The Trap of Life Insurance Third Pillar

| Updated: |(Disclosure: Some of the links below may be affiliate links)

For your third pillar, you can choose between an account at a third pillar provider or a life insurance policy. Many people (often advisors) recommend using a life insurance policy.

However, in practice, these third pillars have many disadvantages. There is no reason to use a life insurance 3a for your third pillar.

In this article, I detail the differences between a third pillar with a bank or an independent provider and a life insurance third pillar (life insurance 3a).

Life Insurance Third Pillar

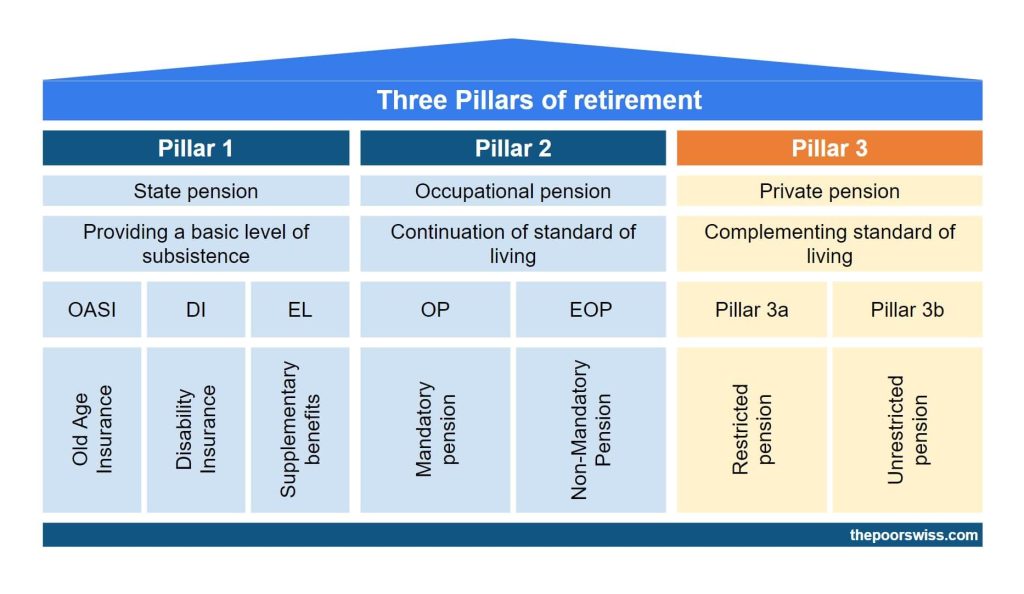

The third pillar is open to workers who pay into the second and independent people who own companies. The idea of the third pillar is simple: save money while you work and get it back when you retire.

The main advantage of the third pillar is that you can deduct your contributions from your taxable income. The third pillar is an excellent way to reduce your taxes. However, employees are limited to 7056 CHF annually (as of 2023). Generally, I recommend most people contribute to their third pillar. I contribute the maximum every year.

For your third pillar, you have two choices:

- An account with a bank or an independent provider (Finpension 3a or VIAC, for instance). I call these standard 3a accounts.

- Life insurance third pillar with most insurance providers in Switzerland. I call this life insurance 3a.

Both options have the same basics:

- You can deduct the contributions from your taxable income

- The money is locked until retirement

- Or until some specific conditions, as seen later

Both standard 3a and life insurance 3a can be invested. In both cases, there are some special retirement funds available. So, your money can be invested in stocks, bonds, or other alternative investments. Since the third pillar is a long-term account, it is excellent to invest this money.

However, they have some significant differences. And as we will see in this article, most of these differences are disadvantages of the life insurance version.

Life Insurance 3a is not flexible

Lets’s start with the first difference: flexibility.

With a standard third-pillar account, you can deposit money whenever you want. But with life insurance 3a, you must pay your premium regularly. For most providers, you will pay for months. But sometimes, you may have to pay quarterly, semi-annully or even annually. This limitation leads to several disadvantages.

First, if you want to max out your third pillar in January and forget about it, you can do it with a third pillar in a bank. With life insurance, you have no choice but to pay when the insurance tells you to.

More importantly, if you are having a bad year and do not want to contribute to your third pillar, you cannot stop paying your life insurance (without penalty). On the other hand, you can stop paying your 3a account for several years if you want. This lack of flexibility is important because it means your life insurance 3a can put you in trouble.

Finally, the maximum amount for the 3a changes every few years. If you start your life insurance 3a with a full contribution, this contribution will not follow the increase over the year.

