How to invest for your children in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Even before my son was born, I knew I would invest for my children. Investing for your children is a great idea, and it makes a lot more sense than letting money rest in a bank account with very low interest rates.

However, until recently, I never worried about how to achieve that. Once my son was born, it was time to research the best way to invest for my children! And I found a great way to do so.

In this article, I share how you can invest for your children and what I will do for mine.

Why invest for your children?

First, you may wonder why invest for your children in the first place. That is a good question.

Most parents will gift some money over time to their children and then give it to them once they reach their majority (or any other specific age). In most cases, this money will end up in a bank account. The problem with that is that bank accounts have little to no returns. So, the money will slowly lose its value due to inflation.

The same reasons to invest that apply to you also apply to your children. We want to increase returns and avoid losing value to inflation.

Another reason to invest for my children is to teach them the value of investing. It may be naive, but I hope to teach my children how to handle their money properly. I will tell you in 20 years how it went!

I also plan to have a bank account for my children. In this bank account, I will deposit whatever he receives as gifts. I also prefer this to be separated.

Remember that you must pay net worth taxes on these assets as long as your children do not pay taxes. So, this is not a way to reduce your net worth taxes!

Decide on what to invest for your children

First, you must decide what you want to invest for your children. In this article, I am assuming you want to invest in stocks. But this technique would work with anything available on the stock market, including funds with real estate, crypto, or gold.

If you are thinking of investing for your children, you are likely to have a portfolio yourself. So, you could replicate your portfolio for your children.

Personally, our portfolio is very simple. It has only two ETFs:

- 80% Vanguard Total World (VT) – An ETF investing worldwide.

- 20% iShares Core SPI (CHSPI) – An ETF investing in Switzerland.

And I could replicate that for my children. However, I have decided to simplify it and invest in VT. I may change this in the future and switch some to CHSPI (or others) as my children get closer to their majority, but for now, I feel comfortable with only VT. Using a single ETF will also make it much cheaper since buying on American stock exchanges is more than ten times more affordable than buying on the Swiss stock exchange.

If you do not know where to start, check out my guide on setting up a portfolio from scratch. But you should try to make it as simple as possible.

The best way to invest for your children

After some research, I have found the best way to invest for my children.

First, I wanted an account in their name, which was impractical since it would significantly limit access to the stock market and good services. So, in the end, the account will be in my name. But this does not matter since I will gift that account once my child is major. And in any case, even if the money is in your child’s name, you are responsible for it until their majority.

The second thing I wanted was for their account to be entirely separated from mine. I did not want to see their shares in my investment account. This separation is crucial because I can separate my net worth from theirs. And it will also show the performance of each portfolio since they will be slightly different.

Third, I needed something where I could start with little money. I do not want to start with 2000 CHF or more just to fit the minimum of some services.

Finally, I wanted something cheap and efficient. That meant investing in index ETFs with low transaction fees for buying.

With all these points, I found only one good investment solution for my children. I will use a separate Interactive Brokers account for each of my children.

This solution is straightforward. You can manage the accounts directly from the same interface on Interactive Brokers. You only have one login. All the accounts are linked together. But they are separated, so each has shares and cash, each with its configuration.

This solution is very cheap since Interactive Brokers is the cheapest broker for Swiss investors. In 2021, Interactive Brokers removed the custody fees below 120’000 USD. So, you can have several accounts with little money and pay no fee. All the accounts are in my name, but this should change nothing.

So, in the rest of this article, I will detail how to invest for your children with Interactive Brokers.

Create a second Interactive Brokers account

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

This article assumes that you are already using Interactive Brokers. As such, we will create a second IB account linked to your main account. If you do not have an IB account, I have a guide on creating an IB account and starting investing.

Creating a second account at IB to invest for your children is relatively easy. You will see a button to open an additional account if you go into your account settings. This button will start creating an account automatically linked to your current account. It means you will have only a single login but two accounts behind it.

