The Trap of Life Insurance Third Pillar

| Updated: |(Disclosure: Some of the links below may be affiliate links)

For your third pillar, you can choose between an account at a third pillar provider or a life insurance policy. Many people (often advisors) recommend using a life insurance policy.

However, in practice, these third pillars have many disadvantages. There is no reason to use a life insurance 3a for your third pillar.

In this article, I detail the differences between a third pillar with a bank or an independent provider and a life insurance third pillar (life insurance 3a).

Life Insurance Third Pillar

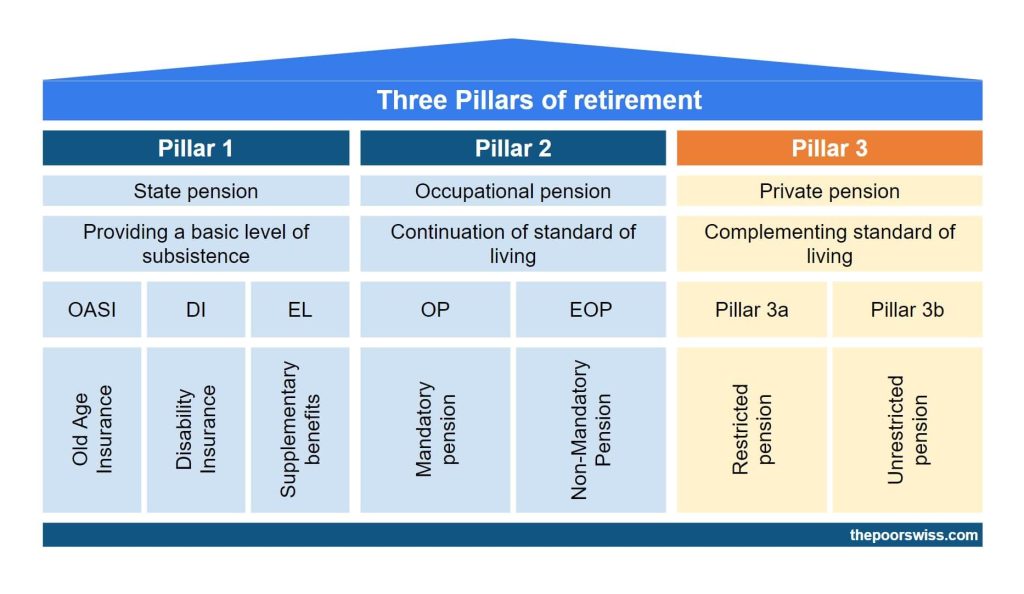

The third pillar is open to workers who pay into the second and independent people who own companies. The idea of the third pillar is simple: save money while you work and get it back when you retire.

The main advantage of the third pillar is that you can deduct your contributions from your taxable income. The third pillar is an excellent way to reduce your taxes. However, employees are limited to 7056 CHF annually (as of 2023). Generally, I recommend most people contribute to their third pillar. I contribute the maximum every year.

For your third pillar, you have two choices:

- An account with a bank or an independent provider (Finpension 3a or VIAC, for instance). I call these standard 3a accounts.

- Life insurance third pillar with most insurance providers in Switzerland. I call this life insurance 3a.

Both options have the same basics:

- You can deduct the contributions from your taxable income

- The money is locked until retirement

- Or until some specific conditions, as seen later

Both standard 3a and life insurance 3a can be invested. In both cases, there are some special retirement funds available. So, your money can be invested in stocks, bonds, or other alternative investments. Since the third pillar is a long-term account, it is excellent to invest this money.

However, they have some significant differences. And as we will see in this article, most of these differences are disadvantages of the life insurance version.

Life Insurance 3a is not flexible

Lets’s start with the first difference: flexibility.

With a standard third-pillar account, you can deposit money whenever you want. But with life insurance 3a, you must pay your premium regularly. For most providers, you will pay for months. But sometimes, you may have to pay quarterly, semi-annully or even annually. This limitation leads to several disadvantages.

First, if you want to max out your third pillar in January and forget about it, you can do it with a third pillar in a bank. With life insurance, you have no choice but to pay when the insurance tells you to.

More importantly, if you are having a bad year and do not want to contribute to your third pillar, you cannot stop paying your life insurance (without penalty). On the other hand, you can stop paying your 3a account for several years if you want. This lack of flexibility is important because it means your life insurance 3a can put you in trouble.

Finally, the maximum amount for the 3a changes every few years. If you start your life insurance 3a with a full contribution, this contribution will not follow the increase over the year.

For instance, in 2019, the maximum contribution was 6826 CHF. But in 2021, the maximum increased to 6883 CHF. If you got your life insurance 3a in 2020, you already lose 57 CHF per year in potential tax deductions. And this will increase every few years.

Of course, you could take out a standard 3a on the side to reach the maximum contribution, but most people will simply not. Usually, this limit will increase every two years. In 2023, it went up 7056 CHF.

With life insurance 3a, you are also not flexible on withdrawal. With a standard 3a account, you can withdraw money early or late. But with insurance, you can only withdraw it on the date set on the contract. So, you are stuck if you want to withdraw later or sooner than your retirement date. A standard 3a account allows you to withdraw up to 5 years in advance or up to 5 years late.

Life Insurance is not tax-efficient

While you contribute to them, both a standard 3a and a life insurance 3a are equally efficient. However, when it comes to withdrawing them, standard 3a has the potential to save you a very significant amount of money.

