Zak vs Neon: Best Swiss digital bank account in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

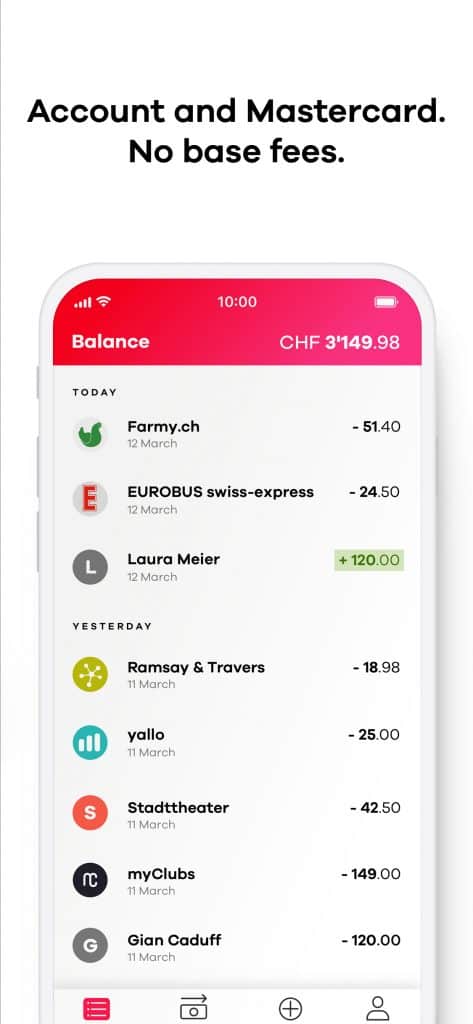

Zak and Neon are two good Swiss Digital bank accounts. This is because they are both entirely digital and accessible through mobile applications.

The great thing about these bank accounts is that they are significantly cheaper than conventional ones. Their low prices are what make them successful. And they have some interesting extra features.

But which one should you choose? Which of Zak vs Neon is better for you? We will find out!

In this article, I compare Zak vs Neon in detail. We see the fees, the security, and the limits of both bank accounts. By the end of the article, you will know which Zak vs Neon is best for you!

|

3.5

|

5.0

|

Zak

Zak is a bank account managed by Bank Cler (previously Bank Coop). So, while it is a digital bank account, it is backed up by a traditional bank, not a startup.

Even if Bank Cler backs it up, Zak has no offices. It is entirely digital. It is also completely mobile, so you must use it from your phone. Zak is not a bank itself. It is merely a bank account offered by Bank Cler.

In addition to the usual banking features, Zak has several extra features you can use with other Zak users. For instance, you can send money directly to any other user of Zak. You can also manage a budget with several other users. This is an excellent feature if you know other users.

For more information on this bank account, you can read my full review of Zak.

Neon

Neon was one of the first Swiss digital bank accounts. Neon is entirely digital. There are no offices where you can do operations. It is fully mobile, and there are no online applications either.

Neon is not a bank. They do not have a bank license of their own. Another bank does not back Neon. However, your money is held at the Hypothekarbank Lenzburg Bank, another reputable Swiss bank. It means you are protected as if your money was in any other large bank.

One very interesting fact about Neon is that they offer free payments abroad with their card. Neon was the first Swiss bank to provide this service! Of course, others quickly followed it (Zak!), but it is interesting to note that they led the innovation.

For more information on this bank account, you can read my full review of Neon.

Which is cheaper? Zak vs Neon

We start with the critical question of the fees! Which of Zak vs Neon is cheaper?

The critical point about these two bank accounts is that they do not have management fees. So, keeping your account open will not cost you anything. This absence of management fees is essential because it is the most significant advantage of digital banks these days.

With Zak, you will get the cards delivered for free. But with Neon, since May 2020 (it was free before), you will pay 10 CHF to get the MasterCard delivered.

Transfers in CHF between bank accounts are free for both accounts. Payments in Switzerland are also free with both bank accounts. However, not every bank in Switzerland offers this for free.

Now, not everything is free with these two bank accounts. So, we need to compare their prices for several features.

We look at withdrawals first. Zak offers withdrawals for free at any ATM from Bank Cler. For all other ATMs, you will pay 2 CHF per withdrawal. With Neon, you get two free withdrawals per month. After this, you will have to pay 2 CHF per withdrawal.

