Revolut Review in Switzerland 2024: Pros & Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

A major issue with many payment cards is their tendency to impose high fees on foreign currency transactions. For instance, if your currency is Swiss Francs and you make a purchase in dollars, you’ll be required to pay a certain percentage of the transaction cost. Often, card issuers charge over 2% in fees for such transactions. Fortunately, Revolut offers a solution to this problem.

Saving money on foreign transaction fees is made easy with Revolut. Unlike banks that typically offer unfavorable exchange rates, Revolut provides you with the best available exchange rates. If you frequently purchase items in other currencies or from different countries, having a Revolut card is essential to keep your expenses in check.

On top of that, Revolut has many other services.

| Monthly fee | 0 CHF |

|---|---|

| Users | 15’000’000 |

| Card | Mastercard prepaid |

| Currencies | CHF and more than 20 |

| Currency exchange fee | Free for small amounts, then 1.0% and weekend 1% |

| Top-up CHF | Free with Swiss IBAN |

| Languages | English, French, German, and Italian |

| Other features | Stocks, cryptos, … |

| Depositor protection | 0 CHF |

| Established | 2015 |

| Headquarters | London, United Kingdom |

Revolut

Revolut is a company from the United Kingdom. They are pretty young. They started in 2015. They offer a prepaid debit card. Except in a few cases, there is little difference between both (unless you want to go into debt).

With Revolut, both MasterCard and Visa are available. They are almost the same for most usages. You can use it online and even withdraw money at an ATM. They offer two types of cards:

- Virtual Debit Card: You can generate it in your Revolut account. You can use it online with its number.

- Physical Card: You can order a physical debit card for a small fee.

But the interesting thing about Revolut is that foreign exchange transactions are cheap! There are no foreign exchange fees. However, while Revolut used to provide the interbank exchange rate, they do not anymore. Since 2023, they have provided the Revolut Exchange Rate, which means nothing, except that they can now add their own surcharge.

So, foreign exchange transactions with Revolut are not free anymore. On average, users are reporting about 0.4% surcharge.

This surcharge is still better than many banks. But there are some interesting alternatives at this level.

It is entirely worth having a new card for these savings. Moreover, since my employer’s headquarters is in the United States, I may travel more than usual, which means I will save even more money.

Since its inception, Revolut started offering many new features:

- Support for cryptocurrencies directly from the application.

- Insurance on some of your purchases

- Premium And Metal plan for users that need even more features

- Saving vaults for your money with saving goals

In 2019, Revolut got a European Specialised Bank License! It is a big deal for the company. They operate as banks in EU countries but not yet in Switzerland. When operating as a bank, your deposits are protected by the European Deposit Insurance Scheme (EDIS) up to 100’000 EUR.

At the same time, Revolut obtained a Swiss IBAN. This is an essential point for Swiss users since it allows them to easily top up their accounts for free.

If you plan to use Revolut to save money on foreign fees, you will be okay with the free Standard plan! You can always upgrade to another plan later.

Sign up for Revolut

Now you are ready to sign up for Revolut. You have to install the application on your smartphone. There is no way around it. It is excellent for most people. But for people like me who dislike phones, it is not perfect. But I guess I have to live with mobile apps now!

Nevertheless, it is pretty straightforward. You can go to the Revolut website to get a direct link to the application to download. You can also search for Revolut in your phone application store (Google Play or App Store).

Once you have installed the application, you can go through the registration process. You will have to enter standard information about yourself. You will also have to scan your ID. At some point, you will have to top up Revolut for authentication. You can use your Wise card now to top it up. And this will be free!

Once you have done this, you can start using a virtual card or order a physical card. You must pay 6.99 CHF for the delivery if you order a physical card. It should be the only time you pay anything to Revolut. My card arrived quite quickly, four working days, I think.

How to Top Up Revolut for Free

Since the Revolut card is a prepaid debit card, you must top it up. You cannot use it if you do not have any money on your card. You have several choices to top it up:

- A debit card: Expensive!

- A credit card issued in your country: Expensive!

- Another credit card: Expensive!

- A bank transfer: Generally free!

You should only use free options to top up your account. Anything else does not make sense. There is no point in spending more money than what you will save on foreign exchange fees.

Top Up Revolut with Swiss IBAN

You can directly transfer money to your bank account.

