The 4% Rule for Swiss Stocks – Can you retire early?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Today, we see if the 4% Rule works in Switzerland, with Swiss Stocks, or not. I have wanted to do this experiment for a very long time. Now, I got all the data I need for a complete simulation!

I have obtained data up to 1924 for Swiss Stocks and Swiss Inflation. It was not easy since not many people were interested in the data. But now, it is done! So I could finally do the simulation!

I know that many of my readers are waiting for this. And I was also waiting for these results.

The 4% Rule

The Trinity Study introduced us to the 4% Rule. If you withdraw 4% of your initial portfolio annually, you can sustain your expenses for an extended period. You will also have to adjust your withdrawal amount based on inflation every year.

Contrary to popular belief, the original study never said you could sustain your portfolio forever. The authors only simulated up to 30 years of withdrawal. But I have done several simulations for up to 60 years of retirement. And if you withdraw less than 4%, you should be able to sustain a very long early retirement.

This rule is the base of the new Financial Independence and Retire Early (FIRE) movement. We should call it the 4% Rule of Thumb. For very early retirement, 3.5% is a better withdrawal rate. On top of that, it will depend on your portfolio.

The Experiment

The issue with this study and most experiments is their focus on United States stocks and bonds. It means it is difficult to apply to other countries. Even if you invest only in United States stocks, you will still have the extra factor of the currency exchange.

I will use the same system I already used to update the results of the Trinity Study. But this time, I will focus on Swiss Stocks first. It will help us understand if we can replicate these results in Switzerland or not!

In my simulation, we are using monthly withdrawals. Each month, the portfolio’s value is updated based on the monthly returns. After that, the monthly withdrawal is updated for inflation. And then it is removed from the portfolio.

For this simulation, I have not done any rebalancing. For more information, I have compared different rebalancing methodologies for retirement.

I am using the data for Swiss Stocks from 1924 to 2019. It is as much data as I could find, and I think it is already an excellent period to see if the 4% Rule works in Switzerland.

2023 Update: I have improved the data, including bonds. This leads to better results for Swiss Stocks and Bonds and early retirement.

The 4% Rule with Swiss Stocks

First, I will consider a portfolio entirely made of Swiss Stocks. I want to see how they compare with United States stocks.

Since this is the first time I am experimenting with the 4% Rule on this data, I will start with a short period and then increase it by ten years by ten years.

Retirement of 10 Years

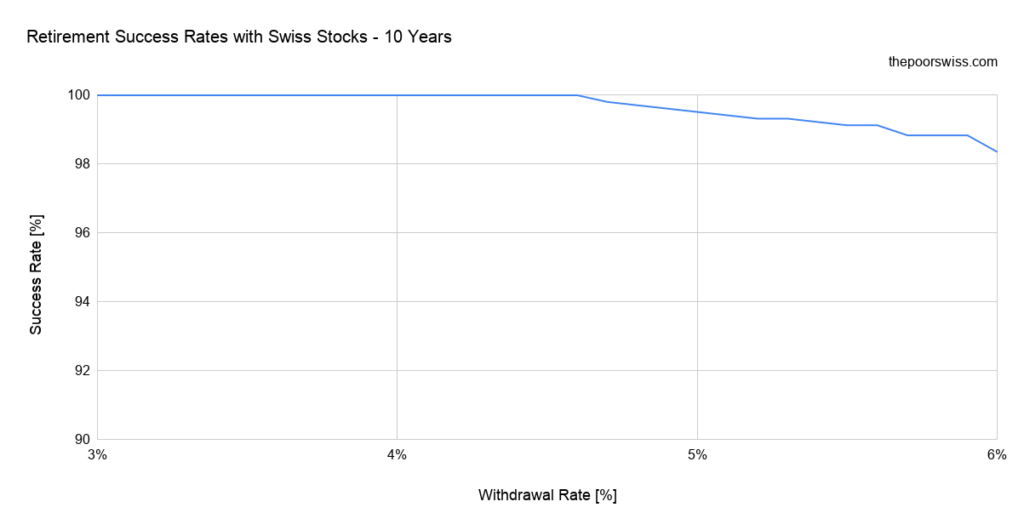

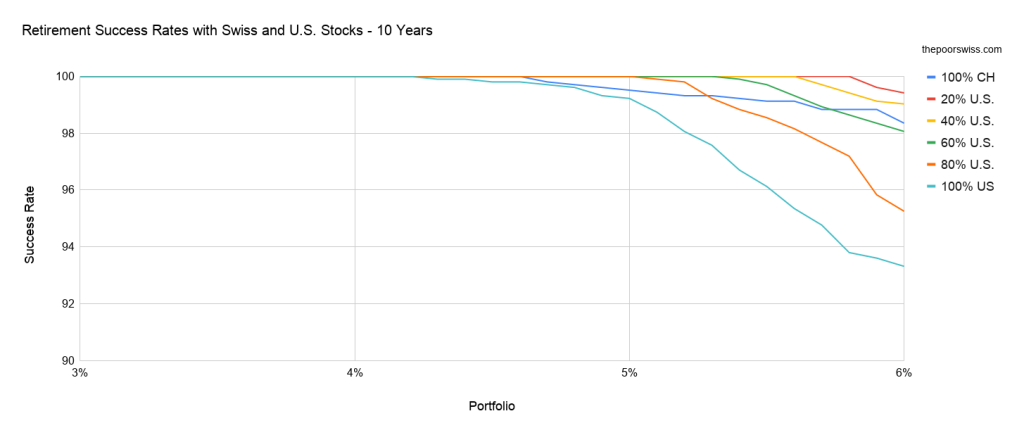

We can see if Swiss Stocks can hold for ten years with different withdrawal rates.

As expected, with a ten years time frame, it is almost impossible to fail. Nearly every portfolio will sustain this.

But it is interesting to note that with a 5% withdrawal rate, it is already possible to fail. It is unexpected. Over ten years, a 5% withdrawal should withdraw more than half of the value. It means there are periods when a Swiss portfolio would not even sustain ten years of retirement. It is not the case with U.S. Stocks.

