Finpension Invest Review 2024 – Pros & Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Finpension already manages the best third pillar and the best vested benefits account. And they have now launched Finpension Invest, their robo-advisor service. It is a very exciting time.

As usual, we will look into the advantages and disadvantages of this new service, in detail. We will also look at the fees, features, and security of Finpension Invest. By the end of this review, you will know whether you should use Finpension Invest and how it compares to other alternatives.

| Management fee | 0.39% |

|---|---|

| Product Costs | 0.08%-0.10% |

| Investing strategy | Passive |

| Investing products | ETFs and index funds |

| Minimum investment | 0 CHF |

| Currency conversion | 0.002% |

| Customization | Very high |

| Sustainable | Not by default |

| Languages | French, German, and English |

| Custody bank | Finpension |

| Users | 30’000 |

| Established | 2016 |

| Headquarters | Lucerne, Switzerland |

Finpension Invest

An excellent and innovative Robo-advisor by Finpension.

- Most tax-efficient Robo-advisor

- Access to private markets

I have already talked at length about Finpension on this blog. They originally had a 1e pillar account and then started to offer vested benefits because their customers wanted to keep their money with them once they quit work. And finally, they created Finpension 3a.

This company is fascinating because I consider their 3a to the best third pillar available at this time. And they also managed to get the best vested benefits account.

Since they have started, they always had an excellent reputation, and they have led several things in the way of innovation. As of 2024, they are managing well over two billion in CHF.

In 2024, they have now introduced another product in their lineup: Finpension Invest. This service is a Robo-advisor, outside the retirement system. They had been hinting at this already in 2023, so it is great to see the final product.

It is important to note that Finpension was approved as a securities firm by FINMA. It means that they can hold the securities themselves and do not need to use a custody bank.

For regulatory reasons, Finpension Invest is only offered to Swiss residents.

So, we will see in details what Finpension Invest is.

Investing strategy

First, we will start with the investing strategy. It is essential to see how a Robo-advisor invests to see whether we should use it or not.

Finpension Invest uses Exchange Traded Funds (ETFs) for stocks. For bonds, they use index funds. Using ETFs is the standard way Swiss Robo-advisors work. The good news is that they only use index ETFs. Index ETFs are following an index instead of trying to pick stocks. This makes them cheap, and in practice they even beat active funds.

There is usually a tax-efficiency downside to using ETFs, but as we will see in the next chapter, Finpension Invest does not suffer from this downside.

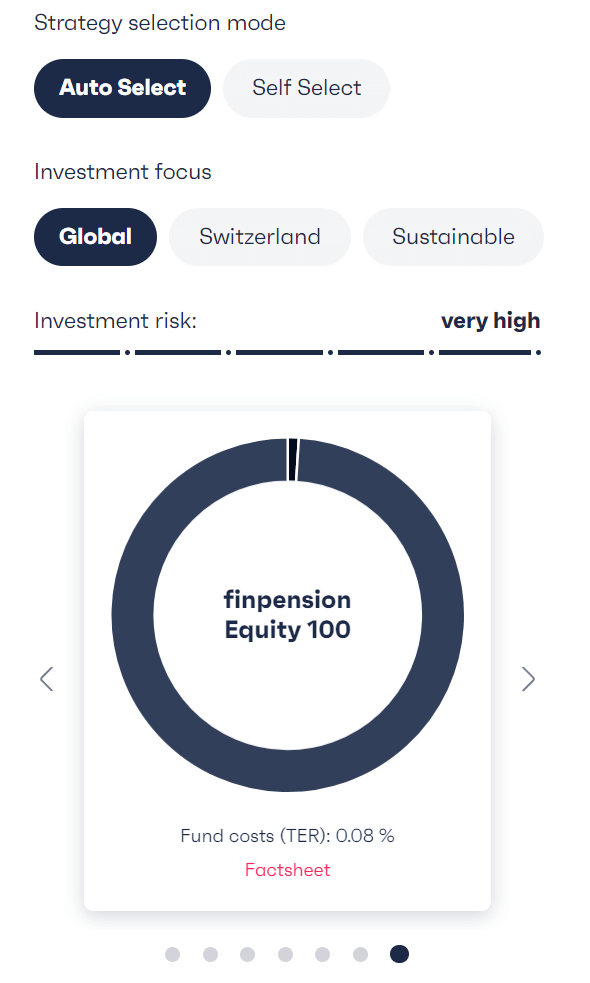

There are two main ways to set up your strategy:

- Auto-Select: Will prepare a portfolio for you.

