Should you contribute to your third pillar in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

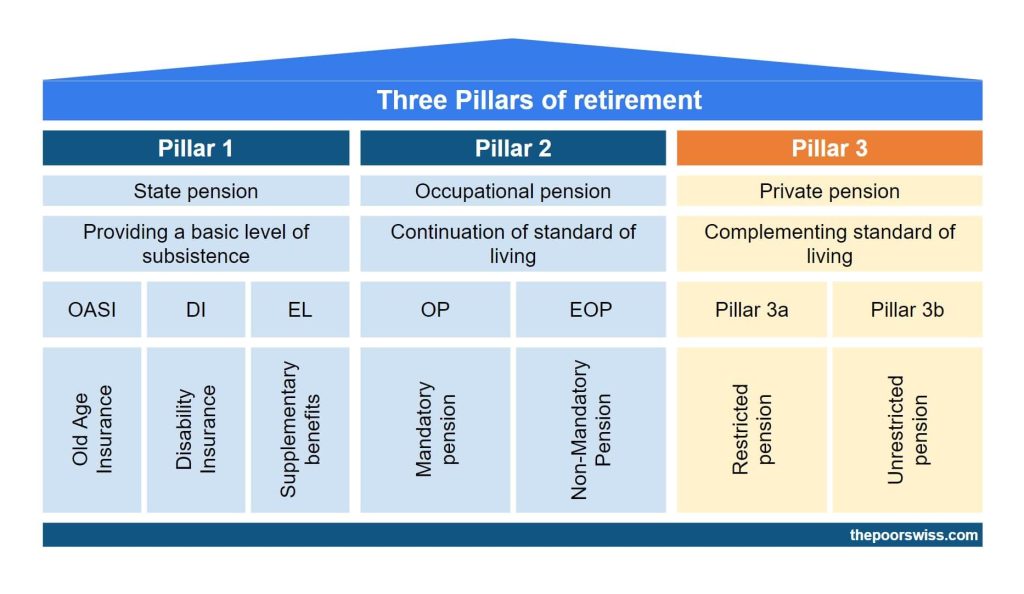

The third pillar of retirement in Switzerland is entirely optional. Your contributions will be locked until retirement. But you will get a significant tax cut from your contributions.

So, should you contribute to your third pillar every year? Before, it was obvious to me. I have always contributed as much as I could to my third pillar. But recently, several people have asked me if they should invest the maximum yearly.

Even though there is a large tax advantage to the third pillar, there are also some disadvantages to the third pillar. Do the benefits outweigh the disadvantages?

I answer this question in detail in this article.

Third pillar Advantages

If you are not yet familiar with the third pillar, I have an entire guide on the third pillar.

All contributions to the third pillar are voluntary. They are entirely optional.

So, why contribute to your third pillar? Contributions to the third pillar can be deducted from your income. These deductions will make a significant difference to your taxes.

You can contribute a maximum of 7056 (in 2023) per year in your third pillar. This amount is the maximum that will be tax-deductible. And there is no advantage in contributing past this point.

How much exactly you will save in taxes, depend on your marginal tax rate. This rate is the tax rate at which extra income is taxed. It will depend on how much income you have. Generally speaking, the higher your income is, the higher your marginal tax rate. For many people, this will be between 20% and 40%.

So, if your tax rate is 20% and you contribute 7056 to your third pillar, you will save 1411 CHF the year of the contribution. If your tax rate is 40%, you will save 2822 CHF.

You can view third pillar contributions as an investment with a return based on your marginal tax rate.

When you withdraw the money, you will still pay taxes on it. But this will be at a reduced rate. How much you will be taxed will depend mainly on two things: the amount of the withdrawal and the place where you live.

There is a second tax advantage for your third pillar contributions. You will not pay any wealth tax on the amount accumulated in your third pillar. If you were to keep this money in a bank account, you would pay a wealth tax.

If you have significant wealth, this can save you some money. It will depend on where you live. Indeed, in Switzerland, the wealth tax is different from canton to canton.

Overall, this could be savings from 0.1% to 1.0%. For most people, this will be on the low side of things. However, compared to the first advantage, this second advantage works every year. So, if you are investing for your retirement in 40 years, this could make a significant difference!

So, the advantages of the third pillar are in the tax advantages it provides.

Third Pillar Disadvantages

Now, there are some disadvantages to contributing to your third pillar.

First, all your contributions will be locked in the third pillar account until you can legally get this money. Generally, you will not get it before retirement age. But this money can also be used to buy a house or start a business (only if you become self-employed). And if you leave Switzerland, you can also withdraw this money under some conditions. But in general, we should assume that this money is not made to be used.

The second disadvantage is that the returns on the third pillar are not as high as when investing directly in the stock market. We have access to pretty good third pillar providers in Switzerland (here are the best third pillar accounts). But still, some rules limit the allocation of stocks you can have. And it also limits the allocation of international stocks you can invest in.