Retirement of 20 Years

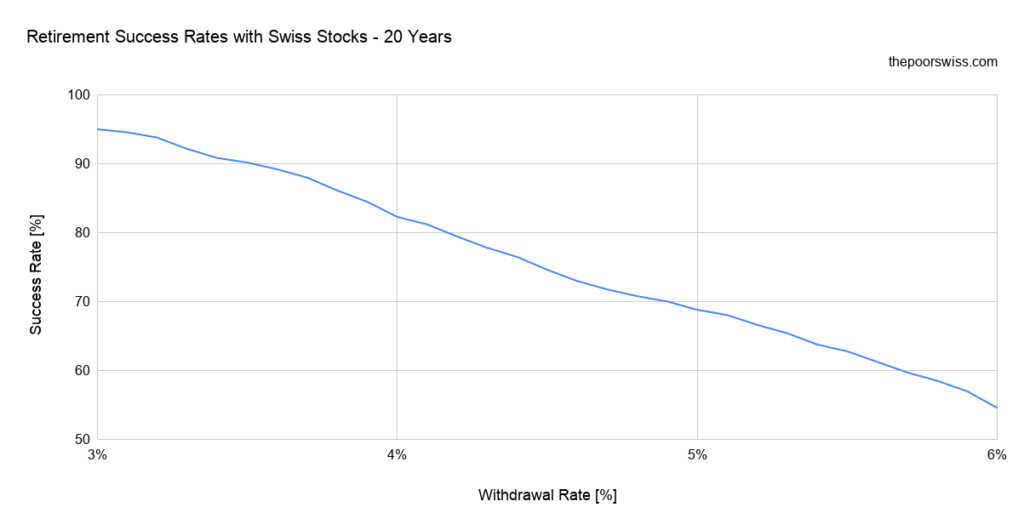

Next, we see what happens with 20 years of retirement. It is already a good period to test the 4% rule. Without any returns and reasonable inflation, this would already withdraw the entire portfolio. So we already need some returns to sustain 20 years.

This time, the results were not nearly as good as I expected. A 4% withdrawal rate only gives you 82% chance of success for 20 years! If you want more than a 90% chance of success, you must use a 3.5% withdrawal rate.

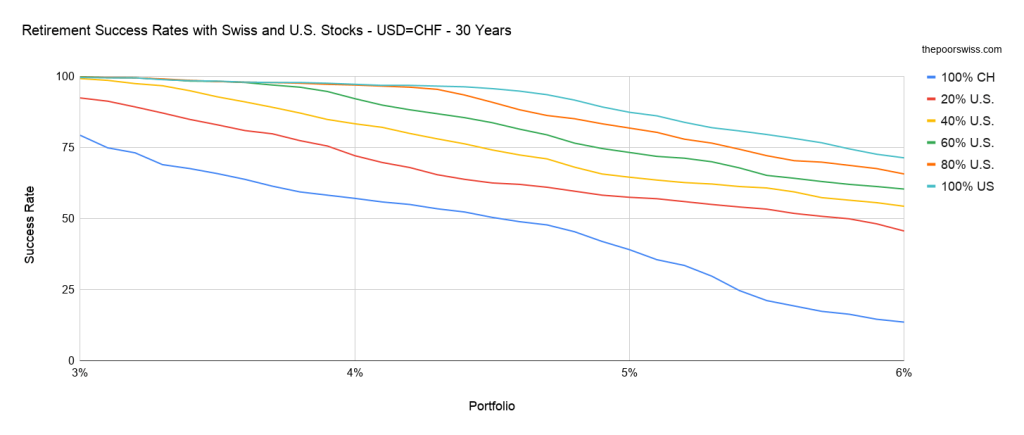

Retirement of 30 Years

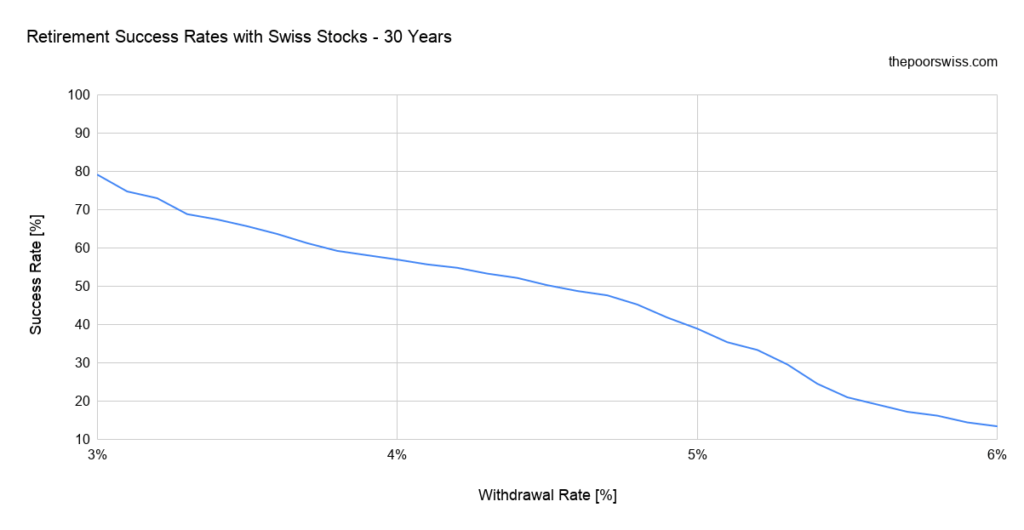

So far, this is worse than I expected. But here is what happens with 30 years.

Sustaining a 30 years retirement with Swiss stocks is difficult. A 3% withdrawal rate would only give you an 80% chance of success. With the standard 4% rule, you will already be lower than 60%. You have just a little more chance of success than flipping a coin.

Swiss Stocks in recent years

There is one good thing with Swiss stocks: They have been performing significantly better in recent years. This fact is a good thing, but we should not base our strategy on the fact that this will happen again.

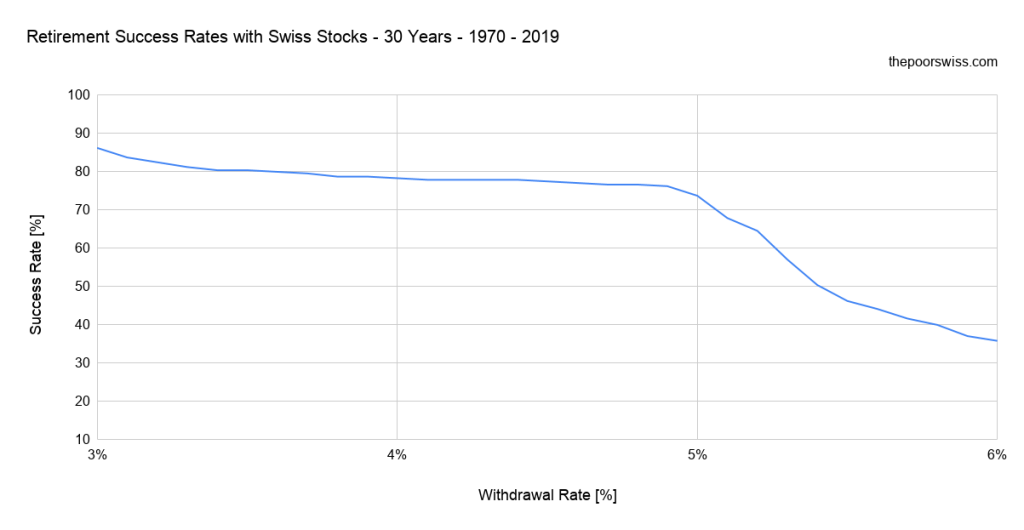

For instance, here are the results for 30 years of retirement if we only take the last 50 years into account.

