Revolut Review in Switzerland 2024: Pros & Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

A major issue with many payment cards is their tendency to impose high fees on foreign currency transactions. For instance, if your currency is Swiss Francs and you make a purchase in dollars, you’ll be required to pay a certain percentage of the transaction cost. Often, card issuers charge over 2% in fees for such transactions. Fortunately, Revolut offers a solution to this problem.

Saving money on foreign transaction fees is made easy with Revolut. Unlike banks that typically offer unfavorable exchange rates, Revolut provides you with the best available exchange rates. If you frequently purchase items in other currencies or from different countries, having a Revolut card is essential to keep your expenses in check.

On top of that, Revolut has many other services.

| Monthly fee | 0 CHF |

|---|---|

| Users | 15’000’000 |

| Card | Mastercard prepaid |

| Currencies | CHF and more than 20 |

| Currency exchange fee | Free for small amounts, then 1.0% and weekend 1% |

| Top-up CHF | Free with Swiss IBAN |

| Languages | English, French, German, and Italian |

| Other features | Stocks, cryptos, … |

| Depositor protection | 0 CHF |

| Established | 2015 |

| Headquarters | London, United Kingdom |

Revolut

Revolut is a company from the United Kingdom. They are pretty young. They started in 2015. They offer a prepaid debit card. Except in a few cases, there is little difference between both (unless you want to go into debt).

With Revolut, both MasterCard and Visa are available. They are almost the same for most usages. You can use it online and even withdraw money at an ATM. They offer two types of cards:

- Virtual Debit Card: You can generate it in your Revolut account. You can use it online with its number.

- Physical Card: You can order a physical debit card for a small fee.

But the interesting thing about Revolut is that foreign exchange transactions are cheap! There are no foreign exchange fees. However, while Revolut used to provide the interbank exchange rate, they do not anymore. Since 2023, they have provided the Revolut Exchange Rate, which means nothing, except that they can now add their own surcharge.

So, foreign exchange transactions with Revolut are not free anymore. On average, users are reporting about 0.4% surcharge.

This surcharge is still better than many banks. But there are some interesting alternatives at this level.

It is entirely worth having a new card for these savings. Moreover, since my employer’s headquarters is in the United States, I may travel more than usual, which means I will save even more money.

Since its inception, Revolut started offering many new features:

- Support for cryptocurrencies directly from the application.

- Insurance on some of your purchases

- Premium And Metal plan for users that need even more features

- Saving vaults for your money with saving goals

In 2019, Revolut got a European Specialised Bank License! It is a big deal for the company. They operate as banks in EU countries but not yet in Switzerland. When operating as a bank, your deposits are protected by the European Deposit Insurance Scheme (EDIS) up to 100’000 EUR.

At the same time, Revolut obtained a Swiss IBAN. This is an essential point for Swiss users since it allows them to easily top up their accounts for free.

If you plan to use Revolut to save money on foreign fees, you will be okay with the free Standard plan! You can always upgrade to another plan later.

Sign up for Revolut

Now you are ready to sign up for Revolut. You have to install the application on your smartphone. There is no way around it. It is excellent for most people. But for people like me who dislike phones, it is not perfect. But I guess I have to live with mobile apps now!

Nevertheless, it is pretty straightforward. You can go to the Revolut website to get a direct link to the application to download. You can also search for Revolut in your phone application store (Google Play or App Store).

Once you have installed the application, you can go through the registration process. You will have to enter standard information about yourself. You will also have to scan your ID. At some point, you will have to top up Revolut for authentication. You can use your Wise card now to top it up. And this will be free!

Once you have done this, you can start using a virtual card or order a physical card. You must pay 6.99 CHF for the delivery if you order a physical card. It should be the only time you pay anything to Revolut. My card arrived quite quickly, four working days, I think.

How to Top Up Revolut for Free

Since the Revolut card is a prepaid debit card, you must top it up. You cannot use it if you do not have any money on your card. You have several choices to top it up:

- A debit card: Expensive!

- A credit card issued in your country: Expensive!

- Another credit card: Expensive!

- A bank transfer: Generally free!

You should only use free options to top up your account. Anything else does not make sense. There is no point in spending more money than what you will save on foreign exchange fees.

