7 Lazy Portfolios to keep investing simple

| Updated: |(Disclosure: Some of the links below may be affiliate links)

We have already talked about the famous Three-Fund Portfolio and its variants. It is a simple portfolio made of only three funds. It is straightforward to manage yet very effective and diversified. We also saw the two-fund and one-fund portfolios. They are even more simple and have many advantages. These two are called lazy portfolios. They are the most well-known lazy portfolios.

But there are more lazy portfolios than these. People have proposed many more portfolios over the years. In this article, I cover more of these portfolios. They are called lazy portfolios because they are all using index funds. And you can keep the allocation of the different funds for many years.

Instead of choosing stocks, which is difficult, you choose stock funds or bond funds. You can either use mutual funds or Exchange Traded Funds (ETFs), depending on what you prefer and what you have access to.

Stock classification

Before covering the different lazy portfolios, we have to cover something new. Many funds are not investing in all the stocks of an index. But instead, they are investing in a class of stocks. There are many classes of stocks. Knowing about the different classes is essential to understand what your fund is investing in.

First of all, people classify stocks by size. The size of a company is its market capitalization. Companies are generally categorized with three different labels:

- Large: Generally, companies with over 10 billion USD market capitalization.

- Medium: Generally, companies between 1 and 10 billion USD market capitalization.

- Small: Generally, companies below 1 billion USD capitalization.

I say “generally” because it depends on the market. Large may not mean the same for the U.S. market as for the Swiss market. We do not have companies with a one trillion dollar capitalization in Switzerland! Generally speaking, there is more volatility but more possibility of returns in the small caps. But this is not always true in every kind of market.

Then, people also classify stocks by style. There are two main styles:

- Growth: The company is growing quickly and is expected to continue to grow quickly.

- Value: The company trades at a premium relative to its real value. People compute real value differently. It is generally based on profits, dividends, book values, etc.

- Blend: The company is between Growth and Value.

Some people only invest in growth stocks, and some other investors are only choosing value stocks. Warren Buffet is an excellent example of a value investor.

And then, you can combine both labels to have something like small value or large blend. You will find many funds for each combination of these labels. And some lazy portfolios are based on these combinations.

1. Core-Four Portfolio

After the three-fund portfolios, here is a four-fund portfolio. The Core Fund Portfolio, by Rick Ferri, is a straightforward portfolio of only four funds. It is very close to a three-fund portfolio.

You can build the Core-Four Portfolio like this:

- Domestic Bond Fund: Use your bond allocation

- Domestic Stock Fund: Use 50% of the remaining funds

- International Stock Fund: Use 40% of the remaining funds

- Real Estate Investment Trust (REIT) Fund: Use 10% of the remaining funds

It is the same as a three-fund portfolio with an added REIT fund. Compared to the three-fund portfolio, there is a preference for REITs. Even though the three-fund portfolio does not have REIT, they are included in the domestic stocks. If you want to give more importance to REIT, this fund is a good idea. If you prefer to consider REIT as their stock market capitalization weight, use the domestic stocks fund.

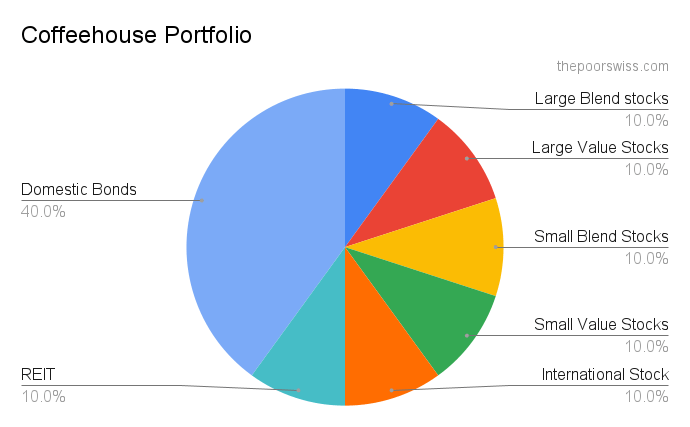

2. Coffeehouse Portfolio (Bill Schultheis)

Bill Schultheis is the author of The Coffeehouse portfolio. For reference, he is also the author of The Coffeehouse Investor. It is slightly different from the other portfolios we have seen so far. It uses a fixed allocation of 40% for bonds. The domestic allocation is sliced for each class. The international allocation uses a single fund.

