Zak vs Neon: Best Swiss digital bank account in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

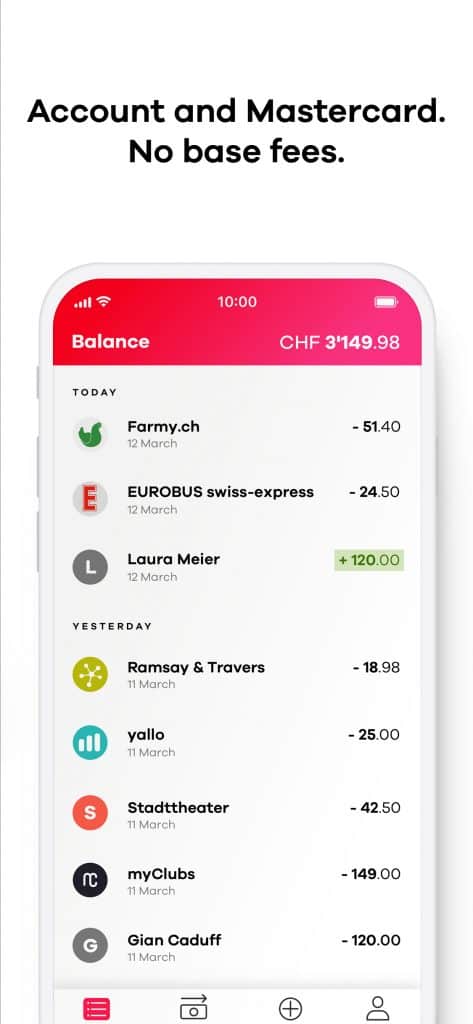

Zak and Neon are two good Swiss Digital bank accounts. This is because they are both entirely digital and accessible through mobile applications.

The great thing about these bank accounts is that they are significantly cheaper than conventional ones. Their low prices are what make them successful. And they have some interesting extra features.

But which one should you choose? Which of Zak vs Neon is better for you? We will find out!

In this article, I compare Zak vs Neon in detail. We see the fees, the security, and the limits of both bank accounts. By the end of the article, you will know which Zak vs Neon is best for you!

|

3.5

|

5.0

|

Zak

Zak is a bank account managed by Bank Cler (previously Bank Coop). So, while it is a digital bank account, it is backed up by a traditional bank, not a startup.

Even if Bank Cler backs it up, Zak has no offices. It is entirely digital. It is also completely mobile, so you must use it from your phone. Zak is not a bank itself. It is merely a bank account offered by Bank Cler.

In addition to the usual banking features, Zak has several extra features you can use with other Zak users. For instance, you can send money directly to any other user of Zak. You can also manage a budget with several other users. This is an excellent feature if you know other users.

For more information on this bank account, you can read my full review of Zak.

Neon

Neon was one of the first Swiss digital bank accounts. Neon is entirely digital. There are no offices where you can do operations. It is fully mobile, and there are no online applications either.

Neon is not a bank. They do not have a bank license of their own. Another bank does not back Neon. However, your money is held at the Hypothekarbank Lenzburg Bank, another reputable Swiss bank. It means you are protected as if your money was in any other large bank.

One very interesting fact about Neon is that they offer free payments abroad with their card. Neon was the first Swiss bank to provide this service! Of course, others quickly followed it (Zak!), but it is interesting to note that they led the innovation.

For more information on this bank account, you can read my full review of Neon.

Which is cheaper? Zak vs Neon

We start with the critical question of the fees! Which of Zak vs Neon is cheaper?

The critical point about these two bank accounts is that they do not have management fees. So, keeping your account open will not cost you anything. This absence of management fees is essential because it is the most significant advantage of digital banks these days.

With Zak, you will get the cards delivered for free. But with Neon, since May 2020 (it was free before), you will pay 10 CHF to get the MasterCard delivered.

Transfers in CHF between bank accounts are free for both accounts. Payments in Switzerland are also free with both bank accounts. However, not every bank in Switzerland offers this for free.

Now, not everything is free with these two bank accounts. So, we need to compare their prices for several features.