The reason is simple: you cannot stagger withdrawals of the life insurance 3a. Usually, you want five different third pillars. Then, you can withdraw a single third pillar account annually to save on taxes.

Indeed, the taxes in most cantons are progressive. You pay a fixed percentage on each bracket. For instance, you would pay a 5% fee on the first 30K, then a 10% fee on the next 30K, and so on.

So, if you can withdraw over several years, you can save significant money. We talk about up to 50% tax savings in the best cases. With staggered withdrawals, you could easily save more than 10’000 CHF!

And with a life insurance 3a, you are wasting money on taxes.

One may argue that you could have several insurance policies, and in theory, you could. However, most life insurance will run to your retirement date, not earlier or later. In practice, it will be tough to plan this properly. And you have to get it right the first time since you cannot change it afterward.

Life Insurance 3a fees are expensive

Many people do not realize that when you invest in life insurance 3a, a significant percentage of your contributions feed the risk premiums. Since this is life insurance, it can pay out in case of death or disability.

And this does not come from the principal but from the risk premiums. Each contribution is split into two parts. Some percentage goes into the capital and stays there until retirement. Another portion goes to the risk premium. This percentage is lost to you and goes to the insurance company.

There is nothing wrong with the principle. Insurances need risk premiums to cover the risks for their customers. However, there are a few things wrong when related to your 3a:

- The risk premium percentage is very significant

- A significant part of your retirement money is lost

- Advisors are not forthcoming with this

In practice, life insurance will take anything from 10% to 25% of your contributions. Every time you contribute to your life insurance 3a, you lose 10% to 25%!

For many people, it is already challenging to contribute a significant amount of money to their third pillar. And seeing such a large percentage disappear is not comfortable!

Not only that, but the fees of the funds available are also very high. I have looked into the funds from Generali, where I have my life insurance, and the fees of funds are all about 1%. And some insurance companies invest in funds with more than 2% yearly fees. And the advisors telling you that these active funds will outperform the market are either lying or delusional.

On top of that, many of these funds have load fees. You will lose even more of your money before it is invested. It is not uncommon to see 5% load fees. Again, whenever your money is invested into the funds, you lose 5% of the value!

So, these high fees will reduce your performance even more.

Life Insurance 3a returns are bad

The advisors will tell you you can get good returns on your life insurance 3a. But in practice, this is far from correct.

You can indeed invest your money from your life insurance 3a. However, the money is invested in expensive active funds that will significantly underperform the market in the long term.

On top of that, these investments are generally very conservative. It is rare to go higher than 35% in stocks. Since this money is locked away for several decades, a high stock allocation would make more sense.

We can take my Generali life insurance 3a as an example. I started to invest in August 2016. At the end of 2019, I asked them about the performance of my money. On average, I got 0.4% returns per year. During that same, the US stock market returned 45%, and the Swiss stock market returned 30%.

And the finpension Global 40 fund would have returned about 19%! Again, finpension 3a would have 45 times more returns during the same period!

The two funds for my life insurance invest 35% in stocks. So, having 0.4% returns yearly during a bull market is a joke!

We can compare one of the funds from Generali, GENERAL INVEST – Risk Control 5, with some other investment options from February 2015 to September 2022:

- Generali INVEST: -10%

- Swiss Stock Market (SPI) ETF: +29%

- US Stock Market (S&P 500) ETF: +87%

- finpension global 40: +23%

- finpension global 100: +69%

With a conservative portfolio at finpension, you would have gained 29% of your money. But with a conservative fund at Generali, you would have lost 10% of your money!

Before making that comparison, I knew that Generali funds were bad, but I had no idea how bad they were. This performance is atrocious.

You likely do not need the insurance

One advantage of life insurance 3a is that you get some insurance benefits.

If you die before retirement, your spouse will get the capital you would have gotten at retirement. And if you are incapacitated and unable to pay your premiums, the insurance will pay for you.

Insurance is all good, but do you need insurance coverage? Advisors will tell you everybody needs this insurance coverage, which is dumb. Insurance that is always worthwhile has not been invented.

First, you do not need death life insurance without dependents or heirs. If nobody depends on you and you die, the capital will return to the insurance company. This could still go to your heirs even if you have no dependents. But you must ask yourself whether they need that insurance if they are not depending on you.

Then, we have good insurance coverage already in Switzerland in many cases.

And if you are a double-income earner household, chances are that your spouse could handle the financial side without you. On top of that, the first and second pillars have benefits for your spouse if you die.

If you lose your job, you will get up to 80% of your income for up to 3 years. You would still be able to pay your life insurance premiums and are unlikely to be in financial trouble.

If you are disabled, you will get disability insurance and receive assistance to return to work if possible.

The need for life insurance is reserved for very few cases. In which cases, better options exist, like pure risk term life insurance.

Life insurance 3a has guaranteed value

We now go over the last difference. A life insurance 3a has some guaranteed value. On the other hand, a standard invested 3a account has no guaranteed value.

Now, we need to relativize that guarantee. First, no interest is guaranteed. So what is guaranteed is the amount without any performance. The performance cannot be negative.

However, you should know that the guaranteed value differs from what you contributed. We have seen that fees are expensive before. These overall fees include the risk premiums. At least 10% of your contributions will be lost to the risk premiums and direct fees.

Since we have seen that returns are very low for life insurance and that you will lose at least 10% to risk, the guaranteed value is not that interesting anymore.

