The Trap of Life Insurance Third Pillar

| Updated: |(Disclosure: Some of the links below may be affiliate links)

For your third pillar, you can choose between an account at a third pillar provider or a life insurance policy. Many people (often advisors) recommend using a life insurance policy.

However, in practice, these third pillars have many disadvantages. There is no reason to use a life insurance 3a for your third pillar.

In this article, I detail the differences between a third pillar with a bank or an independent provider and a life insurance third pillar (life insurance 3a).

Life Insurance Third Pillar

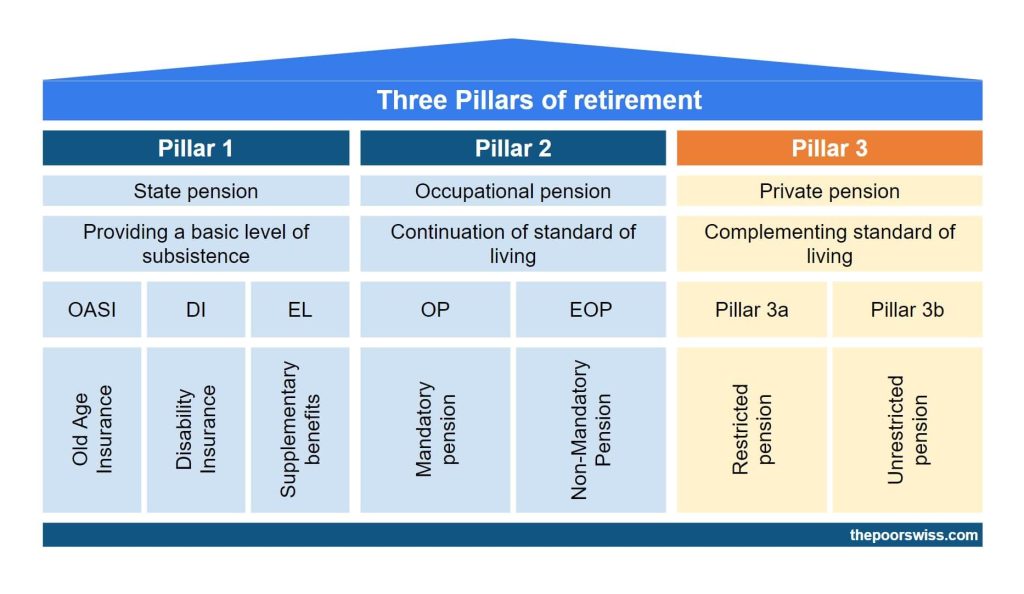

The third pillar is open to workers who pay into the second and independent people who own companies. The idea of the third pillar is simple: save money while you work and get it back when you retire.

The main advantage of the third pillar is that you can deduct your contributions from your taxable income. The third pillar is an excellent way to reduce your taxes. However, employees are limited to 7056 CHF annually (as of 2023). Generally, I recommend most people contribute to their third pillar. I contribute the maximum every year.

For your third pillar, you have two choices:

- An account with a bank or an independent provider (Finpension 3a or VIAC, for instance). I call these standard 3a accounts.

- Life insurance third pillar with most insurance providers in Switzerland. I call this life insurance 3a.

Both options have the same basics:

- You can deduct the contributions from your taxable income

- The money is locked until retirement

- Or until some specific conditions, as seen later

Both standard 3a and life insurance 3a can be invested. In both cases, there are some special retirement funds available. So, your money can be invested in stocks, bonds, or other alternative investments. Since the third pillar is a long-term account, it is excellent to invest this money.

However, they have some significant differences. And as we will see in this article, most of these differences are disadvantages of the life insurance version.

Life Insurance 3a is not flexible

Lets’s start with the first difference: flexibility.

With a standard third-pillar account, you can deposit money whenever you want. But with life insurance 3a, you must pay your premium regularly. For most providers, you will pay for months. But sometimes, you may have to pay quarterly, semi-annully or even annually. This limitation leads to several disadvantages.

First, if you want to max out your third pillar in January and forget about it, you can do it with a third pillar in a bank. With life insurance, you have no choice but to pay when the insurance tells you to.

More importantly, if you are having a bad year and do not want to contribute to your third pillar, you cannot stop paying your life insurance (without penalty). On the other hand, you can stop paying your 3a account for several years if you want. This lack of flexibility is important because it means your life insurance 3a can put you in trouble.

