Investart Review 2024 – Pros and Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Investart is a new online Robo-advisor service that lets you invest in Exchange Traded Funds (ETFs) for a small fee! And not only that! They allow you to invest in custom strategies. So, you could use it either as a Robo-advisor or as a broker for ETFs!

I only recently discovered this service. But it looks exciting. I even started investing some money myself. So, it is time I review Investart.

In this article, I review Investart’s advantages and disadvantages and compare it against similar services!

I wrote this article in collaboration with Investart.

| Management fee | 0.30% per year |

|---|---|

| Product Costs | 0.10% – 0.25% |

| Investing strategy | Passive |

| Investing products | ETFs |

| Minimum investment | 2000 CHF |

| Currency conversion | 2 USD |

| Customization | High |

| Sustainable | Not by default |

| Languages | French, German, and English |

| Custody bank | Interactive Brokers |

| Users | Unkown |

| Established | 2019 |

| Headquarters | Zürich, Switzerland |

Investart

Investart is a Swiss company founded in 2016 by Richard Toolen. The service was publicly launched in 2019. At the beginning of 2021, they reduce their fees to zero! But then, they reintroduced some fees in mid-2021.

They also make money with other services. Indeed, they are proposing several financial services:

- Financial consultation

- Pension planning

- Wealth planning

So, you could invest your money there and then consult with them to plan your financial life and your future investments. Remember that I have not tested their paid services, only their online investment platform.

For more information on the company, I interviewed Investart CEO Richard Toolen. This interview should give you more details about this service.

Investing with Investart

So, we can now review how you can invest with Investart.

The interesting thing is that Investart is a Robo-Advisor, not a broker. But it can do a little bit of both. And it can do it well. I would say that Investart is a portfolio investing service. The service can create a portfolio for you, or you can create one, and the service will automatically invest your money into the portfolio.

There are three ways to invest with Investart:

- Accumulate. You can set a target amount of money you want to reach and your target date. Investart will then derive a portfolio and a monthly amount from reaching your goal on your target date.

- Grow. You can set an initial and monthly investment, and the service will create a portfolio to grow this money.

- Manage yourself. You can create your portfolio from scratch and choose your ETFs.

Moreover, using the Accumulate or Grow methods, you can choose between Conservative, Balanced or Aggressive strategies. In that case, the allocation to bonds will vary. Given the current state of bonds, I think it would be better to keep CHF cash. But this is not a huge deal since most Robo-Advisors do the same thing.

Indeed, even if you start from Accumulate or Grow methods, you can modify the portfolio and switch to a Manage Yourself strategy. If you do not like the bonds, you can switch them over to cash. Of course, you will then have to manage your portfolio yourself.

Investart will rebalance your assets for both methods if they deviate too much (more than 5%) from the target allocation.

With a custom portfolio, rebalancing is semi-automatic. Once your current allocation deviates more than 5% from the target allocation, you can rebalance it. You can then trigger the rebalance from the web interface.

Rebalancing is checked daily, so you cannot change your portfolio during the day and expect changes to be made. Daily rebalancing is an excellent thing since it prevents intra-day trading, which is not a good idea.

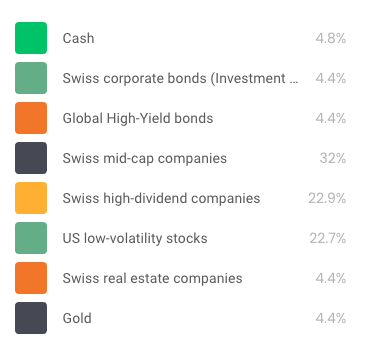

Here is an example of an Aggressive Grow portfolio that Investart generated for me:

This portfolio is typical, although probably a little overcomplicated for me. The amount of bonds is too high for my case. I do not think an aggressive portfolio should need any bond or gold. And it could have better international diversification. However, this is a typical portfolio generated by most investing models. If you look at other Swiss Robo-Advisors, they will always add bonds to a portfolio. So. I am not surprised by this portfolio.

