Should you contribute to your third pillar in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

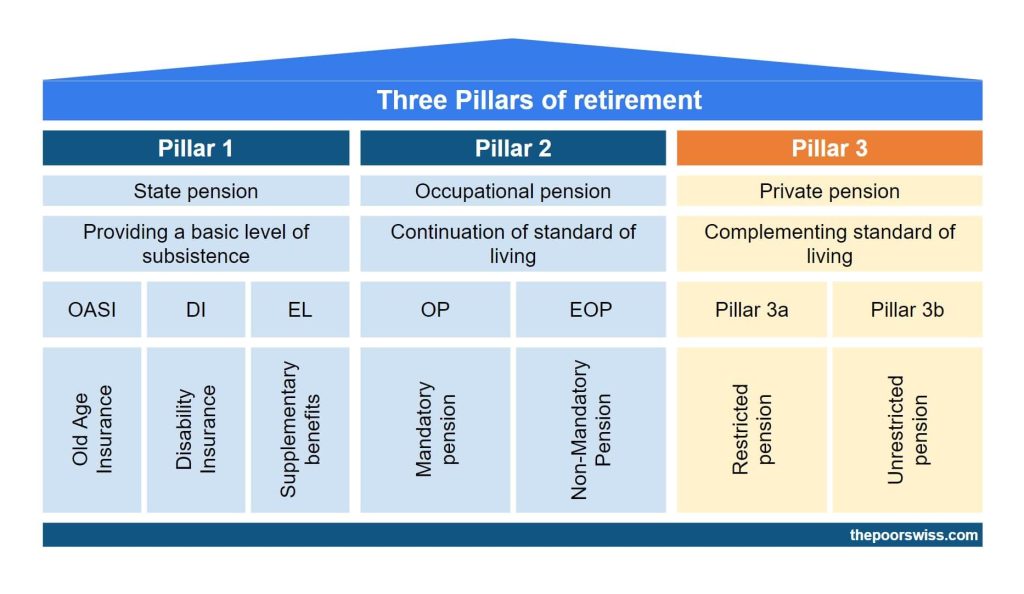

The third pillar of retirement in Switzerland is entirely optional. Your contributions will be locked until retirement. But you will get a significant tax cut from your contributions.

So, should you contribute to your third pillar every year? Before, it was obvious to me. I have always contributed as much as I could to my third pillar. But recently, several people have asked me if they should invest the maximum yearly.

Even though there is a large tax advantage to the third pillar, there are also some disadvantages to the third pillar. Do the benefits outweigh the disadvantages?

I answer this question in detail in this article.

Third pillar Advantages

If you are not yet familiar with the third pillar, I have an entire guide on the third pillar.

All contributions to the third pillar are voluntary. They are entirely optional.

So, why contribute to your third pillar? Contributions to the third pillar can be deducted from your income. These deductions will make a significant difference to your taxes.

You can contribute a maximum of 7056 (in 2023) per year in your third pillar. This amount is the maximum that will be tax-deductible. And there is no advantage in contributing past this point.

How much exactly you will save in taxes, depend on your marginal tax rate. This rate is the tax rate at which extra income is taxed. It will depend on how much income you have. Generally speaking, the higher your income is, the higher your marginal tax rate. For many people, this will be between 20% and 40%.

So, if your tax rate is 20% and you contribute 7056 to your third pillar, you will save 1411 CHF the year of the contribution. If your tax rate is 40%, you will save 2822 CHF.

You can view third pillar contributions as an investment with a return based on your marginal tax rate.

When you withdraw the money, you will still pay taxes on it. But this will be at a reduced rate. How much you will be taxed will depend mainly on two things: the amount of the withdrawal and the place where you live.

There is a second tax advantage for your third pillar contributions. You will not pay any wealth tax on the amount accumulated in your third pillar. If you were to keep this money in a bank account, you would pay a wealth tax.

If you have significant wealth, this can save you some money. It will depend on where you live. Indeed, in Switzerland, the wealth tax is different from canton to canton.

Overall, this could be savings from 0.1% to 1.0%. For most people, this will be on the low side of things. However, compared to the first advantage, this second advantage works every year. So, if you are investing for your retirement in 40 years, this could make a significant difference!

So, the advantages of the third pillar are in the tax advantages it provides.

Third Pillar Disadvantages

Now, there are some disadvantages to contributing to your third pillar.

First, all your contributions will be locked in the third pillar account until you can legally get this money. Generally, you will not get it before retirement age. But this money can also be used to buy a house or start a business (only if you become self-employed). And if you leave Switzerland, you can also withdraw this money under some conditions. But in general, we should assume that this money is not made to be used.

The second disadvantage is that the returns on the third pillar are not as high as when investing directly in the stock market. We have access to pretty good third pillar providers in Switzerland (here are the best third pillar accounts). But still, some rules limit the allocation of stocks you can have. And it also limits the allocation of international stocks you can invest in.

Nevertheless, this is much better than the second pillar, where you can expect very low returns. Overall, you probably lose between 5% and 10% in returns. But this is only true if you are aggressive in both your broker account and third pillar. If you compare cash and your third pillar invested in stocks, the third pillar will get much better returns. We need to compare similar investing strategies.