Nevertheless, this is much better than the second pillar, where you can expect very low returns. Overall, you probably lose between 5% and 10% in returns. But this is only true if you are aggressive in both your broker account and third pillar. If you compare cash and your third pillar invested in stocks, the third pillar will get much better returns. We need to compare similar investing strategies.

Now, the most significant disadvantage is the higher fees! It is where the second pillar loses to DIY investing. The best third pillar accounts have about 0.50% Total Expense Ratio (TER). This TER is significantly higher than a DIY portfolio with between 0.10% and 0.20% TER.

On top of these fees, we will probably lose on the tax efficiency of U.S. Exchange Traded Funds (ETFs). Most third pillars in Switzerland do not invest in U.S. ETFs. They will probably invest in fee-efficient Swiss funds. It means that they are losing on dividend withholding.

This also means they get even better TER (sometimes 0%) using pension funds. Depending on your allocation to U.S. funds, this could account for another 0.05% to 0.1% loss compared to your ETF portfolio with U.S. Funds.

Since 2020, third pillar providers have been allowed to get back this source withholding of the dividends by the U.S. For now, not every third pillar has taken advantage of this. But Finpension 3a and VIAC already implemented this optimization! So, by using them, you will get more returns than other equivalent third pillars!

Finally, contrary to DIY investing, your capital gains will be taxed. Indeed, when you pay the withdrawal tax, you will pay it on the entire capital, not only the money invested.

So, the disadvantages of the third pillar are mostly its slightly lower returns and significantly higher fees. It should not matter too much since you will need money for retirement.

Comparison with DIY Investing

So, with these disadvantages and advantages, we can see if you should contribute to your third pillar.

First, I compare it with DIY Investing. It is what I am doing with my invested money. And this is what I recommend.

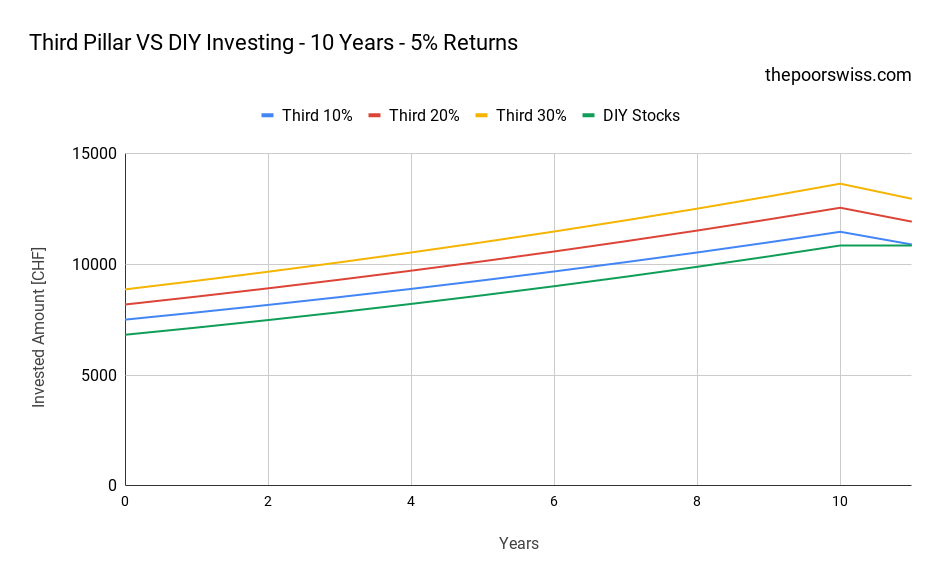

For this, I will assume a 5% return per year on the stock market. And the DIY Investing portfolio will have a 0.20% TER. You could go lower than that, but it is a reasonable average for many people. In both cases, I will consider aggressive portfolios fully invested in stocks. I consider a yearly 0.05% wealth tax.

As for the third pillar, I take Finpension 3a into account. It is currently the best third pillar available to acknowledge. The fees will be 0.44% with the most aggressive strategy. The money saved with the tax relief is invested in stocks in the DIY Portfolio. I assume 4.8% yearly returns for the Finpension 3a portfolio.

