Inyova Review 2024 – Pros and Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Inyova is a Swiss Robo-Advisor that focuses on impact investing. You may know it under the name Yova which was its previous name until June 2021.

The main idea is to invest in improving the world. This way, you will not only get good returns on your investment but also use your money to improve the world.

But how does Inyova compare with other Robo-Advisors, and how much does it cost? This complete Inyova review will reveal the answers.

By the end of this Inyova Review, you will understand all the advantages and disadvantages of investing with Inyova and whether this service fits your personal investing needs.

Disclaimer: I am not investing with Robo-Advisors. DIY investing is better for people willing to invest time and effort, and it will save you money. But DIY Investing takes time and knowledge. For people unwilling to invest their time and effort, investing with Robo-Advisors is the next best thing.

| Management fee | 1.20% – 0.60% (degressive) |

|---|---|

| Product Costs | 0% |

| Investing strategy | Active |

| Investing products | Stocks |

| Minimum investment | 2000 CHF |

| Currency conversion | Unknown |

| Customization | High |

| Sustainable | Very sustainable |

| Languages | French, German, and English |

| Custody bank | Saxo Bank |

| Users | Unknown |

| Established | 2017 |

| Headquarters | Zürich, Switzerland |

Inyova

A very good Robo-Advisor, with a strong focus on impact investing and sustainable investments.

- Very sustainable

- Affordable for large portfolios

Inyova is a Robo-Advisor that focuses uniquely on impact investing. They target people who want to make the world a better place with their money. Of course, since it is an investment platform, they try to invest in profitable companies.

Inyova was launched in 2017 under the name Yova. Even though they are a young platform, they have been growing quickly and are already managing several million CHF. In June 2021, Yova changed its name to Inyova. This new name means “Invest in your values”.

It is important to note that you need at least 2000 CHF to invest with them. This minimum is because, below that level, good diversification would not be possible.

They started with a web application but have also added a mobile one. This is interesting because most Robo-Advisors in Switzerland lack mobile applications.

So, we now delve into the details of this Inyova review.

Inyova Investing Strategy – Impact Investing

We start this Inyova Review by going over their investing strategy.

Inyova has a very different investment strategy from that of other robo-advisors. Indeed, while most Robo-Advisors invest in Exchange Traded Funds (ETFs), Inyova will directly invest in stocks and bonds.

Another way they differ is that they only invest in sustainable companies, following the impact investing philosophy. Other Robo-advisors offer sustainable investing options, but it is not their primary focus. With Inyova, you cannot invest in other companies. So, they are only for investors who want to invest in this fashion.