If you invest that money long-term, you can expect significantly more money. While there have been some 20-year bad periods in the stock market, they are very rare. And over 30 years, the stock market has historically been great.

Life Insurance 3a vs invested 3a

Finally, we can make a small comparison of some products. We will have to assume a few things:

- The bank 3a account will return 0.1% per year, and there are no fees

- The life insurance 3a will return 1% per year after fees, and 10% of the investments will go to the risk premiums

- The invested 3a will return 4.5% per year after fees, and there are no extra fees

Each year of the simulation, 6883 gets invested into the product. There are no adjustments for this amount over time. In practice, this amount would rise for the bank 3a and the invested 3a.

You may think the invested 3a has an advantage in my assumptions. But my numbers are pretty conservative in both senses. A 3a invested 99% in stocks could return significantly more than 4.5% per year. And on the other hand, many life insurance 3a will return less than 1% per year (mine returned 0.4% on average during a bull market for three years).

And on top of that, some insurance will charge more than 20% for the risk premiums. So, these assumptions are being nice to life insurance 3a.

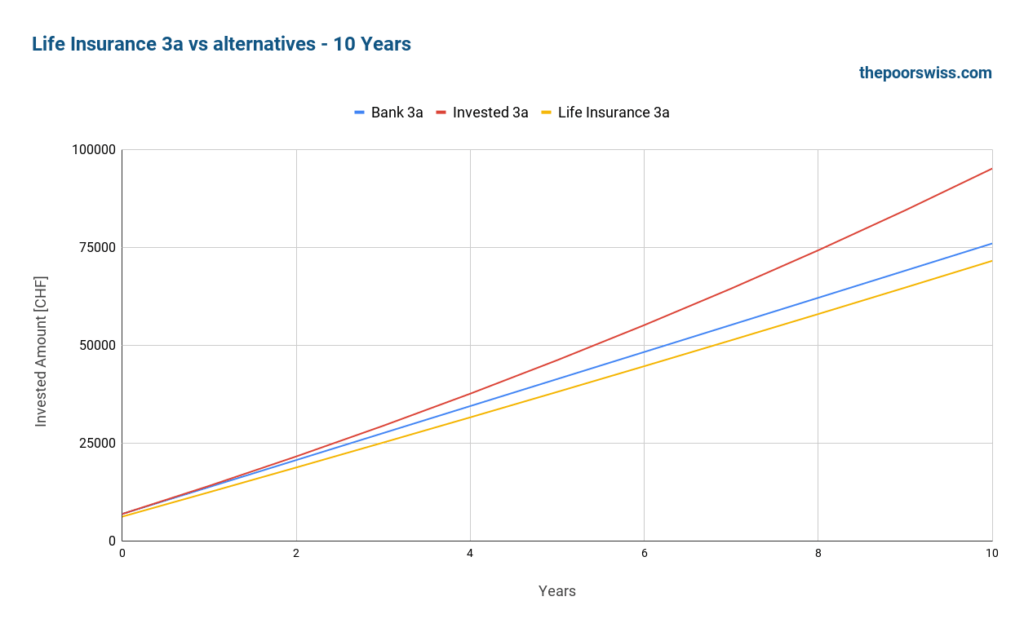

So, here is how these three products would result after ten years:

The result is quite surprising. After ten years, you would be better off with a bank 3a with a 0.1% interest rate than a life insurance 3a. Losing 10% of the premiums makes a huge difference, and poor returns make compensating difficult. Even over ten years, a bank 3a would leave you with 5000 CHF more than the life insurance 3a. With a good 3a, you would have about 23K CHF. Such an amount of money can make a very significant difference in your retirement.

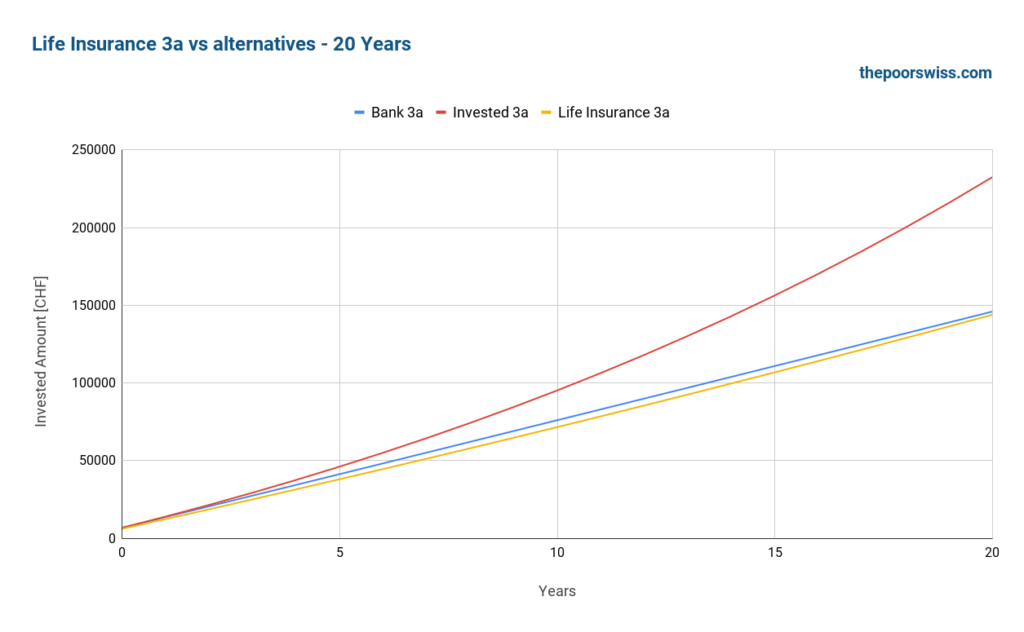

Here is what happens after twenty years.

