Yapeal Review 2024 – Pros & Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Yapeal is a very recent digital bank that was introduced to the public in 2020. It is the first bank in Switzerland to have a Fintech banking license.

Yapeal is advertised as the next generation of banking, with many features and straightforward onboarding. It has a free tier, but several features are not free.

In this review, we see precisely what Yapeal is: its features, its price, its advantages and disadvantages, and much more!

| Monthly fee | 4.90 CHF |

|---|---|

| Users | Unknown |

| Card | Visa Debit |

| Currencies | CHF |

| Withdrawals in Switzerland | 2 CHF |

| Withdrawals abroad | 1.5% |

| Languages | English, French, German, and Italian |

| Custody bank | Yapeal |

| Depositor protection | Money stored in SNB |

| Established | 2018 |

| Headquarters | Zürich, Switzerland |

Yapeal

Yapeal was founded in 2018 and is trying to introduce a completely different style of banking. It is an entirely digital bank without any offices for its clients. Everything is done on mobile directly.

Interestingly, Yapeal is the first bank to obtain a Swiss Fintech License. A Fintech license is a new kind of banking license. So, Yapeal is officially a Swiss Fintech Bank. We will see in the next section precisely what this means for their customers.

While they claim to offer a completely different banking style, they still provide the same features as most banks in Switzerland. You can pay your bills with this account and make domestic transfers. They only offer a Visa Debit Card with your account. I cannot see anything different about the banking style at Yapeal compared to any other digital bank.

Since they are focused on mobile banking, they offer support for Apple Pay, Google Pay, and Samsung Pay. This is great for people that like paying with their smartphones. But this is hardly a novelty since most digital banks now offer these features.

They also provide support for e-bills, which a lot of people look after. E-bills are a great thing since few digital banks already have this feature. Also, they are the only digital bank with full integration inside the app. Other digital bank apps bring you to a website from inside the app to handle e-bills. So, if you are an avid user of e-bill (I am not), you may like this. But you should not be blindsided by looks. The features are what matters, not the looks.

In 2021, they partnered with Wise to offer international payments. Using Wise’s extended network, users can make international payments in many currencies.

Finally, you can also transfer money directly to other Yapeal users. These transfers are instant.

On their website, they are trying hard to be a bank and a community. They are trying too hard, and this makes their website appalling to me. But this may be different for other people. I could not care less about the community of my bank. I want good features that work and a reasonable price for them.

Yapeal and the Fintech License

As mentioned before, Yapeal has a special Fintech banking license. FINMA launched this new kind of license in 2019. But Yapeal was the first institution to get one.

Compared to a standard banking license, there are several limitations:

- The bank is limited to deposits up to 100 million CHF

- The bank is not allowed to invest its client assets

- The bank is forced to deposit all the money of the clients in the Swiss National Bank (SNB)

So, this license is a limited banking license. But this new license is supposed to be easier to obtain than a standard banking license.

Another difference is that there is no security deposit protection. If the bank goes bankrupt, the money is not protected up to 100’000 CHF like other banks. On the other hand, this does not matter since they will store your cash directly in the SNB. So, security should be fine.

Overall, whether the bank has a full banking license or a fintech license does not significantly affect customers. It is only a limitation for the bank itself.

Yapeal Fees

Swiss banks are expensive, and it is essential to avoid paying too much banking fees. So, we take a look at the fees of Yapeal.

They have three different pricing tiers:

- Loyalty is free

- Private costs 4.90 CHF per month

- Private+ costs 8.90 CHF per month

The free Loyalty account is quite limited:

- No domestic payment

- Not possible to pay bills, and no e-bills

- No free cash withdrawals, even in Switzerland

- You have to pay 7 CHF to get the Visa debit card.

- No foreign payment

You can only use mobile payments (Google Pay, Samsung Pay, and Apple Pay). You can also transfer money to other users of Yapeal. All cash withdrawals in Switzerland in CHF will cost 2 CHF and 5 CHF for EUR. Cash withdrawals abroad have a 1.5% fee.

I do not even see the point of this Loyalty account tier. The Loyalty account is free but useless if you cannot make a domestic payment or pay your bills.

The Private account adds support for domestic and foreign payments and paying bills (QR bills and e-bills). Also, the Visa debit card is now free with this tier.

The Private account is already more interesting. But all the features are basic since you would get them with most Swiss banks. And 4.90 CHF per month is not cheap for a bank account. Also, you still do not get any free cash withdrawals with this tier.

I do not understand this pricing. All the features of the Private account are available in other banks for free! Why would anyone pay for features you can get for free at other banks and nothing special?

Finally, the Private+ account adds free cash withdrawals in CHF and EUR in Switzerland and abroad. If you make a lot of cash withdrawals, this may be interesting, but this account is not interesting for most people.

