Impact Investing Interview with Inyova

| Updated: |(Disclosure: Some of the links below may be affiliate links)

I have not talked much about sustainable investing on this blog. The reason is that I am not an expert in the subject. But this is a very interesting and very actual subject. Therefore, I figured I would do better to interview experts on the subject.

For this, I interviewed the Impact team of Inyova, the most sustainable Robo-advisor in Switzerland. Inyova is focusing heavily on impact investing. Their answers are interesting and much more involved than if I wrote an article on the subject!

So, we will see what Inyova has to say about Impact investing.

1. Who are you?

Inyova was founded over five years ago and has since become the leading impact investing platform in Europe. Inyova enables ordinary people to invest their money with real impact, and its mission is to turn millions of people into impact investors. To empower people to take active ownership of companies. To take back control and realign investments with what people and communities value and we want to make sure our grandchildren, and yours, inherit a Planet Earth that is liveable.

We wanted our investments to promote clean energy and equal rights, without fuelling climate change or the weapons industry. But there was no easy way to do this – that’s why we founded Inyova.

The company was founded by Tillmann Lang and Erik Gloerfeld. The two are former environmental scientists, mathematicians and McKinsey consultants. The idea for Inyova came from the search for highly effective solutions to achieve more sustainability – one of the biggest global tasks for the future. Through its Personal Impact Engine (PIE), cutting-edge digital consumer technology and absolute focus on impact, Inyova aims to revolutionize traditional wealth management and investment offerings. The goal: to disrupt the status quo set by asset managers and banks.

We are experts in finance, sustainability and technology. We are portfolio managers, techies, designers, mathematicians, finance masters, developers, marketers and communicators. We are activists for a more sustainable world.

2. What is Impact Investing?

At its base level: impact investing is about change. Specifically, it’s investing with the intention of generating change in the real world. It’s important to keep this in mind: if there’s no change, there’s no impact.

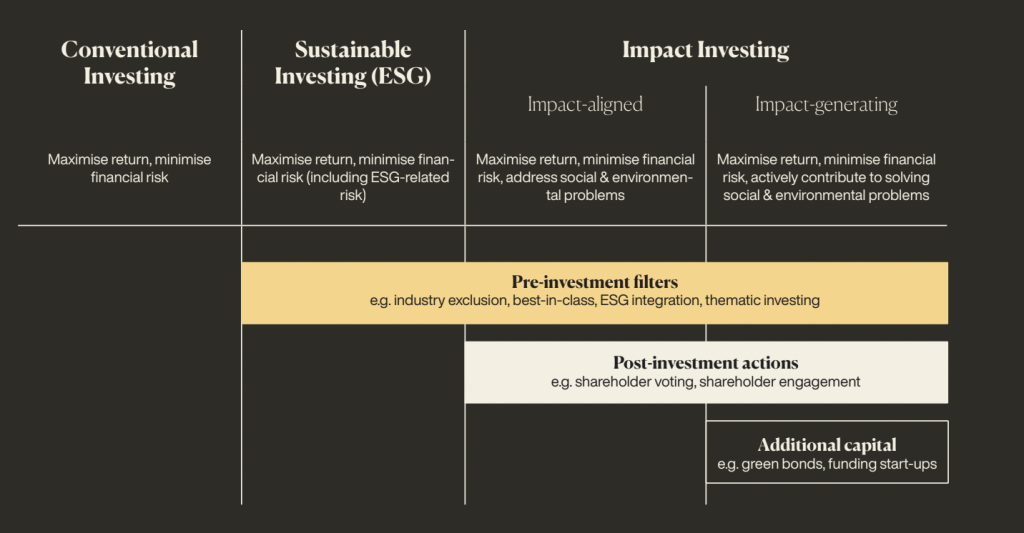

Here, it’s key to understand it in contrast to other types of sustainable investing, which have different motivations and outcomes.

In general, there are 3 big buckets of motivations: performance, values, and impact.

