How to Choose an ETF or an Index Fund

| Updated: |(Disclosure: Some of the links below may be affiliate links)

If you have decided to invest passively in the stock market, you must first choose the stock market index. And then, you will have to decide through which index fund you will invest in this index. For this, you can choose either a mutual fund or an Exchange Traded Fund (ETF). For popular indexes, there will be a wide choice of index funds replicating the performance of this index.

Even if you only choose popular funds for a precise index, it will still be challenging to decide. As you will see in this article, there are many things you can take into account when you compare two index funds. The most important remains the price, as most people know. But there are other points you can use to compare two index funds. And some of these points are not obvious.

In this guide, we see everything you can look at when choosing an index fund, whether a mutual fund or an Exchange Traded Fund (ETF).

Total Expense Ratio (TER)

The Total Expense Ratio (TER) of an index fund is probably the most important metric you need to look at! Sometimes, it is simply called the Expense Ratio (ER). Since you are comparing two funds that follow the same index, the difference in returns will depend on how much fee they are charging you.

The TER is the total fees removed from the fund each year to pay for the fund’s management. These fees include paying for the employees and advertisements, for instance. The TER is expressed as a percentage. This percentage is removed from the fund around the year.

When you invest passively, the only control you have over future returns is the total amount of fees you will pay. Therefore, you must choose an index fund with a very low TER.

For instance, we can look at two index funds following the S&P 500 index:

- Vanguard S&P500 ETF (VOO): The TER is 0.04%

- SPDR S&P 500 ETF (SPY): The TER is 0.09%

If you have 100’000 USD invested and choose VOO over SPY, you will “save” 50 USD per year. 50 USD per year may not sound like much. But after 20 years at 8% yearly returns, this is more than 4000 USD that you will have saved. Therefore, based only on the TER, you should choose VOO over SPY.

In my opinion, the TER is the most important metric for comparing two different index funds. However, this is not the only metric! You need to consider many other things as well.

Assets under Management (AUM)

Many index funds are tracking the same index. Some of them are managing a lot of money, and some of them are much smaller. The amount of money one fund manages is called the Assets Under Management (AUM). This metric gives you how much money people invested in the fund. It is an important metric to see if a fund is popular. However, it is a bit more difficult to evaluate than the TER.

Generally, a very large fund is a better choice than a tiny one. If the fund is very small, there is a risk it may end up being closed. It may also indicate that it is not popular for some other reasons. A very large fund is also probably more liquid than a smaller one.

Now, there is an exception here. If you want to track the performance of an index with small-cap companies, you may want to choose a smaller fund. The reason is that if a fund is too big, large investments in small companies may have a significant effect on its stock price. Moreover, some small-cap funds have been known to start investing in medium-cap companies when they grew. It means you are not investing in the same thing anymore.

In any case, you should not consider absolute values. For instance, a fund managing 400 million dollars is not necessarily better than one managing 350 million dollars. However, something must be said when you compare a fund managing two billion dollars and one managing ten million dollars.

Now, there is a slight twist here. For many funds, you will find two numbers. For instance, if you look at VOO on Vanguard, you will find these two numbers:

- Fund total net assets: 400.7 billion USD

- Share class total net assets: 90.6 billion USD

The reason is that this fund, like many others, is available in several different share classes (ETF, Admiral shares, and Investor Shares). Therefore, the first number is the amount of all the shares of the stock. And the second number is the amount of all assets under management only for shares of the ETF itself. The total net assets is the number you are interested in.

We can take an example again with the Russel 3000 Index:

- iShares Russell 3000 ETF (IWV): 9.6 billion USD AUM

- Vanguard Russell 3000 ETF (VTHR): 420 million USD AUM

IWV is more than twenty times larger than VTHR. Based on only the AUM, you are better off with the IWV.

Number of stocks

Even though you may think two index funds following the same index should have the same number of stocks, it is not always true. Therefore, an important thing to consider when comparing two index funds is the number of stocks (or holdings) of both funds.

At the time of this writing, Vanguard S&P500 ETF (VOO) has 509 stocks. It is quite counter-intuitive since it follows an index of 500 companies! It gets even worse because the S&P500 index has, in fact, 505 stocks. The reason is that some companies, such as Alphabet (Google), have several classes of shares, and the index comprises them all.

