How to invest for your children in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Even before my son was born, I knew I would invest for my children. Investing for your children is a great idea, and it makes a lot more sense than letting money rest in a bank account with very low interest rates.

However, until recently, I never worried about how to achieve that. Once my son was born, it was time to research the best way to invest for my children! And I found a great way to do so.

In this article, I share how you can invest for your children and what I will do for mine.

Why invest for your children?

First, you may wonder why invest for your children in the first place. That is a good question.

Most parents will gift some money over time to their children and then give it to them once they reach their majority (or any other specific age). In most cases, this money will end up in a bank account. The problem with that is that bank accounts have little to no returns. So, the money will slowly lose its value due to inflation.

The same reasons to invest that apply to you also apply to your children. We want to increase returns and avoid losing value to inflation.

Another reason to invest for my children is to teach them the value of investing. It may be naive, but I hope to teach my children how to handle their money properly. I will tell you in 20 years how it went!

I also plan to have a bank account for my children. In this bank account, I will deposit whatever he receives as gifts. I also prefer this to be separated.

Remember that you must pay net worth taxes on these assets as long as your children do not pay taxes. So, this is not a way to reduce your net worth taxes!

Decide on what to invest for your children

First, you must decide what you want to invest for your children. In this article, I am assuming you want to invest in stocks. But this technique would work with anything available on the stock market, including funds with real estate, crypto, or gold.

If you are thinking of investing for your children, you are likely to have a portfolio yourself. So, you could replicate your portfolio for your children.

Personally, our portfolio is very simple. It has only two ETFs:

- 80% Vanguard Total World (VT) – An ETF investing worldwide.

- 20% iShares Core SPI (CHSPI) – An ETF investing in Switzerland.

And I could replicate that for my children. However, I have decided to simplify it and invest in VT. I may change this in the future and switch some to CHSPI (or others) as my children get closer to their majority, but for now, I feel comfortable with only VT. Using a single ETF will also make it much cheaper since buying on American stock exchanges is more than ten times more affordable than buying on the Swiss stock exchange.

If you do not know where to start, check out my guide on setting up a portfolio from scratch. But you should try to make it as simple as possible.

The best way to invest for your children

After some research, I have found the best way to invest for my children.

First, I wanted an account in their name, which was impractical since it would significantly limit access to the stock market and good services. So, in the end, the account will be in my name. But this does not matter since I will gift that account once my child is major. And in any case, even if the money is in your child’s name, you are responsible for it until their majority.

The second thing I wanted was for their account to be entirely separated from mine. I did not want to see their shares in my investment account. This separation is crucial because I can separate my net worth from theirs. And it will also show the performance of each portfolio since they will be slightly different.

Third, I needed something where I could start with little money. I do not want to start with 2000 CHF or more just to fit the minimum of some services.

Finally, I wanted something cheap and efficient. That meant investing in index ETFs with low transaction fees for buying.

With all these points, I found only one good investment solution for my children. I will use a separate Interactive Brokers account for each of my children.

This solution is straightforward. You can manage the accounts directly from the same interface on Interactive Brokers. You only have one login. All the accounts are linked together. But they are separated, so each has shares and cash, each with its configuration.

This solution is very cheap since Interactive Brokers is the cheapest broker for Swiss investors. In 2021, Interactive Brokers removed the custody fees below 120’000 USD. So, you can have several accounts with little money and pay no fee. All the accounts are in my name, but this should change nothing.

So, in the rest of this article, I will detail how to invest for your children with Interactive Brokers.

Create a second Interactive Brokers account

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

This article assumes that you are already using Interactive Brokers. As such, we will create a second IB account linked to your main account. If you do not have an IB account, I have a guide on creating an IB account and starting investing.

