Should you have a home bias in your portfolio in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Many people use a home bias in their investing portfolio. These investors are allocating a large portion of their portfolio to domestic stocks. And this portion is not based on the size of their local stock market. But not every investor agrees with that strategy. And some people do not know what a home bias is.

So, in this article, we discuss whether investors should have a home bias in their portfolios. We also look at existing research on the subject.

Home Bias in investing

So: what is a home bias in investing?

You have a home bias when you dedicate a large portion of your portfolio to stocks of your home country. For instance, you could say that you are allocating 25% of your portfolio to Swiss Stocks if you live in Switzerland.

One important thing is that your home bias does not have to be in the country you are living in right now. If you plan to retire in another country, your preference should be toward this other country. For instance, if you live in Switzerland now but want to retire in England, you may want English stocks as your home bias.

In general, people should invest in a diversified way. If you believe in the efficiency of the market, you want to invest according to stock market valuations. So if your country represents 10% of the entire stock market, you should invest 10% of your portfolio in your country’s stocks.

So, if you invest more than this 10% in your country’s stocks, you have a bias (sometimes called a tilt) towards this municipality. This country bias is your home bias.

We will take the example of Switzerland. Switzerland is about 3% of the world’s stock market. I allocate 20% of my portfolio to Swiss Stocks. So, I have a substantial home bias towards Switzerland.

Benefits of Home Bias

There are two benefits of adding a home bias to your portfolio.

The first advantage is that if something gets bad in other parts of the world, it could reduce the volatility in your portfolio. A home country bias could greatly help you if you need the money at this time of trouble.

This first advantage also helps with currencies. If your bias is in CHF and the USD loses a lot of value, your shares in CHF will be safe from this devaluation. Again, this protection could help if you need to sell at the wrong time.

Research showed that a reasonable home bias (lower than 40%) could decrease volatility in local currency. If you want to retire by withdrawing your portfolio, it is essential to consider volatility.

The second advantage is that you know more about what you invest in. Investors will likely know a lot more about companies in their own countries. And investors are more likely to invest in what they know. So, if you need a home bias to start investing, you should have one, by all means.

Home bias hurts your diversification

Now, an investing home bias also has some disadvantages.

Since it is a bias, it will hurt your diversification and returns. Now, this will highly depend on how biased you are. Diversification is critical for reducing volatility by spreading your investment over multiple countries and different kinds of companies. With good diversification, you will have fewer risks of something happening in a country and ruining your portfolio.

How much such a bias will hurt your diversification will depend on its size. For instance, if your home bias is 80% of your portfolio, you are losing on a lot of diversification. On the other hand, if it is only 20%, it may help you in times of need, and the impact on diversification may not be that high.

While diversification is excellent, it also suffers from diminishing returns. When you have 60% of foreign stocks in your portfolio, the benefits of more diversification get lower. So going from 60% to 70% of diversification has less impact than going from 10% to 20%. Research from Vanguard confirmed these results.

Therefore, if you keep your home bias reasonable, you will not pay a higher price for diversification.

Home bias can be achieved with currencies

In practice, it is unlikely that a global event does not impact your home stocks. On the other hand, a large currency event in some countries could spare your home currency if it is strong.

So, in some cases, it does not have to be in the same country as your home bias, but it needs to be in the same currency. If you plan to retire in France, you could have a home bias with European stocks in Euro. Of course, if you plan to retire in Switzerland, you will be limited to Swiss stocks, which are the only ones in Swiss Francs.

But, you do not have to invest in Swiss stocks to get Swiss Francs in the stock market. You could get some cash, but it would lose value to inflation.

Something that would work instead is to have foreign stocks hedged in your local currency. With this technique, you would not lose on foreign diversification. And you would still benefit from having stocks protected from variations in other currencies.

Now, there are some disadvantages to currency hedging. It could be more expensive in the long term. And no conclusive data shows that currency hedging will yield better performance. And currency hedging will reduce your currency diversification.

Nevertheless, currency hedging instead of a pure home bias could be a good solution for many investors if they worry more about currency fluctuations than local events.

Home bias ETF may be cheaper

Sometimes, an investor may save money by adding a home bias ETF to his portfolio.

In some countries, it is more efficient to invest in domestic stocks than in foreign stocks. In that case, having a home bias will reduce your overall fees. And since we saw that investing fees were very important, doing so may help your overall returns.