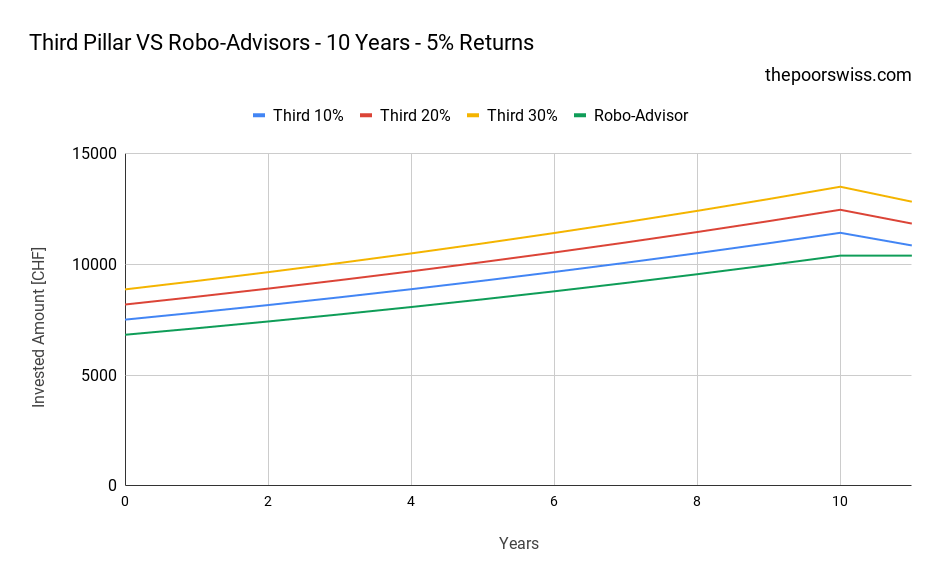

Here is what happens if you have ten years in front of you with different tax rates.

So, with ten years in front of you, it is quite interesting to invest in your third pillar. The direct returns of the first year make a significant difference.

Now, we can see that after ten years, the third pillar with 10% tax returns is at the same level as the DIY stock portfolio. However, 10% is a very tiny marginal tax rate. You would need to earn a tiny income to have such a low tax rate. For instance, even with one salary, we have more than 30% savings from the third pillar. And some people can go all the way to 40%. So, we should not be concerned.

If you have more than a 10% tax rate, invest in the third pillar!

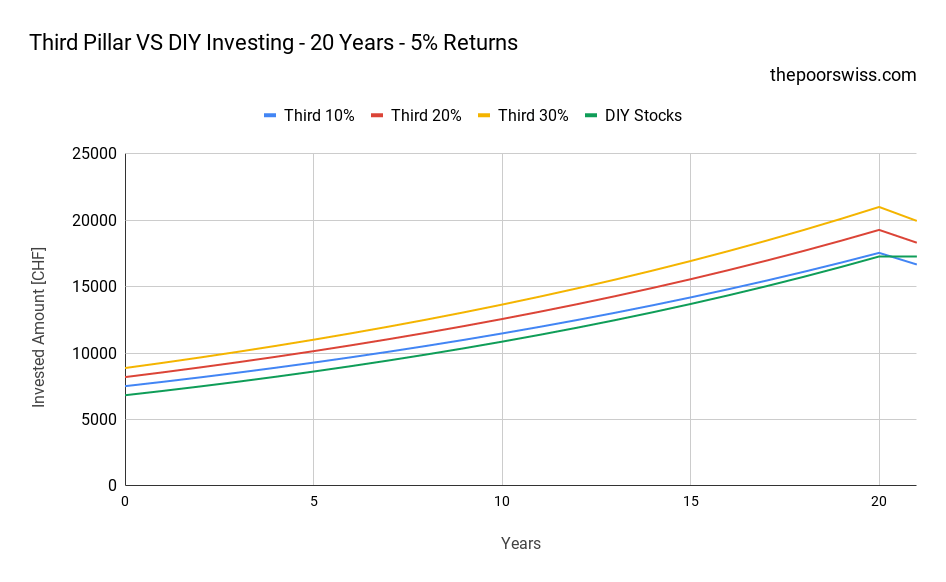

But what happens with a longer period? Here is what happens for 20 years.

After 20 years, the DIY stocks pass the 10% tax rate significantly. But the third pillar is still better if you have about a 15% tax rate. And this is still low.

