Third Pillar: All you need to know to retire in Switzerland

| Updated: |(Disclosure: Some of the links below may be affiliate links)

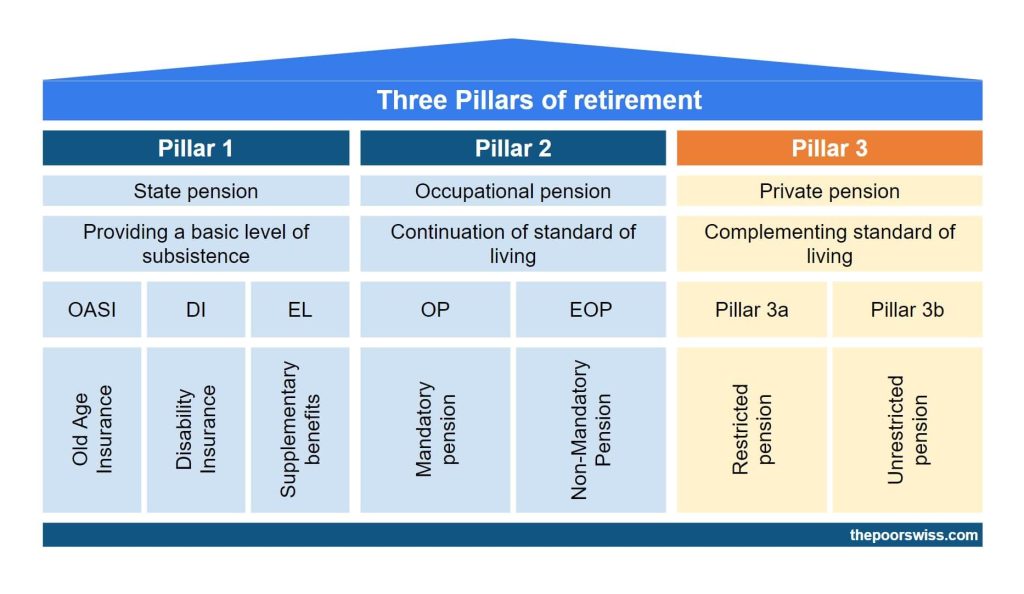

We already talked about the first and second pillars. We now have to cover the most important of the three pillars: The Third Pillar.

The third pillar is the only one that is not mandatory. Everybody is free to choose to invest in the third pillar or not. It is simpler than the second pillar. But there are many more choices that you can make. You can optimize a lot of things for your third pillar.

It is essential to optimize the investment of the third pillar as much as possible. Once you retire, your second pillar should still be larger than your third pillar. But there are not many things you can do with your second pillar.

In this article, you will find all the details you need to invest in a third pillar. And also what you can do to optimize your use of this third pillar.

Types of third pillars

The third pillar is your private pension. This time, there is no complicated name associated with it. It is known everywhere as the third pillar. There is just a slight twist. There are two different third pillars:

- Pillar 3a (restricted pension): Locked and tax-advantaged.

- Pillar 3b (unrestricted pension): Not locked but much fewer tax advantages.

In this article, I mainly discuss the first one, Pillar 3a. For information about the 3b, you can read Section Pillar 3b. Otherwise, when discussing the third pillar, I talk about Pillar 3a.

Pillar 3a

Even when we focus on Pillar 3a, there are still two ways to invest in a third pillar.

You can invest either in the form of a bank account or as insurance. We cover both of them in detail in the next two sections.

In both cases, contributions to your third pillar are tax-advantaged. Each year, you can deduct up to 7056 CHF (as of 2023) from your salary. The exact amount removed from your taxes depends on your income. You can generally save 2000 CHF per year in taxes by contributing the maximum to your third pillar.

The amount of the deduction can vary each year. If you want to keep informed about the maximum contribution, you should consult the official Swiss third pillar website.

Remember to deposit the money by the last day of the year to get a tax reduction. I would recommend investing early in your third pillar.

Since there are no tax benefits, you should never put more than 7056 CHF per year into your third pillar. It is not interesting to lock money without advantages. Most third pillars will prevent you from doing so. There are better alternatives if you do not have tax advantages. You will receive a certificate with your contributions every year. You can use this to file your taxes.

Unfortunately, not everybody can open a third pillar account. Indeed, you need to have a salary and pay for the first and second pillars. If you do not satisfy both requirements, you cannot open a third pillar account. This means that if you only have one income in your couple, only the employed person will be able to contribute.