- Self-Select: Will let you be more specific about your strategy.

In all cases, you can reach up to 99% invested (in stocks or bonds). You will need to keep 1% in cash. You can even keep 99% in a money market fund if you are really risk-averse.

The part not invested in cash, stocks or money-market will be invested in Swiss bonds. This makes sense because your bonds are here to reduce risks in your portfolio. So, you should not introduce currency risk there. And hedging would not solve it because you would pay the costs of hedging and pay higher income tax (because of higher yields in foreign bonds).

For auto-select, you can select between three focuses for stocks:

- Global: Fully diversified internationally.

- Switzerland: Invest globally but with a strong bias on Swiss stocks.

- Sustainable: Only invest in sustainable stocks (globally).

For Self-Select, you have a few more options:

- Global: Fully diversified internationally.

- Europe: Invest globally but with a strong bias on European stocks.

- Switzerland: Invest globally but with a strong bias on Swiss stocks.

- Broad Impact: Sustainable investing with a global impact.

- Climate Impact: Sustainable investing with a focus on climate.

- Social Impact: Sustainable investing with a social focus.

And finally, as is standard with Finpension, you can also do a custom portfolio with Finpension Invest. This means you can pick up the funds directly yourself, among more than 40 available funds. You are full liberty to invest in your portfolio.

In your account, you can have up to 10 different portfolios. Each of these can have a different strategy.

Finally, you can also invest in private markets. Private markets are deals outside the public stock market. With Finpension Invest, you have access to two institutional funds for private markets investment. This is quite impressive because no other Robo-advisor provides you with access to private markets.

It is important to note that private markets will only be offered to those with a very-high-risk profile (based on your answers to the risk assessment). This limitation makes a lot of sense because private markets can be very volatile.

Moreover, you cannot mix private markets funds with other funds in the same portfolio. You can have multiple private markets funds (in different portfolios), but each of these portfolios must be invested fully in private markets. Since you can have 10 portfolios, this is not a big limitation.

Overall, the investing strategy of Finpension Invest is excellent. They have all the bases covered, and they even offer access to private markets, something no other simple Robo-advisor offers at this point. This service can be an excellent tool for long-term investing.

