How to start investing in the stock market in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Do you feel overwhelmed with investing? And you do not know where to start with investing? Do you want a simple guide on how to get started with investing?

Then, this guide is exactly what you need! This article is a step-by-step guide to investing in the stock market.

First, I cover the things you should know before you start investing. And then, I cover how you could get started with investing.

Know why you want to invest

First, you need to understand why you want to start investing. Your reasons for investing will matter a lot in how you will invest.

There are many reasons to invest in the stock market. But we can group them into two categories:

- Investing in the short-term to buy something. It could be to buy a new house, for instance.

- Investing in the long-term for your future. It could be to pay for your retirement. Or you could invest in the long-term for the education of your child.

Now, it is essential to know that investing is a long-term game. If you want to buy a house next year, it is probably not a good idea to invest now. Why is that? As we will see in the next section, the stock market is volatile. It will provide good returns, but only on average. What will you do if you invest now and the market drops 20%?

So, I would only recommend investing if you are investing for the medium or long term. You need to answer a simple question: Can you wait until the market recovers if it goes down?

For instance, if the market goes down 20% next year, will you be able to wait one year or more until it recovers?

If you cannot answer yes to this question, you are probably better off investing. If you sell because you fear the losses, you will be in trouble. There will be some negative years in your investing journey. And you will need to wait until it recovers. Selling in a downturn is the worst thing you can do!

Know why you should invest

You already know why you want to invest. But do you know why you should invest? Could you not save money and let it rest in a savings account and achieve the same goals?

There is one big problem with cash: inflation! The value of your money will decrease over time. Inflation increases the prices of goods over time. On average, inflation goes up.

Inflation means the money you acquire through hard work will have less value. With the same amount of money, you can afford fewer goods.

And the problem with bank accounts is that they do not follow inflation. By leaving money in your bank account, it is losing value over time.

On the other hand, investing in the stock market has higher historical returns than inflation. Investing means that you will generate more value from your money. And inflation will not eat up all your gains.

And since the returns will be higher, your money will grow without you having to do anything. You want your hard-earned money to work for you!

Know the stock market

Then, you also need to know the stock market. Do not worry. You do not need to know everything about it! You do not even need to know the details!

But there are several things you need to know before you even consider investing in the stock market.

First, there is no such thing as an investment without risk! All investments have some risks. It is up to you to decide on the level of risk you are willing to take.

Even low-risk investments will have negative returns sometimes! If you pick a low-risk instrument such as government bonds, you will still experience some downturns. There have been some years where bonds have performed very poorly. We are talking minus 20% in a single year!

You only lose money if you sell in a downturn. You should mix up paper losses and realized losses. If you check your account one day and see you are ten percent down, this is only a paper loss. If you sell, it will become a realized loss. It is essential to understand this.

Finally, you should not time the market. Timing the market means you buy or sell at a particular time in the hope of making a profit. For many people, this means waiting to buy or selling early. But on average, you will lose this bet with the market. People are not able to beat or time the market.

Know the difference between stocks and bonds

In the stock market, there are two main instruments: bonds and stocks. There are others as well. But these two are more than enough to get started.

A bond is a debt that an entity issues. This entity could be a government, a municipality, or a corporation. To keep it simple, you should only focus on government bonds. They are the safest and most straightforward. A bond has a time to maturity and interest rate.

When it needs money, the government will issue bonds people can buy. In return for their money, the bond buyer will receive interest payments regularly. Once the bond reaches maturity, the buyer will receive its money back.

The stock of a company is the set of all the shares of this company. You do not buy stocks directly, but you buy shares of stocks. By purchasing a share of a company’s stock, you will own a part of the company.

People investing in stocks are expecting the share price to grow. Generally, as the company grows, so does its share price. Another advantage of some shares is that the company pays a dividend to its shareowners.

Once a company has some money, it has several choices. It can invest in itself to grow. Or the company can give the money back to the shareowners as a dividend. This dividend will be given in cash to you into your broker account.