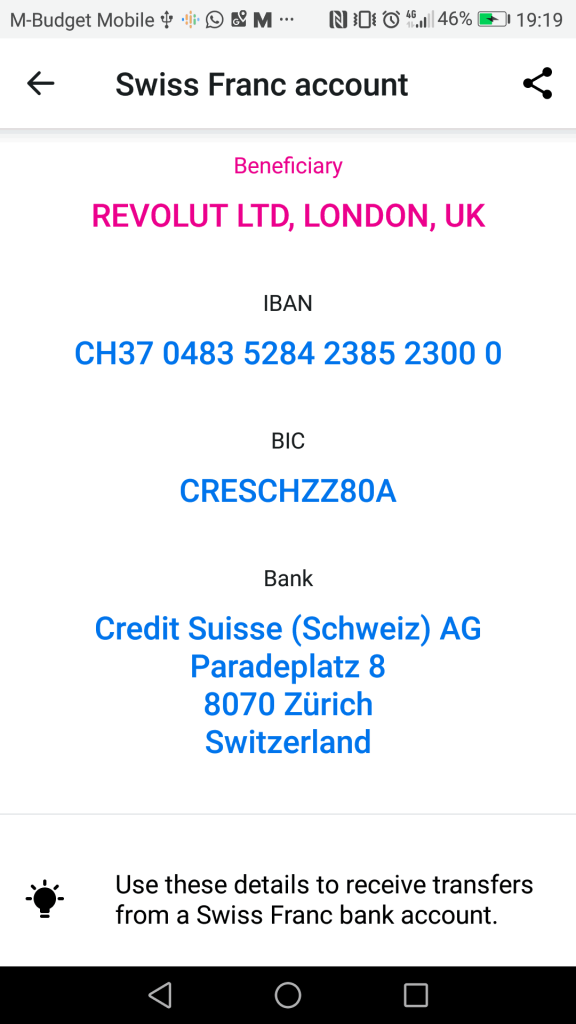

Revolut offers a Swiss IBAN in Swiss francs. You can transfer money directly from your Swiss bank account into Revolut. And this is a real CH IBAN from a Swiss bank! You will not pay any fee for the transfer!

Revolut offers bank accounts for most European countries, making it straightforward to transfer money from most countries.

You can now transfer money for free to your Revolut account directly from your bank account. You only need to wire money from one account to another to top up your account.

To do this, go into the app and click on Add Money (The big button is like a plus sign). Then, you can select “Transfer to your Revolut account”. They will give you all the information necessary for a bank transfer to their account. Be careful when you enter the reference number because this is how they will identify you.

Once you have sent the payment, the money usually takes one working day to appear in your account.

Detailed Revolut Fees

I said foreign transactions are cheap with Revolut. Unfortunately, this is not always true, even with Revolut. There are a few details that are important to know.

First, not all currencies are treated equally by Revolut. There is a 1% fee for Thai Baht, Russian Rubbles, and Ukrainian Hryvnia, while all other currencies are free.

However, there is a monthly limit of 1000 GBP for free transactions. It is equivalent to 1000 GBP (1250 CHF) for other currencies. You will pay a 1.0% fee if you exchange more than this.

Also, the rates are different during the weekend. Revolut will charge a 1.0% extra fee on each exchange transaction during the weekend. You can find more details on the official Revolut price explanation.

In the best case, an exchange costs about 0.40% with Revolut. In the worst case, it can be expensive, with a 2.5% fee. You need to be careful when doing your exchanges during the week. Be aware that some currencies will charge you more. And you should avoid using Revolut for large transfers as well!

Also, it is worth restating that Revolut no longer offers interbank exchange rates.

Alternatives

We can quickly compare Revolut with some alternatives.

Revolut vs Neon

All the services you need to pay, save and invest, in a neat package, with extremely good prices!

Use the poorswiss code to receive 10CHF!

- Pay abroad for free

- Invest with great fees

In Switzerland, Neon is a big contender to Revolut.

Since Neon deposits money in a bank in your name, the money is insured for up to 100’000 CHF under Swiss depositor protection. Revolut has a banking license but does not operate (yet) as a bank in Switzerland. So, your money is safer with Neon.

When you pay with the card, all currency exchanges are cheap with Neon. Revolut has some limits on cheap exchanges. However, Neon uses the Mastercard exchange rate, which is about 0.4% worse than the interbank rate. Revolut provides the so-called Revolut Exchange Rate, which is also about 0.4% more expensive than the interbank rate. The Revolut Exchange Rate is less transparent than the Mastercard Exchange Rate.

Also, bank transfers in other currencies are not free with Neon. These transfers are generally cheaper with Revolut.

Revolut is a multi-currency account. Neon only lets you hold Swiss Francs.

As for reputation, Revolut has a poor reputation with many issues. Neon is currently free of controversies and has a good reputation in Switzerland.