Several reasons may make an index have more or fewer stocks than its index. For instance, if the fund is too small and there are many stocks in the index, it may not yet have the opportunity to buy the smallest companies.

Since most funds are market-capitalization-weighted, there are more shares of the big companies than of the small ones. The fund will acquire the shares of the smallest companies as it grows. Another reason is that for saving money on transactions, some funds do not buy and sell all the time. Therefore, there may be some differences between the index and the fund. Finally, the fund managers can add or remove companies from the index.

Generally, you should prefer funds with a number of holdings as close as possible to the number of stocks in the index. For most indexes, there will not be much difference between funds. But if you look at large indexes, you may want to pay attention to that.

Trading Volume

Another interesting thing to consider is the trading volume of each index fund you are comparing. The trading volume is the number of transactions done for the fund. Each time one share is sold or bought, the volume is increased by one. It is a pretty straightforward notion. Generally, a bigger fund has a bigger trading volume. However, some similar funds have a much higher volume than others.

It is important because it tells you how liquid a fund is. A large trading volume indicates that shares are easy to buy and sell for this fund. But it also tells you that the difference between the ask price and the bid price is small. This difference is often called the bid-ask spread. The smaller the spread is, the better prices you will get when you buy and sell.

If you hold for the long term, it is not that important. But it could be good to know that you can liquidate your shares at the best price.

For instance, we can look at the average trading for three S&P 500 funds:

- SPDR S&P 500 ETF (SPY): This fund has a trading volume of 122 million shares per day.

- iShares Core S&P 500 ETF (IVV): This fund only has 6.3 million trades average daily trading volume.

- Vanguard S&P 500 ETF (VOO): This last fund only has 4.4 million trades per day on average.

Interestingly, even though SPY is less than three times larger than VOO, it has thirty times more trading volume. Thus, it is consistently one of the highest trading volume instruments on the stock market.

Fund Domicile

If you are in the United States, you will likely only invest in the United States. That is not to say you should not invest in indexes outside the U.S., but you can find U.S. funds with international exposure.

In Europe, it is a bit more challenging to choose between index funds coming from different countries. If all other things are equal, the fund domicile should be considered. Of course, there are some cases where you will not find funds from different countries. But for popular indexes such as The S&P 500 index, there are many funds from many different countries.

For European investors, U.S. funds are generally the best. The reason is related to taxes on dividends. Investing in U.S. funds is more tax-efficient than investing in Swiss funds in Switzerland. It is only true for funds containing U.S. equities. But since half of the world stock market is in the U.S., it is more than likely that you have many U.S. equities in your portfolio.

If you invest in an S&P500 fund from the U.S., 30% of the dividends will be withheld. However, you can reclaim the entirety of these dividends. It makes an effective 0% withholding tax. The next best thing is to invest in an Ireland fund where only 15% will be effectively withheld. For other countries, it will vary from 15% to 35% for Swiss investors. So if you can, you should invest in U.S. funds, and if you cannot, you should invest in Ireland funds.

There is just one caveat with U.S. funds: the U.S. estate tax. If you still hold these funds and pass away, you must declare your funds to the Internal Revenue Service (IRS) from the U.S. This will likely burden your heirs. However, unless you have more than 11 million dollars, they should not have to pay a tax on it.

If you are opting for any non-Swiss ETFs (including U.S. ETFs), read my article on how to file your taxes with foreign ETFs.

Dividend Distribution

When you hold an index fund, you own shares from many companies. Some of these companies will pay a dividend. First, the fund managers are receiving these dividends. However, in the end, the dividends are for you. Therefore, at some point, the fund’s shareholders, you, will receive these accumulated dividends.

There are two ways to do that. First, the fund can distribute the money as a dividend from the fund. Generally, funds do that quarterly. The other way is to accumulate dividends directly into the funds. That way, the fund share price will grow the same amount of dividends you would have gotten per share. Interestingly, European fund providers use this a lot. But U.S. fund providers only use it very rarely.

In some countries, there are some tax advantages to accumulating funds. It is not the case in Switzerland. Here, they have the same tax efficiency. Another advantage of accumulating funds is that you can save a bit on transactions because you do not have to buy shares with dividends. If you plan always to reinvest the dividends, accumulating funds may make sense.

