True Wealth Review 2024 – Pros & Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Are you looking for a low-cost and reliable Robo-advisor?

True Wealth is a leading Swiss Robo-Advisor. It is the first Robo-Advisor, having started eight years ago, and it is also the cheapest.

In this in-depth review of True Wealth, I look in detail at their investment models, fees, and security.

| Management fee | 0.50% |

|---|---|

| Product Costs | 0.13%-0.20% |

| Investing strategy | Passive |

| Investing products | ETFs |

| Minimum investment | 8500 CHF |

| Currency conversion | 0.10% |

| Customization | Very high |

| Sustainable | Not by default |

| Languages | French, German, and English |

| Custody bank | BLKB and Saxo Bank |

| Users | 14’000 |

| Established | 2014 |

| Headquarters | Zürich, Switzerland |

True Wealth

TrueWealth is an excellent Swiss Robo-advisor with very affordable prices, making it the best Robo-advisor for serious investors.

- Very customizable

True Wealth is a Robo-advisor founded in 2013 by Oliver Herren (the founder of Galaxus!) and Felix Niederer. And the service became available to the public in 2014. As such, it is the most mature Robo-Advisor in Switzerland. They now have more than 9000 clients in Switzerland. And they manage more than 800 million CHF (as of 2023) of assets for their clients. These are quite impressive numbers!

True Wealth has two main selling points:

- Low fees

- Simple investing

These are significant advantages for people choosing Robo-advisors. Another cool thing is that they have a virtual account. It means you can open an account and test many things. And only later can you decide whether you want to transfer money. You can convert your virtual demo account into a real one anytime.

You can use their investment services from your browser. If you prefer, you can also use their mobile apps on iPhone and Android. The mobile application has all the features of the web application.

True Wealth is available in English, French, and German! This choice of languages is great since most Robo-advisors are only available in one language.

So, we will analyze True Wealth in detail!

Investment Models

First, we see how True Wealth invests your money.

True Wealth follows a passive investing strategy. True Wealth is only investing in index funds. Specifically, they are investing in Exchange Traded Funds (ETFs).

Using passive index funds is great news! Passive investing is the best way for most people to invest.

With True Wealth, you can invest up to 99% in stocks, the highest Robo-advisors offer. It is good to keep a little cash to pay the fees without liquidating the shares, which would be less efficient.

You cannot choose the ETFs you invest in directly. Instead, the Robo-Advisor will decide on a portfolio for you. Based on several questions the tool will ask you, a portfolio will be designed based on your needs. But do not worry—you will have your say in it!

They will ask many questions to evaluate your risk tolerance. For instance:

- How long and how much do you plan to invest?

- How long and how much do you plan to divest?

- What would you do if your assets lost 10% of their value?

- And so on.

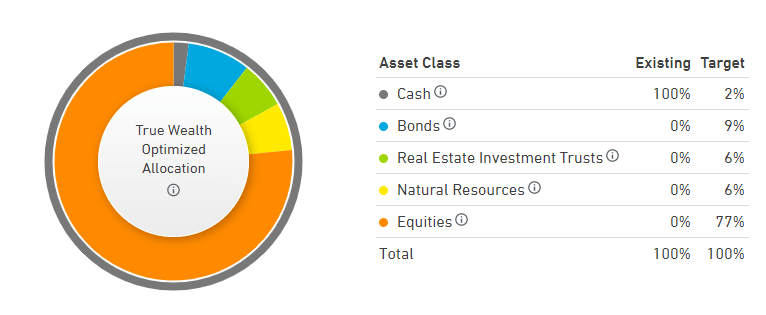

Once you answer these questions (it will take you two or three minutes), you will get your portfolio. For instance, here is mine after answering them:

It is an interesting portfolio. It makes quite a lot of sense to the general public, and based on my answers, I can understand why they would choose it. However, for me, it is not aggressive enough.