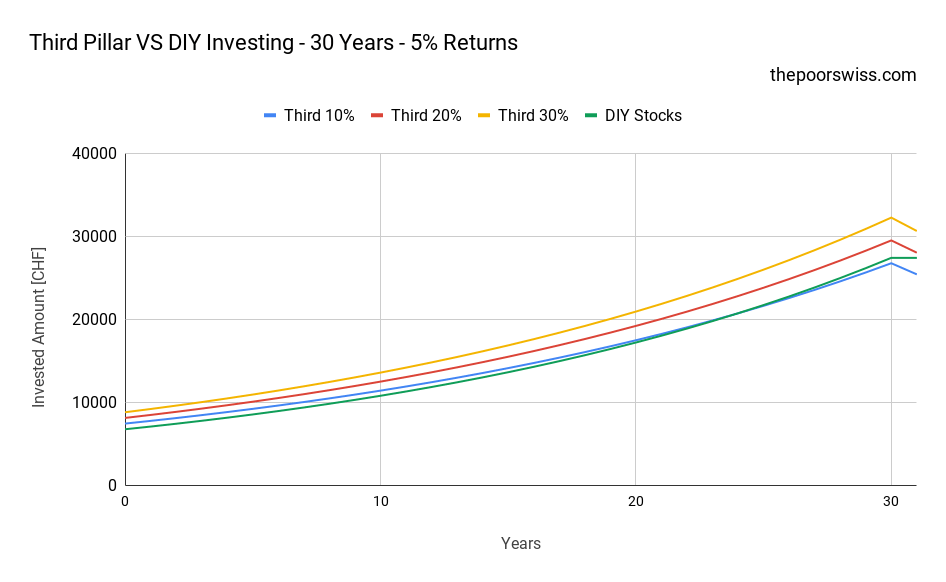

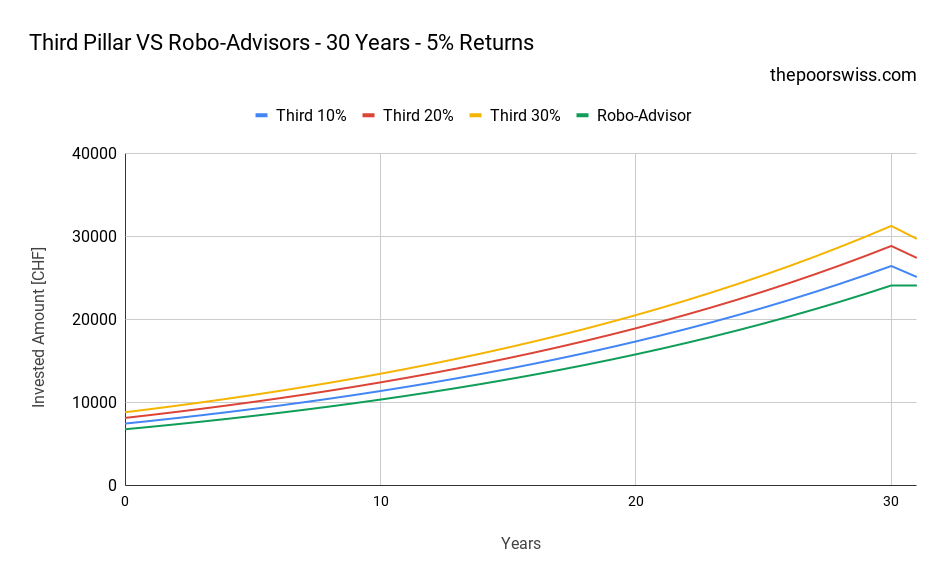

Finally, here are the results after 30 years:

It is interesting that even after 30 years, the third pillar with a 20% tax rate still beats a DIY Stocks Portfolio.

So, even if you invest in your own cheap index ETF portfolio, the third pillar is still very interesting because of the tax returns. But, indeed, the difference is not huge because of the lower yields and higher fees of the third pillar.

Nevertheless, it is still significant. After 20 years, you would still have about 2’600 CHF extra with the third pillar with a 30% tax rate. So, in the end, it will depend on your tax rate, wealth tax rate, and the returns of your portfolio compared to your third pillar.

Comparison with a Robo-Advisor

Now, if you invest with a Robo-Advisor, should you still contribute to your third pillar?

We keep the same parameters for the third pillar as the previous example. However, the money saved by the tax returns is invested in the Robo-Advisor.

For the comparison, I assume you use a very good Robo-Advisor from Switzerland, True Wealth. With an aggressive portfolio at True Wealth, you will have around 0.65% yearly fees. I am expecting the returns of the portfolio to be the same as the stocks (5% per year). And I am expecting Finpension to be at 4.8% per year. If you are using a more expensive Robo-Advisor account, the results will be lower for Robo-Advisor.