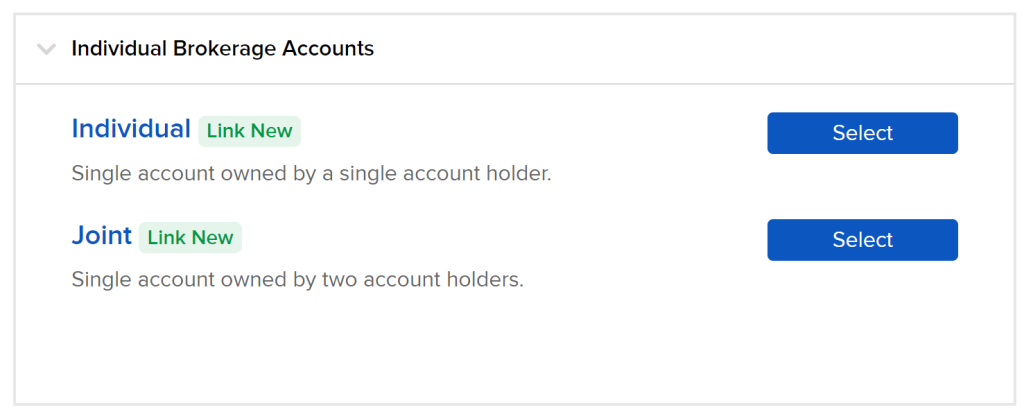

In the next step, you must select whether you want an individual or a joint account. I recommend you create an account similar to your main account.

Then, you must select whether you want a cash or margin account. It would be best if you were unlikely to use leverage with your children’s money, so you probably want to use a cash account here.

After this, you will have to choose which permissions you want. These permissions will decide which stock exchange you can access. This will be the same as your main account and should be fine already.

Then, you will have to check all the agreements and review all the information you have entered. Once you verify this information is correct, you can sign with your name and finish the application.

They will finally ask you why you asked for this account. I answered truthfully, and there did not seem to be any problem.

Then, this will be up to the approval team to approve or deny your account. I honestly do not know what criteria they are using to do so. In my case, getting the new account approved took one working day.

Finalize the new account

Once IB approves your new account, you can view both in Interactive Brokers’ web interfaces. For instance, when you view your portfolio, you can choose between your accounts.

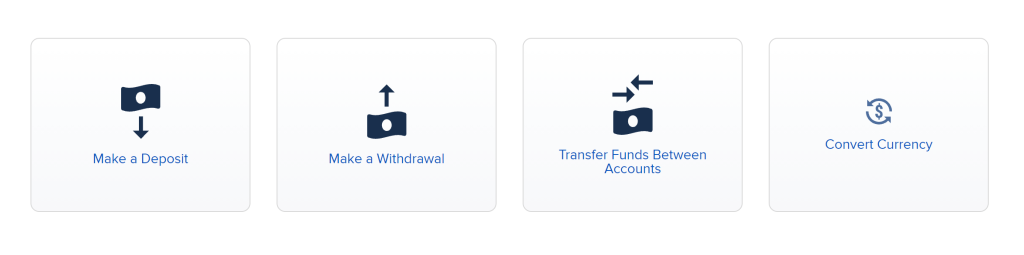

You need to wire money directly to the new account at least once. After this, you can do internal transfers between your accounts. The first deposit is to validate the newly created account.

Once the first deposit is validated, you can access the new internal funds transfer feature in Interactive Brokers. With that feature, you can transfer funds from one account to another. And you can also transfer positions from account to account.

Invest in the new account

You have several ways to invest for your children with this account. And each way has advantages and disadvantages.

The first way is to transfer money monthly, convert it (if necessary), and buy shares in the second account. This technique is fairly simple. But it means doing two transfers (one to your main account and one to your children’s account). And it is also expensive.

You will pay 2 CHF per conversion if you convert CHF to USD. And then, you will pay 0.35 USD to buy a share of a USD ETF. If we take one monthly share of VT, that’s currently about a 2.5% fee on buying shares. This price is high. It becomes an acceptable price if you do not have to convert currency.

If you buy ten shares of VT, that is acceptable. But most parents will not invest that much every month. You could decide to invest less regularly, but that is a bad option since investing often is better.

The second way is to transfer funds from your main account. That way, you can do conversions and transfer some converted cash to your children’s accounts. And then, you can buy shares from there. You will only pay about 0.35 USD per investment.

Finally, you could simply transfer shares from your main portfolio into your children’s account. That way, you can buy shares and transfer some of these to the second account. This is the cheapest way to do it.

Even though it is not the optimal way, I will use the second option. I want to keep track of each operation in the children’s account to know how much I paid for shares. This technique will cost 0.35 USD in extra fees each month, but that is something I can live with.