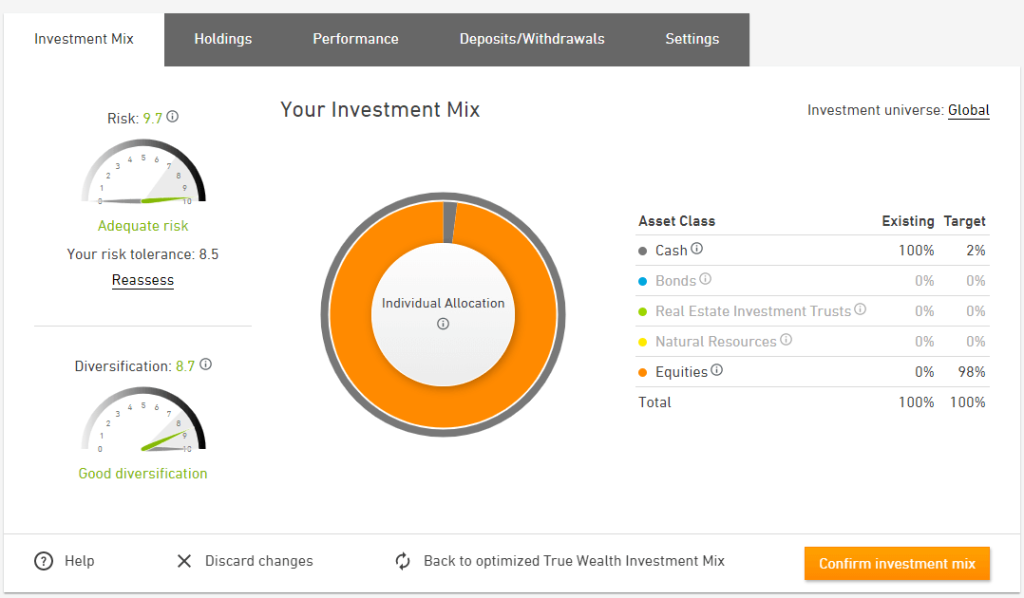

However, the default portfolio is not an issue because you can customize the portfolio! Customization is a great thing about True Wealth! You have great freedom in customizing your investment portfolio!

First, you can configure each of the asset classes. For instance, you can remove all bonds, real estate, and natural resources. You can also increase the allocation of bonds or have more cash.

In my case, I set the portfolio to the maximum amount of stocks (99%). You can choose the portfolio that suits your needs the most. They always keep 1% cash at a minimum to help rebalance and pay fees.

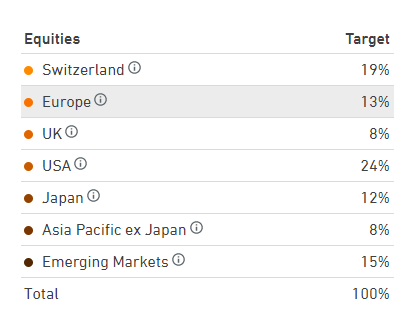

The optimization can go even further. You can customize the composition of each of the asset classes per region. For natural resources, you can choose between metals and diversified natural resources.

For me, this is an excellent level of customization. Some people would like to go one step further by choosing ETFs directly. But, I would argue that if you want to select your own ETFs, you should not invest with a Robo-Advisor in the first place. You should invest by yourself with a broker account.

Overall, I think that the investment system of True Wealth is excellent. You will invest only in low-cost ETFs. And you can customize your portfolio up to the details.

Fees

Now, we look at the fees. If you are investing for the long term, investing fees are extremely important.

With True Wealth, you pay two fees:

- The fees of the ETFs depend on your portfolio.

- The management fees depend on the size of your account.

Together, these two fees are what you will lose to fees every year.

The fees of the ETFs will depend on your portfolio. I have seen that it will vary from 0.13% to 0.2%. The most expensive ETF is the Real Estate ETF. If you do not invest much in Real Estate, you are unlikely to go higher than 0.2%. My very aggressive portfolio has only 0.13% fees!