In practice, there is one significant difference between these two instruments: bonds have smaller risks and smaller returns, while stocks have higher risks and more profits.

In short, it means that stocks are great for the long term. And bonds are better for the shorter term. But bonds will reduce the volatility of a portfolio. They are good for your risk tolerance.

Know what are index funds

Now that you know what stocks and bonds are, you may think that the next step is to choose companies to invest in (picking stocks). But this is not the case! Investing in individual stocks is not a good thing for most people.

Historically, picking stocks had lower returns than the average market itself. Picking stocks is called active investing because people choose which companies to invest in. On the other hand, with passive investing, you invest in a collection of stocks representing the market. These collections of stocks are called indices.

An index fund is a fund that contains all the shares of the index. Instead of buying shares of the stocks, you purchase shares of the index. And by doing so, you do the equivalent of buying shares of every stock in the index. If the market does well, your shares will do well.

There are many advantages of passive investing:

- It outperforms active funds on average.

- It is simpler since you do not have to pick stocks.

- It is cheaper since fees on index funds are generally lower than on active funds.

- It has greater diversification.

Therefore, I would recommend that if you are getting started, you start with passive investing!

Decide between mutual funds and ETFs

As we have just discussed, index funds are the best instruments to start investing. However, index funds come in two flavors:

- Index Mutual Funds. They are funds directly managed by a financial institution.

- Index Exchange-Traded Funds (ETFs). They are funds traded on the stock market.

There are also active mutual funds and ETFs, so ensure you focus on index mutual funds and index ETFs.

Both of these alternatives are index funds. They both invest in many shares and replicate the index itself. You must decide whether you want to invest in mutual funds or ETFs.

The only notable difference is how you invest in these instruments.

- To invest in a mutual fund, you will not need to access the stock market. You can invest in mutual funds through a financial institution like Vanguard or BlackRock. Your big national banks (UBS, for instance, in Switzerland) will also offer access to some mutual funds.

- On the contrary, to invest in an ETF, you will need access to the stock market. You will use a broker as the intermediary. And then, you will purchase shares of an ETF as it was a stock.

Mutual funds are simple to invest in. However, there is a big issue with them in many countries. Most of us do not have access to good mutual funds. For instance, one of the best mutual fund providers, Vanguard, does not offer mutual funds in Europe. We have access to many funds from our banks. But these funds are significantly more expensive and smaller. So, they are inferior alternatives.

It is why most European people invest (or should be) through Exchange Traded Funds (ETFs). Like me, if you are in Switzerland, you have no choice but to invest in ETFs unless you want to waste your money on fees!

If you have access to good mutual funds, for instance, in the United States, you can start to invest directly with them.

If you do not have access to good mutual funds, you will invest in ETFs through a broker account (more on that later).

Choose your asset allocation

Whether you decide on mutual funds or ETFs, you must choose an asset allocation.

Asset allocation is a fancy term that simply means how much bonds, stocks, and cash you have in your investment portfolio. For most people, cash is not part of their portfolio. So you can focus solely on bonds and stocks. Your cash will stay separated from your investment portfolio.

Now, there are no good or bad asset allocations. You need to know the difference between different asset allocations and choose one that suits you personally!

We have already seen that stocks are more volatile and have higher returns. On the other hand, bonds are more stable but will bring lower returns.

Based on that, you should choose your asset allocation based on these factors:

- Your risk tolerance. How much risk are you capable of handling? If your portfolio is down 30%, what will you do?

- Your investing term. How long will you be investing before you will need this money?

Having a good risk tolerance means the ability to take on more stocks. And a long investing term also means you can have more stocks in your portfolio. But do not take these two factors independently. You need to consider them both.

For instance, if you need the money in 20 years (very long-term) but have a low risk tolerance, you should have a significant amount of stocks regardless.

You should not even consider having less than 40% of stocks. You need stocks to have good returns. Here are the most popular asset allocations:

- 100% of Stocks: Investing for the long-term and excellent risk tolerance.

- 80% of Stocks: Investing for the long-term and good risk tolerance.