Finally, the maximum amount for the 3a changes every few years. If you start your life insurance 3a with a full contribution, this contribution will not follow the increase over the year.

For instance, in 2019, the maximum contribution was 6826 CHF. But in 2021, the maximum increased to 6883 CHF. If you got your life insurance 3a in 2020, you already lose 57 CHF per year in potential tax deductions. And this will increase every few years.

Of course, you could take out a standard 3a on the side to reach the maximum contribution, but most people will simply not. Usually, this limit will increase every two years. In 2023, it went up 7056 CHF.

With life insurance 3a, you are also not flexible on withdrawal. With a standard 3a account, you can withdraw money early or late. But with insurance, you can only withdraw it on the date set on the contract. So, you are stuck if you want to withdraw later or sooner than your retirement date. A standard 3a account allows you to withdraw up to 5 years in advance or up to 5 years late.

Life Insurance is not tax-efficient

While you contribute to them, both a standard 3a and a life insurance 3a are equally efficient. However, when it comes to withdrawing them, standard 3a has the potential to save you a very significant amount of money.

The reason is simple: you cannot stagger withdrawals of the life insurance 3a. Usually, you want five different third pillars. Then, you can withdraw a single third pillar account annually to save on taxes.

Indeed, the taxes in most cantons are progressive. You pay a fixed percentage on each bracket. For instance, you would pay a 5% fee on the first 30K, then a 10% fee on the next 30K, and so on.

So, if you can withdraw over several years, you can save significant money. We talk about up to 50% tax savings in the best cases. With staggered withdrawals, you could easily save more than 10’000 CHF!

And with a life insurance 3a, you are wasting money on taxes.

One may argue that you could have several insurance policies, and in theory, you could. However, most life insurance will run to your retirement date, not earlier or later. In practice, it will be tough to plan this properly. And you have to get it right the first time since you cannot change it afterward.

Life Insurance 3a fees are expensive

Many people do not realize that when you invest in life insurance 3a, a significant percentage of your contributions feed the risk premiums. Since this is life insurance, it can pay out in case of death or disability.

And this does not come from the principal but from the risk premiums. Each contribution is split into two parts. Some percentage goes into the capital and stays there until retirement. Another portion goes to the risk premium. This percentage is lost to you and goes to the insurance company.

There is nothing wrong with the principle. Insurances need risk premiums to cover the risks for their customers. However, there are a few things wrong when related to your 3a:

- The risk premium percentage is very significant

- A significant part of your retirement money is lost

- Advisors are not forthcoming with this

In practice, life insurance will take anything from 10% to 25% of your contributions. Every time you contribute to your life insurance 3a, you lose 10% to 25%!

For many people, it is already challenging to contribute a significant amount of money to their third pillar. And seeing such a large percentage disappear is not comfortable!

Not only that, but the fees of the funds available are also very high. I have looked into the funds from Generali, where I have my life insurance, and the fees of funds are all about 1%. And some insurance companies invest in funds with more than 2% yearly fees. And the advisors telling you that these active funds will outperform the market are either lying or delusional.

On top of that, many of these funds have load fees. You will lose even more of your money before it is invested. It is not uncommon to see 5% load fees. Again, whenever your money is invested into the funds, you lose 5% of the value!

So, these high fees will reduce your performance even more.

Life Insurance 3a returns are bad

The advisors will tell you you can get good returns on your life insurance 3a. But in practice, this is far from correct.

You can indeed invest your money from your life insurance 3a. However, the money is invested in expensive active funds that will significantly underperform the market in the long term.

On top of that, these investments are generally very conservative. It is rare to go higher than 35% in stocks. Since this money is locked away for several decades, a high stock allocation would make more sense.

We can take my Generali life insurance 3a as an example. I started to invest in August 2016. At the end of 2019, I asked them about the performance of my money. On average, I got 0.4% returns per year. During that same, the US stock market returned 45%, and the Swiss stock market returned 30%.

And the finpension Global 40 fund would have returned about 19%! Again, finpension 3a would have 45 times more returns during the same period!

The two funds for my life insurance invest 35% in stocks. So, having 0.4% returns yearly during a bull market is a joke!