- Firstly, we have investing for values – captured by the idea of no profit from adverse impact. This developed historically from religious investors who, for moral reasons, did not want to profit from so-called sin goods, such as alcohol or tobacco. Nowadays, this continues in some religious communities (e.g. some Christians not investing in anything profiting from contraception/abortion) but also with other investors, such as not wanting to profit from prisons or fossil fuels or vegans who don’t want to profit from meat. The core part here is about morality: no profit from adverse impact and is normally achieved via exclusions (cutting out certain industries) or also thematic investing.

- Secondly, we have performance. This often underpins many (actually most) ESG-screened investments, with many ESG factors looking to capture sustainability risks to the value of their investment – such as avoiding stranded assets. (e.g. where you have rights to drill for oil in a certain patch of land, but due to regulation or lack of demand new oil fields are no longer worth exploring – this asset is then not worth anything.). This is all about money – they see sustainability as a financial risk, and seek to cover that. As said, this underpins many products on the market, with most sustainable ESG-screened ETFs using ESG data that captures the relative sustainability risk, rather than anything else.

- Thirdly, many people look to invest for impact – which is at its core about making the world a better place, it’s about real-world change in a positive direction. This is actually in general the primary motivation for most people investing sustainably, they want to make a difference. This can only happen if you are either (a) financing new things, or (b) changing existing things.

At Inyova, we go beyond ‘sustainable’ investing, using scientific methods to create traceable sustainability impact in the real world. We’re not simply building investment portfolios based on ESG filters, which have limited real impact. Instead, we create investments that are both impact-aligned and impact-generating.

It’s important to know that sustainable investing often aims to maximize returns by investing in companies that are “slightly better” than others. ESG criteria are layered over these potential companies, and some of the worst offenders are filtered out. Impact investing also includes ESG filters but adds mechanisms for pushing climate compliance and other changes, through actions like shareholder voting & company engagement. Further impact is generated through Green Bonds, which shift additional capital into certified sustainability projects. You can see this clearly illustrated in the graphic below.

3. What is Inyova?

A very good Robo-Advisor, with a strong focus on impact investing and sustainable investments.

- Very sustainable

- Affordable for large portfolios

Inyova stands for “Invest in your values”. With Inyova, your impact investment is personalized to you.

As the leading platform for impact investing in Europe, Inyova enables ordinary people to invest their money with real impact. Before Inyova, impact investing was reserved for very wealthy people at best. Because finding and making impact investments is difficult and costly.

At Inyova, we are changing exactly that. Through our proprietary technology, called our Personal Impact Engine (PIE), we are making impact investing possible for small investors, offering personalized portfolios that match our investors’ values – without sacrificing returns.

We want to enable millions of people to become impact investors and use their money to help solve the climate crisis.

4. Is Inyova really different than buying a sustainable ETF? Is a sustainable ETF greenwashing?

Inyova is very different from buying a sustainable ETF! And to answer the second question, it really depends on the ETF.

This all comes from a fundamental misunderstanding of what most sustainable ETFs are trying to do and the data on which they are built. Understanding this can explain why you occasionally have some weird companies in sustainable-labeled ETFs, such as Chevron or McDonalds. This again all falls back on the 3 motivations I mention above: most “sustainable” ETFs are built on ESG data that is looking to capture relative risks, i.e. they are ultimately using data designed for use in performance-motivated funds. However – they are sold as “sustainable” funds, which is very often not what investors expect (the majority of investors buying a sustainable product actually have the impact motivation!).

So to go back to the original question of whether a sustainable ETF is greenwashing, the answer is it really depends on what your motivation is. If you are looking to invest sustainably to manage financial risks, then it is doing exactly what you want it to do. However, if you are looking to invest for values or for impact – more often than not it won’t be doing what you want it to do. Given that the most popular motivation for investing sustainably is to make a change in the world, many ETFs labeled as sustainable could be viewed by some as being a bit greenwashy, because investors have different expectations to what they’re actually getting.