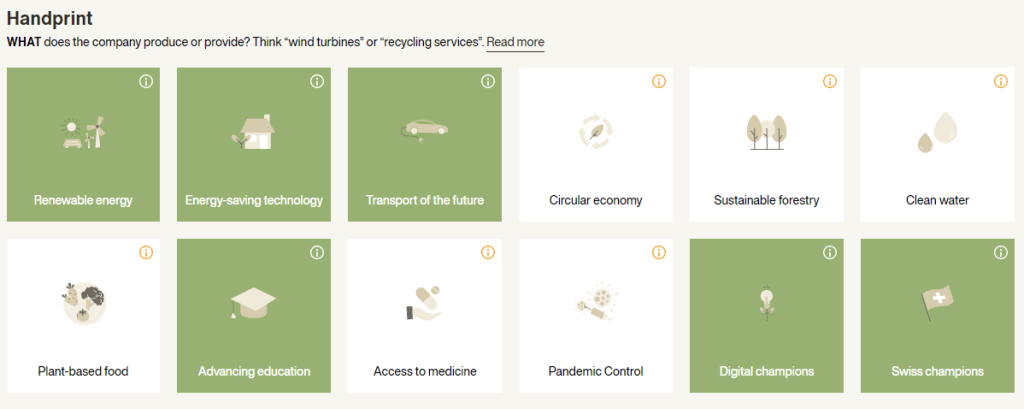

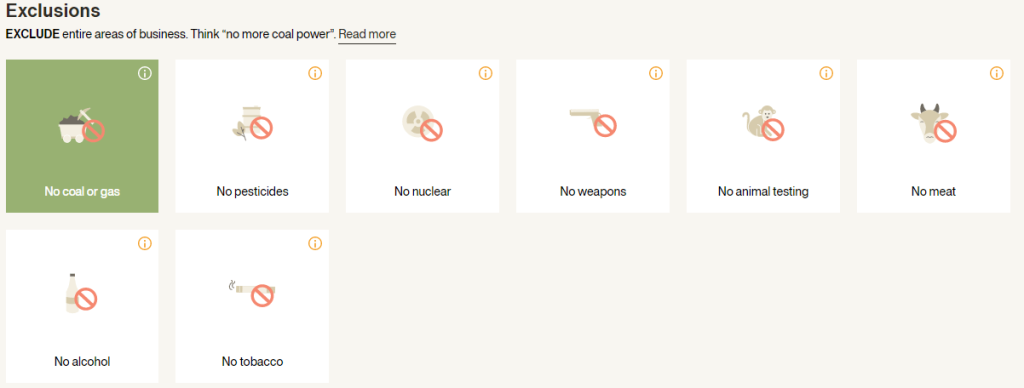

Inyova will choose your portfolio based on some custom criteria based on two main factors:

- The handprint of the company: the products and services

- Renewable Energy and Clean Water, for instance.

- The footprint of the company: how they are doing business

- Gender equality and equal pay, for instance.

Each investor will have access to a personal portfolio. You can choose the topics that matter to you and the things you disagree with.

If you are strongly interested in impact investing, Inyova is the best Robo-advisor for you. They are the only Robo-Advisor in Switzerland that focuses solely on impact investing. And they are doing a great job at it.

In addition, each investor will be able to exclude or include companies directly. All these features make Inyova a highly customizable Robo-Advisor, probably the most customizable Robo-Advisor in Switzerland.

Your asset allocation will be based on your risk profile: how long you want to invest the money and how old you are. For instance, a young investor like me could have 100% invested in stocks. On the other hand, an investor close to retirement may have only 60% of stocks (or even less). So the minimum is 20% invested in stocks, and the maximum is 100%, which is great.

In the end, you will have about 40 stocks in your portfolio. Inyova will diversify these stocks across various sectors and countries.

Overall, Inyova offers an impact investing strategy that is very good if you focus on sustainable investing. They are the best Robo-Advisor for impact investing and sustainable investing. I prefer to have more stocks for more diversification, and I like to invest in wider ETFs to avoid stock picking. Nevertheless, I understand the appeal of sustainable investing.

You can read my interview with Invoya about impact investing to learn more about their strategy.

Inyova Fees

When reviewing an investing service, it is paramount to review the fees. Inyova is different from other services in that there are no fixed fees. The fees you pay depend on how much money you invest with them.

If you have strong financial goals, investing fees are extremely important.

The investing fees at Inyova are all-inclusive annual fees. So, you will pay a portion of your assets as management fees. Here are the fees based on the amount of money invested:

- Below 50’000 CHF: 1.2% annual fee

- Between 50’000 and 150’000 CHF: 1.0% annual fee

- Between 150’000 and 500’000 CHF: 0.8% annual fee

- Above 500’000 CHF: 0.6% annual fee

With a huge amount of money invested, you can get outstanding fees compared to other Robo-Advisors. However, if you do not invest much (like most people), the fees at Inyova are high. For me, a 1.2% annual fee is not acceptable. Of course, you will have to decide for yourself if you are comfortable with this level of fee.

The fees you pay depend on how much your account is worth. So this also includes capital gains. This is great since a good performance can also make your account cheaper.

Finally, you will also pay Swiss stamp duty on the operations that Inyova makes for you. This tax should not be huge, but it is still not negligible.