On the other hand, distributing funds may give you some more flexibility. You will have some extra cash to invest in whichever fund you want. You could use that to rebalance your portfolio. This extra useful cash is the main reason why I prefer distributing funds. To learn more, this article compares accumulating funds and distributing funds.

Replication Technique

I have already talked at length about index replication in the past. First, there are two main families of replication: physical replication and synthetic replication.

Physical replication is simple. It means that the fund will hold shares of the companies in the index. Synthetic replication means they will use some derivatives to replicate the market performance. I do not want to go into detail about synthetic replication. I recommend you do not invest in synthetic ETFs! You should keep it simple with physical ETFs.

There are two main ways of physically replicating the index: Full Replication or sampling.

Full Replication means that the fund will hold shares from all the companies from the index. Full Replication is a simple strategy to replicate the index’s performance correctly. However, this is not always possible. For example, if the index has too many companies, it may not be efficient to hold shares of all the companies.

When it is not possible, or not efficient, to do Full Replication, index funds use sampling. In that case, they own only a part of the shares of the index companies. For instance, they could hold shares of 90% of the companies on the index. Sampling is not bad and is very close to what we discussed in the “Number of Stocks” section.

However, there is something different in that funds can also hold other things. Sampling funds can also contain some derivatives such as futures, contracts, and options to replicate the performance of the market. Thus, the fund managers have more freedom to do what they want.

I much prefer a Full Replication fund rather than a Sampling fund. However, if the index is large, you may not have the choice. In that case, it is better to prefer Sampling funds with the highest number of equities from the index. That way, you will know better what the fund holds!

Tracking Difference and Tracking Error

If you want to go deep into your analysis of an Exchange Traded Fund or an index fund, consider the Tracking Difference and the Tracking Error as metrics to compare two different funds.

The Tracking Difference is the difference between the performance of the ETF and the index’s performance. For instance, if the index returned 10% in one year and the fund returned 8.9%, the tracking difference is 1.1%.

Many things influence the Tracking Difference. The most obvious factor is the TER. Indeed, all the fees of the fund are removing some returns. But this is not the only thing. To reduce fees, funds will only buy and sell shares a few times yearly. That means that they do not always perfectly replicate the market. This can make a big difference. And the number of shares the fund holds can also make a difference.

The Tracking Error is directly related to the Tracking Difference. The Tracking Error measures the variability of the differences in returns. It is measured as the standard deviation of the daily Tracking Differences over one year.

Generally, you want the lowest Tracking Difference and Tracking Error for an ETF. Unfortunately, it is difficult to find these metrics. I have not found a website that gives me the tracking errors and tracking differences for all ETFs. If you know one, please let me know! If you want this data, you must look at the documents provided by the fund provider. They are generally updated every quarter with this information.

However, this is an advanced comparison. You probably will not have to go that deep in your analysis of an ETF!

Historical Fund Returns

Something that some people want to compare is the historical returns of the funds. In itself, it is not useful because this is the past, and we have no way of predicting the future.

Past Performance Is No Guarantee of Future Results

However, it is interesting to see if there is a significant difference between different funds. The past performance is highly related to the Tracking Difference of the funds. If there is a significant difference in Tracking Difference between two funds, there will also be a significant difference in returns. Most of the time, you will see a large correlation with the TER of the funds.

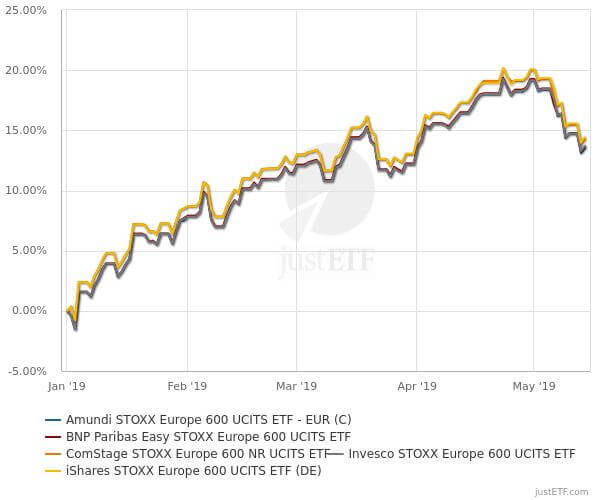

For instance, here is the graph of the performance of five ETFs for the Euro STOXX 600 index:

Two of the funds are performing significantly better than the other three. The five funds have very comparable TERs, so it is different in how they follow the index. In general, you will not have such a difference! I had to look for a while to find a good example. In the long term, these five funds do not differ much.

