You can still cancel the order. You can also edit the limit, for instance. Now, you have to wait until the exchange executes the order.

Once possible, DEGIRO will execute the order. At that point, you cannot cancel anymore. You will have more shares of the ETF you want. You can take a look at your portfolio to see the new total.

Buy ETF on DEGIRO mobile app

Everything we did from the web application is also possible from the mobile application. We can see the same process again on your phone (or tablet).

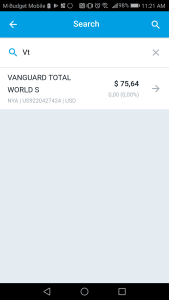

First of all, connect to your account. Then, if you do not have any share of the ETF you want, you can search for the ticker (VUSA, for instance):

Or, if you already have it, you can go directly from your portfolio page:

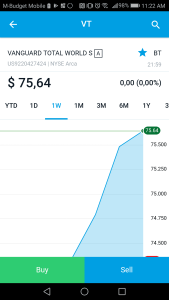

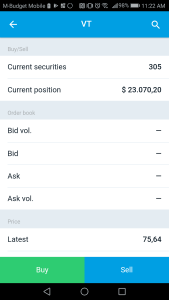

Just click on the Vanguard Total World ETF. This should bring you to the Vanguard Total World ETF Page:

From there, you can buy and sell with the huge buttons at the bottom of the view. To purchase the ETF, press the Buy button.

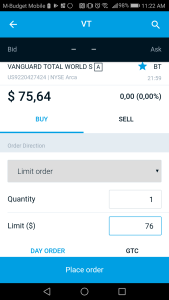

Here you can configure your order. I set a limit order for one share at a maximum price of 76 USD. I explain the different types of orders in the previous section. Once your order is ready, press “Place an Order” to get the final confirmation view.

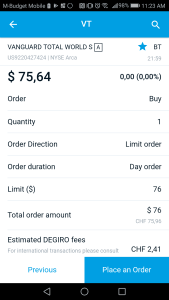

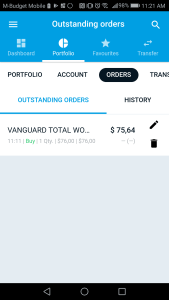

Review all the data carefully and then press Place an order to confirm your order. Once you confirm it, the order will be in the Orders view until the market executes it.

You can still cancel it from this view as long as it is not executed. Once it is possible, DEGIRO will execute your order on the market. After this, you will not be able to cancel the order anymore. If you go to your portfolio view, you should have more shares of the ETF you just bought.

Bonus: Total result in DEGIRO mobile application

In my review of DEGIRO, I mentioned that I did not like that it was impossible to see the total result of the position in the mobile application. The application can only display the daily result of each stock in your portfolio. I do not care about the daily variations of my portfolio. I am much more interested in the total results of my portfolio. It is what most long-term investors should care about.

However, I just found out it was possible to see this information on the DEGIRO mobile application. It took me quite a while to figure out how to find this information. It is just not intuitive. Or maybe, it is just me. But once you know it, it is straightforward to use. Since it was not easy to find it, I will post my findings for all of you!

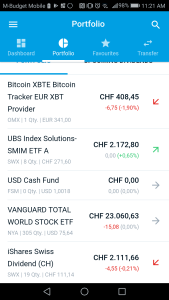

First, start the mobile application and log in to your account. Then, you can go to the Portfolio view. Here, you should see the daily results of all the positions in your portfolio. Once you are in the portfolio view on the application, you should see something like this:

You can see the daily results of all the positions. If you press on a daily result, it then shows the total results of this position. For instance, after pressing on Vanguard Total World and Vanguard International High Dividend Yield, I can see their total results:

This is really useful information, and this is something that was missing for me. I am thrilled I discovered this feature. It makes my life more comfortable since I do not have to use the web application so much. I wish it was a bit more obvious. But maybe it was apparent to most people!

Conclusion

As you saw, buying (and selling) ETFs on DEGIRO is pretty straightforward. Several options are a bit more complicated. But simple investors only need the default options. It makes it very easy. And since you should not be day trading, repeating this process a few times each month should be easy!

