True Wealth 3a Review 2024: Pros & Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

True Wealth is a Swiss Robo-advisor that allows high customization, aggressive investing, and low fees. In November 2022, True Wealth introduced support for third pillars.

Since they are an excellent Robo-advisor, I want to check out their third pillar offer.

In this review, I will analyze the True Wealth 3a offer in detail. We will examine its fees, investment strategies, and pros and cons.

By the end of this review, you will know whether you should use True Wealth 3a.

| Total Fee | 0.34% per year |

|---|---|

| Maximum portfolios | 5 |

| Stock allocation | Up to 99% |

| Maximum foreign exposure | 65% |

| Maximum investment in cash | 100% |

| Investment Strategy | Index funds and ETFs |

| Fund providers | N/A |

| Languages | English, French, German |

| Sustainable option | Yes |

| Mobile Application | Yes |

| Web Application | Yes |

| Custodian Bank | BLKB and Saxo Bank |

| Established | 2022 |

| Foundation’s domicile | Liestal, Basel-Land |

True Wealth 3a

TrueWealth is an excellent Swiss Robo-advisor with very affordable prices, making it the best Robo-advisor for serious investors.

- Very customizable

True Wealth is a mature Swiss Robo-advisor launched publicly in 2014. As of 2022, they are managing more than 800 million in assets. True Wealth is a major player in the investing market in Switzerland.

Their Robo-advisor service is excellent. They have low fees, allow very high investment in stocks, and let you customize your portfolio to the extreme. In short, True Wealth is one of the best Robo-advisors in Switzerland.

In November 2022, True Wealth announced a new product: True Wealth 3a, their third pillar offer.

The 3a Digital Pension Foundation holds True Wealth 3a assets, which True Wealth manages under the foundation’s regulations.

Everything is managed holistically within your account. So, you can see both your 3a and your investments from within the same interface.

It is worth mentioning that the foundation is located in Liestal, in canton Basel-Land. When withdrawing your third pillar while abroad, you will pay withholding taxes based on the location of the 3a foundation. Basel-Land is relatively cheap for withdrawal amounts lower than 500’000 CHF. Higher than this, it becomes quite expensive. Also, for amounts up to 100’000 CHF, it is significantly more expensive than the cheapest tax domicile. But overall, it is a relatively good tax domicile.

You may want to consider this tax domicile if you plan to leave Switzerland. For people retiring in Switzerland, this makes no difference.

Investing Strategy

We should look at how money is invested with True Wealth 3a. True Wealth 3a will invest in index funds (from Credit Suisse) and ETFs. I do not know any other third pillar that uses both.

They focus on passive funds, which is excellent because these funds are low-cost and should replicate the market’s performance.

You can invest up to 99% in stocks in your 3a, which is very good. The 1% needs to stay in cash for rebalancing and fees.

Interestingly, they have a 1.50% interest on cash which may be interesting if you need to temporarily keep your 3a in cash.

One major limitation is that you must have 35% Swiss francs in your 3a. Indeed, they are limiting foreign currency exposure to 65%. So, you must either invest heavily in Swiss shares or use currency hedging. This limitation is quite important and will hit your returns in the long term.

Interestingly, True Wealth is working on a solution that would allow lifting this limitation, just like Finpension 3a did. If they succeed, they will become much more interesting.