We look at withdrawals first. Zak offers withdrawals for free at any ATM from Bank Cler. For all other ATMs, you will pay 2 CHF per withdrawal. With Neon, you get two free withdrawals per month. After this, you will have to pay 2 CHF per withdrawal.

Neon is slightly better than Zak for withdrawals unless you withdraw a lot of cash. But most people should not withdraw cash more than twice a month. However, if you have a Bank Cler ATM nearby, Zak could be better for withdrawals.

For withdrawals abroad, it is different. With Neon, you will pay a 1.5% fee on each withdrawal abroad. With Zak, you will pay 5 CHF per withdrawal abroad with a Visa. Generally, you should avoid withdrawing money abroad.

Neon has a 0.5% total surcharge for payments abroad, while Zak has about a 2% surcharge. This makes Neon much cheaper for payments abroad or in other currencies.

Also, Neon has a partnership with Wise for international transfers. This partnership makes Neon significantly cheaper if you need to send money abroad.

So, regarding pricing for Zak vs Neon, Neon is cheaper than Zak. But both bank accounts are pretty cheap!

Basic Features

We should compare the basic features of Zak vs Neon.

While Neon offers a Mastercard, Zak offers a Visa. This should not make a difference.

Regarding mobile applications, they have the same basic features. You can do all your banking from any of those apps. Both apps have the same features and the same quality.

In some Bank Cler’s ATMs, you can deposit cash directly into your Zak account. Being able to deposit cash is an excellent feature of a digital bank account. However, you must pay a fee if you want to deposit cash in your Neon account. With digital bank accounts, having extra cash is always an issue.

Both bank accounts support eBill. Neon has supported eBill since December 2019, while we had to wait until March 2022 to get eBill support in Zak. But now, they are both on the same level.

Neon is available in French, German, Italian, and English. On the other hand, Zak is not available in English. So, if you do not speak any of the national languages of Switzerland, you may have issues with Zak.

Extra Features – Zak vs Neon

We can also look at some extra features of Zak vs Neon.

Both banks offer a similar feature for sending money directly to other users. With Neon, you can send money directly to your contacts. With Zak, you can use the Zak Illico service to send money to other users.

Both bank accounts offer the ability to have sub-accounts. They are called Savings Pots with Zak and Spaces with Neon. They provide the same feature.

In addition, Zak has one extra notable feature: Common Savings Pot. You can manage some money with up to 10 people. This feature could be very useful in managing the budget of a project with several people. For instance, you could use it to manage money for a vacation with friends.

For extra features, Zak is slightly better than Neon. However, most of these features will only be useful if you know others using the application. If you do not know anybody using Zak, these additional features will not be helpful.

A feature is useless if you do not use it. So, when comparing bank accounts, you should only compare the features you will use.

Which has higher limits?

If you plan to use a digital bank account as your main account, we need to look at Zak vs Neon’s limits.

With Zak, you can pay up to 5000 CHF per day. And you have a limit of 25’000 CHF per week. You can go over this limit, but you will have to call Zak for each transaction that goes over this limit. Using it as your primary bank account could be a limiting factor.

With Neon, you can spend 50’000 CHF per day from the account. In addition, you can withdraw 10’000 CHF per day with the card, spend 5’000 CHF per day in stores, and another 5’000 CHF online. The card has a monthly limit of 10’000 CHF per month.

You can spend more with Neon’s card than with Zak’s card. However, you can spend much more monthly with your Neon account than your Zak account. But you can spend more than enough with the cards in both cases.

However, you could have issues if you have to make large transfers, such as paying a downpayment. So, these accounts seem better as a second active bank account than a first. But if you do not have any big transfers planned, you should be okay with either of these bank accounts. And if you can spread a large transfer over several days, the limit of Neon becomes almost irrelevant.

Security – Zak vs Neon

We must look at security when using these two bank accounts.

First, a critical part is what happens to your money if they bankrupt (or closes down). With Neon, your money is held safely with Hypothekarbank Lenzburg. So, it is protected under Swiss law up to 100’000 CHF. You have the same protection with Zak since Bank Cler holds your money. So, both accounts have the same legal security.