It could be useful to compare the historical returns if you are hesitant between several funds. They should be as close as possible to the index performance.

Currency Hedging

The last thing I want to mention is currency hedging. But first, you need to consider that not all funds are in the same currency. Generally, each fund is in the currency of the country the fund is from. Most S&P 500 funds are in USD, for instance. However, if you take an S&P 500 fund provided by a European fund provider, it could be in EUR. In any case, the underlying currency would always be in dollars. It is just traded in a different currency.

We can get back to currency hedging now. Owning a fund in foreign currency implies a currency risk. If your base currency becomes stronger, your investments in foreign currencies will lose value. And if they become weaker, you will get more. This risk is called currency risk.

In the short term, there can be a lot of variations. Some people do not want to take that risk. Therefore, they buy a fund hedged against their currency. If you buy a USD-denominated fund hedged to CHF, it will not matter if the USD or the CHF becomes stronger. Currency-hedged funds always have more fees than the equivalent unhedged fund. The hedge fee is a premium you pay to eliminate the currency risk.

There is something fundamental to know. It is not because you have an S&P 500 fund denominated in CHF that you do not have any currency risk. If the dollars go up or down, the value in CHF will vary greatly! But, as said before, the underlying currency of the S&P 500 is always the dollar. And all the companies in this index trade in dollars!

I do not invest in currency-hedged funds. I am investing in the long-term. As such, I do not believe the fees are worth it. If you invest consistently, the variations in the foreign currencies will also be averaged over time.

If you want more information, read my in-depth article about currency hedging.

Conclusion

As you can see, even after you selected an index, it remains a difficult task to pick a mutual fund or an Exchange Traded Fund (ETF) for this index. You can take many parameters into account when you compare two funds.

You do not have to use all these parameters. Depending on the situation, you may only need to look at a few. Although it is a critical parameter, the TER is not the only thing you should look for in a fund. Sometimes, the cheapest fund is not the best. It may be too small or hold too many derivatives. And even if you do not need these parameters to make your choice, it is essential to know them for the funds you are investing in. It is essential to understand your investments!

Now that you know how to choose an index fund, you may want to know how to design an entire ETF Portfolio!

If you do not have a broker account yet, I recommend you try Interactive Brokers. IB is a very cheap broker with a lot of great features.

What about you? How do you choose between two funds?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- How to Choose an Index ETF Portfolio?

- Investing Instruments: Cash, Bonds and Stocks

- What is the Efficient Market Hypothesis (EMH)?

Hi Baptiste,

I was considering investing into the VT ETF, which you also apparently have in your portfolio. Given that VT is ~60% US, have you ever considered replacing it by 60% VTI + 40% VXUS? From what I’ve seen, it seems to offer several (although minor) advantages as far as I understand: (1) VTI TER is 0.03% (vs. 0.07% for VT and VXUS), (2) you can play with that 60% percentage, which gives you more flexibility in the future, e.g. if VTI suddenly drops, you can more easily adjust, (3) and maybe also get more dividends by comparing the dividend yield vs cost of VXUS and VTI separately against VT alone…?

BUUUT… I also see drawbacks: (1) you double your brokerage cost every time you buy by having 2 ETFs instead of one, (2) playing with that 60% percentage on your own might be ‘dangerous’ (the guys behind the index surely know better than me what’s best), and (3)… would you say there a disadvantage/advantage of splitting VT into VTI+VXUS in terms of Swiss taxes? (in terms of tax filing, you’ll double the number of entries so that’s annoying, but in terms of costs?… I’m assuming there’s no difference?)

PS: while I’m at it, out of curiosity, at what frequency (biweekly? monthly? quarterly?) do you re-buy into your VT and CHSPI ETFs? I’m asking mainly for CHSPI, with that 5 CHF brokerage cost…

Thanks for your inputs! (and thanks again for this amazing site, really)

Hi martin,

I think you missed one disadvantage in that it’s more complicated. It’s not the end of the world, but you must maintain two ETFs, meaning you may have to rebalance. Your advantage 2) is actually a disadvantage for 99% of people. 3) should not be an advantage, you should get (in theory) the same dividends.

