Should You Contribute to Your Second Pillar in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

In Switzerland, you can make a voluntary contribution to your second pillar. These contributions come with tax advantages since you can deduct them from your income. Therefore, you have a return equal to your marginal tax rate. And this return is almost instant.

However, the money is then blocked into the second pillar. And the returns on that blocked money have been very low in recent years. Finally, you can only withdraw the money from your second pillar if you retire, buy a house, start a company, or leave the country.

Many ask whether they should contribute money to their second pillar or continue investing in stocks. In this article, I answer this important question.

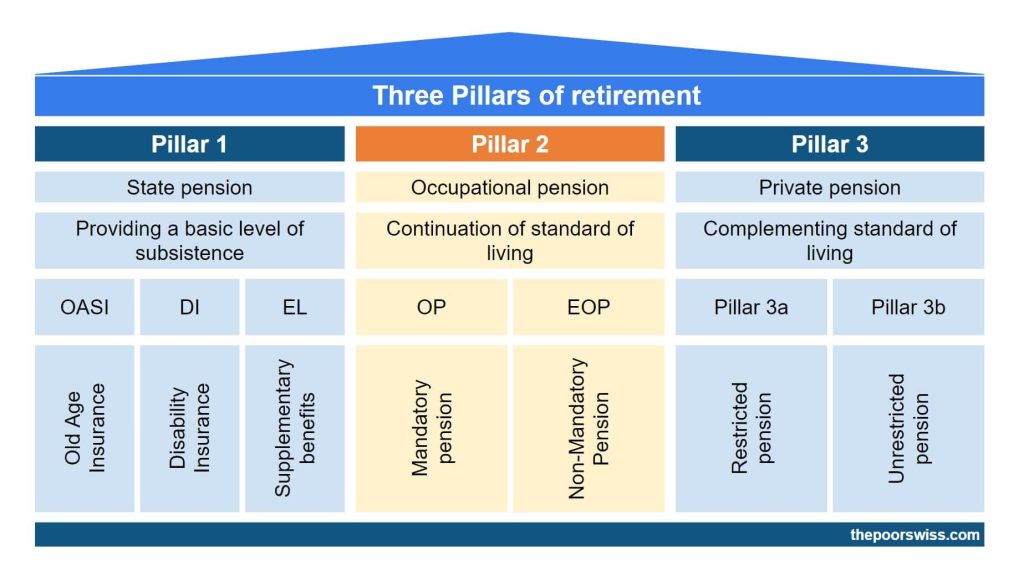

Second pillar contribution

So, how does a voluntary contribution to the second pillar work?

Usually, you pay each month some amount of your salary to the second pillar. And this is matched by your company. You do not have a say in this. So, there is no way to optimize that.

However, you can contribute some amount to cover the holes in your second pillar. If you had a low salary when you started, you will surely have holes in your contributions. When you contribute, you can deduct it from your taxes, just like the third pillar. The second and third pillars are among the best tax deductions.

How much of a reduction in taxes this will realize is challenging to calculate correctly. It depends on your marginal tax rate. The amount will depend on your income, your wealth, and where you pay your taxes. In most cases, this will be between 30% and 40%. That means that the immediate rate of return of this contribution will be 30% to 40%. We can view voluntary contributions as a form of investment.

Now, the invested money will be blocked until you can take it. In the second pillar article, we have seen only four cases when you can take this money out: building a house, starting a company, retiring, or leaving Switzerland. In those cases, you will lose out on the part of the second pillar as taxes. But this is not as much as your marginal tax rate.

Voluntary contributions are always blocked for three years (only the amount of the voluntary contribution is locked, not the entire second pillar).

As long as it is inside the second pillar, your money will get some interest rate. Unfortunately, the interest rate is currently low now. You can expect about a 1% interest rate in most pension funds in Switzerland. Nevertheless, it is a safe interest rate for now. It cannot go down. So, you can consider the second pillar as a place to allocate your bond.

However, if you are lucky, you will get a better pension fund. Some pension funds have average of up to 5% per year, but they are quite rare.

There is a second tax advantage to the second pillar. You do not have to pay taxes on the second pillar assets. So, if you have a large net worth, you will not have to pay wealth tax on your second pillar assets.