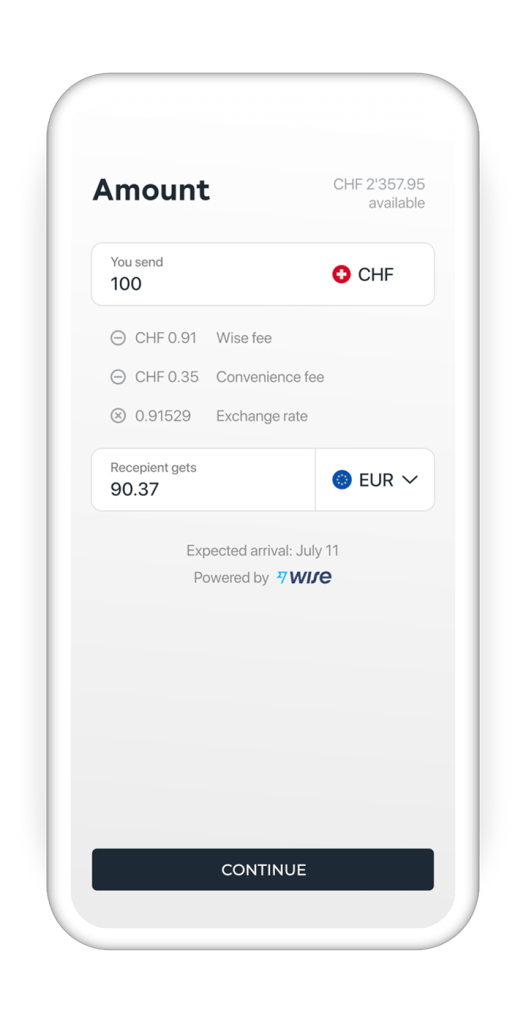

International transfers are done using Wise. In addition to Wise fees (0.40%—1.30%), you will pay a 0.35% convenience fee.

If you pay annually, you will save two months of subscriptions. You would pay 89 CHF per year for the Private+ account and 49 CHF per year for the Private account. But that remains too expensive.

One good thing about Yapeal is that international payments are very cheap. They use the Visa transfer rate, which is generally quite good, and Yapeal does not add any markup to the transactions.

Security

The technical security at Yapeal is good. They verify all their customers during the onboarding process. They also emphasize security for their transactions.

We already talked about depositor protection. Since they have a Fintech license, they have no depositor protection guarantee (no esisuisse). On the other hand, they are forced to deposit your money in the Swiss National Bank. So, the security will be about the same in case of bankruptcy.

So, overall, there does not seem to be anything wrong with Yapeal’s security.

Alternatives

Finally, we should compare Yapeal with other digital banks.

Yapeal vs Neon

For me, Neon is currently the best digital bank in Switzerland. So, we can compare Yapeal and Neon.

While Yapeal has a Fintech license, Neon does not have a banking license. But they are depositing your money in an official Swiss bank. So, from a customer perspective, there is no difference between the two models.

There are a few differences between these two banks on the feature side. They both offer the same features for mobile and domestic payments and have a partnership with Wise for international payments.

Both also offer free purchases abroad with their card. Neon has a Mastercard, while Yapeal has a Visa. It should not matter since both are pretty equivalent.

The differences start when we look at the fees. The Neon account is always free, while only the basic Loyalty tier of Yapeal is free. Neon has many more features than the Yapeal loyalty account.

At Neon, you get two free withdrawals per month. With Yapeal, you must pay 2 CHF per withdrawal with the Private account or get them free with a Private+ account. The Private account is 49 CHF per year, while the Private+ account is 89 CHF.

The only advantage of Yapeal is that you can get cash withdrawals abroad for free with the Private+ account. This would cost 1.5% with Neon. So, if you withdraw more than 6000 CHF abroad annually, Yapeal will be cheaper. But very few people are withdrawing this kind of cash abroad.

All the services you need to pay, save and invest, in a neat package, with extremely good prices!

Use the poorswiss code to receive 10CHF!

- Pay abroad for free

- Invest with great fees

Overall, Neon has the same features as Yapeal but is also significantly cheaper in almost every use case. If you want a digital Swiss bank account, I strongly recommend Neon over Yapeal.

For more information on Neon, you can read my review of Neon. Or, if you prefer a traditional bank, you can also take a look at Zak. Zak will still be significantly cheaper than Yapeal.

Yapeal FAQ

Is Yapeal free?

Yapeal has a free tier. However, this tier is extremely limited and unlikely to be enough for your banking needs.

Does Yapeal support TWINT?

No.

Can you transfer money internationally with Yapeal?

Yes. Yapeal has partnered with Wise to offer international transfers directly from the app. This adds a 0.35% convenience fee on top of Wise's fees.

Can you use Yapeal on your computer?

No, Yapeal is a fully digital bank, only used on smartphones.

Is Yapeal a bank?

