Zak vs Neon: Best Swiss digital bank account in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

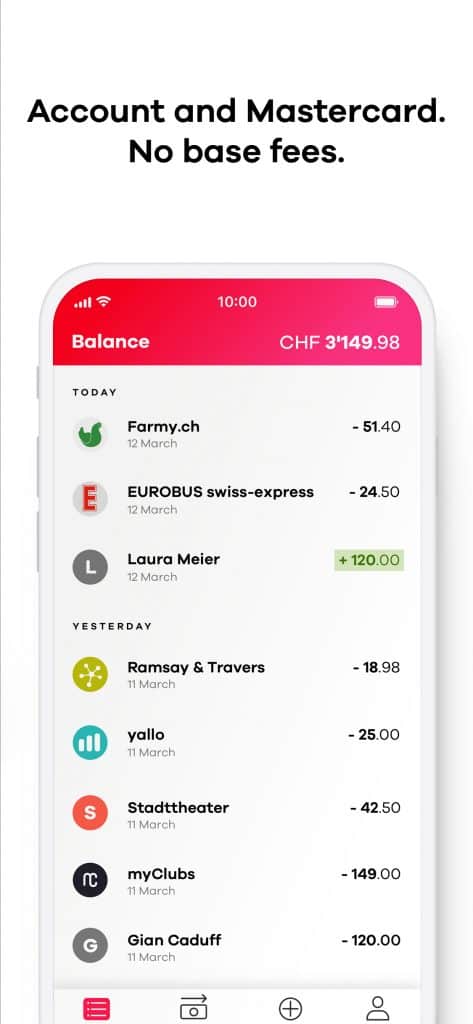

Zak and Neon are two good Swiss Digital bank accounts. This is because they are both entirely digital and accessible through mobile applications.

The great thing about these bank accounts is that they are significantly cheaper than conventional ones. Their low prices are what make them successful. And they have some interesting extra features.

But which one should you choose? Which of Zak vs Neon is better for you? We will find out!

In this article, I compare Zak vs Neon in detail. We see the fees, the security, and the limits of both bank accounts. By the end of the article, you will know which Zak vs Neon is best for you!

|

3.5

|

5.0

|

Zak

Zak is a bank account managed by Bank Cler (previously Bank Coop). So, while it is a digital bank account, it is backed up by a traditional bank, not a startup.

Even if Bank Cler backs it up, Zak has no offices. It is entirely digital. It is also completely mobile, so you must use it from your phone. Zak is not a bank itself. It is merely a bank account offered by Bank Cler.

In addition to the usual banking features, Zak has several extra features you can use with other Zak users. For instance, you can send money directly to any other user of Zak. You can also manage a budget with several other users. This is an excellent feature if you know other users.

For more information on this bank account, you can read my full review of Zak.

Neon

Neon was one of the first Swiss digital bank accounts. Neon is entirely digital. There are no offices where you can do operations. It is fully mobile, and there are no online applications either.

Neon is not a bank. They do not have a bank license of their own. Another bank does not back Neon. However, your money is held at the Hypothekarbank Lenzburg Bank, another reputable Swiss bank. It means you are protected as if your money was in any other large bank.

One very interesting fact about Neon is that they offer free payments abroad with their card. Neon was the first Swiss bank to provide this service! Of course, others quickly followed it (Zak!), but it is interesting to note that they led the innovation.

For more information on this bank account, you can read my full review of Neon.

Which is cheaper? Zak vs Neon

We start with the critical question of the fees! Which of Zak vs Neon is cheaper?

The critical point about these two bank accounts is that they do not have management fees. So, keeping your account open will not cost you anything. This absence of management fees is essential because it is the most significant advantage of digital banks these days.

With Zak, you will get the cards delivered for free. But with Neon, since May 2020 (it was free before), you will pay 10 CHF to get the MasterCard delivered.

Transfers in CHF between bank accounts are free for both accounts. Payments in Switzerland are also free with both bank accounts. However, not every bank in Switzerland offers this for free.

Now, not everything is free with these two bank accounts. So, we need to compare their prices for several features.

We look at withdrawals first. Zak offers withdrawals for free at any ATM from Bank Cler. For all other ATMs, you will pay 2 CHF per withdrawal. With Neon, you get two free withdrawals per month. After this, you will have to pay 2 CHF per withdrawal.