This data is already looking much better. And it looks even better in the last 40 years. But this is starting to be too short for any simulation. It is still good to know that Swiss Stocks are not fairing too badly in recent years.

Swiss Stocks and the 4% Rule

We can already draw the first conclusion: Swiss stocks do not generate enough returns on their own to sustain a long retirement. You must get a very low withdrawal rate for this to work. And this means you would have to accumulate a substantial amount of money.

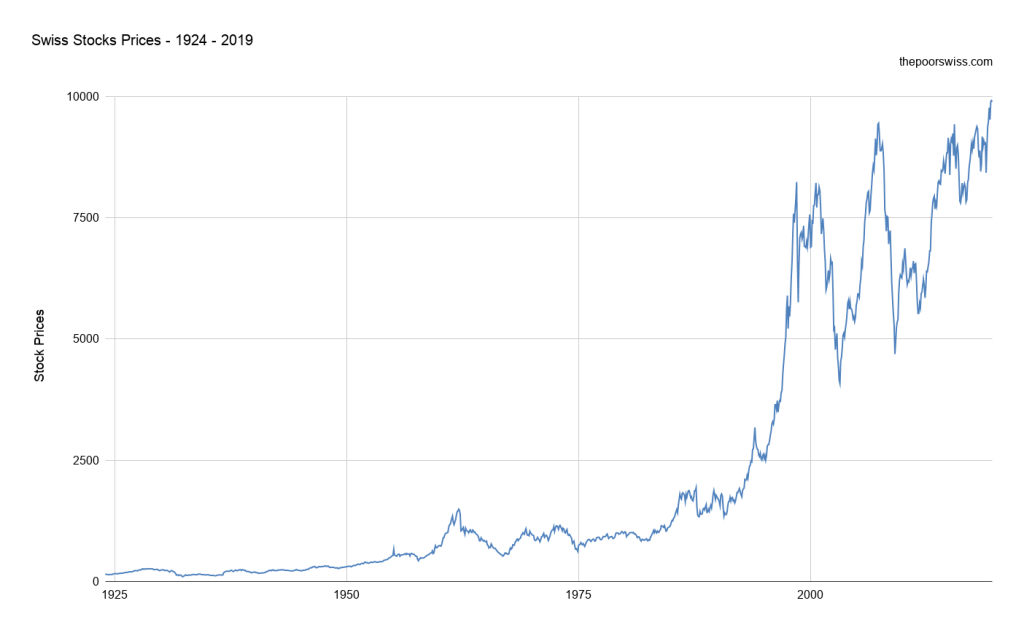

The second interesting fact from this data is that Swiss Stocks have done much better in recent years than before. They have been pretty flat until 1950. After that, they have seen good results. In recent years, they have done pretty well. And they are generally not as volatile as U.S. Stocks.

Diversifying our Swiss Stocks Portfolio

Generally, Swiss investors should not invest only in Swiss Stocks.

It makes sense for Americans to invest only in U.S. Stocks. Indeed, they represent half of the world’s stock market.

However, Switzerland represents about 3% of the world’s stock market. So, people in Switzerland should diversify their investments. Ideally, this would be with a World ETF. Since I do not have the data for the world stock, we will do it with U.S. Stocks.

Instead of using only Swiss Stocks, we will see different allocations of Swiss Stocks and U.S. Stocks.

But this means we have one more thing to consider: currency exchanges! In that case, we need to scale the value of the U.S. Stocks to CHF based on the exchange rate. I could find historical data for the USD/CHF exchange rate for this simulation.

Retirement of 10 Years

We start again with ten years of retirement.

Adding some U.S. Stocks improves our chances of success. But adding too much decreases them. This situation is something I did not expect!

The 100% U.S. Stocks portfolio is the worst performing portfolio. I would have expected it to be the best. It seems that exchange rates are not as good for our portfolio.

But this is a very short period. We need to see what happens with more extended periods.

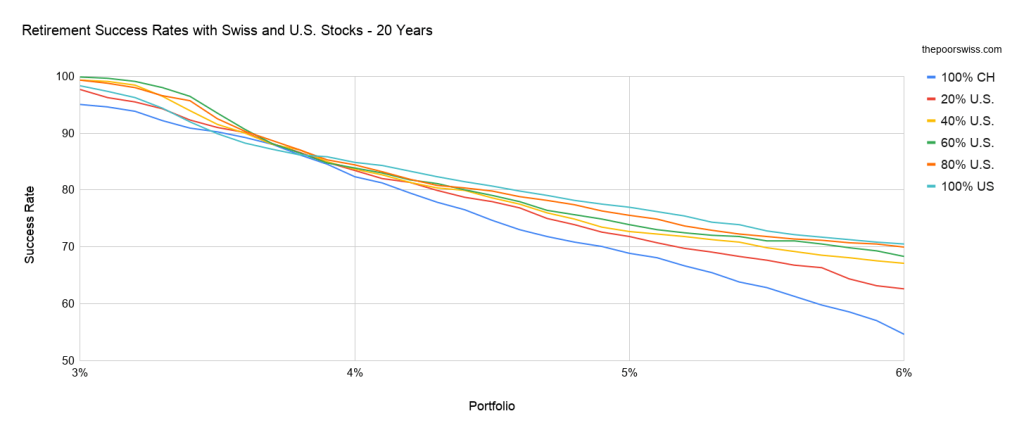

Retirement of 20 Years

So, here is what happens with 20 years of retirement.

For a high withdrawal rate, there is a significant improvement by adding some U.S. Stocks. However, for low withdrawal rates, it is not that significant, unfortunately.

Even with 100% U.S. Stocks, the chance of success for 20 years is only 84%. These results are not too bad but not too great either. And this is only 20 years. In practice, we would want to last longer than that. So what is the issue?

