The best broker for Swiss investors in 2024

| Updated: |(Disclosure: Some of the links below may be affiliate links)

I have talked about several brokers on this blog. But I have not yet answered the question of which one is the best broker in Switzerland!

This article answers this critical question. There are several Swiss brokers, and most Swiss banks have their own broker service. However, some international brokers are also available in Switzerland.

You need a broker account to invest in the stock market. So, before investing, you need to choose a broker account. You need to choose carefully since changing brokers is neither easy nor free. Therefore, it is essential to pick the best broker possible.

By the end of this article, you will know which broker you should use as a Swiss passive investor in ETF!

How to choose a broker?

Choosing a broker is not very difficult but critical!

You are likely to use the same broker for many years. You can always switch to a new broker. But moving your shares to a new broker is neither free nor straightforward. So, it is better to start with the right decision directly. Ideally, you want to start with the best broker for your needs.

You first need to ensure that you only trade with a reputable broker. You will entrust your investments with this broker. So you want a broker with a good reputation and excellent security.

You must ensure the broker will hold your assets separately from the broker’s legal entity. You can reclaim your assets through the secondary entity if the broker defaults. This separation is called asset segregation, something that any proper broker will do.

Second, you should check whether the broker gives you access to the exchanges you need. For instance, you will need access to the Swiss Stock Exchange (SWX) if you want to trade in Swiss stocks.

Due to a bad set of laws, it is currently challenging to access Exchange Traded Funds (ETFs) from the U.S. Indeed, European investors cannot currently invest in these funds.

Only Interactive Brokers (among the affordable brokers) will offer Swiss investors access to these U.S. ETFs. So, your choice is highly limited if you want to invest in these funds.

Finally, you need to look at the prices of transactions. Price is the main issue with most Swiss brokers. They are expensive. As we will see later, there can be a vast difference in fees between different brokers. Most people do not realize this! When you compare brokers, you will see that the difference is too big to ignore!

Out of these three criteria, the third one is the one that requires the most research. Finding reputable and safe brokers is not very difficult. But, finding an affordable broker giving you access to the stock exchanges you need is not always easy. If you research correctly, you will directly start using the best broker for your needs.

The best brokers in Switzerland

As I said before, there are many options. You can probably trade directly with your bank. However, Swiss banks are costly for trading. It would be convenient to trade directly with your bank. Unfortunately, they are too expensive. So, you should not trade with your bank.

In Switzerland, we have a few good options for online brokers. My favorite Swiss online broker is Swissquote (my review of Swissquote). FlowBank (review) and Corner Trader (review) also have acceptable prices.

These are already much more interesting than trading with your bank. But they are not cheap either. Finally, there are several international online brokers available for Swiss investors:

These two brokers are the best options available for Switzerland. They are significantly cheaper than all the other options available in Switzerland. They may not be Swiss, but they offer their services to Swiss investors. This makes them the two best brokers in Switzerland.

To see if this is the case, we will compare the fees of the different brokers. We can also consider that you do not have to pay Swiss Stamp Tax with them.

Comparison of the brokerage fees

We can quickly compare the fees of some of these brokers for some operations.

I cannot compare all the brokers available because there are too many. So, I picked the most popular brokers in Switzerland. I included two bank brokers, two online Swiss brokers, and two international brokers.

This should be a good set of brokers for comparison. This should help to show what are the best brokers in Switzerland.

For information, I am using the Tiered pricing of Interactive Brokers for this comparison. It is generally cheaper than the Fixed pricing.