After twenty years, life insurance 3a still is worse than bank 3a. This result is bad. The difference is only 2000 CHF, but it still shows the extremely poor returns of life insurance 3a.

After twenty years, the difference with a good 3a becomes extremely impressive. Indeed, in that simulation, the invested 3a has 88K CHF more than the life insurance 3a. Put another way, the person with an invested 3a has 61% more money in retirement than the person with a life insurance 3a.

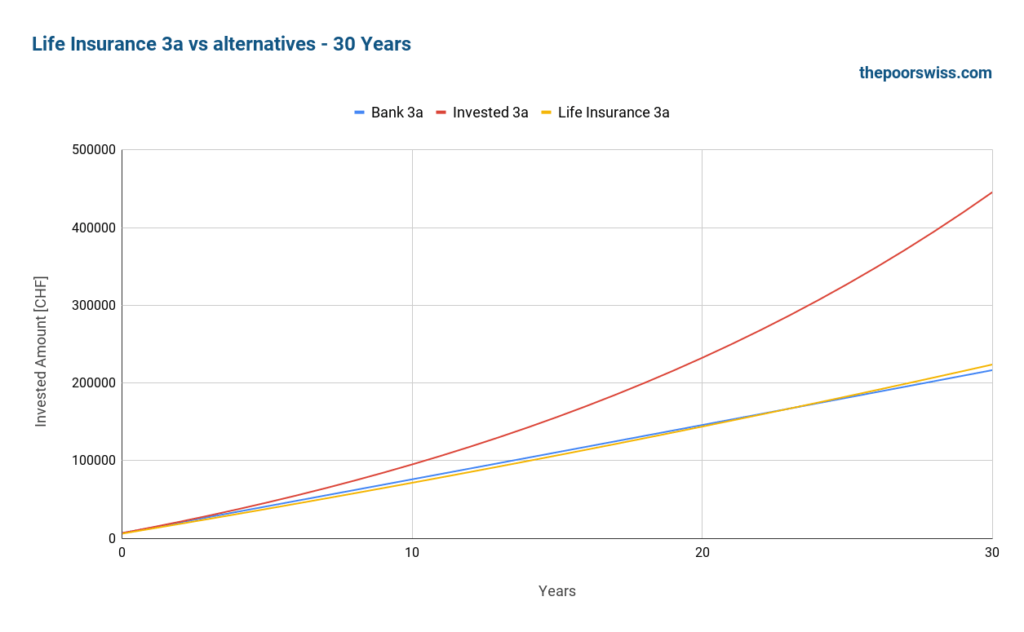

Finally, we look at thirty years.

Finally, life insurance 3a is at the same level as bank 3a. However, the difference is only 7000 CHF.

After thirty years, the invested 3a now has twice more money as the life insurance 3a. We are talking about a difference of more than 220’000 CHF after thirty years. Such an amount of money could change your life in retirement.

This result comes from only a single simulation. In practice, there are some cases where life insurance would do better than this one. But there are also cases where the invested 3a does much better. And there are some much worse insurance policies out there. I strongly doubt any insurance 3a comes close to a good invested 3a.

Why does life insurance 3a exist?

With all these disadvantages, we may wonder why these products exist. And it is a fair question.

After doing all this research, I believe life insurance 3a should not exist! They are horrible investments and will likely result in much lower retirement money than if you had used a proper third pillar account.

The reason life insurance 3a exists is simple: They are highly profitable to insurance companies and insurance advisors. I think there is no good reason for their existence.

Advisors make large commissions on these products. So, they push these products quite hard. Unfortunately, most Swiss people are not educated enough about investment and retirement to understand these products. And most people trust advisors.

What to do instead?

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

The third pillar in Switzerland is great for investing money and saving taxes. Life insurance 3a being bad should not stop you from investing in the third pillar.

If we eliminate life insurance 3a, there are two options for your third pillar. Either you invest with a bank, or you invest with an independent provider. In practice, I highly recommend using an independent provider like Finpension 3a.

Finpension (and other independent providers) have many advantages over a life insurance 3a:

- You will get more returns on average

- All your contributions will go to the capital

- You will pay lower fees on the invested capital

- You will get a more transparent third pillar

- You are flexible as to when you contribute

- You can save taxes with staggered withdrawals

And if you are afraid of investing and want guaranteed capital, you can invest in a bank and get a tiny interest rate. In my opinion, a bank 3a is already better than a life insurance 3a.

If you need help choosing the third pillar, read my articles about the best third pillar in Switzerland.

And if you need life insurance, you should get a pure-risk term life insurance policy. There are many of them. I have never delved into them, so I do not know which is best, but I am sure there are some good ones.

For a simple example, I have looked at the calculator for Allianz for 30 years and 120’000 CHF coverage, comparable to my insurance policy. This pure risk life insurance includes paying your premiums if incapacitated. So, this is very close to a life insurance 3a.