How much you will get in retirement will depend on whether you have a third pillar in a bank or with an insurance company.

Pillar 3a and self-employment

So far, we have covered the case of employed people, with a salary. However, self-employed people do not get a salary directly. We are talking about sole proprietorship.

If the self-employed does not contribute to a second pillar, he can contribute to a third pillar. In this case, the maximum contribution is at most 20% of the net revenue of income and at most 34’128 CHF (five times the maximum contribution of employees).

Other than the maximum contribution, the other facts are the same for self-employed and employed persons.

1. The third pillar in a bank

The simplest third pillar is a bank account.

It is a regular bank account, except that it is locked. You cannot withdraw anything until you retire. You can directly deposit money into this locked account. Pretty much every bank has one or several third pillar accounts. The only difference between these accounts is the (small) interest. The interest on the third pillar is generally higher than the interest on your savings account. But today, it is ridiculously low.

More interestingly, you can also deposit this money in Third Pillar funds. For instance, my previous bank (PostFinance) has three different retirement funds. One with 25% stocks, one with 45% stocks, and one with 75% stocks.

Since you are investing this money for the long term, it is better to invest it in stocks rather than let it grow very slowly with current interest rates.

Normally, you will withdraw the money at retirement age. But, you can also withdraw the money at most five years before retirement age. And if you continue working, you can also withdraw at most five years after retirement age. You cannot do a partial withdraw. You have to withdraw the entire amount.

How to choose a third pillar account?

Which third pillar account should I choose?

You should pay attention to the following points when you search for a third pillar account:

- Interests. If you are not using a retirement fund, you should worry about the account’s interest rate. Be aware that currently, it is pretty bad. The best interest rate I have found is 0.75%. But most banks offer much lower interest on the third pillar.

- Choice of funds. If you plan to invest in a fund, you should check the funds proposed by the bank. Some banks have a large panel, while some others have a poor choice.

- Allocation to stocks. You do not have a lot of choice in what the retirement fund will be investing in. But you can decide how much investment in stock you want. You can be very high based on the provider you choose. The highest investment in stocks is 99% (with Finpension 3a). Be careful with your asset allocation before you choose your fund.

- Total Expense Ratio (TER). When you are comparing third pillar funds, you should pay attention to the TER of the fund. This is the total amount of fees that you will pay for your money. The TER is removed from your money each year. The fees are generally high on these funds. The lowest fee I know of is 0.44% (with Finpension 3a). Even the lowest fee is still high, in my opinion.

- Diversification. Another critical point is to see how the stocks (and bonds) are invested in the fund. Many of the retirement funds are only investing in Swiss stocks and Swiss bonds. But some of them are more diversified. For instance, Finpension 3a offers one fund with 60% world stocks.

You should do your research well and think about what you want from your third pillar. And do not worry if you already have a third pillar account. You can have as many as you want.

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

Unfortunately, there are many bad third pillars in Switzerland. So, it is important to choose the best third pillar account for your needs. Currently, for most people, the best third pillar is Finpension 3a. I have an entire article about choosing the best third pillar for your retirement.

2. The third pillar with an insurance

The other option is to have a third pillar in the form of life insurance.

You will pay a certain monthly amount that will go into your insurance. Once you reach retirement age, you get some money (plus maybe some interest). The minimum amount of money that you will get at the end is guaranteed. But, the interest you will get is not guaranteed. And the returns are not great.

If you cannot pay anymore (if you are disabled, for instance), it is still guaranteed. This is only the case for some stated reasons in your contract. You cannot stop paying simply because you want to. If you die before the contract terms, your spouse will get the guaranteed amount.

If you break the contract or stop paying, you will lose much of the money you invested. The amount your life insurance is worth will increase faster and faster over time. In the first two years, it will not even be worth anything. If you think you may break the contract or stop paying, never contracts life insurance!

Many people will tell you not to use this kind of insurance. And many insurance people will tell you that everyone should have one. So, who tells the truth?

Should I take Life Insurance Third Pillar?

No! For most people, life insurance 3a is a bad idea.

First, you will not get back the entire amount you paid, contrary to a third pillar bank account. However, this amount is guaranteed. If your third pillar in a bank has done poorly because of a bear market, you can end up losing money.

With third pillar insurance, you will get at least the guaranteed amount. The interests will vary, of course. And generally, they are quite optimistic about the interests they are predicting. You should only care about the guaranteed amount. All the rest is a bonus.

