How to Calculate your Financial Independence (FI) Ratio

| Updated: |(Disclosure: Some of the links below may be affiliate links)

When you have a goal, it is always good to know your progress toward this goal. If you are trying to become Financially Independent, it will be essential for you to know how far away you are from your goal!

For this, you will need to know your Financial Independence (FI) Ratio. This ratio will tell you how close or how far you are from reaching your goal of being financially free!

Your FI ratio will tell you exactly where you are on your path to Financial Independence. In this article, we see precisely how to compute your net worth goal. And then how to calculate your progress toward your goal. It will help you know if you need to adjust your strategy to reach your goal on time.

Stay tuned if you want to know when you will be financially free!

Financial Independence

First, what is Financial Independence (FI)?

Financial Independence means you do not need to work to sustain your lifestyle. It is also sometimes called Financial Freedom. You are financially independent when you have enough money to maintain your lifestyle without working.

For this, your wealth must generate income. And this income must be higher than your expenses. The primary way to generate income from your net worth is to withdraw from it. In general, withdrawing means selling shares from the stock market and using the realized money. However, you must withdraw little enough to sustain your wealth for the longest time. Otherwise, you will end up with no money.

It is only one of the ways to reach Financial Independence, but this is the most standard way in the community. Some people prefer to focus on passive income. And some people focus entirely on real estate to become financially independent.

There are many reasons to become Financially Independent. It is currently very popular on the internet. Especially with the Financial Independence and Retire Early (FIRE) philosophy. The idea is to become Financially Independent as soon as possible and retire early. But you can also be Financially Independent and not retire. You can then choose to do precisely what you want with your life since it does not depend on your career income anymore.

First, we will assume you are following the withdrawing idea of Financial Independence. But I will also talk about the FI ratio in entirely passive income.

Your Withdrawal Rate

If you want to become financially independent by having a large enough net worth to sustain your expenses, you may have heard of the 4% rule.

This rule states that if you only withdraw 4% of your investment portfolio yearly, it should sustain you for at least 30 years. This percentage is your Withdrawal Rate (WR) or Safe Withdrawal Rate (SWR).

This rule assumes that you invest your portfolio in the stock market. Generally, the 4% rule assumes 75% stocks and 25% bonds. But the asset allocation is up to you. 4% is the recommended safe withdrawal rate. But some people choose to be more conservative (<4%) or more aggressive (>4%). I am more conservative, so my withdrawal rate is 3.5%.

Remember that the original 4% rule is based on 30 years of retirement. If you retire very early and plan for 50 years, it may not work in the same way. For this, you may have to reduce your withdrawal rate. You can take a look at my retirement calculator to help you.

To learn more about Withdrawal Rates and the 4% Rule, read about the Trinty Study Results!

Your Financial Independence Number

Now I got my withdrawal rate, how much do I need to be FI?

It is pretty straightforward. By dividing 100 by your withdrawal rate, you will have the number of years of expense you should save. For instance, for my withdrawal rate of 3.6%, I have to accumulate 27 (100 / 3.6) years of my annual costs.

If you think your expenses will go up or down in the future, you should also account for that. Indeed, you should use the number of expenses you plan for when you are financially independent. However, this amount is difficult to estimate. If your retirement is far in the future, you may take your current annual costs as a good estimation. It is what I am doing. Every year, I update my FI Number to reflect our current situation.

Your target net worth (your FI number) is 100/SWR times your planned annual expenses. If you have yearly spending of 100’000 USD and a withdrawal rate of 4%, you need to accumulate 2.5 million dollars to become Financially independent (=(100/4) * 100’000). If you spend 50’000 USD per year and plan to withdraw 3.5% every year, you will need to accumulate 1.4 million dollars (=(100/3.5)*50’000).

This target net worth is also called the Financial Independence Number or FI Number. I wrote an entire article to help you calculate your FI Number.

Your FI Ratio

Finally, how do I get my FI ratio?