But this is a smaller advantage than the first one. It will still reduce your taxes a little further, but where the first tax advantage can be up to 40%, the second advantage is about 1% in the best case. Nevertheless, it is still important to know that you do not pay any wealth tax on your second pillar.

Scenarios

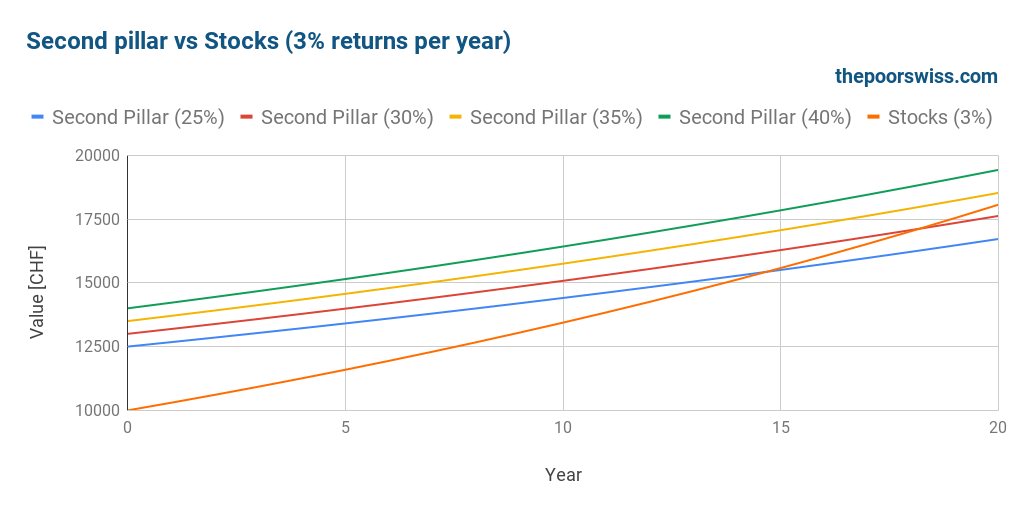

The obvious alternative is to invest in stocks. We can check how the same sum behaves if invested in stocks or contributed to the second pillar. First, we run some scenarios to see how that works. We will simulate a one-time investment of 10’000 CHF.

We start with a return per year of 3% for the stocks. This is a very conservative estimate. For the second pillar, we will consider 25%, 30%, 35%, and 40% marginal rates. The current interest rate on most second pillars is 1%. So we will take that as the reference.

The tax savings of the second pillar will be reinvested in stocks directly. So, if you have a marginal tax rate of 30%, 10’000 CHF invested in the second pillar will also result in 3000 CHF in stocks.

Here are the results for twenty years.

As you can see, it takes about 15 years for the stocks to catch with even the lowest marginal rate. And it would take more than 20 years for the stocks to catch up with the high marginal tax rates.

In that case, a 3% return per year on the stock market is slow to catch up with a substantial interest rate as a tax deduction. So, if you expect 3% from stocks, you should probably favor your second pillar.