- 60% of Stocks: Investing for the medium-term or average risk tolerance.

- 40% of Stocks: Investing for the medium-term or low risk tolerance.

These are only rules of thumb, of course. Nothing prevents you from a 75/25 portfolio. It would be a perfectly fine portfolio.

And one last thing on asset allocation: It does not need to be set in stone. You should not change it often. But you can change it. First, as you age, your risk tolerance may change. And as you get closer to your term, you may want to increase the bonds to avoid a big surprise.

If you want to see the difference between asset allocations, you can check these retirement simulations. And if you need more details on this subject, I have an entire guide about asset allocation.

Choose a portfolio

Now, you know the allocation to stocks and bonds in your portfolio. It remains for you to decide on what indexes you will invest in. You do not have to pick stocks. But you still need to pick indexes.

Choosing a portfolio is essential. You should not rush this decision. You must choose a portfolio that will suit your needs.

To simplify your search, you should avoid index funds that are too specific. For instance, you should not invest in sector index funds. These funds are investing in only one sector, such as Technology. They introduce a bias towards an industry. Keep it simple and invest in whole countries.

The same is true for funds that only invest in companies of some sizes. For instance, some funds are invested only in small companies. This is also a bet on which companies are doing to do best. And you should avoid bets! You need to bet on the entire market. It is the safest bet.

You will need to decide in which countries you want to invest. If you live in a vast country like the United States, you can invest only in your country. But if you live in a tiny country like Switzerland, it is best to diversify across many countries.

If you have bonds in your portfolio, I recommend only investing in bonds from your country in your currency. The idea of bonds is that they will reduce the volatility of your portfolio. If you add currency risks to that, you lose some of the advantages of bonds.

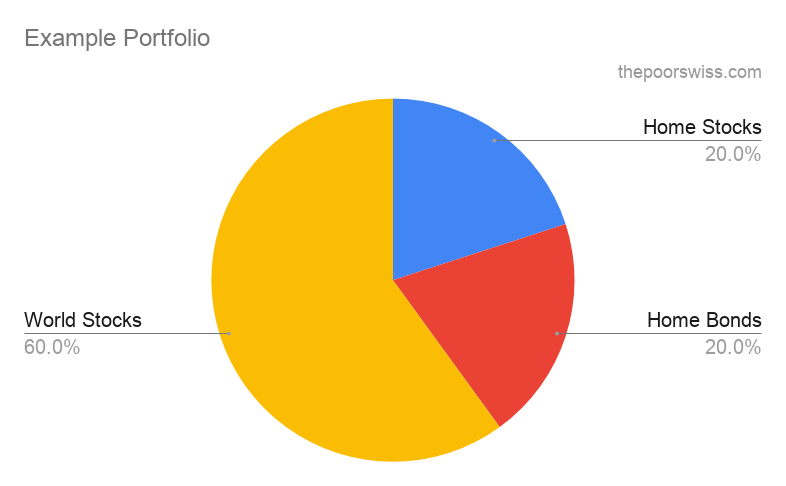

A good portfolio could be 80% of World Stocks and 20% of Swiss Stocks for Switzerland. If you want bonds, you could do 60% of World Stocks, 20% of Swiss Stocks, and 20% of Swiss Bonds.

For me, the best funds are the ones covering the entire world. For instance, Vanguard Total World (VT) is an excellent ETF. It is the one I am investing 80% of our portfolio with. But there are others. I would recommend you consider a world portfolio as your base index fund.

Once you have decided which countries you want to invest in, you can pick the best index fund for each country. There are many tools to compare ETFs. My favorite tool for this is justETF.

If you want more information on this step, I have a complete guide on designing an ETF portfolio from scratch. This guide will help you choose an index, select a fund for this index and finally put your funds together to form your portfolio.

Decide how much you want to invest

Now, it is time to decide how much you will invest.

First, do you already have some money that you want to invest? If you already have a lot of cash, you can consider investing part of it.

Then, how much do you invest to invest regularly? Investing part of your monthly salary in the stock market is a good idea.