Such insurance would cost me 379 CHF per year. Over 30 years, this pure risk life insurance would cost 11’370 CHF. If you remember the results two sections before, the life insurance 3a will result in 220’000 CHF less money than the invested 3a. For the cost of 11’370 CHF, you can get a great 3a and separate life insurance.

Note that I do not particularly endorse Allianz. Their calculator is the simplest I found.

This simple comparison shows how bad life insurance 3a is. You can get good life insurance for cheap and good 3a with much higher returns and transparency.

Conclusion

When I started this article, I knew life insurance 3a was a bad investment. But after going through the research, I now realize life insurance 3a is a horrible investment!

There are much better alternatives out there. I would not recommend life insurance 3a to anyone. Instead, use a great third pillar like finpension (my review here). And if you need life insurance, take pure risk insurance instead and continue investing in a good 3a.

Now, there is one question I have not answered in this article: What should you do if you already have a bad life insurance 3a? First, do not be ashamed. Many people fell into the life insurance 3a trap, including me. That is right! I fell into this trap!

There are a few options to get out of a life insurance 3a. I encourage you to at least look at them if you have life insurance 3a.

To start investing with an excellent third pillar, you should read about the best third pillar from Switzerland or my review of Finpension 3a.

What about you? What do you think of life insurance 3a? Did you fall into this trap?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- What is a 1e pension plan (pillar 1e)?

- Can you retire early with Swiss Stocks and Bonds?

- What is the Substitute Occupational Benefit Institution?

Hi Baptiste,

I am sure you would get this often! Thank you for all your effort in explaining the Pillar 3A system. I was very nearly sucked into a bad insurance linked pillar 3A with enormous hidden costs. Your blogs and resources helped uncover the numerous negative aspects of a policy that sounded like a great option when pitched by a so-called “independent” financial advisor.

Expanding on your conversation with “Nicolas”, my offer from Axa was with an option to invest 100% in a globally diversified fund and increase the premium to maximize the 3a tax saving potential should it also increase. Their projected performance for a moderate performance of the fund was 5.16 % p.a. The sticking point was the costs and fees associated. They say that the cost of funds add up to 0.5% p.a. Seemed like a cracking option, but a careful inspection of their projected returns with some basic calculations seemed to show added costs that are not very transparent.

Do you think any insurance company linked pillar 3A products with 100% fund investment options could be beneficial purely from a fund performance aspect (apart from the obvious inflexibility and “lock-in”)?

If not and funds from banks and/or finpension, VIAC, frankly outperform funds from insurance companies, why do these pillar 3A exists (as you pointed out that it is beneficial to decouple insurance and pension savings)?

Thank you very much!

Hi,

Thanks for sharing the details. Indeed, 0.5%, at first sight, looks good, but then you have to read all the small letters to make sure there are no hidden fees (and there are often). Also, the performance is only on the invested part, not on the premiums part which is lost.

From what I have seen, I do not think any insurance company provides a good 3a. They do not even come close to Finpension 3a.

In my opinion, they exist solely because these policies make a lot of money to insurance companies and insurance advisors. I do not see any other reason for them to exist.

Thank you Baptiste!

I hope resources such as yours get more visibility than these heavily marketed products. I also think these companies and advisors are learning as one of the first thing my advisor told me was, “you do not pay any premiums for insurance, as some basic insurance component is provided for free”.

So, looking at my offer documents, the product is called, Axa SmartFlex, where there are options to add/remove insurance components, and options to even invest 100% of the contribution toward a fund. However, the sticking point was the hidden fee (and the lack of flexibility), which I wouldn’t have known. So I think advisors are catching up and tuning their pitch to catch more people.

I would be extremely surprised if any Swiss insurance company provided any service for free!

But they are doing a good job of presenting offers to people. And unfortunately, their websites rank much higher than mine because they have much more resources to make them rank. But at least, I can reach a few people already, and that’s good!

Hi Baptist!

Thank you for your blog and all the work you put into your posts! Fantastic resource for ex-pats!

The product mentioned by Nicolas is not a pure 3a life insurance option but rather “3a saving insurence option”(so-called 3a Sparversicherung). I was recently advised by an advisor from SVAG company to get one. I don’t know if you have heard of them, but it seems like the advisor itself does, not directly benefit from you signing the agrement.

This GENERALI products is called Multi index100 – which, funny enough, is in the PDF file someone posted here. Their TER is 0.27% and its invested 82.5% stocks, 17.5 % in commodities and physical gold. Stocks are invested in basket of fair ETFs weighted 20% swiss, 17.5% European, 35% US, 10% Japan. Among the ETF issuers are Vanguards, and iShares. Management fee for the found seems to be 0.25% as it invests into passive instruments.

I need to find out what % of payment is actually invested into the fonds. At the same time I wonder if in this option, though, it does not even out getting normal life insurance policy as the Allianz one in your example.

Could you also comment on that:

“Normally, as long as you plan to come back, you can keep your 3a, either life insurance or bank, while living abroad for a few years. It should not be a difference whether you have life insurance or bank 3a.”

is there are limit into how many years you leave the country for? This particular advisor is stressing that in my situation where perhaps i would be leaving the country for few years and coming back – 1/2 insurence 3a, half VIAC 3a is a best option.

sorry for prolong post, and thank you for your expertise!

M.

Hi Maria,

Thanks for your kind words.

At first sight, it does not look too bad. However, there is an issue fee of 2%. So 2% of everything that goes inside is lost.