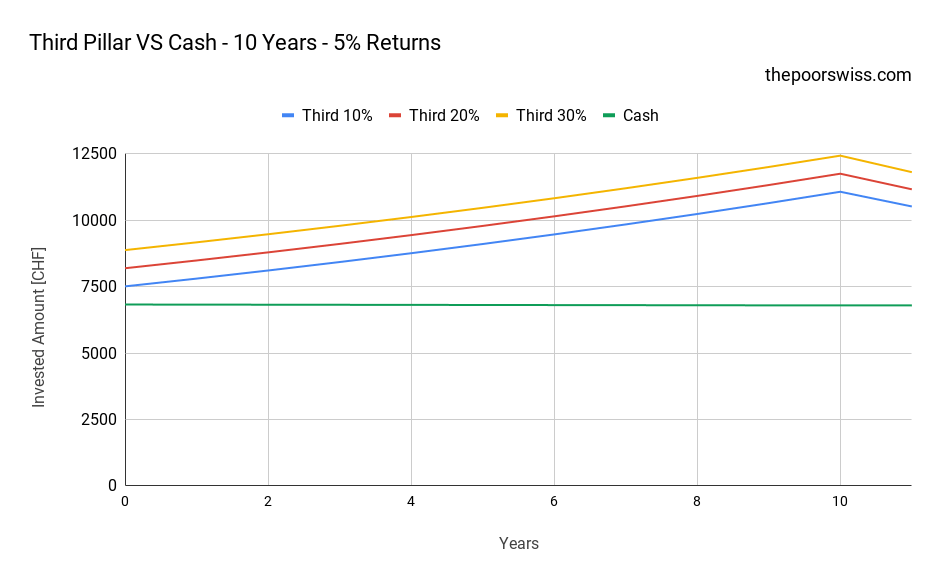

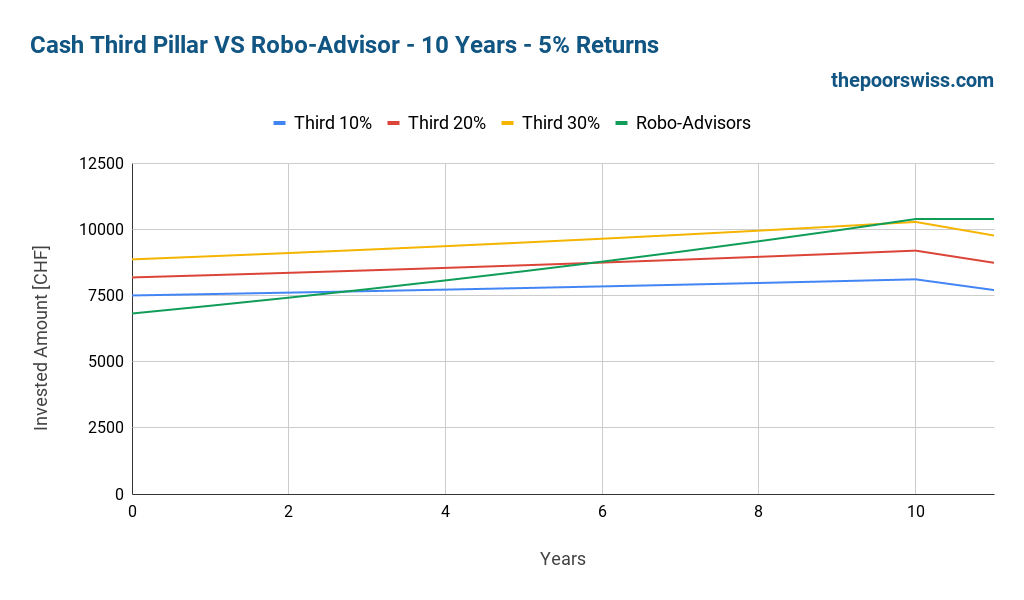

Again, here are the results for ten years:

Even with the lowest tax rate (10%), you still have a benefit over the Robo-Advisors outside of the third pillar. So, if you use one of the cheapest Robo-Advisors in Switzerland, you have a good reason to invest in the third pillar.

Can directly skip over to 30 years period:

Over 30 years, the differences are more significant. After 30 years, you have gained 5500 CHF more with the third pillar than with a Robo-advisor.

The results are quite logical. An excellent third pillar has very few disadvantages compared to a Robo-Advisor. The returns may be slightly lower. But the fees of Finpension 3a are better than the fees of the best Robo-Advisor! So, the initial tax advantage is better than the difference in returns.

So, if you are investing with a Robo-Advisor, you should contribute to your third pillar! The difference is significant. The best third pillar is better than the best Robo-Advisor.

Comparison with savings account

Finally, we can compare it with keeping money in a savings account, uninvested.

It means the money you do not invest in your third pillar is left in a savings account. For this savings account, we consider 0% returns and 0% fees. You may have a fee on your bank account these days.

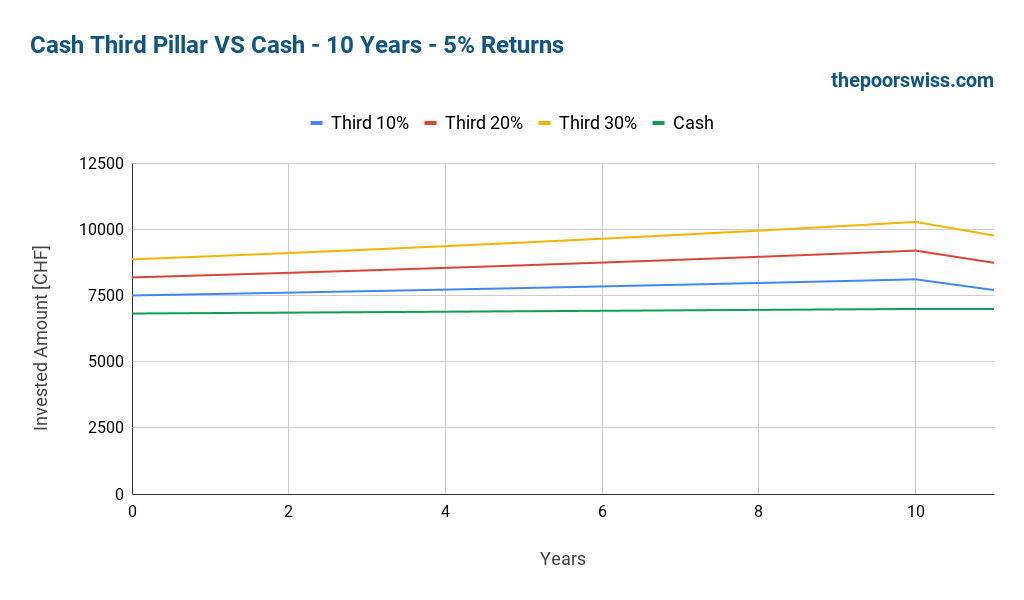

Here is what would happen after ten years:

The results are pretty obvious! If your money is uninvested, invest what you can in the third pillar. Contributing to your third pillar will make a huge difference!