For instance, in 2019, the maximum contribution was 6826 CHF. But in 2021, the maximum increased to 6883 CHF. If you got your life insurance 3a in 2020, you already lose 57 CHF per year in potential tax deductions. And this will increase every few years.

Of course, you could take out a standard 3a on the side to reach the maximum contribution, but most people will simply not. Usually, this limit will increase every two years. In 2023, it went up 7056 CHF.

With life insurance 3a, you are also not flexible on withdrawal. With a standard 3a account, you can withdraw money early or late. But with insurance, you can only withdraw it on the date set on the contract. So, you are stuck if you want to withdraw later or sooner than your retirement date. A standard 3a account allows you to withdraw up to 5 years in advance or up to 5 years late.

Life Insurance is not tax-efficient

While you contribute to them, both a standard 3a and a life insurance 3a are equally efficient. However, when it comes to withdrawing them, standard 3a has the potential to save you a very significant amount of money.

The reason is simple: you cannot stagger withdrawals of the life insurance 3a. Usually, you want five different third pillars. Then, you can withdraw a single third pillar account annually to save on taxes.

Indeed, the taxes in most cantons are progressive. You pay a fixed percentage on each bracket. For instance, you would pay a 5% fee on the first 30K, then a 10% fee on the next 30K, and so on.

So, if you can withdraw over several years, you can save significant money. We talk about up to 50% tax savings in the best cases. With staggered withdrawals, you could easily save more than 10’000 CHF!

And with a life insurance 3a, you are wasting money on taxes.

One may argue that you could have several insurance policies, and in theory, you could. However, most life insurance will run to your retirement date, not earlier or later. In practice, it will be tough to plan this properly. And you have to get it right the first time since you cannot change it afterward.

Life Insurance 3a fees are expensive

Many people do not realize that when you invest in life insurance 3a, a significant percentage of your contributions feed the risk premiums. Since this is life insurance, it can pay out in case of death or disability.

And this does not come from the principal but from the risk premiums. Each contribution is split into two parts. Some percentage goes into the capital and stays there until retirement. Another portion goes to the risk premium. This percentage is lost to you and goes to the insurance company.

There is nothing wrong with the principle. Insurances need risk premiums to cover the risks for their customers. However, there are a few things wrong when related to your 3a:

- The risk premium percentage is very significant

- A significant part of your retirement money is lost

- Advisors are not forthcoming with this

In practice, life insurance will take anything from 10% to 25% of your contributions. Every time you contribute to your life insurance 3a, you lose 10% to 25%!

For many people, it is already challenging to contribute a significant amount of money to their third pillar. And seeing such a large percentage disappear is not comfortable!

Not only that, but the fees of the funds available are also very high. I have looked into the funds from Generali, where I have my life insurance, and the fees of funds are all about 1%. And some insurance companies invest in funds with more than 2% yearly fees. And the advisors telling you that these active funds will outperform the market are either lying or delusional.

On top of that, many of these funds have load fees. You will lose even more of your money before it is invested. It is not uncommon to see 5% load fees. Again, whenever your money is invested into the funds, you lose 5% of the value!

So, these high fees will reduce your performance even more.

Life Insurance 3a returns are bad

The advisors will tell you you can get good returns on your life insurance 3a. But in practice, this is far from correct.

You can indeed invest your money from your life insurance 3a. However, the money is invested in expensive active funds that will significantly underperform the market in the long term.

On top of that, these investments are generally very conservative. It is rare to go higher than 35% in stocks. Since this money is locked away for several decades, a high stock allocation would make more sense.

We can take my Generali life insurance 3a as an example. I started to invest in August 2016. At the end of 2019, I asked them about the performance of my money. On average, I got 0.4% returns per year. During that same, the US stock market returned 45%, and the Swiss stock market returned 30%.

And the finpension Global 40 fund would have returned about 19%! Again, finpension 3a would have 45 times more returns during the same period!

The two funds for my life insurance invest 35% in stocks. So, having 0.4% returns yearly during a bull market is a joke!

We can compare one of the funds from Generali, GENERAL INVEST – Risk Control 5, with some other investment options from February 2015 to September 2022:

- Generali INVEST: -10%

- Swiss Stock Market (SPI) ETF: +29%

- US Stock Market (S&P 500) ETF: +87%

- finpension global 40: +23%

- finpension global 100: +69%

With a conservative portfolio at finpension, you would have gained 29% of your money. But with a conservative fund at Generali, you would have lost 10% of your money!

Before making that comparison, I knew that Generali funds were bad, but I had no idea how bad they were. This performance is atrocious.

You likely do not need the insurance

One advantage of life insurance 3a is that you get some insurance benefits.