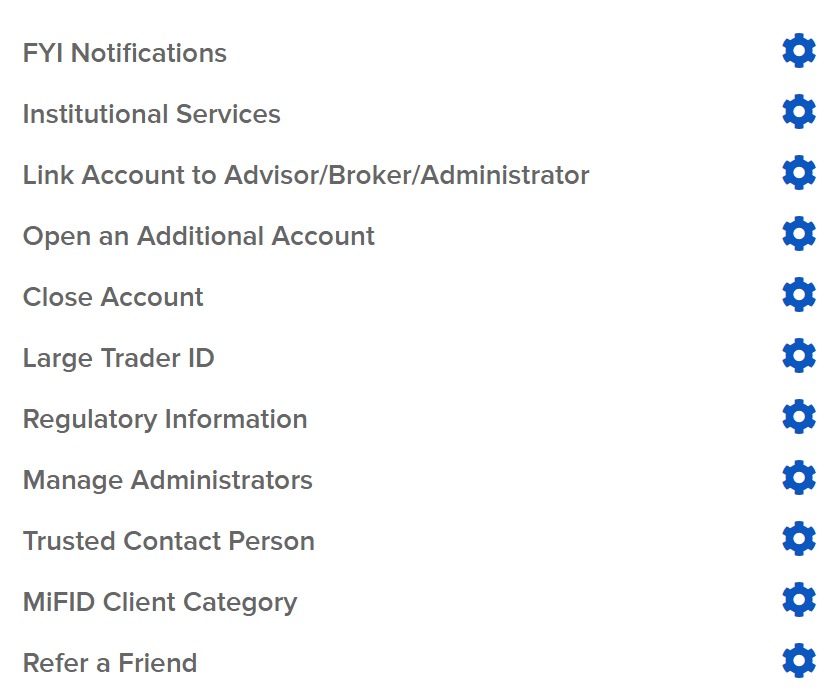

Creating a second account at IB to invest for your children is relatively easy. You will see a button to open an additional account if you go into your account settings. This button will start creating an account automatically linked to your current account. It means you will have only a single login but two accounts behind it.

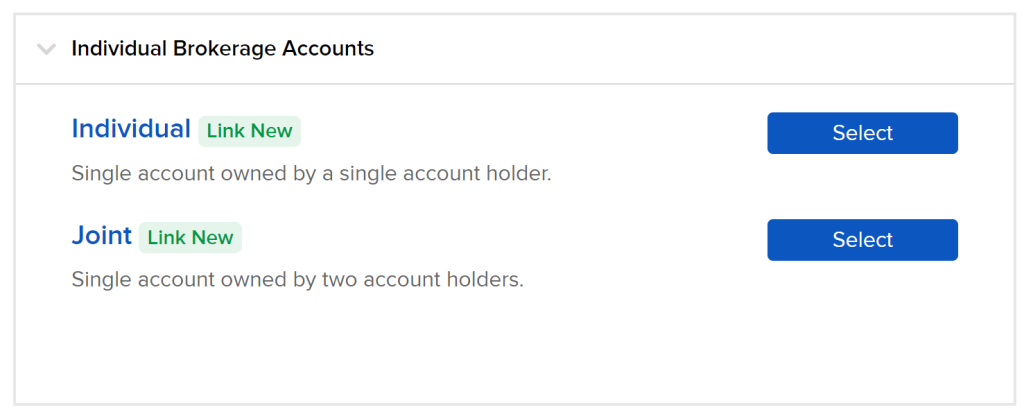

In the next step, you must select whether you want an individual or a joint account. I recommend you create an account similar to your main account.

Then, you must select whether you want a cash or margin account. It would be best if you were unlikely to use leverage with your children’s money, so you probably want to use a cash account here.

After this, you will have to choose which permissions you want. These permissions will decide which stock exchange you can access. This will be the same as your main account and should be fine already.

Then, you will have to check all the agreements and review all the information you have entered. Once you verify this information is correct, you can sign with your name and finish the application.

They will finally ask you why you asked for this account. I answered truthfully, and there did not seem to be any problem.

Then, this will be up to the approval team to approve or deny your account. I honestly do not know what criteria they are using to do so. In my case, getting the new account approved took one working day.

Finalize the new account

Once IB approves your new account, you can view both in Interactive Brokers’ web interfaces. For instance, when you view your portfolio, you can choose between your accounts.

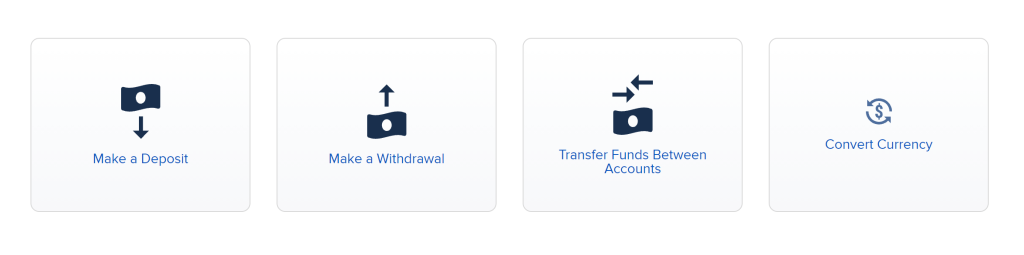

You need to wire money directly to the new account at least once. After this, you can do internal transfers between your accounts. The first deposit is to validate the newly created account.

Once the first deposit is validated, you can access the new internal funds transfer feature in Interactive Brokers. With that feature, you can transfer funds from one account to another. And you can also transfer positions from account to account.