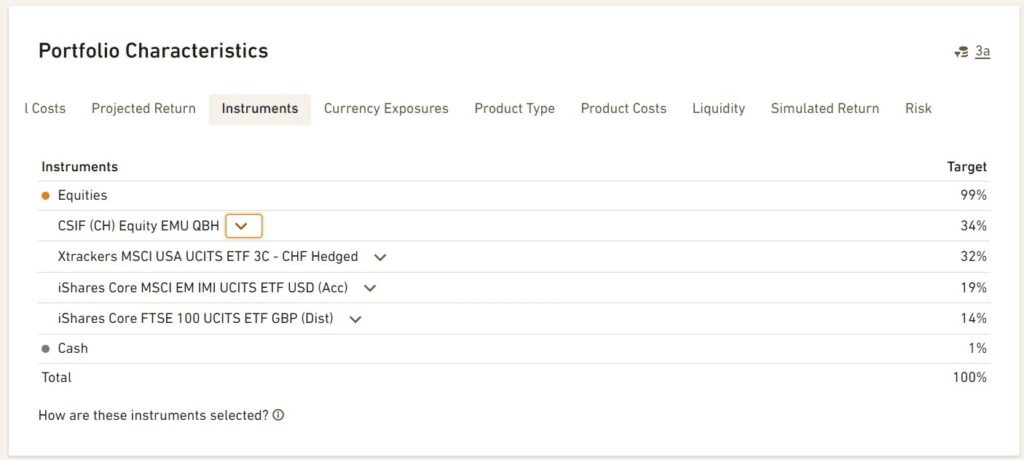

True Will will propose a well-diversified portfolio (diversification is critical). As an example, here is the portfolio True Wealth 3a proposed for the maximum risk profile:

We can see that there are four instruments:

- CSIF (CH) Equity EMU QBH – An index fund from Credit Suisse, investing in European stocks, hedged into CHF

- Xtrackers MSCI USA UCITS ETF 3C – An ETF from Xtrackers, investing in US stocks, hedged into CHF

- iShares Core MSCI EM IMI UCITS ETF USD – An ETF from iShares, investing in emerging markets

- iShares Core FTSE 100 UCITS ETF GBP – An ETF from iShares investing in UK stocks.

I see several issues with this portfolio:

- Too much currency hedging

- Too much invested in Europe and UK

- Too much in emerging markets

- Too little in US stocks

I will now go over these issues in detail.

First, there is too much currency hedging. 66% of the assets are hedged into CHF. Currency hedging is an interesting tool in the short term but should not be used that much in the long term. Over the long term, currency-hedged funds will likely underperform non-hedged funds.

Also, I do not understand why 66% are in Swiss francs since the minimum is 35%, so why add an extra 31%?

Second, this portfolio invests too much in Europe and UK. Together, they represent 48%, much more than I recommend investing in these two regions. As of November 2022, Europe represents about 15% of the world stock market. This allocation is a huge bias compared to what these two regions represent. The UK is only 4% of the world stock market, so why invest 14%? This allocation does not make sense!

Third, this portfolio invests too much in emerging markets. I do not understand why one would like to invest 19% in emerging markets. As of November 2022, Emerging markets make up 11% of the world stock market.

Finally, as a direct consequence of the previous biases, this portfolio invests too little in US stocks. The US forms a huge portion of the world stock market (60% in November 2022). But True Wealth 3a only invests 32%.

Overall, I do not like this portfolio. It differs way too much from global market capitalization. I do not understand these biases.

As a Robo-advisor, True Wealth has excellent customization. However, this is not the case for the 3a account. Indeed, you can only have a single global portfolio shared by the untied assets and the 3a. There is no way to tune the 3a to your needs without changing the free assets portfolio. I was expecting better from True Wealth.

The investing strategy of True Wealth is all right, using low-cost passive index funds and index ETFs. However, the portfolio proposed by default is far from optimal. On top of that, having 35% in Swiss francs is a significant limitation.

Investing Fees

If you want maximum returns over the years and use passive investing, it is important to reduce the fees. The fees are the best lever for passive investors.

Currently, there is no management fee on True Wealth 3a. This fact is amazing.

In addition, there are a few fees. First, you will pay the TER of the ETFs and index funds. This fee depends on your portfolio. The fees vary from 0.15% for global portfolios to 0.25% for sustainable portfolios. So, we can take 0.20% as a base fee.

Then, you also have to pay stamp duty taxes when shares are bought and sold. This tax is only for ETFs, not for index funds. It should not make a huge difference since it only applies to operations. This can be reduced by netting and pooling.

There is also a small markup of 0.10% for foreign currency exchanges. Again, this can also be reduced with pooling and netting, so it should not be too significant. Given the high amount of CHF in the portfolio, this fee should not pose an important issue.

You will pay an overall 0.20% fee on your True Wealth 3a asset. This fee is incredibly low, almost twice lower than the cheapest available third pillar.

So, where is the catch? I mentioned that, currently, True Wealth 3a does not have a fee. However, the 3a foundation can add a 0.225% management fee to the True Wealth 3a assets.

True Wealth has a contract with the foundation that says the fees cannot increase until at least January 2024. True Wealth will try to maintain free management fees further, but we have no guarantee that this will hold after January 2024.