If you die before retirement, your spouse will get the capital you would have gotten at retirement. And if you are incapacitated and unable to pay your premiums, the insurance will pay for you.

Insurance is all good, but do you need insurance coverage? Advisors will tell you everybody needs this insurance coverage, which is dumb. Insurance that is always worthwhile has not been invented.

First, you do not need death life insurance without dependents or heirs. If nobody depends on you and you die, the capital will return to the insurance company. This could still go to your heirs even if you have no dependents. But you must ask yourself whether they need that insurance if they are not depending on you.

Then, we have good insurance coverage already in Switzerland in many cases.

And if you are a double-income earner household, chances are that your spouse could handle the financial side without you. On top of that, the first and second pillars have benefits for your spouse if you die.

If you lose your job, you will get up to 80% of your income for up to 3 years. You would still be able to pay your life insurance premiums and are unlikely to be in financial trouble.

If you are disabled, you will get disability insurance and receive assistance to return to work if possible.

The need for life insurance is reserved for very few cases. In which cases, better options exist, like pure risk term life insurance.

Life insurance 3a has guaranteed value

We now go over the last difference. A life insurance 3a has some guaranteed value. On the other hand, a standard invested 3a account has no guaranteed value.

Now, we need to relativize that guarantee. First, no interest is guaranteed. So what is guaranteed is the amount without any performance. The performance cannot be negative.

However, you should know that the guaranteed value differs from what you contributed. We have seen that fees are expensive before. These overall fees include the risk premiums. At least 10% of your contributions will be lost to the risk premiums and direct fees.

Since we have seen that returns are very low for life insurance and that you will lose at least 10% to risk, the guaranteed value is not that interesting anymore.

If you invest that money long-term, you can expect significantly more money. While there have been some 20-year bad periods in the stock market, they are very rare. And over 30 years, the stock market has historically been great.

Life Insurance 3a vs invested 3a

Finally, we can make a small comparison of some products. We will have to assume a few things:

- The bank 3a account will return 0.1% per year, and there are no fees

- The life insurance 3a will return 1% per year after fees, and 10% of the investments will go to the risk premiums

- The invested 3a will return 4.5% per year after fees, and there are no extra fees

Each year of the simulation, 6883 gets invested into the product. There are no adjustments for this amount over time. In practice, this amount would rise for the bank 3a and the invested 3a.

You may think the invested 3a has an advantage in my assumptions. But my numbers are pretty conservative in both senses. A 3a invested 99% in stocks could return significantly more than 4.5% per year. And on the other hand, many life insurance 3a will return less than 1% per year (mine returned 0.4% on average during a bull market for three years).

And on top of that, some insurance will charge more than 20% for the risk premiums. So, these assumptions are being nice to life insurance 3a.

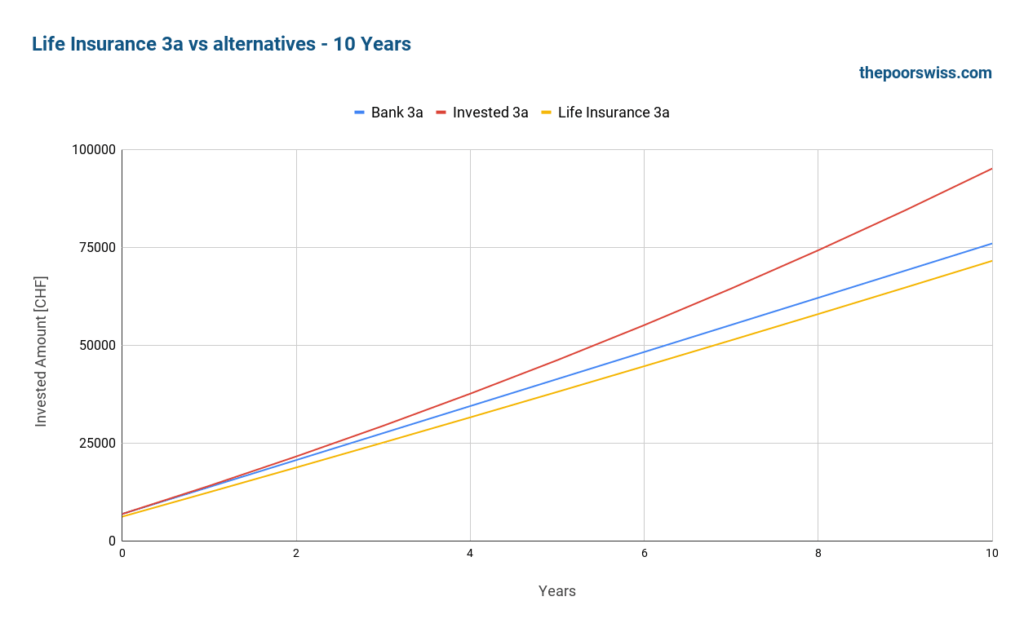

So, here is how these three products would result after ten years:

The result is quite surprising. After ten years, you would be better off with a bank 3a with a 0.1% interest rate than a life insurance 3a. Losing 10% of the premiums makes a huge difference, and poor returns make compensating difficult. Even over ten years, a bank 3a would leave you with 5000 CHF more than the life insurance 3a. With a good 3a, you would have about 23K CHF. Such an amount of money can make a very significant difference in your retirement.