Of course, it is also a matter of how much you can invest. You must remember that this money will not always be available. You need to invest money that you do not need right now. If the market is down and you need the money, you will realize significant losses. So if you know you will need the money, do not invest it!

You should also keep some money in the form of an emergency fund. And you should not invest your emergency fund since you want it to be available.

An excellent way to get started is to start with lower amounts. You can decide to invest 100 CHF each month. Or it could a 1000 CHF. It will depend on your budget and means.

It is much better to get started now with 100 CHF per month than never to invest. Starting with little money will help you break your investing paralysis.

As for the frequency, I recommend investing every month. But some people prefer to invest quarterly. I think it is good to invest as soon as you have money available for it.

Decide how you want to invest

There is one more thing you need to decide. You have three main options to invest in the stock market:

- Invest through a bank

- Invest through a Robo-advisor

- Invest yourself

I would discourage you from trying option one. Banks are expensive to invest in and are the worst option. There remain two options, investing by yourself or through a Robo-advisor.

By investing by yourself, you will maximize the efficiency of your portfolio and minimize the fees. However, this means more complexity and time necessary to invest. And you also have more margin for errors and personal decisions.

On the other hand, a Robo-advisor will add substantial fees to manage your portfolio. This is easier. Since the platform will manage your portfolio, you will have few things to do.

I invest myself and recommend most people do that. However, if you do not feel ready, investing with a Robo-advisor is much better than not investing.

For more information, you can read about how much time investing by yourself takes and the different levels of investing.

Choose a broker

You know enough things and have decided on what to invest in. It is time to get started with the actual investing.

You will not need a broker if you use mutual funds instead of ETFs. You just need to create an account with the chosen fund provider.

For investing in the stock market, you must use a brokerage company (a broker for short). Your broker is the intermediary between you and the stock exchange. Against a small fee (more on that later), the broker will place orders for you on the stock exchange. Without a broker account, you will not be able to buy shares of your funds on the stock market.

Each country has many brokers. Most big banks will be brokers themselves. However, banks are not the best option for a brokerage account. They are way too expensive. We are talking about an order of magnitude more expensive.

As a small example, we would buy 2000 dollars of shares on the New York Stock Exchange (NYSE). In PostFinance, this would cost us 35 USD. With Interactive Brokers (IB), this would cost us 0.5 USD! PostFinance is 70 times more expensive than IB.

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

For Europe, there are two great brokers:

- Interactive Brokers. It is a U.S. broker with a U.K. branch for European people. They have very low prices and offer a wide range of investments.

- DEGIRO. It is a European broker from the Netherlands. They also offer a good range of investments at low prices.

I recommend IB over DEGIRO because they have lower prices and a better offer of investments. They are also more professional, and I trust them more than DEGIRO.

I would recommend you start investing with IB. If you are still hesitant, I wrote a comparison of Interactive Brokers and DEGIRO.

If you want to avoid foreign brokers, you can opt for a Swiss Broker.

Choose a Robo-advisor

If you decide to invest through a Robo-advisor, you must choose which. There are many Robo-advisors in Switzerland.

There are very significant differences between Robo-advisors:

- Some are much more expensive than others

- Some are investing differently

- Some are much more complicated than others

|

4.5

|

4.0

|

|

Great Robo-Advisor

|

Very affordable

|

|

|

|

|

|

Good

|

Good

|

- Beginner-Friendly

- Degressive Fees

- Great diversification

- A good strategy with ETF

- Little customization

- Outstanding fees

- Very customizable

- Great diversification

- A good strategy with ETF

- High minimums

- Not always easy to use

For Robo-advisors, I recommend going with either:

- True Wealth for their excellent fees

- Selma for their simplicity

You can also try both if you want and decide later which one you want.

Make your first investment!

You have now made all the necessary decisions. You can make your first investment in the stock market!

If you are using a mutual fund, transfer your funds to the mutual fund provider and invest the funds in your choice’s mutual fund.

If you are using an ETF, transfer money to your broker account and purchase shares of the ETF of your choice.