We can compare one of the funds from Generali, GENERAL INVEST – Risk Control 5, with some other investment options from February 2015 to September 2022:

- Generali INVEST: -10%

- Swiss Stock Market (SPI) ETF: +29%

- US Stock Market (S&P 500) ETF: +87%

- finpension global 40: +23%

- finpension global 100: +69%

With a conservative portfolio at finpension, you would have gained 29% of your money. But with a conservative fund at Generali, you would have lost 10% of your money!

Before making that comparison, I knew that Generali funds were bad, but I had no idea how bad they were. This performance is atrocious.

You likely do not need the insurance

One advantage of life insurance 3a is that you get some insurance benefits.

If you die before retirement, your spouse will get the capital you would have gotten at retirement. And if you are incapacitated and unable to pay your premiums, the insurance will pay for you.

Insurance is all good, but do you need insurance coverage? Advisors will tell you everybody needs this insurance coverage, which is dumb. Insurance that is always worthwhile has not been invented.

First, you do not need death life insurance without dependents or heirs. If nobody depends on you and you die, the capital will return to the insurance company. This could still go to your heirs even if you have no dependents. But you must ask yourself whether they need that insurance if they are not depending on you.

Then, we have good insurance coverage already in Switzerland in many cases.

And if you are a double-income earner household, chances are that your spouse could handle the financial side without you. On top of that, the first and second pillars have benefits for your spouse if you die.

If you lose your job, you will get up to 80% of your income for up to 3 years. You would still be able to pay your life insurance premiums and are unlikely to be in financial trouble.

If you are disabled, you will get disability insurance and receive assistance to return to work if possible.

The need for life insurance is reserved for very few cases. In which cases, better options exist, like pure risk term life insurance.

Life insurance 3a has guaranteed value

We now go over the last difference. A life insurance 3a has some guaranteed value. On the other hand, a standard invested 3a account has no guaranteed value.

Now, we need to relativize that guarantee. First, no interest is guaranteed. So what is guaranteed is the amount without any performance. The performance cannot be negative.

However, you should know that the guaranteed value differs from what you contributed. We have seen that fees are expensive before. These overall fees include the risk premiums. At least 10% of your contributions will be lost to the risk premiums and direct fees.

Since we have seen that returns are very low for life insurance and that you will lose at least 10% to risk, the guaranteed value is not that interesting anymore.

If you invest that money long-term, you can expect significantly more money. While there have been some 20-year bad periods in the stock market, they are very rare. And over 30 years, the stock market has historically been great.

Life Insurance 3a vs invested 3a

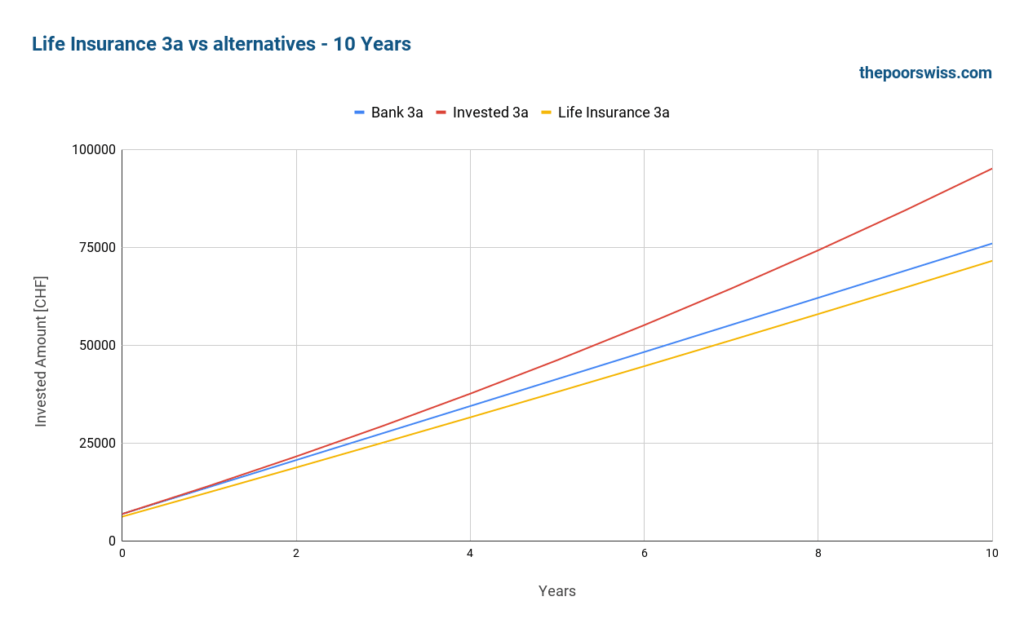

Finally, we can make a small comparison of some products. We will have to assume a few things:

- The bank 3a account will return 0.1% per year, and there are no fees

- The life insurance 3a will return 1% per year after fees, and 10% of the investments will go to the risk premiums

- The invested 3a will return 4.5% per year after fees, and there are no extra fees

Each year of the simulation, 6883 gets invested into the product. There are no adjustments for this amount over time. In practice, this amount would rise for the bank 3a and the invested 3a.

You may think the invested 3a has an advantage in my assumptions. But my numbers are pretty conservative in both senses. A 3a invested 99% in stocks could return significantly more than 4.5% per year. And on the other hand, many life insurance 3a will return less than 1% per year (mine returned 0.4% on average during a bull market for three years).

And on top of that, some insurance will charge more than 20% for the risk premiums. So, these assumptions are being nice to life insurance 3a.

So, here is how these three products would result after ten years:

The result is quite surprising. After ten years, you would be better off with a bank 3a with a 0.1% interest rate than a life insurance 3a. Losing 10% of the premiums makes a huge difference, and poor returns make compensating difficult. Even over ten years, a bank 3a would leave you with 5000 CHF more than the life insurance 3a. With a good 3a, you would have about 23K CHF. Such an amount of money can make a very significant difference in your retirement.

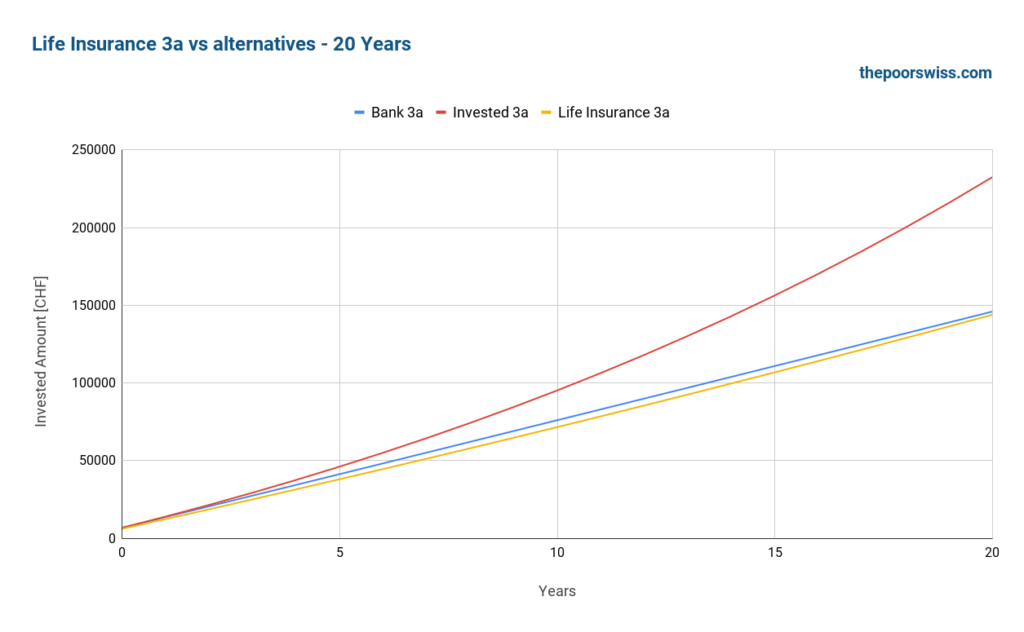

Here is what happens after twenty years.

After twenty years, life insurance 3a still is worse than bank 3a. This result is bad. The difference is only 2000 CHF, but it still shows the extremely poor returns of life insurance 3a.

After twenty years, the difference with a good 3a becomes extremely impressive. Indeed, in that simulation, the invested 3a has 88K CHF more than the life insurance 3a. Put another way, the person with an invested 3a has 61% more money in retirement than the person with a life insurance 3a.