But again, this is not a huge deal since more involved investors can choose their own portfolios. For this, we have access to a large list of Exchange Traded Funds (ETFs). When I wrote this article, there were 70 ETFs. They have a large selection of ETFs for Switzerland, Europe, and the United States. They even have a few (4) ETFs for sustainable investing. But they plan to add more options in the future.

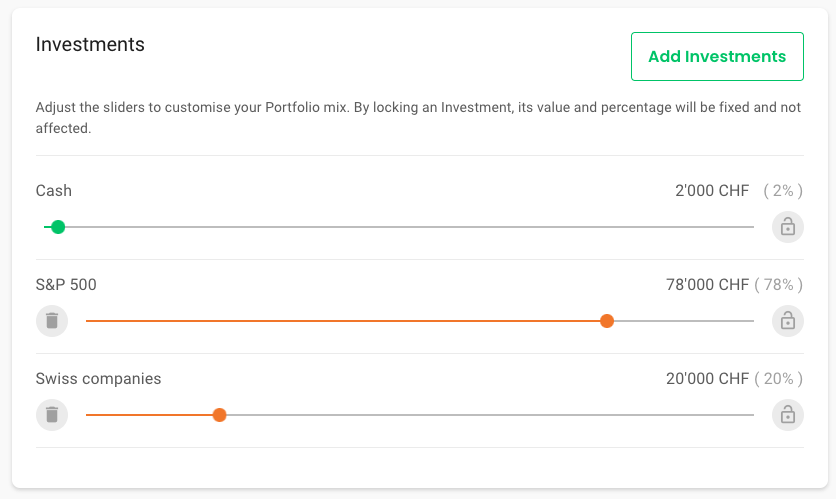

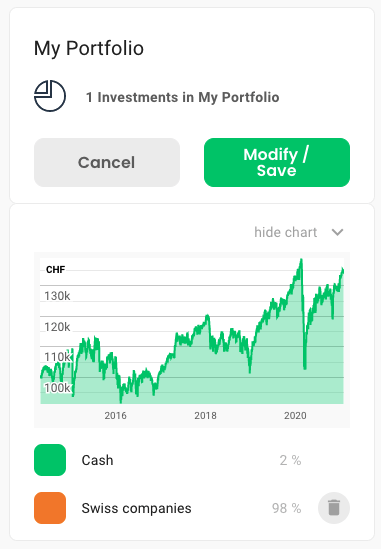

For instance, here is one simple custom portfolio I did:

You can do a lot of things with your custom portfolio. But there are a few things we should note:

- Many of their ETFs are currency-hedged, and I would prefer more non-hedged alternatives. However, there are probably enough non-currency-hedged ETFs to make a decent portfolio for many people.

- You need to keep a minimum of 2% in cash. This is fairly standard since they keep the cash for rebalancing.

You can start investing with Investart with at least 2000 CHF. It is not possible to invest in amounts lower than this.