Neon is slightly better than Zak for withdrawals unless you withdraw a lot of cash. But most people should not withdraw cash more than twice a month. However, if you have a Bank Cler ATM nearby, Zak could be better for withdrawals.

For withdrawals abroad, it is different. With Neon, you will pay a 1.5% fee on each withdrawal abroad. With Zak, you will pay 5 CHF per withdrawal abroad with a Visa. Generally, you should avoid withdrawing money abroad.

Neon has a 0.5% total surcharge for payments abroad, while Zak has about a 2% surcharge. This makes Neon much cheaper for payments abroad or in other currencies.

Also, Neon has a partnership with Wise for international transfers. This partnership makes Neon significantly cheaper if you need to send money abroad.

So, regarding pricing for Zak vs Neon, Neon is cheaper than Zak. But both bank accounts are pretty cheap!

Basic Features

We should compare the basic features of Zak vs Neon.

While Neon offers a Mastercard, Zak offers a Visa. This should not make a difference.

Regarding mobile applications, they have the same basic features. You can do all your banking from any of those apps. Both apps have the same features and the same quality.

In some Bank Cler’s ATMs, you can deposit cash directly into your Zak account. Being able to deposit cash is an excellent feature of a digital bank account. However, you must pay a fee if you want to deposit cash in your Neon account. With digital bank accounts, having extra cash is always an issue.

Both bank accounts support eBill. Neon has supported eBill since December 2019, while we had to wait until March 2022 to get eBill support in Zak. But now, they are both on the same level.

Neon is available in French, German, Italian, and English. On the other hand, Zak is not available in English. So, if you do not speak any of the national languages of Switzerland, you may have issues with Zak.

Extra Features – Zak vs Neon

We can also look at some extra features of Zak vs Neon.

Both banks offer a similar feature for sending money directly to other users. With Neon, you can send money directly to your contacts. With Zak, you can use the Zak Illico service to send money to other users.

Both bank accounts offer the ability to have sub-accounts. They are called Savings Pots with Zak and Spaces with Neon. They provide the same feature.

In addition, Zak has one extra notable feature: Common Savings Pot. You can manage some money with up to 10 people. This feature could be very useful in managing the budget of a project with several people. For instance, you could use it to manage money for a vacation with friends.

For extra features, Zak is slightly better than Neon. However, most of these features will only be useful if you know others using the application. If you do not know anybody using Zak, these additional features will not be helpful.

A feature is useless if you do not use it. So, when comparing bank accounts, you should only compare the features you will use.

Which has higher limits?

If you plan to use a digital bank account as your main account, we need to look at Zak vs Neon’s limits.

With Zak, you can pay up to 5000 CHF per day. And you have a limit of 25’000 CHF per week. You can go over this limit, but you will have to call Zak for each transaction that goes over this limit. Using it as your primary bank account could be a limiting factor.

With Neon, you can spend 50’000 CHF per day from the account. In addition, you can withdraw 10’000 CHF per day with the card, spend 5’000 CHF per day in stores, and another 5’000 CHF online. The card has a monthly limit of 10’000 CHF per month.

You can spend more with Neon’s card than with Zak’s card. However, you can spend much more monthly with your Neon account than your Zak account. But you can spend more than enough with the cards in both cases.

However, you could have issues if you have to make large transfers, such as paying a downpayment. So, these accounts seem better as a second active bank account than a first. But if you do not have any big transfers planned, you should be okay with either of these bank accounts. And if you can spread a large transfer over several days, the limit of Neon becomes almost irrelevant.

Security – Zak vs Neon

We must look at security when using these two bank accounts.

First, a critical part is what happens to your money if they bankrupt (or closes down). With Neon, your money is held safely with Hypothekarbank Lenzburg. So, it is protected under Swiss law up to 100’000 CHF. You have the same protection with Zak since Bank Cler holds your money. So, both accounts have the same legal security.

From a security point of view, both apps are linked to your phone. So you will have a password to enter the application. The application is linked to your phone. It means that your phone acts as a second-hand factor. So, the application is protected as long as the security of your phone is not compromised. So, again, Zak and Neon have the same technical security.