Together, True Wealth’s total fees will be between 0.63% and 0.70%, on average. These fees are excellent.

The default management is 0.50% per year. If you have an extensive portfolio, it can go down even lower. From a 500’000 CHF portfolio to an 8’000’000 CHF portfolio, the fees will decrease from 0.50% to 0.25%! For instance, a 1’000’000 CHF portfolio will only cost 0.39%. These low fees are a great result. You can find the details on their website. If you plan to retire early and invest with a Robo-Advisor, it is terrific for your future.

There is an extra fee on top of this: the stamp duty tax. If you want details about this, I have an article about the Swiss Stamp Tax. This fee is paid on each purchase and sale of ETFs. It will cost you 0.15% for a foreign ETF and 0.075% for a Swiss ETF.

It is difficult to say how much this will cost in the percentage of your portfolio since it is also based on the purchase price and sale price. Also, it is not due each year. Overall, it should add up to less than 0.05% per year. It is a pity that True Wealth does not include this in their total fees! It would make things simpler.

Finally, you will also pay a 0.10% fee for each currency conversion done by True Wealth. This fee is the best currency conversion fee of all Swiss Robo-advisors.

Overall, the fees of True Wealth are excellent! When you compare with other Swiss Robo-Advisors, they have significantly lower fees! In total, you can invest for a minimum of 0.63% TER!

Robo-Advisors are a tradeoff of simplicity versus cost. You can save on fees if you do not mind the hassle of investing alone. Of course, the fees are higher than for DIY investing. But if DIY investing is not for you, Robo-Advisors are the next best thing.

If you are not convinced that fees are important, I urge you to consider what investing fees do to your retirement money.

Opening a True Wealth account

Opening an account with True Wealth is very simple and can be done entirely online. I will not describe each step since you only have to follow the workflow; there is nothing special about it.

Once you have created your base account, you must undergo a risk assessment. This is how each Robo-advisor works in Switzerland. They will ask you a few questions to establish your risk profile.

They will propose a portfolio for you based on your risk profile. You can change it, but you will be warned that if you go higher, you may be outside of your risk tolerance.

Deposit and Withdrawals

We can also take a look at how funding and withdrawing work.

First, I need to mention a downside: True Wealth has a minimum of 8500 CHF to invest with them. 8500 CHF is too much of an entry point for many people who want to get started. And many people would probably like to try the service without investing that much money. On the other hand, you can test the service by creating a virtual account.

To fund your account, you can deposit money by transferring money to a personal IBAN. Your cash is held in your name at the custodian bank account, so you get a personal IBAN.

Interestingly, you can deposit CHF, EUR, USD, and GBP! This is an excellent feature.

You can also withdraw your money from the interface. You can only transfer to an account in your name. You must close your account to withdraw less than 8500 CHF.

Withdrawing and depositing money into your True Wealth account is quite standard. There are no surprises here.

Is it safe to invest with True Wealth?

You must consider its safety if you invest significant money in an online service.

First, we look at how assets are stored. Your assets are not held by True Wealth itself. Instead, a custodian bank holds your assets. True Wealth uses two custodian banks:

- Basellandschaftliche Kantonalbank (BLKB)

- Saxo Bank Switzerland

You can choose which one you prefer. In both cases, your shares are protected from the bankruptcy of True Wealth since they are held in your name. With BLKB, you have unlimited protection for your cash. With Saxo Bank, your cash is protected up to 100’000 CHF. In most cases, your cash will be safe since you should not hold that much cash.

In the case of both custodian banks, they cannot lend your securities to other investors. Not allowing securities lending improves the safety of your assets. And this is a nice guarantee provided by True Wealth.

So, you are very well protected against bankruptcy or a takeover of True Wealth.

Is True Wealth Secure?