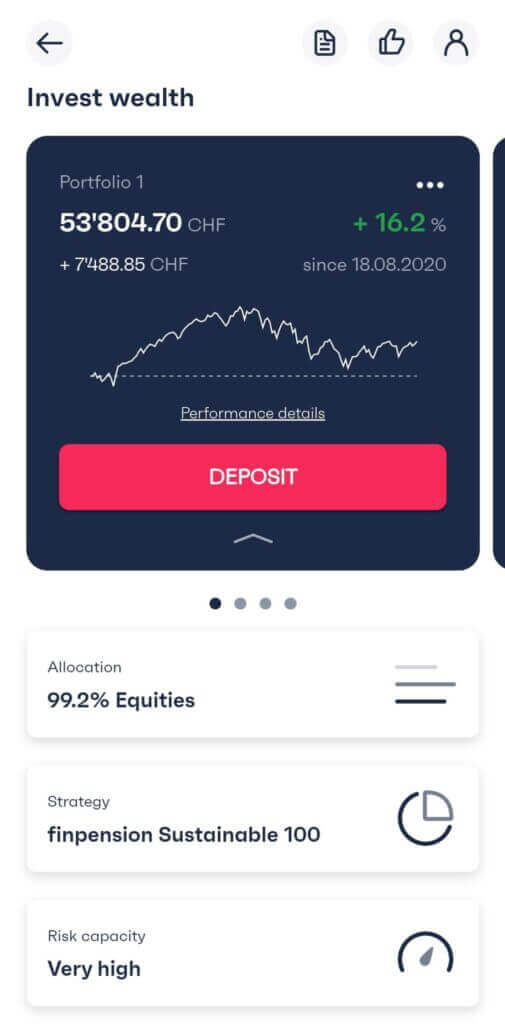

Example portfolio

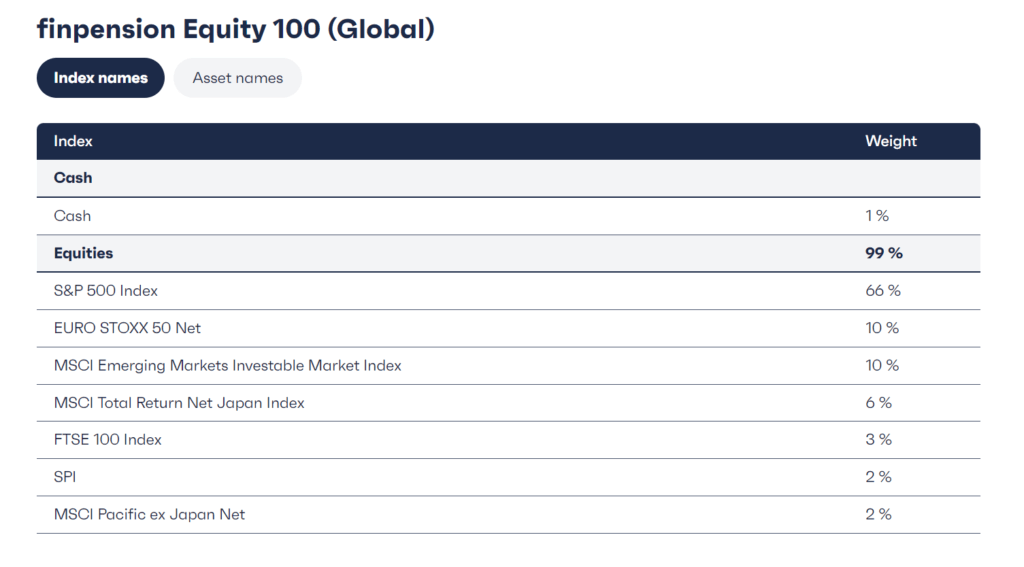

We can pick an example to look at the details of the strategies proposed by Finpension Invest. For me, the default Finpension equity 100 (Global) strategy is a good example to look at.

This portfolio is very well diversified since it covers all markets. Each country and region are represented based on their market capitalization. For instance, Switzerland is about 2% of the entire world stock market, while the US is currently about 66%.

You may be surprised by the number of funds. In theory, it would be simpler to use a world fund and let the fund pick the countries and do the rebalance. However, since Finpension Invest wants to be extra efficient with taxes, they have to pick at least one fund for the US to allow BlackRock to do the full withholding reporting for them.

So, while I would generally prefer not having tiny percentages in a portfolio, in this case it makes total sense and this is very well diversified and balanced.

Finpension Invest Fees

Typically, the best criteria to distinguish between two Robo-advisors is the price. To maximize your returns, you want to minimize your fees. So, it is essential to analyze the fees of Finpension Invest in detail.

Finpension invest has a 0.30% custody fee and a 0.09% wealth management fee. This gives us a total fee of 0.39%. These fees include VAT.

It is worth nothing that on your yearly statement, you will see these two fees separated. The custody fee is something you can usually deduct custody fees from your taxes, in most cantons. So, it is nice that they provide these two numbers separated.

On top of the 0.39%, you will need to pay the TER of the funds. On average, this will range from 0.08% to 0.10%.

Finally, Swiss stamp duty is also due on the transactions (for ETFs only, not index funds) and is not included in the all-in fee. As wealth managers, Finpension is obligated to charge this.

There is one extra fee worth considering, the currency exchange fee. At Finpension Invest, you will only pay 0.002% in currency exchange fee. This is a tiny fee compared to other Robo-advisors. And it may even be reduced in practice through pooling and netting.

Since they are using ETFs, there is no issuing or redemption commission when you buy or sell.

Overall, the fees of Finpension Invest are excellent. A total of about 0.49% fee is really among the best we can find in Switzerland.

US Withholding Tax

We said before that ETFs generally have a disadvantage in tax-efficiency. This is because the US taxes dividends at source. With a US ETF, you can avoid this, but not with a European ETF and no Swiss Robo-advisor offers US ETFs. With a European ETF, you would lose 15% of the dividends coming from US stocks.

It is easy to estimate that cost. US stocks are currently 66% of the world stock market and have an average yield of 1.50%. So, on average, losing these dividends is the same as adding an extra fee of 0.1485% (rounded to 0.15%).