If you can, you should not buy a single share of an ETF when you can buy more. It is not the most cost-efficient way to buy shares. I just did this as an example since I had 100 CHF in my account in cash!

Now that you know how to buy an ETF on DEGIRO, you have no excuse not to start investing!

If you want to learn more about DEGIRO, I wrote an in-depth review of DEGIRO.

Do you have more questions on how to buy ETFs on DEGIRO? Or more questions on DEGIRO?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Brokers

- More articles about Investing

- Neon vs Yuh: Best digital bank in 2024?

- Yuh vs Swissquote 2024 – Best Broker in 2024

- DEGIRO vs eToro: Which Is Better For You in 2024?

Hi Mr. Poor Swiss,

Congratulations for the blog! A lot of useful information!

I would like to start investing using Degiro platform ( I will invest less than 100K). However, we (me and my husband) are UE citizens (different countries) and living in Switzerland. I am curious to know

What will happen if we will leave in 2 years (for example) ? We will need to close our DEgiro Swiss account? Or we can keep investing?

With Degiro, it’s possible to have 2 currency: CHF and Euro? Like this we can avoid exchange fees?

Many thanks in advance!

Hi Liana,

That’s a good question. And unfortunately, I do not know the answer. Indeed, degiro.ch will be only for Swiss residents. So, I think that you will have to switch to another DEGIRO is you move back to EU. In that case, you could do a transfer between DEGIRO accounts, but this is not free.

I would ask DEGIRO this question if I were you.

It’s possible to have several currencies if you do manual conversions for the currency. But this can be quite expensive for small conversions. And it’s not possible to send several currencies to the account, so I do not see how you could save on exchange fees. But maybe I am missing something.

Thanks a lot!

Hi PoorSwiss,

I have a question for the tax report is better an ETF accumulative or dividend? Do you know how it works?

I have this question :)

Kind regards,

linux

Hi Ricardo,

There is no difference in Switzerland, you will pay the same taxes and you will have to declare all the dividends regardless of whether it’s accumulating or distributing :)

Thanks for stopping by!

Hello,

Is this still true in november 2021??

I want my EFTs to offer accumulating dividends to take advantage of compounded interests over long term and not pay tax as I do not take out the profit???

Thanks

sybille in Switzerland

Yes, it’s still true :) Use accumulating ETFs does not save you taxes in Switzerland :)

Hi Mr Poor Swiss,

great article, thanks a lot for detailing the process. I found your post because I was looking for an answer about the process of buying ETFs using the limit order method.

It is required to put a value for the limit, and I am wondering how to determine such value, so that I am 100 % sure to buy the ETFs. In your example, the market value was 75.64 usd, and you chose the value of 76 USD. Is it ok to always choose the next closed number above current market value? What would happen if I chose a much lower value, e.g. 70 USD to follow this example?

Thanks a lot, and greetings from a fellow Swiss guy.

Hi Greg,

If you chose a much lower limit, your order would probably not be executed because nobody sells 8% cheaper than the market price.

I could have put my limit at 75.70 and it would have been fine. Some people try to put it even lower than the market value, 75.60 for instance but this is dangerous because if it’s going up quickly, you may not buy shares.

The limit order simply gives you a guarantee of not paying too much if the spread is big. But for big ETFs, Market Orders are still fine.

Thanks for stopping by!

Super! Merci beaucoup :)

Hi Mr. Poor Swiss,

Thanks a lot for all the work you put into your blog, it is very informative! I would like to open a broker account but given all your articles and the ones from your mates MP and RIP – I still remain puzzled about what I should do.

Context: I am ready to invest some cash ca. 20k CHF and 1000-2000 CHF per month afterward.

I want to focus on ETFs (and a couple of stocks) and was wondering if you would still recommend Degiro instead of IB given that VT isn’t available anymore and the custody fees still get quickly quite expensive in comparison to IB? (FYI: The UI of IB doesn’t scare me and as soon as I have 100k I will move to IB without a doubt)

Also, how does your portfolio look like at the moment on these brokerage platforms (e.g. ETFs, Stocks, etc.)?

Thanks a lot for your support, I look forward to your reply!