It is not the case in every country. For instance, in Switzerland, you do not have lower taxes for Swiss Stocks than for foreign stocks. On the other hand, ETFs for Swiss Stocks generally have higher Total Expense Ratios (TERs) than foreign stocks ETFs. And the Swiss Stock Exchange itself is much more expensive than American Stock exchanges.

But there is one thing where they will differ: currency exchange fees. When you buy a U.S. ETF, you will need dollars. If the dollar is not your base currency, you must buy dollars with your local currency. Foreign exchange conversions are not free. If you have a good broker like Interactive Brokers, these transactions will not be expensive. But for many other brokers, like DEGIRO, currency conversion can be expensive. So, this adds a fee that buying Swiss Stocks will not have.

Consider the big picture

One problem with home bias is that many investors are bad at considering the entire picture.

If you have a home bias in your primary investing portfolio but have a lot of home stocks in your retirement accounts, you are likely to have too large of a bias. As we saw before, a home bias that is too large will hurt diversification. In turn, a lower diversification will reduce your returns and increase the volatility of your portfolio.

So, you should consider your entire net worth and decide how much home country bias you want in this net worth. You should not consider only your investing portfolio. It is always essential to have a good view of where you are standing and what your assets are.

For instance, in Switzerland, you should consider your second and third pillars as well. You probably have more Swiss Stocks than you think. It is always a good idea for your asset allocation to represent your total assets, not a small portion of them.

How much home bias do people have?

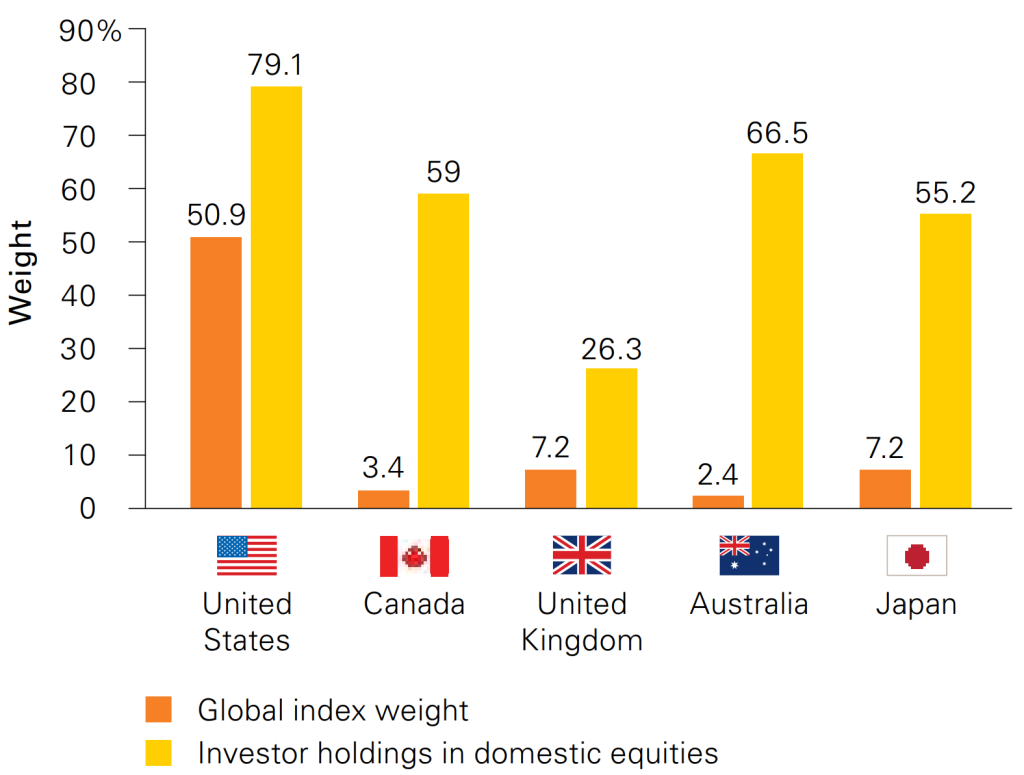

To understand what investors are doing, we can look at how much home country bias investors from different countries have in their portfolios.

I have found the results for five countries in a research paper by Vanguard.

As we can see, most investors have a strong bias toward domestic stocks. The most extreme example is Australia, where the domestic stock market is only 2.4% of the world, and Australian investors are allocated 66.5% to domestic stocks.