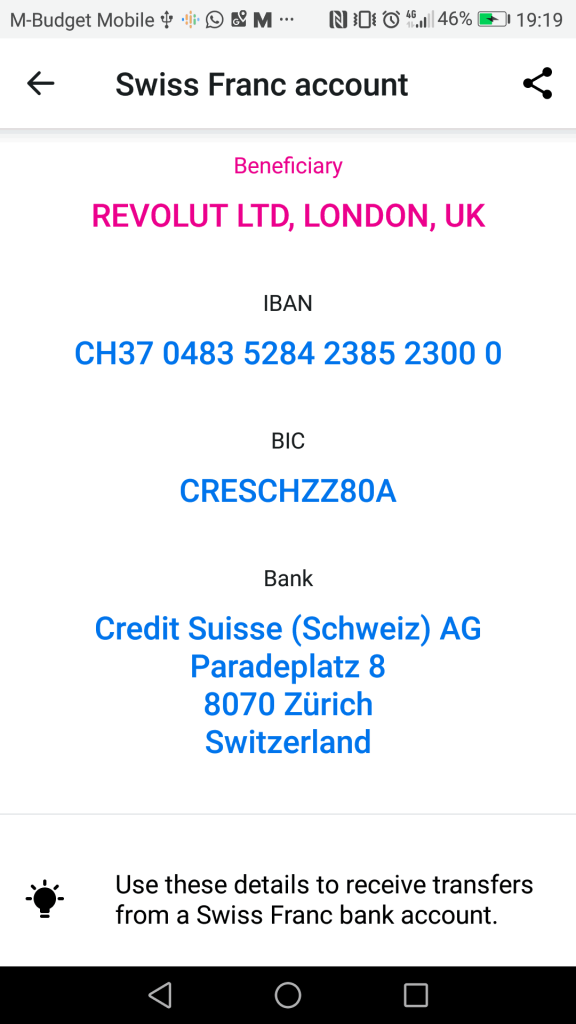

Top Up Revolut with Swiss IBAN

You can directly transfer money to your bank account.

Revolut offers a Swiss IBAN in Swiss francs. You can transfer money directly from your Swiss bank account into Revolut. And this is a real CH IBAN from a Swiss bank! You will not pay any fee for the transfer!

Revolut offers bank accounts for most European countries, making it straightforward to transfer money from most countries.

You can now transfer money for free to your Revolut account directly from your bank account. You only need to wire money from one account to another to top up your account.

To do this, go into the app and click on Add Money (The big button is like a plus sign). Then, you can select “Transfer to your Revolut account”. They will give you all the information necessary for a bank transfer to their account. Be careful when you enter the reference number because this is how they will identify you.

Once you have sent the payment, the money usually takes one working day to appear in your account.

Detailed Revolut Fees

I said foreign transactions are cheap with Revolut. Unfortunately, this is not always true, even with Revolut. There are a few details that are important to know.

First, not all currencies are treated equally by Revolut. There is a 1% fee for Thai Baht, Russian Rubbles, and Ukrainian Hryvnia, while all other currencies are free.

However, there is a monthly limit of 1000 GBP for free transactions. It is equivalent to 1000 GBP (1250 CHF) for other currencies. You will pay a 1.0% fee if you exchange more than this.

Also, the rates are different during the weekend. Revolut will charge a 1.0% extra fee on each exchange transaction during the weekend. You can find more details on the official Revolut price explanation.

In the best case, an exchange costs about 0.40% with Revolut. In the worst case, it can be expensive, with a 2.5% fee. You need to be careful when doing your exchanges during the week. Be aware that some currencies will charge you more. And you should avoid using Revolut for large transfers as well!

Also, it is worth restating that Revolut no longer offers interbank exchange rates.

Alternatives

We can quickly compare Revolut with some alternatives.

Revolut vs Neon

All the services you need to pay, save and invest, in a neat package, with extremely good prices!

Use the poorswiss code to receive 10CHF!

- Pay abroad for free

- Invest with great fees

In Switzerland, Neon is a big contender to Revolut.

Since Neon deposits money in a bank in your name, the money is insured for up to 100’000 CHF under Swiss depositor protection. Revolut has a banking license but does not operate (yet) as a bank in Switzerland. So, your money is safer with Neon.

When you pay with the card, all currency exchanges are cheap with Neon. Revolut has some limits on cheap exchanges. However, Neon uses the Mastercard exchange rate, which is about 0.4% worse than the interbank rate. Revolut provides the so-called Revolut Exchange Rate, which is also about 0.4% more expensive than the interbank rate. The Revolut Exchange Rate is less transparent than the Mastercard Exchange Rate.