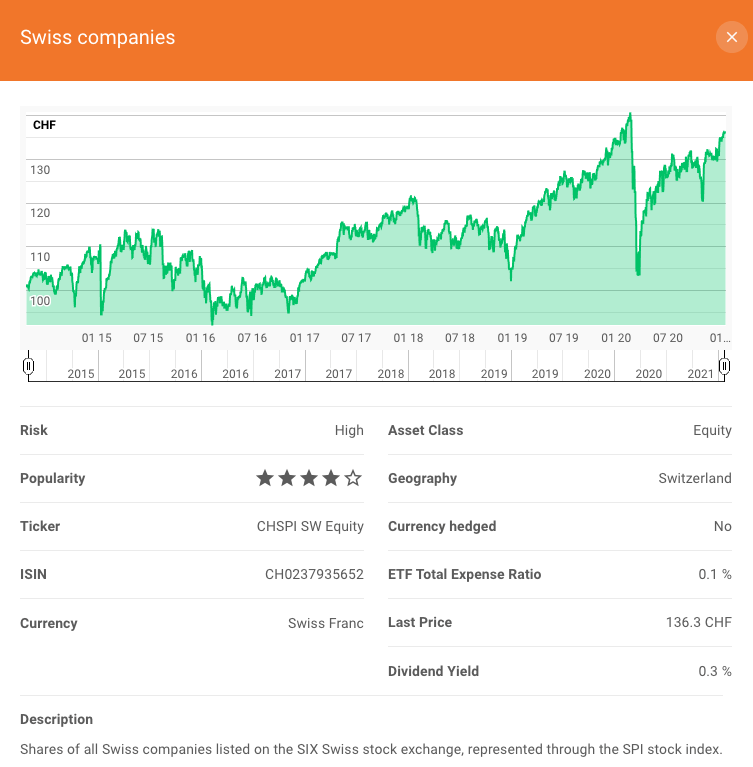

One great thing is that they share the exact ETFs they invest in. For instance, the Swiss Companies block is investing in CHSPI, my favorite ETF for Swiss stocks:

Overall, the investing options at Investart are excellent. For people who are not experts (or do not want to spend the time), the generated portfolios are acceptable. For others, the fact that we can create custom portfolios is really interesting.

With Investart, we also have access to U.S. ETFs. These ETFs are the most efficient ETFs available to Swiss investors.

However, some limitations will make this not entirely optimal. For instance, many ETFs are currency-hedged, which may not be the best option for everybody.

Fees

We should also review the fees of investing with Investart.

With Investart, you pay a 0.025% fee per month. Over a year, this is a management fee of 0.30% of what you have invested with them. Everything is included in this management fee: transaction fees, foreign exchange fees, and Swiss Stamp Tax Duty.

The only other fee you will pay is for the ETFs you are using. And this can go very low. For instance, the CHSPI ETF (the best ETF for Swiss Stocks) only has a Total Expense Ratio of 0.1%. Such a level of fee is as good as you can get.

This total fee is really low. With only a 0.3% management fee, Investart is the cheapest Swiss Robo-Advisor I know. Most robo-advisors in Switzerland are about twice as expensive as that, sometimes even more.

Since investing fees are extremely important, this can make a significant difference in the long term.

Create an Investart account

Creating an Investart account can be started online.

To start the signup process, you can go to Investart and click the big green Sign Up button on the top right corner. Then, you must choose whether you want a Demo or a Real account.

The first step is to choose a username and a password. Then, you will have to verify your ID. The verification can be done with your passport or your national ID.

The verification was not smooth at all for me. I tried to do it from my computer with my webcam (full HD), and it never worked. After ten tries, I gave up and switched to my phone, which worked directly. So, I would encourage you to do the verification on your phone. But this means people on computers need to use two devices.

After this, you will have to fill in your personal information and then your employer’s information.

Then, you will have to give information about your net worth and your trading experience. This is fairly standard. The only weird part is that you have to set the different components of your net worth. And you have to set if they will contribute to the investart account. These are the same questions you get if you open an Interactive Brokers account, and Interactive Brokers mandate these questions.

Then, you must accept all the terms and conditions, sign the documents digitally, and upload proof of residence.

Then, you will be connected to your account. You will probably see a Demo portfolio on your account. But do not worry. This portfolio will be transformed into a Real (non-demo) portfolio once funding has passed.

The first time you log in to your account, you must set up Two-Factor Authentication (2FA). This is a great idea, and it will increase your security!

Your Investart account will be instantly created. However, you must wait for the Interactive Brokers account to be created. And this is a manual process at IB that can take one or two days. In my case, it took one working day to be created. In the meantime, you will have access to your account as a Demo account.

You will then receive an email indicating that your account has been created, and you can deposit money on it. You must do a bank transfer (directly to Interactive Brokers) to top up your portfolio.