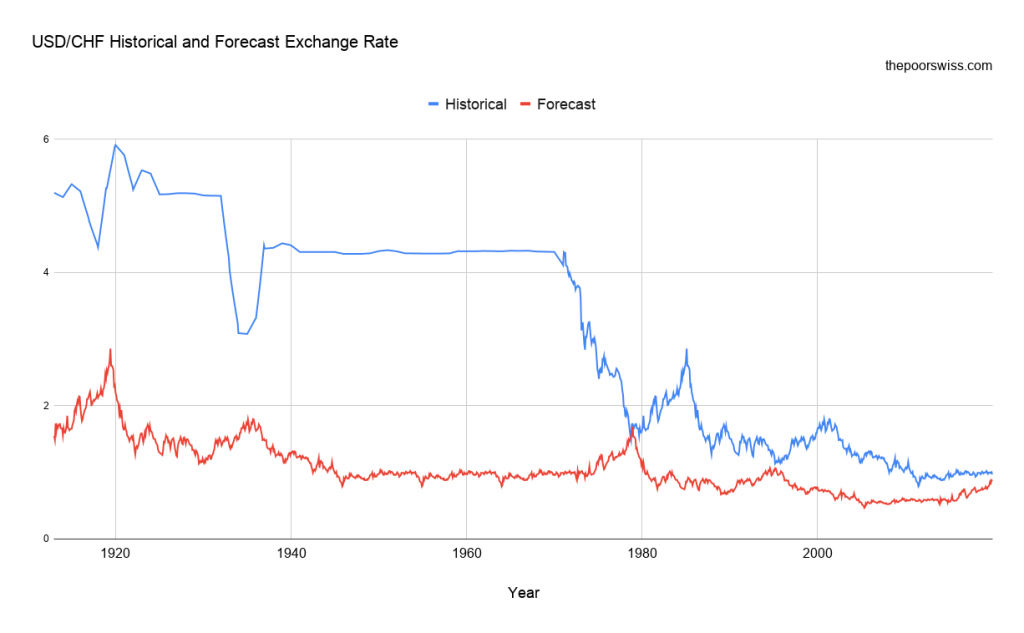

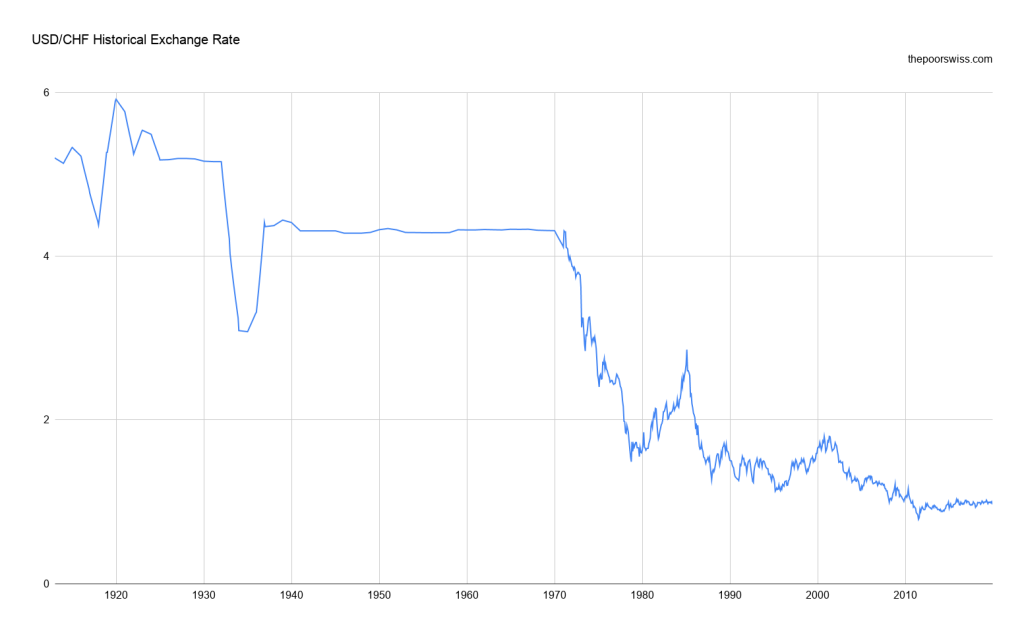

USD / CHF Exchange Rate

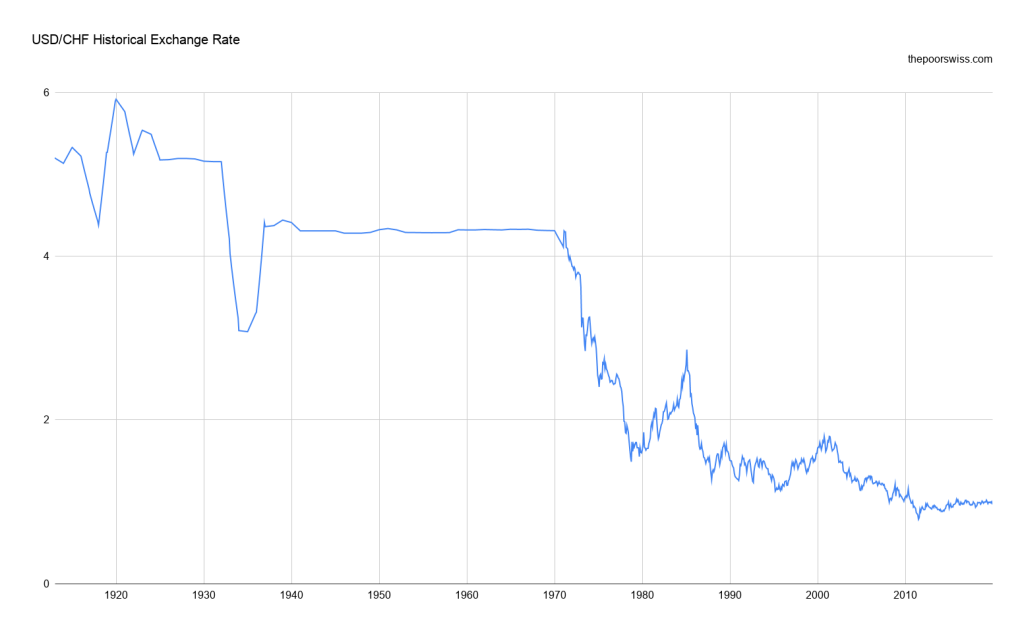

To understand the problem, we have to look at the USD / CHF Exchange rate historical data.

The first time I saw this graph, I was shocked. The data before 1980 is just weird. But it makes sense. To explain some of the big moves, we need to learn about U.S. dollar history.

First, since 1900, the United States dollar has been convertible to gold. This conversion is called the Gold Standard. It is essential to know this to understand this graph.

The first significant drop was at the beginning of the world war in 1914. When the United States entered the war, the dollar’s value started to recover. And after the war, it went very high since the economy rose very quickly as well.

Then, we have an almost flat graph until 1933. At this time, Franklin Roosevelt changed the gold standard. He changed the value of a dollar from 1.505 grams of gold to 0.888 grams of gold. This change explained the massive drop in the graph in 1933.

After this, we can see a very flat line. It is primarily due to the Gold Standard and a little to the Bretton Woods system. When the Bretton Woods system was abandoned in 1970, we can see a slight decline. But the colossal fall only started after Richard Nixon abandoned the Gold Standard in 1971. This action halved the value of the dollar in less than eight years.

So, why am I talking about these details? Because the data is not representative of the future. We will never see a new gold standard or a new Bretton Woods system. And we will not see huge drops as before.

So now, we have to do something bad: predict the future! In the last ten years, the dollar has been mostly stable. And in the past 30 years, it has been mostly going down. However, I do not think the dollar’s value will be cut in five ever again, or at least not in a short time. The United States has a strong economy and will remain strong for many years.

I see two ways of estimating a better dollar forecast:

- Ignoring the exchange rate by setting the same value to the dollar and the Swiss franc.