You now have your target net worth (or FI number). That is the net worth at which you will reach Financial Independence. As soon as your net worth exceeds this number, you are financially independent!

For this, you will need to know your current net worth. As an example, you can see how I calculate my net worth. Your net worth is the value of all your assets minus your liabilities (debts). But you must be careful about some assets that can depreciate or are difficult to sell.

Your FI ratio is simply your current net worth divided by your target net worth. It could not be simpler!

If you have a target of 1 million CHF and you have 100’000 CHF, your FI ratio is 10% (100’000 / 1’000’000). Or if you have a target net worth of 1.4 million USD and have 200’0000 USD, your FI ratio is 14.28% (200’000 / 1’400’000).

As soon as your FI Ratio reaches 100%, you are financially free!

My Financial Independence Ratio

As an example, we can see how my situation is at the current time. I have calculated the results for my goal. I’ve also calculated how many years it will take to get there at the current pace. Here are my results:

| Withdrawal rate | 3.6% |

|---|---|

| Expected Annual Return | 5.0% |

| Years of expense | 27 |

| Running expenses | 93735 CHF |

| Monthly expenses | 7811.31 CHF |

| Target Net Worth | 2530865 CHF |

| Current Net Worth | 337653 CHF |

| Missing Net Worth | 2193211 CHF |

| Yearly income | 133200 CHF |

| Running Savings Rate | 44.25% |

| Yearly savings | 58946 CHF |

| FI Ratio | 15.39% |

| Months to FI | 216 |

| Years to FI | 18 |

| Date to FI | 2039-01-09 |

| Current Withdrawal Rate | 27.76% |

| Months of FI | 43.22 |

| Years of FI | 3.6 |

I have computed my expenses over the last 12 months (not counting this month). It gives me about 2.5 million CHF to save. So, at the time of this article, I am missing about 2.1 million CHF. If you compute the ratio of your net worth and the target net worth, it gives you your FI ratio. Mine is a meager 15.39%.

You can also estimate how many years you need to save this amount. I have computed my savings rate as the average of these twelve months. I am assuming a 5% annual rate of return, which is conservative. It gives me almost 18 years until I reach FI.

This result is not so bad since this will be before I am 50. And my primary goal is to become Financial Independent before I am 50. It seems I am on track to reach my goal! But things can change in the future, and I am aware of that.

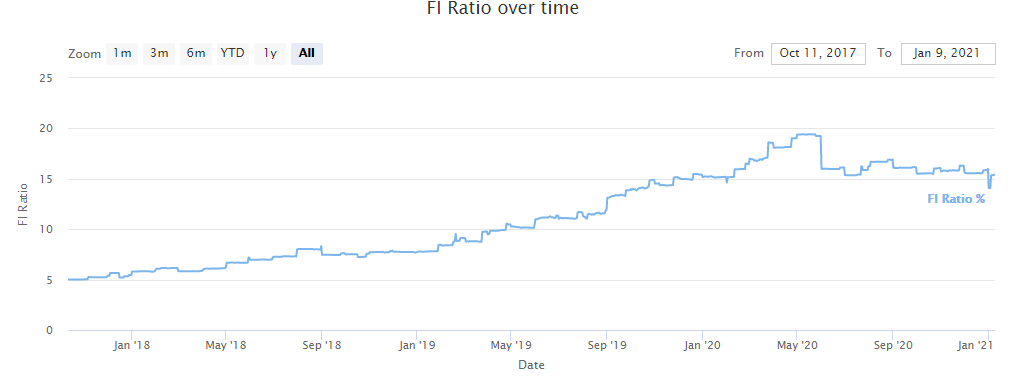

For reference, here is our FI Ratio since we started our journey to Financial Independence.

It does not look that great! But we are still working on improving it, and it should now start to grow over time.

Improvements for the calculation

My calculations are not entirely correct.