Also, bank transfers in other currencies are not free with Neon. These transfers are generally cheaper with Revolut.

Revolut is a multi-currency account. Neon only lets you hold Swiss Francs.

As for reputation, Revolut has a poor reputation with many issues. Neon is currently free of controversies and has a good reputation in Switzerland.

Since I started using Neon, I have not used my Revolut account. I much prefer Neon over Revolut for their safety and professionalism. Neon is now as cheap as Revolut.

To learn more, read my comparison of Neon vs Revolut.

Revolut vs Wise

Wise is probably Revolut’s biggest competitor.

Revolut and Wise are digital bank accounts focusing on currency exchanges at a fair price.

Overall, Wise has a much better reputation. Many controversies tarnished Revolut reputation.

Both services are on the same price level.

- Wise has fees on each currency conversion, which is very transparent.

- Revolut has a surcharge of 0.40%, which is not transparent and not visible in the app.

- Revolut has free conversions for up to 1250 CHF per month.

- Wise prices are simpler than Revolut fees. Indeed, Revolut has different fees during the week and weekend. Revolut also has different fees for different currencies (called exotic prices).

While Wise focuses on its core business, Revolut tries to do everything from its app. Indeed, Revolut offers crypto, stocks, and commodities from within the app. You can even book stays using the app. I do not see this as an advantage. I prefer having a few apps doing a good thing than a single app trying to do everything.

I should also mention that Wise has been profitable for a while Revolut only had a single profitable year since its creation.

Overall, I prefer Wise over Revolut for its reputation and for not trying to do too much. But both apps are interesting. Since the latest changes in 2023, Revolut is no longer cheaper than Wise.

For more information, you can read my detailed comparison of Revolut vs Wise.

Revolut vs N26

Of the main competitors of Revolut in Europe is N26.

Both Revolut and N26 are digital bank accounts. Both have a bank license, but Revolut has not yet implemented it. So, N26 has a slight advantage in terms of regulations and safety.

Interestingly, both companies have a poor reputation, which has generated several significant controversies.

N26 is cheaper than Revolut since all primary services are free. Indeed, payments in other currencies are always free with N26. However, Revolut has some substantial limitations. Also, N26 allows you to withdraw EUR for free in your country five times a month, while Revolut only allows 200 EUR per month.

When it comes to Switzerland, N26 has very poor support of Switzerland. Indeed, they have no Swiss IBAN. So you have to deposit EUR into your account, which is inconvenient for people.

Also, N26 does not support CHF in the app. This means that you cannot have a balance in CHF and that any payment in CHF will go through a currency conversion with the card provider, which is not free.

So, N26 is probably better in Europe, but Revolut is much better in Switzerland.

To learn more about these two, read my detailed comparison of N26 and Revolut. Or, you can read my review of N26.

FAQ

Is Revolut a bank?

Revolut has a digital banking license, that makes it a digital bank. However, since they got that license after getting started, many of their accounts are not under the license.

Is Revolut free?

It depends on how you use it. There are limits under which it is free. For instance, you can convert 1250 CHF per month for free, during weekdays, but you would have to pay a fee during the weekend. So, make sure you check their fee schedule in advance.

Who is Revolut good for?

Revolut is good for people that want to use this card to travel and pay relatively low fees abroad and in foreign currencies. These people should not hold too much money on their accounts.

Who is Revolut not good for?

Revolut is not good as primary bank account. It is not good if you a transparent exchange rate or want to hold a lot of money on your account.

Revolut Summary

Revolut offers a debit card without any fees for currency exchange. On top of that main feature, they have plenty of advanced features such as stock trading, cryptocurrencies and sub-accounts.

Product Brand: Revolut

3

Revolut Pros

Let's summarize the main advantages of Revolut:

- Cheap currency exchanges during the week.

- Can hold many currencies in the account.

- Very fast transfers to other users.

- Fast transfers to other bank accounts.

Revolut Cons

Let's summarize the main disadvantages of Revolut:

- Very poor transparency on exchange rates

- Expensive during the weekends.

- Free exchanges are limited to 1250 CHF per month.

- Expensive for some exotic currencies.

- Revolut has a poor reputation.

- There are reports of many people getting their accounts blocked and losing access to their money.

Conclusion

I like using a travel card. It is free and saves me a lot of money each year. Every time I travel to another country, I use my travel card to pay for everything! I have never had any issue getting it accepted anywhere.

