Our Portfolio

(Disclosure: Some of the links below may be affiliate links)

In order to reach Financial Independence (FI), I am investing as much as possible. My money is invested in stocks in a custom ETF portfolio. I am trying to minimize the fees, diversify my investments and get enough returns to reach FI faster.

I am going to try to keep this page updated along the way with the state of my portfolio. If you are interested, you can see exactly which funds I hold in my investment portfolio. I am only holding Exchange Traded Funds (ETFs) and only those that use indexing and not active investing.

If you want to design your portfolio yourself, I have a guide on how to design an ETF portfolio from scratch. I also have an article about the best ETF Portfolio for Switzerland where I go into detail.

If you have a comment regarding my portfolio, I would be very glad to hear it!

Even simpler – 24.06.2019 – Current

Once I moved my portfolio from DEGIRO to Interactive Brokers, I have also simplified my portfolio even more:

- 80% World Stocks (Vanguard Total World, VT)

- 20% Home Switzerland Stocks

- Switzerland Stocks (CHSPI)

Having only two funds is simpler than having three funds. Also, investing in dividends is not very tax efficient in Switzerland. So, it was better for me to simply invest in the SPI index instead of in medium companies and large companies with high dividend.

You can read more about this change in how I moved from DEGIRO to IB.

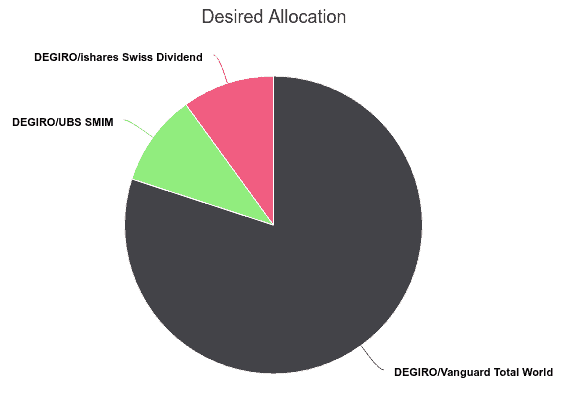

Simplicity is key – 04.05.2018

I made a complete overhaul of my portfolio to make my portfolio simpler. The previous portfolio was really too complicated. And I did not need bonds in my portfolio.

- 80% World Stocks (Vanguard Total World, VT)

- 20% Home Switzerland Stocks

- 10% Switzerland Dividend Stocks (iShares Swiss Dividend, CHDVD)

- 10% Switzerland Mid Cap (UBS SMIM)

There were many issues with the previous portfolio that the new one is overcoming:

- The previous portfolio was too overweight in tech. This is especially since I also work in Tech. I do not want to have two biases in the same industry. So, I sold my Tech ETF.

- I wanted to overweight China with Vanguard Pacific ETF, but it turns out that this ETF did not invest in China at all. So, I sold this ETF and I also decided not to invest in Chinese stocks.

- With my second pillar, I did not need any more bonds in my portfolio so I sold my bond ETFs.

- I have realized that small percentages do not help much the portfolio. I do not want any allocation smaller than 10% in my portfolio.

- I had invested in Europe to serve as a home bias on top of my Swiss bias, but it’s better to keep to my Swiss ETF since I do not want exposure to EUR for my home bias which is supposed to be in local currency.

- Finally, the fees could be reduced. For instance, I had VYMI with a high TER of 0.32% for a very limited advantage. So, I sold it to reinvest in VT and reduce my fees and increase my diversification.

Overall, this new portfolio is much simpler than the previous one and it is also cheaper.

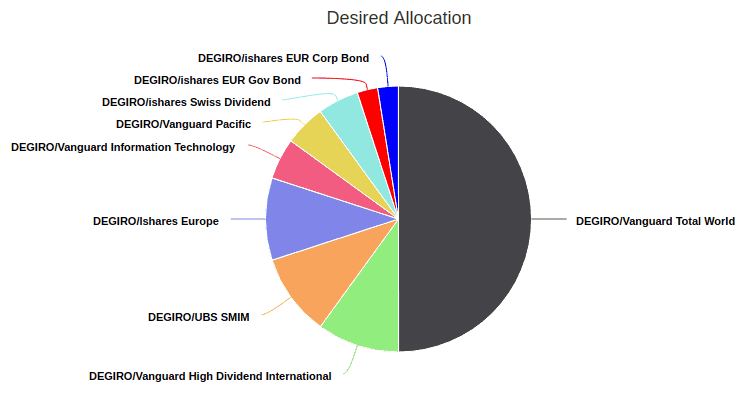

Add bonds – Remove Crypto – 06.03.2018

I got rid of my crypto-currencies and added a few bonds and some Switzerland dividend-paying companies.

- 50% World Stocks – Vanguard Total World (USD)

- 10% Switzerland Medium-Cap Stocks – UBS SMIM (CHF)

- 10% Europe Stocks – iShares Europe (EUR)

- 10% High Dividend World – Vanguard High Dividend Int. (USD)

- 5% High Dividend Switzerland – iShares Swiss Dividend (CHF)

- 5% Tech – Vanguard Information Technology (USD)

- 5% Pacific – Vanguard FTSE Pacific (USD)

- 2.5% Europe Corporate Bonds – iShares Core Euro Corporate Bond (EUR)

- 2.5% Europe Government Bonds – iShares Core Euro Government Bond (EUR)

Original Portfolio – 01.01.2018

This is the first portfolio I settled on. We’ll see how this goes.

- 55% World Stocks – Vanguard Total World

- 10% Swiss Medium Stocks – UBS SMIM

- 10% Europe Stocks – Ishares Europe

- 10% High Dividend – Vanguard High Dividend Int.

- 5% Tech – Vanguard Information Technology

- 5% Pacific – Vanguard FTSE Pacific

- 2.5% Bitcoin – XBT ETN

- 2.5% Ethereum – XBT ETN

What about you? In what portfolio do you invest?