What if you have a third pillar in cash?

Some people have a third pillar in cash. These accounts have very low returns but usually have no fees. So, how do they compare with the other means of investing?

Before comparing, I emphasize that I do not recommend these third pillars. The only time it would be adequate is when your retirement is very close.

So, we can take a third pillar account with 0.3% interest as an example of this analysis.

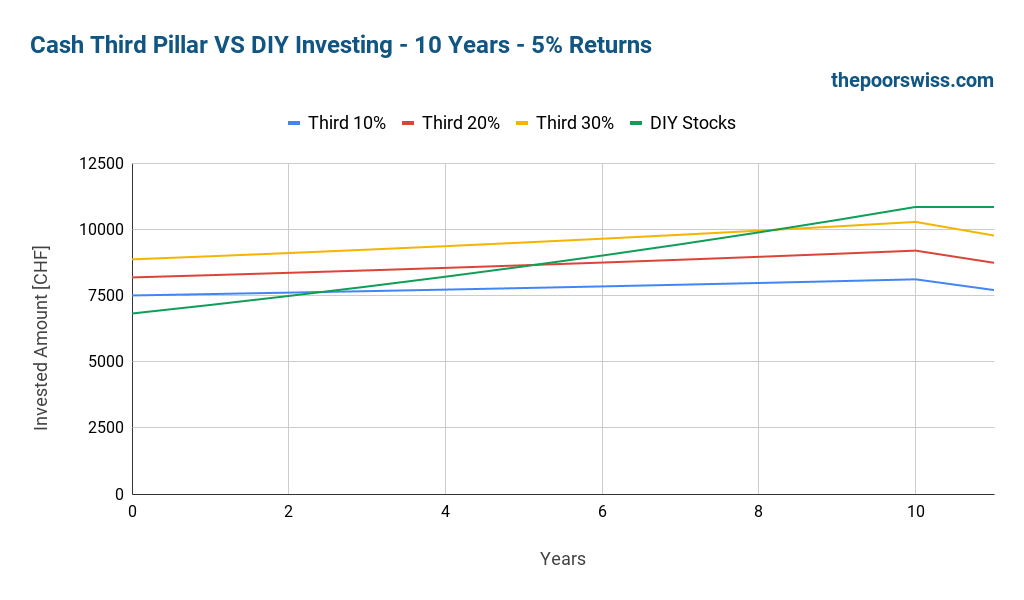

First, we compare it with a DIY Stocks Portfolio:

In less than ten years, the DIY Stocks portfolio will outperform the third pillar, even with large tax returns. This result is expected because of the much larger performance of a DIY Stocks portfolio compared to a cash third pillar.

So, if you only have access to a cash third pillar account and are a DIY Stocks Investor, you should not contribute to the third pillar! The exception would be in the last few years before your retirement. But I do not see how an investor would invest in such a third pillar.

We can see if the same holds when compared with Robo-Advisors:

We get almost the same results as with the DIY stocks portfolio. If you invest in stocks in a Robo-Advisor, you should not invest in a third pillar in cash.

Finally, we see what happens if you invest in cash:

In that case, we still have enough advantages with the original tax returns to make it worthwhile.

Now, I must repeat: you should invest in stocks in your third pillar if your risk tolerance allows it. And ideally, you should invest in stocks in your primary portfolio.

Conclusion

So, now we can answer the question: should you contribute to your third pillar? Yes!

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

If you contribute to a good third pillar with low fees and high returns (Finpension 3a probably), the tax advantages of the third pillar will outperform even your DIY Stocks Portfolio.

And the third pillar gets better as your income grows. If you have a substantial income, you have no excuses not to contribute to the third pillar.

With an aggressive DIY portfolio, the difference is not huge, but it is still significant. But if you are investing with a Robo-Advisor, the third pillar will be even more investing. And if you are uninvested, the third pillar will be your best investment!

And in some cases, indeed, the third pillar is not worth it. If you are in a canton where withdrawals are heavily taxed, the tax on capital gains may outweigh the benefits of the tax benefits. But that is unlikely, for most people, it is still interesting to contribute to the third pillar.

Now, of course, you will not gain much by investing in a third pillar in cash. You need to invest in a good third pillar for the long term.