Since I started using Neon, I have not used my Revolut account. I much prefer Neon over Revolut for their safety and professionalism. Neon is now as cheap as Revolut.

To learn more, read my comparison of Neon vs Revolut.

Revolut vs Wise

Wise is probably Revolut’s biggest competitor.

Revolut and Wise are digital bank accounts focusing on currency exchanges at a fair price.

Overall, Wise has a much better reputation. Many controversies tarnished Revolut reputation.

Both services are on the same price level.

- Wise has fees on each currency conversion, which is very transparent.

- Revolut has a surcharge of 0.40%, which is not transparent and not visible in the app.

- Revolut has free conversions for up to 1250 CHF per month.

- Wise prices are simpler than Revolut fees. Indeed, Revolut has different fees during the week and weekend. Revolut also has different fees for different currencies (called exotic prices).

While Wise focuses on its core business, Revolut tries to do everything from its app. Indeed, Revolut offers crypto, stocks, and commodities from within the app. You can even book stays using the app. I do not see this as an advantage. I prefer having a few apps doing a good thing than a single app trying to do everything.

I should also mention that Wise has been profitable for a while Revolut only had a single profitable year since its creation.

Overall, I prefer Wise over Revolut for its reputation and for not trying to do too much. But both apps are interesting. Since the latest changes in 2023, Revolut is no longer cheaper than Wise.

For more information, you can read my detailed comparison of Revolut vs Wise.

Revolut vs N26

Of the main competitors of Revolut in Europe is N26.

Both Revolut and N26 are digital bank accounts. Both have a bank license, but Revolut has not yet implemented it. So, N26 has a slight advantage in terms of regulations and safety.

Interestingly, both companies have a poor reputation, which has generated several significant controversies.

N26 is cheaper than Revolut since all primary services are free. Indeed, payments in other currencies are always free with N26. However, Revolut has some substantial limitations. Also, N26 allows you to withdraw EUR for free in your country five times a month, while Revolut only allows 200 EUR per month.

When it comes to Switzerland, N26 has very poor support of Switzerland. Indeed, they have no Swiss IBAN. So you have to deposit EUR into your account, which is inconvenient for people.

Also, N26 does not support CHF in the app. This means that you cannot have a balance in CHF and that any payment in CHF will go through a currency conversion with the card provider, which is not free.

So, N26 is probably better in Europe, but Revolut is much better in Switzerland.

To learn more about these two, read my detailed comparison of N26 and Revolut. Or, you can read my review of N26.

FAQ

Is Revolut a bank?

Revolut has a digital banking license, that makes it a digital bank. However, since they got that license after getting started, many of their accounts are not under the license.

Is Revolut free?

It depends on how you use it. There are limits under which it is free. For instance, you can convert 1250 CHF per month for free, during weekdays, but you would have to pay a fee during the weekend. So, make sure you check their fee schedule in advance.

Who is Revolut good for?

Revolut is good for people that want to use this card to travel and pay relatively low fees abroad and in foreign currencies. These people should not hold too much money on their accounts.

Who is Revolut not good for?

Revolut is not good as primary bank account. It is not good if you a transparent exchange rate or want to hold a lot of money on your account.

Revolut Summary

Revolut offers a debit card without any fees for currency exchange. On top of that main feature, they have plenty of advanced features such as stock trading, cryptocurrencies and sub-accounts.

Product Brand: Revolut

3

Revolut Pros

Let's summarize the main advantages of Revolut:

- Cheap currency exchanges during the week.

- Can hold many currencies in the account.

- Very fast transfers to other users.

- Fast transfers to other bank accounts.

Revolut Cons

Let's summarize the main disadvantages of Revolut:

- Very poor transparency on exchange rates

- Expensive during the weekends.

- Free exchanges are limited to 1250 CHF per month.

- Expensive for some exotic currencies.

- Revolut has a poor reputation.

- There are reports of many people getting their accounts blocked and losing access to their money.

Conclusion

I like using a travel card. It is free and saves me a lot of money each year. Every time I travel to another country, I use my travel card to pay for everything! I have never had any issue getting it accepted anywhere.

I am also using it to pay online on foreign websites. For instance, I often have to pay in EUR or USD if I order something on eBay. With my Revolut, the conversion is free at an excellent exchange rate!

A travel card is a perfect companion to your local payment card.

However, many people had issues with Revolut and got their accounts blocked without proper communication. There are also many negative online reviews about Revolut. So, you should still be careful not to trust Revolut with too much money.

I never had a lot of money in my account. My rule is not to have more than 500 CHF on my Revolut account.

All the services you need to pay, save and invest, in a neat package, with extremely good prices!