Neon is slightly better than Zak for withdrawals unless you withdraw a lot of cash. But most people should not withdraw cash more than twice a month. However, if you have a Bank Cler ATM nearby, Zak could be better for withdrawals.

For withdrawals abroad, it is different. With Neon, you will pay a 1.5% fee on each withdrawal abroad. With Zak, you will pay 5 CHF per withdrawal abroad with a Visa. Generally, you should avoid withdrawing money abroad.

Neon has a 0.5% total surcharge for payments abroad, while Zak has about a 2% surcharge. This makes Neon much cheaper for payments abroad or in other currencies.

Also, Neon has a partnership with Wise for international transfers. This partnership makes Neon significantly cheaper if you need to send money abroad.

So, regarding pricing for Zak vs Neon, Neon is cheaper than Zak. But both bank accounts are pretty cheap!

Basic Features

We should compare the basic features of Zak vs Neon.

While Neon offers a Mastercard, Zak offers a Visa. This should not make a difference.

Regarding mobile applications, they have the same basic features. You can do all your banking from any of those apps. Both apps have the same features and the same quality.

In some Bank Cler’s ATMs, you can deposit cash directly into your Zak account. Being able to deposit cash is an excellent feature of a digital bank account. However, you must pay a fee if you want to deposit cash in your Neon account. With digital bank accounts, having extra cash is always an issue.

Both bank accounts support eBill. Neon has supported eBill since December 2019, while we had to wait until March 2022 to get eBill support in Zak. But now, they are both on the same level.

Neon is available in French, German, Italian, and English. On the other hand, Zak is not available in English. So, if you do not speak any of the national languages of Switzerland, you may have issues with Zak.

Extra Features – Zak vs Neon

We can also look at some extra features of Zak vs Neon.

Both banks offer a similar feature for sending money directly to other users. With Neon, you can send money directly to your contacts. With Zak, you can use the Zak Illico service to send money to other users.

Both bank accounts offer the ability to have sub-accounts. They are called Savings Pots with Zak and Spaces with Neon. They provide the same feature.

In addition, Zak has one extra notable feature: Common Savings Pot. You can manage some money with up to 10 people. This feature could be very useful in managing the budget of a project with several people. For instance, you could use it to manage money for a vacation with friends.

For extra features, Zak is slightly better than Neon. However, most of these features will only be useful if you know others using the application. If you do not know anybody using Zak, these additional features will not be helpful.

A feature is useless if you do not use it. So, when comparing bank accounts, you should only compare the features you will use.

Which has higher limits?

If you plan to use a digital bank account as your main account, we need to look at Zak vs Neon’s limits.

With Zak, you can pay up to 5000 CHF per day. And you have a limit of 25’000 CHF per week. You can go over this limit, but you will have to call Zak for each transaction that goes over this limit. Using it as your primary bank account could be a limiting factor.

With Neon, you can spend 50’000 CHF per day from the account. In addition, you can withdraw 10’000 CHF per day with the card, spend 5’000 CHF per day in stores, and another 5’000 CHF online. The card has a monthly limit of 10’000 CHF per month.

You can spend more with Neon’s card than with Zak’s card. However, you can spend much more monthly with your Neon account than your Zak account. But you can spend more than enough with the cards in both cases.

However, you could have issues if you have to make large transfers, such as paying a downpayment. So, these accounts seem better as a second active bank account than a first. But if you do not have any big transfers planned, you should be okay with either of these bank accounts. And if you can spread a large transfer over several days, the limit of Neon becomes almost irrelevant.

Security – Zak vs Neon

We must look at security when using these two bank accounts.

First, a critical part is what happens to your money if they bankrupt (or closes down). With Neon, your money is held safely with Hypothekarbank Lenzburg. So, it is protected under Swiss law up to 100’000 CHF. You have the same protection with Zak since Bank Cler holds your money. So, both accounts have the same legal security.

From a security point of view, both apps are linked to your phone. So you will have a password to enter the application. The application is linked to your phone. It means that your phone acts as a second-hand factor. So, the application is protected as long as the security of your phone is not compromised. So, again, Zak and Neon have the same technical security.

From a security point of view, Zak and Neon have the same level of security.

What about Zak Plus?

The primary account at Zak is free. But they have an offer for the Zak Plus account.