Now, we can also examine technical security. We do not want a hacker to steal all our assets!

For that, all communication with True Wealth will be encrypted. And you can use Second Factor Authentication (2FA) to add an extra layer of security. I highly recommend that you do so for each online service you use. They are offering support for the most used 2FA platforms. So this is great!

On top of that, you can only transfer your assets to an account in your name. This limitation is very good for security! If a hacker took hold of your account, they would also have to hack your bank account to get your funds. This security makes it unlikely to lose your assets!

Overall, I think True Wealth’s technical security is as good as it can be. It seems that True Wealth is very security-aware, which is excellent news for its investors.

Do not forget that the most significant security problem is the human factor. So, you need to take online security seriously.

Sustainable Investing with True Wealth

Sustainable investing is very popular these days.

And fortunately for investors who are motivated by this, True Wealth also lets you invest sustainably.

When you design your portfolio from True Wealth, you can choose between two investment universes:

- Global: All stocks for each asset class

- Sustainable: Only stocks from sustainable companies for each asset class

So, you only have to change a single thing, and your entire portfolio becomes focused on sustainable investing.

When you choose the sustainable universe, True Wealth will use Socially Responsible Investing (SRI) ETFs from MSCI. So, all the ETFs will be replaced by their SRI equivalents.

These ETFs are more expensive than the base ones. So, the total fees of your portfolio will be higher if you choose sustainable investing. For instance, the portfolio I selected for me had total fees of 0.63% and went up to 0.80% with the sustainable universe.

I think that the True Wealth system for Sustainable Investing is quite good. I wish that the ETFs were cheaper. But that is not something that True Wealth has much control over. Their approach to sustainable investing is similar to that of most other Robo-Advisors.

If you are not clear about that, read what is Sustainable Investing, ESG, and SRI.

Investing for your children with True Wealth

As of 2023, you can open accounts for your children with True Wealth.

With that, the legal representative can open an account for the child in the child’s name. This account is then managed by the representative until the child is 18.

Once the child is 18, the account can be transferred to his management directly.

This feature is great because there are few options to do that in Switzerland.

True Wealth Reputation

It is important to look at the reputation of any financial service before using it.

Overall, the reputation of True Wealth is quite good. They have 4.9 stars out of 5 on their Google Reviews (out of 31 reviews). Reading the reviews, people are really happy about multiple points:

- The service is very easy to use;

- The performance is good;

- True Wealth is very transparent;

On the negative side, I could only find two complaints:

- The lack of a mobile application. But this is now addressed since True Wealth has mobile applications as well.

- The lack of proper phone support.

I also looked at some reviews on TrustPilot, but there are only 15 of them. Some people complained that the performance was lower than the S&P500’s. I wanted to mention that review because many people misunderstand ETF Robo-advisors.

True Wealth manages a fixed index ETF portfolio for you. They will not perform any magic to perform better than the market. You can get S&P500 performance (minus fees) at True Wealth by only holding this index in your portfolio. The main advantage of a Robo-advisor is ease of use, not performance.

So, overall, the reputation of True Wealth is really good, and customers seem very happy.

Alternatives

We should quickly compare True Wealth with some alternatives.

True Wealth vs Selma

|

4.5

|

4.0

|

|

Great Robo-Advisor

|

Very affordable

|

|

|

|

|

|

Good

|

Good

|

- Beginner-Friendly

- Degressive Fees

- Great diversification

- A good strategy with ETF

- Little customization

- Outstanding fees

- Very customizable

- Great diversification

- A good strategy with ETF

- High minimums

- Not always easy to use

Selma is another well-known Robo-advisor from Switzerland. Both are quite similar in their investment strategy.

There are two main differences between these Robo-advisors:

- Selma is simpler to use if you know nothing about investing

- True Wealth can be significantly cheaper

So, if you are looking for the cheapest Robo-Advisor, True Wealth is the way to go. On the other hand, if you are looking for a beginner-friendly Robo-advisor, you should go with Selma.