Yes, Yapeal is a Fintech licensed bank (the first with this license). This means they are regulated by the FINMA. And contrary to standard banks, they have to deposit all the money directly in the Swiss National Bank (SNB).

Who is Yapeal good for?

Yapeal has no significant advantages over its alternatives. I do not see a compelling reason to use it.

Who is Yapeal not good for?

Yapeal is not good if you are looking for very affordable digital bank account. Yapeal is always not good if you are looking for a service without a lot of useless fluff.

Yapeal Summary

Yapeal is a Swiss digital bank, with a Fintech banking license. They are planning to be the next generation of banking.

2.5

Yapeal Pros

Let's summarize the main advantages of Yapeal:

- Good integration of e-bill

- Access to Google Pay, Apple Pay, and Samsung Pay

- Cheap international payments and transfers

- Available in four languages

Yapeal Cons

Let's summarize the main disadvantages of Yapeal:

- The free account of Yapeal does not have enough features to be useful

- The paid tiers are more expensive than most other Swiss banks

- Extremely cringy website

- Minimal information on the website

- No TWINT

Conclusion

Overall, Yapeal is not very appealing. They have interesting features, but these features are already available in most digital Swiss banks.

In addition to these features, Yapeal is significantly more expensive than other digital banks like Neon and Zak. Even my traditional bank, Migros, is cheaper than Yapeal!

I see no advantage of Yapeal over other digital banks. It feels like an expensive gimmick that tries to build a community and insists on appealing to young people with mobile phones. People should focus on a bank’s features and prices rather than its looks and community. But maybe I am already too old for this kind of bank.

If you are looking for a bank, you should read my comparison of Switzerland’s best banks.

What about? What do you think about Yapeal?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best banks

- More articles about Save

- Wise vs Revolut: Which Is Best in 2024?

- What is the Best Swiss Bank in 2024?

- Revolut Review in Switzerland 2024: Pros & Cons

Hi,

looking for a cheap way to pay in foreign currencies (holiday trip or online store). Did you or somebody compared rates & fees (like you did it for revolut & beon) between yapeal & revolut?

Thanks.

Hi,

I did not do a full comparison. Revolut will always be cheaper during the week, below 1250 CHF per month. After that, it highly depends on the VISA exchange rate, which is not highly predictable.

Thanks for this article, most insightful. As negative interest rates have disappeared, then that is not an issue any more. Regarding depositor protection. If Yapeal does go bankrupt then is not the entire deposit is protected as Yapeal cannot touch it?

Thanks for letting me know, I have updated the article about negative interest rates.

There is no protection from the depositor protection insurance. However, since the money should be in the SNB, it should be safe. But that does not protect against them not respecting their license, but this is very unlikely indeed.

Hello Baptiste,

I am looking for a neo bank account for my daughter which is 12 years old.

So far I could only find Yapini by Yapeal to do the job.

Do you know any other neo bank?

Thank you.

Greetings,

Thomas

hi Thomas,

I am afraid I do not know any good neo banks for Children. I have opened an account for my son at Migros bank. I can manage directly from my other bank account, so that’s convenient.

I use revolut junior. My daughter likes it very much, it’s also completely free

Update:

Domestic payments, bills payment and e-bills payments are possible with the free account.

Hi Bob,

Thanks for the update. This is great news. This makes the free loyalty account much more interesting in my opinion.

I will update the review when I get some time!

Are you sure about that? I wanted to update the article. But looking at their prices (https://yapeal.ch/en/pricing/), I still see none of these features for the free account.

I’m testing Yapeal since a few months. One thing I’m very much enjoying is the eBill integration, it’s just a joy! The neon integration is so clunky and basically just a browser window of the six-ebill viewer while yapeal has it’s own integration and the flow is just *chef’s kiss* – of all the digital banks I’m actually enjoying the UX of Yapeal the most, Revolut’s interface is too cluttered and neon’s too “child-is” and has too much whitespace.

Hi Daniel,

Thanks a lot for your feedback. It’s true that Neon’s integration of ebills is very limited.

I personally do not care about UX at all, as long as I can do things easily. And I do not like having features I do not use, therefore for me, Neon is perfect, simple to use (except for e-bills, but I do not use them).

I will add a note to the article that they have a good e-bill integration.

I use Revolut and Neon: but I believe Revolut has many advantages.

Thanks for the review! Personally I use Revolut as it allow me to deal with all my international payments, uses low exchange rates and has a free visa card. The Free tier has a great offering too!

I really appreciate both the “neutral” pros and cons, the comparison with what you use and your personal take on it…

BTW you have a small typo: “Neon has a Mastercard while Visa has a Visa” <– first visa should probably be yapeal :-)

Hi Jeremie,

Thanks for your kind words!

I was using Revolut a lot before, but now I am mostly using Neon for most things that are not in CHF.

Thanks for pointing out the typo! This should be fixed now :)

Thanks for a very honest review! This is the first time I hear about them.