Now, there is something else I dislike about their pricing: their comparison with other pricing. Here is how they compare themselves with other alternatives:

The first thing that irks me is that they compare themselves against a Robo-Advisor with a 0.94% fee, which is already high for Switzerland. The cheapest I know would have a fee of 0.64%, almost half as expensive as Inyova. This is a common marketing strategy, i.e., to not compare against the best.

On the other hand, it irks me that they compared themselves with an expensive DIY Platform (SwissQuote). There are two major problems with this comparison.

First, they use a costly platform (SwissQuote) instead of a cheaper and better one, like Interactive Brokers. Using a better broker would dramatically reduce this.

The second problem is that they are comparing against ETF Robo-Advisors but not comparing against ETF DIY Investing. If we take my case, I pay about a 0.2% annual fee, all-inclusive. My fees would come down to being four times cheaper than Inyova. Since I have more than 100’000 CHF invested, the fee would be down to 1.0% for me (still three times more expensive than my fees!).

I am not saying that to show off that my strategy is cheaper than Inyova. I am saying that because it does not help customers! People should know that investing by themselves is less expensive than what Inyova tries to show. If you want more details about such a comparison, read my article about the different levels of investing.

Overall, I think that Inyova’s fees are not great. For small invested amounts, the fees are too high compared to a cheaper Robo-Advisor. On the other hand, if you have a considerable amount of money invested in Inyova, the fees will be good. Finally, their comparison with other alternatives could be more transparent.

How to open an account with Inyova?

Opening an account is straightforward. You can start an account for free to familiarize yourself with their systems.

When you are opening an account, the first step will be to create your strategy. To define your strategies, you will have to make several decisions.

The first decision is to pick your handprint topics. It is at the base of impact investing with Inyova. At this stage, you can focus your investing on particular products or services companies use. For instance, you can invest in companies working for renewable energies.

The second decision is to pick your footprint topics. You can narrow your focus on companies based on how they are operating. For instance, you can focus on companies with a low CO2 footprint.

Finally, the third decision is whether to exclude some categories from your portfolio. For instance, you could exclude all companies focusing on coal energy.

After this crucial step, you must inform Inyova about your risk profile. You will only have to answer four questions about that. Then, they will give your risk profile and your allocation to stocks. You can override this stock allocation if you want more or less than they recommend.

After these steps, you will have access to your portfolio. You will get a list of 30-40 stocks they will invest in for you. And you still have the choice to exclude some companies from the list or add companies to your portfolio.

Once you are happy with your strategy, you can continue the registration process. At this point, you will create your account with SAXO Bank (where Inyova will hold your assets) and fill in the regular information about yourself.

Overall, the registration process is smooth. It goes very fast, and it is great that we can start with the strategy before all the other steps. It lets people know their portfolio before adding money to their accounts. And the level of customization is excellent as well.

Is investing in Inyova safe?

An essential part of an investing service is its online security. So we will see if investing with Inyova is safe.

First, since they are not a bank, they cannot hold your assets. All your shares will be held, in your name, by SAXO Bank. Inyova is only considered the asset manager. So, they can execute trades in your name, but they cannot access your funds. The cash is still protected by the general Swiss deposit protection, up to 100’000 CHF. So the portion of your assets that is not yet invested is also safe.

If Inyova goes bankrupt, all your funds will be accessible in your name at SAXO Bank. It is a good level of safety for your assets. It is the same strategy used by almost all Robo-Advisors in Switzerland.

From a technical perspective, all communication is encrypted, which is the standard minimum these days. You can also use a second factor of authentication (2FA). This will significantly increase the security of your account. If you care about online security, you should always use 2FA.

So, overall, investing with Inyova will be safe since it uses asset segregation. However, technical security would be much better if they had second-factor authentication support.

Inyova Third Pillar (Inyova 3a)

From December 2021, Inyova also offers a third pillar account: Inyova 3a

The principle is the same as Inyova. You can invest sustainably according to your values. Inyova 3a is the first fully sustainable third pillar in Switzerland.

You can start investing from 100 CHF since they allow fractional shares. This is great to get started! You will have to choose our values, which are just like the standard Inyova account.