From a security point of view, Zak and Neon have the same level of security.

What about Zak Plus?

The primary account at Zak is free. But they have an offer for the Zak Plus account.

Zak Plus will cost you 8 CHF per month. But it will reduce the prices of the features of Zak. The prices when you use the Visa and the Mastercard will not change. But with the Visa, several things become free:

- Unlimited withdrawals at any ATM

- Unlimited withdrawals abroad

Given that Neon offers free purchases abroad with their Mastercard for free, I think there is little value for Zak Plus over Neon or Zak Basic. Of course, an advantage of Zak Plus is that you will get withdrawals abroad for free compared to the Neon 1.5% fee. But it is not every day that you need cash abroad.

Zak vs Neon – Summary

We can now make a final summary of the comparison of Zak vs Neon:

|

Best Swiss Bank

|

|

|

5.0

|

3.5

|

|

|

|

|

|

2 free withdrawals per month

|

Free withdrawals at Bank Cler ATMs

|

|

0

|

0

|

- Pay abroad for free

- Cheap international transfers

- Everything from your phone

- Medium limits

- Translated in English

- Difficult to deposit cash

- Expensive withdrawals abroad

- No Maestro card

- Pay abroad for free

- Can deposit cash in account

- Support for e-bills

- Not very transparent fees

- Low limits

- Expensive international transfers

- Expensive withdrawals abroad

- No Maestro card

- No physical card for abroad

- No English support

Neon has a few more advantages than Zak. But both Zak and Neon are good choices with different strengths:

- Neon offers much cheaper payments abroad and in foreign currencies

- Neon offers international transfers cheaper than Zak

- Neon has higher limits

- You can deposit cash in your Zak account for free

- Both banks are open to foreigners living in Switzerland.

You may want to choose between Zak vs Neon based on your needs. Or you may use both if you wish. Since both are free, you can also try both and choose the one you prefer after some time.

Zak vs Neon Conclusion

Choosing between Zak vs Neon is not easy. They are both good digital bank accounts. They have both their advantages and disadvantages.

All the services you need to pay, save and invest, in a neat package, with extremely good prices!

Use the poorswiss code to receive 10CHF!

- Pay abroad for free

- Invest with great fees

Regarding Zak vs Neon, I prefer Neon over Zak for several reasons:

- Neon has much cheaper payments abroad

- You can do international transfers with Neon at a good price.

- Neon is truly innovative. Indeed, Neon introduced all the features first, and Zak tries to follow.

Now, Zak has a few advantages, as well. For instance, with Zak, you can deposit cash directly into your bank account for free with Bank Cler ATM. Of course, it could be practical if you often get cash. But I cannot remember when I had to deposit some money into my account.

Since they are both cheap, you could try them and see which one you prefer afterward.

If you want a good credit card, you will have to look at some other credit cards with cashback. Neither Neon nor Zak offers an excellent card for domestic purchases, but they both offer good cards for purchases abroad.

If you want more digital alternatives from big Swiss banks, you can read my review of CSX from Credit Suisse.

What about you? Which of Zak vs Neon do you prefer?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best banks

- More articles about Save

- Alternative Bank Switzerland Review 2024: Pros & Cons

- How to create a Neon account and use the mobile application

- Coop Finance+ Review 2024 – Pros & Cons

Hi there, I would like to open Zak using your referral but I cannot find it in Apple store. When I went to the website and clicked on the the app to launch, I got an error message “This app is currently not available in your country or region”.

My country in my Iphone is Switzerland! I could find and download all other Swiss apps (e.g. Neon) without any problems. Do you think Zak is not available in Bern?

Thanks!

Hi MH,

Thanks for considering using my referral code :)

It should be available in all of Switzerland! Here is the link from Zak website: https://apps.apple.com/ch/app/bank-cler-zak/id1290157822

If it’s not available on your phone, I would recommend you contact them because that’s not normal :)

Never mind! I finally worked it out after a few months!

> What about you? Which of Zak vs Neon do you prefer?

Neither. Yapeal is superior to Zak and Neon. As they deposit the money at the Swiss Nationalbank, the money is safe as well.

Hi Steven,

Maybe you could share why you find Yapeal superior? I actually find it significantly inferior to both Neon and Zak. I have a review of Yapeal.