For more information, you should read my in-depth comparison of True Wealth vs Selma.

FAQ

What is the minimum you can invest with True Wealth?

You need at least 8500 CHF to start investing with True Wealth.

How much will you pay in fees for True Wealth?

You will pay a management fee of 0.5%. On top of that, you will have to pay the fees of the funds. The total should amount to about 0.65% to 0.70% per year. If you have more than 500’000 CHF, you will pay lower fees, all the way to a minimum of 0.25%.

Who can invest with True Wealth?

All legal residents of Switzerland that are at least 18 years old can invest with True Wealth. True Wealth is planning to have children’s portfolios in the future, to invest for your children.

What happens if True Wealth bankrupts?

If they go bankrupt, your assets are safely stored in a custodian bank. Your cash will be protected by up to 100’000 CHF in case of bankruptcy of the custodian bank.

Can we use a TrueWealth account to invest for children?

Yes, True Wealth offers portfolios for children and young people. The portfolio can be open by the legal representative. And once the children are of age, the account can be transferred fully.

Can we open a True Wealth account from abroad?

No, True Wealth is only open to Swiss residents.

Who is True Wealth good for?

True Wealth is great for advanced investors that want to use a Robo-advisor and minimize their fees.

Who is True Wealth not good for?

True Wealth is not the best to beginners, being a bit more complicated than some other alternatives.

True Wealth Summary

TrueWealth is an excellent Swiss Robo-advisor with very affordable prices, making it the best Robo-advisor for serious investors.

Product Brand: True Wealth

4.5

True Wealth Pros

Let's summarize the main advantages of True Wealth:

- Fees are significantly lower than other Swiss Robo-Advisors.

- Great investing strategy with passive investing.

- Can deposit money in several currencies.

- Excellent customization of your portfolio.

- You can invest sustainably with True Wealth.

- True Wealth has good security.

- Your assets are well protected in case of bankruptcy.

- Very transparent information.

- Relatively simple to use.

- Free demo account that you can use directly.

- Fully featured mobile application.

True Wealth Cons

Let's summarize the main disadvantages of True Wealth:

- You need at least 8500 CHF to invest with True Wealth

- Stamp Duty is not included in the management fees.

Conclusion

TrueWealth is an excellent Swiss Robo-advisor with very affordable prices, making it the best Robo-advisor for serious investors.

- Very customizable

Overall, I am impressed by True Wealth. They are proposing a great investment system at a very low cost. And on top of that, the freedom to choose your portfolio is high! You can decide on your exact portfolio. In the long term, True Wealth is a great service for a serious investor.

If I had to choose a Robo-Advisor, I would invest with True Wealth. They are the cheapest Robo-Advisor in Switzerland. And these low fees will make a significant difference in your returns in the long term. Also, the fact that you can tune the portfolio to your needs will make it good for most people.

However, I would prefer if they had a lower minimum. The minimum of 8500 CHF for investing is steep for many people who want to get started.

Other than that, it is an excellent service!

Keep in mind that I do not use a Robo-Advisor. I invest in stocks by myself in a broker account. DIY investing is more complicated, but I pay much lower fees than with a Robo-Advisor. Ultimately, it is a tradeoff, whether paying an advisor or doing it yourself.

It is also worth mentioning that True Wealth also offers a third pillar account. This offer is directly integrated into the main application, and you can manage all your assets holistically. You can find more information in my True Wealth 3a review.

If you want to know how it compares with other alternatives, read my comparison of True Wealth and Selma. Or, if you want more information about True Wealth, read my interview with Felix Niederer, the CEO.

What about you? What do you think about True Wealth?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Robo-Advisors

- More articles about Investing

- Investart Review 2024 – Pros and Cons

- Interview of Felix Niederer, CEO of True Wealth Robo-Advisor

- Swiss Robo-Advisors 2024: Invest without any hassle

Dear Baptiste,

Many thanks for all these precious information. This blog is really amazing!!