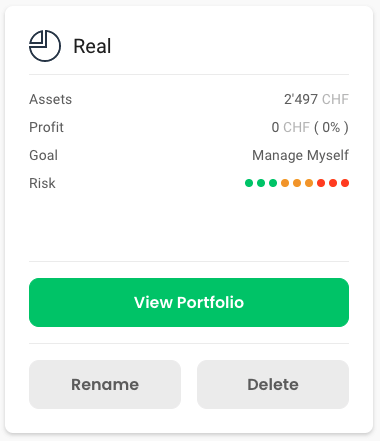

Once the money has been received and processed (one more working day), your account will be fully operational. Here is my simple portfolio:

I funded my account with 2500 CHF, which was invested the next day in my straightforward portfolio. I decided to invest in the CHSPI ETF (Swiss companies), part of my IB portfolio.

Overall, the account creation process at Investart is okay but could be improved. Several things could be improved and cleaned up. For instance, the verification process on a computer camera should be improved. It would also be great if this could be done faster. However, since the main bottleneck is creating the IB account and the money transfer, Investart cannot do much on the speed side.

Security

Of course, we need to look at this service’s security if we invest any money.

From a technical standpoint, everything looks good with Investart. Their website uses good encryption levels and shares good security information. They are also following FINMA compliance for their network infrastructure, which is always a good thing.

One great thing is that Investart is forcing people with a real account to use a second-factor authentication! This is great since this adds a good layer of security.

I have not been able to find information about security issues with Investart. However, since they are very young, this does not mean much, even if it is already a good sign.

Your money and shares are held by Interactive Brokers (IB) UK. Indeed, they use IB as their trading platform for all operations. IB itself is extremely well-regulated and well-protected. Investart will open a dedicated IB account for each customer. This is excellent since it improves the segregation of assets.

The level of protection is entirely appropriate. IB UK is a member of the Financial Services Compensation Scheme (FSCS). This scheme offers compensation for up to 85’000 GBP in case of failure of IB. This protects slightly more than 100’000 CHF (depending on the exchange rate).

On top of that, IB UK is also part of the Securities Investor Protection Corporation (SIPC), which provides an extra level of protection. However, this may not last due to Brexit. But currently, this provides an extra 250’000 USD in protection.

Investart is regulated as an asset manager by VQF (The Financial Services Standards Association). And they are also registered with FINMA. VQF regularly audits them.

Overall, I think that investing with Investart is safe. They are taking the necessary measures to ensure the security of the invested money. The technical security is also quite good. The only thing in their disfavor is their young age as a public investment company.

Alternatives

It is important to consider alternatives when reviewing a product. We can compare Investart with some alternatives.

Investart vs a broker

Investart is not a broker, but it lets you invest in a portfolio of ETFs. For a passive investor, this is all that matters, so it is interesting to compare Investart with other brokers.

It is difficult to compare with other brokers since the fees are flat regardless of how much money you have and how much you invest. For small accounts, Investart may be slightly more expensive than some brokers. And with large accounts, Investart may be slightly less expensive than some brokers, especially large brokers. But overall, the prices are in the same order of magnitude.

However, with an actual broker, you can access more ETFs than the 70 ETFs available at Investart. Now, for most people, these 70 ETFs will be enough. However, if you have some niche needs, this may not be the case.

If we compare with Swiss brokers, I think that Investart is better for simple and passive investors. They will be slightly cheaper and offer enough ETFs.

Compared with the best broker for Swiss investors, Interactive Brokers, IB still leads the way. IB will be even cheaper than Investart. And with IB, you can invest 100% of your money. So, I think that the ability to choose more ETFs at IB is a nice advantage. On the other hand, with Investart, you will get a slightly easier experience and robo-advisor service. Investart is the only Swiss service that even comes close to IB.

Overall, Investart could be an excellent alternative to a broker, especially a Swiss broker, if you can make a portfolio with a choice of 70 ETFs.

The main advantage of Investart is that it is easier to use than a traditional broker.