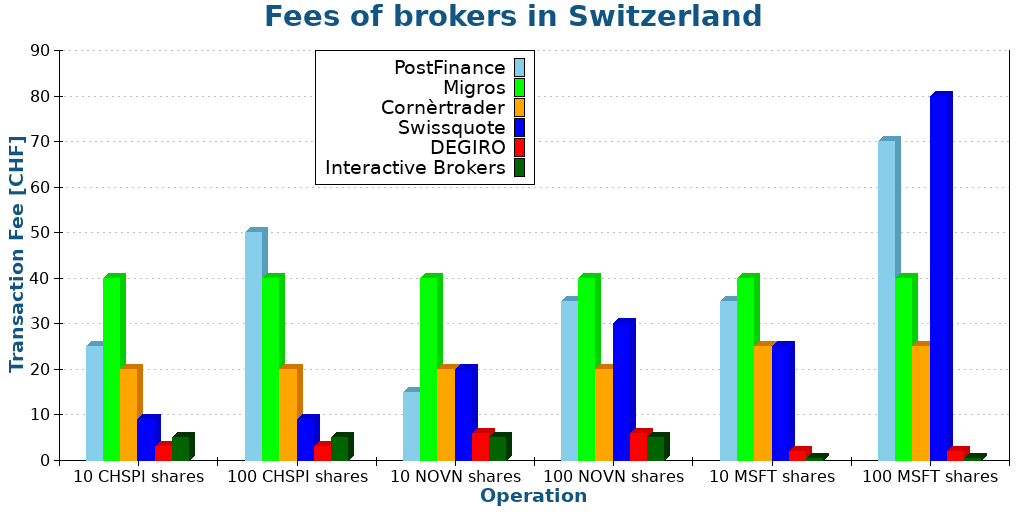

Here are the fees for these six brokers for a few examples of Swiss and American stock exchange operations. I used the share prices of April 16th, 2022, for the comparison. Here is all the data I have collected:

| Action | Postfinance | Migros | Cornèrtrader | Swissquote | DEGIRO | Interactive Brokers |

|---|---|---|---|---|---|---|

| Custody Fees | 90 CHF / year | 0.23% / year Min 50 CHF |

10 CHF / quarter If inactive |

0.025% / quarter Min 15 CHF Max 50 CHF |

0 CHF | 0 CHF |

| Buy 10 CHSPI shares | 25 CHF | 40 CHF | 20 CHF | 9 CHF | 3 EUR | 5 CHF |

| Buy 100 CHSPI shares | 50 CHF | 40 CHF | 23 CHF | 9 CHF | 3 EUR | 5 CHF |

| Buy 10 NOVN shares | 15 CHF | 40 CHF | 20 CHF | 20 CHF | 6 CHF | 5 CHF |

| Buy 100 NOVN shares | 35 CHF | 40 CHF | 20 CHF | 30 CHF | 6 CHF | 5 CHF |

| Buy 10 MSFT shares | 35 USD | 40 CHF | 25 CHF | 25 USD | 2 EUR | 0.35 USD |

| Buy 100 MSFT shares | 70 USD | 40 CHF | 25 CHF | 80 USD | 2 EUR | 0.36 USD |

Or, if you prefer, here is the data in graphical format:

As expected, the traditional Swiss brokers are in a poor position. Swiss online brokers are already significantly better. For instance, Swissquote is quite affordable in most cases. The worst would be Migros since they do not have a maximum on their custody fees, which is a terrible drag once you have an extensive portfolio.

In all cases, Interactive Brokers is the cheapest broker. In most cases, DEGIRO follows quickly. However, DEGIRO can become expensive when you take currency conversion into account. So our two online foreign brokers are cheaper than the others. In the worst case, IB is hundreds of times more affordable than Swiss brokers!

On average, if you are doing big enough transactions, IB will be much cheaper than the other brokers. They are consistently among the most affordable and are never among the most expensive options. This shows that IB is the best broker available in Switzerland. If you do not want a broker from the US, DEGIRO becomes interesting.

If you want more brokers included in this comparison, let me know. I can extend the list if many people are interested. I understand that some people want to have a Swiss broker. I have an article comparing the best Swiss brokers for them.

Currency exchange fees

Brokerage fees are important, but many often forget about currency exchange fees. This is the fee you pay for exchanging one currency for another.