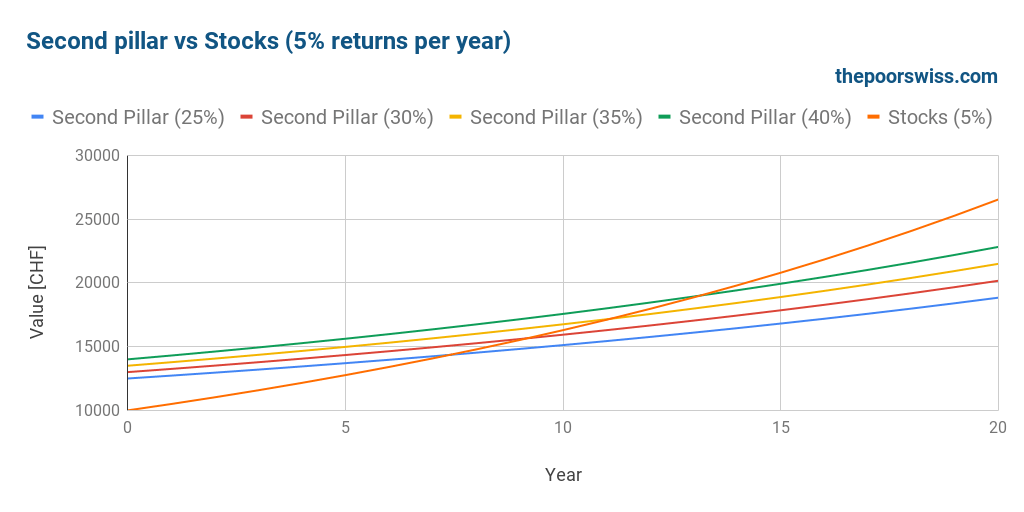

But generally, stocks are returning more than 3% per year. So, we will see what happens with a 5% return per year. This is what I expect on average from the stock market.

This time, it takes less than ten years for the stocks to increase as much as the second pillar, with the lowest marginal tax rate. But it almost takes 15 years to catch up with the highest marginal tax rates.

This exponential growth is the power of compounding. Even 5% per year can return a lot in the long term. 5% per year is what I expect from the stock market.

Obviously, in practice, you will not get 5% per year. You may get 10% one year and -20% the next year. But this is how the stock market works, and I am prepared for this. You can only expect average returns over the long term.

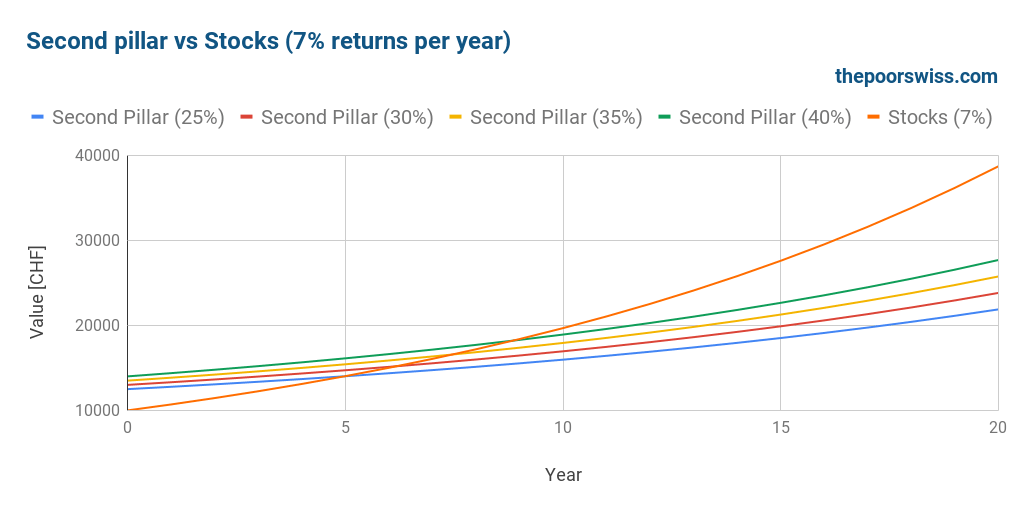

Now, some people are counting on about 7% of yearly returns. So, here is how that will go:

With 7% of stock returns per year, the return on the second pillar contributions is dwarfed. Even the highest marginal tax rates would be beaten after less than ten years. Compounding gets stronger and stronger as the returns increase.

So, we can draw a few conclusions from these results:

- The second pillar is interesting if you have a high income.

- The second pillar is interesting if you reinvest the tax savings in stocks

- If you expect very high returns from stocks, you should avoid the second pillar

- Over ten years, the second pillar is interesting

- Over more than 20 years, the second pillar is rarely interesting

However, there are other considerations. First of all, it will depend on the term of your investment. If you are investing long-term, it is probably better to stick with stocks. But if you are to get access to your second pillar soon, it may be a solid investment. It could be a good investment if you retire soon, build a house, or start a company in the medium term.

But do not forget that voluntary contributions are blocked for three years. So, if you intend to buy a house in the next three years, you should not invest in the second pillar (unless you already have enough in the second pillar without the voluntary contribution). If you plan to buy a house without the second pillar, you can continue your contributions if you have enough cash for the downpayment.

Another thing you need to take into account is whether you have a great second pillar account or not. If you have a good second pillar account invested in stocks, it will become more interesting to invest in it! But most people in Switzerland will not have access to a good second pillar.

The other consideration is whether you need bonds in your net worth.