I am currently evaluating my options to investing in a 3A pillar account for the year 2022 (do not have one yet).

I have seen that you recommend Finpension for the 3rd pillar, here:

https://thepoorswiss.com/finpension-3a-review/

TrueWealth is offering since very recent a 3rd pillar account and I am very interested to know how it compares to Finpension.

Is it possible to do such a comparison before end of year 2022 please?

Thank you very much and keep up the great work!

Hi Mike,

Please use the search function :)

I already wrote an article about True Wealth 3a.

Hey Baptiste,

I’m thinking of transferring an existing 3rd pillar to them, but I want to have control over how much of it remains in cash (and get the 1%?) and how much gets invested in stock.

Basically, I don’t want to put everything in stocks right now, rather, stage the investment, e.g. 2k per month, for 10 months, or something like that.

From what you’ve seen with TW, can I do that?

Thanks & keep it up with your posts! Would love to have a private chat some day.

Hi Dimitris,

You can tune your portfolio and include cash in the portfolio. If you only have a 3a with them, you should indeed be able to choose how much cash you get in your 3a by tuning the portfolio in your account.

Hey Baptipse,

I went through your review for TrueWealth 3a, as well as their online docs, and I’m not sure if there is an option to configure how much cash you want in your portfolio/3a.

I’ve created a demo account and no matter what the risk profile ends up being, the cash portion is always 1%. What changes is essentially the bond/stock allocation percentages. E.g. a super conservative portfolio has 84% Bonds, 7% Real Estate, 9% Equities and 1% cash.

You can configure the amount of money you plan to put int your 3a account/year (the auto top-up), but that doesn’t affect the investment allocation profile.

So no matter what, the cash portion is 1% and I suppose that on that 1% you get the advertised 1% rate.

In short, I don’t see how you can tell TW to keep X amount of your portfolio in cash, and apply the chosen investment profile for the rest.

Someone with a fully activated account maybe can tell us what is possible and what not.

Thanks and Regards!

Hi Dimitris,

You have to create a custom investment mix. From the “Investment Mix” tab, click on cash, and then you can slide the configuration all the way to 100% cash.

Aha, I’ve missed that, thanks Baptiste, I’ll give it a go.

The interface and the processes looked very sleek with TrueWealth.

What I don’t like so far is the fact that you can only have 1 investment profile.

Thanks again!

Yeah, I agree, the investment profile should be separated from 3a and free assets and you should possibly have one investment profile per 3a.

Dear Poor Swiss,

TW now has a 3A option, what are your opinions on this?

https://www.20min.ch/story/jetzt-kannst-du-deine-altersvorsorge-anlegen-ohne-versteckte-gebuehren-473149593030

Hi,

I don’t have an opinion yet, but it’s on my todo list to research this and write about it.

Dear Baptiste,

Since I have discovered your blog, Im reevaluating all my investment/pension strategies (and regretting them!). I would be grateful for your advice on our 3a (which is strictly not a 3a but an ‘Assurance épargne liée à des fonds de placement avec apport unique.-prevoyance libre’)

As UN employees (Swiss citizens), we (husband and myself) don’t pay taxes (yay), but cant open finpension or VIAC accounts as we also don’t pay AVS which is a prerequisite to transfer money. We currently have 3 policies with La Mobliere, which are a mix of a guarantee of own principal investment, risk coverage and life insurance i.e. principal amount is guaranteed for self and somewhat less for the remaining partner and results are linked to the stock market performance. All 3 policies have some capital guaranteed for the surviving partner and we also have two separate life insurance policies (very Swiss!). At the current monthly rate, we will contribute CHF 115,000 over the next 12 years to the 3 policies.

Questions

1. Should we buy back the policies at the current value (we will lose some money) and invest this amount (about CHF 100,000) in TW?