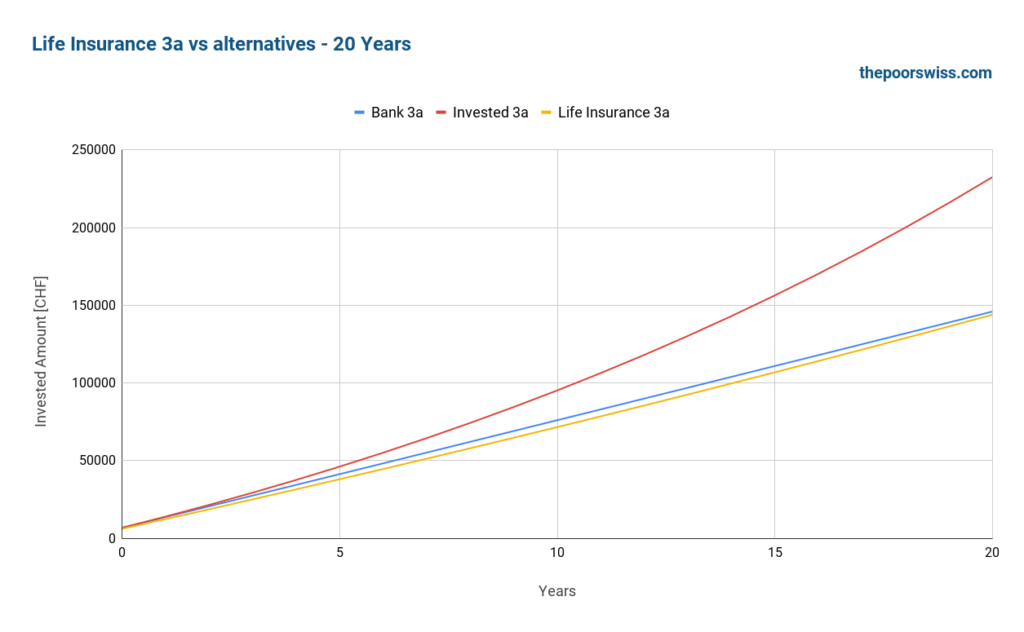

Here is what happens after twenty years.

After twenty years, life insurance 3a still is worse than bank 3a. This result is bad. The difference is only 2000 CHF, but it still shows the extremely poor returns of life insurance 3a.

After twenty years, the difference with a good 3a becomes extremely impressive. Indeed, in that simulation, the invested 3a has 88K CHF more than the life insurance 3a. Put another way, the person with an invested 3a has 61% more money in retirement than the person with a life insurance 3a.