Normally, this is not reclaimable. However, Finpension managed a very innovative technique. They have a deal with BlackRock (the fund provider of the ETF). BlackRock will give them all the necessary information for each of the dividend withholding. Then, Finpension can tie this back to the shares held by the users. And from that, they can produce a statement that can be added to the tax declaration to reclaim this fee!

It is worth noting that Finpension is currently speaking to the different tax offices to validate this technique. But we already know that Lucerne accepted this reclaim. So there is a good chance that more cantons follow.

The DA-1 deductions can only be claimed if you reach a minimum of 100 CHF. The total will include Finpension claims and possibly other deductions you are doing yourself.

This feature really shows that Finpension knows their stuff. This feature gives a tremendous advantage to Finpension Invest against other Swiss Robo-advisors.

Opening a Finpension Invest account?

If you already have a Finpension account (for your 3a, for instance), you can directly create a Finpension Invest portfolio from it. Otherwise, you can start creating an account from scratch either from the website or from the app, it should be a fairly quick process.

As with any Robo-advisor onboarding, you will need to answer the usual risk assessment questions. From there, they will define your risk capacity. And again from there, they will suggest portfolios, but you can override the choice.

If you use my code FEYKV5 during the onboarding, you will get a 25 CHF fee credit. So, you will not pay the first 25 CHF in fees.

Overall, it is fairly standard to open an account at Finpension Invest.

Deposits and withdrawals

We can also look at how to deposit and withdraw money to and from your account.

First, we should note you can start investing with as little as 1 CHF in your account. This is great because many Robo-advisors have significantly higher limits.

To fund your account, you can do a simple bank transfer. However, you must declare your bank accounts in advance. This means you can only transfer money from an account you have declared, and this account must be in your name. You can register multiple accounts in the app.

You can currently only fund your account in CHF, like most Robo-advisors.

Furthermore, you can also withdraw money directly from the interfaces. You can choose to which saved account you want to transfer money to.

Overall, deposits, and withdrawals are really convenient at Finpension Invest. And we will see in the next section, you can make it even easier by automating it.

Extra features

On top of the base investing features, there are also some very interesting extra features.

First, you can transfer money directly from one portfolio to another. This can be very practical. And this also allows you to transfer money from one portfolio to another service, like your 3a. I think they did an impressive job of integrating all their services together.

You can fully automate your investment thanks to the weekly reinvesting. With that, people can set up a standing order from their bank to their Finpension account and everything will be invested at most a week later. It is akin to a savings plan.

And you can also do the contrary with a de-savings plan. This allows you to set a standing order to withdraw money automatically and regularly. For instance, you could say you want 1000 CHF per month and Finpension Invest will automatically sell enough shares to reach that amount and send that to your bank account. Again, you can set up multiple of these plans for each of your portfolios.

Overall, it is excellent to see all these features already on the first version of Finpension Invest. From the start, they already have more features than most competitors.

Safety

Of course, we should not forget about the security of our money. You never want to send your money to a service that you cannot trust with this money.

Contrary to most Robo-advisors, Finpension Invest has a securities firm license. It means they can hold securities directly themselves, without relying on a third-party custody bank. From a regulation perspective, everything is in order.

If Finpension were to bankrupt, shares would be safe because Finpension has to segregate customer assets from their own. It would likely take a while because it would have to be transferred to a new custodian bank, but this should work well.

It is worth mentioning that Finpension has been profitable since 2019 (only a few years after creation). This is important for the long-term use of the service. Many Robo-advisors in Switzerland are losing money.

I have not been aware of any technical security issue with Finpension.

The only small downside is that they are a new securities firm (since March 2024). However, Finpension itself has been managing money since 2016 and has well over 2 billion Swiss francs in assets under management. This gives them a lot of experience.

Overall, money at Finpension Invest should be as safe as with any other Swiss Robo-advisor.

Alternatives

An excellent way to get an idea of how good a service is to compare it against other alternatives. There are many Robo-advisors available in Switzerland. I have compared Finpension Invest against three services.

Finpension Invest vs True Wealth

TrueWealth is an excellent Swiss Robo-advisor with very affordable prices, making it the best Robo-advisor for serious investors.

- Very customizable

True Wealth is a very affordable Robo-advisor, the most mature available in Switzerland. They also have a great range of features and are serious.

The investing strategies of these two services are really similar. They both use ETFs and focus on cheap index ETFs. And you have a very high level of customization in both cases. A slight advantage of Finpension would be to offer access to private markets, but it depends on whether you want that or not.