Here is the full allocation of the Coffeehouse Portfolio:

- Large Blend stocks Fund: 10%

- Large Value Stocks Fund: 10%

- Small Blend Stocks Fund: 10%

- Small Value Stocks Fund: 10%

- International Stocks Fund: 10%

- REIT Fund: 10%

- Domestic Bonds: 40%

Compared to other lazy portfolios we have seen before, this one has a very low international allocation. And very high bond allocation. In my opinion, this is a very conservative portfolio. The bond allocation should move with time.

We should not set the bond allocation like this. You can still use this portfolio with a smaller bond allocation. Just keep the other funds in the same global proportion.

Also, I think that seven funds are already too much to manage. It is starting not to be that lazy!

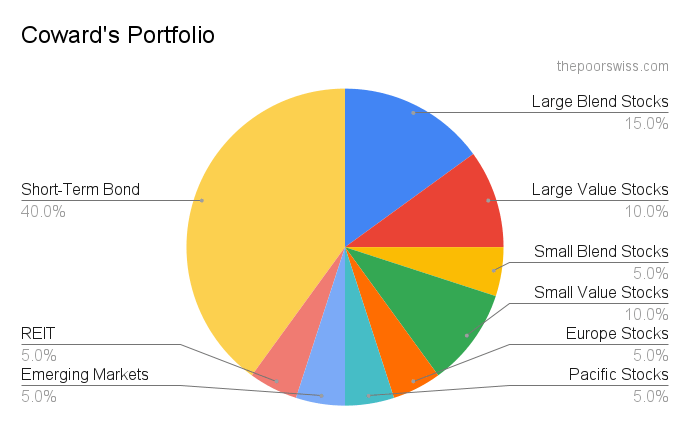

3. Coward’s Portfolio (William Bernstein)

William Bernstein elaborated on The Coward’s Portfolio. He is the well-known author of The Intelligent Asset Allocator and The Four Pillars of Investing. This portfolio is even more complicated than the Coffeehouse. It also slices up domestic allocation. But it mixes it with a fund for the domestic stock market. And several regions are forming the international allocation.

Here is the allocation of the Coward’s Portfolio:

- Large Blend Stocks Fund: 15%

- Large Value Stocks Fund: 10%

- Small Blend Stocks Fund: 5%

- Small Value Stocks Fund: 10%

- Europe Stocks Fund: 5%

- Pacific Stocks Fund: 5%

- Emerging Markets Stocks Fund: 5%

- REIT Fund: 5%

- Short-Term Bond Fund: 40%

Again, this portfolio has low international allocation and high bond allocation. I also feel that the bond allocation is too high for most people. I think that this portfolio is too complicated. Splitting international stocks into several different funds does not make sense.

That means you weigh the different regions instead of considering their market capitalization. And many allocations are too small, making it complicated to balance. Another difference is that the portfolio uses short-term bonds, whereas most portfolio uses a mix of bond terms.

4. Ideal Index Portfolio (Frank Armstrong)

Frank Armstrong created The Ideal Index Portfolio. Frank Armstrong is the author of The Informed Investor. The Ideal Index Portfolio is quite similar to Coward’s Portfolio. But it does not slice up the International Stocks and has more of it. And it has a lower bond allocation.