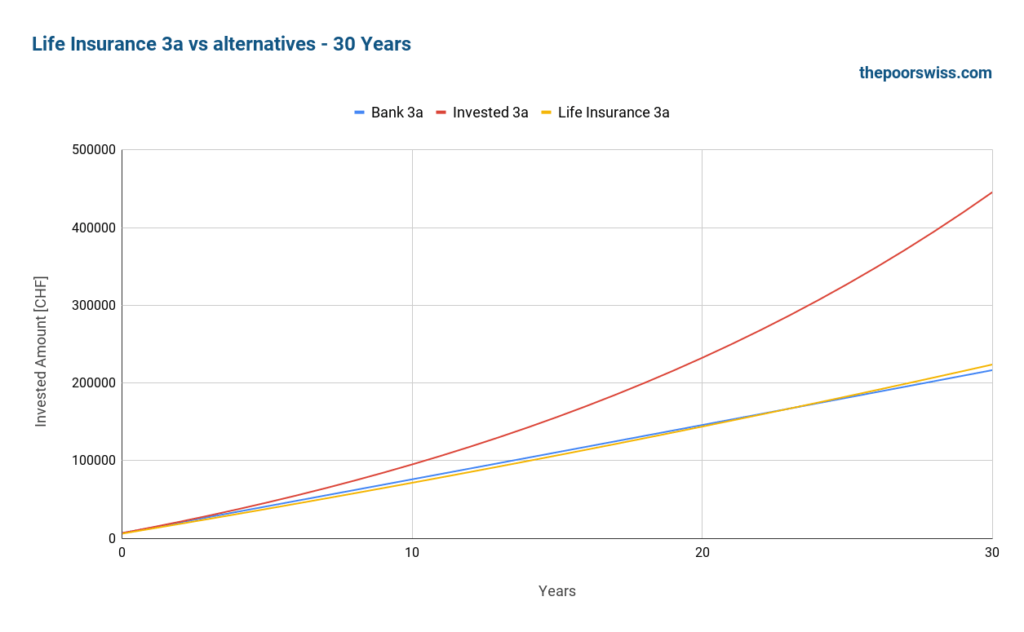

Finally, we look at thirty years.

Finally, life insurance 3a is at the same level as bank 3a. However, the difference is only 7000 CHF.

After thirty years, the invested 3a now has twice more money as the life insurance 3a. We are talking about a difference of more than 220’000 CHF after thirty years. Such an amount of money could change your life in retirement.

This result comes from only a single simulation. In practice, there are some cases where life insurance would do better than this one. But there are also cases where the invested 3a does much better. And there are some much worse insurance policies out there. I strongly doubt any insurance 3a comes close to a good invested 3a.

Why does life insurance 3a exist?

With all these disadvantages, we may wonder why these products exist. And it is a fair question.

After doing all this research, I believe life insurance 3a should not exist! They are horrible investments and will likely result in much lower retirement money than if you had used a proper third pillar account.

The reason life insurance 3a exists is simple: They are highly profitable to insurance companies and insurance advisors. I think there is no good reason for their existence.

Advisors make large commissions on these products. So, they push these products quite hard. Unfortunately, most Swiss people are not educated enough about investment and retirement to understand these products. And most people trust advisors.

What to do instead?

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

The third pillar in Switzerland is great for investing money and saving taxes. Life insurance 3a being bad should not stop you from investing in the third pillar.

If we eliminate life insurance 3a, there are two options for your third pillar. Either you invest with a bank, or you invest with an independent provider. In practice, I highly recommend using an independent provider like Finpension 3a.

Finpension (and other independent providers) have many advantages over a life insurance 3a:

- You will get more returns on average

- All your contributions will go to the capital

- You will pay lower fees on the invested capital

- You will get a more transparent third pillar

- You are flexible as to when you contribute

- You can save taxes with staggered withdrawals

And if you are afraid of investing and want guaranteed capital, you can invest in a bank and get a tiny interest rate. In my opinion, a bank 3a is already better than a life insurance 3a.

If you need help choosing the third pillar, read my articles about the best third pillar in Switzerland.

And if you need life insurance, you should get a pure-risk term life insurance policy. There are many of them. I have never delved into them, so I do not know which is best, but I am sure there are some good ones.

For a simple example, I have looked at the calculator for Allianz for 30 years and 120’000 CHF coverage, comparable to my insurance policy. This pure risk life insurance includes paying your premiums if incapacitated. So, this is very close to a life insurance 3a.

Such insurance would cost me 379 CHF per year. Over 30 years, this pure risk life insurance would cost 11’370 CHF. If you remember the results two sections before, the life insurance 3a will result in 220’000 CHF less money than the invested 3a. For the cost of 11’370 CHF, you can get a great 3a and separate life insurance.

Note that I do not particularly endorse Allianz. Their calculator is the simplest I found.

This simple comparison shows how bad life insurance 3a is. You can get good life insurance for cheap and good 3a with much higher returns and transparency.

Conclusion

When I started this article, I knew life insurance 3a was a bad investment. But after going through the research, I now realize life insurance 3a is a horrible investment!

There are much better alternatives out there. I would not recommend life insurance 3a to anyone. Instead, use a great third pillar like finpension (my review here). And if you need life insurance, take pure risk insurance instead and continue investing in a good 3a.

Now, there is one question I have not answered in this article: What should you do if you already have a bad life insurance 3a? First, do not be ashamed. Many people fell into the life insurance 3a trap, including me. That is right! I fell into this trap!

There are a few options to get out of a life insurance 3a. I encourage you to at least look at them if you have life insurance 3a.

To start investing with an excellent third pillar, you should read about the best third pillar from Switzerland or my review of Finpension 3a.

What about you? What do you think of life insurance 3a? Did you fall into this trap?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- Free by 40 in Switzerland – Book Review

- Can you retire early with Swiss Stocks and Bonds?

- What is the Substitute Occupational Benefit Institution?