You need 8000 CHF to start with True Wealth, while Finpension Invest lets you invest with as little as 1 CHF.

Looking at the fees, True Wealth has a total fee of about 0.63% while Finpension Invest is at 0.49%. This is a significant difference. It is worth mentioning that True Wealth has degressive fees. So, if you have a massive portfolio, True Wealth could become cheaper.

But once we factor the 0.15% tax advantage of Finpension Invest, it will always be cheaper than True Wealth. It is worth mentioning that True Wealth also has a feature to reclaim the US dividends. However, this will depend on which custody bank you use. If you use BLKB, you will not get any tax advantage. You will get it only with Saxo because they will then be able to use US ETFs. But this is very poorly documented by True Wealth.

Overall, both have more or less the same feature set, but Finpension Invest is significantly cheaper and has a lower minimum.

Finpension Invest vs Findependent

Findependent is a very affordable Robo-advisor with a focus on sustainable investments. Invest your money easily! Get 20CHF in your account with code PoorSwiss.

- Excellent fees

Findependent is a more recent Robo-advisor with low prices and a nice range of features.

Both Robo-advisors use ETFs. Findependent only lets you invest 98% in stocks, slightly below 99% of Finpension Invest. Furthermore, by default, Findependent will only use ESG ETFs. You can create a custom portfolio to go around this. So, overall, Finpension is more flexible in the choices, especially with the addition of private markets.

You need 500 CHF to start with Findependent while Finpension Invest will let you start with 1 CHF.

On the fee perspective, both are quite well priced. Findependent charges a 0.40% fee, while Finpension Invest is at 0.39%. But the currency exchange fees of Findependent are much higher (0.50% against 0.002%) and stock exchange fees are not included in Findependent. And when we factor in the extra tax efficiency of Finpension Invest, it will be cheaper than Findependent. However, it is worth mentioning that Findependent has a staggered fee (all the way to 0.29% at one million of assets).

Overall, Finpension Invest has some significant advantages over Findependent. It is cheaper, more flexible and has a lower minimum.

Finpension Invest vs Selma

Invest easily with Selma: a great way to invest in the stock market without the hassle of doing it yourself.

- Beginner-Friendly

- Degressive Fees

Selma is another Robo-advisor that has a stronger target on beginners. They aim to make investing simple, without the bells and whistles.

Selma only gives you the choice between sustainable and standard investment. Apart from this, you will have no choice on the portfolio. The portfolio will be chosen based on your answers to the questions from the risk assessment. This makes it easier for beginners, but almost much less flexible than Finpension Invest.

As for fees, Selma has a base fee of 0.68% plus about 0.22% for the ETFs, for a total fee of a 0.90%. When we compare this against the 0.49% total fee for Finpension Invest, this is a very significant difference. And if we take the extra 0.15% in tax efficiency, this gets even more significant.

It is worth mentioning that Selma fee can be reduced if you have a large portfolio. The minimum fee is 0.42% with 500’000 CHF, much closer to Finpension Invest.

For any medium to advanced investors, Finpension Invest is a significantly better option than to its flexibility and fees. Using Selma would mean paying a significant premium that should be well thought of.

Finpension Invest FAQ

How many portfolios can you have with Finpension Invest?

You can have up to 10 portfolios, each with a different strategy.

What is the minimum you can invest with Finpension Invest?

You can start investing with as little as 1 CHF.

Who can invest with Finpension Invest?

All Swiss residents that are at least 18 years old (and are not US citizens).

Who is Finpension Invest good for?

Finpension Invest is great if you want to invest in the stock market (or private markets) and want to minimize their fees.

Who is Finpension Invest not good for?

Finpension Invest is not great if you are a total beginner in invest or if you are expert enough that you can invest by yourself.

Finpension Invest Summary

Finpension Invest is a new Robo-advisor, by Finpension, already behind the best third pillar. So, we see how good is this new service!

Product Brand: Finpension

5

Finpension Invest Pros

Let's summarize the main advantages of Finpension Invest:

- Outstanding fees.

- Excellent tax-efficiency.

- Can invest up to 99% in stocks.

- Can invest with as little as 1 CHF.

- Great investing strategy.

- Excellent integration with other Finpension services.

- Web and mobile applications.

- Advanced customization.

- Access to private markets.

- Very transparent.