The third pillar costs 0.80% per year. On top of that, depending on your strategy, you will pay between 0% and 0.24% for the product costs. Since the bonds are the most expensive, the most aggressive strategies are cheaper. If you have no bonds, you will not get any extra fee, so only 0.80% total. And this will get simpler later with an all-inclusive fee.

You can get more information on Invoya’s website.

User Reviews

I wanted to see what people were saying online about Inyova. Unfortunately, there are very few online reviews about this service. My favorite source of reviews, TrustPilot, has zero reviews for it. However, there are a few reviews on Google. Based on 28 reviews, they got an average grade of 4.7 stars out of 5.

Of course, there are not enough reviews to draw proper conclusions, but it is still interesting. I also looked at forums to find people’s opinions on Inyova.

Overall, the positive points in the reviews are mostly about the team itself. Indeed, the team seems easily approachable and very helpful. People also greatly appreciate the level of customization that is possible in their portfolios.

On the other hand, the negative reviews were about two things:

- The very high fees of the service.

- Their heavy advertising campaign.

Overall, Inyova users have excellent reviews of the service. People not using Inyova mostly complain about the high fees and that we can invest elsewhere for much cheaper.

Alternatives

When evaluating a service, comparing it with some alternatives is essential. So, we will compare Inyova with two Swiss robo-advisor alternatives.

Inyova vs Selma

|

4.5

|

4.0

|

|

|

|

|

|

Good

|

Good

|

- Beginner-Friendly

- Degressive Fees

- Passive Investing

- Great diversification

- Good fees

- No customization

- Not highly sustainable

- Great customization

- Very sustainable

- Degressive Fees

- Stock-Picking Strategy

- Lack of diversification

Selma is another good Robo-Advisor in Switzerland. Selma also has an option for Sustainable investing.

There are some major differences between these two Robo-Advisors. Indeed, Selma will invest in Exchange Traded Funds (ETFs) instead of single stocks.

Selma will invest in sustainable versions of its ETFs when you select sustainable investing.

Now, these two versions of sustainable investing are different. Inyova’s sustainable strategy goes much further than Selma‘s. With Selma, you only have the bare minimum of sustainability. If you care about impact investing, Selma will probably not be enough for you.

On the other hand, Selma’s fees are better than Inyova’s. With Selma, you will only pay about 0.98% in fees for your portfolio. Unless you have more than 150’000 CHF, Selma is cheaper than Inyova.

From an ease-of-use point of view, both solutions are good.

For more details, I have an in-depth comparison of Inyova vs Selma.

Inyova vs True Wealth

|

4.5

|

4.0

|

|

|

|

|

|

Good

|

Good

|

- Very customizable

- Excellent fees

- Passive investing

- Great diversification

- Not highly sustainable

- Great customization

- Very sustainable

- Degressive Fees

- Stock-Picking Strategy

- Lack of diversification

Another serious alternative is True Wealth, which has an option for sustainable investing.

True Wealth uses the same strategy as Selma in that it invests in the ETF, so it has the same sustainability quality as Selma. However, regarding sustainability only, Inyova is better than TrueWealth.

On the other hand, True Wealth is even cheaper than Selma and much cheaper than Inyova. With sustainable investing, True Wealth only costs 0.8% per year. So, you need 150’000 CHF invested with Inyova for its fees to be cheaper.

Finally, True Wealth is slightly less user-friendly, but not by a huge margin.

FAQ

What is the minimum you can invest with Inyova?

You need to invest at least 2000 CHF to open an account with Inyova.

How much will you pay in fees for Inyova?

You will pay 1.2% of your portfolio to get it managed. If your portfolio gets bigger than 50’000 CHF, your fees will go down.

Who can invest with Inyova?

Every Swiss resident that is at least 18 years old can open an Inyova account.

What happens if Inyova goes bankrupt?

Your shares are stored in your name, in Saxo Bank. So if the service goes bankrupt, you can get back your assets.

Who is Inyova good for?