I am also using it to pay online on foreign websites. For instance, I often have to pay in EUR or USD if I order something on eBay. With my Revolut, the conversion is free at an excellent exchange rate!

A travel card is a perfect companion to your local payment card.

However, many people had issues with Revolut and got their accounts blocked without proper communication. There are also many negative online reviews about Revolut. So, you should still be careful not to trust Revolut with too much money.

I never had a lot of money in my account. My rule is not to have more than 500 CHF on my Revolut account.

All the services you need to pay, save and invest, in a neat package, with extremely good prices!

Use the poorswiss code to receive 10CHF!

- Pay abroad for free

- Invest with great fees

If you do not want to trust your money with a foreign bank, you could use Neon bank for your purchases abroad. They also have free transactions in foreign currencies and abroad. This means you can have the advantages of Revolut with the benefits of a local bank. For more details about how I use cards, read about my entire payment card strategy.

Although I still have my Revolut card, I mainly use my Neon card now. It is more practical, more transparent and about the same level of fees.

Finally, if you do not know what to choose between Revolut and Wise, I have written an entire article about Revolut vs Wise.

Have you ever tried a Revolut card? Which payment card do you use?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best banks

- More articles about Save

- UBS Bank Review 2024 – Pros & Cons

- How to create a Neon account and use the mobile application

- 7 Simple Steps to Change Bank Account in 2024

Hello there. I had the silly idea of transfer 1000 chf per month to REVOLUT and change it for free to dollars. Then from there send it to IB to pay the dollar investment.

Not sure If this is just silly or good idea.

Hi

This is silly :)

1000 CHF will cost about 4 USD to convert on Revolut (about 0.4% worse than interbank on average) and only 2 USD on IB.

Hi

I’ve got here following this link (https://thepoorswiss.com/revolut-credit-card-no-more-foreign-exchange-fees/) from another article with the title:

Get rid of currency exchange fees with Revolut: Learn how to remove currency exchange fees entirely using Revolut.

So I just wanted to say that this “entirely” is maybe a little too good …

Hi gig,

The link you are mentioning was written when Revolut had no currency exchange fee (it was only introduced recently in the form of a surcharge).

Please keep in mind that I have more than 500 articles and that things keep changing all the time. I simply can’t update every single link to take this into account.

Hi thanks for sharing. Bank transfer from a swiss bank to Revolut is free on workdays. But if I want to transfer back some CHF in my Revolut to my bank account in Switzerland e.g CSX or neon, is there any fee? I try to make a bank transfer, it says no fee on revolut but might be charged by the partner banks.

Hi Vivi

Yes, if you are doing a transfer from Revolut to a Swiss bank, it will be free (if you have a Swiss revolut account) because it will a transfer from one CH IBAN to another.

As always, great article!

I’ve got few question because i would open an alternative account/card to my swiss one (UBS).

– I travel frequently from Switzerland to Euro countries, so i would need something that i can pay with as lowest fee as possible when paying in Eur. Is that Revolut, NEON or other the best?

– My main account is UBS, hence i’ll transfer money to the secondary account from that one. What is the best option to do that? hence lowest fee on receiving money?

What would you suggest?

thanks!!

Hi Alessandro

* Neon and Revolut are almost on the same level of fees now. I would use Neon since it’s Swiss, but Revolut would work.

* You can do a simple wire transfer from UBS to both Neon and Revolut for free since they both have a CH IBAN.

Thanks for reply me.

But if I need a second card/account mainly for euro payment isn’t that better a non Swiss? I thought same as you but eventually the payments will be always converted from chf in eur. That’s why I considered revolut. Is there something I’m missing? Thanks

With Revolut you have indeed the advantage of being able to hold EUR which you can’t with Neon. But this is only an advantage if you have EUR in the first place. If you need to convert it, it will be the same.

So, if you sometimes receive EUR directly and want to hold it to use it in Europe, then yes, a multi-currency account such as a Revolut (or Yuh) will be good.

According to Revolut’s support it’s not possible to receive CHF without fees, even if the Revolut account was received in Switzerland. They were not able to tell me if it was possible before (but this article and others say yes).

Apparently they don’t provide Swiss IBANs anymore and they don’t have a bank account to send CHF to. Everything has to go through to SWIFT now…

That makes Revolut a very unappealing option in Switzerland now. We can’t benefit from their favorable conversion rates anymore, and we have to pay outrageous fees just to top-up the account using CHF.