Congratulations, you are now invested in the stock market!

Keep it going

Getting started with investing is a great thing. But you need to keep it going. From now on, you should invest regularly.

I recommend investing every month. Even if it is small amounts, it will pile up quickly. It is how I am investing. After receiving my salary and paying all the bills every month, I transfer the remaining amount to my broker account. And from there, I buy the shares of my portfolio.

To limit your costs, I recommend buying only one ETF shares each month. The best way to invest is to purchase shares of the ETF that is the most out of balance.

For instance, you want 60% of the VT ETF and 40% of the CHSPI ETF. If you only have 30% CHSPI, you buy shares of CHSPI this month. On the other hand, if you have 55% of VT, you buy VT this month. It is a great simple way to keep your portfolio balanced.

Conclusion

Following all these steps will help you start investing in the stock market. Investing is a great way to make your money work for you. And it will help you beat inflation.

I realize these are many steps. But these are all small steps. You do not have to rush through them. Even if this takes you one month to decide on everything, this is fine. You do not want to rush any decision.

Once you start developing a routine of investing, it will get simpler. And as soon as you begin to get the investing going, you will start to see the benefits of investing. It feels great when your portfolio grows without you doing anything.

I hope this will help you get started. If there is still something unclear, let me know in the comments below.

To get started, you can read more about the best brokers in Switzerland. Or, if you want to get started with IB, find out how to buy your first ETF with IB.

If you want more reading about the stock market, you can read about the myths surrounding the stock market.

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Thank you for the answer, now forgive me, i have another question about ETFs. You say you use JustETF as a screening tool to find ETFs. I tried it today and I’m under the impression it provides no ETFs that are listed in the USA, only European exchanges. Is that right, and if yes, why is it so? I use IBKR and I have access to USA ETFs too, is there an appropriate search tool for American ETFs?

You are correct. I think it used to show them but since the breakdown on US ETFs by the EU (to promote their own funds, not for their customers), I think they simply removed them all since most people in the EU cannot use them.

Unfortunately, I do not know of any good tool for US ETFs. I am generally looking for an index and then researching ETFs for that index on Google. There are some good resources on MorningStar and ETFDB, but not as good as justetf.

Hi Baptiste, thank you for this website which is really helpful. I have a question about currency risks. As a CHF-based investor, I am wary of long-time investments in USD or EUR (look at the 10 year USDCHF or EURCHF charts…). If I understand correctly, you invest a lot in USD-denominated ETFs. Do you have a plan for currency hedging? Is that something a retail investor is able to do at all?

Thank you, Andrea

Hi Andrea

I believe that in the long term, currency hedging is not useful. So, I will simply take currency exchange into account and reduce my withdrawal rate accordingly. I think a CHF-investor should be more cautious than a USD investor for that. But not much more is necessary.

I have an article about currency hedging if you want more detail: Should you use currency hedging in your portfolio?

I have question on how you invest, meaning the mechanics of it. So far, my only experience is with an “ETF savings plan” with a German bank: You create that savings plan, choose the ETFs and how much to invest in each per month and then the shares are bought automatically on the same day each month and as many as you get for the pre-set amount and by that I mean also fractions of one share, say 1.534 shares of one ETF in one month. This way, I spent the same amount each month.

Now I am looking at Neon Invest but to do the same there I would have to manually buy every month and only full shares. So how do you do it? Do you calculate each month what your savings equal in shares and buy? What if a share is several hundred Dollars and you just don’t have enough for another one, do you buy more the next month?

I kind of really liked the system so far because it assures I get as many shares as possible for my money as soon as possible without having to wait until I have enough for one whole. But I am thinking of moving to a Swiss solution if only to a) not lose to German capital gains tax every time dividends are distributed or should I decide to sell (or that decision made for me as recently happened with a reverse split, where the fractions of a share were sold for me without any notice) and b) make the tax declaration easier with the e-tax document because inputting all those buys per month every year is SO tedious.