For whether Inyova is different to a sustainable ETF, the answer is absolutely yes because of our personalization, transparency, and impact generation. You can fully personalize your investment to your values (you have control via the wish/blocklist features). If you see something you don’t like, you can kick it out of the portfolio. This is in contrast to ETFs where it’s a “one-size-fits-all” approach.

There is also total transparency – you can see everything in the portfolio, as well as descriptions of the individual instruments (both the good and the bad). We really want people to be able to make an informed decision. Finally, and possibly most importantly, Inyova offers real impact via active ownership. The biggest ETF providers, in some cases, actually hinder sustainable change, in 2021, the big 3 (BlackRock, State Street, and Vanguard) voted against a majority of environmental and social shareholder proposals.

5. With sustainable investing, am I missing on diversification?

There are some key rules to follow to ensure diversification, and here at Inyova, the way our impact portfolios are built, we make sure you are not compromising on diversification.

Let us explain:

Inyova, as your asset manager, takes care of diversification for you.

To spread your chances of success as widely as possible, we therefore, distribute your assets in the equity section across large and small companies and different countries, sectors, and currencies. This means that you are less exposed to risks that affect individual assets or markets. At the same time, this ensures that your portfolio develops in line with the overall market.

For this purpose, your investment amount is evenly distributed among 30 to 40 companies in the equity part. Thus, each company forms about 2 – 3 % of your portfolio.

Depending on your risk profile, you invest not only in shares but also in green bonds in your portfolio (The bonds in your strategy are a Green Bond ETF – Exchange Traded Fund – It contains a mixture of green corporate and government bonds). The fact that you have an additional type of investment in your portfolio creates additional diversification.

We constantly monitor the weighting of the various positions for you and carry out regular rebalancing to restore the initial balance of your strategy.

In addition, we adjust your portfolio composition occasionally if risk, security, or sustainability parameters can no longer be met by individual companies. This means that certain companies can be added or removed from your portfolio. We will, of course, inform you about any changes we make to your portfolio composition.

6. Am I missing out on returns?

From a scientific point of view, it is quite clear that sustainable investments do not compromise returns.

In a meta-analysis, we analyzed over 2000 individual studies since the 1970s. The vast majority of the sustainable investments examined performed equally well or even better than the market.

Adjusted for risk, the financial performance is likely to be significantly more advantageous.

Sustainable investment strategies can ensure that assets do not become “stranded”, when they completely lose their value due to new regulations, shifting environmental factors, or more environmentally friendly preferences. Given that demand for environmentally friendly technologies and products is rising, sustainable investments are becoming increasingly profitable.

Consistent population growth also offers potential for sustainable investments: the UN forecasts that the global population will reach almost 8.5 billion by 2030. Climate change, scarcity of resources, and population growth are immense challenges facing our society and can only be resolved through technological advancement and sustainable solutions. However, these factors also offer opportunities for companies that are innovating and helping to solve the world’s big issues.

There’s a growing body of evidence that shows environmentally friendly, socially responsible investment opportunities also have the power to generate attractive returns. A study published by Munich-based rating agency Oekom Research analyzed the performance of an investment portfolio consisting of 300 shares in companies with good sustainability ratings. The shares in the companies were compared against the market average over a period of seven years. The result? The portfolio outperformed the market, growing in value by 31% compared to the market’s 27%.

There are a number of other interesting studies that have produced similar results (including from Harvard, Wharton, Royal Bank of Canada, Morgan Stanley, Center for Sustainable Finance and Private Wealth at the University of Zürich, Research Group for Sustainable Finance in Hamburg).

These studies not only show that sustainable investment is no riskier than conventional investment – but also that stronger returns can be achieved (Source).

Inyova’s proprietary technology, the Personal Impact Engine (PIE), designs your investment so that you invest in high-impact companies – without compromising returns. An Inyova portfolio of 100% stocks has an expected return of 6 % – 7 % per year over the long term before fees.