You have to be careful that this is the fund TER. There is generally an extra management fee for holding the fee, directly from the issuer of the life insurance.

So far, I have not found a single example of a good life insurance 3a, so I would be really careful if I were you.

The limit is mostly where you are going to leave for. If you are going to leave for some complicated countries like the US in terms of regulations, you may be forced into selling your 2nd and 3rd pillar and in this case both a life insurance or an invested 3a. But if you plan to go to a European country and come back, you should be good.

What the advisor says makes no sense. The life insurance 3a has no advantage over VIAC 3a for leaving the country. If you are not going to liquidate and come back, you are much better off with a good third pillar like finpension or viac than with a life insurance 3a.

hi, can you compare possibilities to leave Switzerland and keep 3a? I think it can be only case in insurance deals.

Hi,

Sorry, but I don’t understand your question. Can you rephrase it?

Swiss Life has possibility to relocate permanently from Switzerland to Germany (i guess any UE country) and still let paying insurance premiums. If someone is not sure how long stays, it can be advantage.

Oh, I understand now.

Normally, as long as you plan to come back, you can keep your 3a, either life insurance or bank, while living abroad for a few years. It should not be a difference whether you have life insurance or bank 3a.

Hello Mr. Poor Swiss,

Thanks for this article. I have been reading your articles following this subject and hoping to convince my husband to get out of the life insurance 3a. He has been putting money into it for about the past 10 years. He still has another 10 – 12 years before retirement. Do you think it is best he gets out now? I can’t wait to read your next article on how to get out of these traps!!!

Hi Julie

Over 10 years, it’s a difficult question. If he contributed 10 years, he might be losing a large portion of the invested part. Also, at this point, it’s difficult to recommend investing in the stock market as well.

You should run the numbers for your situation. Ask the insurance company how much returns he got for the last 10 years. You should also ask yourself whether you need life insurance or not.

You can read about the several options you have with your life insurance 3a.

Interesting post, I’m glad I found it since I’m currently considering whether to go with an insurance 3a. While you you make some convincing arguments against insurance 3a, I think some of the points you make are not quite true or don’t seem as dramatic when looking at the offers I’ve been given. Here are some things that are different in my offers:

1. I can have up to 100% invested in stocks.

2. I can increase the amount paid to the legal maximum whenever that changes.

3. I think your example of insurance 3a returning on 1% and resulting in 200k less at the end is extreme. I have an offer from Helvetia where the middle scenario is estimated to yield 5.5% (this value is net, i.e. after the costs). After 13 years, they compute that I would have 519k. If I invested the 6883 at a 5.5% net yield, I’d end up with 589k. If I invested the 6883 minus the premium for a separate life/premium insurance (using the same Allianz calculator you use, similar coverage, that would cost ~820/year), I’d end up with 519k. That is then the same value as the life insurance almost to the franc.

This is not an argument for insurance 3a, since that still has the disadvantages of inflexibility, but the yield difference is much less dramatic than what you calculated.

Some other offers I got:

– AXA 90% stock, middle scenario 5.5%: 423k, ~100k loss compared to bank 3a + equivalent insurance

– Swiss life 90% stock, middle scenario 5%: 438k, ~81k loss compared to bank 3a + equivalent insurance

– Zurich 100% stock, middle scenario 5%: 380k, ~140k loss compared to bank 3a + equivalent insurance

Now, I don’t know how much to trust these projected yield percentages, especially with respect to hidden costs. But I can’t imagine that an insurance company would be able to tell you that with a yield of X% you would end up with a pay out of Y.- if that is not actually the case at all.

So, this leads me to the conclusion that none of the insurance 3a options are better than bank 3a + separate insurance. But the differences may not be that big, depending on the company.

Generali published a comparison of the fees for 3a investment solutions:

https://www.generali.ch/dam/generali/documents/files-en/produktedokumente/3a/Our-costs-compared-to-the-market

I am extremely surprised they added VIAC into the comparison, that’s actually a fair comparison.

Keep in mind again that these are funds, not life insurance 3a.

Hi Nicolas,

1) Interesting that you can invest 100% in stocks, I did not see such offers before. But keep in mind that that you only get one part invested. The part that goes for the insurance premiums are lost forever and not returning anything.

2) That’s a good feature, I did not know it existed

3) You have to extremely careful about what they say they can do and what they can do in practice. They will not tell you they will give you 1% per year. They are going to tell you that CAN give you 5.5% per year. I would be extremely surprised if any insurance returns 5.5% net on average over a decent term.

They can tell you whatever they want as long as these are possible returns and projections. They cannot you tell you you will get guaranteed returns of 5.5%, but they absolutely can tell you MAY get returns of 5.5%. But I would be really surprised if they talked net of fees, because half of the fees are hidden behind complex structures.

You are also forgetting the fact that 90% of the population does not need life insurance but is still sold one for the sole purpose of making a commission.

I may be painting a too bleak picture of life insurance 3a, but you are painting a too shiny one.

Certainly the yield numbers (they always give you a low, middle, and high scenario) are very fuzzy and unclear. Obviously they can’t guarantee any specific yield, but it does seem like a place for them to hide things or at least “advertise” whatever they want.

Here is what the Helvetia offer says about the yield scenarios:

“Das für die Beispielrechnungen verwendete Berechnungsmodell für die Renditen wurde vom Schweizerischen Versicherungsverband (SVV) in Zusammenarbeit mit dem Institut für Versicherungswirtschaft der Universität St. Gallen entwickelt.”