Your bond allocation

Due to its safe nature and the guaranteed interest rate, I consider my second pillar bonds. I integrate my second pillar into my net worth as bonds.

So, another reason to buy into the second pillar depends on your allocation. If your bond allocation is too low for your current allocation, you can voluntarily contribute to increasing it. Given that it also has a nice tax advantage when you purchase, it is probably better than bonds.

When Swiss bonds are negative, the second pillar is also much more interest than Swiss bonds. If I need to increase my bond allocation, I will invest more in my second pillar instead of bonds.

At the start of 2021, we had 5.2% allocated bonds in our net worth. Since we aim for 10% bonds. So, it shows that we should contribute a little to our second pillar. Unfortunately, it is not a good time for us, as we will see in the next section.

Proper Timing

There are some cases where it becomes very interesting to make such contributions.

- When you know that you will retire or buy a house in the medium term (but further than three years). Since they are short-term investments, it is good to use them as such.

- When you know that you will leave your company and switch to vested benefits account. This could be the case when you are retiring early or leaving Switzerland. These accounts are often much better than second-pillar funds. So it could be interesting to max out your contributions to have them invested properly.

On the other hand, there is one case where you should not contribute to your second pillar: when you do not get any tax advantage. When you withdraw money early from the second pillar (for a house or business), you will not get any tax advantage until you have paid back the withdrawn money. So, as soon as you withdraw money from the second pillar, it becomes pretty much useless to put more money into it.

This is the case for us. We just withdrew money from our second pillar and cannot get any tax advantage until we contribute at least 50’000 CHF. So, without the tax advantages, it does not make sense for us to invest in the second pillar.

These examples show that timing is important for second pillar contributions.

Conclusion

From an investment point of view, contributions to the second pillar can be a good medium-term investment. However, you should only do them if you have a high income.

On top of that, if you expect very high returns from your stocks, the second pillar becomes less interesting. And you should try to reinvest your tax savings in stocks. Even though they have a substantial initial return on investment, they have very low returns per year after that.

On top of that, the money in a second pillar is an excellent alternative to bonds. They have a guaranteed (at least for now) interest and offer an excellent tax reduction. These tax reductions would be quite interesting as one is nearing retirement. But remember that you can only contribute to your second pillar if you have a salary or have your own company.

But it is not necessarily the best investment at all times. Like every other investment, it will depend on your context and your situation. You should consider every element before you decide on any investment. And never make any rash decisions!

Since our marginal tax rate is increasing, I wish I could contribute a little to the second pillar. Unfortunately, we just withdrew 50’000 CHF from it. So, we would need to contribute 50’000 CHF back without tax advantages before we could get tax advantages. So, we will first put that 50K CHF back into the pension fund before having benefits.

If you are interested in saving money from taxes, you can read my article about the best tax deductions in Switzerland.

What do you think about this? Are you contributing to your second pillar?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- Third Pillar: All you need to know to retire in Switzerland

- The Three Pillars of Retirement in Switzerland

- The Trap of Life Insurance Third Pillar

I’ve contributed large amounts in my second pillar to catch up the amount I lost after my divorce, it feels nice to have a tax reduction resulting from that but I now regret it. I should have invested that money in stocks (long term) instead of being happy with the short term, one year, tax reduction. I’m in my mid forties but I don’t think the strategy should change depending on your age. With 1% max yield on the second pillar it doesn’t make sense to invest more into it.

Hi Jake,

I would not regret it, it’s good to get some diversification :) And now you know :)

When you are getting much closer to retirement, it actually makes more sense, but that would be around 60, not 40 indeed!

Good luck with your future investing!

Very good article. Thank you. I really enjoy your blog. One thing that came into my mind reading your article was lowering the monthly contribution to the second pillar as my employer has 3 different plans and I always chose to contribute the maximum. As the contribution of the employer is not effected by that I started to doubt that choosing the maximum was the smartest idea. However, I ran the numbers and was quite surprised that it doesn’t seem to make a meaningful difference after almost 30 years. Is the effect for monthly contributions different. I don’t get it. The difference is roughly 500 chf a month between highest and lowest contribution on my side, marginal tax rate is roughly 36%. Maybe I am missing something?

Hi Jan,

I am not sure I understand what you mean by the meaningful difference?