But yes, it will be cheaper to use two ETFs instead of VT. Everybody has to decide whether that’s worth the extra complexity or not. For me, I have decided this is not worth it.

As for taxes, there should no difference except that you will have twice the number of entries.

I invest monthly since I receive my salary monthly. If I received it less or more frequently, I would adapt my frequency of investing as well.

But what I do is buy only one ETF each month. So I generally buy VT most months and then CHSPI. That’s simple and quite cheap.

Cheers

Thanks a lot for the detailed answer.

I think you’re right with avoiding the complexity. I would be constantly thinking about that VTI/VXUS balance and have actually no clue what the ‘right’ balance should be. The option of just replicating VT by using the same percentage is probably the best one, but as you said, don’t know if that’s worth the trouble just to save some costs.

And yes, investing on a monthly basis seems the most logical for me as well. Thanks again!

Dear Mr Poor Swiss,

Thank you so much for your informative blog. I am trying to be more informed about personal finances and put a long-term plan in place and it has been really useful.

I had a question about the advice to invest in US domiciled funds if possible. Above you mention the estate tax but that it’s only an issue for above $11 million. However, I recently read Millionaire Expat by Andrew Hallam and he seemed to say it was on any holding above $60,000. Is it possible to verify this?

Hi Cara,

Good for you to try to put a long-term plan in place!

Excellent question. In general, it’s indeed 60’000, but in Switzerland, we have an exception since we have a treaty with the US, making this much higher. So, you can read my article about the estate tax for more details.

Thank you for the article.

What about holding all U.S. stocks in a U.S domiciled fund and the rest in Ireland funds ?

Hi southpacific,

For anything that does not have U.S. Stocks inside, both U.S. and IE funds are really good indeed.

What do you think of https://seekingalpha.com/article/4436732-avoid-voo-s-and-p-500-sell-low-dividend-yield

Ps. great blog, I’m going through loads of articles and already started my IB account thanks to how simple you explain stuff ;)

Thanks for your kind words :)

Regarding this article, I am not convinced. Dividends are important, but they are only one part of the returns, not the entire component. They are also very tax-inefficient in Switzerland. I doubt that if we go back into high inflation, many ETFs will be able to keep up.

It’s a bit dump to compare current dividends with future potential high inflation.

I have an article about dividends that could interest you.

They are also very tax efficient in Switzerland?

Your article from 2018 says the opposite “Dividends are not tax-efficient in Switzerland.” which makes more sense to me.

Holding high yield dividend ETFs combined with a high taxable income in Switzerland seems to be questionable anyway. With many ETFs you can’t choose the dividends anyway, but why hold dividend oriented ETFs if you have to pay income tax on the dividends. Might be worthwhile to compare in a future article.

Hi Capmac,

Thanks for pointing that out, that’s a big typo in my comment. I meant to say very tax-inefficient! I write too fast.

I agree that it’s not worthile. With the same return, a higher yield will end up with more taxes compared to lower yield.

Hello,

regarding AUM you write: ‘The total net assets is the number you are interested in.’ But both (‘Fund total net assets: 400.7 billion USD’ and ‘Share class total net assets: 90.6 billion USD’) have ‘total net assets’ in the description so I don’t understand which one…

Thanks

Hi Francesca,

That’s a good question :)

In that case, you are interested in Fund total net assets. This is the money in the entire fund. The share class total net assets is only the money in the ETF or mutual (depending on what you are looking at).

Hi Mr Poor Swiss, thanks for the insights. Question: didn’t Swiss investors lose access to the U.S. domiciled ETF’s – doesn’t that include the Traditional Index Funds like the ones from Vanguard or iShares and similar? So the only way for the Swiss (or EU) investors would be to invest into the Irish S&P500 fund?

Hi Kranz,

Fortunately, we did not lose this access! I was thinking that it would happen in 2020, but apparently, it may still happen in 2022 for foreign brokers. But I am honestly not fully understanding the law here.

So, funds from Vanguard are still usable but only the ones from Vanguard Europe, not the ones from Vanguard U.S. And yes, most of these are in Ireland since they are more tax-efficient than most other countries.

Thanks for stopping by!

“If you invest in an S&P500 fund from the U.S., 30% of the dividends will be withheld. However, you can reclaim the entirety of these dividends. This makes an effective 0% withholding tax.”