So how does True Wealth make money? Usually, commission-free services make money in a way that is detrimental to users. However, I do not see this with True Wealth.

The reason they are making it free is two-fold:

- They offer a new service to their existing clients at a very low cost for True Wealth

- They hope to bring in new customers for their Robo-advisor service, which is not free (but very affordable).

We should also mention that since True Wealth uses some ETFs instead of institutional funds, they cannot get back the dividend withholding. Dividend withholding means that you will lose some of your dividends. Depending on your risk profile, this can account for 0.02% to 0.14% (for the most aggressive investor).

For an aggressive investor, we get a total fee of 0.34% per year. And for conservative investors, this would be around 0.22% fee per year.

With the extra 0.225%, the total fee would only be 0.565% which is still a fair fee. A conservative investor would reach 0.445%, which is quite good.

So, overall, True Wealth 3a fees are excellent! If a management fee is introduced later, it will become fairly priced but not excellent any more.

Investing in True Wealth 3a

If you already have an account with True Wealth, you can open your True Wealth 3a in a few minutes. Everything is included in the web application.

If you do not have True Wealth, you will need to open an investment account, and then you will be able to open a 3a. The minimum for the 3a is 1 CHF. If you want to also invest in their free assets, you will need a minimum of 8500 CHF.

True Wealth has an excellent feature for contributing to your True Wealth 3a account: auto top-up. With this feature, every time you contribute to your True Wealth account, the money will go to your 3a until the maximum is reached. And then, the rest of the money will go to your regular Robo-advisor account.

But that is not all! True Wealth will automatically create five third pillar accounts. True Wealth will fund these accounts with a similar amount over the years. Having five retirement accounts is optimal since you can stagger the withdrawals over five years to reduce the taxes you will pay.

This feature is amazing because it makes investing in a third pillar easy. You do not have to worry about investing the maximum every year or opening and balancing five accounts.

You can also transfer money directly from your free assets. True Wealth made it very easy to fund their 3a.

On the other hand, you have to be careful that adding a 3a to your account can change your free portfolio! When I added a 3a to my account for testing, True Wealth added some real estate to my free portfolio.

I strongly dislike this, and adding a 3a should not change my custom portfolio because I added a 3a. You can change it back, but you must notice it first! I may have missed the notice, but if there is a notice, it is not very visible.

So, be careful about your free portfolio changing without enough notice.

Alternatives

We should quickly compare True Wealth 3a against two alternatives.

True Wealth 3a vs Finpension 3a

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

I am currently using Finpension 3a for my third pillar accounts. Finpension 3a is currently the best third pillar in Switzerland. So, we should compare True Wealth 3a and Finpension 3a.

The investing strategies are relatively similar. However, Finpension 3a uses only index funds, while True Walth 3a uses a mix of ETFs and index funds. Both services let you invest 99% in stocks.

The customization is much better with Finpension 3a. True Wealth only lets you have a global portfolio shared between your free assets and your 3a. On the other hand, with Finpension 3a, you can have a different portfolio for each account, and everything is highly customizable.

True Wealth 3a has the unique feature of automatically creating five accounts and balancing them. I wish Finpension 3a could implement something like this.

Regarding fees, Finpension 3a costs about 0.39%, while True Wealth 3a costs about 0.34%. True Wealth will incur stamp duty taxes, and its currency conversion fee is higher than Finpension’s.

Overall, True Wealth 3a is slightly cheaper than Finpension 3a. If the management fee of True Wealth 3a comes into action in the future, Finpension 3a will become much cheaper than True Wealth 3a.

On the other hand, the portfolios by Finpension are better diversified than those by True Wealth 3a. Indeed, the portfolio from True Wealth 3a is heavily biased towards Europe.

Also, True Wealth 3a forces you to do a lot of currency hedging, which will eat into your returns. At Finpension 3a, you can make a portfolio without hedging, while True Wealth 3a has a limit of 65% foreign exposure. The amount of hedging is a very significant disadvantage of True Wealth 3a.

For me, the disadvantage of currency hedging is enough to tip the scale in favor of Finpension 3a, which will generate higher returns in the long term. So, overall, Finpension 3a is better than True Wealth 3a.