Here is the final allocation of the Ideal Index Portfolio:

- Large Blend Stocks Fund: 7%

- Large Value Stocks Fund: 9%

- Small Blend Stocks Fund: 6%

- Small Value Stocks Fund: 9%

- International Stocks Fund: 31%

- REIT Fund: 8%

- Short-Berm Bond Fund: 30%

I do not understand the numbers exactly. Nevertheless, I think this portfolio makes more sense than the previous one. It has more international allocation and fewer bonds. There are a lot of small-capitalization stocks compared to the other ones. It may give it an edge. But it will depend on the market.

But, it is probably too complicated for most investors. Keeping such small allocations balanced will bring a lot of trouble. I prefer fewer funds and higher allocations.

5. Lazy Portfolio (David Swenson)

David Swenson, the author of The Unconventional Success, designed the Lazy Portfolio. It is simpler since it does not slice over different classes. The main difference between the previous portfolios is that there are two bond funds instead of one. It also uses a lot of Real Estate.

Here is the Lazy Portfolio allocation:

- Domestic Stocks: 30%

- International Developed Markets: 15%

- Emerging Markets: 10%

- Real Estate: 15%

- Domestic Treasury Bonds: 15%

- Domestic Treasury Inflation-Protected Securities: 15%

I like that this lazy portfolio does not slice over the different classes of stocks. But for me, there is too much Real Estate in this portfolio. I am not a massive fan of Real Estate. But this is only my opinion. And the difference in bonds is a bit complicated.

6. All-Weather Portfolio (Ray Dalio)

The All-Weather Portfolio is a portfolio introduced by hedge fund manager Ray Dalio. The idea of this portfolio is to try to do well all the time. It is not a portfolio optimized for returns. But optimized to work during any financial time.

This particularity makes it very popular. Many people like having a portfolio that would do well during a bear and bull markets. This portfolio is a conservative portfolio that resonates with many people.

Here is the allocation of the All-Weather Portfolio:

- 40% Long-Term Bonds

- 30% Stocks

- 15% Intermediate-Term Bonds

- 7.5% Gold

- 7.5% Commodities

I like the fact that this lazy portfolio does well at all times. However, this is not the best lazy portfolio if you want high returns. But, if you want a conservative portfolio that will weather most financial storms, this could interest you.

The problem with this portfolio is that it is challenging to replicate in Switzerland or Europe. Bonds are currently yielding negative interest. So having such a significant allocation to bonds and so few stocks would prove difficult.

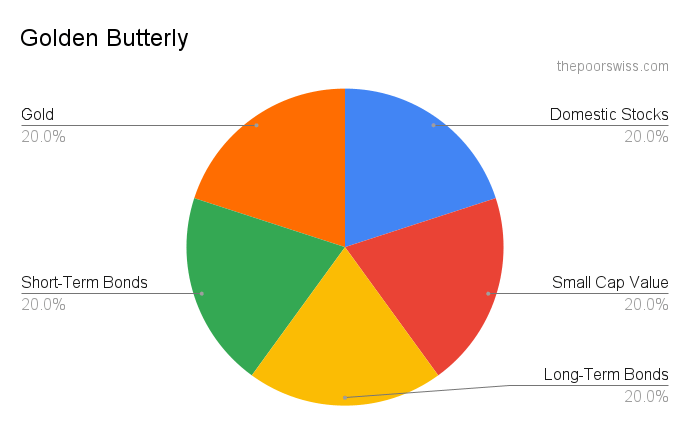

7. Golden Butterfly

Finally, we look at the Golden Butterfly Portfolio. This portfolio is designed to match the returns of the total stock market but significantly reduce the volatility. It is also a very popular portfolio these days.

Here is the allocation of the Golden Butterfly Portfolio:

- 20% Domestic Stocks

- 20% Small Cap Value Stocks

- 20% Long-Term Bonds

- 20% Short-Term Bonds

- 20% Gold

The Golden Butterfly is probably the portfolio that makes the most sense to me. I like that it is evenly spliced and has no small allocations. It will be easy to rebalance such a portfolio. However, if you are not in the United States, you cannot replicate it correctly.