Hello,

Have you computed bank 3rd pilar + life insurance vs life insurance 3a?

Best regards

Hi Matraca,

Not really, but for me even a bank 3a + a term life insurance would be better than a life insurance 3a because it gives you the opportunity to later switch to investing 3a if you decide to.

Even in money terms?according to your graphics it seems that both bank 3a and life insurance 3a are quite “close”. I was curious to see what happens if we add life insurance to that equation. Would you be confortable to send to me your equations so i can compute myself?

Thank you

Given that these days, interest rates are rising, bank 3a + life insurance will become better and better compare to a life insurance 3a.

In my computation, I have used 0.1% returns for the bank 3a and 1.0% returns for the life insurance 3a. These days, we can get significantly more for the bank 3a.

Hello,

I am getting very confused about the 3a pillar now. Last year I worked, but didn’t make 2nd pilar contributions because my previous year I did not make enough money. I was told by someone at the bank that I could put 20% of my salary into a 3a pillar, so I did. Now I read from your article that this is only for independant company owners, which I am not. I work for a company, but I didn’t make enough money to contribute to an LPP. I have still not made my 2022 income tax return, where this 20% amount would be declared. Is this not allowed in my case then? For the year, 2023, because I made enough income in 2022, and in 2023 I have started contributing to the company LPP and continued contributing to my 3a pillar. I am concerned, have I done something wrong and what should I do if I have done something wrong?

Hi Julie,

Indeed, if you are employed, the 20% rule does not apply, only the yearly maximum (7056 CHF currently). If you have not contributed to an LPP (not reached the minimum) in 2022, you should normally not have contributed to the third pillar. Are you sure you are not contributing to an LPP?

This means that you won’t get any tax benefits from your contribution. However, I am not sure whether you can take out the money or not.

I would recommend contacting your 3a company and ask whether this money should stay in the 3a or should be taken out.

Hello,

Thank you for your response.

Yes, I am sure I was not contributing to an LPP. I already contributed the 20% to a bank 3a pillar. In fact they told me I could contribute 20% of my salary since I didn’t contribute to an LPP. Everyone seems so confused and not competent in their advice for me. This was in 2022.

Maybe I can carry the amount over for the next year’s contributions to take advantage of the tax rebate!?! I guess my accountant will soon let me know. Funny how the advisor’s at the bank mixed this advice up for me. I’m soooo disappointed!

You unfortunately can’t carry over to another year :(

Good luck getting to the bottom of this.

Hi Baptiste,

I wanted to share my recent experience with a financial advisor regarding opening an account with FinPension. Initially, I was excited about the idea, but the advisor warned me that the money may not be guaranteed if the company were to go bankrupt. This concerned me, but I wasn’t fully convinced yet.

To help me make a decision, the advisor presented a comparison between different banks and insurance companies, including UBS, Banco Stato, Allianz, and SwissLife. Here are the key parameters he used in the comparison:

N.B (simulated for 35 years, I’m 30 years old)

Costs: UBS had the highest cost at 1.75% p.a, while SwissLife had the lowest at 0.40% p.a.

Yearly premium: All companies had the same yearly premium of 7056 CHF.

In case of death: The banks provided no benefit in this regard, but SwissLife offered 208,883 CHF.

Premium Waiver: Insurance companies offered a premium waiver, which the banks did not.

Amount saved in taxes per year: The tax savings were the same for all companies at 2062 CHF annually.

Amount saved in taxes for the entire period: This remained constant for all companies at 72,170 CHF (2062 CHF * 35).

Expected Earnings: The expected earnings varied with the lowest being 90,448 CHF for UBS (return of 1.67%) and the highest being 361,712 CHF for SwissLife (return of 7.49%).

Based on the comparison, the advisor suggested that by choosing SwissLife, my total payment by the end of the contract plus the tax savings for the entire period could amount to 680,842 CHF. He also informed me that SwissLife would invest 90% of the funds in stocks, considering my age, and balance it with cash as I get older.

I took a look at the funds SwissLife invests in, and they seem to align with the ones you’ve recommended in the past, with generally low TERs, although I couldn’t find the exact details at the moment.

Now, I find myself at a crossroads as I haven’t invested anything yet but have already signed a contract. I’m not sure about the implications of the contract or if I still have time to cancel it. I feel somewhat cheated as there are certainly things he left out:

-yearly quantity not increasing every two years

-premium payments for life insurance

I value your insights, Baptiste, and your blog has been incredibly helpful to me. I would greatly appreciate your thoughts on this matter.

Thank you so much for your time and assistance.

Best,

Jaime

Hi Jaime,

I am sure advisors have a lot of way to sell their insurance policies.