On top of that, the returns over time are really bad. You will lose a significant amount of money in the long term.

To know more, you should read my article about life insurance 3a.

How to choose third pillar insurance?

Again, I do not know which life insurance is the best one. Here are some things you should pay attention to when you research life insurance:

- The amount per month: You should pay an amount that you are comfortable with. You will pay for this for many years. This will set the guaranteed amount in the end. I would not recommend more than 300 CHF. You should keep some to invest in a third pillar bank account.

- The guaranteed amount in the end: The most important number is how much you will get in the end. The insurance guy will try to make you look at projections. I would advise you to care mostly about the guaranteed amount. Nobody can predict returns over 30 years or more. You should consider the interests as a bonus.

- The investment of your funds: Each insurance will invest your money differently. They will probably propose you different asset allocation or investing strategies. You should pick the one you are the most comfortable with.

You should do your research well. Do not make any rash decisions.

Third pillar and inheritance

In the case of death, the rules are slightly different, based on which third pillar you have.

For the third pillar in a bank, the shares will be divided according to inheritance law. Generally, this will be divided between your spouse, your children, other dependent persons. If you do not have children or a spouse, this could be divided among your brothers, sisters, and parents.

If you want to change this, you can also write a will. Just be aware that there are strong limits in Switzerland regarding what you can and cannot do with inheritance. For instance, you cannot disinherit your children or your spouse.

For the third pillar insurance, inheritance is based on the policyholder. Generally, you need to indicate on your policy who is the beneficiary. For most people, it will be your spouse.

Once again, inheritance law can play a role here. For instance, under some conditions, your heirs can claim some of this money even if they are not mentioned in the policy.

Optimize your third pillar

There are a few things you can do to use the third pillar in the most optimized way.

First, always try to contribute the maximum each year into your third pillar. If you can! Do not get into a bad financial situation just to max out your third pillar. But the best advantage of the third pillar is in the tax advantages. So, maximizing it is interesting.

If you have it in a bank account, consider using a retirement fund. You should consider a fund with an asset allocation that you are comfortable with. You should consider how many years you will invest and how much risk you want to take.

Now, a slight twist. When you withdraw your third pillar, you will pay taxes on the amount. This amount is taxed at several levels, and it depends on which canton you are in. For instance, in Geneva, for up to 25’000 CHF, you will pay 250 CHF in taxes (0 CHF for a married couple). For up to 50’000 CHF, you will pay 1’500 CHF (500 CHF for a married couple).

If we take the canton I am living in (Fribourg), it is different. There is a 2% tax on the first 40’000 CHF. Then a 3% tax for the next 40’000 CHF and the tax keeps increasing until it reaches a 6% tax. You may have already seen the problem here. The more money you have, taxes get more expensive, and the more money you will pay. And it is quickly getting worse if you withdraw even more.

You can withdraw your third pillar money up to five years before and five after the official retirement age (if you still work). Thus, you can work around these taxes by having several third pillar accounts and only withdrawing one each year.

For Geneva, you should try to have less than 25’000 CHF on each account before the withdrawal. Below 50’000 CHF, the taxes are still fair. So you may keep your accounts below 50’000 as well. But you should not go higher. For Fribourg, you should stay below 40’000 CHF. You have to check the exact taxes for your current canton.

Now, there are two tricky things with this. First, there is no way to know how much will be on your third pillar account if you have a retirement fund. The returns will depend on the market. If you think your investment will double before retirement, you should stop contributing at 12’500 CHF. The difference between a 24999 and 25001 will result in 1500 CHF of taxes! This is absolutely insane, in my opinion.

Now comes the second tricky issue. Some cantons in Switzerland are considering this as tax evasion! For instance, the canton of Vaud allows you to have three different accounts. My canton (Fribourg) does not currently prevent this. But this may change.

So, you should be careful with this technique. You should check with your canton before you try to do this.

Just to be clear, it is never a problem to have several third pillars. The problem arises when you optimize the withdrawals over several years. Thus, I advise you to create several smaller third pillar accounts. But only spread out the withdrawals over several years if your canton allows it!

If you want to learn more, you can read my article about staggered withdrawals. It also explains how to combine this with your second pillar.

Third pillar and tax at source

It is important to mention that you only get tax advantages with the third pillar if you can declare it. And you can only declare it in a tax declaration.

So, if you are paying tax at source and are not filing a tax declaration, you will have no tax advantages with a third pillar. And in that case, you are likely better off saving in a broker account or robo-advisor.

