How to implement the Trinity study in 2024

| Updated: |(Disclosure: Some of the links below may be affiliate links)

The Trinity Study is the root of the Financial Independence and Retire Early movement. Its main teaching is that it is possible to retire for 30 years based on a portfolio of stocks and bonds, withdrawing a given percentage of the initial portfolio each.

So, if you want to implement the Trinity study and retire early, you must accumulate x times your yearly expenses and then start withdrawing from that portfolio to retire.

But how do we implement the Trinity study? In this article, we will go into the different phases and steps and critical practical points on how to be financially independent following this idea.

The Trinity study

As a reminder, the Trinity study is an old study by professors from Trinity University. They studied the likelihood of a portfolio surviving up to 30 years of withdrawal. They have analyzed different portfolios and withdrawal rates in the United States.

The main conclusion was that you could withdraw 4% a year from your portfolio, which would likely survive for 30 years. The so-called 4 percent rule was born from these results. And the Financial Independence and Retire Early movement was born from this rule, leading many people to try to retire early and live from their savings.

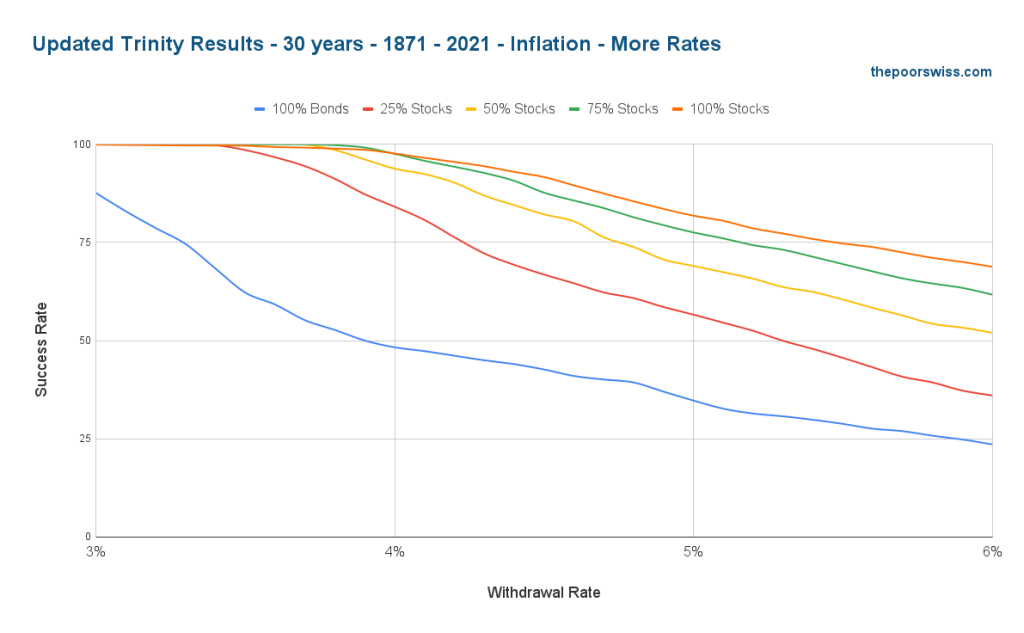

I have updated and improved the results of the Trinity Study up to last year. Even with many more years of simulations and using monthly returns, the study’s results still hold to this day. Using an adapted withdrawal rate, we can survive up to 60 years. However, for most people, the 4% rule would not work. We need to be a little more conservative.

I have already covered various aspects of the Trinity Study, but I want to cover the practical aspects necessary to implement the Trinity Study in detail. By implementing it, I mean retiring early using a similar withdrawal strategy as the study.

We will cover the three different phases of FIRE:

- The planning phase is where you make all the decisions.

- The accumulation phase is where you save enough money to retire.

- The retirement phase is where you live off your accumulated money.

So, this article should contain information for everybody regardless of where they are in their FIRE journey.

This article will assume that you are going to use index investing. If you invest in single stocks, many decisions should be taken differently.

The planning phase of FIRE

The first phase is the planning phase. During this phase, you will decide on everything for the next two phases. It is an essential phase because it will draft the next two.