- Cutting the early crazy years and replicating the latter more reasonable years.

We will both now. Remember that the future may hold something entirely different for the dollar and the Swiss franc. I have no way of knowing better! And nobody knows better!

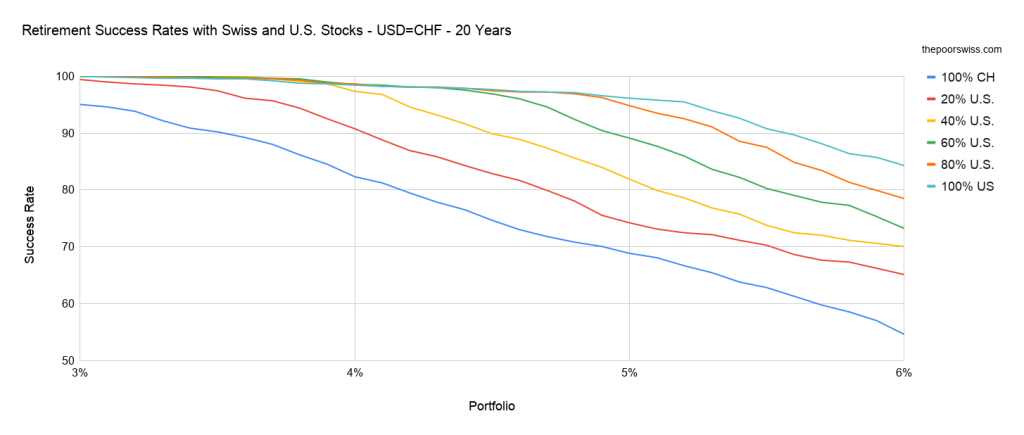

Ignoring the USD/CHF exchange rate

We have seen that if the exchange rate repeats its history, it will not be good for Swiss investors. We can start by seeing what happens when we ignore the exchange rate of USD/CHF. It means we set all the exchange rates to one.

Retirement of 20 Years

We start directly with a retirement of 20 years.

This graph is already much better! If we ignore the exchange rate, adding U.S. Stocks dramatically improves our chances of success. It is logical since they have historically had much better returns. Adding 40% of U.S. Stocks already makes a big difference.

Retirement of 30 Years

Here is what happens for 30 years.

We can see that for 30 years, U.S. Stocks are necessary. To get a chance of success higher than 90% with a 4% withdrawal rate, 60% of U.S. Stocks are necessary. Swiss stocks cannot sustain a high withdrawal rate.

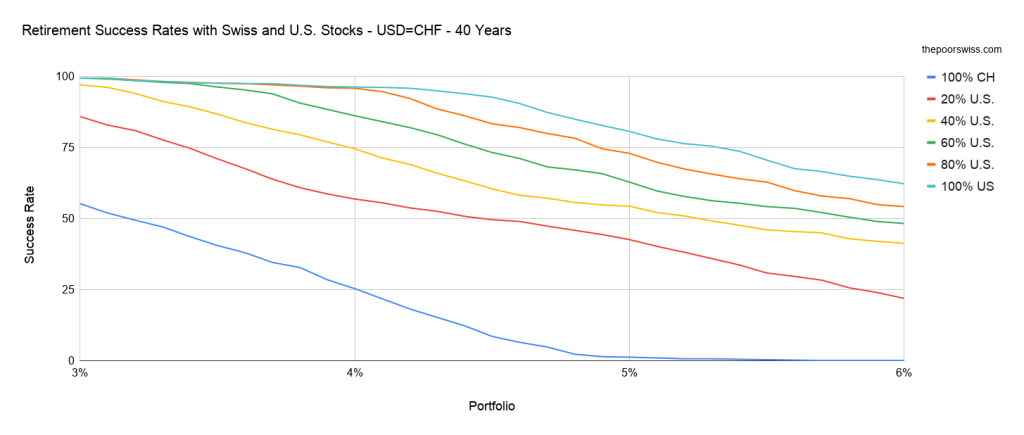

Retirement of 40 Years

What if we want our money to last for 40 years?

For 40 years, even with 60% of U.S. Stocks, it is starting to look dangerous at an 86% chance of success. It would still be okay with a 3.5% withdrawal rate. Interestingly, for a 4% withdrawal rate, both 20% and 0% Swiss Stocks are at almost the same performance. However, for larger withdrawal rates, the portfolio with 100% U.S. Stocks dominates more clearly.

Forecasting the USD/CHF

Setting the exchange rate to 1 CHF = 1 USD is not too bad for the short term. But it is not great at all for the long term. Also, it eliminates risks that we should not ignore. So I propose we do a small forecast based on actual returns.

Here are the forecasted estimations for the USD/CHF exchange rate:

In blue is the actual exchange rate, while in red is the forecast I am making. The beginning of the curve is the real data from 1978 to 2020, followed by the data from 2009 to 2020. Finally, the rest is using the monthly returns from 1978 to 2020 to complete the data.

It is not perfect at all. And it will not turn out to be like this. But I believe that this is a much better representation of what the dollar will become in the future.

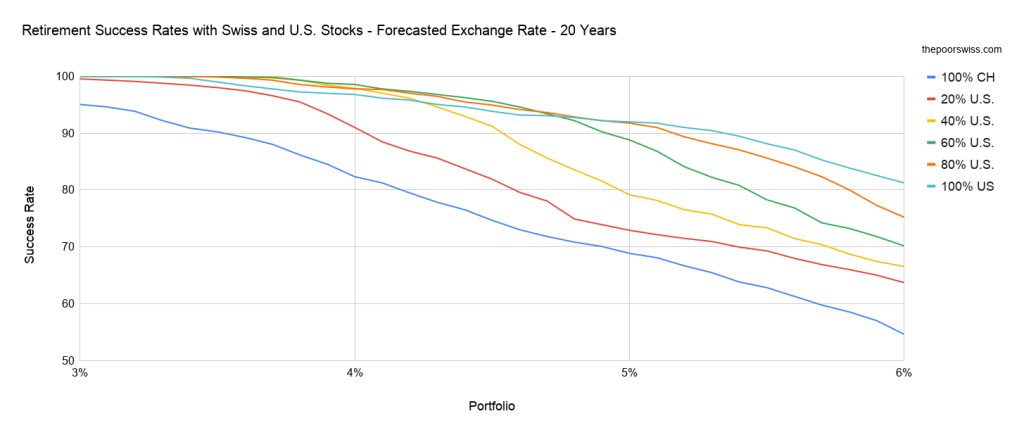

Retirement of 20 Years

We should see what would happen with our imaginary forecasted exchange rate.

Now, the results are more interesting! We can see that there is not a clear separation with each increase in the U.S. allocation. As we expect, a too-large allocation to Swiss Stocks does not have much chance of succeeding.