In the United States, investors have an extensive bias toward domestic stocks. On the other hand, the American stock market is half of the world’s stock market. So these investors are making themselves less of a disservice than Australian investors.

In the United Kingdom, the results are better. On average, English investors have 26.3% invested in domestic stocks. So, English investors are doing a better job at diversification than most.

I also found some interesting results from Vanguard for Switzerland. Here is what Swiss investors have in their portfolios on average:

- 43.79% of Swiss Stocks

- 36.97% of European Stocks

- 19.24% of Other Stocks

Two things are interesting in these results for Swiss investors. First, Swiss investors have a strong home country bias. They allocate more than 43% to domestic stocks. Also, Swiss investors have a second bias toward European Stocks.

Overall, Swiss investors invest more than 80% in European and Swiss Stocks. However, these stocks only represent about 25% of the world stock market. It means that Swiss investors have an extreme European bias.

These results are fascinating. I did not think that Swiss investors had such a bias. I would not recommend such a high bias towards Swiss or European Stocks. If you want both biases in your portfolio, you could do 20% in each and then keep 60% fully diversified globally. But I prefer having only a Swiss home bias.

Conclusion

While it is a bias, I still believe a home bias makes sense. However, it is not strictly necessary, and it should not be too large. Home bias in 10-40% may help you invest and protect yourself against some foreign events. But a more considerable home bias will hurt your diversification.

I like having a home bias in my portfolio. I want at least 20% Swiss stocks in Swiss Francs in my portfolio. Since I consider my allocation on my entire net worth, my allocation in Swiss Stocks ETF may be lower. But overall, I try to stick to this 20%. I want to have such a bias in Swiss Francs to hedge against foreign currencies getting deflated.

If you do not know what to do with your home bias, I recommend adding a small home bias to your portfolio. Doing so will likely reduce the volatility of your portfolio. And it could help if you need to sell when it is the wrong time for foreign stocks.

Continue to learn more about portfolios by reading about currency hedging and whether you should use it in your portfolio.

What about you? Do you have a home bias in your portfolio?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- What Makes Vanguard Unique?

- 13 Greatest Stock Market Myths that do not die

- What is Compound Interest? Is it Magic?

Hi. I currently live in Norway and therefore thought of having a home bias in norwegian krone. However looks like it is not possible to invest in a Norwegian ETF on ibkr. What do you recommend in that case?

Hi ina,

I am surprised there are no Norwegian ETFs. There seems to be at least a few US ETFs for Norway, but I did not find any UCITS (for Europeans) ETFs for Norway.

In this case, if you want a home bias, you could consider either buying stocks directly or buying Treasury bonds.

Hi Baptiste,

Thanks for such a quick reply. After doing a bit of research and reading your articles as well I have 2 options: to choose at least 20 companies in the Norwegian market and invest in their stocks directly OR to invest in bond fund, which I am struggling to find possible through ibkr and also through my bank in Norway. I would prefer to keep things simple and therefore do you think just investing 20% of my portfolio in European etf would be a good idea? In NOK currency the only other option I have are mutual funds from the bank, but they generally have quite high TER :/

The problem with European ETFs is that first it’s in EUR and not NOK and second it will only a tiny part of norway.

Maybe you can get a stock fund at your bank that would not be too expensive?

Thank you Baptiste for another great article!

I am a little be troubled about the Swiss stocks bias as:

a. The big 3, are about 50-60% of the SPI or SMI

b. The revenue of the big 3 is coming from outside Switzerland (more than 95%)

The way I see it, by investing in SMI or SPI you have a high exposure to only 3 companies and without the benefits of the home bias (e.g. currency hedging)

Maybe SPI-extra could be a better job? No exposure in practically a few companies + investment in companies with revenue mainly from Switzerland.

Haven’t found though an ETF for SPI-extra :/

Hi

It’s true that both the SPI and the SMI are very exposed to the big 3 stocks.

And they are indeed quite global companies.

You could use the SLI instead, they have strong rules for weighting large rules. I have an article about Swiss stock market indexes.

Indeed the SLI improves a little bit the situation.

Still 4 companies take 37% and 10 companies about 64% of the index.

All 10 largest companies I checked are multinational with revenue coming mainly from abroad!