Could you please explain how this reclaiming works. I know that because of tax-treaties the dividend tax can be reduced to 15% (for example if you’re living in Germany), but how can you make it 0%?! You are still supposed to pay your US dividend taxes? Is there something I’m missing?

Thanks for the great blog!

Hi,

In Switzerland, 15% will not be withheld by the United States since we have a tax treaty, this will only be true if you fill a W8-BEN from with your broker. This 15% are not-recoverable if the fund is not American.

The other 15% is withheld by Switzerland. It will also be withheld, but it will be counted towards what you already paid in taxes once you fill your tax declaration.

Does that make any sense?

Sorry it’s confusing. For both Switzerland and Germany the tax treaty reduces the US tax from 30% to 15%. It is never 0% as far as I know. Of course you need to fill a W8-BEN form to be eligible for this reduction. So you have to pay 15% US tax regardless of what you do in your home country. Isn’t this right?

Hi,

Actually, you are right, my explanation was pretty bad :s

You are right, you cannot lower the withholding to 0%, the minimum if 30%. With a tax treaty from Switzerland (and apparently Germany, but I do not know anything about that) and a W8-BEN, we can reduce the withholding to 15%.

On top of that, for foreign funds and stocks, there is no withholding from Switzerland.

But, you can declare the 15% withheld by the United States using a DA-1 form on your tax declaration. This means that this 15% withheld will be counted as already paid taxes. This is what I meant by getting back the 15%.

I hope it makes more sense now.

I really need to put that in an article :)

Thanks!

I guess DA-1 is Switzerland specific? Do you have to pay taxes on foreign income in Switzerland? Let’s say you have funds in the US and you end up paying 15% US tax on dividends. How much more do you have to pay in Switzerland?

Hi,

Yes, DA-1 is a Swiss form in the tax declaration.

Yes, we pay taxes on foreign dividends and income. Dividends in Switzerland are taxed like income. So, how much you pay depends on the total of your income and many other factors. The higher income you have, the higher taxes you will pay on dividends.

Thanks for stopping by!

Hi,

That’s only partially correct because there’s a strange formula that at least the taxation authorities in the Vaud canton use, that says something along the lines of “if the US withheld amounts are higher than the respective Swiss amounts, then the US withheld amounts will not be reimbursed”

… ;-)

Not sure if it applies to both US-164 and DA-1 or only one of them, as have not (yet?) been able to get to the gist of it other than trying to encourage myself to invest more in Swiss stocks…

Hi Pedro,

That’s correct. There are several limits that apply.

This is described here: https://www.estv.admin.ch/dam/estv/fr/dokumente/verrechnungssteuer/merkblaetter/da-m.pdf.download.pdf/da-m.pdf

Is that the one you are talking about? It depends on how much you are deducting already. It’s way too complicated :(

Hello Mr. The Poor Swiss,

Great article thank you!

How about putting up an article about best ETF fund to invest for 2020? Or about how to reclaim the 35% withholding for US stocks?

That would be a very useful blog post indeed!

Thank you for sharing your thoughts!

Hi LearningFI,

These are excellent suggestions. I really need to update my post on portfolio for Switzerland. I will put that on the list.

As for the other, this is also a good idea. I just do not know if there is enough for an article. It’s actually only 30%. 35% is for Swiss Stocks.

In any case, I am going to try to put these two on my priority list. It’s indeed important that this is covered on the blog.

Thanks for stopping by!

Hello,

I am a big fan of your blog:)

About the ETF’s from the US, why are they so much better?

I get that you will be able to get the complete dividend from the US by asking, but so do you with Swiss Etfs, so they are equal in that point.

Thanks and have a great day,

Philippe

Hi Philippe,

There are two advantages to U.S. ETF:

1) You can get back 15% of the dividends that would be withheld otherwise. If the ETF is in Ireland for instance, you will not be able to reclaim U.S. dividends.

2) They are cheaper in TER and bigger.

No, Swiss ETFs are not equal at all! If a Swiss ETF (or any other country not U.S.) holds U.S. securities, dividends will be withheld at source by the U.S. Tax Office, these dividends you will never be able to reclaim! You will be able to reclaim the 35% withholding of the dividends in the end, yes, but you will have lost 15% of the U.S. dividends. And since the U.S. is half of the wold stock market, this is significant.