But even 20% of U.S. stocks can give you an increased chance of success, up to a 90% chance of success with a 4% withdrawal rate. The most interesting is that the best chances are not with 100% U.S. but with 60% U.S. stocks. Starting at a 5% withdrawal rate, the 100% U.S. Stocks dominate, but this is too high of a withdrawal rate for most people.

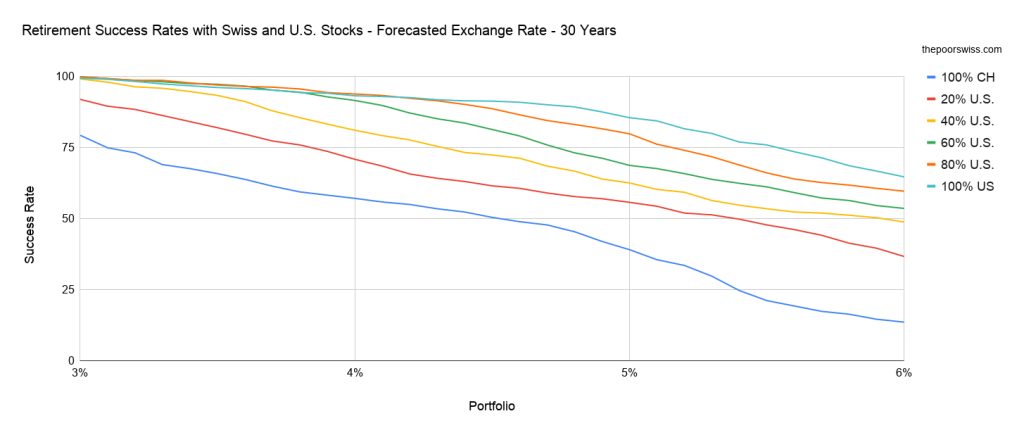

Retirement of 30 years

We can also see if we can observe the same trend with 30 years of retirement.

We can observe the same behavior here as before. For an extended period, you will need at least 60% of U.S. Stocks in your portfolio. Keeping some Swiss Stocks will still help your chances of success with a reasonable withdrawal rate. But this is not by a large margin.

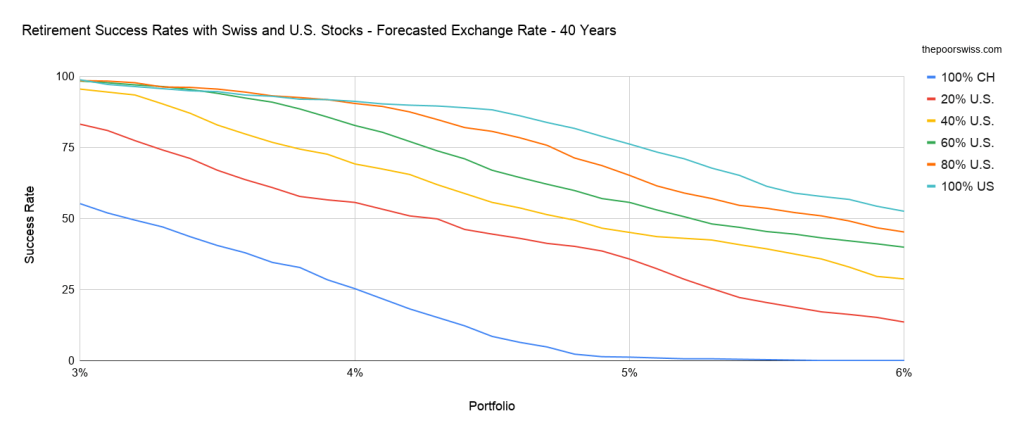

Retirement of 40 years

Finally, we should see what happens if retirement lasts for 40 years.

This time, the performance with 20% Swiss Stocks and 100% U.S. Stocks is almost identical except for high withdrawal rates. But we can now see a very low performance for even 40% of U.S. Stocks. If you have 60% U.S. Stocks, you will need a lower withdrawal rate to sustain.

Exchange rate conclusion

We can see that exchange rates have a substantial impact on the returns. Historically, the exchange rates for USD and CHF have been quite crazy, and I do not think we have to worry too much about it being too crazy. However, I think we still have to consider it.

20% of Swiss Stocks is a reasonable allocation to have some hedge against bad exchange rates. People using a low withdrawal rate could even consider having 40% in Swiss Stocks to hedge against exchange rate fluctuations.

The Data for Switzerland

If you want more details about the simulation, I detail the technique in my post about my FIRE calculator based on my tool and data. The source code is also available!

Swiss Stocks

For Swiss Stock values, I have gotten historical data from the HSSO. Since this data only lasted until 1995, I have completed it with SMI data from 1988 to 2020.

Here is how the Swiss Stocks have looked historically:

As we can see, it has not been a smooth ride for Swiss stocks. Until 1980, they were stable and returned little. After that, they started returning much more. But they have also been more volatile. They have begun looking quite similar to U.S. stocks but with a smaller magnitude.

Historical Inflation in Switzerland

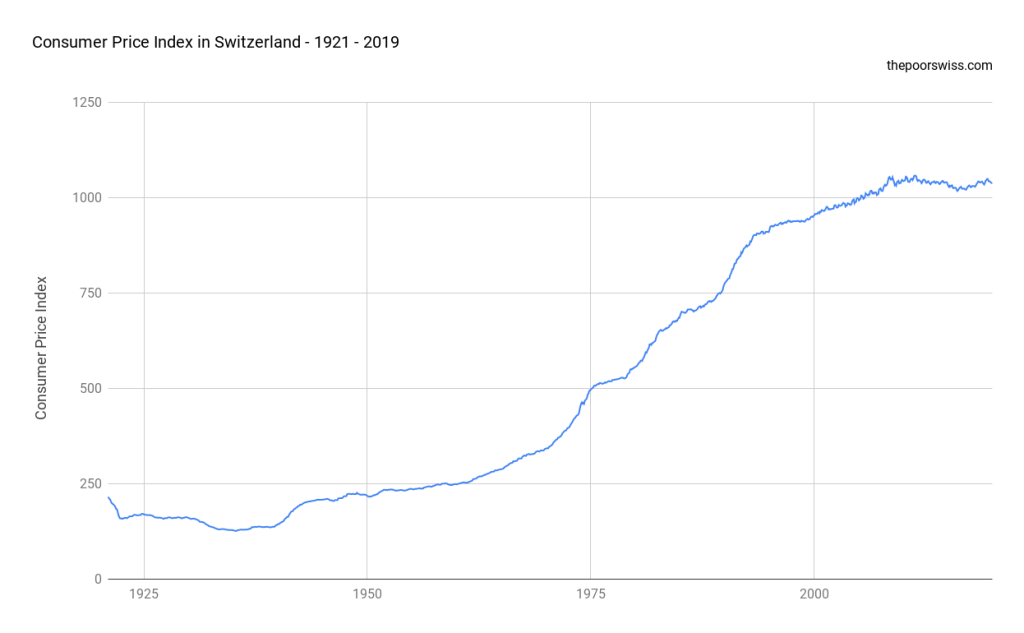

For this simulation, I have gotten historical inflation data from the official statistics office. Since the index has changed several times, I have taken 1924 as the reference and computed the prices from each period based on the previous period.