Swiss Life basically just says “No guarantees”

Zurich also refers to the SVV and says “In den Hochrechnungen sind die Kosten berücksichtigt.”

AXA is the most explicit:

“Die Fondsrendite wird nach Abzug der Anlagekosten gezeigt (Annahme: Kapitalerträge 2.00 % p.a.).

Das Szenario «moderat» basiert auf der Wertentwicklung in der Vergangenheit. Die angenommene

Verzinsung basiert auf aktuellen Zahlen. Alle Szenarien berücksichtigen die anfallenden Kosten (Risiko-, Abschluss-, Verwaltungs- und

Anlagekosten) Ihres Vorsorgeplans. Sie beruhen auf Annahmen, d. h. sie sind nicht gesichert. Wertentwicklungen in der Vergangenheit sind kein Indikator für die Zukunft. Aus den Beispielrechnungen lassen sich somit keine vertraglichen Verpflichtungen ableiten.

Die Anlagekosten (Fondsmanagement und -verwaltung) betragen aktuell 0.700 % p. a. des Ertragsguthabens.”

So basically, the TER of the chosen fund (AXA Strategy Fund Sustainable Equity CHF in this offer) is 0.7% and the middle scenario reflects the current performance. I don’t understand the statement about the Kapitalerträge of 2%. Do you?

Now, the SVV is an organization of the insurance companies, so this just means they’re all playing by the same rules they made up for themselves.

But I do have a hard time believing that a well known insurance company can make a claim such as “in the past, this fund has had this net performance” and that being wildly inaccurate.

Hi Nicolas,

I do believe they can advertise whatever they want. Then, they can always come back and say that the market did not behave as they thought. That’s what fund managers do all the time.

Remember that I don’t read German, so my understanding comes from a translator. I would say that the 2% is related to the interest rate on capital.

I don ‘t think they are saying that these numbers are based on the past performance of their fund but based on backtesting their model with the past performance of the market.

The insurance broker is also warning me of the issuance commission (Ausgabekommission), which applies for bank 3a solutions but does not for insurance 3a.

He said the following:

With an insurance, I have costs of 4% of my payments (which he assumes to be ~220k), i.e. a 8.8k fee. (I believe with the 4% fee, he is referring to just the premium waiver)

With the bank, I’d have an issuance commission on the final value of the account, wich at ~425k would result in a 12.7k fee.

I can see that finpension explicitly states that they do not charge an issuance commission. This article lists some, although none are as high as 4% (the article is 5 years old though) https://www.nzz.ch/finanzen/fonds/versteckte-kosten-bei-saeule-3a-fonds-ld.1341370

But I’m not confident I am aware of all the hidden costs that bank solutions have (they’d like you to only look at the TER). Let’s not pretend that they are angels.

I think that’s bull****. An issuance commission is something that is lost when investing into a fund, not when selling (redemption). For instance, the funds used by Finpension have something like 0.02% issuance and redemption fees.

A third pillar fund with 4% is extremely bad. But obviously, the insurance company is not going to compare against Finpension or VIAC :)

And some life insurance funds also have issuance fees.

Or maybe he is referring to the capital tax when withdrawing the money, but that tax is the same on life insurance and bank 3a.

Hi Baptiste,

Many thanks for sharing these insights and backing it up with strong statistical modelling.

I am looking at the finpension provider that you have recommended – they seem to be very transparent with their fee schedule, investment strategies and so forth. With 0.39% annual fee it almost looks too good to be true.

My worry is that a strategy of a independent 3a provider like finpension is to attract as many investors as possible at the beginning and then raise the fees once the investor pool is big. And it’s pretty expensive to get out once you’re in.

What would you say about this risk of rising management fees?

Thank you,

Justinas

Hi Justinas,

I am really not worried about that. They have recently lowered their fees! It’s actually easier for a company to lower fees when they have more people.

It’s actually not really expensive to get out, but you may indeed have to sell your shares.

Hi Baptiste,

I don’t the fees would get lower as a profit-making company would not necessarily pass on their savings to clients. But it is true that getting out of their fund does not seem to be too expensive.

Another aspect I would appreciate your inputs on – are these independent providers regulated? What would happen to the individual’s savings in case of the provider’s bankruptcy?

Many thanks again,

Justinas

Another

Hi Justinas,

It’s true that they don’t have to pass all the profits to the customers, but so far they did. I don’t see them increasing their fees, but everything can happen.

Yes, they are heavily regulated. Finpension has to create a third pillar foundation, and this foundation is approved and regulated as any third pillar foundation in Switzerland.

Your assets are in a custody account. In case of a bankruptcy of Finpension, the foundation (separated from finpension itself) will need to find a new asset manager for its customers.

loving your posts

could you make a blog around the best options/companies for a pillar 3B ( non insurance options offcourse)

Hi,

As far as I knonw, there are no non-insurance options for the 3b that would be tax-advantaged.

Hi Baptiste,

my wife and I moved to Switzerland ~18 months ago and following your blog since then! Thanks for all the resources you are sharing!

As many expats, we’ve been contacted by an advisor who is pushing us for a 3a with SwissLife and Axa.

Didn’t sign anything so far, and looking at your blog I’m starting changing my mind!

What would you recommend for an expat couple willing to live in CH for a max of 5/10 years, then moving back to our country (IT)?

AFAIK, Banks & Indipendent providers 3A cannot be transformed into 3B.