For me, this portfolio is too conservative. The 40% allocation to bonds is too much for me. But I like the split into stocks and small-cap value stocks as well. And we have seen that adding gold to a portfolio can make a lot of sense.

Conclusion

As you can see, there are many different lazy portfolios.

You now know seven more lazy portfolios. And there are many more of them. However, I would not invest in them. But they may be interesting to some of you. They are too complicated for most investors. And most of them also have too many bonds. Every investor should decide on their bond allocation. One should not set it in stone in a portfolio.

I am an advocate of simplicity in a portfolio. Your allocation should use weights based on market capitalization, with a small domestic preference. Even though I may not advocate these portfolios, having a broad view of the possibilities of investing is essential.

Another issue with most of these lazy portfolios is that they are difficult to translate into European countries. Here, bonds are not as good as in the United States. It does not make a lot of sense to invest in negative bonds. Also, the stock market being tiny, we need higher international allocation.

In the next article of the series, I cover Target Retirement Funds. They are funds of funds specially tailored for retirement. A Target Retirement Fund is even lazier than a lazy portfolio since you only need to keep one fund.

If you want an example, you can look at my portfolio. Otherwise, I would recommend sticking with the three-fund portfolio.

What do you think of these portfolios? Do you follow any of them?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hi,

The question is what to do with chf cash.

Why not exchange it for usd as the usdchf exchange rate has been fluctuating for 20 years between 0.96 and 1.10

Hi IC,

I think there is too much risk in that. I think the better option is to limit the amount of cash you have.

15 years ago, it was at 1.3 and less than 10 years ago it went down to 0.75, so it fluctuates more than that.

Thanks for stopping by!

I just setup my first ETF DeGiro portfolio this week using infos from your pages (among others).

SP500 + World Stocks | Long term Gov Bonds | Gold.

Well done!

May I ask why you used both the S&P 500 and World Stocks ? World Stocks will contain the S&P 500 stocks. Which bonds did you choose ? Swiss ?

Yes, good question! As a matter of fact, I did also the same portfolio as my brother, he chose the ETFs. Indeed the WORLD contains the US stocks, but the 1Year momentum is lower (We use a 1Year momentum strategy where we swap one of the four 25% part for one with better 1Y performance. For instance, I actually didn’t buy Gold (although part of our target porfolio model), as the 1Y momentum is negative. I keep cash instead). Then we’ll do monthly rebalancings and recheck the momentums.

For the bonds we chose a European bonds ETF (mostly France, Italy, Germany, Spain).

I bought now, so as to get my feet wet ASAP and learn while doing, so my ETF choices are quite likely to evolve over time.

Anyway, I still need to learn a huge lot, so all suggestions are welcomed!

Wow, that’s already an evolved strategy. I didn’t know many people were following momentum metrics as indicator. That seems interesting though. Keep me up to date with the results!

I also found out that ETF choices evolve the more you learn about investing. I changed already several times (too many times :P).

Thanks for the series of posts. One “lazy” portfolio to consider is Harry Browne’s Permanent Portfolio. It puts 25% into each of: total world stock, total bond fund, gold, and cash. Each holding is intended to represent four different components of the economic cycle: Prosperity (stocks), Deflation (bonds), Inflation (gold), and Recession (cash). I don’t personally use it, but it is one of the well known lazy portfolios.

Thanks for stopping by!

That’s a good idea, I will include it in my next update or in a further post. Thanks :)

The problem now for Swiss investors is the cash part of it with the negative interests actual situation. How would you deal with it?

Hi Francesca,

That’s a very good point!

If you hold your cash in savings accounts, you can still hold it for free. But I would not hold 25% of Swiss cash at the current rates. This is ok with USD cash if you live in the U.S. since it will return some interests.

Unless you need your Swiss cash in the short-term, you probably do not want to hold too much of it. You could hold some USD if you want but this incurs a small currency risk as well.

Thanks for stopping by!