Inyova is great for people that want to invest in the most sustainable way.

Who is Inyova not good for?

Inyova is not great for people wanting to optimize their costs because of its relatively high fees (especially for small portfolios). Inyova is also not great for investors that want the option to invest sustainably or not since Inyova only offers sustainable investing.

Inyova Summary

A very good Robo-Advisor, with a strong focus on impact investing and sustainable investments.

Product Brand: Inyova

4

Inyova Pros

Let's summarize the main advantages of Inyova:

- Highly customizable sustainable portfolio.

- Excellent focus on impact investing and sustainability.

- You can invest up to 100% in stocks.

- Easy account creation.

- Low fees if you invest more than 500'000 CHF.

- Web & Mobile applications

Inyova Cons

Let's summarize the main disadvantages of Inyova:

- Very high fees if you invest less than 150’000 CHF.

- Lack of transparency with their pricing and marketing.

Conclusion

A very good Robo-Advisor, with a strong focus on impact investing and sustainable investments.

- Very sustainable

- Affordable for large portfolios

This Inyova review should contain everything you need to know about their offer. Overall, Inyova is a good Robo-Advisor for investing sustainably in the future. It will let you invest very simply in the stocks and bonds of companies that positively impact the future. You will also be able to customize your portfolio to your exact principles.

However, this highly sustainable investment comes at a price. Inyova’s fees start at a very steep price. Below 50’000 CHF, you will pay a 1.2% fee on your assets. For me, this fee is too high.

Other alternatives allow you to invest sustainably in the Robo-Advisor world, and you will save on fees. Both Selma and True Wealth are significantly cheaper. And I much prefer investing in ETFs than in single stocks. Even though having about 20 to 30 stocks is enough for diversification. Using ETFs means you do not have to pick the stocks. Therefore, I prefer passive investing, while Inyova is more active investing.

On the other hand, Inyova is the only Robo-Advisor focusing on impact investing. Other Robo-Advisors have straightforward sustainable investing options but no strong impact investing options.

You can save even more fees by investing yourself. Most people overestimate the complexity of investing by themselves. Investing fees are very important, and there are significant differences between different investing levels.

What about you? What do you think of Inyova?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Robo-Advisors

- More articles about Investing

- Selma Review 2024 – Pros & Cons

- Findependent Review 2024 – Pros & Cons

- clevercircles Review 2024 – Pros & Cons

Thank you for this review. For me as someone who really cares what sort of business my money supports, inyova convinced me to (finally) start investing:). So far I am quite happy with the portfolio and with the current dip in the market it is a good starting point to start or buy-in.

Hi Vero

Thanks for sharing! I am glad you were able to start investing! Indeed, they have a good way to decide where your money goes and especially where your money does not go.

Good luck with your investing!

Hi there, I saw a CHF 240 voucher to start at Inyova before end of February last week and now I wanted to use it but seems to have disappeared?

Hi,

Sorry, I am not aware of this voucher.

Really nice review :) I’ve been investing with Inyova for nearly 2 years now. In summary: I really like the product, the team and the vision. I truly think they are offering something valuable and I would highly recommend to any newbie investor or anyone currently on Level 0 or 1 of investing (https://thepoorswiss.com/investing-levels-control-fees/).

As I become more familiar with investing and keen to learn more, the 1.2% fee is enough to push me towards looking into other options. Likely I will keep some money in Inyova, but start experimenting and moving some to DIY solutions bit by bit.

Thanks a lot for all the really useful info on this site!

Hi Annette,

Thanks for sharing! It’s really good to hear about your experience with Inyova.

I also agree that 1.2% quickly starts to be a lot. But if you reach higher levels of invested amount, it can go down to more reasonable levels. But I believe they should lower the base level.

Hi Poor Swiss,

As always very high quality review! I love your blog! I would add some comments or questions

1. Yova site now claims that they cover duty stamp. Is that new or they speak of something different?

2. I personally don’t understand the criteria, how Yova decides on choosing the companies in the portfolio – why Swisscom or Richemont or Swiss Life Insurance are included and not others? Not saying that they are not sustainable but why only them?