This fee is important because most Swiss investors will invest in foreign products in a foreign currency. For instance, 80% of my portfolio is in US ETFs in USD. So, every time I invest, I need to convert my CHF to USD.

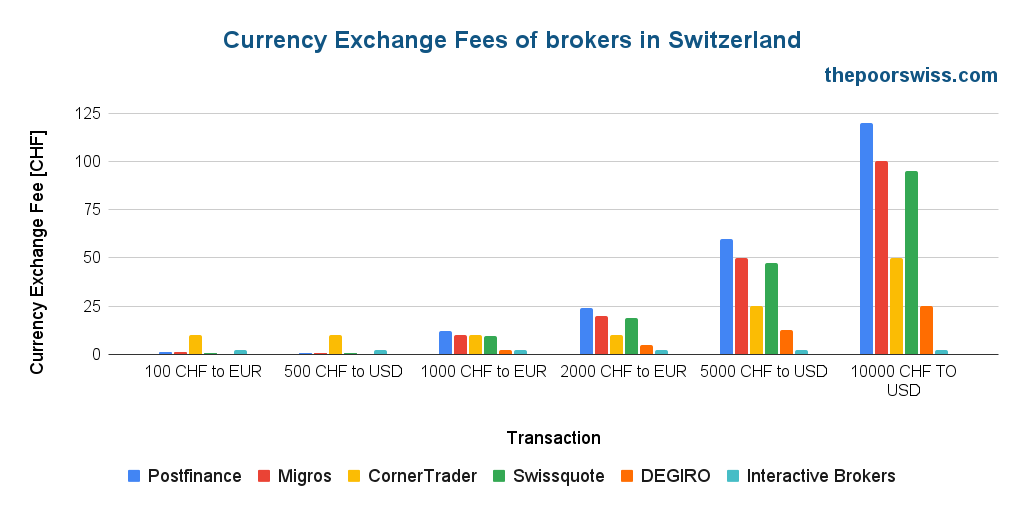

So, again, we can compare the currency exchange fees for all these brokers.

| Conversion | Postfinance | Migros | Cornèrtrader | Swissquote | DEGIRO | Interactive Brokers |

|---|---|---|---|---|---|---|

| 100 CHF to EUR | 1.2 | 1 | 10 | 0.95 | 0.25 | 2 |

| 500 CHF to USD | 6 | 5 | 10 | 4.75 | 1.25 | 2 |

| 1000 CHF to EUR | 12 | 10 | 10 | 9.5 | 2.5 | 2 |

| 2000 CHF to EUR | 24 | 20 | 10 | 19 | 5 | 2 |

| 5000 CHF to USD | 60 | 50 | 25 | 47.5 | 12.5 | 2 |

| 10000 CHF TO USD | 120 | 100 | 50 | 95 | 25 | 2 |

And here on a graph:

Once again, the two foreign brokers are much better than the Swiss brokers. Interestingly, IB can be relatively expensive for small operations because it has a fixed 2 USD fee. On the other hand, DEGIRO has a 0.25% fee. So, below 800 CHF conversion, DEGIRO will be slightly cheaper than IB.

For small operations, the cheapest Swiss broker will be Swissquote. For larger operations, Cornèrtrader is only twice more expensive than DEGIRO (but much more expensive than IB).

So, we come to the same conclusion as for the previous tables. If you do big enough currency conversions, IB will be much cheaper than the other brokers.

Swiss Stamp Tax and brokers

Switzerland has a Swiss Stamp Tax (or Swiss Stamp Duty). This tax is also called the Swiss Securities Transfer Tax. This is a federal tax.

This levies a tax on each transfer of securities when a Swiss securities dealer is involved. By “Swiss securities dealers”, the tax means Swiss banks and brokers.