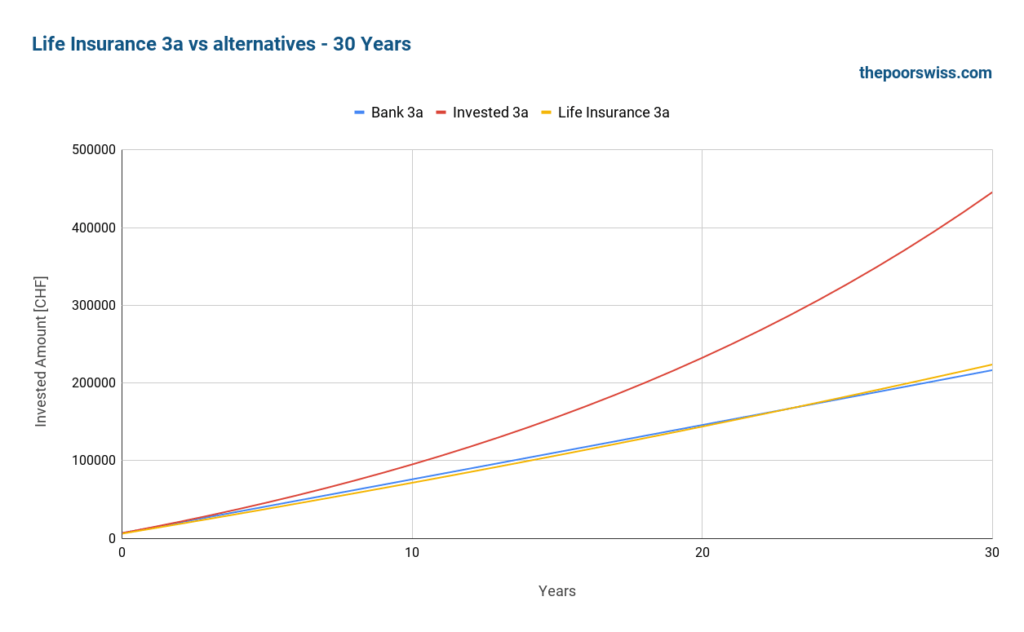

Finally, we look at thirty years.

Finally, life insurance 3a is at the same level as bank 3a. However, the difference is only 7000 CHF.

After thirty years, the invested 3a now has twice more money as the life insurance 3a. We are talking about a difference of more than 220’000 CHF after thirty years. Such an amount of money could change your life in retirement.

This result comes from only a single simulation. In practice, there are some cases where life insurance would do better than this one. But there are also cases where the invested 3a does much better. And there are some much worse insurance policies out there. I strongly doubt any insurance 3a comes close to a good invested 3a.

Why does life insurance 3a exist?

With all these disadvantages, we may wonder why these products exist. And it is a fair question.

After doing all this research, I believe life insurance 3a should not exist! They are horrible investments and will likely result in much lower retirement money than if you had used a proper third pillar account.

The reason life insurance 3a exists is simple: They are highly profitable to insurance companies and insurance advisors. I think there is no good reason for their existence.

Advisors make large commissions on these products. So, they push these products quite hard. Unfortunately, most Swiss people are not educated enough about investment and retirement to understand these products. And most people trust advisors.

What to do instead?

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

The third pillar in Switzerland is great for investing money and saving taxes. Life insurance 3a being bad should not stop you from investing in the third pillar.

If we eliminate life insurance 3a, there are two options for your third pillar. Either you invest with a bank, or you invest with an independent provider. In practice, I highly recommend using an independent provider like Finpension 3a.

Finpension (and other independent providers) have many advantages over a life insurance 3a:

- You will get more returns on average

- All your contributions will go to the capital

- You will pay lower fees on the invested capital

- You will get a more transparent third pillar

- You are flexible as to when you contribute

- You can save taxes with staggered withdrawals

And if you are afraid of investing and want guaranteed capital, you can invest in a bank and get a tiny interest rate. In my opinion, a bank 3a is already better than a life insurance 3a.

If you need help choosing the third pillar, read my articles about the best third pillar in Switzerland.

And if you need life insurance, you should get a pure-risk term life insurance policy. There are many of them. I have never delved into them, so I do not know which is best, but I am sure there are some good ones.