Finpension Invest Cons

Let's summarize the main disadvantages of Finpension Invest:

- Entirely new solution.

- Stamp Duty is not included in the management fees.

- Maybe not suited to total beginners.

Conclusion

An excellent and innovative Robo-advisor by Finpension.

- Most tax-efficient Robo-advisor

- Access to private markets

Finpension did it again! Their new service, Finpension Invest, is again an excellent service. They offer a very nice set of features, excellent portfolios and top of the line fees.

This service offers very innovative features, such as the wonderful tax withholding support for US dividends. Now that I see this, I wonder why no other service went through this before. This really shows that Finpension is willing to go one step further to provide exceptional service.

Seeing all these features and fees together, I now believe that Finpension Invest is the new best Robo-advisor available.

For transparency, I must mention that I am not using a Robo-advisor myself. I am investing directly through a broker account. If you have the knowledge and the willingness to do so, investing by yourself with a great broker will be cheaper than investing through a Robo-advisor.

What about you? What do you think about Finpension Invest?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Robo-Advisors

- More articles about Investing

- FlowBank Review 2024 – Pros and Cons

- Investart Review 2024 – Pros and Cons

- Simplewealth Review 2024 – Pros & Cons

Thanks Baptiste for yet another very helpful review.

I’m trying to decide for an investment account for my daughter, and setting money aside via Finpension Invest Wealth seems like a good hassle free solution vs. even something like IBKR.

I was wondering though about the Swiss Stamp Duty, which I understand is something like 0.15%, and how investing with Finpension might off-set that fee, because IBKR misses out on the withholding tax optimisation, which based on the example in your separate article on Swiss Stamp Duty tax also amounts to around 0.15% for foreign ETFs.

What’s your view on that, and which solution would you go with for setting aside money for your kid between the two?

Hi Alex

IBKR does not miss out on the withholding tax, it is exactly as efficient as Finpension Invest in that regards. IBKR will always be cheaper than any Robo-advisor, except maybe for tiny sums.

Neither of them will offer you accounts in the name of your child. But both offer sub-accounts so you can use this for yourself and for your children.

I am doing IBKR for my son. But if my main investment was with Finpension Invest, I would keep my son’s money there as well.

Truewealth also provides all data for a DA-1 form to reclaim foreign withheld taxes.

Interesting, I never heard that. Is that a new feature? I will check that with True Wealth and update my articles accordingly!

Apparently, this is only for people using Saxo as the custody bank and not BLKB, so this gives a significant advantage to using Saxo custody. I will continue researching that and update my articles when I have all the information.

Hi Baptiste!

I am new in Switzerland and I have bank funds of around 170k CHF.

Is there anything you suggest to me? I am reading everything from your blog but it is too much information and very hard to pick one option!

I already kind of decided to use Finpension 3a for the third pillar but I do not know what to do with that amount and for sure it is not smart to leave it in the standard bank account.

I will be pleased with your suggestion!!

Hi Arthur,

I suggest taking your time :)

It’s indeed important to invest that money if you have long-term goals. But you should be sure of what you want to do with that money.

Maybe this article can help you get started: Get started Investing

If you have no experience and are not willing to learn to invest by yourself, you can indeed use a Robo-advisor and in that case, Finpension Invest seems to be a great option.

Hello Baptiste,

I was eagerly awaiting your article on finpension Invest and enjoyed your analysis. I‘m currently with Swissquote, and am considering to fully move to finpension. Moving forward, I‘ll stick with ETFs only and doing some quick math, their platform is much cheaper in comparison.

A total cost comparison between IBKR and finpension Invest would be dope!

Thanks for you work

Hi Paul,

Interestingly, Finpension is likely to be cheaper than Swissquote for up to large portfolios indeed. The main difference is that the custody fee of SQ has a maximum, while the one from Finpension does not. SQ likely gets cheaper at around 100K.

I will consider doing such comparisons in detail later.

Hi Baptiste

Thx for the article!

Which of the private funds (“The Partners Fund” or “Schröder GAIA II Global Private Equity”) is investing in SpaceX?

Green

Peter

Hi Peter,

It looks like none of them is. I looked into their annual report and could not find any mention of SpaceX in either. But I am no expert and only skimmed through the long annual reports.

I should not have mentioned SpaceX in the article.

Hey Baptiste, congratualations again for this great article! : )

I will try out the two private market funds only with little money (and your code) to see how it goes, for the rest I have IBKR.