Contributing 500 CHF a month at your marginal tax rate should save about 2160 CHF per year in taxes. If the employer does not match the contribution, I would not do it either.

6000 CHF in stocks or 6000 CHF in the second pillar should make a significant difference after 30 years.

Without seeing how you ran the numbers, I can’t tell you that you are missing something :)

Thanks for a very interesting article. Just out of curiosity, if you purchase a home, can you withdraw future Pillar 2 contributions to pay the amortization?

Hi William,

I am not sure I understand you well. There are two things with the second pillar and purchase of a house:

1) You can use the second pillar to pay up to 10% of the value of the house (half the down payment generally)

2) Every five years, you can withdraw parts of the second pillar to amortize the house

Does that answer your question?

Apologies for not being clear :) I think you answered my question under #2. Basically, I was wondering whether you can withdraw your second pillar to use for the amortization. Based on your answer, I gather that this is possible, but only every five years. In other words, you cannot withdraw it on an annual basis to cover up the full amortization?

That’s correct, you can only do it every five years :)

Two follow-up questions if you do not mind :)

1. To my understanding, you align on an amortization installment plan with your bank. Do the installments have to be the same amount or is it possible to agree on paying more during certain years, e.g. every 5th year when you can withdraw your second pillar for the amortization?

2. If I choose to pledge my second pillar when purchasing a house, instead of withdrawing it, is my understanding correct that I still can make voluntary purchases that are tax deductible?

I do not mind :)

1) I do not know. I imagine that you can discuss that with your bank and do something different. I am not sure a bank will allow you to wait 5 years for the first amortization. But you can probably talk to them and negotiate an alignment with your second pillar.

2) Yes, it’s also my understanding. Since nothing was withdrawn, you can continue to make voluntary tax-deductible purchases.

Thanks for yet another great piece! I have one rather basic (perhaps foolish) question. As an alternative to making a Pillar 2 contribution, you are considering the returns from stock mkt investments, assuming an average return of 5% per year, noting that one may get 10% one year and -20% the other. The point I don’t fully understand is that these are all only notional returns right, until the point one sells the stocks? What one ultimately gets in hand depends solely on the price of the stock on the day of sale (and any dividends that might have been distributed annually previously). So, if one sells the stock when the market is low, one’s overall return on original investment can actually be pretty terrible. So one might just be better off making the Pillar 2 contribution and saving the marginal tax. Am I missing something here? Great if you could write a post for beginners on how to realistically evaluate stock market investments/returns over time. Many thanks

Hi Still Learning,

It’s true that your returns are entirely dependent on the day you sell your shares. However, you can choose when you are selling. The idea is to hold these shares for the very-long-term and only sell them when you need them. And at this point, we expect the shares to be significantly higher than we started investing.

Sometimes, you have to sell low, but you should actually avoid it as much as possible.

Does that make sense?

Hi Mr Poor Swiss,

When you withdraw your 2nd pillar to buy a home, you need to pay taxes on this amount. And when you reimburse this early retrieval, you get this tax back. So I am not clear on why you would not pay back the 50k? Once you reimbursed the full amount, you can continue contributing with tax advantages.

Another reason to contribute to your 2nd pillar is to receive your monthly pension as of 58 yrs (early retirement). There are pension funds in Switzerland where you can leave your 2nd pillar if you are above 50 and stop working as an employee in Switzerland. When you get to age 58, you can ask for your monthly pension.

Hi Judit,

It’s true that I would get back the taxes I paid on the 50K, but then I would still have to pay back this tax when I withdraw the second pillar in the future. So it does not make much difference. Also, this small withdrawal tax is significantly lower than my large marginal tax rate. So, I do not think this is interesting compared to investing my money.

Yes, you can legally get your pension at 58. However, this will reduce your pension.

Hey TPS,

If the second pillar ROI is bad with the incentive of the direct tax margin reduction, doesn’t this mean that there is absolutely no incentive to refill the second pillar if you took out of it to build a house or create a company? Sounds to me like it would be a lot more attractive to directly buy bonds (if you need them) or stock and get a general higher ROI

However, from your article, I inferred that you are refilling your second pillar to compensate for what you took for the house (“But currently, we cannot get any tax advantages for several years”). Can you explain the rational behind this move?