Hi!

quick question, do you think keeping an account on both digital banks is a good way to manage all your transactions and savings in switzerland and abroad?

or could this be a too conservative way of going about it? specially because of the 3rd pillar thing.

thanks in advance! love the blog!!!

Hi Gabriela,

Having accounts with both banks is not an issue. But keeping too much money in both would be conservative and sub-optimal compared to investing the money. So, it’s not about the number of accounts but the amount in each accounts.

Thanks for stopping by!

Hey Mr. Poor swiss

Is there any more affordable way for withdrawing cash outside of Switzerland and still being connected to your account?

I have read the option with zak plus, but paying additional 8 CHF monthly is in my opinion too much. Or revelot (free cash withdraw up to 200£, after 2%), but I found the need of charging your account inconvenient. As someone who travels to countries that cash is still the main way of payment, I’m paying a lot on fee’s, one year in india cost me about 300 CHF of fees (which is about another month worth of traveling, in that case maybe the zak plus is better ) I didn’t had the best deal at the time… Fix withdraw fees + currency exchange fees.

What so you think?

You see, not all want to retire early, some prefer a more laid back and humble living (:

Hi Yaron,

I do not know about a better offer for withdrawals abroad. If you are doing a lot of withdrawals, Zak Plus remains a good option (would only be 96 CHF per year, not that bad).

Withdrawals are always expensive, unfortunately. You could also batch the withdrawals, but then it may be dangerous to carry much money around.

Thanks for stopping by!

Hi Yaron,

I found an option where you can withdraw EUR 1,000.00 at a time and EUR 2,500.00 annually. This could be useful if you need this function only occasionally.

However there are some other limitations:

– you can top up only EUR 5,000.00 annually and only in EUR or GBP currency (exchange available in the app)

– you can top up only from bank card (Revolut reject this kind of payment but TransferWise accept it)

– it is available only in EEA (UK and EFTA except Switzerland)

Available currencies: EUR, GBP, USD, CHF, PLN, CZK, RUB, CNY

https://paysend.com/en-ch/global-account

Maybe the following product can help you if the above one doesn’t applicable for you. (I haven’t try it.)

https://www.centtrip.com/

Hi Yaron,

I forgot to mention one more product.

You get one EUR account and available 2 cryptocurrency wallet also (Bitcoin and Ethereum).

Everything is free of charge except lost/stolen card replacement, crypto related trades (buy, sell also) and transactions (sending but only network fee).

Worldwide withdrawals are free also (limit: EUR 3,000.00/withdrawal).

The whole process could be slow because instant SEPA and “top up from card” aren’t available therefore you have to prepare.

To sign up: you need to have residency in EEA (Switzerland included) with wide range of nationality (except many African, Asian countries and US).

Supported documents: https://www.bitwala.com/documents/

Hi,

Just got the following notice from Zak, which is much better for me:

We are increasing the limits for transfers: from mid-October you can transfer up to CHF 25,000 per week. This means that in the future you will no longer have to call us for approval up to this amount.

Hi Doods,

Yes, I have received this message as well. This is great news! I will have to update my articles regarding Zak to reflect this new value.

Thanks for stopping by!

Good overview as always, but I’ve seen you mention one thing several times about e-bills, that is wrong in my opinion, unless I misunderstood: e-bills are not automated payments, like LSV. E-bills are like a normal invoice, but instead of receiving it by mail and then more or less manually have to enter the details into your online banking, you will receive it straight into your online banking. But you still have to manually review it and approve or reject it. So really the only difference to a normal bill is the way you receive it.

Hi Mischa,

You are right, e-bills are not really automating anything. But it’s not the reason I do not like them (although I may not have been clear indeed on that point!).

The problem with e-bills is that they bind you to a bank. When I had ebills at PostFinance, it was a huge pain to move them to a new bank account. In the end, I simply canceled them all to make it easier to change bank accounts. And even canceling them was a pain…

So, I prefer to be able to change my bank account easily than use e-bills. For instance, next year we plan to move to a joint account. Not having e-bills will make it much easier than last time.

Thanks for stopping by!