Zak Plus will cost you 8 CHF per month. But it will reduce the prices of the features of Zak. The prices when you use the Visa and the Mastercard will not change. But with the Visa, several things become free:

- Unlimited withdrawals at any ATM

- Unlimited withdrawals abroad

Given that Neon offers free purchases abroad with their Mastercard for free, I think there is little value for Zak Plus over Neon or Zak Basic. Of course, an advantage of Zak Plus is that you will get withdrawals abroad for free compared to the Neon 1.5% fee. But it is not every day that you need cash abroad.

Zak vs Neon – Summary

We can now make a final summary of the comparison of Zak vs Neon:

|

Best Swiss Bank

|

|

|

5.0

|

3.5

|

|

|

|

|

|

2 free withdrawals per month

|

Free withdrawals at Bank Cler ATMs

|

|

0

|

0

|

- Pay abroad for free

- Cheap international transfers

- Everything from your phone

- Medium limits

- Translated in English

- Difficult to deposit cash

- Expensive withdrawals abroad

- No Maestro card

- Pay abroad for free

- Can deposit cash in account

- Support for e-bills

- Not very transparent fees

- Low limits

- Expensive international transfers

- Expensive withdrawals abroad

- No Maestro card

- No physical card for abroad

- No English support

Neon has a few more advantages than Zak. But both Zak and Neon are good choices with different strengths:

- Neon offers much cheaper payments abroad and in foreign currencies

- Neon offers international transfers cheaper than Zak

- Neon has higher limits

- You can deposit cash in your Zak account for free

- Both banks are open to foreigners living in Switzerland.

You may want to choose between Zak vs Neon based on your needs. Or you may use both if you wish. Since both are free, you can also try both and choose the one you prefer after some time.

Zak vs Neon Conclusion

Choosing between Zak vs Neon is not easy. They are both good digital bank accounts. They have both their advantages and disadvantages.

All the services you need to pay, save and invest, in a neat package, with extremely good prices!

Use the poorswiss code to receive 10CHF!

- Pay abroad for free

- Invest with great fees

Regarding Zak vs Neon, I prefer Neon over Zak for several reasons:

- Neon has much cheaper payments abroad

- You can do international transfers with Neon at a good price.

- Neon is truly innovative. Indeed, Neon introduced all the features first, and Zak tries to follow.

Now, Zak has a few advantages, as well. For instance, with Zak, you can deposit cash directly into your bank account for free with Bank Cler ATM. Of course, it could be practical if you often get cash. But I cannot remember when I had to deposit some money into my account.

Since they are both cheap, you could try them and see which one you prefer afterward.

If you want a good credit card, you will have to look at some other credit cards with cashback. Neither Neon nor Zak offers an excellent card for domestic purchases, but they both offer good cards for purchases abroad.

If you want more digital alternatives from big Swiss banks, you can read my review of CSX from Credit Suisse.

What about you? Which of Zak vs Neon do you prefer?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best banks

- More articles about Save

- Everon Review 2024 – Pros & Cons

- How to create a Neon account and use the mobile application

- Wise vs Revolut: Which Is Best in 2024?

I have neon since a year and it’s awsome. Make my life easier. Neon was my backup, because Postfinance was my main account. I used neon mostly on holliday and for paying bus, voi scooter and staff like that.

Since two weeks i quit my postfinance account for ZAK, and i’m very dissapointed. The most important thing don’t work properly. Scanning orange bill. It says “coudn’t read code properly” and you have to do everything manually. O.K now try to type manually Orange bill with all the codes plus Adress.

I really regret now opening account there. On the top of that, you have to type sms code each time you want to send payment. Really frustrating.

There is only one solution. I made my neon as my main account and ZAK as backup. On ZAK i have only 50-100 CHF max. for paying bus etc.

Hi,

Thanks for sharing your experience!

Could you also use only Neon? That way, you would have a simpler setup?

Yes I could but I don’t want to. Both banks have sometime problems. For example a couple weeks ago you couldn’t pay any bills with Zak. Also scanning bills … nothing worked. That was confirmed from Zak. They updated server and iOS app but it took three day. Right now there is problem with neon and TWINT. I send money with Twint to my friend. He didn’t receive the money but my neon Konto was charged. This is also confirmed from neon. The solution is wait couple of days. I wrote email to neon about this issue and they didn’t answered me. Tried to call them the whole day with no success. Nobody pick up the phone. Right now I’m gonna keep the both. So I have one backup account if other won’t work

Thanks for sharing, this is very interesting to know.