So I’m worried that, in case of a prolonged bearish market, I will need to withdraw my money when departing from CH and may lose a lot of the investment, something instead I do not have to do with Life Insurance.

Any suggestion?

Thanks!

Hi mithrandir,

Good for you for not signing!

If you are not planning to live in CH to stay for more than 5-10 years, don’t do any 3a, it’s too much of a hassle for when you need to take the money out. If you know you are going to leave Switzerland, it’s not worth it unless you are planning to leave around retirement time.

In that case, I recommend investing your money yourself with a either a broker account or a robo-advisor account. But don’t sign a 3a life insurance, it’s pointless for your situation.

Hi Baptiste,

thank you so much for your reply!

I’m a bit surprised about your answer, so following up here with one more :)

Do you think that even a basic 3a savings account (with basically ~0 interest, but 0 risk) it’s not worth it?

I appreciate this is quite an extreme case, but both my wife and I are working 100% and we expect to be hit by a huge increase in taxes this year, as we’ve got married during the summer.

I was sure that a 3a was anyway convenient just to optimize your tax burden, even without considering profits you can make investing.

Is it really so bad to withdraw your money once you leave the country? Which are the roadblocks you may face, do you have any example?

We are in Zurich and if we get to accumulate 30/40K on those accounts, the withdrawal tax should be around 4/5% if I’m not wrong.

Am I missing something fundamental?

Thank you so much again!

Hi,

If you have huge income and fill a full tax declaration (not tax at source), it may be interesting. But if you have huge income, you will pay huge taxes, so the difference would not be huge but still likely significant.

In general, you would pay much lower withdrawal taxes than the tax savings.

If you leave Switzerland for good, you can indeed withdraw the money. In some cases, you will have to pay some fees for “early withdrawal”, up to 500 CHF in some cases.

If you think it’s worth the trouble of then withdrawing it in 5 years, paying the withdrawal fees, declaring it in your tax declaration and paying the withdrawal taxes, it would indeed be an optimization. But you have to weigh the pros and cons, not only the tax benefits.

In any case, don’t use a life insurance 3a.

Hi Baptiste,

thanks!

I wouldn’t consider my income huge (especially for Swiss standards!), but I was above the threshold even by myself last year.

So adding my wife on top, with a salary anyway very similar to mine, will make things quite bad on taxes side!

Thanks for your suggestions, I honestly think that it is a no brainer to save now and manage the hassle later when it comes to withdrawing what we deposited!

I kinda fell into this trap two years ago, but I’m not sure in my case it’s bad enough to warrant breaking the contract.

I subscribed to a Life Insurance 3a, but only of 60CHF per month (720CHF per year). I got lured into this also because it gave me some advantages (zero costs with all of my Postfinance banking activities, that otherwise would cost me like 5-10CHF per month, and a one-time bonus of 300CHF when I subscribed).

Now, I’m not so thrilled about this choice I made, but I’m not convinced about breaking the contract and losing a good chunk (if not all) of the more or less 1500CHF I contributed to it so far, and here are a few reasons why (curious of your opinion, Baptiste):

* I only contribute to this 720CHF per year, which is about 10% of the max Third Pillar contributions, and this percentage will only get smaller and smaller as the total amount of the Third Pillar contribution will increase over the years, but the amount I contribute to this life insurance will not increase;

* If I stopped this, I would need to pay 5-10CHF per month for my banking activities. Yes, I do need a Postfinance account (it’s not my only bank, but it’s one of them);

* The idea of having a small chunk of my Third Pillar “safe” (basically almost like having it in cash), doesn’t strike me as that bad. I know stocks should outperform in the long term, but that’s no guarantee, and there have been 15-20 year periods where stock indexes have gone nowhere, and many people think we are entering such a period right now; is it that bad to have 5-10% of my third pillar in cash, considering the rest is invested in stocks? The contract is for 35 years, so in total it will be 25’200CHF when I’m 65. I think that will be a really small part of my Third Pillar, so probably it can’t alter my overall performance by that much?

I’m curious about Baptiste’s or anybody else’s opinion.

Hi Ivan,

Mathematically, it’s bad regardless of how much you put per month. But, indeed, the losses on 720 CHF per year are not great.

As for the safe part, in many cases, a bank cash 3a has outperformed a life performance 3a.

I would say it depends on your age. If you have a long-term horizon and you want to keep it safe, you could keep it as the safe part of your 3a since that will likely outperform cash. If you have 10-20 years in front of you, cash may outperform a life insurance 3a. That’s how I would see it.

Regardless of what you are doing, I would still recommend nobody taking it even with the conditions you describe. It may not be worth canceling, but it is not worth signing either! A cash 3a and paying the 5-10 CHF per month (ideally moving out of PF too) would be better.

What about using the life insurance 3a for an indirect amortization? It seems banks won’t accept an investment 3a. Do the tax benefits by keeping your principle mortgage debt high make it slightly better?

Hi Aaron

It would make it slightly better, but not enough in my mind. Banks accept investment 3a, but only their own. For instance, you could put the indirect amortization in Migros Bank 3a if you have a mortgage with Migros Bank. But they won’t let you use Finpension 3a, for instance, unfortunately.

Generally speaking, the tax benefits of indirect amortization are overestimated by most people.

Are the MIGROS Pilar 3a any good?

No. The best they do is 0.85% in stocks and a TER of 0.97%.