If you do not know where to start, check out my guide on how to start investing. And if you want to save money from taxes, you can read my article about the best tax deductions in Switzerland.

What about you? Are you contributing to your third pillar?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- Can you retire early with Swiss Stocks and Bonds?

- Switzerland is unfair to married couples

- Your retirement benefits after your death

Hi,

I am not still sure I entirely understand 3a pillar – you can have 4 accounts where you put 6883 in each every year, i.e. 27,532, correct?

The amount you can deduct from your taxes in your tax return every year is CHF27K or CHF6.9K?

Is it true you can only take money out of 3a pillar maximum 5 years before retirement? What if I decide to retire earlier than that? I am only considering these two scenarios – retirement by law at 64 or early retirement, not going self-employed, house purchase etc. Many thanks!

Hi,

You can have 5 accounts in total. But the number of accounts does not change the tax deductible. It’s 6883 total. And you should never invest more than that per year (in fact most third pillars will not let you invest more).

It’s correct, 5 years in advance at most. The third pillar does nothing for early retirement. If you retire before that, you have to live without your third pillar until you can withdraw it.

Hey PoorSwiss

As a newbie to Switzerland (Geneva) your site is like digging for gold and striking it rich! The information here makes understanding everything I need to wrap my head around much less stressful.

I’m 45 years old and have roughly 20 years of working life left to catch up on a very poor position I am in for retirement. I basically consider myself as starting from scratch. I’ve started investing in the stock market this year, but would like to make the most of the options available in switzerland…versus Canada. I plan on sticking around Switzerland for as long as I can. I am looking to commit 4k CHF monthly for the next 10 years – I say 10 years as I figure I could catch up by then on my retirement savings..and this does not include any extra income that I can use to top up my savings.

I gather from some research I’ve done and reading on your site that maximizing investments in the 3rd pillar- distributed across 5 accounts is the way to go.

Looking for advice on the best route to take to invest the rest of my monthly contributions (I’m willing to go for moderate-high risk for the next 10 years with my investment…if that’s a good decision to make).

Hi mj,

Thanks for the kind words :)

Indeed, I would say that starting with the 3rd pillar, and opening 5 accounts in the next 5 years is a great way to get started.

This will only take you 1 1/2 of your monthly contributions. The rest should go into your investments.

If you know you are going to retire in Switzeralnd, you may consider filling up your first and second pillar, but since you are starting up, it may make more sense to start with investments.

As for investments, this will depend on yourself. If you are ready for DIY investing with a broker, then this is the cheapest way to invest. But this is also the one you are the most involved with.

Another good option is to use robo-advisors. There are some good ones like Selma and True Wealth. It is very easy to use but you pay more fees. And it is also easy to manage risk.

Thank you so much for this article. Should one keep just one third pillier or have multiple third pilliers?

Hi Nicola,

You should try to get 5 third pillars, for tax optimization.

In some cantons, you would not be able to optimize with 5, but 5 is the maximum of any cantons, so 5 is a good number for everybody.

I think this is a very good comparison. However, you make one big assumption: You expect 4.8% yearly returns from VIAC and 5% returns from the stock market.

I don’t think these numbers are very realistic. You can look up the performance over the last 10 years of VIAC Global 100 and compare it to a global ETF like VT:

VT: 9.17% per year

VIAC Global 100: 8.5% per year

It would be interesting if you repeated your calculations with these numbers. I think you will get very different results that are favored to DIY investing (assuming you invest 100% in VT).

I think the problem with third pillars in Switzerland is that they aren’t diversified enough and invest too much of the portfolio into Swiss ETFs.

Altough I only looked at the performance of the last 10 years I think in the future third pillars will continue to underperform global ETFs.

Hi Kristopher,

It’s true, I should probably have taken 4.5% for VIAC instead of 4.8%. The exact numbers do not matter, but the difference between them matters a lot.

Now, if you have Finpension 3a, you have get much more aggressive than with VIAC and have only a World fund. In that way, it should be much closer to VT than VIAC.

Also, some part of the performance of the third pillar is higher because dividends are not taxed. And dividend taxes are more important than most people.

I would still argue that even with VIAC and slightly lower performance, it’s still worth it. It forces you to save, it gives you quick returns with the tax savings, it diminishes your wealth tax and it ensures that some of your money stays there until retirement.

But there are some cases indeed where mathematically, it is better to invest aggressively in a broker account rather than use the third pillar.

Thanks for stopping by!

Yes, I agree, Finpension 3a is the most interesting option at the moment. However, even their Global 100 option still has 39.6% Swiss ETFs. It’s hard to say if Finpension is closer to VIAC or VT. I’d say it’s probably closer to VIAC because of the similar portfolio.

But if you factor in all the different taxes the calculation gets a lot more difficult and depending on your situation the third pillar might be worth it. And the fact that your money is locked away might also be an argument for the third pillar.

I’m still not sure whether I will create a Finpension 3a account or just continue investing into VT. Both are probably good options.