Use the poorswiss code to receive 10CHF!

- Pay abroad for free

- Invest with great fees

If you do not want to trust your money with a foreign bank, you could use Neon bank for your purchases abroad. They also have free transactions in foreign currencies and abroad. This means you can have the advantages of Revolut with the benefits of a local bank. For more details about how I use cards, read about my entire payment card strategy.

Although I still have my Revolut card, I mainly use my Neon card now. It is more practical, more transparent and about the same level of fees.

Finally, if you do not know what to choose between Revolut and Wise, I have written an entire article about Revolut vs Wise.

Have you ever tried a Revolut card? Which payment card do you use?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best banks

- More articles about Save

- PostFinance Bank Review 2024 – Pros & Cons

- N26 vs Revolut in 2024: Which is best for you?

- Wise vs Revolut: Which Is Best in 2024?

Thanks for the helpful post. Revolut was issued in Switzerland through Credit Suisse. Now that Credit Suisse no longer exists and has been taken over by UBS is there a risk that Swiss residents will no longer be able to use it?

Thanks in advance for your thoughts.

I don’t think that’s a big risk.

Credit Suisse still exists, it’s just part of UBS. All features from CS are still working and currently it has not changed anything.

Hi The Poor Swiss :)

Thanks a lot for your awesome work! Really appreciated.

What would be your recommendation for storing EUR? It looks to me Neon is a great choice for purchasing when abroad but it changes at purchase time the CHF it stores to foreign currency.

If I want to exchange CHF -> EUR when the exchange rate is high and store if for later, what would you recommend?

N26 would be a safer options than Revolut but I am not convinced due to the poor reputation and several large controversies you mentioned.

Any other secure bank with a free EUR bank account offer?

Thank you so much!

Hi,

Thanks for your kind words.

I would say the best place to store EUR is Interactive Brokers :) But it depends on what you want to do with it. If you want to spend it abroad, I would say the best option is Wise and pay the fees. If it’s a small amount of money both Revolut and N26 are fine I would say.

Try Wise

Hello, first of all: great blog – I discovered you few months ago and I’m catching up on all yours posts, useless to say that I used your suggestions to make some decisions (IBKR, pension funds, credit card)

Then, I’m here in order to ask your opinion: as you probably know, revolut will start to charge a fee to transfer money in the revolut cart from a Swiss bank account!

Considering that this fees are up to 1.15% for debit card and to 1.50% for credit card, I feel it’s not worth to have a revolut card for me anymore.. what do you think? Do you consider Neon to be a valid alternative? Considering that I mainly use the card when traveling for the EUR and USD exchange rates.. thanks a lot!

Thanks for your kind words, Zaza!

No, I did not know that, do you have a source?

Why don’t you use a bank transfer to top up your account? I always did that.

For traveling, Neon is great, I only use Neon abroad.

Thanks for the prompt reply! I actually received an e-mail from Revolut on the 19/10, I copy paste here below the content:

“ Nous voulions vous informer que nous facturerons bientôt des frais lorsque vous ajoutez de l’argent sur votre compte en utilisant une carte émise en Suisse. Ces frais seront de 1,15 % pour les cartes de débit et de 1,5 % pour les cartes de crédit émises en Suisse.”

As I just have swiss accounts, I’m kind of obliged to pay the fees ! Imagining that in 2023 a person transfer 10 KCHF it would result in 150 chf of fees.

Well, I’ll probably look into Neon and consider closing my Revolut account!

I believe the rules changed for Revolut since 25 October such that top ups are subject to a fee in Switzerland- not sure how much this affects the benefit of the transfers now

https://help.revolut.com/en-BE/help/adding-money/with-card/why-was-i-charged-a-fee-for-my-card-deposit?promo=NC_BE

Thanks for sharing, Ming!

I will try to update my Revolut articles with this.

I was opening both a neon account (with your code) and also a revolut one. It is much faster to open a revolut one- I have noticed that the fees for exchanging money for transfer is better with the revolut one to gbp compared with neon. However I am not sure if overall it is beneficial once you take into account the fees into the account. In the meantime I am still waiting for my money to transfer from my bank account into the neon account before trying out neon. I guess it takes some time-

But I am looking forward to your update :) You seem to be the veteran at this.

Hi ming,

In my update for October, this was only about using a credit card to top up Revolut, the rest of the fees haven’t changed.

Revolut is indeed cheaper than Neon to convert currency BUT:

* Revolut has extra fees on weekend

* Revolut is limited to 1250 CHF per month for free

I used Neon also a lot abroad.

But it wasn’t always accepted.