Now, the most significant disadvantage is the higher fees! It is where the second pillar loses to DIY investing. The best third pillar accounts have about 0.50% Total Expense Ratio (TER). This TER is significantly higher than a DIY portfolio with between 0.10% and 0.20% TER.

On top of these fees, we will probably lose on the tax efficiency of U.S. Exchange Traded Funds (ETFs). Most third pillars in Switzerland do not invest in U.S. ETFs. They will probably invest in fee-efficient Swiss funds. It means that they are losing on dividend withholding.

This also means they get even better TER (sometimes 0%) using pension funds. Depending on your allocation to U.S. funds, this could account for another 0.05% to 0.1% loss compared to your ETF portfolio with U.S. Funds.

Since 2020, third pillar providers have been allowed to get back this source withholding of the dividends by the U.S. For now, not every third pillar has taken advantage of this. But Finpension 3a and VIAC already implemented this optimization! So, by using them, you will get more returns than other equivalent third pillars!

Finally, contrary to DIY investing, your capital gains will be taxed. Indeed, when you pay the withdrawal tax, you will pay it on the entire capital, not only the money invested.

So, the disadvantages of the third pillar are mostly its slightly lower returns and significantly higher fees. It should not matter too much since you will need money for retirement.

Comparison with DIY Investing

So, with these disadvantages and advantages, we can see if you should contribute to your third pillar.

First, I compare it with DIY Investing. It is what I am doing with my invested money. And this is what I recommend.

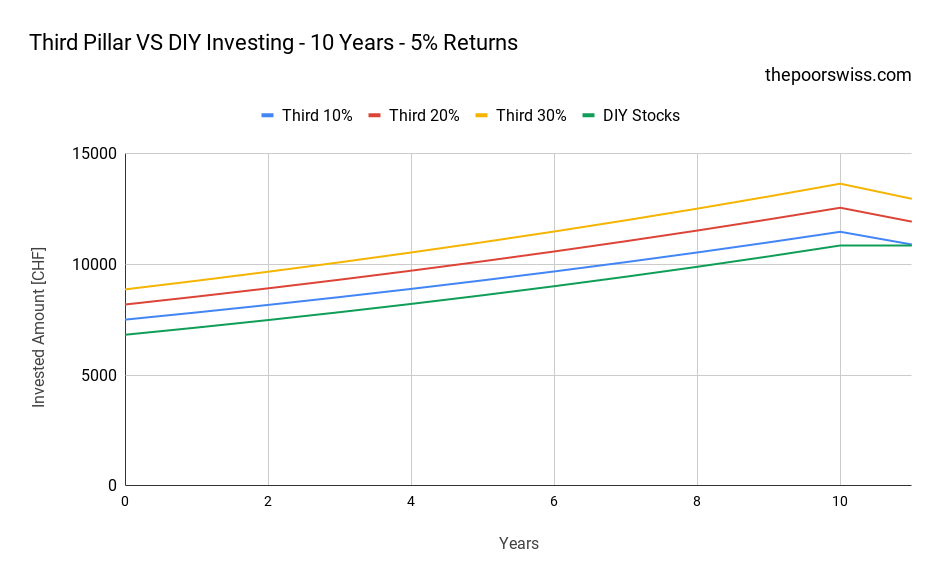

For this, I will assume a 5% return per year on the stock market. And the DIY Investing portfolio will have a 0.20% TER. You could go lower than that, but it is a reasonable average for many people. In both cases, I will consider aggressive portfolios fully invested in stocks. I consider a yearly 0.05% wealth tax.

As for the third pillar, I take Finpension 3a into account. It is currently the best third pillar available to acknowledge. The fees will be 0.44% with the most aggressive strategy. The money saved with the tax relief is invested in stocks in the DIY Portfolio. I assume 4.8% yearly returns for the Finpension 3a portfolio.

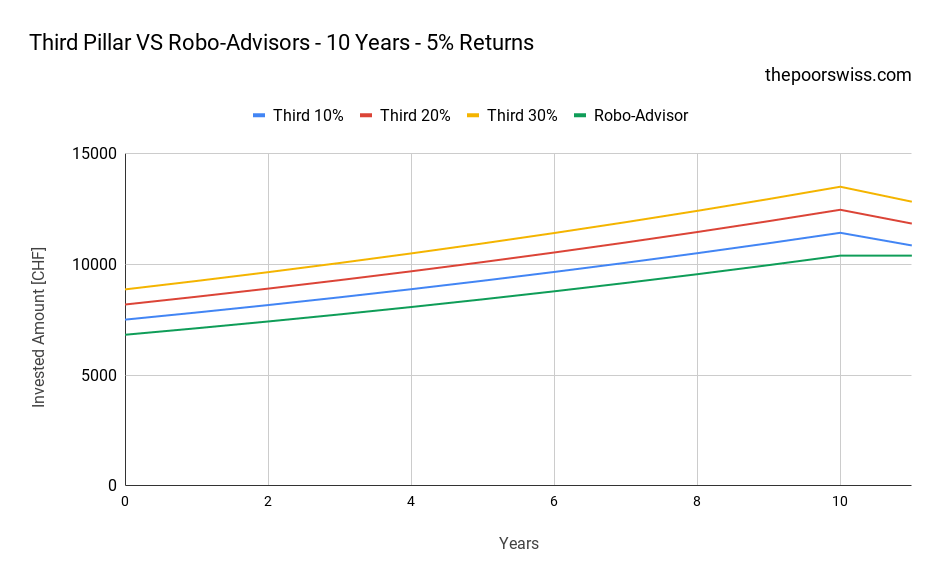

Here is what happens if you have ten years in front of you with different tax rates.