Invest in the new account

You have several ways to invest for your children with this account. And each way has advantages and disadvantages.

The first way is to transfer money monthly, convert it (if necessary), and buy shares in the second account. This technique is fairly simple. But it means doing two transfers (one to your main account and one to your children’s account). And it is also expensive.

You will pay 2 CHF per conversion if you convert CHF to USD. And then, you will pay 0.35 USD to buy a share of a USD ETF. If we take one monthly share of VT, that’s currently about a 2.5% fee on buying shares. This price is high. It becomes an acceptable price if you do not have to convert currency.

If you buy ten shares of VT, that is acceptable. But most parents will not invest that much every month. You could decide to invest less regularly, but that is a bad option since investing often is better.

The second way is to transfer funds from your main account. That way, you can do conversions and transfer some converted cash to your children’s accounts. And then, you can buy shares from there. You will only pay about 0.35 USD per investment.

Finally, you could simply transfer shares from your main portfolio into your children’s account. That way, you can buy shares and transfer some of these to the second account. This is the cheapest way to do it.

Even though it is not the optimal way, I will use the second option. I want to keep track of each operation in the children’s account to know how much I paid for shares. This technique will cost 0.35 USD in extra fees each month, but that is something I can live with.

Limitations

Remember that this technique to invest for your children does not work if you have several IB accounts with the same email address. In that case, you will not even see the button to add a new account.

In this case, you have two options:

- Delete the other accounts.

- Change your email in your other accounts so that your main account is the only one with this email.

This issue happened because I had an investart account with the same email address for testing. And Investart is using IB accounts to invest in your name. Once I cleared this out, I could create a new account.

Robo-advisors alternatives

TrueWealth is an excellent Swiss Robo-advisor with very affordable prices, making it the best Robo-advisor for serious investors.

- Very customizable

Robo-advisors offer a decent alternative to IB if you do not want to use a foreign broker. There are two good robo-advisors with this feature in Switzerland:

- True Wealth will invest in general-purpose ETFs

- Inyova will invest in highly sustainable companies

Both robo-advisors offer a similar principle for your children. You can open an extra account in your child’s name, which will be invested like a standard account. Once your children reach 18, the account will be transferred to their name.

There is one significant advantage to this technique! At 18, the transfer will be done entirely internally without any fees. The shares will not be sold, and you will be left with precisely what was on the account. This is a sound system!

If you are worried about using a foreign broker, Swiss robo-advisors will offer an excellent alternative.

Conclusion

There you have it! A second Interactive Brokers account is a great way to invest for your children. This solution is very cheap, very simple, and very complete.

I use this technique to buy one share of VT every month until I give this account to my son once he is 18. If I have other children, I will then open yet another account.

There are probably other ways to invest for your children. Unfortunately, this is the best way I have found. All other brokers have strong disadvantages, either in costs or efficiency (or both!).

If you are not interested in using a foreign broker, opt for a Swiss Robo-advisor like Inyova or True Wealth.

If you do not already, I recommend investing for you before investing for your children. To help you, I have a guide on how to get started investing in the stock market.

What about you? Do you invest for your children? How?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- Mutual Funds and Index Investing

- Best Personal Finance Books

- Diversification is important – Free lunch in Investing

Great article as usual. I too have been blessed with a baby boy in September and am pretty much in the same boat regards to investing.

I have a question regarding the approach of using a fixed amount per month towards my son’s investment rather than a share a month. IB lets you buy fractional shares. What your opinion on them?

Hi,

Congratulations for you baby boy!

I thought about using fractional shares and investing a fixed amount, it’s pretty good strategy too. It seemed easier to simply buy a share each month rather than deal with fractional shares.

The biggest issue with fractional is that it’s less liquid, so it may have a higher spread when buying and selling. But aside from this, there is nothing wrong with them.

Hi, I know that you aren’t a fan of crypto investing, but the more I read into it, the stronger my convicton that the value of BTC will continue to rise. On top of that, there are several interest paying crypto accounts offering in excess of 8%, (some even at 17%). There is also the option to loan your crypto. There is high volatility in the crypto market, but kids have the benefit of time, so I would argue that they are good candidates for these sorts of investments. Interested to hear your view.

Hi James,

For me, anything that says a guaranteed interest rate of 8% is already a scam. I am not convinced it will be a better investment than stocks in the long term.

I am pretty sure there will still be crypto currencies in the future, but I am not sure BT will still be here in 18 years. I am not confident enough to invest any of my kid’s money into it.

But indeed, in the very long term, it could make an interesting gamble.

Hello,

Thanks a lot for, again, a very good and practical article!

It just seems to me that one section is missing. How do you then transfer the account to your children? Is it that easy in IB to “gift” an account to someone or to change the name of the account holder? Aren’t there some verifications involved?

