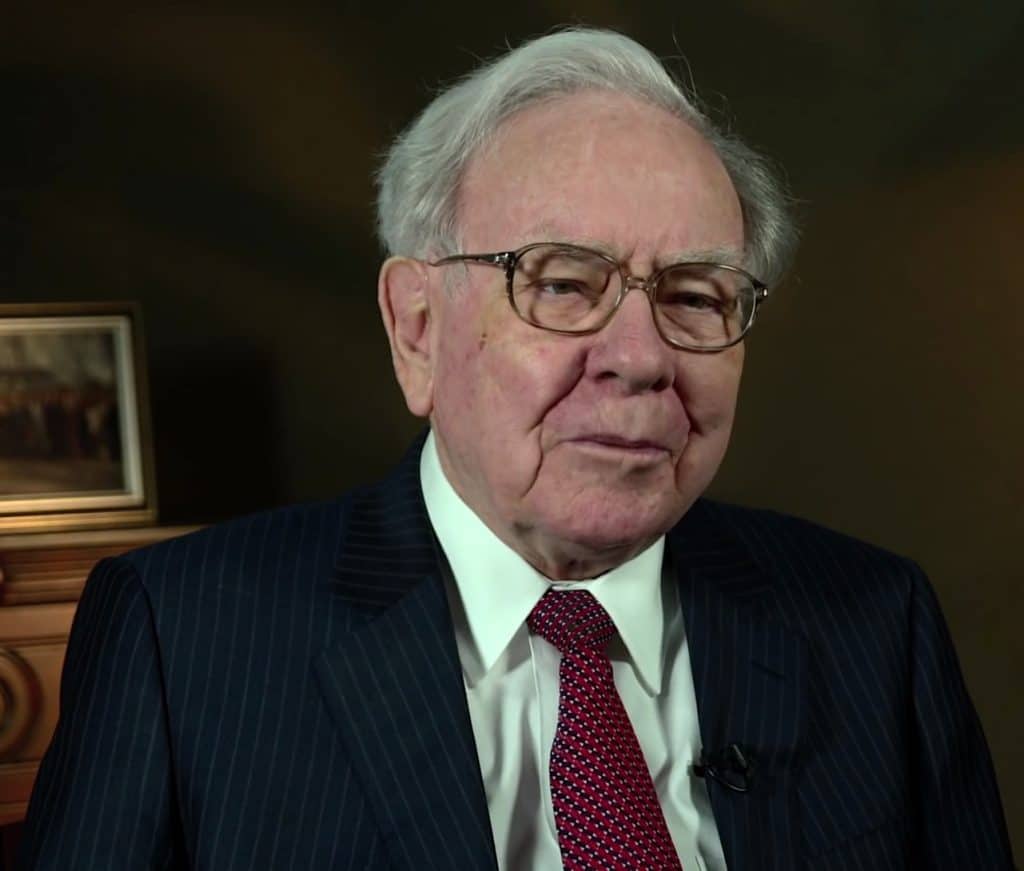

Who is Warren Buffett ? The Man and His Investments

| Updated: |(Disclosure: Some of the links below may be affiliate links)

If you are following personal finance blogs or podcasts, you probably have heard the name Warren Buffett. He is very famous in the community. Warren Buffett is a very successful investor.

He made a fortune from nothing. Being one of the wealthiest people in the world also helps to make him a very well-known figure. It is the first reason he is famous in the community.

The second reason is that he advised his fortune to be invested in index funds once he passes away. It is one of the few big investors who are supporting index funds. Finally, he also beat the market for many years, which is complicated.

In this article, we look at the history of Warren Buffett first. Some numbers may not seem much in the early years. You need to take into account inflation. One thousand dollars 70 years ago are worth around 10’000 dollars now. We primarily focus on the most significant investment he made. Then, I will talk about some essential traits of this great man.

The early years

Warren Edward Buffett was born in 1930 in the state of Nebraska in the United States. He is coming from the town of Omaha. Hence his surname of the Oracle of Omaha. His father was a congressman. Warren Buffet wanted to skip college to focus directly on business, but his father forced him to go to college.

He started very early to be interested in investing and business. For instance, he did some door-to-door selling of chewing gum and Coca-Cola bottles. He also worked with his grandpa to make some extra money. He even had a paper route. At 15, he sold his first business for 1’200 dollars. It was some pinball machines installed in several barbershops.

He bought his first shares at 11, buying shares of Cities Service Preferred. In high school, he had already invested in one of his father’s business and even bought a farm. At the end of college, he already accumulated about ten thousand dollars.

Warren then went to the University of Pennsylvania for two years and finished its Bachelor of Sciences in Business Administration at the University of Nebraska. He then completed his Master of Science in Economics at the University of Columbia. There, he was taught by Benjamin Graham, another famous investor. Benjamin Graham is often referred to as the father of value investing.

Buffett Partnership Ltd.