So, with ten years in front of you, it is quite interesting to invest in your third pillar. The direct returns of the first year make a significant difference.

Now, we can see that after ten years, the third pillar with 10% tax returns is at the same level as the DIY stock portfolio. However, 10% is a very tiny marginal tax rate. You would need to earn a tiny income to have such a low tax rate. For instance, even with one salary, we have more than 30% savings from the third pillar. And some people can go all the way to 40%. So, we should not be concerned.

If you have more than a 10% tax rate, invest in the third pillar!

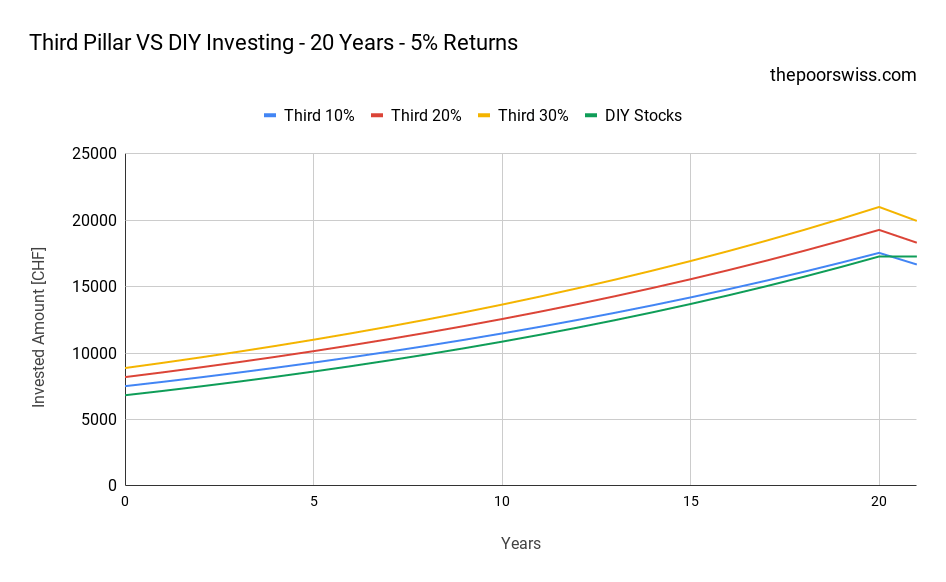

But what happens with a longer period? Here is what happens for 20 years.

After 20 years, the DIY stocks pass the 10% tax rate significantly. But the third pillar is still better if you have about a 15% tax rate. And this is still low.