Kind regards

Hi,

Excellent point. I should have talked about this.

I plan to discuss that with my son before gifting the shares. I plan to create an IB account with him and transfer the shares with Automated Transfers. I won’t be able to gift the account directly.

I want to have a separate account so that I can show him the results of the investing.

Very good article, as usual. Thanks for sharing.

You mentioned the parallel bank account for the child, have you already decided on what bank and/or account type to use? Appreciate if you could elaborate a bit on that.

Thanks!

Hi Manuel,

I created that bank account at Migros. But honestly, I didn’t even compare. I have a bank account at Migros, so I created a kid’s account with them as well. It’s free and returns 0.6% per year.

Great article! Thanks for sharing. I have a query re VT – isn’t that at risk to estate duty in the US? I avoided the Vanguard ETFs for that reason…

Hi James,

This is a common misconception. You can read my article about US ETFs and the US Estate tax for more info.

Great article ! I get the advantage to have a dedicated account especially for the children. That way he gets everything that is on the account, no more no less, and it is good practice to save a little every month. However I have decided not to do it: instead I have decided that he gets 8-10 VT shares per year until he is 18. That means 150-200 shares at the end. That’s it. I don’t have to do open an account, I don’t have to spend additional fees and I don’t have to do any money transfer.

Hi Michael,

So, you are taking the shares out of your own portfolio? How do you know how much you own and how much he owns?

Thanks for sharing!

As I said I consider that he has 8 – 10 shares per year (I have to decide on that :-). Therefore he owns when he is 18 approx 180 shares.

If I have 10000 , then I own 9820 and he gets 180. This is more simple than you think :-)

Haha, if it was me, I would want real-time net worth for me, so I would want to know how many shares I have given each month and so on. But, I do have a tendency to complicate this kind of thing!

It’s good for you if you can manage to keep it simple!

You are totally right but since the name of the account is yours , technically it is part of your NW. Also if you really want to know your real time NW then it is a simple substraction. Personally since the 180-200 shares won’t be such a huge amount of money I don’t really care. But if I would I would simply consider that the 180-200 shares are already paid for him (I have >2000 VT shares) and remove 200* price of VT to the NW calculation.

That’s a good point. I could consider that I already contributed all the shares in advance (216 in my case) and this would make it easy!

whats the advantage compared to buying the etfs for your kid in degiro? also, how do you transfer money or shares between the two subaccounts?

Hi mindz,

There are quite a few advantages:

* You can use U.S. ETFs instead of European ETFs, they are more tax-efficient and have lower fees

* IB in general is cheaper

* IB is a much more professional broker

* IB offers great currency conversions

I have an article comparing both (for European ETFs).

With IB, you can freely transfer cash and shares between the two accounts if they linked.

I put the money from family subsidies (allocations familiales) 200 CHF/month since 1999 and 2001 respectively in a bank account from birth until they were 10 years old, reduced to 100 CHF/month afterwards (as they had more money at 10 than we had at 35 :-).

At some point deciding that they seemed to be OK kids transferred from accounts in our names to accounts in their names a TCS account at 2.5% and another at a local bank at 2%.

Additionally in 2018, my Dad wanted to do a donation higher than the 50K CHF tax free in the Vaud canton, so I asked him to do 2x 10K donations to my kids to invest (Private Equity) in a firm that we know, in honor of my Mom.

As to proper investment in stocks or ETFs, I’ve shared with them what I do (the good and the bad) and I’m trying to encourage them to look at investments but they seem shy about it and not yet willing to test the waters…

Hi Pedro,

Congratulations on saving so much for your children!

If you can find good bank accounts, it is not bad to put money in a bank account. But today, its not great.

It’s great to share with them how you can invest money. I really hope I can transfer my knowledge about investing and money to my son

Thanks a lot for sharing your strategy!

Hi there, thank you for this nice article. I recently opened an IB account too.

One question do you bank transfers from Switzerland to the US directly? Or do you suggest another way to fund the IB accounts?

A friend of mine is doing it from his Revolut account. And then the other question is about the convenience from a CHF to USD conversion perspective…

Thanks for sharing your thoughts

Hi Fernando,

IB has a CH IBAN. You can wire CHF directly to that account from your Swiss bank without any fees.

There is really no need for revolut here. A conversion costs about 2 USD at IB, so it’s pretty cheap unless you convert small amounts.

Hi MPS

Thanks for your articles.

What you mean with VT?

Kind regards.

Great question, I should make that clear in the article. VT is Vanguard Total World ETF. It’s an ETF investing in the entire world. And it’s my favorite ETF and part of the ETF portfolio I am recommending.