I was actually thinking of their custom strategies. You can do a portfolio with 100% World Fund and no hedging. This is the closest you can get to the performance of VT.

As you said, if you want to be perfectly accurate, it becomes complicated and very personal :)

Both VT and a third pillar are very good options for the long-term. You may also see the third pillar as a diversification over online services.

Ohh I didn’t even know you could do that. That makes Finpension even more interesting. Thanks for pointing that out. I’ll definitely consider Finpension now :)

Nice comparison, I would have think that it was worth it in all cases but you are right it might not always be, thus in most cases it is and it’s a safe bet for the future as well.

Did you compare vs investing everything in Bitcoin and Ethereum 10 years ago? Ahah no just kidding.

Hi Eluc,

Even though there are some cases where it’s not entirely worth it over more than 30 years, I would still recommend people to do it. Income is likely to increase over time and as such, the marginal would increase as well.

And for most people, it’s good to have some money locked away :) Also, a good way to diversify.

No, I did not ;)

Some of you may have already read that VIAC is the best 3rd pillar option. If you wish to bag the discounts on the 500 chf invested, feel free to use the brand new codes when registering with VIAC:

zCdN60a

TC49nDt

bCUjuxE

7ChsUst

QCBicQo

Happy investing!

Hi Poor Swiss!

My question relates to timing of third pillar investment. I opened up VIAC and have it as a cash pillar for now. My initial idea was to invest in Global 100 fund but then the pandemic led me to change that decision and opt for the cash solution. Did I make a mistake? All those funds are losing now. Why would I want to put my money in them right now? Thanks for help!

Hi Chris,

This is all about timing the market. You could now wait until the next crash, but it could take 10 years (or one month).

It’s not an easy decision, but if it were me, I would invest right now. If you are scared about doing that, maybe you do not want to go 100% in stocks. In that case, you could consider a portfolio with more cash.

But it will also depend on your investment horizon. If you are close to retirement, it makes sense to hold onto your cash, but if you are very far, it will not make that much of a difference.

Thanks for stopping by!

Hi Mr. The Poor Swiss

As always, thank you very much for the interesting content you have on your blog. This particular blog entry is again very interesting.

Regarding the situation around taxation of dividends of US stocks: Since the beginning of this year, Swiss vested benefit foundations have the possibility to reclaim the US withholding tax. VIAC has already implemented this in their systems. So that particular disadvantage compared to DYI is gone.

Sources:

– https://viac.ch/fr/academy/frais-reduits-et-rendements-plus-eleves/

– https://www.sif.admin.ch/sif/fr/home/dokumentation/medienmitteilungen/medienmitteilungen.msg-id-76477.html

Hi Skywalker,

That’s a very good point. I forgot about that!

I will mention that in the article, it’s one more reason to invest in the third pillar!

Thanks for sharing!

One additional thing I would think about is the governments creativity when it comes to taxes. The money you put into 2nd and 3rd pillar is essentially locked away until you reach retirement age. If new or higher taxes are introduced you have no possibilities to put your money elsewhere. If instead you keep your assets liquid in most scenarios you‘ll be able to act if tax laws should change.

Btw: your blog is great – keep up the amazing work!

Hi Mark,

That’s a good point. You have much more control over the money invested in your broker account than the one invested in your third pillar. If you want to move your assets, you can do it easily. But you cannot move your third pillar money easily.

Thanks for stopping by!

Good article, thank you !

A quick note : “this money can also be used to buy a house or start a business.” –> only if you start a business as independant, not if you create an anonymous society (SA or Sarl).

This money can also be used to pay a part of your real estate mortgage each 5 years.

Hi Seb,

Thanks, this is a great point, I will make it more precise.

Do you mean to say that you can use to amortize every 5 years or that you can use it every 5 years at most?

Thanks for stopping by!

I mean, every 5 years (minimum) you can take out your 3rd pillar to amortize your main residence. That makes you a amortization of 5 * 6826 = approximately 34000, which makes you lower the interests of your debt.

I talk about this tip on my blog :

https://lalibertefinanciere.ch/impots-guide-doptimisation-fiscale/

I named this tip “La tactique du 3ème pilier” :)

Très bon article merci!!!

Je te suis depuis un certain temps et la qualité de ton travail s’améliore!

Ma question est la suivante:

Je vais acheter une maison dans 3 mois, et je vais retirer mon 3a Viac et Finpension pour le financer (le fameux 10% de cash d’apport). Est-ce que cela vaut encore la peine de continuer à cotiser sur ces 3A d’ici le retrait?

Merci d’avance pour ta réponse.

Oui, les retraits en 3a ne sont pas verrouillés pour 3 ans comme le deuxième pilier. Vous allez donc profiter des avantages fiscaux. Après, il faut faire attention à ce qu’il y a beaucoup de coûts liée à l’achat. Faites donc attention à avoir assez d’argent pour ça!