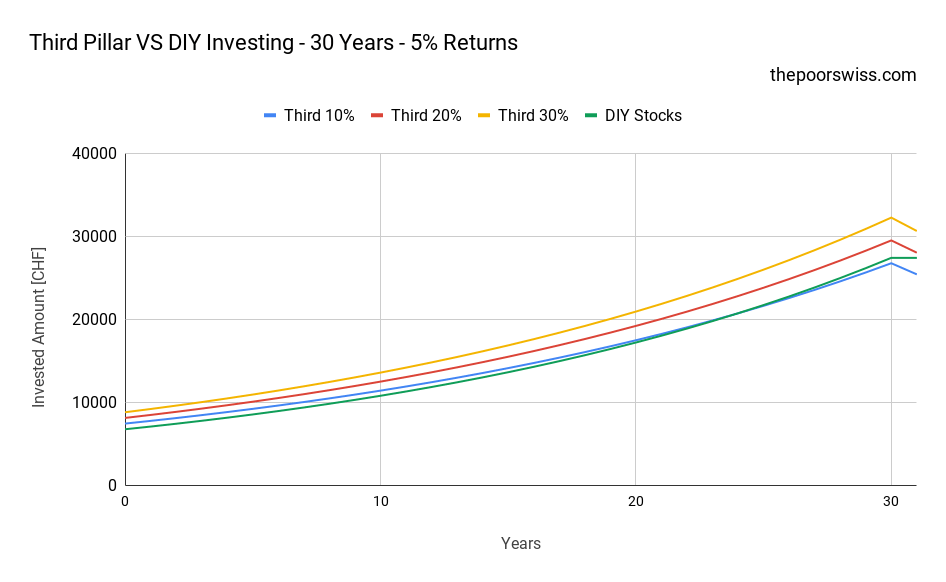

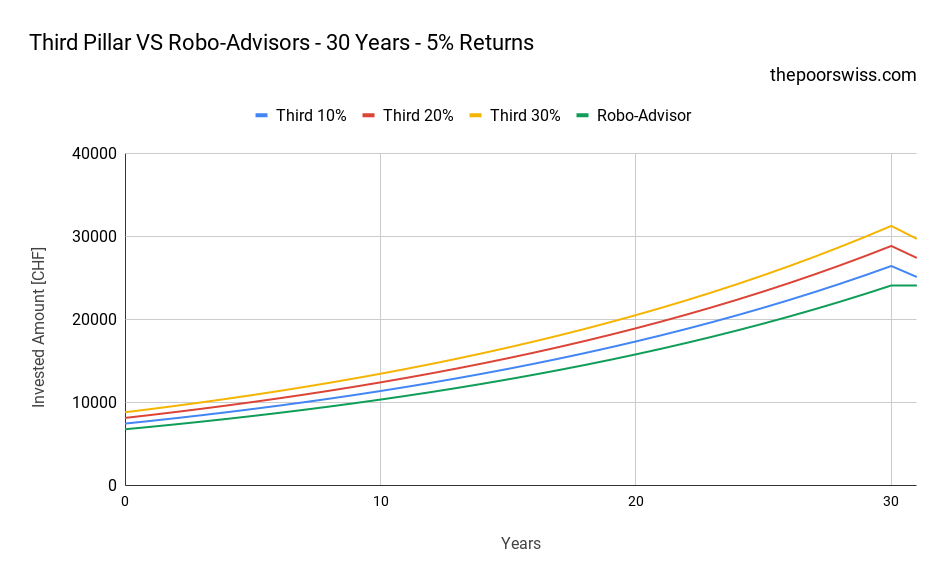

Finally, here are the results after 30 years:

It is interesting that even after 30 years, the third pillar with a 20% tax rate still beats a DIY Stocks Portfolio.

So, even if you invest in your own cheap index ETF portfolio, the third pillar is still very interesting because of the tax returns. But, indeed, the difference is not huge because of the lower yields and higher fees of the third pillar.

Nevertheless, it is still significant. After 20 years, you would still have about 2’600 CHF extra with the third pillar with a 30% tax rate. So, in the end, it will depend on your tax rate, wealth tax rate, and the returns of your portfolio compared to your third pillar.

Comparison with a Robo-Advisor

Now, if you invest with a Robo-Advisor, should you still contribute to your third pillar?

We keep the same parameters for the third pillar as the previous example. However, the money saved by the tax returns is invested in the Robo-Advisor.

For the comparison, I assume you use a very good Robo-Advisor from Switzerland, True Wealth. With an aggressive portfolio at True Wealth, you will have around 0.65% yearly fees. I am expecting the returns of the portfolio to be the same as the stocks (5% per year). And I am expecting Finpension to be at 4.8% per year. If you are using a more expensive Robo-Advisor account, the results will be lower for Robo-Advisor.

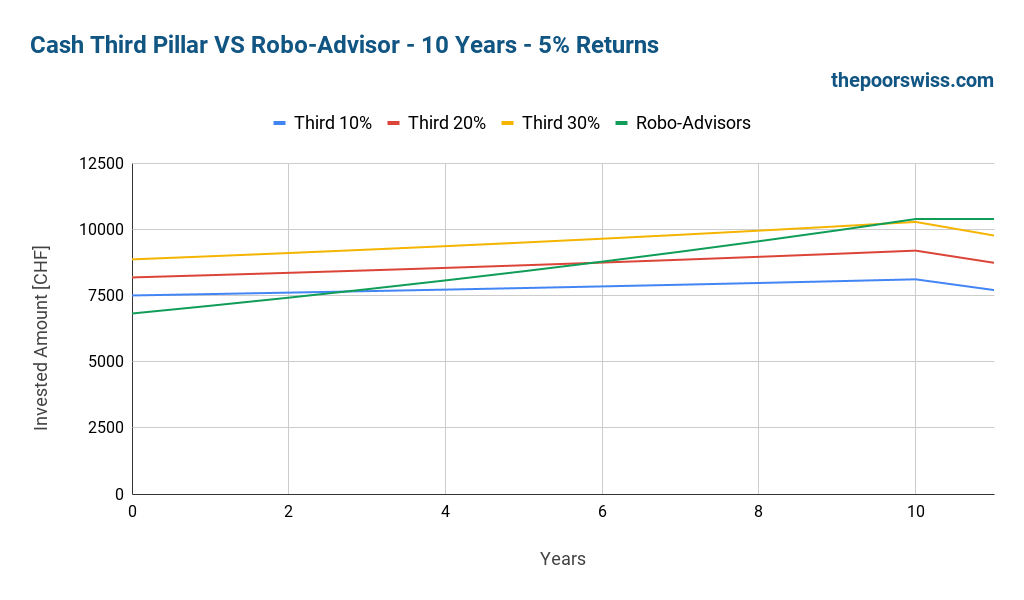

Again, here are the results for ten years:

Even with the lowest tax rate (10%), you still have a benefit over the Robo-Advisors outside of the third pillar. So, if you use one of the cheapest Robo-Advisors in Switzerland, you have a good reason to invest in the third pillar.

Can directly skip over to 30 years period:

Over 30 years, the differences are more significant. After 30 years, you have gained 5500 CHF more with the third pillar than with a Robo-advisor.

The results are quite logical. An excellent third pillar has very few disadvantages compared to a Robo-Advisor. The returns may be slightly lower. But the fees of Finpension 3a are better than the fees of the best Robo-Advisor! So, the initial tax advantage is better than the difference in returns.