The amount of the tax depends on the exchange:

- Swiss securities: 0.075% fee

- Foreign securities: 0.15% fee

This tax only applies to Swiss securities dealers, not foreign securities dealers! Choosing a non-Swiss broker will save on the Swiss Stamp Tax! Since this tax is levied in both directions (buy and sell), you are effectively losing 0.30% of your transactions by using a Swiss Broker! Over the years, this can quickly add up to a large amount!

This tax effectively moves people away from Swiss brokers. This law officially makes foreign brokers the best brokers for Swiss investors.

For more information, read my article on the Swiss Stamp Tax Duty.

The two best brokers in Switzerland

As we can see from the comparison, the choice is relatively easy. From a fee point of view, only Interactive Brokers and DEGIRO are good choices. All the others are too expensive. Interactive Brokers is the cheapest of the available brokers.

For me, Interactive Brokers is the best broker available in Switzerland. Even though DEGIRO is cheap, it cannot compare with IB.

There is one big difference currently between these two brokers. Only Interactive Brokers currently offer access to U.S. ETF. So, if you want to invest in U.S. ETF, you must use IB. This is only the case for ETFs. Both brokers are giving access to all other U.S. securities.

Aside from these two differences, they are both good brokers. DEGIRO is much more expensive for currency exchange. This makes it more expensive for a Swiss investor.

On the other hand, DEGIRO is slightly cheaper for European securities. So, it makes DEGIRO interesting for European investors. European investors do not have access to U.S. ETFs anyway, so they have more choices of brokers.

IB is cheaper and offers excellent foreign exchange trading. And it provides tons of features and analysis tools. This comes at the price of complexity. At first sight, Interactive Brokers is quite intimidating. But it has become better and better over the years. As a simple investor, you will only need a small portion of all the features of IB.

Interactive Brokers – The best broker

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

As mentioned before, Interactive Brokers is the only one of the two best brokers to give you access to U.S. ETFs. So, if you plan to invest in them, IB should be your choice. It is my favorite broker, the one I use and recommend!

Interactive Brokers is a broker from the United States. But if you are in Europe, you will use its United Kingdom subsidiary. But this remains the same broker. It is a very well-established broker founded in 1978. It has many customers all over the world.

Although it is a low-cost broker, it offers many features. They offer access to almost all instruments available in many stock exchanges. You can trade in stocks, contracts, options, and other derivatives. And they have an excellent platform for FOREX trading. For passive investors, you will have many more features than you need.

The most significant disadvantage of IB is that it is sometimes a little obscure to use. IB has many user interfaces. Initially, it is unclear which one you should use.

Other than that, IB is an excellent broker!

If you are interested, I have a guide on opening an account at Interactive Brokers and a guide on trading ETFs with Interactive Brokers.

DEGIRO – The simplest broker

DEGIRO is the broker I have started with. It is a good and cheap broker. It is relatively simple to use. However, they are much less professional than IB.

DEGIRO is a broker from The Netherlands available to most European countries. It started in 2008, and they have been growing fast since then. Now, they are one of the major brokers in Europe.

One disadvantage of DEGIRO is that it does not offer proper FOREX trading. You cannot hold different currencies in your account. Your cash is converted automatically when you trade in a foreign currency.

And you will have to pay fees for these transactions. This makes it more expensive than IB when your base currency is not the currency of your primary ETF.

It can also be more expensive on some transactions than Interactive Brokers. But this should not be a big difference unless you are doing substantial transactions.

A significant limitation is that DEGIRO does not let Swiss investors invest in U.S. ETFs. This is probably fine for starting investors and people who do not plan to invest much money. But with an extensive portfolio, you can save significant money investing in these U.S. ETFs.

Finally, you need to be aware that, by default, DEGIRO will lend your shares to other investors. On IB, you can choose to do so, and they will distribute half of the profits to you, another significant advantage for IB.

If you are interested, I have a tutorial on how to open an account with DEGIRO.

What if you want to use a Swiss broker?

Everything you need to start investing in the stock market! Open an account with Swissquote and get 100 CHF in trading credits with my code MKT_THEPOORSWISS.