For a simple example, I have looked at the calculator for Allianz for 30 years and 120’000 CHF coverage, comparable to my insurance policy. This pure risk life insurance includes paying your premiums if incapacitated. So, this is very close to a life insurance 3a.

Such insurance would cost me 379 CHF per year. Over 30 years, this pure risk life insurance would cost 11’370 CHF. If you remember the results two sections before, the life insurance 3a will result in 220’000 CHF less money than the invested 3a. For the cost of 11’370 CHF, you can get a great 3a and separate life insurance.

Note that I do not particularly endorse Allianz. Their calculator is the simplest I found.

This simple comparison shows how bad life insurance 3a is. You can get good life insurance for cheap and good 3a with much higher returns and transparency.

Conclusion

When I started this article, I knew life insurance 3a was a bad investment. But after going through the research, I now realize life insurance 3a is a horrible investment!

There are much better alternatives out there. I would not recommend life insurance 3a to anyone. Instead, use a great third pillar like finpension (my review here). And if you need life insurance, take pure risk insurance instead and continue investing in a good 3a.

Now, there is one question I have not answered in this article: What should you do if you already have a bad life insurance 3a? First, do not be ashamed. Many people fell into the life insurance 3a trap, including me. That is right! I fell into this trap!

There are a few options to get out of a life insurance 3a. I encourage you to at least look at them if you have life insurance 3a.

To start investing with an excellent third pillar, you should read about the best third pillar from Switzerland or my review of Finpension 3a.

What about you? What do you think of life insurance 3a? Did you fall into this trap?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- What should you do with a life insurance 3a?

- Your retirement benefits after your death

- Third Pillar: All you need to know to retire in Switzerland

Simply put: a fantastically drastic demonstration of the difference. Excellent example with the separate insurance at the end – it shows who is making the money on the insurance.

Thanks :)

Yes, the results are quite dramatic.

Ooof. Yeah… guess I’ve fallen into said trap. Have a Mobiliar 3a and the risk premium is 10.5%. It’s being invested there in their Fonds 60A plan (the new 90A started 2019 goes higher though) and I’m investing 3000 yearly. The rest I’m doing with bank 3a solutions and 100% stocks (but a high TER of 1%). I’ll have to take a look at Finpension… wish I’d have known more about this and your blog back then! ;) I guess that’ll be my next 3a “solution”. I think you can have up to 5 (?) 3a accounts without getting into trouble regardless of canton? Ideally keeping funds per account at roughly 30-50k due to tax reasons?

Still, I guess the most important thing is actually maxing out yearly 3a… and according to the statistics ~10% do that. So whatever one of these options, you’re better off than a majority here in Switzerland when it comes to pension planning.

Yes, spreading your 3rd pillar withdrawals across up to 5 fiscal years is a good way to mitigate tax progression.

In practice, it means you need at least 5 accounts because institutions do not split existing accounts nor allow partial withdrawal at maturity. However, the tax office does not mind if you withdraw more than 5 accounts in total, only that you do it on up to 5 fiscal years.

Thanks for sharing!

That’s correct, 5 is the ideal number. But some cantons will not allow you to withdraw them over 5 years, so, you have to learn about that before withdrawing. The idea is to keep them all at the same level more or less.

But you are right, a life insurance 3a is still likely better than no 3a :)

Hi Baptiste

What do you think about Mobiliar’s new 3a solution: “Vorausschauende

Sparversicherung”? Looks like a good (or at least better) offer on first glance…

Hi,

I think it’s just a marketing idea to do something different. But I don’t see that as a major advantage. Removing money from your returns and then adding it when it’s low as a strong opportunity cost over the long term since we expect the market to go up in average.

Also, they share nothing about fees.

I wish I’ve known this back in 2014 when we signed for an insurance 3a with Zurich. We stopped after a few years after realizing a nice loss. Never take an insurance 3A, ever!

Thanks for sharing, Laszlo!

And congratulations on getting rid of it!

Great insights as usual!

Might wanna link your finpension review in the conclusion text.

Thanks, Paul!

I added the link :)

Thank you for this overview. I have subscribed to an Axa 3a insurance about 18 months ago and so I am now very concerned with how to best contain the damage. As far as I understand, if I stop paying I will lose what I contributed so far. But I know that I can also reduce my contribution from the current CHF 570 monthly circa (6880 / 12) down to a minimum of about CHF 50 / month. This way, I could open a new investment 3a. In this case, I guess my existing contributions would not be lost and I would somehow diversify the risks keeping a “small” insurance 3a next to the main invested 3a. Would this be smart? Or should I just quit, pay the consequences and restart?