First, I am still working on increasing our savings rate. My current income is also higher than it was in most of the twelve last months. Finally, I am also working on improving my expenses. The last twelve months include some pretty bad months. So, hopefully, our future income should be higher, and our future expenses should be lower.

Another important thing is that your expenses in retirement will likely be different from now. For instance, you will pay fewer taxes in retirement than now. But it is quite likely that your health expenses will go up. It is challenging to compute the costs you must pay in retirement.

There is another thing that we have not taken into account. The second pillar and the third pillar can only be taken out at the retirement age. For now, I include them in my net worth. But this money will only be used once I reach the official retirement age.

Also, the first pillar will give you a retirement pension. If you want a really accurate calculation, you must integrate many more factors. It means that from retirement age, some of your expenses will be covered by the first pillar. It would be the same in the United States with social security.

In every case, the FI Ratio remains an estimation. It can be a good estimation if you take care of all the details, but you never know what will happen.

Improving your FI Ratio

Of course, now that you have this metric, it is essential to improve your FI Ratio. You may want to become financially free faster than the current predictions.

Of course, you can increase your net worth to increase your FI ratio. But it is not trivial to improve it. And this is not something that will happen in one day unless you play into the lottery’s terrible odds.

The first thing you should do to improve your FI ratio is to reduce your FI Number. For this, you have to lower your expenses. All your yearly costs get multiplied by 100/SWR. If you plan on using the 4%, all your expenses are multiplied by 25. If you can cut your costs by 1000 USD per year, this is 25’000 USD that you do not need to save!

The second thing you can do to speed up your FI ratio is to improve your income. Increasing your income will not directly increase it. But it will grow faster over the years. Of course, this is only true if you do increase your expenses. Do not fall into the trap of Lifestyle Creep.

Another thing you can do to increase your FI Ratio is to use a larger withdrawal rate. Now, this is dangerous. The higher your withdrawal rate is, the more risks you deplete your net worth in case of a large downturn. But this would decrease your FI number significantly and increase your FI ratio. I would not do that unless I were aware of the risks.

Finally, by increasing your returns on your capital, you will also speed up your FI Ratio. To increase your profits, you generally can take on more risks. Once again, this is dangerous. And it is not easy to get a guaranteed return on income. But this would significantly increase the speed at which your net worth increases.

If you follow some of these ways, you will become Financially Independent faster!

If you want to know how many you need until you can retire, you only need to know your savings rate. You can use the savings rate to estimate how many years you have until retirement.

Notes

Keep in mind that all these numbers are only estimates. Your expenses could go up. Your salary could change. The stock market could crash. Your Financial Independence ratio and the estimated number of years left are useful numbers. But they are not definite.

For instance, I plan to have kids. This will increase my expenses. And my income will probably increase by the time I retire. It should not prevent you from calculating your FI ratio. You should just update your FI number at least once a year instead of using a fixed amount for too long.

Remember that the safe withdrawal rate rule has been created for the US market. You may have to adapt it to your country. And, if you plan to retire early (in your thirties, for instance), this rule will not cover you long enough. So take everything like this with a grain of salt. Every situation is different.

If you want to read more (much more) about safe withdrawal rates, you can read the Ultimate Guide to SWR, by Early Retirement Now. It is excellent.

Is a 100% FI Ratio enough?

By definition, when your FI Ratio reaches 100%, you are Financially Independent. In theory, this means you can quit your job.

In practice, you have to be careful about being exactly at a 100% FI Ratio.

First, if you retire from your job, you will have a lot of time. And filling your time may cost you money. You may visit more museums, for instance. Or you may travel more. It is difficult to estimate how much you will spend in retirement.

Secondly, you will have no margin of safety. This means that if something bad happens and costs you a lot of money, it could be bad. I am not talking about small emergencies but large ones. Your emergency fund should cover small emergencies.