So, if you are investing with a Robo-Advisor, you should contribute to your third pillar! The difference is significant. The best third pillar is better than the best Robo-Advisor.

Comparison with savings account

Finally, we can compare it with keeping money in a savings account, uninvested.

It means the money you do not invest in your third pillar is left in a savings account. For this savings account, we consider 0% returns and 0% fees. You may have a fee on your bank account these days.

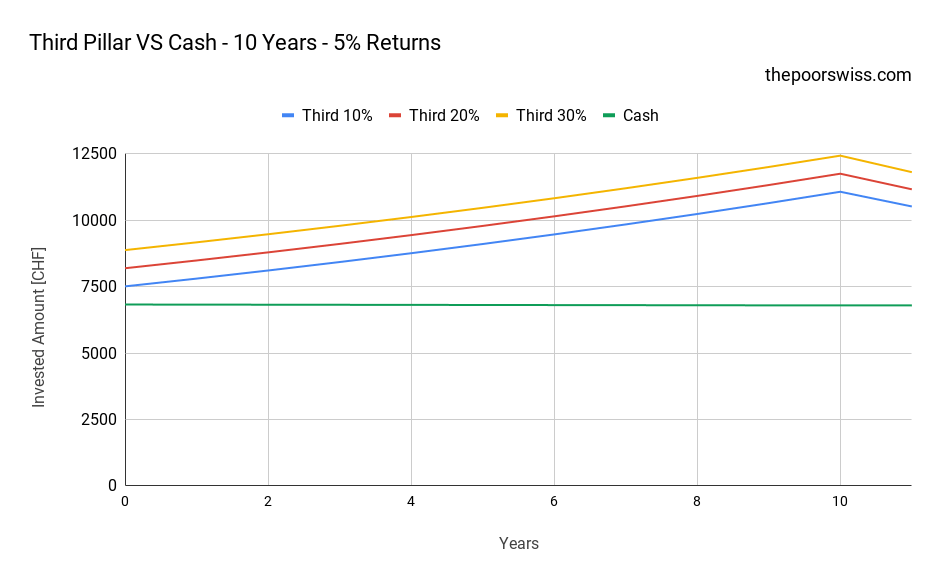

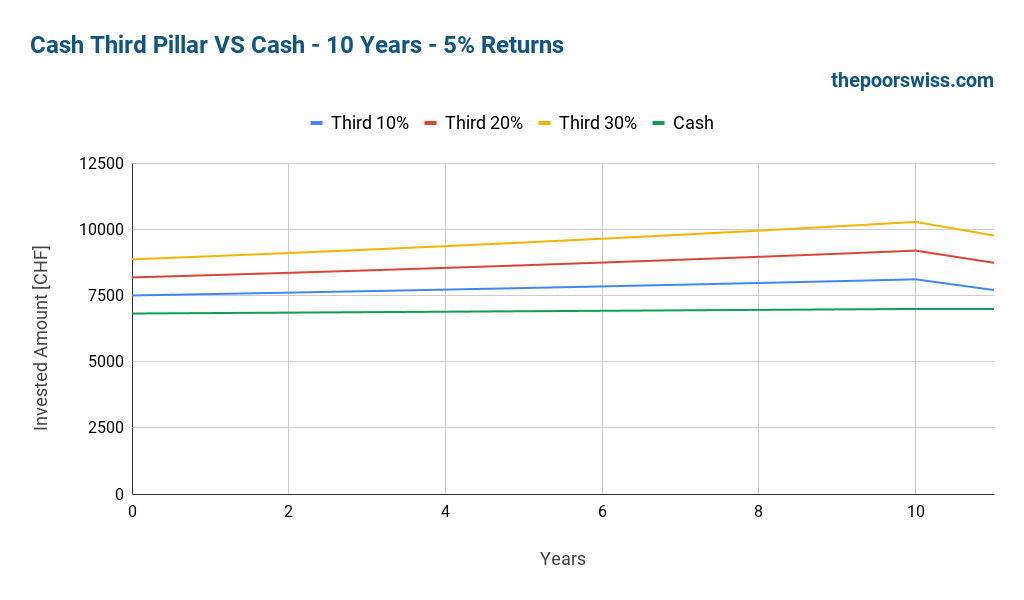

Here is what would happen after ten years:

The results are pretty obvious! If your money is uninvested, invest what you can in the third pillar. Contributing to your third pillar will make a huge difference!

What if you have a third pillar in cash?

Some people have a third pillar in cash. These accounts have very low returns but usually have no fees. So, how do they compare with the other means of investing?

Before comparing, I emphasize that I do not recommend these third pillars. The only time it would be adequate is when your retirement is very close.

So, we can take a third pillar account with 0.3% interest as an example of this analysis.