Regarding findependent, they have today (coincidence!?) reduced the fee from 0.44% to 0.40%. Still finpension will be a much better choice, but findependent now looking better after the reduction.

Hi Claudio

Thanks for sharing!

Let us know how the private market funds are doing!

Interesting, it may be a coincidence indeed :D I will update my articles for the new Findependent fee.

Personally I had terrible experience with robot advisors. I tried both Selma and Truewealth for about 2 years. I invested 15.000 each… and after 2y lost 1500 on each. It was prompt to crash after supply chain crisis and war in Ukraine; however it never recovered while US markets were thriving end of 2023, which is when I decided to put an end to this misery and take my loss. Robot advisors do not at all mitigate market dowturn, and due to the strong biais towards CH market on both of them, that has been performing very poorly vs SP500, performance never recovered. Since then I invested by myself on IBKR and got much better results. Don’t waste your money on robot advisors!

Hi Sylvain,

I am not sure it’s very fair to compare against the S&P500 given the huge difference.

But it’s true that by default, most Robo-advisors will be biased towards CH. And Robo-advisors will not beat the market, definitely.

Even VT took about 30 months to recover from the top of 2021. And there has been negative periods of 15 years in the stock market. So, 2 years negative is not really surprising.

What’s the benefit vs just using IB?

The only benefit of a Robo-advisor is to be slightly easier to use and less intimidating. There are some people who do not want to go to the trouble of picking their portfolios or do not trust themselves to not make an error on a broker.

But DIY will always be cheaper than Robo-advisor.

Do you know of such a service for US citizens living in Switzerland?

I am afraid I do not. US citizens are likely better off investing by themselves with something like IB.

Thank you for the interesting article. Regarding the comparison with other Robo-advisors, do you know if it’s possible to transfer holdings directly from TrueWealth to Finpension Invest without needing to sell and repurchase them?

Hi naro

No, it’s not possible and will very likely never be possible for two reasons:

* They have no incentive of doing that :)

* They use different funds, so it would be difficult anyway to implement.

Hi Baptiste,

Always thank you for your nice and useful blog.

I started investing through the Selma Robo-Advisor around 1 year ago, I have in it around 7000 CHF and it’s gaining around 1000 CHF.

Then 3 months ago I stopped putting money in Selma and started instead investing with IB using your same portfolio (80% VT and 20% CHSPI), I put there around 3000 CHF and it’s gaining at the moment around 100 CHF.

What do you suggest me to do?

1) Keep things how they are

2) Moving my Selma money into the new Finpension Invest Robo-Advisor

3) Moving my Selma money into IB.

4) Something else

Thanks,

Giacomo

My 5 cents:

If you’re comfortable with IB, then I see no reason to not do everything there (you are familiar already with IB, so there is no advantage of robo-adivsors).

If you don’t want to move everything to IB, then at least move it to Finpension as you suggested. Selma is too expensive in my opinion. And in my own experience it even performed worse than the market average (could be bad timing/luck, but still).

Baptiste, it would be interesting to see a comparison between Fp Invest and IBKR.

In my perception, IBKR is still much better. However, we are humans and prone to errors. Many errors and tempations can arise from IBKR (during transaction execution, currency conversion or just because we are tempted by some stockpicking). A well optimised Roboafvisor removes much of these biases.

Any thoughts? Any way we can account for that in the comparison?

Thank you for the fantastic blog.

For small to medium-ish portfolio, I think Finpension Invest can be cheaper than IB. However, from medium to large portfolios, IB will be much cheaper. But I have never done the full comparison.

That being said, Finpension Invest is the only Robo-advisor that could even come close to IB level.

Very rough estimation: I do about 10 currency conversions per year (20 USD), 10 purchases of US ETFs (4 USD) and 3 purchases of Swiss ETF per year (25 USD), this is about 50 USD I spent per year at IB. So, FP would be cheaper below 13’000 USD and IB cheaper after that. But this is missing many of the parameters. It would indeed be interesting to do the full math once.

Hi Giacomo

If you are fine with IB, stick with it, it will be the cheapest in the long-term.

If you want to diversify, use two services: IB and another.

I think I’ll finally move everything to IB, since I know now how it works. But to move money out from Selma I think the unique way is selling the money I have there, isn’t it?

Yes, everything will be sold and then you will have to transfer the remaining cash.