Limitations

Remember that this technique to invest for your children does not work if you have several IB accounts with the same email address. In that case, you will not even see the button to add a new account.

In this case, you have two options:

- Delete the other accounts.

- Change your email in your other accounts so that your main account is the only one with this email.

This issue happened because I had an investart account with the same email address for testing. And Investart is using IB accounts to invest in your name. Once I cleared this out, I could create a new account.

Robo-advisors alternatives

TrueWealth is an excellent Swiss Robo-advisor with very affordable prices, making it the best Robo-advisor for serious investors.

- Very customizable

Robo-advisors offer a decent alternative to IB if you do not want to use a foreign broker. There are two good robo-advisors with this feature in Switzerland:

- True Wealth will invest in general-purpose ETFs

- Inyova will invest in highly sustainable companies

Both robo-advisors offer a similar principle for your children. You can open an extra account in your child’s name, which will be invested like a standard account. Once your children reach 18, the account will be transferred to their name.

There is one significant advantage to this technique! At 18, the transfer will be done entirely internally without any fees. The shares will not be sold, and you will be left with precisely what was on the account. This is a sound system!

If you are worried about using a foreign broker, Swiss robo-advisors will offer an excellent alternative.

Conclusion

There you have it! A second Interactive Brokers account is a great way to invest for your children. This solution is very cheap, very simple, and very complete.

I use this technique to buy one share of VT every month until I give this account to my son once he is 18. If I have other children, I will then open yet another account.

There are probably other ways to invest for your children. Unfortunately, this is the best way I have found. All other brokers have strong disadvantages, either in costs or efficiency (or both!).

If you are not interested in using a foreign broker, opt for a Swiss Robo-advisor like Inyova or True Wealth.

If you do not already, I recommend investing for you before investing for your children. To help you, I have a guide on how to get started investing in the stock market.

What about you? Do you invest for your children? How?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hi! Do you mind sharing how to transfer shares between accounts. The only option I see is transfering funds between accounts (i.e. a currency) but not shares.

Any idea?

Hi,

In Transfer & Pay, there is a Transfer Positions menu that allows you to do that. Then, you can go into Internal Transfer and you will be able to transfer shares between your linked accounts.

Hi PS!

This is a technical question, if we have an interactive brokers account in CHF and we want to buy the VT which is in USD, first we need to convert the CHF to USD and then buy the stocks? Could you please describe what is the cheapest way to do this?

Thanks a lot!

Hi Julian,

That’s correct, you first need to convert CHF to USD and then buy the stock.

Each currency conversion cost 2 USD.

In my case, I do the conversions in the main account, so that I convert more than 1000 CHF at a time. Then, I transfer USD to the account of my son.

Hi Mr. The Poor Swiss,

I really appreciate your blog, keep going!

According to some information I found on line it seems that VT cold be mimicked with lower expense ratio using Vanguard Total Stock Market ETF (VTI) for US stocks + the Vanguard Total International Stock Market ETF (VXUS) for international stocks due to the fact that the current divide between U.S. and International market for VT is about 60-40.

With an expense ratio of 0.03% for VTI and 0.08% for VXUS, the average expense ratio for a 60-40 portfolio would be 0.05% which is less than the expense ratio of 0.08% of VT. This amount can add up over time for a large compounding portfolio like the one you are crating for your son. Additionally, since VT is market cap weighted, there is no rebalancing required as the international segment could rise or fall depending on relative performance to the U.S. segment.

Probably VT gives a little bigger diversification than VTI + VXUS but I don’t think it is going to be significant over a long period of time.

What do you think? Would it worth to make the investment strategy a little bit more complicated to save a little fee? And if so, would make sense also to sell VT to switch to VTI + VXUS or would it be just for future investments?

Regards

Hi marco,

Thanks :)

Yes, you can indeed do that and you will indeed about 0.03% but you would lose significantly on simplicity. Over time, you will have to rebalance your portfolio more than if you hold only VT.

I don’t feel it would be worth it honestly. The difference is so little that I am not even sure you are going to make up for it with the extra transactions costs of having two ETFs and having to rebalance them.

Now, is it more efficient? Yes, very slightly. So, it’s up to everybody to decide whether they want simplicity or efficiency in that case. I will choose simplicity for myself :)

Hi,

Thank you for the valuable insight! So far I used a German broker for my daughter, as some have cheap saving plans on etf. But I might consider changing to IB as we live in Switzerland as well.