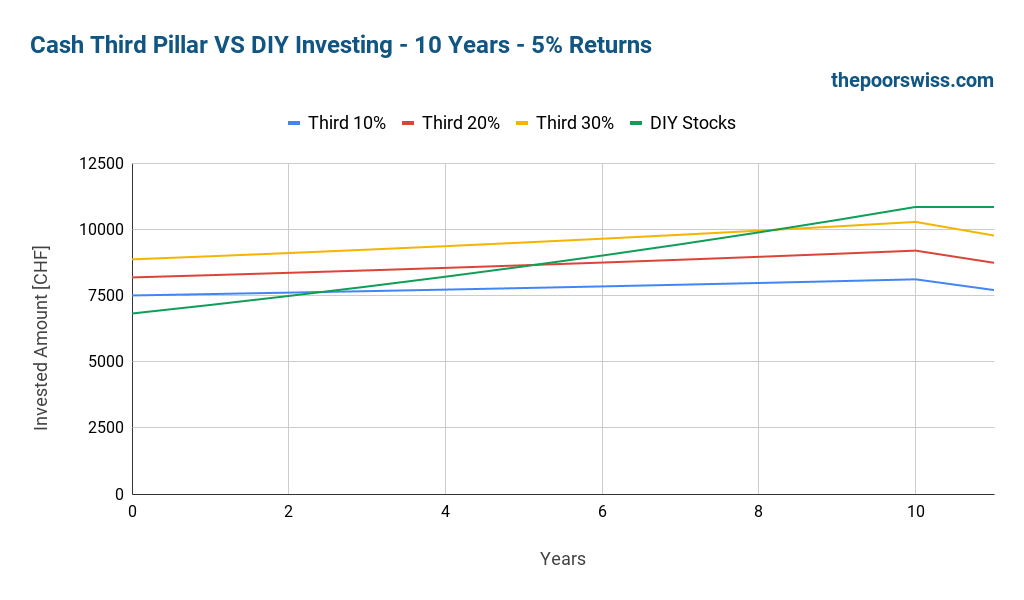

First, we compare it with a DIY Stocks Portfolio:

In less than ten years, the DIY Stocks portfolio will outperform the third pillar, even with large tax returns. This result is expected because of the much larger performance of a DIY Stocks portfolio compared to a cash third pillar.

So, if you only have access to a cash third pillar account and are a DIY Stocks Investor, you should not contribute to the third pillar! The exception would be in the last few years before your retirement. But I do not see how an investor would invest in such a third pillar.

We can see if the same holds when compared with Robo-Advisors:

We get almost the same results as with the DIY stocks portfolio. If you invest in stocks in a Robo-Advisor, you should not invest in a third pillar in cash.

Finally, we see what happens if you invest in cash:

In that case, we still have enough advantages with the original tax returns to make it worthwhile.

Now, I must repeat: you should invest in stocks in your third pillar if your risk tolerance allows it. And ideally, you should invest in stocks in your primary portfolio.

Conclusion

So, now we can answer the question: should you contribute to your third pillar? Yes!

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

If you contribute to a good third pillar with low fees and high returns (Finpension 3a probably), the tax advantages of the third pillar will outperform even your DIY Stocks Portfolio.

And the third pillar gets better as your income grows. If you have a substantial income, you have no excuses not to contribute to the third pillar.

With an aggressive DIY portfolio, the difference is not huge, but it is still significant. But if you are investing with a Robo-Advisor, the third pillar will be even more investing. And if you are uninvested, the third pillar will be your best investment!

And in some cases, indeed, the third pillar is not worth it. If you are in a canton where withdrawals are heavily taxed, the tax on capital gains may outweigh the benefits of the tax benefits. But that is unlikely, for most people, it is still interesting to contribute to the third pillar.

Now, of course, you will not gain much by investing in a third pillar in cash. You need to invest in a good third pillar for the long term.

If you do not know where to start, check out my guide on how to start investing. And if you want to save money from taxes, you can read my article about the best tax deductions in Switzerland.

What about you? Are you contributing to your third pillar?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- What should you do with a life insurance 3a?

- Vested benefits accounts: All you need to know!

- The Three Pillars of Retirement in Switzerland

Hey Baptiste,

Thank you for the informative article.

I have a question about the phrase below ?

Is there a public website where you can see the withdraw taxes for 3rd pillar per canton ?

And in some cases, indeed, the third pillar is not worth it. If you are in a canton where withdrawals are heavily taxed, the tax on capital gains may outweigh the benefits of the tax benefits.

Many thanks!

Hi Stefan,

You can find this information for each canton online. But I have not found a website that keeps track of all this information. This can also change, so I would be careful about a website not being up-to-date.

I think you would need a very hefty tax on withdrawals to diminish the tax benefits enough for a large marginal tax rate, but it’s true that this could be possible.

Hi Bapriste,

Thank you for all the information that you share with us!

Nevertheless, I cannot agree with the following statement:

” Finally, contrary to DIY investing, your capital gains will be taxed. Indeed, when you pay the withdrawal tax, you will pay it on the entire capital, not only the money invested. ”

If I understand correctly your idea, it’s not a fair interpretation of what is happening. Let’s define A0 as the initial amount in question, T as the tax rate and R as the return during the period in question. So if you do not use the tax efficient investment, then your final amount is

A1 = A0 * (1 – T) * (1 + R)

If you do use the tax efficient investment, then your final amount is

A2 = A0 * (1 + R) * (1 – T)

So if T and R in both cases were the same, you would get the same outcome: A2 = A1. However, in case of capital gain taxation (T1), the formula would be:

A3 = A0 * (1 – T) * (1 + R * (1 – T1))

So our capital gain case is different from the other two.