3. I have tested with 50 kCHF, no bonds, the solution comes with 35 companies. Only 35? I don’t find it diversified nor by number, region or industry.

Other than this I find the concept the guys are working on very appealing.

Hi Evgeny,

1. I did not find this information on their website, where did you find it? I will contact them to make sure.

2. I do not understand it very well either, but it’s relatively well documented. Have you read their paper? This is the more complete information they have on how they pick stocks

3. I am not surprised. Companies that do active stock-picking like Yova very rarely use more than 30-50 companies. In fact, they told me that modern financial theory shows that enough diversification is reached with 16 companies. I do not agree with that, but many portfolios are based on this theory. You can read my article on diversification for more information.

Hi Evgeny,

I just got confirmation from Yova that they do not include the stamp duty in their fees. So, you will pay it in addition to the fees.

Great post, helped me a lot. Decided to start with Yova and open a second portfolio in truewealth to diversify.

I liked the sustainable choices of Yova

Thank you for this very useful review. I am in the process of finding the best solution to invest and your job has helped a lot.

Glad I could help!

Thank you for the detailed review and comparison. I am currently looking and comparing different options for myself and this helped a lot to get some better picture. Yova also attracted my attention, because I strongly believe in the long term benefit and performance of sustainable investments.

However, something on the fee comparison crossed my mind, and it would be interesting to hear your thoughts on this and if my reasoning makes sense…

When I buy an ETF, there are also always some “indirect” management fees on the ETF (TER). These fees would be on top of the robot-advisor commission. So even if Yova asks for 1.2% and TrueWealth only for 0.8… when you add 0.4-1% of ETF-expenses to TrueWealth, the fees on the actual performance of “your shares” is higher than with Yova, which invests directly into the shares without additional management fees in between. Therefore, Yova would be a cheaper option for holding an individually designed but automated investment portfolio than holding ETFs in other robo-advisors or maybe even in normal DIY-platforms?

Hi Jo,

Actually, there is a small thing wrong with your reasoning. I already took the ETF TERs into account for the 0.98% (0.68+0.) and 0.8% (0.5+0.3) total fees for Selma and True Wealth. It’s indeed very necessary to take this into account when comparing robo-advisors.

And indeed, it’s even more important to do the comparison properly since Yova invests in stocks so no management fees while the other invests in ETFs hence management fees for the ETFs themselves.

Thanks for stopping by!

You could update your review..

Yova has 2FA available now in Account Settings.

Thanks for letting me know, I will update the article.

Hi everybody,

Many thanks Mr. The Poor Swiss for this nice review. It is detailed and most informative. I tried YOVA and would like to give a feedback. As I am a complete newbie and probably more interested in using my money to change the world rather to make a huge profit, YOVA seemed perfect for me (see the review). And I can confirm. It is very easy to set up and also very flexible. You can fine tune in what you want to invest, down to the company level if you want. Keeping track on your assets on the application is trivial. But the performance is actually also very good. From September to January, I reach +15%, while the global market would be rather negative. I can only strongly recommend it.

Hi Laetitia,

Thanks a lot for sharing your review. This is very valuable :)

It’s good that they were able to give you good returns while you can invest according to your values!

Thanks for stopping by!

Nice and objective review. I started with Yova some time ago despite the higher fees compared to other Robo-advisors as Yova offers better sustainability portfolio and customization. The rationale here is that the transition of the the economy to a true sustainability comes with a cost and as investors we have also a responsibility. If I had time to research each and every company I invest in than I would go DIY e.g. via IB. If you are interested here is my personal invitation code that gives you 6 months free of charge investing at Yova: c793f

Hi Vince,

Thanks for sharing your experience with Yova. I understand your logic and I know that many investors of Yova are like you :)

If you want to do true impact investing with IB, you would need to do a lot of research indeed. But you could opt for the middle ground and ESG ETFs with much lower fees than Yova (maybe less sustainable).

Thanks for stopping by!