Here is what prices in Switzerland look like in the last 100 years.

The last ten years have been mostly flat. Before that, inflation was much stronger. But inflation in Switzerland has always been more reasonable than in some countries.

USD/CHF Exchange Rate

I have found two sources for the historical data on the USD/CHF exchange rate. First, I found yearly data from 1924 to 2018, and I completed this with monthly data from 1971 to 2019.

We have already looked at the graph for U.S. Exchange Rate:

You can read the previous section about the USD/CHF exchange rate to learn what happened to this exchange rate.

Conclusion

A simple guide you through all the basics to your own Financial Independence and if you want it, your own early retirement.

Start your journey to financial freedom now!

From this analysis, we have learned many interesting things about Swiss Stocks and retirement in Switzerland.

First of all, Swiss Stocks alone would not have been enough to sustain a portfolio for a long time. Their returns have been too low historically to support withdrawals. However, in the last 50 years or so, they have been doing better. This fact does not prove they will do any better in the long term. But this still shows that they are going in the right direction.

Another thing we can learn is that the USD/CHF exchange rate in the last 100 years has been quite hectic. With changes in the gold standard, the Bretton Woods System, and the abandonment of the gold standard came many sharp drops and rises in the exchange rate.

This hectic exchange rate would diminish our chances of success in retiring early in Switzerland. Since the Swiss Stocks are not returning enough, we need some U.S. Stocks (or World stocks) to balance that. But then, we are exposed to currency risk.

I do not think this exchange rate is representative of the future. There is no such thing as the gold standard anymore. And I do not see a new Bretton Woods system coming back. Keep in mind that I am just making guesses.

If we consider a less volatile exchange rate, we can hope to sustain our withdrawal for 40 years. With a 4% withdrawal rate, we would need at least 80% U.S Stocks. And with a 3.5% withdrawal rate, we would need a least 60%.

After doing this simulation, I will stick with my current plan. I will keep 20% of Swiss Stocks in my portfolio, possibly increasing that to 25%. And I will keep a withdrawal rate of about 3.75% or lower. I will consider adding 5% extra Swiss Stocks to my portfolio for hedging against the currency risk. But more than that does not seem necessary.

What do you think of these results?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- Should Swiss investors worry about the U.S. Estate Tax in 2024?

- What is the Russell 3000 Index?

- How to Change Broker and Transfer Your Portfolio

Hi and thank you for all the articles you have written. I don’t know if you’re familiar with a study the bogleheads did in 2020. They summarized the situation of 16 countries and had a look which ratios of global vs domestic investing was beneficial for a certain country in the past 50 years:

https://www.bogleheads.org/blog/2020/03/02/50-years-of-investing-in-the-world-part-3/

No, I was not familiar, thanks for sharing! I will need to read that in detail! It looks like Swiss is among the worst stock markets.

Hello there,

the USD-CHF exchange rate is directly related to inflation (and other factors).

Invest in US stocks is going to be a problem if the dollar is going to be worthless, then your returns are going to be affected. But that would mean (most probably) that another economy/country is going to be new world economy leader (China) and we will have other issues.

Everything can happen (also WW3), but if the situation is going to be the same as last 20 years, even if we are in recession, the US will hopefully recover. At that point it doesn’t matter the currency fluctuation, once you have shares of a US company.

Hi,

It’s true that we don’t know what country is going to be the next world leader. It’s not going to be Switzerland.

The way I see it, having a well-diversified ETF is the best since we don’t know enough. The currency of the ETF does not matter much, it’s the shares inside that matter.

And having some CHF on the side as well will help counterbalance large shifts in currency.

Great work, I love your simulations!

I am not sure I understand your logic of adding the 20% CH home bias via SMI, though.

Afaik the Switzerland domiciled SMI companies only derive +/- 10% of their revenue from within Switzerland. With the other 90% you would be exposed to other markets, thus other currencies, thus currency volatility – it is simply hidden in the balance sheets of the CH domiciled companies.

For this reason I do not see the benefit of having a home bias with multinational companies no matter where they are domiciled. If you would focus on companies that mainly operate and have their revenue streams within Switzerland and CHF-denominated that should be a different story in my understanding.

Am I misinterpreting something here?

Hi Stephan,

Thanks for your kind words :)

The reason is pretty simple: That’s the only data I have available! I do not historical data for other indexes.

I completely agree that the SMI is not the best home bias. I am currently using the SPI and it’s only slightly better. The problem with Swiss indexes is that they are three huge companies that completely skew the index and that derive a lot of income abroad.

Do you have a suggestion for a good Swiss index?

My favourite Swiss index is the „MSCI Switzerland IMI Extended SRI Low Carbon Select 5% Issuer Capped NTR CHF“.

The reason why I like it is not the ESG aspect, but simply the fact that even giants like Nestlé, Roche and Novarts are capped at 5%!

UBS does have an ETF (CH0492935355) on this index with 61 positions and a fund volume of 730m:

https://www.ubs.com/ch/fr/asset-management/private-investors/funds-prices/product-details/ch0492935355.html

The index is indeed interesting for its cap. And the ETF itself is not too bad at 0.28%.

However, I find it quite funny that Nestle is in a sustainable fund… They are one of the biggest polluter on the planet.

Hi, interesting read. I assume that if you are talking about Swiss Stocks, you are refering to the SMI index. You should consider an allocation to SMI extra stock. Historically (the last 20 years) they returned 5 or 6 time what SMI stock returned. Even if you invest into a Swiss Leaders Index (SLI) which are the SMI stock and the 10 biggest Small and Mid Cap companies, you are far better of than only SMI.

Regarding USD/CHF: I use 6months or 12 months forwards in order to secure my USD investments.

Keep up the good work.

Best regards,

Daniel

Yes, I have used SMI historical data. It’s always possible to get more returns. The issue is that it is very difficult to get historical data. That’s why I used a single index.

That’s an interesting advanced strategy. How much does the use of forwards cost you to secure your USD?

Fascinating reading. I would love to see the data using the UK £!

Hi Bryan,

Thanks :)

I, unfortunately, do not have the resources to do it for every country :)

Hi

that’s a very interesting study, and a big help for me saving me a lot of time. One question: Did you consider the dividends?

Greets

Sammy

Hi Sammy,

Yes, the dividends are included in the returns of each stock index.

Thanks!