One year later, he had already operated three partnerships. And two years later, it was up to seven. At this point, he was able to find eleven people to invest 10’000$ into his partnership. At this time, this was a large amount of money. One of the most interesting facts from this period is about the Sanborn Map Company. Although the stock sold at 45 dollars, Buffett valued it at 65 dollars based on the company’s portfolio. When he had enough shares to have a seat on the board, he was able to push the company to repurchase the shares at this value. This operation was a 50% return on investment in two years!

Millionaire and Berkshire Hataway

Most people that know Warren Buffett also know about Berkshire Hataway, the company of Warren Buffett. However, most people do not know that, in the beginning, it was a textile company. In 1962, Buffett became a millionaire with the value of his partnerships. At this point, he began investing in Berkshire Hataway. In 1964, he was the majority owner of the textile company. Unfortunately, the company was not doing great. The textile mill industry was starting to go down. Warren said that the textile company was its worst trade. The company was kept but changed focus over the years. By 1985, the last textile mill was sold.

Warren started diversifying the company. In 1967, he began expanding into the insurance sector by purchasing another insurance company, Indemnity. After this, Warren Buffett began to a long list of investments. It started with a department store. In 1973, Berkshire Hataway acquired stocks in the Washington Post. Then, in 1979, they began to purchase shares in the media industry with ABC.

In 1969, Warren liquidated the partnerships and transferred the assets to all the partners. At this point, he had many shares of Berkshire Hataway. Ten years later, Berkshire Hataway began trading at 775 dollars per share, ending at 1310 dollars. At this point, Warren already had a net worth of more than 500 million dollars.

In 1988, he started buying stocks of Coca-Cola. Currently, Berkshire Hataway owns 7% of the company. Coca-Cola was one of the best investments made by Berkshire Hataway.

Billionaire

In 1990, Berkshire Hataway began selling A-shares. These shares have much more voting rights than the standard class B shares. They started selling at 7000 dollars, making Warren Buffett a billionaire.

In 2002, he entered in forward contracts, delivering U.S. dollars against other currencies. He made over two billion in four years with this deal.

He had a significant role during the subprime crisis of 2007-2008, not investigating it but investing and helping during the crisis. For instance, he acquired 10% of the preferred stocks of Goldman Sachs, with a considerable dividend promise. He also helped Dow Chemical pay for Rohm & Hass, becoming the largest shareholder in the merged group.

In 2008, he became the wealthiest person in the world for the first time, with a net worth of around 60 billion. He lost the place 2009 to Bill Gates, the richest man in the world before Warren. During 2008 and 2009, both men lost a substantial amount of money due to the stock market crisis.

In 2008, he purchased three billion dollars of General Electric’s preferred shares. At this time, investors were very nervous about General Electric’s ability to stay financially relevant.

The rise of Berkshire Hataway to new heights

In 2009, he invested over two billion in Swiss Re, a reinsurance company. He also bought Burling Northern Santa Fe (BNSF) Corporation for more than thirty billion. They purchased the rail company to diversify Berkshire Hataway from the finance and insurance industry. After the bubble, Goldman Sachs bought back the preferred shares. Buffett would have wanted to keep the shares generating an immense amount of dividends.

In 2011, he bought 64 million shares of IBM for around 11 billion. Until then, Buffett has always been reluctant to invest in technology stocks. He always said that he did not understand these companies. And he did not want to invest in a market he did not understand. This purchase marked a turn in investment at Berkshire Hataway with more Technology investments than before. Since that point, he has also invested heavily in Apple. In 2018, Apple and IBM were two of the top five investments of Berkshire Hataway before they sold all IBM shares.

In 2012, he bought Media General, a corporation of more than 60 newspapers. And in 2013, he purchased the Press of Atlantic City, yet another newspaper. In 2013, Berkshire Hataway bought several million shares of H.J. Heinz, the food processing company, becoming a majority owner a year later by buying more shares.

2014 was an excellent year for Berkshire Hataway. The company went back to its pre-recession status. In the second quarter, it generated more than six billion in profit, a record. And in August, the price of the A-shares hit 200’000 dollars. It means a capitalization of 328 billion dollars.

In December 2017, A-shares reached 300’000 dollars per share for the first time. Interestingly, these shares were never split. The idea was to keep them focused on long-term investors. And they only paid a dividend once, already a long time ago. The earnings were always used to grow the company. It is something on which Warren Buffet always insisted.

Investment Philosophy

Over the years, Warren Buffett’s investments have been hugely successful. He was able to beat the market for many years. But he stated that beating the market was pure chance.

As for his philosophy, Warren Buffett is a value investor. It means he is buying stocks with a market value below the value he thinks the stock should have. Most of the time, Warren invests in the long term. He is an advocate against day trading. He buys companies that have the potential for significant growth.

One thing that is very interesting about his style is that he primarily invests in something that he deeply understands. It changed in the later years when he invested heavily in some technology companies such as Apple and IBM. But this helped a lot during the dotcom bubble, where Berkshire Hataway almost didn’t suffer since they had not a lot of these tech stocks.

When evaluating a stock’s value, he considers twelve different points. They can be grouped into four different categories. There are business points, management points, financial points, and value points. For instance, one of the questions he is asking is, “Is management rational?”. It is not an easy question to answer. It requires a lot of research to find enough information on these twelve points.