Thanks

Jeremie

Hi Jeremie,

There is an error in this part of the article, I will update it ASAP.

I was thinking that monthly contributions would count towards replenishing the second pillar limit in terms of tax advantages, but this is not true. I got the confirmation from somebody at AXA that if you withdraw 50K from the second pillar, you need to do 50K in voluntary non-tax-advantaged contributions before you can get tax-advantages. So, I do not plan anymore to invest in the second pillar at all. Because it does not make sense to contribute to the second pillar without the tax advantages.

If you get tax-advantages, the second pillar is currently better than cash and better than bonds. Currently, bonds have negative returns, in Switzerland. So cash is currently better.

Does that make more sense?

Hi TPS,

Thanks! It’s very clear now!

Jeremie

I found this very interesting: https://www.handelszeitung.ch/podcasts/hz-insights/pensionskassen-das-mussen-versicherte-wissen (unfortunately in german only); if you take that idea and combin it with smth like valuepension …

It may be interesting, but I can’t understand enough German :)

What they discuss seems to be a very clever way to get your money out: Next time you switch jobs, you tell your old pension fund to transfer the money into 1 or more “Compte de libre passage”. (maybe into ETFs at valuepension?). Then when you start with your new company you just tranfer parts of your pension fund into the fund with your new employer. It is not legal to do so, but you can’t be convicted and there is nothing they can do about it.

Unfortunately i don’t want to switch in the near future, so i will probably not have the chance to try it.

Thanks for the summary! I have already heard of this technique and I know people doing this. But for me, this is more than a gray area. You are required to move all your funds to the new pension fund when you switch companies. I really do not want to delve into techniques like that on this blog.

my second pillar institution this year distributed 6% instead of 1% interest rate, is it an isolated case?

additionally, I read a lot online incl. NZZ that contribution makes no sense for people below 50, and the shorter the money stay in the pensionskasse the higher the interest. young people should never pay in to pensionskassen.

this on the assumption that the tax saving is much greater than the real return by interest, and given also that the pension law is subject to change in the next 20-30 years, i.e. lower returns rate are likely.

my institution tries to convince people to buy in and as said they really distribute interests, but with 32 I think it’s too early.

your view? thanks

Hi Karl,

Yes, it’s an isolated case, you should feel lucky!

You have a great second pillar! Many big foreign companies in Switzerland are getting very good second pillar companies.

This seems to go with my conclusions of short term investing. But keep in mind that most people get very little interest while you get 6% (at least for one year).

If you think you are going to get 5% annual rate on your second pillar, it’s an excellent investment when coupled with the tax savings. Now, let’s keep in mind that depending on how they invest, this could definitely not last. So we have to be careful about average returns.

With a low-interest rate, it’s indeed a short-term move.

In any case, it’s not mandatory to do it and it’s a personal decision as well. If you feel it’s too early, then do not do it :)

If I had a really good second pillar (and I could invest with tax advantages), I would invest a little every year into it.

Hey TPS :-)

reading some Blogs from you.

Since i’m in the investment business and get over and over the same questions about blogs like yours. Why you never show your income? How should people only calculate with a % rate? its switzerland, the rate is changing massively with the income. :-)

Hi Clau,

On my monthly updates, you can easily find my income. I think I share more than enough information compared to other bloggers.

Hi Mr. Poor Swiss,

great article! Thanks!

I don’t know if this will ever be an option for me as I’m still below 120k salary (no wealth taxes) and in my canton withholding taxes are very low (and so the returns). Also, I asked my second pillar provider and it seems that the buyback counts as extra mandatory and so they will likely return less than 1% (min. is 0.25% in my case).

Hi Azz,

This is a good point about mandatory or non-mandatory. Depending on your second pillar, you may actually get even lower interests in the second pillar.

Regarding withholding taxes, I am not sure what you mean? Do you mean your taxes are really low? At 120K salary, you should already have at least a 20% marginal tax rate, so the returns would already be 20%, no?

Thanks for stopping by!

Hi Mr. The Poor Swiss,

yes, I have progressive tax here that is very low.

Anyway, I was just agreeing with you that is probably always better to invest in stocks instead of 2nd pillar, especially with that low interest rate.

Alright, I get it :)