Withdraw before retirement

You can withdraw money from your third pillar before retirement (early withdrawal).

The rules are the same as for early withdrawal for the second pillar. You can withdraw to buy a house, start your own company or leave Switzerland.

There is another case when you can withdraw money from the third pillar. In fact, you can withdraw money from the third pillar to contribute to your second pillar. I am not sure there is a lot of value in doing that. You will not be able to deduct this contribution to the second pillar from your taxes, so that you will not be able to deduct it twice. And generally, the conditions of the third pillar are better than the second pillar. If you use a third pillar invested in stocks, it is better than a second pillar.

Accounting for the Third Pillar

Accounting for the third pillar in your net worth is fairly easy. For a third pillar in a bank, you can simply account for it like all your other accounts. It is money you own. It is just locked until retirement age.

For a life insurance third pillar, it is a bit more complicated. Your insurance should give you a guaranteed amount year by year. Using this, you can extrapolate the monthly values to see how much you currently have. You can have a look at how I accounted for my life insurance in my net worth.

Pillar 3b

Pillar 3b is a bit more obscure and is less known. There are many significant differences between 3b and 3a. Pillar 3b is often misunderstood.

Pillar 3b means anything outside of the three pillars. So, a bank or broker account is part of the 3b. And in most cases, there are no tax advantages.

Indeed, only two cantons have tax advantages. For instance, my canton (Fribourg) allows a married couple to deduct up to 1500 CHF yearly. Geneva is even better. You can deduct up to 2200 CHF per year. And based on your number of children, you may even be able to deduct more.

However, these tax advantages are only for 3b life insurance. And these products are generally so bad that they are undesirable for anybody. Insurance companies heavily advertise them, but they only profit from them, not you.

However, life insurance linked to a third pillar is a bad investment. It is not worth the tax advantages, so I would recommend against it.

FAQ

What is the third pillar in Switzerland?

The third pillar is a private pension system in Switzerland. Every people with a salary in Switzerland can contribute a maximum amount each year. This account is tax-advantaged.

How much will I receive from the third pillar?

How much you will receive is entirely depending on how much you contributed. It will also depend on the returns on your investment you got.

How can I optimize my third pillar?

The first thing you need to do is to contribute the maximum each year. Then, you need to find a third pillar provider with the lowest fees. Finally, you need a third pillar account with a large allocation to stocks (up to your asset allocation). Stocks will increase the returns of your third pillar.

Conclusion

The third pillar is the last part of the retirement system of Switzerland.

It will help you cover what is missing from the first and second pillars. Contrary to the previous two pillars, it is an optional part of the system. It is entirely up to you to invest in it. Since it is tax-advantaged, you should invest in the third pillar.

At retirement age, you will get the capital back and pay some taxes on it. But the amount of taxes will be greatly reduced compared to not investing!

If you have not yet read about the first pillar or the second pillar, I encourage you to do so now. In the next and final article, I summarize Switzerland’s retirement system. I also talk about early retirement in this context.

What do you think about the third pillar? What is your preferred account? Do you have tips to optimize it? Do you have any questions regarding this pillar?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- Your retirement benefits after your death

- Should You Contribute to Your Second Pillar in 2024?

- What is a 1e pension plan (pillar 1e)?

Hi,

thanks for writing the article. Very interesting.

I have a comment regarding the exposure in stocks.

100% is reasonable when you are quite far from reaching the retirement year.

I suppose that when you only have 5-10-15 years left from the retirement, you want to start gradually converting that capital into something that implies lower risks to consolidate the capital. Do you know if that is possible?

Thanks

Hi Marco,

You can lower your risk as you get closer to retirement. But not everybody does that.

At VIAC, that is something you can do indeed. You can change your portfolio once a month.

Thanks for stopping by!

Hi, I’m also researching life insurance (I have a property and a family – we are dual income earners but I don’t want my husband to be solely responsible for paying down my property if I die). I also came to the conclusion that it’s better to keep pillar 3a and life insurance separate. I’ve spoken to a few brokers but no one can give me straightforward answers on the structure of the investment if I combine pillar 3a with life insurance, and life insurance itself (for me) would come out to something like CHF23/month, which is not that much (a total of 7,000 chf over the 25-year course of the insurance, or 2.8% of the overall cost over 25 years).

Hi D,

Standard life insurance is indeed cheaper than linked life insurance. But you will lose the entire amount, so it’s an expense, not an investment. And you have to choose the term yourself.