I guess we cannot do anything about that…

Another thing that troubles me, is the Entry fees (5%) and Redemption fees (3%) of the respective ETFs (Checked UBS and iShares ETFs)

From my draft simulations, if you invest a fixed amount every year and with a return of 5%,

the Total Return LOSS due to the above 2 fees is about 50%, 30% and 20% if you sell your ETF after 5, 10, and 20 years respectively!!

Makes me think if such a loss combined with the big bias towards a small number of Swiss companies that are actually getting their earnings from all over the world makes sense in the first place.

Maybe a World/US CHF hedged ETF with no entry/exit charges (any recommendation?) would cost less and without the drawback of the SLI/SPI/SMI companies bias?

OK, forget the second part of my previous message. Apparently these fees do not apply if you trade in the secondary market.

My mistake…

Hi huskarl,

Keep in mind that we have a tiny stock market, so it makes sense that there is a concentration of large companies.

There are no entry or redemption fees on ETFs. This only applies to mutual funds. An ETF is like a stock, you will pay the transaction fees and you are subject to the spread of the market.

hi IB, I know your blog is dedicated more to Swiss residents and it makes total sense to have such a focus but I am reading a book which is also touching upon home bias and the author recommended a lighter allocation toward retirement destination if it’s an emerging country as Thailand, Brazil, etc. I am from an emerging country and may eventually retire in South East Asia but the thought of investing in a SEA market index (ex Singapore) knowing that those currencies are gonna be inflated like crazy really doesn’t make any sense to me. In this case, is home/retiring destination allocation still worth?

Hi

It’s entirely true that home bias depends on a lot on where you are going to retire. You need to consider the local currency and the local stock market before. The Swiss stock market is quite stable and the currency is strong, so I feel like it’s a good home bias.

I don’t know asian markets or countries, so I can’t be specific about them. But you cannot know how they will inflate in the future. Many people go without a home bias and are perfectly fine.

Hahaha I guess I was waiting for your last sentence. Seem like I won’t have a home bias until I am more certain where I would like to retire. Thanks for the rep <3

Indeed, a home bias makes more sense when you need to spend that money, so if you don’t know in which currency you will spend it, it becomes less interesting to have a home bias.

Hi Mr Poor Swiss!

Thank you for another good article.

Strategy speaking, which one is better to keep the 80/20 (global/swiss) balance?

10months investing on a global etf and 2 months investing on a swiss etf? (assuming that every single month the same amount of money is invested)

or

every single month: 80% of the invested money on a global etf and 20% on a swiss etf?

thank you very much

Hi Ric,

I would say it depends on how much you invest and the fees you are going to pay for both.

First, 10 and 2 would not get you in your home bias, but 16.66 (2/12). For 80/20, you should invest 4 months in the US, then one month in CH, and repeat the cycle. For, me that would be ideal to minimize investing fees.

If you are investing large amounts (at least 2000 CHF per month), it makes less difference since the fees are less relevant. For instance, I pay 0.35 USD for my US ETF and about 5 CHF for my Swiss ETF. So, I generally buy what needs to be bought based on the balance of my ETFs, sometimes two ETFs per month.

Ok. thank you very much.

Do you have an article about balancing a portfolio?

Have a nice day

Hi Ric,

No, I thought it was too simple to have an article. What would you like to read on balancing?

But I do have simulations on rebalancing in retirement.

Hello,

No, the one in your link is very clear=) it was the kind of informations that i was looking for.

Thank you very much.

Have a nice day

Some dead links, here are the updated ones (I think):

https://assets.informa.com/MarketingImages/2017/Vanguard_2017/ISGGAA_022017.pdf

Thanks for letting me know! And thanks a lot for the updated links, they look good! I have updated the artice.

hello

The first one is dead.

Have a nice day

Thanks Ric, I will fix this!

Good evening Swiss,Thanks for this valuable blog.

I would like to ask you the following regarding your allocation portfolio and ter.

What do you thing of mixing the VXUS+VTI instead of VT? In terms of ter and performance isn’t it more efficient?

Another alternative should also be VOO. I think this way you don’t need to much Europe allocations since VXUS has about 39% European stocks. What do you thing?

Thanks f…

Hi clair,

You could save on the TER, but I don’t think it’s worth it. If you use VXUS + VTI (or VOO), you will have a lower TER than VT. However, then, you have to rebalance both and you also have to find out the percentage for the US.