One thing is true is that insurance companies usually have a guaranteed amount, offer premium waiver and a life insurance in case of death. However, they all have a large risk premium that goes to the insurance not in your money. I would also be surprised if Swiss Life was 0.40% all included. This is probably only the custody fee and then you pay the product costs. And I would also be amazed if they could generate 7.49% average returns. They can say anything they want about expected returns.

For me, this just shows how far they are willing to tangle their net of bad products.

Thank you so much for your reply, Baptiste. May I ask your thoughts on the safety of the FinPension funds? I was considering using the 99% equity option. In this case I am insured up to 250,000 CHF of my funds, is this correct?

The protection would be only 100’000 CHF. And there is no “protection” on invested money. However, the invested money is part of the fund.

I think the funds are safe. The funds are managed by Finpension, but held by Credit Suisse (now held by UBS). So, even if CS or UBS went bankrupt the money should remain in the fund until they find a new fund manager.

Hi Baptiste,

I fell into the trap of an insurance 3a as an expat with little to no knowledge of the Swiss pension system and an “advisor” recommended it. I am in the Generali Index Serie 75 – which does invest 70% in stocks which is a good proportion and why I chose it. I have been in this plan for the last 20 months and would love your advice on what to do. Should I try to get out of this instrument and invest in an invested 3a? Also I do not know if I will stay long term in Switzerland and may return home to Ireland, can I withdraw the funds from an insured 3a before leaving Switzerland or do i need to leave the funds in the 3a and receive on retirement?

Thanks.

Gav

Hi Gavin,

You will have to assess yourself whether you want to take the hit of losing the money or not.

Personally, after only 20 months, I would definitely cancel it entirely and hopefully get some money back and swallow the loss.

Normally, you can keep your 3a if you move abroad and you will be able to withdraw it at retirement time. If you are leaving for good, you can also withdraw it in advance when you leave but if you come back you will need to put it back.

If you don’t know how long you are going to stay or if you know this is going to be short, maybe you should not even invest in the 3a, you should keep a 3a in cash like VIAC.

Hello. When speaking about long term projection i do not understand it. If i compare projection of Finpension (100% equity) and SwiffLife Dynamic Element (projection from SwiffLife consultant) for more than 30 years from now, Swisslife project roughly 20% more than Finpension. Both have same fees.

So who should i believe :P? Based on numbers SwissLife should be far better at the end.

Thanks

Anybody selling you something should not be trusted with their projections. I would say projections from Swiss Life has little to no value. It’s just marketing.

Finpension is based on passive investing on indexes. Therefore, we can estimate their future returns to be the returns of the market.

On the other hand, Swiss Life is expecting to beat the market and provides high projections. In pratice, fund managers do not beat the market consistently.

For returns, I would bet on Finpension many times over Swiss Life. I would also be extremely surprised if a life insurance 3a from Swiss Life had the same fees as Finpension 3a. I would expect the fees from Swiss Life life insurance 3a to be significantly higher (and mostly hidden).

But of course, you have to make your own mind and decide who to trust.

Thanks Baptiste.

For sure Finpension has much more clear and quickly available detail of its services. Swisslife is more complex and uncertain to understand returns, fees and so forth.

Hello,

could you explain better the part of ‘Life Insurance is not tax-efficient’. What does that mean with some examples?

thanks a lot for your work

Hi Alessandro,

Usually, all life insurance 3a are set to be withdrawn on the year of your retirement. On the other hand, a standard 3a can be withdraw up to 5 years in advance. This allows you to stagger the withdrawals.

For instance, you could withdraw like this:

Y-2: 3a #1

Y-1: 3a #2

Y: 3a #3

In most cantons, this would cost you much less taxes than if you were to withdraw the three 3a at the same time.

Thanks a lot again

Hi Baptiste,

Thank you for your post and sharing your knowledge and experience with the rest of us.

I have two questions:

– I am from abroad and I might want to return to my home country sometime in the future. By the time I do that, I would need to withdraw the amount I have in my 3a pillar (currently with VIAC). If I had to do this when the return was negative, I would have losses. I was told that insurance companies allow you to transfer the 3a pillar into a 3b so you don’t necessarily have to withdraw the money by the time you leave the country (specially if your return is negative). How can I avoid to withdraw money from VIAC or a similar 3a by the time of leaving the country? Or can we see this as an advantage of having a life insurance third pillar?

– I have been in Switzerland for two years already and I am thinking to open a second 3a pillar. How many different 3a pillars do you suggest to open and how long would you suggest to wait between opening the second 3a, the third 3a, etc.? How would you diversified your 3a portfolio?