Two more questions: 1. Did you leave your insurance 3a? 2. What would happen in sustained bear market? I would expect insurance 3a portfolio to still perform better in very bad times.

Thanks and I look forward to the new article.

Hi Andrea,

If you stop paying (releasing the premiums), you may not lose anything. But you have to check whether that’s possible with your contract. Indeed, reducing the premiums to a minimum is a good option.

Keep in mind that during the first few years, you are losing the most money. Mathematically, it’s probably better to break the contract and start over.

Next Tuesday, I have an article about the options on what to do and I will share my own strategy, stay tuned!

Thank you Baptiste,

I also fell into this trap.

They made me an offer where my loan on the house was more attractive if I signed up.

I thought that sounded pretty much like my 3 pillars.

I have to deal with it and stop it.

So I’ll be watching for your article that suggests how to do it without too much damage.

Hi Dror

Thanks for sharing!

It’s sad that banks are also pushing that even though they know the consumer is not going to profit from that.

Hi Baptiste,

Thanks for this review. I knew life insurance 3a was pretty bad but your charts make it actually frightening! I am glad I got my 3a invested through my bank mutual funds (which were really bad) and could at least easily switch to finpension!

As far as third pillar 3b is concerned, do you have any tips? I understand that there is not a lot of choice aside from life insurance? I like 3b because of premium deductibles in Geneva. Thanks!

Hi Benedicte,

Doing the research also made me realize it was much worse than I thought.

And indeed, a bad bank 3a is much better than a life insurance 3a.

I think 3b is indeed only tied to life insurance. Given the very low tax deductions, I would avoid it.

Have always wondered about this version of penision and why it existed. Thanks for clarifying! By the way I think you say it outperforms the market instead of underperforms near the start of the article, prob a typo. Great article!

Hi Daniel,

It should not exist :(

Thanks, I think I have updated the typo!

I fell into the trap as well. I kept the life insurance for 2 years and after seeing the poor returns I surrendered. I opened a VIAC account since then and am very happy.

I lost a few thousand with surrendering the life insurance, but lesson learned and since then I’m investing the poor Swiss way, far away from any financial advisors :)

Same here! It hurts but it would have been much worse if we had waited longer.

Hopefully this message gets to a lot of people so they do not make the same (expensive) mistake.

Well done Adrian!

Hi huybster,

Well done! It sucks losing this money, but over the long-term, this is going to be a net gain!

Banks might require an insured 3a for the indirect amortization of a mortgage.

It’s still a bad investment but it’s better then direct amortization

I disagree. I would much prefer direct amortization to an insurance 3a indirect amortization.

VitaInvest passive in UBS has not the best TER in the world (0.90%), but it’s following pretty much VT.

In another forum there was someone doing the comparison with direct amortization and it was not so different.

Hi Wavemotion,

I don’t think Vitainvest is a life insurance 3a. It’s a banking 3a with funds from UBS, no? These are two different subjects.

oops, I thought that Mauro was referring to a bank 3a

I know that SwissLife tries to sell you the insurance in “exchange” of a lower interest rate. Not sure about banks.

Banks like life insurance 3a too, so maybe they would lower interest rates for them?

The goal for the bank is to have an insurance for the case where you stop paying the agreed amortization due to loss of income. A 3a insurance product makes that straightforward. At the same time the customer profits from the (suboptimal) 50-100% stocks allocation that is desirable given the long investment horizon (15+ years) of an amortization plan.

Ideally, the bank would be happy just with any 3a and a separate insurance, but that cannot be pledged as a bundle far as I know.

Can you clarify why you think direct amortization would be preferable in such a situation? That would be the case if the insurance 3a would return less than the invested capital after 15 years.

Direct amortization has only a small advantage: you save money on taxes and you keep money in a better investment instrument. However, a life insurance 3a over many years will return less than the money in your home and what you save on taxes. Indirect amortization makes sense if you can put it in a good 3a, not if you put it in a bad life insurance 3a.

Finpension 3a and direct amortization will save you tens of thousands over the long term compared to indirect amortization in a life insurance 3a.