But I agree with you that it’s probably best to keep it separated. That way, you will save money on the pillar 3a.

Keep in mind that you can also do it as a pillar 3b life insurance. In some states, you can deduct this money from your taxes. But it will depend on the state you are living in.

Thanks for stopping by!

Hi Mr. The Poor Swiss,

PostFinance now has a retirement fund with 100% shares: Pension 100

https://www.postfinance.ch/en/private/products/retirement-savings-life-insurance/retirement-funds/pension-100.html

72% is invested in Swiss companies and 28% in the rest of the world. With VIAC it is about 40% Switzerland and 60% global, if I understood correctly.

The TER of Pension 100 is 0.98%. This is still a high cost compared to VIAC, but the increase compared to the other PostFinance retirement funds is not that high:

– Pension 25: TER 0.87%

– Pension 45: TER 0.91%

– Pension 75: TER 0.97%

I have two questions for you. Firstly, what do you think about this new retirement fund Pension 100 in general? Secondly, for someone stuck with PostFinance for other reasons, would you consider Pension 100 a good option?

Thanks and keep up the good work!

Hi RetirementDreamer,

This is quite interesting. This is already a better option than the other funds from Postfinance. It’s sad that they only went to 28% of the world, the legal maximum is 40% like VIAC. It would have made the fund significantly better. And they could make an effort on the fees, but that’s not really what PF is about :(

If I was stuck with PostFinance for a good reason (only a mortgage there could do that), then yes, I would use that. Otherwise, VIAC is still largely superior (smaller TER and higher international).

Thanks for stopping and sharing :)

Thank you for your response!

I agree with you, that they could work on their fees. After all, they push them as being passive.

Something small I noticed in your article. You say: “You will be able to withdraw the money at most five years before retirement age and at most five years after retirement age.” The second part is only true, if you continue working. If you retire before or at retirement age, you have to withdraw the money before your birthday of the year you reach retirement age. If you keep working, you have to withdraw your money when you retire, or before your 5th birthday after retirement age. Whatever comes first.

As you also have to balance when to get the money from your second pillar, this might be an important detail to optimize the taxes you have to pay when getting the money from your accounts.

Thanks again for your interesting blog!

Hi again :)

That’s very interesting. I was wrong! I will have to update this in the article!

As for balancing, it’s a difficult question. When you start getting each of the three pillars is a very important consideration to have before retirement. It can make significant differences.

Thanks a lot for letting me know!

Here are some VIAC referral codes to save fees:

1BCWqu

RCCk0S

wKtsog

For almost all cases I would not use a 3a insurance product. It makes much more sense to split the saving from the life insurance. So depending on your situation a life insurance might make sense but it’s much better to get a life insurance on its own as this will be cheaper as the cost is transparent to you. The 3a insurances are hiding a lot of the cost with giving you less interest. So normally it’s better to go with account/deposit for 3a and get a life insurance separately. This normally also is more flexible as it will even allow you to limit the phase of your life where you actually need/want a life insurance.

Hi P,

That’s a good point. You can also take a real life insurance (not linked to a third pillar) and still invest in the third pillar. In that case, you will still get the benefits of the life insurance and of the third pillar :)

Thanks for stopping by!

Hi,

Thank you very much for the detailed content, very helpful to understand how to best invest and optimize the future results. Keep it up with the good work!

I am glad you like it!

Thanks for stopping by!

Hi Mr. The Poor Swiss!

great site and great articles! Very much appriciated :)

I now also looked closer into the 3a savings account but arrive at a differnt conclusion than you, as is – it is in most cases not beneficial to put your money into a 3a savings account(!!).

You will likely think now that I am insane or made some calculation errors and that can of cource be true – but until now I think it I did not, here is why (extremly simplified).

(The calculations will be different for anybody based on factors like residence, income, marital status, yearly contribution, etc… so I used some simplifications to proove the point)

The basic outcome is that a 3a savings account is only beneficial if you believe that the percentage increase per year will be lower than 4% per year. If the stock market (ie your fund) has a higher increase you would loose money.