Thank you and please keep writing :)

Hi Ruben,

* Depending on where you leave, you don’t have to withdraw the money. It depends on the country. You could keep the 3a invested and only withdraw it at retirement time.

* Insurance advisors are good at selling, not investing, it’s just marketing.

* You should have 5 third pillars. But you may not be able to scatter payments if you leave the country.

* You should not wait long. If you are doing monthly contributions, you can rotate between the five accounts. If you are doing yearly, the same rotation works as well, but it takes 5 years to get the fifth account. And then you always contribute to the account with the lowest amount.

Hey Baptiste,

why you suggest 5 Pillar 3a? do you mean open 5 different account for Pillar 3a?

thanks again for your contribution

Yes, 5 different accounts in a 3a. They can be at the same provider. For instance, I have 5 different portfolios with Finpension 3a.

Hi Baptiste,

you said you had a 3a with an insurance company. How did you terminate the contract and after how long? Was it expensive to terminate it? Thanks, Giu

Hi Giu,

I still have it. I need to wait until I can renew my mortgage and untie my 3a life insurance from the mortgage so that I can then release the premiums.

I detail this in the followup article: What should you do with a life insurance 3a?

For hidden costs, they said there are none. Nevertheless, like you said, if I have to pay 15 CHF a month for the insurance ($ that I loose for the actual insurance), than it is 180 CHF a year. In case I invest 1k a month (12k a year) that 180 CHF of before is now 1.5% lost. In addition to the 0.5% in fees, it is like paying basically 2% in fees a year.

Unfortunately I haven’t found yet a financial advisor that doesn’t get a commission :)

So, your idea is to do everythin by myself? I do that already on Degiro, but to diversify, I was thinking of also an active managed portfolio. Would you consider maybe an active managed portfolio with a bank (UBS) for like 1.5% including ter? or for example with the company of my financial advisor (SwissEssential) for 1.2%? Otherwise, what is the best way to invest in CH from your point of view?

If there are really none, then it’s not too bad indeed. But as you mentioned, the insurance fees themselves will weigh you down.

I don’t recommend active investing as a diversification! You could diversify brokers by having an account at IB. And you could buy some single shares there if you really felt like it. But currently, I see no reason to purchase active funds. If you are already investing passively, the active part will simply have the stocks but different weightings.

Hi Baptiste,

Thank you for the great post on the 3a.

What do you think of the 3b as investment? Fees on AXA and Swisslife are pretty low, around 0.5% all included per year and per month you pay around 15-20 CHF for the life insurance.

They will provide an active investment plan and I was thinking to put 1k per month in it.

I fully agree with you for the 3a with the insurances, infact I opted for Viac on the 3a. But what do you think of the 3b? Would you consider it or would you simply avoid it and put money on your own on some global ETF every month? I would love to hear your point of view on the 3b. Is it worth it overall?

FYI I have a family with 2 kids, if this info can support your decision

Hi Ale,

I think that 3b is quite dumb. I do not really understand why it exists. Only two cantons in Switzerland have tax benefits, which are really small. I would strongly recommend against it.

If you think you need life insurance, take a proper term life insurance. And if you want to invest 1k per month, use a robo-advisor or a broker account.

Thank you for your honest feedback :) Nevertheless, don’t you think that a 0.5% in fees is good for an active asset managed portfolio with 90% in stocks/ETF and 10% in funds/cash?

Which cantons take advantage of it? I am based in Zurich.

I don’t need a life a insurance, but with 2 kids, it is a nice to have on top. I am considering this simply because my financial advisor suggested me that as first step in our relationship (I know he gets a commission from the insurances). I don’t pay directly anything to him, but I need to have either an active fund with him/his company or the 3b to get his service.

Becuase I don’t have time and I am busy, like everyone with kids, having some support from a consultant is a nice to have and I get quite some knowledge (I live in CH since 6 years). For this reasons, I consider the 15 CHF per month a fee I pay for the insurance plus his service.

Consider what I wrote and my specific case, would you consider to go for the 3b?

Hi Ale,

0.5% is not great but not too bad. But knowing insurance companies, I am sure there are hidden fees in the instruments used to invest.

On top of that, you also pay some part for the insurance which is lost.

As far as I know, only Geneva and Fribourg have advantages but I may be wrong. And even in these cantons I don’t recommend it.

I would not invest in anything just to get a step in a relationship with financial advisor. The only financial advisor I would trust does not get any commission.

Considering what you wrote, I would still not go for 3b at all. And I would consider dropping your financial advisor. Instead, take the time to learn about investing and retirement and take your own decisions. It won’t take you nearly as much time as you think.