It is important to get it right. But it does not mean that once you are done planning, you will not be able to change anything. There is room for change and improvement in the next two phases, especially in the accumulation phase.

1. Index ETF or index mutual funds

The first decision is not critical but will define some of the following actions.

You must decide between index Exchange Traded Funds (ETFs) or index mutual funds. The difference in returns is minimal. You can successfully implement the Trinity Study with both ETFs and mutual funds.

The main difference (and the only important one) is how you access these two instruments:

- Mutual Funds are accessed directly through a fund company such as Vanguard or Blackrock. With this account, yOu will be limited in the mutual funds from this company.

- Exchange Traded Funds are accessed on the stock exchange with a broker account. With a broker, you will get access to all the ETFs available.

It is really up to you to decide which you want to use. But in some cases, the choice may be limited. For instance, in Switzerland, we do not have access to good mutual funds (no access to Vanguard), but we have access to the best ETFs. Therefore, in Switzerland, I would recommend choosing ETFs over mutual funds.

If you have access to a great mutual fund provider like Vanguard, investing in their funds will be easier than going through the stock market.

2. Broker or Robo-advisor

The only technical decision should be taken early on. It is not the most critical decision, but it will shape how you go about the other decisions. This decision only matters if you are using Exchange Traded Funds. If you use mutual funds directly, you can skip to the next step.

You need to decide whether you will invest yourself or through a Robo-advisor. Investing directly by yourself is more efficient but requires a little more involvement. Robo-advisors are more straightforward but more expensive. Investing with a Robo-advisor is twice as expensive as investing by yourself.

I recommend everybody to try to invest directly in the stock market. Only then should they go through a Robo-advisor if they do not like it. That being said, there is nothing fundamentally wrong with Robo-advisors. You can also implement the Trinity study with a Robo-advisor. But you need to choose them carefully because some are too expensive.

If you invest by yourself, you will need to choose a broker. A broker is a service allowing you to access the stock market. There are many brokers, but you must choose well to minimize fees and have all the necessary features. I have a few recommendations for brokers.

An important thing to keep in mind is that all Trinity study experiments are done by investing directly in the stock market. Since a Robo-advisor has higher fees, your chances of success will be lower. So, you will have to accumulate more money with a Robo-advisor, which will take you longer. However, I have demonstrated that retiring early with a Robo-advisor is possible.

3. Asset Allocation

One critical choice is to choose your asset allocation. Your asset allocation is the percentage of different asset classes (stocks, bonds, precious metals, and such). For instance, my portfolio is 100% stocks.

Your asset allocation is important because it will drive several other decisions you must make. And it is crucial because if you are choosing an asset allocation that is not suitable for you, you may end up losing money when bad market conditions arise.

When using a Robo-advisor, most services will choose your asset allocation for you. But in some cases, you will be able to choose yourself. And in any case, it is still essential to know your allocation to stocks and what it means.

There is no wrong asset allocation. However, if you are too conservative, you must accumulate more money since stocks are the main returns driver. But you can implement the Trinity study with various amounts of bonds.

If you want more information, I have a complete guide on asset allocation.

4. Choose your portfolio

By this point, you should know your risk capacity and your asset allocation. From your asset allocation, you can choose your fund portfolio. It is important to note that some Robo-advisors (if you use them) will significantly limit your portfolio choice.

The most important point in your portfolio is diversification. You must invest in a well-diversified set of assets. Index investing is great for this because they are many funds that invest in all the stocks of a country. There are even some funds that invest in the entire world. I recommend this kind of fund since it offers the highest diversification.

An important choice is whether you will have a home bias in your portfolio. A home bias is a part of your portfolio allocated to your home country. And this part does not necessarily represent the size of the local stock market (hence the bias). It generally makes sense to have a home bias to help with currency risk. But many people do not have one and are perfectly fine without it.

For reference, my portfolio for an investor in Switzerland is as follows:

- 80% World ETF (VT): Stocks from the stock exchanges of the entire world.

- 20% Swiss ETF (CHSPI): Stocks from the Swiss stock exchange.

For all the details, you can read my guide on choosing an ETF portfolio.