- Swiss broker

- Easy to use

As you can see, Swiss brokers cannot compare with these international brokers. Using Interactive Brokers or DEGIRO will let you save some money. And I do not think we will see any Swiss broker cheaper than these two soon.

However, Swiss brokers are not all bad. Some Swiss brokers are bad and only try to get money out of you. But that is not the case for every Swiss broker. They are more expensive for several reasons:

- They have to obey different regulations

- They have to pay Swiss employees (they cost more)

- They have to deal with Swiss banks (they cost more)

There are several good Swiss brokers. So, if you are uncomfortable having your shares in a foreign broker, you can check out the best Swiss brokers. I would personally use Swissquote if I were to use a Swiss broker. You can check out my review of Swissquote for more info.

You can still invest successfully with a Swiss broker, which will be more costly. If this brings you peace of mind, you should accept the price. Peace of mind is better than optimization!

Conclusion

Interactive Brokers is the best broker available in Switzerland. They are both reputable and safe brokers. And they are the cheapest brokers available in Switzerland. Moreover, you will save on the Swiss Stamp Duty that you only have to pay with Swiss brokers.

Swiss brokers are working fine, and they have nothing fundamentally wrong. But they are much more expensive than online foreign brokers.

And when you add the Swiss Stamp Duty on top of that, the difference is significant. You do not want to waste your returns on fees when you invest. So, you need to minimize the fees. And for that, you need to choose the best brokers.

I firmly believe that Interactive Brokers is the best broker for Swiss investors in all cases. There are a few cases where DEGIRO is slightly cheaper than Interactive Brokers.

And IB is a much more complete solution for investors. It also has a better reputation. Finally, given that they offer access to U.S. ETFs, IB can help you save a lot of money. If you want, here is a guide on how to get started with Interactive Brokers.

And again, if you want a Swiss broker, I got you covered with my comparison of the best Swiss brokers.

What about you? What is the best broker for you?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Brokers

- More articles about Investing

- How to Buy an ETF on Interactive Brokers the Easy Way

- Cornèrtrader Review 2024 – Cheapest Swiss broker

- Neon vs Yuh: Best digital bank in 2024?

Thank you for this informative article.

I was wanting to create investment accounts for my children and pay small amounts into them on a monthly basis. Given that IB charges 10 per month, DEGIRO, seems to be the most sensible option. It would probably make better sense to create and consolidate all investments into one account, but, I would really like each child to have their own. I live and work in Switzerland.

I have been searching FIRE bloggers for recommendations on the best way of doing this but have found little. Would you have any recommendations?

Hi ASK,

Yes, you are right, IB would not be very good with that. I am also thinking about doing that once we have children. And I did not find a good way to make it work with IB. So I will either have a single account at IB or several other accounts at DEGIRO.

Now, it will depend on where you are taxed. In Switzerland, gifts to Children are generally not taxed. It means that you can keep the shares in your account and then transfer the shares to them when they are of age. But it’s a bit less cool (but also simpler) than having true accounts for the children.

If I were to do it in a single account, I would use IB otherwise I would use one DEGIRO account for each of my children.

Thanks for stopping by!

what about etoro?

Hi,

I did a comparison between DEGIRO and eToro.

Basically, eToro is worse than DEGIRO for Swiss investors and DEGIRO being worse than IB, IB is still the best broker for Swiss investors.

Thanks for stopping by!

Looking at my curent portfolio with Swissquote it’s mainly ETFs (CHF based) and funds. These funds can be active ones with bonds for exemple or can be passive and reflecting an index. Anyway the whole article seems to focus on individual stocks which I don’t recommend to retail clients or on US ETFs which shouldn’t be the main focus for Swiss Investors. I think I will stick to Swissquote. It has expensive custody fees but as far as I know DeGiro and IB don’t have the same fund platform offering a flat fee of 9.- for sales and purchases. there are many good funds in there.