For example i could not pay Highway toll in Italy with Neon. I really didn’t know why. Meanwhile i found out that Neon card is actually prepaid not debit.

All other Banks are using Debit card. Only neon is using prepaid.

Hi HP,

That’s correct, the fact that neon is a prepaid card is sometimes an issue. And in some cases, they will only accept credit cards in which cards there no good options abroad.

Hello Baptiste, Great post !

Just wondered how would revolut charge me in the following example, (let’s assume that 1GBP = 1.25 CHF)

June 2022: I transfer CHF 1250 to 1000 GBP in my revolut account

July 2022: I transfer CHF 1250 to 1000 GBP in my revolut account

TOTAL = 2000 GBP available in my account–> No fees

August 2022 = I spend for 2000 GBP while travelling in the UK, only by paying with the card (no withdrawals)

In this example, I should not have any exchange fees ?

Thank you

James

Hi James,

My understanding is that you would pay no fees in August since you have not done any currency exchange fees. And in July and June, as long as you do your conversions during the week, you should also pay no fees.

the revolut is giving a uk iban not swiss iban

i tried to talk to cust service . but they also confirmed no swiss iban for moment

Hi jay,

That’s really weird, they had a Swiss IBAN before. Are you a Swiss resident?

Hi Baptiste, it doesn’t depend that much on where you’re resident but where/with which entity you created your Revolut account. Specifically for EU members, Revolut split entities between UK and LT on brexit. If you move to CH while having an LT entity account, you can’t use the Swiss IBAN top-up. Furthermore, there is no easy way to switch the entities. Revolut does not allow having multiple entities. You need to close the current account and open a new one and you need to transfer the funds to an external bank in the meantime.

Interesting. It’s sad how brexit complicated everything :(

Thanks for sharing the details!

I agree. This is btw similar to IBKR, but they can at least handle the transfer between entities internally if both entities support the same funds.

just looked into getting Revolut here and Switzerland isn’t listed as a Revolut country (anymore)?!

That’s weird, on the home page, when creating a new account, they still offer Switzerland as a choice for phone numbers. So, I think it should still be good. There has not been any communication with this change.

You get Swiss IBAN ofcourse but it’s pooled IBAN.

Meaning every Swiss Revolut customer has same swiss IBAN. This is only for making local payment, if you want to transfer money from other Swiss Bank account to Revolut account. For this you use this Swiss IBAN. The reference part is important.

Don’t try to receive the salary on this IBAN.

I didn’t understand correctly this week-day “free” vs weekend “fee” currency conversion.

If I have a Revolut account with a few CHF on it and I make an online purchase in EUR on a weekend, does it mean that a fee will be charged? What is the online purchase is on a week-day?

Is there a way to avoid it whatsoever which is specially useful for a holiday in an EU country? Like topping the Revolut account up in CHF and converting the whole amount into EUR?

If you have 1000 CHF and pay in EUR on a Saturday, it will be converted into EUR automatically but you will pay the weekend fee.

If you have 1000 EUR and pay in EUR on a Saturday, the EUR will be used directly and you won’t pay a fee.

So, the way to avoid this is todo the conversion in advance during the week :)

Hi, ThePoorSwiss. Thank you for the amaying work you do.

I wanted to know if you have any reccomendation for getting payments in USD on a swiss IBAN. Unfortunately, my salary is credited in USD and UBS gives an exchange rate that is so poor that it’s equivalent to a 2.5% fee. Any idea of other banks or services I could use to reduce these costs? Thanks in advance :)

Hi Michael,

Revolut and Wise would work if you trust them enough for your salary. And if your employer is willing to pay you on these platforms.

Otherwise, Interactive Brokers should work as well.

I’ve used revolut to send large amounts of money around (>100k) and had no issues, I just had to send some documents for anti money laundring checks

Thanks for sharing. I would not dare do it, but it’s good that it went fine for you!

Hi, at the moment I top up my Revolut card with my UBS card and there are no fees both ways. I charge a significant amount to my card mostly to buy stock for my side hustle online (overseas transactions) and was looking to optimize my cash back.

Do you know which cash back cards are best for topping up the Revolut card without fees?

Hi Steve,

The Cumulus card from Migros worked well the last time. But I have not tried in a long time. You will get 0.33% cashback in form of Migros coupons.

I do not know any other car that works for sure.

Hello, thank you for your post. I just moved to the UK and a friend of a friend mentioned about Revolut. Because I wanted to make sure this is legit as well as to fully understand its advantages, I needed to do some more reading. Your post has been helpful. Thanks.

Glad it was useful :)