5. Choose your withdrawal rate

I have talked about withdrawal rates in the introduction. A withdrawal rate is a percentage of your initial portfolio you withdraw yearly. For instance, if your withdrawal rate is 4% and your initial portfolio is two million CHF, you will withdraw 80’000 CHF annually.

Therefore, your withdrawal rate is extremely important because it will define how much you need to accumulate and how much you will live on.

Nevertheless, you should not stress too much about it at this point. This is a variable that can be changed several times before retirement. I have already changed mine several times, and I am sure I will change it several times before I retire.

First, you must estimate how long you must live off your money. For instance, if you plan for only 30 years, it will be easier than if you plan for 60 years. But it may be difficult if you plan for 30 years and live 40.

You can choose a withdrawal rate from your asset allocation and estimated retirement time. Each withdrawal rate has a specific historical success rate. So, you need to choose a withdrawal rate with an acceptable success rate.

For this, you can use my FIRE calculator. You can enter your portfolio and years to retirement and will have historical information about a withdrawal rate. You can try different withdrawal rates and choose the one that fits you best.

If you need more information, I have an entire article about choosing a safe withdrawal rate.

6. Find your target

Finally, it is time to find your final target. This target is your Financial Independence Number, FI Number (or sometimes FU number). Once you have reached this amount in your FI Net worth, you are financially free, and you can theoretically move from the accumulation phase to the retirement (or withdrawal) phase.

For this, you will need to estimate your expenses while retired. It is challenging because estimating what will happen in many years is difficult. I recommend basing your estimation on your current expenses and adapting your estimation over time.

Now that you got your expenses and your withdrawal rate, it is time to do some math. Your target is computed by Yearly Expenses * (100 / Withdrawal Rate). For instance, a withdrawal rate of 4% with expenses of 100’000 CHF will give you 2.5 million CHF as a goal.

If you do not like math, you can use my retirement calculator. It will do all the math for you and give you more information, such as estimate your time to retirement.

7. Do not neglect the margin of safety

You have now taken all the decisions from the planning phase and are ready to implement the Trinity study. But I want to remind you not to forget the margin of safety.

Without any margin of safety, a slight change in the environment or simply running out of luck may mean trouble for your situation. Therefore, it is important to consider some margin of safety in each decision.

Here are a few examples:

- You could plan for 5% extra expenses.

- You could reduce your withdrawal rate by 0.1%

- You could add 100’000 CHF to your target

As with everything, this will vary a lot from person to person. Some people are more risk-averse than others. We will add some margin of safety in two ways. We will plan for slightly higher expenses. And I also think I will wait an extra year after reaching my target.

The accumulation phase of FIRE

The second phase is the accumulation phase. This phase will take significantly longer than the first phase. It is the phase during which you will accumulate all the money necessary to start the retirement phase.

At this point, you have already made all the decisions. Therefore, this phase is relatively simple (but not easy).

When should you invest? You should invest in the stock market every single month. Generally speaking, you should invest your money as soon as it is available. So, if you are paid once a month, like most people in Switzerland, you should invest once a month. If you are paid more frequently, you should invest more regularly.

So, once you have money, you must invest it, not wait. If you are using a Robo-advisor, you only have to send money to your Robo-advisor account, and they will invest for you.

If you are investing by yourself, you have a few options:

- You could invest in one ETF per month, which is very cost-efficient. You need to choose the ETF that is the most out of balance. For instance, if your portfolio is 80% VT and 20% CHSPI and CHSPI is only 16%, you invest all your available money into CHSPI.

- You could invest in each ETF based on the allocation. With the same portfolio, you would invest 20% of your available money into CHSPI.

I recommend not rebalancing your portfolio by selling shares during the accumulation phase. Since you have money available, you should use that money to balance your portfolio by investing in the ETFs that are too much out of balance. This is more efficient than having to sell shares. And that way, you will never realize any capital gains.

During this phase, you will also receive increasingly high dividends. You should invest these dividends with your monthly investments.

That is almost all you have to do during the accumulation phase. There are very few things to do, but it will take a long time. The important part is to get your investing into a habit.