I considered the following:

Consider you pay the maximal amount into your 3a savings account every year (neglect possible increase of that amount): 6826CHF.

a) Lets assume that the saved taxes by this single contribution is 1250CHF (higher than it would in my case)

b) We payed the amount into an 3a account at VIAC (like https://thepoorswiss.com/viac-best-third-pillar/)

c) lets leave it in our account for 40 years (considering retirement age will rise…) and the total tax saving would be 50’000CHF over the years

d) With a 4% on average increase per year this would result in a total amount around 674’000CHF after the 40 years

e) assume you would need to pay 8% Tax on this (which you can only reach with different accounts and gradual withdraws – at least in Zurich) the tax you would need to pay is almost 54’000CHF! -> Already a loss of 4000CHF

ans finally their are more factors making things worse like: the probable increase in the amount you can pay into your 3a savings account, the tax savings per year could be less each year as in my calculation and the biggest one, you would get 0.5% more year by year if you would invest your money at the stock market yourself (plus you can freely choose where to put your money). All of this means that the real “break even” percentage is likely much lower than 4% – I think it is probably below 3% or even close to 2%.

Did I make some obvious mistakes? I would love to here what you think about this.

Cheers

Hi Mmmm,

This is an interesting analysis.

There is one thing I do not understand with your break-even point. You mean that below 4% increase per year, it is beneficial to get a 3a and above that, it’s not beneficial. Is that it?

There is one thing you forgot in your calculations. The 1250 CHF you save each year can be invested as well. If you invest them in a broker account and also 4% per year on them, this will compensate the tax that you will pay at the end.

At least in my calculations, if you want the tax savings, you are always better off investing in the third pillar.

Now, there is one case in which a third pillar is not a great idea. If the returns on the third pillar are significantly lower than the returns on the stock market outside of the third pillar (you have much more liberty). Let’s say you generate 8% per year on your broker account and only 4% per year on your third pillar. In that case (a bit extreme), you are indeed much better off not investing in the third pillar.

And as you said, this will be completely different in each situation: for some people, the third pillar makes more (or less) difference than 1250, for other, 8% tax will be different as well.

I agree that the third pillar is not perfect.

However, I still believe that it is a good investment.

Thanks for sharing!

You don’t get additional 1250 CHF to invest. That is a misunderstanding in my opinion.

You have earned 6826 CHF as income and need to pay income tax on it. Marginal tax rate is 1250/6826=18% which is low by the way. I’m usually above 25% and live in Zurich with lower taxes compared to the rest of Switzerland. In Fribourg it must be higher for the same income.

Anyway there are two options

– transfer 6826 CHF into third pillar 3a

– pay 1250 CHF income tax and invest/spend the difference 5576 CHF

You don’t get money back as tax savings in either of the two cases for that year.

Wrt break even point between investing with third pillar vs normally. In the latter case you need to consider the lower starting point of 5576 CHF. Or with 30% marginal tax rate its 4778 CHF.

Lets say you don’t invest at all with your third pillar money. With the 5576 CHF investment option you need 5 years at 3% yearly to reach 6826 CHF.

At 30% marginal tax rate its 8 years at 3.9%.

Not to mention the risk which hasn’t been calculated in.

Good luck with catching up ;)

Hi,

You don’t get money back, but you still save money on taxes and you can invest that money.

For instance, let’s say you still have 6826 CHF to invest at the end of the year.

1) If you do not invest in the third pillar, you will invest 6826 CHF in the stock market

2) If you invest in the third pillar, you will invest 6826 CHF into a third pillar and you will save 1250 on taxes that you can then invest on the stock market.

I think you have to take this into consideration if you want to be fair.

If you do not invest your third pillar money, then the third pillar becomes much less interesting indeed.

Are you investing in the third pillar yourself?

Thanks for stopping by!

Mmmm and capmaxmc made a valid point. The third pillar with a high stock percentage has a big drawback that most people don’t realize: You have to pay taxes on the stock gain! When you invesr freely (i.e. outside the third pillar) stock gain (but not dividends) is tax-free. The higher the profit and the longer you invest the more money you’ll loose with the third pillar.

Here are some resources with examples:

https://www.truewealth.ch/point-of-view/saeule-3a-achtung-vor-der-steuerfalle/

https://www.graffenried.ch/de/ueber-uns/publikationen/?oid=10225&lang=de&news_eintragId=20041

Apologies for answering very late. Yes, I invest my third pillar money. Viac, as many do.

I’m still convinced that your way of thinking in this matter is flawed.

It should be:

1) If you do not invest in the third pillar, you will invest only 4778 CHF (with 30% marginal tax rate applied) in the stock market.

2) If you invest in the third pillar, you will invest 6826 CHF into a third pillar

With 1) you need the 1250 CHF to pay the additional income tax.