This change completely rules out Revolut as a viable option in Switzerland as far as I’m concerned.

Hi Paul,

That’s weird. I just checked on my Revolut app and when I click on Deposit Money, I get the same CH IBAN I always did. Nothing seems to have changed.

If you are a Swiss resident, you should have the same thing.

Two people from customer support told me the same thing, but then the 3rd told me that I would get a personal Swiss IBAN if I closed my account and opened another one in Switzerland.

In order to confirm I asked him if this IBAN would be mine exclusively and not shared with other users and he confirmed. I have doubts… But I believe that it’s reasonable to think that I will have a shared Swiss IBAN, which is all I care about (I want to transfer CHF for free to Revolut).

I have additional questions:

1) Is it possible to make SEPA transfers (EUR) from a Swiss Revolut account to an EU bank?

I want to make sure that I won’t get ripped off by SWIFT and the correspondance banks taking their outrageous cut during the transfer.

2) Is it possible to make local transfers (CHF) from a Swiss Revolut account to a Swiss bank account (Yuh) without incurring fees?

This would be helpful when I need to transfer money from my Revolut account back into my Yuh account.

Thank you for your help!

It’s indeed only available to Swiss residents, with a Swiss revolut account.

However, it’s not a personal IBAN! You need a personal reference number to add to the transfer to distinguish between people.

1) Yes, I have done that multiple times

2) Yes, I have done that multiple times

There are very little differences between a Swiss Revolut account and a EU Revolut account:

* Your money will not be insured, Revolut does not act as a bank in Switzerland

* You have access to a CH IBAN for transfers to your own account

* You probably lose some access to some advanced features

Thank you Baptiste for your reply.

In the meantime I contacted customer support and they told me that they would give me 2 months of complimentary Premium once I create a new account, so that I could order a new credit card for free. I saved the conversation as PDF before deleting my account because I suspected that they would ‘forget’.

I deleted my French Revolut account, I asked a friend of mine to refer me, and I then created a Swiss Revolut account. I contacted customer support and of course they ‘forgot’ that I was promised 2 months of complimentary Premium. I sent the conversation PDF transcript as a proof after which they added the 2 months of Premium. I was able to order 2 cards for free without issues.

After all of this, I can confirm that my new Swiss Revolut account indeed shows me the pooled CHF details and a special reference to put in transfers so that they know to route the money to my account (rather than another Revolut user). So all three customer representative were wrong: the first two told me that I wouldn’t get any Swiss account details (shared or not), while the third told me that I would have a personal Swiss IBAN (I asked him twice to confirm after rephrasing my question, so it’s not just a mutual misunderstanding).

Note: for receiving EUR I used to have French account details on Revolut but now I only have UK account details (GBxxxxxx…). I initiated a transfer of EUR 100 from a real French bank account to these UK account details shown in my Swiss Revolut account and I confirm that I received the money in less than 10 seconds and without any fees. So as far as I’m concerned it doesn’t change anything compared to having French account details on Revolut.

Hope that my comment will help future users who need to go through the same steps.

Thanks for sharing all the details.

This is quite sad that customer support can be so wrong, 3 times in a row :(

And well done for saving the transcript!

Normally, GB versus other EU accounts should change little on your account indeed, thanks for confirming!

At least, it’s good to you were able to get what you wanted even though it should have been much simpler!

Hi,

If I send money out of Switzerland, which IBAN will be used? I am asking as I have been told that when my bank receives money from Switzerland, they charge a fee due to the fact that Switzerland is not a member of the European Economic Area. So if use revolut – will the money still be sent from Switzerland?

I hope my question makes sense! Thanks!

Hi Vess,

I believe you can send money to a CH bank account without any fees with Revolut. They would use their CH account if you are from Switzerland.

Ok, thanks! My case is that I need to send money to a bank of an EU country (Bulgaria) – if I send it with revolut from Switzerland then revolut will use its Swiss account and not an account in EU (not sure which country exactly that would be). Do I understand correctly?

Normally, any EUR transfer should occur from a EU IBAN. Revolut is quite good at doing transfers properly and avoiding any fees. In the past, when I did EUR transfers, it was always without any fees and it was within EU, not using the CH IBAN even though my account was in Switzerland.

thanks a lot for the information!

Revolut business account in Switzerland vs. Wise business account in Switzerland? Which is better, which is safer?

I don’t know, I have never reviewed either of these accounts.