Once you experience your first bear market, you must also see whether your asset allocation makes sense. If you sold your shares because you were afraid, your asset allocation was too aggressive for you. And if you wanted to have more stocks when the prices were low, it is likely because your asset allocation is not aggressive enough. So, after a bear market is an excellent time to reconsider your asset allocation.

Every year, I recommend you revisit your plan. If everything goes well, there is nothing to do. But if you are far off target, you may want to adjust. Also, if your expenses have changed significantly, it is an excellent time to adjust your FI number.

The retirement phase of FIRE

Finally, the last phase is the retirement phase (or withdrawal phase). In this phase, you are retired and living off money from your portfolio. Congratulations if you reach this phase!

During the retirement phase, you will withdraw money from your phase. Withdrawing money means selling stocks and getting the money out of your account. This works similarly with Robo-advisors, ETFs, and mutual funds.

I recommend withdrawing money once a month, not once a year. Generally speaking, you should withdraw money as late as possible when you need the money. Ideally, you want your stocks to stay in the stock market for as long as possible.

There is also the question of rebalancing in retirement. There are two schools of thought possible here:

- You never rebalance in retirement to maximize your success rate. Since stocks will generally outperform bonds, you do not sell stocks to buy back bonds so that your overall performance is higher.

- You rebalance yearly to reduce your volatility. If you do not rebalance, bonds will likely be underrepresented, increasing your volley.

This is up to you and will mostly depend on your risk capacity. And if you do not have any bonds, you will not have to rebalance anything.

During retirement, you should keep track of your effective withdrawal rate. While your withdrawal rate is your target, your effective withdrawal rate is how much you withdraw. It is a bad sign if it goes up over time. This may be a sign that you are spending too much.

And that is already all you need to know about this phase.

Conclusion

There are many important concepts necessary to implement the Trinity study. However, once you have passed the planning phase, you will already have made most decisions. The accumulation phase is simple but will take time.

This guide should help you as the main blueprint to plan your financial independence. As you can see, there are many links to further articles if you want to go more in-depth. Otherwise, this article would have been much too long.

We are personally in the accumulation phase. We are at less than 20% of our financial independence target. So, we will be in this phase for at least ten more years.

What do you think about this guide? Are you planning to implement the Trinity study yourself? Did I miss anything?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Dear,

The clarity you provide is exceptional. Thank you so much for doing all the great -and I am sure tedious- work.

I have a question with regard to asset allocation. More specifically property-ownership. How do you suggest I take this into account when going building the plan since property has a different return profile than stocks and bonds?

Thank you again,

Thomas

Hi

Thanks for your kind words, I am glad it’s clear :)

It depends. Your residence itself should be excluded entirely because it does not contribute to your early retirement.

Any investment property should be taken out of the FI net worth n my opinion. However, the returns from these properties can be used to cover expenses. So, you have less to cover with your main portfolio. And I would probably be conservative and only account for 75% (or even less) of the property income given it’s large variability, especially with a low number of properties.

Does that make sense?

Hi,

Very helpful. Thank you.

It makes sense to take out the primary residence since, in order to access it, you need to sell it. Not sure I follow the reason for excluding other properties as that is really an asset allocation with an expected value growth attached to it – be it, lower than stock returns.

thank you again,

Thomas

The problem is that you cannot sell it without consequences: you lose income. So, either you take the value into account into your FI net worth or you take the income into account into your needs. But if you do both, you are double-couting its value.

Something we have seen in this last year that can heavily affect retirement is inflation. Maybe calculators should include this, because we might calculate that we will spend 70k per year, and once we get to that age, that has increased to 85k due to inflation (and that will continue increasing during the withdrawal phase).

There are then other events that can change things, such as kids, inheritances… tricky to simulate everything.

Hi,

Inflation will indeed play a large role. But inflation is taken into account in all of my simulations and calculators.

Thanks for this post, very useful.

Glad you like it.

very useful article

at 50 years of age i wonder if its already too late to start

which ETFs would you recommend specifically

Hi YASIN,

It’s probably not too late to start, but you won’t be able to retire at 52. You could also view this as an aside for your retirement and not live entirely from it.

You can take a look at my recommended portfolio: The best ETF Portfolio for Switzerland in 2023