Hi Nick,

Where did you see that I recommend individual stocks?

It’s not even mentioned in the article. I only recommend ETFs. And both IB and Degiro have a very large offering of ETFs. ETFs are linked to stock exchanges, so most brokers will have the same offering.

Both IB and DEGIRO give you access to at least as many ETFs as Swissquote (and much more for IB) and they are both cheaper for ETFs fees and for custody fees. So I do not understand your logic.

Thanks for stopping by

I guess my point is that a well diversified portfolio cannot only hold ETFs especially in CHF. You also need bonds and other alternative investments. In Switzerland, one of the best way is to use mutual funds. I don’t think DEGIRO and IB offer much of that. ETFs in bonds in CHF are very limited At the moment. I would appreciate your point of view there. Thanks

Hi Nick,

You can hold only ETFs and have a diversified portfolio. There are many bonds ETFs as well as Real Estate and commodities ETFs. So, there is not much you can’t do with ETFs.

It’s true that IB and DEGIRO have limited offers for mutual funds. But I never found a case where a mutual fund was better than an ETF. In general, they are equivalent. And in Switzerland, mutual funds are often worse than ETFs.

Thanks for stopping by!

Hey!

Great article. I had a quick question, does Interactive Brokers lite work in Switzerland?

HI Milutin,

No, we can only use the Pro version. I think the Lite version is only for the U.S.

Thanks for stopping by

Hi,

I’m an italian living in Switzerland, and I wanted to start investing now.

You mentioned many times that it will change for swiss people to invest in ETF. I might have misunderstood from other comments, but can we actually still do it? or we can only keep what we already have (which is nothing in my case?).

I’m also struggling to register to IB, can’t go further the first registration form page, no matter which browser, and I cant even oipen the Help me pop-up… Is it always so bad the UI?

Hi Daniel,

We can still do it indeed. Unfortunately, I do not know how long it will be the case. Many people have diverging opinions on that and I have not been able to find a definite answer.

I have never had an issue with IB UI, that’s weird. Did you try in incognito mode? Maybe one of your extensions is messing with it?

Thanks for stopping by!

Thanks a lot for the very informative article!

When you say “The two best brokers in Switzerland” you effectively mean “available in Switzerland”. What if you want to keep your money in a Swiss bank? There are plenty of people who think that keeping their money in a Swiss bank is safer (whether that sentiment is justified or not is another story…).

What is the best option in this case? I thought that it would be Swissquote but it may not be depending on your trading strategy/activity and available funds. For example, if you buy the 100 CHSPI shares twice a year, PostFinance will charge you 90 + (2*50-90) = 100 CHF over the year because the custody fees go towards you trading credits (I don’t use their e-trading services but that’s how I understand their conditions). If you hold 200 kCHF at Swissquote, you will pay 200 + 2*9 = 218 CHF over the year, which is more than twice as much. If I made a mistake or there’s something I missed, please let me know.

I would be interested to hear your thoughts on this.

Hi Thomas,

Yes, that’s correct, I meant Best Brokers for Swiss investors. As you said, there are people who would prefer to use a Swiss broker regardless of the significant increase in costs.

Your interpretation of PF custody fees is correct, they are given you back in trading credits. It seems your math is correct wit PF and SQ. You can quickly reach a maximum of 200 CHF per year with SQ which is higher than other brokers.

But in that case, I would think that CornderTrader would be cheaper at 46 CHF, no? Any reason for not considering CT?

If you were to trade 12 times a year 100 shares of CHSPI, it would be different since the low price of SQ would be interesting.

Now, most people would want some other shares, and SQ pretty much sucks at U.S shares.

I would think that overall CT is probably the cheapest of the Swiss brokers.