Interesting. I haven’t changed bank since I use e-bills, but are you sure they our bound to the bank? I don’t know about PostFinance, but my bank (Raiffeisen), uses, I believe, a third party system, where I think I had to sign up using my email address.

You may be right, I haven’t looked into it, but from the looks of it, it seems the e-bills are bound to me personally, not my bank account.

But yes, if that’s your reason you don’t like them, that makes sense. I had the impression you don’t like them because you thought they are automated payments like LSV, but I understand now.

(Btw, I agree on automated payments. They are not good and I don’t use them ever. I also try to avoid subscriptions as much as possible, for the same reason).

Hi Mischa,

No, I am not entirely sure.

Last time I had to do that, I checked with one of the issuer (one insurance) and they told me the only way was to cancel it in my current bank, enable it again in my new bank account. And another issue told me, I had to cancel it, pay at least one month a paper bill, and then enable it again for the next month. So in the end, I decided it would be easier to cancel them all.

Now, it’s entirely possible that there is a better system available!

And it’s also entirely that I am too much biased :) Which I can live with :)

Regarding automation, I should maybe make that more clear in my articles that not all automation is bad. Only automated payments and things that bind you too much to a bank are bad from my point of view.

Thanks for the discussion :)

Hi there

E-bill is an external provider to your own bank. They are a MASSIVE pain to say the least and I wish I could do without. Their API is sluggish, unfriendly at best …and there’s no easy way to contact them (because of course when it doesn’t work, it’s not your bank’s fault… and never theirs either).

But I love receiving invoices electronically, there’s a market there, a world of improvement to grab.

Keep up the good work Mr.ThePoorSwiss :)

Hi Trish,

As you said, the system could get some improvements!

If the system was good and it was easy to change bank accounts, I would also like to get my bills easily. But for now, I really do not want to go through the pains of changing bank accounts with ebills.

The idea is good, the implementation is meh.

Thanks for stopping by!

Hi Mr Poor Swiss,

Really interesting read, thank you.

Do either if the digital banks cater for joint/shared accounts?

My husband & I would like to have the same account for household bills etc

Hi Jennifer,

Thanks for your kind words :)

They currently do not, no. I do not yet know any digital bank that allows for a joint account.

On its FAQ, Neon mentions that they working on figuring out a way to do that, but there is no extra details.

That’a good question! I should have to make more research on join accounts.

That’s the only thing that prevents me from using Neon/Zak instead of Postfinance, joint accounts. I guess it looks better in terms of growth when each couple has to open two separate accounts ;)

Haha, that’s a good point. I do not think this is the reason they are not offering it yet ;)

But hopefully, this feature will come.

Hello Mr. The Poor Swiss,

A good review from this two digital bank. Just to give a bonus for withdrawal. You can have unlimited withdrawal with Neon if you use Sonect ;-) I try it once in a Kiosk and it’s really easy to set up. But, these digital banks are not set up for this kind of use in my opinion.

See you in a next article.

Hi Yanikuza,

That’s interesting! I actually did not know about Sonect! I never tried it. But indeed, it could help with the limit number of withdrawals.

Now, I very rarely needed to withdraw cash more than twice in a month, so for most people, it should not be an issue with Neon.

But that’s a good point!

Thanks for stopping by!

Neon has a limit of 30k from the account per day (not 24k per year, as you wrote) – 24k/year would make Neon useless to me ;)

https://www.neon-free.ch/de/faq/?category=7&article=63

So totally enough as first hand account

Hi Fabian,

Yes, 24K was the old limit (and it was indeed per month, my fingers betrayed me). 24K per year would make it useless to everybody I think.

This has been updated already, but the mistake may still be in cache.

Thanks for letting me know!

Thanks for the review. I am considering between Zak! and Neon and this was helpful!.

You mention the 24k CHF / Year limit with Neon. But I don’t see it mentioned anywhere in their website.

The only limits I could find were: https://www.neon-free.ch/en/faq/?category=7&article=63

Could you update the numbers and clarify where you got the 24k CHF value from?

Hi Gokul,

I am glad this was helpful!

Good catch, this is wrong indeed. This is a limit per month and not per year. And 24K is the previous limit, it’s been raised to 30k Now.

I have updated the article. It’s now a limit of 30K per month for None.

Sorry about that!