Have a great start into the week.

Hi Ray,

If you are planning to move to IB anyway later, I would recommend directly using IB. It’s a pain to move broker.

Currently, my portfolio is still the same: 70% VT, 10% VOO and 20% CHDVD.

I hope that helps :)

Thanks for stopping by!

hi Mr. Poor Swiss,

Thank you for your wonderful blog! I have decided to become an investor, thanks to your inspiration!

I just opened an account on DeGiro (too bad I didn’t see the affiliated link to get €20! :(), and now when I look at some ETF to buy, I don’t see the TER (fee). Could you show me which number indicates the fee (TER) in the platform? With much thanks.

Hi Minty,

Unfortunately, you cannot find the TER on DEGIRO directly. Sometimes, you can go into the Documents section and the documents will have the TER inside. However, this is not really practical.

I would advise that you use justetf.com to find information on funds. Just make sure you Select Switzerland Private Investor in the Top Left Corner. Then, you can find information about all the ETFs available.

Let me know if you find the information you are looking for!

Congratulations on starting your investing! And good luck!

Hi,

I’ve just opened an account using your link (I hope it worked). Can you tell me if Degiro allows to buy fractional ETFs?

Hi K,

Thanks a lot for using my link :) Unfortunately, they do not allow to buy fractional ETFs, no :(

Also, be aware that DEGIRO does not offer the VT ETF anymore.

Thanks for stopping by :)

Hey there,

Just jumping in really quickly here. Is there any broker in the EU the allows you to buy fractional shares of ETFs in the US?

Thank you!

Hi Rafael,

I am not even sure there is a broker in the EU that lets you shares of US-ETFs, so fractional shares would be even more unlikely.

Hi ThePoorSwiss,

Yesterday, I did my first buy on Degiro.

The UI is a bit different from the one you have here, but it was easy to buy some shares.

The transfer from my bank to Degiro, took 2 days as expected.

Keep posting!

Best regards,

Hi,

Did you do the trade on the web application ? Did it really change so much ?

I am glad you were able to do it easily :)

Care to share what you bought ?

Thanks for stopping by and good luck investing :)

Hi,

No, minor UI changes (web application) but easy to buy with the steps you described.

Only VT. My plan will be similar to yours probably, 80% VT and 20% Swiss.

Best regards,

Thanks for sharing!

OK, good to know :)

I didn’t even realize there were changes.

Congratulations on your investing!

I haven’t tried with an ETF yet on Degiro but I read on the MP forum that with the new regulations Swiss/European residents cannot by ETF listed on American exchanges since Jan 18. Have you had any problems (It doesn’t seem like it based on the post) but have you heard about this as well?

Hello Kelvin,

It is not that they are blocked, but they need some special documentation before they can be available to EU. This is due to new regulations. However, I haven’t had any issue with any of the ETF I’m using. VT is still available for instance. If you only use VT, they should not be any issue. But I don’t know if all ETFs are available now.

Thanks for stopping by :)

Nice to hear that! I plan to make my 1st transfer to Degiro later today.

Good for you :)

Let me know how it goes!

Hi,

Very good article. I thank you for all this valuable information. However, I have some questions about taxes.

How do I proceed with my Swiss tax return?

Could you do an article about that?

Thanks, looking forward to keep reading your blog.

Hi Nelson,

Thanks :)

You mean how to fill your tax declaration ? You need to declare every single fund you got as an asset in your tax declaration.

You also need to declare the dividends you’ve got. For this, it will depend on which ETF you have. If you have the VT ETF as in my example, the dividend will be withheld by the US. You can reclaim these with a DA1- form.

Personally, I never reclaimed the dividends so far. I plan to study this in depth and post about this, but this may not be for some time.

If you need more information, you can read this post by MP: https://www.mustachianpost.com/2017/04/09/how-to-fill-your-tax-declaration-in-vaud-canton-with-vaudtax-guide-step-3/

Or this post on the forum: https://forum.mustachianpost.com/t/tax-optimisation-for-etf-investing/67

I hope this will help you :)

Hi Mr. The Poor Swiss,

Thank you for your answer. I’ll read this quietly.

Thank you and see you soon.