Investart vs a Robo-Advisor

Investart offers the same services as a Robo-Advisor. Indeed, with the Grow and Accumulate strategies, your portfolio will be adapted based on their financial models. So, we can compare Investart with other Robo-Advisors.

From a fee point of view, it will all depend on the amount of money invested. Investart is expensive for small portfolios and cheap for large portfolios. They may be significantly cheaper than affordable Robo-Advisors like Selma (my review) and True Wealth (my review).

Since they give you strong strategies, they provide the same features as other Swiss Robo-advisors. Having about 70 ETFs in the choice makes it very interesting. And they are the only Robo-Advisor with U.S. ETFs.

Investart has a few missing features compared to other Robo-advisors. For instance, they do not have options for sustainable investing. Also, the reporting is a little lacking compared to other Robo-Advisors to give you an overview of your finances.

The other disadvantage is the company’s young age compared to most established services. However, since they are well-regulated, I do not think this is a big issue.

Overall, investart is much cheaper than other Swiss Robo-Advisors. As such, it has a major advantage. So, if you are looking for an affordable Robo-Advisor with a good investment portfolio, it is a good choice.

FAQ

Is Investart free?

No, Investart has a 0.025% management fee per month. This amounts to a total 0.30% fee per year.Since they invest in ETFs, you will also have to pay for the ETF fees yourself (the TER).

How does Investart make money?

On top of the management fees, they are providing paid services to their users. For instance: Pension planning, Wealth planning and Personal consultations for investing.

What happens if Investart goes bankrupt?

The great thing with Investart is they are opening IB accounts in the name of each investor. So, if they went bankrupt, this money would still only belong to the user. The money would not be part of the bankruptcy settlement. In case of bankruptcy, the user could claim the Interactive Brokers account as his own. That way, he would be able to keep his shares and continue investing. Of course, this means he would have to pay IB fees, and he would not have a managed portfolio. But this is a great way to ensure the safety of the money.

Who is Investart good for?

Investart is good for investors that want to aggressively invest in the stock market, with medium to large sums of money. These investors should not mind having their funds held by a foreign broker (Interactive Brokers).

Who is Investart not good for?

Investart is not for investors who are afraid of foreign brokers. And Investart is also not great for people wanting to start to invest small sums because of relatively high fees in that segment.

Investart Summary

Investart is a very interesting robo-advisor, based on Interactive Brokers. They offer low fees and good access to ETFs.

Product Brand: Investart

4

Investart Pros

Let's summarize the main advantages of Investart:

- Very cheap Robo-advisor

- Invest in index ETFs

- Access to U.S. ETFs

- You can create your own portfolio

- Transparency on the ETFs being used

- Well-regulated

- Good technical security

Investart Cons

Let's summarize the main disadvantages of Investart:

- Very young company

- A limited set of ETFs to invest in

- Focuses on currency-hedged ETFs

- You need to keep at least 2% in cash

- Few options for sustainable investing

- Online verification process could be better from a desktop computer

- It takes a few days to open an account

Conclusion

Overall, I am impressed by Investart! Their offer is interesting. When it was free, I opened an account and started investing with Investart to test it.

Now that it is not free anymore, it will only be interesting for large portfolios. If you have over 20’000 CHF, the fees start to look interesting. But below that, the fees are expensive. If you have more than 50’000 CHF in your account, Investart will be the cheapest Robo-Advisor for you.

You can use Investart like a Robo-Advisor, and it will choose a portfolio based on your needs. Or you can manage your portfolio directly. And you have access to U.S. ETFs! So, this is a very efficient portfolio.

There are also some other disadvantages. For instance, you have only a limited set (about 70) of ETFs you can invest in. Also, Investart is a very young company, and they still have to work on the business model. So, we will have to wait and see how this works long-term.

If you need help setting your portfolio, you can look at my guide for creating your own ETF portfolio from scratch.