For me, it’s not worth it. But if you have several million invested, this kind of optimization can start to make sense.

Hi,

Thanks for the nice article. I have been following your blog for some time, keep up the good work!

I’d like to share a different approach to the home bias. They way I see it, the biggest asset a person normally posesses is their potential to work. By that I mean, that the biggest part of one’s savings come by their salary, especially when you are young/far from retirement age (or even once you are already FIRE, since you can always go back and work if there is a big shortcoming). Your work is by definition very heavily biased by your home (at least pre-covid that teleworking was not very common). Therefore, I’d argue that one should have a negative bias on their investment to balance this pre-existing bias!

I hope it makes sense, looking forward to your thoughts!

Cheers,

Alex

Hi Alex,

Your work is indeed a home bias. And you are paid in your local currency generally, so this offers some bias toward your local currency as well.

Now, this is only a good bias if it is stable and if you have a job. So, this cannot replace a home bias in retirement.

Now, if you want to negate this bias, it means you will have no bias at all. This is not what I am doing since I have a home bias in my investments. And according to your theory, I actually have two biases one for my job and one for my investments.

Now, since the company I work for is actually a U.S. company, there is less of a bias. I can live with these biases since I plan to retire in Switzerland.

Overall, I kind of agree that working in a country already is a bias. But I do not think we have to take this into account or negate it.

Thanks for sharing!

So if your 2p/LPP represents 20% of your total assets, does that mean you wouldn’t buy any Swiss stocks? Or would you maintain 20% Swiss stocks, and with your LPP, this would represent 40% of your total assets? Thanks!

Hi Emoe,

Good question :)

In my case, I consider my second pillar as bonds since it returns basically nothing but is very safe. So, I do not count it towards my Swiss Stocks.

However, I was able to invest my second pillar (i.e. if I had a vested benefits account), I would count its swiss stocks part towards my overall Swiss Stocks allocation. So, if the Swiss Stocks of my second portfolio represented 20% of my overall assets, I would not need to invest in my broker account.

It’s indeed complicated to get a good balance when you have different investments (second, third, broker). What I would do is choose a similar portfolio in each layer:

* Second pillar: 20% Swiss Stocks, 80% Global Stocks

* Third pillar: 20% Swiss Stocks, 80% Global Stocks

* Broker: 20% Swiss Stocks, 80% Global Stocks

That would be ideal for me if I could do that. But I cannot invest my second pillar and my third pillar has more limitations on Swiss stocks.

Thanks for stopping by!

Thanks Poor Swiss, I think you make a really good point about needing to look at pension/3pillar investments when thinking about your holdings.

You mentioned taxes, and while these are not different in CH I think they are significant in some other market. I believe in Canada taxes on dividends significantly different for domestic & foreign companies.

The other factor, bureaucracy, my friend in Australia has to apply to trade US equities with his broker, added paper work etc… encouraging keeping it simple with domestic stocks

thanks again

Hi FrancInvesting,

That’s completely correct, in some countries, where you invest will make some large differences in Taxes. Fortunately, here it’s not the case, even though the withholding is different, the final taxes are the same.

In Switzerland, it’s simple to buy US equities and especially easy to buy ETFs with U.S. equities. But as you said, some countries may have more difficulty. And as such, this may encourage them to have a large home bias.

Now, even in Switzerland, the average home bias to Swiss Stocks (44%) is too large. And many people have a large European bias (37%). Together, this is a very strong bias against diversification.

But I do not know why this is the case in Switzerland since it’s easy to invest outside? Maybe just bad advice from banks.

Thanks for stopping by!

Another thing worth considering is where the companies you invest in do business.

As an extreme example, I own some Phillip Morris International. They are listed on the US stock exchange but do no business at all in the US (a sister company serves the US market.)

Thus they aren’t really a “US” business. Really you are investing in Indonesia, Middle East, Russia etc. where the company actually sells the product.

This is especially important as we live in Switzerland, a small country. Nestle, Novartis and Roche are a huge portion of the Swiss stock market but only do 1 or 2% if their business in Switzerland. Thus, if you really want home bias you might want to invest in smaller companies.

Hi Joe,

That’s a good point. And the example of Switzerland is a good one with the three huge companies that make up most of their businesses in other countries.

I would have to insist more on globalization in this article.

Thanks for sharing!