Sorry Baptiste for misspelling your name :-(

Don’t worry about it! I have seen much worse :)

I don’t follow your logic either. The first two cases serve what purpose?

I am comparing DIY investing in a broker acocunt and a third pillar (for instance at Finpension).

Let’s say you invest 10’000 CHF in your broker account and 10’000 in your third pillar. After 10 years, you withdraw that money and it has doubled in value (20’000 CHF now).

* In the case of the broker account, you can simply withdraw the 20’000 CHF and you will pay no capital gains tax.

* In the case of the third pillar, you will pay the withdrawal tax on the 20’000 CHF, not the 10’000 CHF, meaning more taxes than if capital gains were not taxed.

Of course, there are other points, this is only a single point form your article. The only thing I am saying is that capital gains are taxed in the 3a but not in your investments.

” The first two cases serve what purpose? ”

A1 = A0 * (1 – T) * (1 + R)

– this is the case when “you invest 10’000 CHF in your broker account”.

A2 = A0 * (1 + R) * (1 – T)

– this is when you invest “10’000 in your third pillar”.

They demonstrate mathematically, that 3a does not introduces some new “capital gain tax”. The taxation is equivalent, just the amount of tax T is different (in favor of 3a).

***

“you will pay the withdrawal tax on the 20’000 CHF, not the 10’000 CHF, meaning more taxes than if capital gains were not taxed.”

This looks like a misrepresentation of the situation. 10000 in case of 3a and in case of a broker account are essentially different things. In the former case it’s pre-tax, in the later it’s post-tax.

To have a fair apples-to-apples comparison, we should start with the amount a person has earned. So if the pre-tax income is 10`000, the tax is 20%, and the return is 100%, then in the case of 3a you will get:

10`000 * 2 * 0.8 = 16`000

and in the case of a broker account you get the very same amount (commutativity of multiplication):

10`000 * 0.8 * 2 = 16`000

So in case of 3a we have not the tax on the capital gain, but the tax on the original income, just indexed. You indeed pay more tax in case of 3a, but you also get more return from originally non-taxed income. So the state just “takes back” the amount of the return that you got from the taxes that you have not paid originally.

Hi Baptiste,

Great job, thanks !

Maybe I may add that if you consider 3a 3rd pillar with mutual funds/stocks/ETFs, the fees are quite important on the long run. High impact on the return and the available amount at the end.

Banks sells “products” that are real “cash cow” for them. On the insurance side, it’s even worse. Total rip-off with hidden fees, lack of flexibility and poorly performing mutual fund of the bank/insurance itself.

Fortunately, some fintech compagnies such as VIAC, Finpension or Frankly offer better service/solutions with much lower TER.

Best !

Tux

Hi Tux,

You are absolutely right, the fees are very important in the long-term. I have talked about this in all my articles about choosing a third pillar!

Thank you for your blog, Question – when I want to withdraw all savings from 3a for purchasing the house, or for paying the mortgage, have I to pay any taxes?

Hi Baptiste,

After reading about the Pillar 3a tax benefits, I did the max contribution for 2022. As a foreign national, I am currently taxed at source (Quellensteuer), so I have to submit a ”nachträglich ordentliche Veranlagung (NOV)” for the tax benefit.

However after reading this article:”https://www.tagesanzeiger.ch/auslaendische-staatsangehoerige-erhalten-jetzt-gleich-lange-spiesse-377832186766”

I live in Kriens, so I’m wary of paying more taxes than I currently pay and receiving no tax benefit. Is there a way that I can calculate the difference between paying Quellensteuer and submitting normal tax returns every year?

Hi Moz,

If your canton has a software for the tax declaration, you may try to fill the tax declaration and then get an estimate of the taxes and then compare that to what you usually pay. This won’t be perfect because the software only does an estimation based on your data. Also, if the software for your canton does not do an estimation, this won’t help. I don’t see any other solution.

Dear,

Thank you very much for your blog. It is beneficial.

After reading, I still have a question.

I don’t know when I will leave Switzerland but I would like to know if I can invest in my 3a pillar even without a residence in Switzerland. I want to keep my 3a pillar until retirement but I also want to do DCA outside of Switzerland.

Thank You Very Much

Hi Tiago,

No, you, unfortunately, can’t. Once you leave Switzerland, you won’t be able to contribute to your third pillar any more.

Hello Poor Swiss,

Thanks for this blog, it is truly amazing, I purchased your book a year ago before arriving to your country and have been really useful.

I am not from Switzerland as you may have already realised, does it make sense to me to contribute to the 3rd pillar? considering that I will be here for maybe 5 or 10 years? can I unlock this money when leaving Switzerland?

Hi Omar,

Glad this was useful to you :)

It depends on many factors. If you have a large income, it may be interesting since this would save you some money that you can invest in other things (or spend).

However, if you invest your third pillar, over 5-10 years, you may lose money and in which case, it may be better not to invest. But then, you have the consider the opportunity cost of not investing, so it will depend on your current expected returns for your current investments.

You can generally unlock when leaving, but it depends on which country you are leaving to.