Based on the history of the relevant stock markets analyzing the last 100 years, a diversified portfolio is expected to return 6 – 7 % per year. As we use a wide and strict diversification approach across the markets of US, EU, and CH, we expect your portfolio to move along the overall stock market over the long term. (Please be advised that past performance is not a reliable indicator for future returns.)

7. Why should people invest sustainably?

A bit is explained in question #2, with the 3 motivations. You might want to invest sustainably for risk management, for values-based reasons, or to change the world. In particular, changing the world with your investments is particularly attractive and necessary as we continue to see the worsening effects of the climate crisis. If you can both invest for your future AND do something good for people and the planet, the question is more: why not?

8. Where did sustainable investing make a difference?

It’s again important to differentiate between the different types of sustainable investing here! There is very limited evidence that pure values-based investing makes a difference (it’s possible there are some signaling effects) – but it’s not actually trying to make any measurable difference. Same with performance-based sustainable investing. On the other hand, impact investing in the public equities space has many examples where utilizing rights as shareholders and becoming an active owner has made a big difference.

Here are some examples:

- Engine No.1 got 3 of their chosen directors onto the board of Exxon Mobil to help push them away from fossil fuels (Source)

- Nuns against guns: the Interfaith Center on Corporate Responsibility won a resolution on gun safety at American Outdoor Brand’s annual shareholder meeting, the same resolution it successfully passed at Sturm Ruger earlier this year. Smith & Wesson’s parent company has to make a report on whether it is adequately addressing the risks that its products are associated with gun violence and to show evidence it is exploring ways to make safer guns. (Source)

- HSBC shareholders voted to end coal financing (Source)

- You can also find a long list of engagement efforts in 2022 from NGO ‘As You Sow’ here

9. Where do you see the greatest opportunity in investing for sustainability?

Perhaps intuitively, we see the greatest opportunity in investing for sustainability in companies you wouldn’t immediately consider sustainable. For example, Inyova ran an engagement campaign last year with BMW. We see them as a company with a LOT of sustainability potential: they have amazing expertise and engineers, as well as a well-respected brand. However: they weren’t fully capitalizing on this, and were instead continuing to sink a lot of money into petrol- and diesel-based engine technology, which will be banned for use in new cars in the EU by 2035.

We didn’t want them to become the Blackberry of the automotive industry, so we engaged them. After conducting a lot of research, including interviews with experts, NGOs, and think tanks, we put together an investor briefing to make our case. We wrote letters to the CEO and chair of the supervisory board, made an election proposal for the supervisory board, and spoke up at their AGM to draw attention to these issues.

The end result was that 15% of independent shareholders voted for our candidate, and we received a lot of positive feedback by fellow investors and broad media coverage of our campaign. What we have seen since is clarification that their new platform (Neue Klasse) will be battery-electric only, exceeded their sales targets regarding electric vehicles and made this a part of their executive remuneration scheme, and increased female representation in their board committees.

So here, BMW is not what most people immediately think of as a sustainable investment – but there is a lot of potential for impact. We’re continuing this by pushing them to improve their electrification target even further: from 50% in 2030 to at least 60% or higher. As we see it, they should fully focus on EVs and not sink any investments in ICE or plug-in hybrids that damage the climate and represent a serious stranded asset risk. This kind of position and possibility is all built into Inyova’s approach, where as part of your diversification you have a mix of interesting green companies and what we call ‘transition positions’: companies that are not the worst but not yet the best in their sustainability performance.

More on this active ownership initiative here.

10. Should everybody invest sustainably? Who is investing with Inyova?

We’re more than a little biased here, but the short answer is: yes! The world is hurtling towards more and more crises related to the climate. If we want to have any chance of doing something about it, everything will have to become sustainable – including investing.