Hope that makes sense :)

Ok thanks now I understand:)

I meant with an Swiss Etf only containing Swiss Stocks I did not see any difference with the dividend.

But the point Nr.2 is indeed interesting!

Thanks for clarifying.

Best,

Philippe

Hi Philippe,

Then, yes, you are right. This special difference is only for U.S. Stocks. If you have a fund with European stocks, Ireland is slightly better than other countries in Europe but it is not a huge difference.

Only for U.S. stocks are U.S. ETFs really much better.

Thanks for stopping by!

Since you are explaining basics here and I am just a beginner investor, let me ask you a very simple question. Where can I find the list of all ETFs? Probably, the obvious answer is in the Internet. Indeed, I found 2 websites which I believed will provide me the same list of ETFs: http://www.etf.com and http://www.justetf.com. However, when I started looking at them, I got completely lost.

Let’s take the same example as you used: Vanguard S&P500 ETF

On the etf.com I could find it easily: https://www.etf.com/VOO. Indeed, TER is 0,04%, as you mentioned. Fund domicile is ??? – I don’t see this information on the webpage, probably US. ISIN is ??? (If we could see ISIN on this web page, then we could figure out the domicile from the first two letters)

However, if we go to justetf.com, we will not find this ETF. Instead, I found Vanguard S&P 500 UCITS ETF: https://www.justetf.com/ch-en/etf-profile.html?isin=IE00B3XXRP09. TER is 0,07%. Fund domicile is Ireland. ETF Ticker is ??? What does mean UCITS? Is it an attribute saying that this ETF can be traded in European stock exchanges?

It seems that those 2 ETFs are different funds of the same issuer Vanguard. I don’t understand “domicile” of ETF, and why there are two funds from Vanguard tracking the same index S&P 500 but it looks like domicile is important characteristic when choosing an ETF and it is worth mentioning in your article.

I we look at iShares Core S&P 500 ETF, this is even more confusing because there are 3 such funds.

Here is the link: https://www.etf.com/IVV. TER is 0,04%. ETF Ticker is IVV.

On the other hand, justetf.com give us the following:

iShares Core S&P 500 UCITS ETF (Acc): https://www.justetf.com/ch-en/etf-profile.html?isin=IE00B5BMR087 TER is 0.07%, Fund domicile: Ireland, Distribution policy: Accumulating

iShares Core S&P 500 UCITS ETF USD (Dist): https://www.justetf.com/ch-en/etf-profile.html?isin=IE0031442068 TER is 0.07%, Fund domicile: Ireland, Distribution policy: Distributing.

Hi Aleksei,

Finding the entire list of all ETFs is quite difficult.

VOO is domiciled in the U.S. And they do not use ISIN in the U.S.

Vanguard S&P 500 UCITS is another ETF from Vanguard Europe following the same index. As you saw, it has slightly higher TER.

UCITS represent funds regulated by the European Union.

Vanguard offers funds in several countries. So they have both a S&P500 ETF in the U.S. and a S&P500 in the European Union. The regulations are different.

The problem with ishares is the same, they also have iShares US and iShares Europe. As for the distributing policy, this should be straightforward ;)

You’re right, I should have talked more about the fund domicile. I will do that in the next revision of the post!

I hope that helps and thanks for stopping by!

Thank you for the explanation.

Indeed, you are right. ETF selection on the http://www.justetf.com are adapted to the country shown on the top left corner. The database of the site only contains European domiciled ETFs (no US domiciled ETFs are available). It explains why I cannot find VOO or IVV.

“VOO is domiciled in the U.S. And they do not use ISIN in the U.S.” In fact, I managed to find ISIN for VOO here: https://www.trackinsight.com/fund/US9229083632. It is US9229083632. (As expected, it begins with the letters ‘US’.) The only think remains unclear is why etf.com does not provide this information.

As for UCITS, you are also right. ETFs that have UCITS in their name conform to European Union regulations designed to protect the general public from unsuitable investment vehicles. UCITS stands for Undertakings for the Collective Investment of Transferable Securities. More info here: https://www.justetf.com/uk/news/etf/legal-structure-of-etfs-ucits.html

Thank you.

You’re most welcome.

Oh, it’s good to know that they have ISIN as well! Since I never saw anyone use it in the U.S., I assumed they did not have it. Thanks for letting me know!