Happy New Year and thanks a lot for your another fantastic post. Thanks to all your work I have opened my 3a. :) Is it legal to have 3a with two different providers (my case VIAC and finpension)? I have also used your code to enter the lucky draw at finpension. :)

Btw I love your book. I bought it from Amazon DE and have it delivered here in CH without any problem.

Hi Lila,

Thanks for your kind words!

Yes, it’s entirely legal to have 3a with different providers :)

Thanks for buying our book! If you got time, a review on Amazon would be very helpful for us!

Hi,

I really like your detailed analysis with simple modeling.

After all, this is December, and many people ask the same question: Is it worth buying the 3rd pillar?

However, I disagree with your simulation. It all depends on the inputs.

You assumed very low 5% return. My experience tells: with UBS most aggressive 3a fund you get 8% return per year (average of 5 yrs). Then, DIY stocks–5% return per year is _nonsense_. The average is 9-14% (average of 10 yrs).

The best is to put dynamic calculator into your page and let people input their returns :)

The result (3a efficiency over DIY stocks) depends on the inputs.

Put it simple: with 3a most aggressive funds you can get 8% annual return; with DIY stocks it can realistically be double; this year i did triple of UBS. Forget fees–very low.

I insist that your DIY portfolio gives your at least double return than your bank gives in 3a fund. Thus, after few years DIY portfolio outperforms 3a fund (and its tax advantage).

Given all that, I keep doing 3a myself :)

Irrational human, I guess)

[BTW, withdrawal from 3a is a flat-rate tax with is lower than normal tax rate (people say it is ~6%). Hence, the tax benefit of ~30% becomes roughly 24% for the initial contribution (plus 6% on the gains). Again, this is minor; the driver is double return on DIY stocks/ETFs.]

Hi Val,

I have used the same returns for a good third pillar, as the stock market, minus the fees. So it won’t make big difference whether you do the simulation for 8% for both or 5% for both. I also consider 8% real returns per year to not be sustainable.

And I don’t agree that you can get double. A good 3a will invest in the same index funds you are going to invest yourself. The only difference is the fees, that’s it. There is no way I can get double of what Finpension 3a is doing for me. Absolutely, no way. And nobody is likely to do double, in the long-term.

If you are an active investor that’s another story, but I won’t go there.

And withdrawal from 3a is not a flat rate, it’s progressive. For instance, 1% below 10K, then 2% for the money between 10K and 20K. And all the tax rates and progression depend on each canton. And it’s already taken into account in my graph as you can see at the end of line that goes down.

Hi Baptiste,

Appreciate your great blog and the discussion!

Let’s compare apples to apples: 5-10 yr average of a sexy 3a fund return is ~8%/yr (plus ridiculous TER of >1%; but I believe the reported returns are net of TER); in ETFs on IBKR the same average annual return is 25% or higher (US ETFs of cause). Why do you think you cannot have this? Both returns are 5-10-yr averages. They are long-term.

Why you think Finpension 3a will be giving you the same return as DIY if the market shows long-term historical _double_ and _triple_ returns in DIY approach? They are clearly sustainable, because they are averaged for 10 (or longer) years. Maybe longer than Finpension (my guess). On the contrary, I would question sustainability of rather new Swiss-offered 3a funds, simply because they are newborns. They don’t have 10-15-yr performance statistics.

Honestly, I believe that the Finpension is having the same 20-25% a year, and giving you 8%, keeping the rest for itself (on top of the TER).

The above were the historical, long-term numbers.

My personal (short-term) 2-yr-averaged DIY numbers concur: bank 3a fund return 9% per year vs 20-30% in DIY portfolio (not daily trading, but monthly, semi-monthly simple buys).

In my simulation, if I put 9%/yr 3a return, and 18%/yr for DIY portfolio, the latter prevails only after 10 yrs; during the first 10 yrs, the difference is small, but 3a is better. My strategy: month DIY investment, followed by end-year 3a buy.

The risk

3a has a clear advantage: the marginal tax economy on 6883 chf is guaranteed every year, whereas DIY portfolio performance is not guaranteed to be 18% consistently.

Higher profit goes hand in hand with higher risk)

Thanks again for your interesting blog!

\Val

If you want to compare apple to apples, you need to compare the performance in the same kind of investments. Of, course if you invest in single stocks, like MSFt or TSLA, you cannot compare your DIY stocks with Finpension 3a (or any 3a).

TER is much lower than 1%, about 0.44% only. But that’s a detail.

How do you get average returns of 25%. Even VOO does not have this on average. Obviously, if you are investing aggressively in funds that are not well diversified, you can reach that in the medium-term. But you will be surprised when the bubble bursts…

I expect 8-10% per year on my DIY ETF portfolio, not more. And I expect about the same for my Finpension 3a.

Hi Poor Swiss,

Thank you for all the mazing work that you are putting in your blog.

I am new in Switzerland and I am 33, and I am planning to start investing with finpension Global 100%. But I would to know your strategy (so maybe I can copy it :p) : Are you planning to invest in your 3a until you reach the retirement age (65 or 5 year earlier) or you have a target and then you stop putting money on your 3a ?

Thank you.

Hi fish_chips,

I will continue putting money into my 3a for as long as I can :)

I plan to retire early (my current goal is 50), so I probably won’t be able to contribute after that.