Hi

Fantastic work. thank you very much for sharing it and for the entire blog. I made my own thoughts before I even came across your blog -would have saved me a lot of time if I digged earlier in your thoughts and calculations. Some thoughts and questions from my side:

A) The Trinity study as well as your calculations assume a distinct starting point of investment (a particular month in a particular year). Wouldn‘t the results dramatically change, in case you spread your initial investment over a certain period (an initial investing period followed by the actual investing period). This would be for example: Four years with equal monthly investments in the choosen portfolio (e.g. 80/20) till full investment. From that period onwards one stays fully invested and withdraws at the rate choosen.

B) I know, most people focus on low TER, but given your own calculations, wouldn‘t hedging in CHF not be the best idea?

For example a world ETF hedged in chf, same exists for bonds. It increases the TER but the increase is about 0.3% only.

thank you again and please let me know your thoughts.

Best

Frank

Hi Frank,

A) Actually, my calculations assume an actual retirement starting point. All my calculations assume that you start when you are financially independent and fully invested. I have not done calculations for before that date. But I am not sure to understand your point.

B) For Swiss investors, hedging could have helped indeed in some periods. Now, during the periods where the dollar had very large variations, I am not sure how much hedging would have worked. In theory, it would have worked fine, but in practice, currency hedging is not perfect. But, for a Swiss investor, some amount of currency hedging could make sense indeed in retirement to remove some uncertainties.

Thanks for stopping by!

But SMI is basically three companies, it would be better to try with Swiss Performance Index or even Swiss All Share Index

I do not think it would make any difference. The Swiss Performance Index (SPI) has more than 50% in these three companies. And the top 10 companies in the index are about 70% of it.

And, in my data, the SMI is only taken starting from 1988.

If you are able to find proper data for the SPI or All Share Index, then I may be able to do further testing.

Yes, or use SLI where the top stocks are limited to 9% each.

That’s a good point! If you want to avoid too much allocation to the three behemoths of the Swiss Stock Market, the SLI is a good alternative.

It would be interesting to see the results using the SMIM as well. This way the big-three are not included at all, and you will still have some exposure to them via the All-World ETF anyway. What do you think?

Hi,

It would be interesting indeed, if anybody finds the data. The biggest problem with these simulations is not to run them and analyze, it’s to find the data. The SMIM is a recent index, from 1999, so historical data is really lacking. And doing a backward analysis by hand by selecting the companies would be too much work.

So, I am afraid I won’t be able to do that.

Thanks for stopping by!

Hey, thanks a lot. Accounting the safe withdrawal rate for FX rates was long overdue from a Swiss perspective!!

I don’t agree with your findings, however. I think the Swiss Franc will continue to get stronger every year, because we have lower inflation than in other countries. Also from a risk perspective, I’d never place 80% of my money in USD when I must calculate in CHF because I live in Switzerland. So I’d just work with >50-80% invested in CHF and work with a lower withdrawal rate.

Just look at the past 20 years where EUR and USD lost 1/3 of their value, why should this trend change?

If you plan to retire in a country with a very weak currency, then, at least in the past, you were even better off keeping your funds in CHF. In fact, I’d say it’s best to invest in CH stocks but to retire outside CH, this should lead to yearly increases of purchasing power of your retirement money.

Hi Marco,

You do not agree with my results or with my conclusions?

Don’t you think that over time inflation will start being higher in Switzerland in the future? You make a good point since inflation in Switzerland has been lower than in the United States. This can account for some of the differences in exchange rates as well, although not for the huge one.

What about my forecast USD/CHF exchange, don’t you think this is a plausible scenario?

I agree that in the past 20 years, the CHF has been very strong, especially compared to the USD and the EUR. And there is a chance indeed that this will change in the future.

With 50% in CHF, how much withdrawal rate would you use? May I ask how much CH stocks you have now?

I agree that from a math point of view, it’s probably to retire in another country. But money should not be the only argument for the retirement location. I don’t see myself retiring in another country and I am prepared to work several more years in order to achieve this.

Thanks for stopping by!

Thanks for sharing your thoughts.

I just think that if you want to retire in Switzerland, you have to calculate in CHF. The market does not reward you for taking risks in foreign currencies. At least that’s the theory.

GDP growth in Switzerland has historically been lower than in other countries. Inflation rate as well. Because of PPP (purchase power parity) the exchange rate tends to make currencies in low inflation countries stronger. So I’d not speculate on CHF getting weaker, and certainly not against USD or EUR where governmet debt is so high…

Personally, I don’t hold much stocks, so I’m the wrong person to ask. I missed the whole boom since 2015 because I sold instead of DCA…

All my 2nd + 3rd pillar is in cash only (huge mistake in retrospective). I’ll move those funds into stocks in the coming 3 years (VIAC ftw).

I think I’ll go with at least 50-75% CH stocks, with a significant share of CH dividend stocks.

I feel confortable with 3.5% withdrawal rate. Plus as you said, AHV will kick in at some point. Plus I don’t think I will ever stop working completely, and I also think I will never use up 100% of withdrawals because it’s against my frugal mindset :)

Hi Marco,

Just to make sure we speak of the same thing, all my calculations were in CHF as the base currency. All the withdrawals are made in CHF and currency exchange is taken into account. This is why the first result with exchange rates are not great at all.

I would not speculate either on CHF getting weaker. Regarding the EUR, I think it is going to fall even lower. But for the USD, I am a bit more confident that it will retain value over the years.

But you do make great points regarding the state of Switzerland and the difference with countries falling under loads of debts.

3.5% withdrawal sounds very reasonable. From what you were saying, I was expecting 3% or less, which is too conservative. I do not think I will entirely stop working either. I will stop working at a 9to5 job. But I hope I will be able to generate some income with various small things. But this is so far in the future for me!

By the way, now may be a good time to go back to stocks, no?

In any case, I am expecting many things to change after the current crisis. So, plans may change :)

Good luck with your investing!

Outstanding work, thank you!

Wade Pfau has come to similar conclusions https://retirementresearcher.com/the-shocking-international-experience-of-the-4-rule/ for Switzerland.

What is your rationale to use a 3.75% WR? Don’t your results imply a rate closer to 3%? What is an acceptable failure rate for you?

Hi Mark,

Thanks again for helping me with the data!

I actually did not know this blog. It looks really interesting, I am going to take a look and subscribe.

For me, an acceptable failure is about 90%.

I have two arguments for this:

* First, we are going to have some income in retirement (the first pillar), this could make a significant difference. Now, obviously, if the first pillar is not here anymore in retirement, this will change my plans.

* I am optimistic for now that the dollar will not fluctuate too much in the coming years. But again, this may change. And I am likely to review my position after the current crisis.

With my forecast (probably completely bad!), the data still indicates that 3.75% would be fine with 20% CH Stocks. Ignoring the exchange rate is not reasonable but I do not think we are going to see another gold standard or another Bretton Woods systems again.

Now, I may be a bit optimistic. And I said 3.75% or lower. Currently, I am still computing my FI number with 3.6%. And I may take an extra 5% of Swiss stocks in the future.

Thanks for stopping by!