Hi Barbara

My protocol is extremely simple. At the end of the month, I transfer what is left above in my account (minus my emergency fund and about a 1000 CHF extra) to IBKR. And then, I buy one ETF, the one that is the most out of balance in my portfolio. I only buy full shares, so I buy as many as I can with the money available. And that’s it. IF there is money left, it’s not lost, it will be there next month.

IB also has features to automate investments.

Don’t think too much about it, it’s a simple thing, keep it simple.

Hello Baptiste,

Can you please elaborate on why you recommend buying only 1 ETF a month oe how that reduces costs as proposed.

How does that apply for people who want to invest weekly?

Hi Edmund

If you have a portfolio of N ETFs, you can invest in N ETFs each month. For instance, with 50/50 split, you would invest 50% in A and 50% in B

Or, you could invest in A one month, and then in B the next month and then in A again, … Basically, you invest in the ETF the most out of balance every month.

You divide your transactions by N approximately.

You can do the same weekly, by investing in only one ETF each week.

Hi Babtiste ,

Question on retiring to another country. I currently live in switzerland and want to follow your advise and invest in ETFs through interactive brokers.

If I retire back to UK will I need to do anything with my investments

Hi Niall,

Since we use IB UK, you should be fine to relocate to the UK, and your account will not change. You will simply have to change your residence.

Since the UK is not the EU anymore, I am unsure whether you can access US ETFs in the UK, but this should not change much. In the worst case, you will not be able to buy more US ETFs, but you can sell.

Are there CHF money market funds in CH, like are now very popular in the US? I am sitting on a fair amount of CHF cash, and I find the stock and bond market markets too unpredictable now. A nice, safe MMF yielding 4+% sounds pretty good right now. Any thoughts on these?

Hi Jay,

At least, both CS and UBS have money market funds available. However, I am not sure they are available as ETF.

However, you are not going to get 4%. These funds may slightly better interest rate than the bank accounts, but not much more since they are based on the same thing: CHF interest rate.

Also, keep in mind that these funds can change interest rate very quickly, it’s nothing guaranteed.

Thanks, Baptiste. I saw the UBS (Lux) Money Market Fund – CHF (ISIN LU0395198954) on the UBS website, as an example, but it does not look nearly as attractive as a USD MMF. It doesn’t seem to maintain a CHF 1 value and it’s returns are very low. What would be something analogous to a US MMF in the Swiss context — low risk but stable return?

Low risk but stable returns is a direct bond. You can get CODs at your local banks.

Hi Baptiste,

I am living in Switzerland and wanted to invest a sum of money I got through an inheritance. Your blog has been a great source of information and at this point I have clear how I want to invest. Of course, as you say american ETFs are great but I am having cold feet about the fact that the US dollar is more in danger than ever for losing its status as world currency reserve. I am worried about what this could mean for the States and our investments mainly in USD. I am not saying this will happen overnight but as long term investor I would worry about a huge depreciation of the dollar . What are your thoughts on this?

Hi Raquel,

Thanks for your kind words :)

I am not really worried, because this will happen over time and we will adapt.

If you are worried about that (perfectly fine), you have two options:

* You can increase your home bias: Should you have a home bias in your portfolio in 2023?

* You can use currency hedging: Should you use currency hedging in your portfolio?

Hi Baptiste!

I know my home stock market very well but I’m totally “illiterate” when it comes to the Swiss one. I am a long term active investor (retirement purposes) and my stock portfolio is focused on dividends (volatility balanced with bonds). It has worked for a long time and therefore I have a hard time to have to move on to starting investing on funds, but I also have heard that it is extremely costly to actively invest in stocks in Switzerland. I would have time to do my homework, if that’s the only condition – which i understand that many don’t feel safe. What would you do in my case?

Hi,

If you are an “active investor” in dividend stocks in another country, I am not sure you need to invest in the Swiss stock market. There are a few interesting stocks I guess, but it’s very small.

The Swiss Stock Exchange is indeed an expensive exchange. But again, I am not sure there are benefits for people outside of Switzerland to invest directly in these stocks.