But, of course, his investment style is not perfect. Over the years, he made many mistakes. According to him, his biggest mistake was to buy Berkshire Hataway. He also invested in Conoco Phillips, thinking that oil prices would continue to rise. However, he purchased at too high a price, resulting in a loss of several billion for Berkshire Hataway.

Index funds

Over the years, Warren Buffett has become more critical of active management in mutual funds. He argues that active funds are highly unlikely to outperform the market in the long term. It is a point that is often used by personal finance figures. It has been shown many times that no active funds can beat the market for many years.

Therefore, he advises most investors to move their money to low-cost index funds. Like this, people can save on fees while still tracking many stocks. That is the strategy he wants his wealth after his death for his wife.

He even made a bet about it in 2007. He stated that a simple S&P 500 index fund would beat managed hedge funds over ten years. In 2017, he won that bet by a large margin. No manager was able to beat the market for ten years during that bet. Once again, proving the point that passive funds are superior to active funds.

Philanthropy

Warren Buffett is a very generous philanthropist. Over the years, he has donated many billions to charity. Buffett stated several times that his fortune would go to charity. Although he is still among the wealthiest men in the world, he already donated a large amount of his net worth.

In 2006, he said 83% of his fortune would go to Bill & Melinda Gates Foundation. This foundation tries to enhance healthcare and reduce poverty in the world. And he also tries to expand education in the United States. He pledged around 30 billion dollars of Berkshire Hataway shares. The foundation will receive some of the money each year under some conditions.

He also donated several billion to the Buffett Foundation. This foundation invests in reproductive health and family planning. Moreover, he auctioned one of his cars for charity. And he auctioned several times a dinner with him for the Glide Foundation.

Since 2000, Warren Buffett estimated to have donated around 46 billion dollars. It makes him the most charitable billionaire of the world. It is incredible. And if you add this to his current net worth, this would make him the wealthiest man in the world by a long shot!

Frugality

It is fascinating to note that even though Warren Buffett is one of the wealthiest men in the world, he is very frugal.

He bought his house in 1958 for 31’500$. And he has lived in this house for 60 years. It is not a luxury house either. He drives himself an old car. He does not have a personal computer on his desk. He is often seen in McDonald’s restaurant and enjoys simple steakhouses. Doing that is kind of crazy for a man with billions of dollars. And he is known to keep his breakfast around 3$ each day.

He even has frugal hobbies. He reads a lot and plays bridge (often with Bill Gates). And he does not even travel a lot.

It is awe-inspiring how frugal he kept over the years. I am trying to be careful now. But if I had as much money as he, I would not be that frugal! But, of course, his net worth is linked to his frugality. It is also by spending little that he became rich. Many rich people are cheap because they need to be cheap to become rich.

Personal Finance Quotes

Finally, we can finish with some advice from Warren Buffett about personal finance.

Do not save what is left after spending but spend what is left after saving

This one is one of my favorite personal finance quotes. It is essential to understand the difference. You should first save money, then spend it. It should be one of your goals. And then, if you achieve your saving goal, you can afford to spend money.

Do not put all your eggs in the same basket

OK, he is not the only one having said that. But it is a vital quote, nonetheless. It is essential to diversify investment in a wide range of assets. Investing in a single company can be harmful. Investing only in real estate can also be a bad thing, for instance. Investing too heavily in the company you are working for is the same problem.

Price is what you pay, value is what you get

This quote is based on value investing. Try to find some bargains where you pay less than the value of something. By doing so, you made a profit in net worth. But be aware that finding the real value of things is often difficult. If you overestimate the value, you may well pay more than the actual value. It also applies to other things than investing, such as buying things online.

Our favorite holding period is forever.

This one is also essential advice. You should hold your stock positions forever. Do not try to make a short-term profit on them. But invest in things you believe in and that you can hold for a very long time. Only sell when you need the money from the sale.

Of course, over the years, Warren Buffett had many more great quotes. I encourage you to read more about them. The man is full of great and inspiring quotes!

Conclusion

To conclude, I think that Warren Buffett is a great man. He is a brilliant investor, a very generous philanthropist, and a very frugal person. He made many great things over the years and never made any fuss about it. I wish more businessmen would be like him.

Researching this article, I learned many things about him. I hope you learned a thing or two while reading it. Warren Buffett has a lot to teach people.

To learn things about another great man, you can read my article about John Bogle, the founder of Vanguard.

I have not been able to find free pictures of him at a young age, unfortunately. If you know where to find some, please let me a comment, and I will add them to the article.

What do you think about Warren Buffett? Do you have anything to add?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Amazing and comprehensive overview of Warren Buffett, great post Poor Swiss :)

P.S. I both can’t wait to see what happens when he dies with his pledge and at the same time can’t think of a world without him!

Hi Mr. RIP,

Thank you very much!

Yes, I would also like to see what happens at his death, but I also wish to see him leave longer and see what great things he’s still going to do!

Thanks for stopping by :)