Are there any updates on the possibility to invest in US funds with IB for Swiss investors? I seem to remember, that after IB kicked out EU residents from IB UK and barred the access to US funds for them, there was talk that it might happen to Swiss investors with IB as well in 2022.

Hi Nils,

I have heard that some german brokers are pretty good indeed, but never tried one.

Currently, there is no update yet. But it may be worth waiting until 2022 to be sure :)

Hi Mr. Swiss Poor,

Since your are investing for 18yrs (very long term), have you considered taking a slightly bigger risk? VT doesn’t give you that many returns.

Longer the investment, safer it gets.

I would suggest you can go for VUG, VOO, etc.

Hi Manole,

I am considering that indeed. But currently, I am a little worried about the huge valuations of the US stock market and not willing to invest too much in something like VOO or VUG.

But it’s true that I can afford some controlled risks in this portfolio.

For my son’s portfolio, I think VT will be good, I’d rather not take too much risks on what I consider to be his. But I am considering that for my own portfolio with also many years horizon.

Hello

As always an inspirational post.

By your logic of long-term investment, wouldn’t you just invest 20.000 when your child is born and then just let it sit till they are 65. Chances are that it would be the 1 million. And it would be easier on efforts and cheaper on fees. Best!

Hi Eon,

That’s correct, it would be higher. But by doing it once a month, I was to show how much he could do himself if he did the same thing.

Also, if I were to buy more 200 shares of VT now, this would delay my own investments, the total would be net zero.

I am not within the Swiss tax system. But what are the limits / taxes you need to pay when (at which ever age) you transfer the portfolio in the account to your child?

Many countries have quite a high limit of what you can gift tax free from parent to child, but at a certain limit you need to pay taxes. How do you plan for this?

Hi Japke,

Excellent question. It depends on each state. In my canton (Fribourg), gifts from parents to children are tax-free. I believe this is the case in most cantons.

My son will have to declare this as wealth in his declaration.

Hey Baptiste, I hope your son gives you at least 3 consecutive hours of sleep by now.

I have another question on taxes. Any idea if your son will need to declare or pay taxes on the dividends?

Cheers

Hi ILS,

We have some 3 hours consecutive, some nights, not all.

Until he’s 18, I will have to pay taxes on the dividends of this portfolio, as well as the wealth tax. When he’s 18, the portfolio will be his truly and then, he will have to pay taxes.

Thanks for an very helpful post. Do you know how to works when your kid turns 18 then? How does that account become his? And why did you go for this option and not opening a custodian account?

Hi Guy,

Once he turns 18, I will have to create another account for him and transfer the securities there.

As far as I know, I can’t open a custodian account for a minor and manage the account from my own, no?

Hello there! Thank you for your blog, always very interesting. One question though, if you would have to choose a Swiss broker for your children, would you go with Cornertrader ? If I read it correctly, the trading fees are quite small and the inactivity fee would not apply if there is 1 buy per trimester. So it is quite competitive for a Swiss broker, isn’t it ? Is there any other downside with Cornertrader compared to other Swiss brokers ?

Hi,

I would personally go with Swissquote. I trust them more than CornerTrader, even though they are indeed sometimes more expensive. You can read my review of Swissquote for more info.

I have tried neither, so, it’s mostly a personal feeling and based on the reputation of both brokers.

Hi Mr. Poor Swiss

I have my brokerage at Postfinance and simply opened up a second brokerage account for my son, but still under my name. It costs CHF 30 per year, but you can use this as trading credits. I save the monthly Kinderzulage for him and once per year, on his birthday, I buy the Swiss Dividend ETF from iShares for him. He’s now only six years old, but one day the dividends will be his pocket money. So, he will already learn and get educated about money I hope.

Regards from Schaffhausen Thomas

Hi Thomas,

Thanks for sharing!

If you invest once a year only, PostFinance is really not that bad. And using dividends as pocket money is not a bad idea either to teach him the value of investing!

Hi,

Thanks for sharing this good info, I was searching for this idea exactly.

I have a question, is there any fees if I have multiple accounts linked on my account , I have an idea to make separate account for each finical goal if it is free.

thanks

Hi mgad,

Currently, no. IB has removed the custody fees, so each account will be free.