From a security point of view, both apps are linked to your phone. So you will have a password to enter the application. The application is linked to your phone. It means that your phone acts as a second-hand factor. So, the application is protected as long as the security of your phone is not compromised. So, again, Zak and Neon have the same technical security.

From a security point of view, Zak and Neon have the same level of security.

What about Zak Plus?

The primary account at Zak is free. But they have an offer for the Zak Plus account.

Zak Plus will cost you 8 CHF per month. But it will reduce the prices of the features of Zak. The prices when you use the Visa and the Mastercard will not change. But with the Visa, several things become free:

- Unlimited withdrawals at any ATM

- Unlimited withdrawals abroad

Given that Neon offers free purchases abroad with their Mastercard for free, I think there is little value for Zak Plus over Neon or Zak Basic. Of course, an advantage of Zak Plus is that you will get withdrawals abroad for free compared to the Neon 1.5% fee. But it is not every day that you need cash abroad.

Zak vs Neon – Summary

We can now make a final summary of the comparison of Zak vs Neon:

|

Best Swiss Bank

|

|

|

5.0

|

3.5

|

|

|

|

|

|

2 free withdrawals per month

|

Free withdrawals at Bank Cler ATMs

|

|

0

|

0

|

- Pay abroad for free

- Cheap international transfers

- Everything from your phone

- Medium limits

- Translated in English

- Difficult to deposit cash

- Expensive withdrawals abroad

- No Maestro card

- Pay abroad for free

- Can deposit cash in account

- Support for e-bills

- Not very transparent fees

- Low limits

- Expensive international transfers

- Expensive withdrawals abroad

- No Maestro card

- No physical card for abroad

- No English support

Neon has a few more advantages than Zak. But both Zak and Neon are good choices with different strengths:

- Neon offers much cheaper payments abroad and in foreign currencies

- Neon offers international transfers cheaper than Zak

- Neon has higher limits

- You can deposit cash in your Zak account for free

- Both banks are open to foreigners living in Switzerland.

You may want to choose between Zak vs Neon based on your needs. Or you may use both if you wish. Since both are free, you can also try both and choose the one you prefer after some time.

Zak vs Neon Conclusion

Choosing between Zak vs Neon is not easy. They are both good digital bank accounts. They have both their advantages and disadvantages.

All the services you need to pay, save and invest, in a neat package, with extremely good prices!

Use the poorswiss code to receive 10CHF!

- Pay abroad for free

- Invest with great fees

Regarding Zak vs Neon, I prefer Neon over Zak for several reasons:

- Neon has much cheaper payments abroad

- You can do international transfers with Neon at a good price.

- Neon is truly innovative. Indeed, Neon introduced all the features first, and Zak tries to follow.

Now, Zak has a few advantages, as well. For instance, with Zak, you can deposit cash directly into your bank account for free with Bank Cler ATM. Of course, it could be practical if you often get cash. But I cannot remember when I had to deposit some money into my account.

Since they are both cheap, you could try them and see which one you prefer afterward.

If you want a good credit card, you will have to look at some other credit cards with cashback. Neither Neon nor Zak offers an excellent card for domestic purchases, but they both offer good cards for purchases abroad.

If you want more digital alternatives from big Swiss banks, you can read my review of CSX from Credit Suisse.

What about you? Which of Zak vs Neon do you prefer?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best banks

- More articles about Save

- Migros Bank Review 2024 – Good Traditional Bank in Switzerland

- Coop Finance+ Review 2024 – Pros & Cons

- Everon Review 2024 – Pros & Cons

Hi TPS,

Thank you for your great blog. Quick question: you write “For payments abroad, Neon has a 0.5% total surcharge”. Where does this number comes from?

Neon claims that payments abroad are free ( https://www.neon-free.ch/media/neon_services_and_prices_en.pdf ). Do they have some hidden costs? Am I missing something?

Thanks !

Hi Antoine,

Neon itself does not charge you anything for payments abroad. But Mastercard itself has a surcharge compared to the interbank exchange rate of about 0.5%. Very few cards offer interbank exchange rates, only the likes of Revolut and Wise.