Thanks for stopping by!

i started this year with degiro and i really like it. i know that when you transfered your portfolio to ib you sold on degiro and then re purchased it at ib.

how much would be the cost if you had let it transfered by them?

how long does it take until your portfolio is completely transfered if you let them do it? did you close your degiro account? does it come with any costs if you close your account?

i just wanna know if my portfolio ever reaches over 100k if it is wise to change to ib or stay at degiro.

i love the blog, keep up the good work!

thanks

Hi,

I’m sharing my experience here, as I closed my Degiro account one year ago.

As per their fees leaflet, a transfer out (per line) costs 10 euros + external costs.

I wanted to transfer my positions, but once Degiro provided me with the full pricing, it was more cost efficient to sell everything and transfer the cash.

One year ago, it was:

18€ per line on Euronext Amsterdam

56€ per line on Nasdaq & NYSE

78€ per line on Swiss stock markets

54€ per line for LSE

With such fees, it seems that the sell, transfer the cash and buy, will always be cheaper, even for a ine line portfolio (i.e. VWRD or VWRL).

VWRD is listed on LSE and VRWL in SIX Swiss exchange.

There is no fee withheld when you close your account.

hi,

thanks for the info. that was really usefull.

Hi Guillaume,

Thanks a lot for sharing!

Interesting, the external costs are much higher than I expected. This is indeed expensive.

Be careful that when you sell and transfer the cash, it may take a few days until you have the cash on the new platform. The market could have moved significantly in that time. So the costs could be high.

Thanks!

Hi Mikey,

Yes, I did indeed sell everything and rebuy everything, but I would not recommend doing that.

To transfer out of DEGIRO, you will pay 10 EUR per position. And you will probably pay a fee at IB to receive them.

I do not know how long it will take, but from what I heard, it is not that slow, 2-3 weeks I would say.

I closed my account indeed, for free.

It could be worth it but only if you plan to switch to U.S. ETF. Otherwise, it makes very little difference.

Thanks for stopping by!

thank you.

how about the account on degiro? would you recomend changing from the basic account to something else? i hold only etf’s that pay dividends.

have a nice day

Hi Mikey,

No, I think the basic account is fine. There are a few more risks, but I do not think this is worth 3% of the dividends to switch to the custody account.

But that just my point of view. If this risk keeps you up at night, then, sure, change account type :)

Thanks for stopping by!

Dear Mr. Poor Swiss,

Thank you very much for the very comprehensive analysis provided. I congratulate you for the excellent work.

What do you think about eToro? The reason I am interested in eToro is that I am starting with investing with really a minimum amount and they are very cheap. I saw that eToro has ETF Vanguard SP500. I would like to know your opinion about it.

With thanks and best regards,

Tham

Hi,

I will soon publish an article on eToro. I am not a fan for several reasons:

* They do not have a CHF account, this means you will have to transfer USD and CHF which is expensive from Switzerland.

* Their Forex conversion fees are very expensive which makes it difficult to invest in anything else than USD shares.

* They have very poor reviews

If you get paid in USD, it could be worth using it, otherwise, I would definitely not even consider them.

Thanks for stopping by!

Hi! Good article, very informative. I was wondering what you think about tastytrade. Their focus is on options trading, but they have zero fees on ETFs. They are American based, but I use them as a Swiss citizen.

Hi Nicolas,

I have never heard of tastytrade or tastyworks before. For now, I do not have an opinion on them :)

But thanks for letting me know about them, I will try to do some research.

Thanks for stopping by!

Hi,

thanks for the analysis. Did you ever look into LYNX? It’s an IB implementation focused on Europe and it does not come with the ‘high’ depot costs for <100k CHF. I think you could even use the account to log into the IB platform.

Bests,

Lars

Hi Lars,

I have not looked in details at Lynx so far. It seems more expensive than IB from what I have seen, but the removal of the limit could be good for a lot of people. But they are only interesting if they still offer access to U.S. ETF from Switzerland, which should be the case if they are a reseller for IB.

I will try to review them in the future, but this is not high on my priorities right now :)

Thanks for stopping by!