This is a really good and insightful comment, thanks a lot! It seems that it is worth investing with 3a only the safer, low-yield part of one’s portfolio.

I have a question which I couldn’t find an answer to anywhere else. Let’s say that I want to invest in real estate — perhaps because I’d like to buy my own house at some point and hence it might be good to track the housing market. The first question is, taking into account all the taxation aspects discussed here, does it make sense to do this as part of a Pillar 3a account, via, e.g., one of the property investment ETFs? My understanding, partly based on the articles posted by Thomas in the sibling thread, is that it does make sense because, besides investing with pre-tax money, you also avoid dividend taxation.

Does this make sense? Do I miss something? The same question applies for any other fixed-income investing, so you can disregard the “real estate motivation” from above.

Hi C.,

If you want to invest in anything that provides high dividends, the third pillar is indeed the best place for that. The second pillar as well if you have access to a good vested benefits account (most people don’t).

It will save you a lot on dividends taxes.

Now, keep in mind that any strong tilt in your portfolio (real estate for instance), is a bias towards less diversification. For instance, Real Estate ETFs did worse than Global Stocks ETF during COVID. Diversification is generally the way to go.

If you want to follow local prices, then, make sure you use a local real estate ETF / fund and not a global one.

If you are planning to buy a house in five years or more, I would simply invest in a diversified way, knowing that it could delay your purchase a little.

Thanks for stopping by!

Hi Mmmm and the others! This is a very interesting observation. But, technically, even if, at the end (when you withdraw), you lose in taxes all the money you saved in taxes over the years (so these 50k), don’t you still win more in absolute terms?

In this example (4% interest, 40 years, 8% withdrawal tax), what you lose is: 40*6826 + 0.08*674000 = 273040 + 53920 = 326960

And what you gain is 674000 + 50000 = 724000

So, the difference (the actual profit) is 724000-326960 = 397040. Let’s add some pessimistic noise to the story and say it is 300k.

Now, in my opinion, the real question here is how would this profit compare with a less aggressive option, with a smaller percentage placed in stocks? What I am trying to say, maybe having this huge loss in taxes in the end is still worth it, if your overall profit is bigger. A less aggressive option would indeed give you smaller losses in taxes, but probably the overall gain would also be significantly smaller. I.e., if you want to avoid losing in taxes in the end, you also need to have a significantly smaller profit in the end!

In your example, this is easily verifiable if we assume a smaller interest rate. Let’s assume we chose an option that has only 50% in stocks and thus the average yearly interest rate is 2%. In that case, after 40 years, you get 412500. The 8% tax on the withdrawal day is 33000 (so smaller than 50000 – i.e., you DON’T lose in taxes). Now, your total losses are: 40*6826 + 0.08*412500 = 273040 + 33000 = 306040. And the total gains are 412500 + 50000 = 462500. Your profit is 462500 – 306040 = 156460. So, approximately 150k – which is approximately half of the total profit in the first scenario!

Please let me know what you think and whether this makes sense, or if you find a mistake in my computations.

Hi Pavo,

Without checking all your numbers, this looks good to me.

I also believe it makes sense, in most cases, to invest in the third pillar.

I plan on writing a calculator to do the math for any situation, that will be easier.

you have written “actions and bonds”..

Thanks for letting me know! It’s fixed now :)

Hey,

Thanks for your post.

As I already mentioned earlier, I started a VIAC 3a account at the beginning of this year. I know they going to update their product this spring and allow up to 5 portfolios / accounts per person.

I live in the state of Vaud and I was unable to find the official ressources which says they only allow up to 2 accounts (that’s what I also read somewhere but I only found one information on a french blog from bonasavoir, it’s an old article from 2011…). Couldn’t find these informations on vd.ch or anywhere “official”… Where am I supposed to check this ?

Also about the taxation rate, in a case of 30-40 years ahead and mostly invested in stocks (let say 75% if via PostFinance and more via VIAC), I don’t think 50’000 CHF / account is a good example. I couldn’t neither find the informations on the % of taxation in the state of Vaud for these 3a withdraws… Let’s say with between 500k CHF – 2Mio CHF (total). How much taxes does it cost for that kind of amount ? And split between 1 withdraw (no optimisation), 2 withdraws (apparently max allowed in Vaud…), and 5 (max in certain german cantons apparently), how big is the difference ?

Any informations ? Thanks for the help.a

Cheers.

Hi Cashfl0w,

You are welcome :)

Very interesting! I’ll definitely have to check VIAC next year.