If you are interested, I can write an entire comparison between these two products. Let me know in the comments below.

True Wealth 3a vs VIAC

VIAC is another great third pillar provider. So, we can also quickly compare VIAC and True Wealth 3a.

VIAC uses only index funds, while True Wealth 3a uses a mix of ETFs and index funds.

VIAC fees are at 0.40%, while True Wealth 3a is at 0.34%. So, True Wealth 3a is cheaper than VIAC. The stamp duty taxes may add a little to the fees of True Wealth 3a since they use ETFs.

VIAC has a foreign exposure limit of 60%, while True Wealth’s limit is 65%. So, True Wealth 3a will let you invest more aggressively in foreign currencies.

As long as the extra management fee is not included, True Wealth 3a is better than VIAC! The fees are lower, and you can invest more aggressively.

FAQ

What is True Wealth 3a auto top-up?

Auto top-up allows you to automatically send money to your True Wealth 3a account in priority and spread the balances over five different third pillar accounts.

Will True Wealth 3a remain free forever?

We do not know. Currently, True Wealth 3a is guaranteed to be free until 2024. The 3a foundation has the contractual rights to add 0.225% management fees on top of the assets. True Wealth will try to maintain the zero management fee as long as possible.

How much foreign currency can you have with True Wealth 3a?

The foreign exposure is limited to 65% with True Wealth 3a. So, at least 35% should be in CHF or hedged into CHF.

What is the minimum to invest in True Wealth 3a?

You can invest as little as 1 CHF in your True Wealth 3a.

Can you customize your True Wealth 3a portfolio?

Not really, True Wealth 3a is tied to a global portfolio in the account, shared between free assets and the 3a. Therefore, changing your portfolio results in changing it for both your untied and 3a assets.

Can you use a different portfolio for each 3a account?

No, each 3a is tied to the same global portfolio.

How many third pillars can you have with True Wealth?

You can have up to five (optimal!) third pillars with True Wealth 3a.

Who is True Wealth 3a good for?

True Wealth 3a is good for users of True Wealth that want a good 3a and do not want to use two different providers.

Who is True Wealth 3a not good for?

True Wealth 3a is not good if you do not want to invest with True Wealth. It is also not great if you want a high foreign currency exposure in your 3a.

True Wealth 3a Summary

True Wealth 3a is a robo-advisor third pillar, created by True Wealth. They allow aggressive investing at a very low price.

Product Brand: True Wealth

4

True Wealth 3a Pros

Let's summarize the main advantages of True Wealth 3a:

- You can invest 99% in stocks

- No management fees

- Holistic interface for your free and 3a assets

- Automatically create and balance five accounts for you

- High interest rate on cash

True Wealth 3a Cons

Let's summarize the main disadvantages of True Wealth 3a:

- Foreign exposure limited at 65%

- Impossible to change the portfolio of the 3a independently

- Cannot have a different portfolio for each 3a

- Use ETFs and not index funds

- Management fees could be added in the future (but TW is not planning to)

- Default portfolio heavily biased toward Europe

- Adding a 3a can change your global portfolio

Conclusion

TrueWealth is an excellent Swiss Robo-advisor with very affordable prices, making it the best Robo-advisor for serious investors.

- Very customizable

I am impressed by True Wealth 3a fees. I was not expecting them to cut down fees to zero. Generally, commission-free has a big catch, but that does not seem to be the case here. The fees may change in the future, but until that happens, True Wealth 3a is the cheapest third pillar in Switzerland.

Even when factoring in the inefficiencies of ETFs for a third pillar, True Wealth 3a is still very affordable.

On the other hand, I also see several issues with True Wealth 3a. First, the foreign currency exposure limit is 65%, forcing investors into hedging. Second, the portfolio proposed by default is heavily biased toward Europe. On top of that, customization is limited since the portfolio is shared between the free and 3a assets.

The low fees do not make up for these issues. I would rather pay a little more in fees and have better returns in the long term.

Nevertheless, if you already have a True Wealth account, having a 3a with them may make sense. However, I would not recommend opening a True Wealth account to use their 3a. Instead, I still recommend Finpension 3a as the best third pillar available in Switzerland.

If True Wealth manages to remove the 65% foreign exposure limit, they are going to be much more interesting, and I will reconsider at this time.