I never had issues with Neon, but I also never had TWINT :)

Considering these issues, I guess it does indeed make sense to keep both accounts if you want to be on the safe side!

E-bill is now supported by ZAK, siehe https://www.cler.ch/de/info/zak/ebill

Yes, they announced that today. I will update my articles once I get some time.

Hi Baptiste

Did you also check out YUH? The Swiss app for paying, saving and investing seems to be a very interesting option. They have a decent amount of tradeable securities with a sound pricing model.

Thanks for your time.

Regards,

Jonaldo

Hi

Yes, I did a fully review of Yuh.

Thanks for the detailed review! I’ve had Neon since last summer and love it. Great app, easy to use and sign up. Now I wanted to open a Zak account, but unfortunately, there’s a technical issue in the app when verifying the ID with the camera. Even though I have a great Samsung phone, the app doesn’t allow it to focus. After contacting Zak they said this is a known issue with Samsung phones and they will send me the registration documents by post. Although customer service was fast and friendly, I’m disappointed that they are not fixing the root cause. The whole point of an app only bank is that I don’t have to deal with a bunch of paperwork…

Hi Eli,

I had the exact same issue when creating a Zak account. It’s really painful. I had to call three times before they could verify the documents.

I think digital banks still have some work to do before paperwork is really eliminated.

Thanks for sharing.

Hi Baptiste,

Thank you for compiling all this information and presenting it in a fair and entertaining manner.

In a few occasions you mention that international transfers and currency conversion is much cheaper with Neon vs Zak. If you ever find the time to provide additional data on that point, I would thank you.

Hi Flutiste,

For international transfers, Neon is using TransferWise, which makes it much cheaper than going through standard Bank Cler exchange rates.

For payment abroad, both have no fees, but Neon is using the Mastercard exchanges which are significantly cheaper than Viseca exchanges. And with Zak, this is only free with the virtual car.

Thank you for this useful comparison. I’m interested whether those banks also offer a desktop version (I’m uneasy with App only) and whether you can download easily account statements or the expenses according to the spending categories.

Hi,

Neither of those banks offers a desktop version. Very few banks still offer a desktop version. But you can easily download account statements. But no idea about spending categories, never used that in any of these tools.

Migros Bank still offers a desktop version, but it’s really bad.

Does Neon offers immediate notification for card payment, similar to Revolut? This is the only thing missing for me to go full Neon.

Hi Vladimir,

They do SMS notifications when you use the card. And they are planning push notifications in the future.

Is it possible to increase the limit on the new zak visa cards? How much by max? The virtual cards zak is getting rid of were so much more convenient without any limits, just that the max you could hold was 10k at a time, whereas the new cards have only a 3k per month and 2k per day limit, even 10 year olds spend more these days lol

I really hope 10 years old don’t spend that much :)

You can’t change it in the app, unfortunately. However, you can call them to change the limit. At least that’s what the app says. But I don’t know how high you can go. In general, you should not expect much from the app, you can’t even change your address from there.

Hi,

I am curious, what is the issue with ebill?

Hi Jose,

For me, there are two issues with ebill

1) Most people will blindly pay them without thinking about what they can do to optimize them

2) It’s a huge pain to change bank account once you have them, I have had a bad experience with that. But according to some of my readers, this has been improved.

Hi the Poor Swiss, great review.

I would like to ask if it is possible to get an additional second account in EUR with neon (like for example post finance offers).

If not do you perhaps know which bank (digital or not) offering the possibility to get a second free account in EUR and which is the cheapest?

Thanks in advance!

Hi Luca,

Neither Neon nor Zak has a EUR account.

I am not aware of any banks offering free EUR accounts. PostFinance is among the cheap ones for EUR accounts. You could also use Revolut or N26 maybe.

Hey Luca, best EUR account for Swiss people is DKB or N26. N26 is a finntec from Berlin and is completely online. DKB has most of their stuff online and a couple of ATMs in major german cities. But you can use any ATM in germany and abroad for free withdraws (as long as you have a monthly income of 700€ to the account). You can also withdraw currency different from EUR. I don’t know about the limits though.

Great review. Do you know if the accounts can still be used if you leave Switzerland and move abroad? What do you think is the best bank account to keep managing savings in CH once you are back in your country?

Hi,

Unfortunately not. These accounts are only for residents. If you leave Switzerland, you will have to close these accounts.

I would an account in one of the big Swiss banks (UBS or CS probably) if you plan to leave Switzerland.