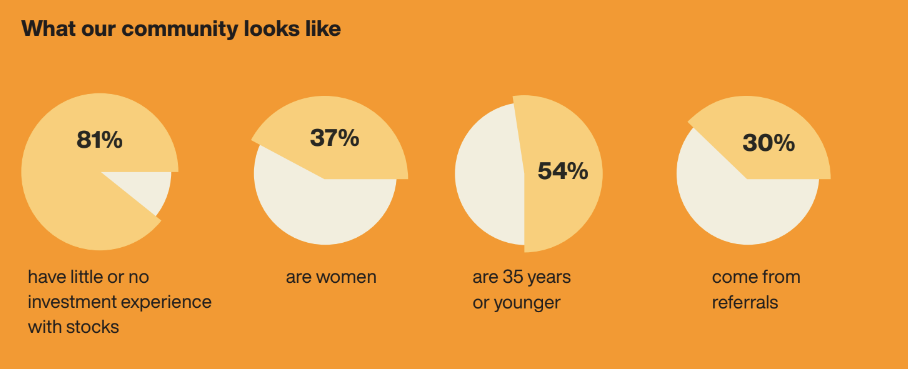

Our customers are primarily people who care about sustainability in their private lives and who also want a sustainable option for their money. And real sustainability with transparency, without the risk of greenwashing.

Our community already includes over 10,000 impact investors. We are building a more equitable and sustainable future, and growing every day.

11. Do you have some examples of Swiss sustainable companies?

It depends on what you mean by sustainable companies! At Inyova we look at lots of different themes, including environmental and social ones – so what counts as sustainable depends on the specific domain you’re interested in.

Geberit is an interesting one in the environmental space, as they provide technology that helps save a lot of water.

On the social side, we recently included Sonova in our ‘Social Justice’ topic, as they make hearing aids that allow people with hearing loss to more easily join in society where good hearing is so often taken for granted.

Switzerland also has many amazing sustainable startups, such as Climeworks and Planted.

12. Is sustainable investing in Switzerland growing?

Yes, according to Swiss Sustainable Finance (SSF) sustainable investing volumes increased by 30% to CHF 1,982.7 billion. The fastest-growing segment was sustainable thematic investments, growing at 157% in 2022 (Source).

Conclusion

A very good Robo-Advisor, with a strong focus on impact investing and sustainable investments.

- Very sustainable

- Affordable for large portfolios

Thanks a lot to Inyova for answering my questions! Their answers are very interesting and touch on many points I have not yet discussed on this blog.

The difference between investing for values and investing for impact is really important. And this was not really clear to me before going through this interview. I especially liked the example of BMW, which is really not obvious.

If you want to learn more about Inyova, you can read my review of Inyova.

I hope you will find these answers interesting! Let me know if you would like more content on sustainable investing.

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- How to Choose a Stock Market Index for 2024

- Should you use currency hedging in your portfolio?

- How to Invest in the 2020 Bear Market

I am sorry, but using BMW use-case and implying that EVs are environment-friendly is the greenwashing at its best and a definitive turn-off from such companies. At least the usual investment is less hypocritic.

Why aren’t EVs environmental-friendly? Shouldn’t more people drive EVs and shouldn’t we stop fossil fuel cars?

Plenty of research published about the EV: mostly it’s about their batteries that use rare metals (NCA and lithium in li-ion for example) and those are mined in Africa using some shady middlemen and allegedly children labour and after depletion they can’t be utilized in an environmentally-friendly way. A quite comprehensive video on the topic you can check “Electric Vehicles’ Battery Problem” from wendover productions on YouTube. Then there comes their weight and typically faster acceleration and breakings: more damage to the roads that require more frequent repairs and tires must be changed more frequently.

I personally believe that the personal cars do not scale for the future and public transportation must replace them en-masse.

It’s true that the battery is a major problem and we may be introduced a new problem to fight a current problem. And it’s also true that current EVs are way too powerful without a good reason. They should make smaller EVs.

But I still believe that EVs are significantly better than fossil-fuel cars at this point, as long we buy a small EV and importantly as long as that EV is recharged with renewable energy (otherwise it makes no sense).

But yes, we have too many cars in our society and more public transportation could help in that regard.

Good points!