To learn more, read about the best third pillar in Switzerland.

What about you? What do you think about True Wealth 3a?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best retirement accounts

- More articles about Retirement

- Finpension Vested Benefits Review 2024 – Pros & Cons

- Frankly 3a Review 2024: Pros & Cons

- Yuh 3a Review 2024 – Pros & Cons

Hey Baptiste, as always kudos to your work!

I am looking for some real past performance stats for both TrueWealth, Viac, Finpension or Selma but didn’t find them easily on Google. They all show projections but not how some portfolio performs in the past. Since we can’t pick individual products with these providers but we rely on their strategies, I’d find it a key factor to see who performed better in a given time range.

Do you think we can find them somewhere or are you aware?

Thanks

Hi Eva

With Finpension, you can find them on their website: https://finpension.ch/en/3a/strategies/credit-suisse/

With True Wealth, you can also find them on their website: https://app.truewealth.ch/app/demo/allocation/simulated-return

As for Selma, I don’t think you can find it indeed.

As a side note, you can actually pick individual funds with Finpension and True Wealth.

There is a lot of buzz about new financial players such as Viac, Finpension, Truewealth, and Inyova. I have invested a small amount of money in Finpension, Truewealth, and Inyova for 2-3 years. Their benchmarks show a loss of 5-10% in my personal dashboards, while the MSCI World can perform at the same level or better. The dashboards in the tool promise huge wins in 20 years. At the same time, I see the fees running monthly/quarterly and ask myself if I am just paying fees to lose my savings. If I had parked my money in a bank account, I would not have lost 5-10% for sure. And there are always those promo codes. Honestly, it smells like a bubble.

Hi Paul,

The entire world stock market has not been performing well in the last 2-3 years. These providers are using index funds so cannot perform better than the market.

Sure, when the market goes badly, you could have stayed in cash. But if you had stayed in the cash in the last 20 years, you would have lost a ton of money compared to investing in stocks. Over 2-3 years, or even 5, performance is irrelevant.

Hi Baptiste,

Always great to have your reviews as a guide. Thanks for all the efforts and sharing your thoughts. You should think about a second career as a financial advisor.

Today I reorganized our Säule 3a investments away from the AKB. At the time, this gave us advantages for the mortgage, but now it’s better to benefit from lower fees. Despite your suggestion, I choose True Wealth over Finpension though, as to me, it seems much more customizable. As you say, the default investments in True Wealth are not optimal, but you have a lot of freedom to adjust the portfolio to fit your overall asset allocation and 0.0% fees is hard to beat. Their philosophy is just more based on making the best use of correlation between assets classes, compared to your focus on mirroring global markets and keeping it simple. Diversification is widely known as the only free lunch in finance, so why not make good use of it. Some of your own articles show nicely how a pinch of gold or real estate can stabilize and even enhance returns over the long run.

Hi Joerg,

Thanks for your kind words.

I agree that customization and diversification is very important. And TW is a very good option. But isn’t Finpension 3a as customizable as TW? You can create custom portfolios and choose pretty much anything you want. I am not saying that to change your mind, just curious how TW is more customizable?

Hi Baptiste,

I haven’t used Finpension, but only checked their website to decide. And seems you were right, I have just missed the offer to set up allocations yourself. They even have a precious metal fund with 0.0% TER, not sure how this is possible. Anyhow, I thought they only had those couple of options with different allocations to stocks and bonds.

By the way, True Wealth is planning a children account for this summer. Perhaps an idea for a future article.

Greetings from Zürich.

Joerg

Hi Joerg,

Several of the accounts from Finpension 3a are free because they can be used only for retirement funds so fees are lower.

Yes, looking forward to this child account. Other services are also planning one and Findependent just started one. These accounts are going to make it easier for people to invest for their children.

Hi Joerg

Thanks for sharing the info about children account from True Wealth. Just curious: where have you read about this? I was not able to find any information about this.

I am looking for such a thing for a long time already. Inyova says that they offer it – but in my eyes the do not really: you can only open an additional strategy / account, but it is in your name and not the name of the child… That means the money is not protected (parents could take the money out at any time), and when you want to hand it over to the child at a later point, you need to liquidate all shares. Findependent just started something which looks very similar as Inyova to me. I really hope True Wealth does a better job here than others. It shouldn’t be that hard – cash savings accounts are also possible in the name of the child with any bank.