First, don’t forget that opening many accounts is not a problem for the state. The problem is when you spread the withdrawals over several years. So you can always open several accounts even if you are not sure you are going to spread the withdrawals.

For my state, I found the information on the guide of the taxes (https://www.fr.ch/scc/files/pdf97/instructions_2017_fr.pdf). I just took a look at Vaud instructions and it seems they are more vague than Fribourg. Normally, taxes on the third pillar fall under “Prestations en capital imposées séparément”, but they don’t give details. Let’s take 500’000 CHF as a base example. For my state, here are the details: 2% for the first 40’000 CHF, 3% for the next 40’000, 4% for the next 50’000, 5% for the next 60’000 and 6% for the rest. If we do some math, that gives us 25’600 CHF of taxes with 1 withdraw (no optimization), 21200 CHF with 2 withdraws and 14000 CHF for 5 withdraws. The maximum case is 10 withdraws with only 11’000 CHF of taxes. This makes a very significant difference in my opinion.

Now for your state, I found the information in the law directly (Impôt cantonal et communal / Loi du 4 juillet 2000 sur les impôts directs cantonaux (LI)). Please don’t cite me on this, I’m not a law expert neither a retirement expert, neither a tax expert ;) If you look at “Art. 49 Prestations en capital provenant de la prévoyance”, it states that your third pillar is taxed at a third of normal tax. Normal tax is shown in “Art. 47 Taux d’imposition”, it’s more complicated than my state. For the same example of 500’000 CHF. If we do the math again, it gives us 22’970 CHF for 1 withdrawal, 20107 CHF for 2, 15389 CHF for 5 and 11960 for 10. Again, it’s pretty significant. I encourage you to do the math yourself to make sure and triple-check all my numbers :)

My source for the tax evasion was also the same as you, in French. If you want the details for your state for tax evasion, I advise you to call the tax service of Vaud (or email them), their contact information is on their site. It’s their job to give you all the information you need. If you get the information, please let me know, I’d very interested :)

I hope that is helping :)

Thanks for your help and your findings. I finally found these documents.

What base numbers did you use to get to your numbers ? I tried to take your final numbers and calculate the base numbers by I arrived to weird stuffs (or I’m completely wrong somewhere…)

I also tried to double check results via these two calculators from vd.ch and postfinance but I end up with huge numbers also (but both are close though), not sure what’s happening…

For the vd calculator I tried to simulate with the third checkbox (“Je désire effectuer une simulation de l’impôt distinct sur les prestations en capital provenant de la prévoyance”)

https://www.vd.ch/themes/etat-droit-finances/impots/impots-pour-les-individus/calculer-mes-impots/

https://www.postfinance.ch/fr/particuliers/assistance/outils-calculateurs/impots-capital-deuxieme-pilier.html

Both give me about 7-12% of taxes (100k = 7% and 500k = 12% normal ?) which seems huge I don’t get it. Seems they compute like it was taxed at the full rate and not at the third.

Hi,

You are most welcome :)

I used 500’000 CHF as base example. I forgot to mention it :S

For the calculators, I dont’ get the same numbers as mine either. But, they are including both the state and the county, so they are more than twice higher than my own calculations.

I still agree that it is weird :s It does not seem correct.

It seems they are applying the last percent to the entire sum, for instance for Fribourg, 6% of 500000, instead of 40000*2%+40000*3%+50000*4%+60000*5%+310000*6%

To be sure, I would call them or contact them by email. Try to give them an example and work out the tax, for instance 100’000 and then we can be sure.

I may have been misunderstood the law, but it does not seem that complicated.

Yikes! That third pillar is incredibly oddly structured and taxed! Having to drain the entire account at once is not very friendly for a retiree and having to set up multiple small funds to avoid it is pretty complex. However we’ve got ridiculous regs in a lot of areas over here too. Very interesting set of posts, it is fun to see how other countries handle things. I would be retirees are in much better shape in your country both because of the three pillars and because, well, you guys are Swiss!

HI steveark,

Yeah, it’s a bid odd at first :)

I completely that having to drain the entire account at once is a very bad idea. On the other hand, you are likely to be able to invest it better outside of a third pillar. Therefore, you’ll probably reinvest it, but that will incur fees as well. It would definitely be better to be able to take it out in small parts.

Yeah, it’s great to see how the different countries handle thing.

For now, we can’t really complain about the system indeed. We’ll see if it’s still working in 30 years ;)

Thanks for stopping by!