2. Going forward add CHF 10000 per year in TW

2. Take a separate life insurance policy (death/disability coverage) to cover the risk element

Basically it would mean we will have no guaranteed capital in 10-15 years except a self-owned apartment and about 200 K in cash.

I would truly appreciate your inputs.

Thank you once again.

Priya

Hi Priya,

It mostly depends on whether you actually need life insurance. If you are both working (which seems to be the case), you likely don’t need it. In that case, I would indeed recommend lose some money to save in the long-term.

But in general, if you need a life insurance policy, it’s much better to take proper life insurance and use a good investment system instead. And since you don’t pay taxes, the third pillar has little advantages to you. So, TW 100% would be more efficient.

Now, are you going to retire in 12 years? 12 years is not short-term but not very long-term either. Will you get a pension as well? Do you have a second pillar?

Hi Baptiste,

Firstly I opened a TW account using the link on your site but have yet to transfer the CHF 8,500. Its an odd site feature as one cant really see the investment options without transferring money.

To sum up:

1. We are both working and will retire in 15 years but can choose to retire at 62 (12 years from now) which is my preference.

2. We both have pensions, and pretty decent ones (if we retire at 65), less attractive if we retire earlier.

3. We are not entitled to AVS.

4. We do need the life insurance (its the only death and disability coverage we have in the absence of the swiss invalidity insurance) and its encouraged (read ‘mandatory’) if we need a good interest rate by the mortgage lending banks for home loans and it just gives us some security (we are also not entitled to unemployment benefits).

So my understanding is that we divest the mixed policies to get some liquidity, keep the unique life insurance policy and identify an investment option through TW which I found through your blog. Super glad that you have taken the time to respond :-)

Thank you very much and Happy Sunday.

Priya

Hi,

You can create a demo account at TW where you can see all options.

Since you are talking about mortgages, be careful that if you have pledged life insurance, you cannot cancel it.

Your understanding is what I would do indeed. But keep in mind that I am no personal finance advisor :)

Hi

Thank you for your good review which I read out of curiosity.

I was recommended TW by a friend and have invested with them for over a year. I’ve been really satisfied with the offer and service overall – so clear and fuss-free for someone who doesn’t live and breathe finance. Another advantage which you did not mention is that funds can be withdrawn at any time, should they be needed. This is not always the case with investments.

TW – highly recommended investment option.

Hi Linda,

Thanks a lot for sharing! I am glad you are happy with TW.

It’s indeed a good point that you can get access to your money quickly.

Hi Poor Swiss,

Please update your recommendation. Right now Investart has all-in-fee of 0.3% per annum, which looks far better than TrueWealth offer.

All the best,

Maciej

Hi Maciej,

There is a big difference between TW and IS, TW will keep all your funds in Switzerland. On the other hand, IS will invest through Interactive Brokers. So your funds will not be in Swiss banks or accounts. This is an important distinction for many people.

For people that are willing to have their funds outside of Switzerland, IS is a great robo-advisor indeed. But for most people, TW is still more adequate.

Thanks for your reccomendations. Looks like a real good investment option for the non-experts :)

They asked me to give up my US citizenship to open an account with them! /facepalm

Instead of communicating this fact on their website (IMHO this is discrimination) they first questioned me a lot of details including US tax number etc.

It’s actually well document in their FAQ.

Unfortunately, this is not only the case with True Wealth. Many financial services in Switzerland will not accept US citizens because of the strong regulations they would have to follow with these citizens.

Go blame the (your) US government for this…

True Wealth now available in French!

Yes, that’s great news :) I still need to update my articles to reflect that now :)

Dear Poor Swiss,

I decided to go forward and try True Wealth after reading you review. So far the experience has been good and their support was very responsive.

It’s a very good deal in my opinion if we compare it with other investment opportunities in Switzerland.

Hi Manu,

Thanks for your kind words! Good luck with investing with True Wealth.