Hi Baptiste,

I am new to the investment field and find your pages and articles super useful! Thanks a lot for that!

I recently opened my TrueWealth investment account and was planning to have my 3rd pillar there too. However, after reading your article about 3rd pillar, I saw tha FinPension 3a might be a more competitive option than TrueWealt. Does this apply only in case of 3rd pilar accounts or is also valid if I have my investment account with TrueWealth?

2) In addition, I was planning to transfer my old 3rd pillar accounts from UBS to either TrueWealth or FinPension; is this a good idea and which one to choose? Thanks a lot in advance, Marina

Hi marina,

1) If you already have your TW account, having your 3a with them gives you the advantage of having both at the same place. Finpension 3a is better but not by a huge margin, unless you remove currency hedging which requires a custom portfolio.

2) Moving from UBS to anything seems like a good idea. As for which one, I think it mostly depends on you. I would choose Finpension 3a, but TW 3a is not a bad idea.

Hi Baptiste, thanks again for an excellent review. Do you know how much interest rate these solutions (finpension and true wealth) provide on cash chf?

Thanks,

Dimich

Hi Dimich,

Currently (these changes often), VIAC offers 0.20% interest on cash. Finpension 3a does not let you hold cash.

Thanks Baptiste. I was more referring to the TW 3a. For example, I know that you cannot get uninvested with Finpension. Does the same hold for TW? How much in cash does TW let you have? (for example in finpension is only 1%).

For example, in postfinance, you can put some amount in your 3rd pillar initially in cash. Afterwards, you can decide how much of this amount you want to invest in some of postfinance’s possibilities. Is this possible with TW?

Thank you and best regards,

Dimich

Hi Dimich,

You can have cash with TW, and you get 1% interest on your cash. You can then change your cash allocation, and it will get invested.

Kind of a shame… I have a feeling this launched too quickly. I think I’ll wait before opening a 3a there. Maybe they’ll add ways to diversify in the future (?) The whole allocation/biases seem odd especially considering how good their ‘normal’ solution is. Glad I waited for your review though!

I don’t think it’s too early, it’s still a good product. But there are great products out there so it’s difficult to compare. This 3a is still much better than most third pillar in Switzerland.

Dear Baptiste

Your reviews are really useful. They are deep dives into often complex subjects, diligently tested yet explained simply and precisely. You point out things, like the Basel withdrawal tax, which could prevent losing a lot in tax. Thank you!

I have an account and a 3A account with Selma Finance, a trial to see if a robo-investor could outperform the bank and the libre passage account with Liberty in Schwyz. What really counts is the investment performance, which is difficult to establish.

I am pretty ignorant about investing and am looking for unbiased advise. I value your articles, if you were ever to start an investor club to help beginner investors, I would be interested.

Keep doing what you do so well.

Hi Jane

Thanks a lot for your kind words! I am glad my articles are useful!

So far, I don’t have any plan for an investor club, but all my advice is on this blog, that should help more people than an investor club :)

Good luck with your investing!

Love your reply and values, Baptiste.

You also lose an estimated 0.15% on the allocation shown in the blog due to the lack of withholding tax exemption compared to VIAC and finpension 3a.

Which is mentioned my article, as the 0.14% “fee”.

Thanks for this interesting read! I have read about True Wealth 3a on Mustachian Post, and tried it right away. So far, I am very convinced.

Your note that you need to have a non-3a portfolio with them is not correct. I have opened a new account, and I am just using 3a. I have to pay 0 management fees to them according to the information displayed in the app.

Regarding the strategy: I have adjusted their proposal, to replicate more or less my previous Finpension Global 100 strategy without issues. Probably your risk level is too low to do these adjustments? I can see that there are some hedged instruments in my portfolio, but the TER with 0.12% is pretty low in my opinion. If I remember correctly, also the Finpension strategy had some hedged funds in it.

Hi,

The minimum and the need for an actual account have been confirmed to me by True Wealth themselves. I will ask them again because it’s weird if you did not have to fund your account.

My risk level is 10/10 :)

Finpension has some hedged funds by default, but you can change your portfolio to not have any hedging.