What about you? What do you think about Investart?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Robo-Advisors

- More articles about Investing

- Inyova Review 2024 – Pros and Cons

- Interview of Felix Niederer, CEO of True Wealth Robo-Advisor

- Swiss Robo-Advisors 2024: Invest without any hassle

Hi Baptiste,

I’ve been reading your blog and would like your opinion on Investart’s auto-generated portfolios.

First off, I’m not proficient when it comes to investing, which is why I opted for their suggested aggressive portfolio to grow my savings:

US Stock (40%): MSCI USA

Swiss mid-cap stocks (35.9%): ISHARES SMIM

Swiss high-dividend stocks (26%): ISHARES SWISS DIVIDEND

Swiss real estate stocks: (1.3%)

After reading a few of your blogs, I find the allocation to my home bias to be quite high. I’m 28, not risk averse, with a longer timespan on the market. I’m thinking of switching to your suggested 80% VT and 20% Swiss stocks.

Happy to receive your opinions and thoughts on this. I also don’t want to jump into this without more consideration since, again, I’m not that competent with investing.

Thank you!

Hi Julian,

It’s not a bad portfolio, but I would indeed recommend some changes. If you are young with a good risk capapcity, I would increase the number of international shares to 70 to 80%. The portfolio you mentioned has too much Swiss stocks. And in Switzerland, it makes little sense to focus on dividends because of taxes.

And 1.3% in real estate is simply dumb because it will make no other difference than to complexify your portfolio.

Hi Babtiste,

Many thanks!

You are welcome!

Hi Baptiste,

Do you know if this firm is still alive? They haven’t posted anything in their blog/socials in almost a year and on the web there are no other reviews other than yours. What do you think, is it trustworthy?

Thank you!

Hi Roberto,

That’s a great question. I will ask them and update back here based on the answer.

Hi Roberto,

I just contacted their CEO, who confirms everything is running smoothly. They had a change in marketing that explains the lack of news.

We should expect some communication again on the different channels in the next few months.

Hallo M. The poor Swiss

I am thinking about to start either with truewealth or investart. I didn’t decide it yet.

Investart has like half of the fees from TW but the fact that is a young company is keeping me in doubts.

My question:

In case I start with one of them and later, there is a good reason to change the robo advisor. Would it be easy to do? It is depending the robo, to offer a service like that?

Maybe it would be a interesting topic to make an article.

Thank you in advance

hi,

It’s easy to change robo-advisor, but it may not be efficient.

To change robo-advisor, you have only one choice: sell everything and withdraw to your bank account, then transfer to the new one and wait until the money gets invested.

The problem is that you may be out of the market for a few weeks with that. It’s not the end of the world, but it’s also not very efficient.

But that does not mean you cannot change.

Why not try both IS and TW? You may even keep them both in the long term.

Thanks for the review.

There is no mention of currency exchange spread and I wonder/suspect is revenue generating for Investart. Can anyone comment? Other reflection on my side is risk related to providing all key identity documents for account opening to such a young company.

One further query is if an independent IB account is created, can it be accessed directly subsequently?

Thanks again for the review and kudos to Investart 👍🏻

Hi Trin,

Since they use IB as a platform, I am assuming that they also use IB for currency conversion. This would lead to excellent currency conversion rates.

It’s indeed a risk considering the fact that they are starting out.

I believe you can access the account yourself, you can request this information from Investart, but I have never tried.

I’ve just got the email from Investart that they added VT ETF as World Stock category. They even ask which US ETF we would like to see on the platform next.

That’s a great new for small (and not so small) investor in Switzerland, to have access to this and other ETF without fee (in the background you have an IB account that Investart manage for you without paying the 120$ fee below 100k of invested money).

I’ve already deleted 3 ETF to replace them by VT in my portfolio and reduce my TER for a similar or better exposure.

Thanks for the review.

I found the lack of social presence of the team and transparency, understanding of the business model suspicious despite of finding the service extremely interesting theoretically