Finally, at 100%, you are still subject to bad timing. If you retire at the peak of a bull market with a 100% FI Ratio, you are in a risky situation. The market may crash 40% the year after. And your portfolio is unlikely to recover from that. On the other hand, a 100% FI Ratio at the bottom of a bear market would be much better.

Since we cannot time the market, it is better to get some margin of safety with our FI Ratio. The exact goal would probably depend on people’s risk tolerance. For me, 110% would probably be fine.

The Passive FI Ratio

Now, what we have seen is the definition of Financial Independence that I use. But there is another definition of the FI Ratio used by some people.

Some people do not want to withdraw from their principal in retirement. That means they will focus on passive income. It can be an income from their principal, such as dividends or interests from a bank account. Some people focus, especially on P2P Lending. You can also include social security or other retirement benefits into your passive income.

For some people, this can also be income from a blog. However, that last one is not passive (contrary to what some people would like you to think)! But it sure can help you retire.

For these people, we can compute a Passive FI Ratio. It is simply the ratio between your passive income and current annual expenses. For instance, if you have a passive income of 10’000 CHF and yearly expenses of 40’000 CHF, your current Passive FI Ratio is 25%.

I do not focus on passive income. But I think this ratio is quite interesting. It is not necessary to aim for a Passive FI Ratio of 100%. Both ratios can play together. If you have a Passive FI Ratio of about 50%, this can reduce your FI Number consequently since you will need a smaller net worth. If you can get a guaranteed income of 1000 CHF per month in retirement, this will significantly reduce your yearly expenses!

For instance, one of the bloggers using Passive FI Ratio’s definition is Joe Udo at retireby40. He focuses a lot on his passive income.

FAQ

What is the FI Ratio?

This ratio tells how far you are from reaching Financial Independence (FI). It is a percentage of where you are compared to your goal.

How to compute your FI Ratio?

You can obtain your FI Ratio by dividing your current net worth by your FI Number.

Conclusion

Your Financial Independence (FI) Ratio will tell you exactly where you are on your road to FI.

The FI Ratio is a straightforward metric that can help you track your progress. It is a great metric that should probably be part of your financial metrics. But there are plenty of other personal finance metrics.

Even though it may not be vital, it is an interesting metric to follow. It will give you an overall idea of where you are in your quest for financial independence. If you graph it against time, you will also see if it grows faster over time or not.

In the future, I will follow the evolution of my FI Ratio. But for now, I will not pay too much attention to it. I will focus on decreasing my expenses and increasing my savings rate. I am not worried about the large number of estimated years before retirement. Indeed, I am just getting started on my journey. And I know I can reduce my spending and increase my income. It will help me reach FI faster.

If you liked this FI Ratio Metric, read about More Personal Finance Metrics.

By the way, you do not have to do the math yourself. You can use my Retirement Calculator.

What is your Financial Independence (FI) Ratio? What do you think of this metric?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hi man :) Thanks for yet another great post. There is one thing I do not understand in your calculation. You have included the PF (2nd pillar) and 3a into the net worth but not in your “savings” moving on. I really believe you have less years to FI :) If your 65,830 CHF is only the cash which is left on hand coming from your salary, you still need to add the yearly PF and 3a value increase. If you will work for let’s say next 10 years, it should add up to a really nice net worth increase. Yes, you will only be able to take it out when reaching 65 (unless when you will quit your job you put it in a smart way into self employment investment company – good topic for a blog post imho:), but it still adds up to your maybe 20+ years of life.

So you could even try to think about it in 2 phases:

– Phase 1: Until 65, where your cash pool can slowly go down to some rational level, which is ok

– Phase 2: 65+ when you still maybe have 50% of Phase 1 money and you get that nice juicy injection from 2nd and 3rd pillar.

I may be wrong or missing some important considerations, still discovering the topic, but please let me know your thoughts.

Hi Jakub,

Regarding the third pillar, I do not count it as expenses so my contributions to the third pillar are already included in the 65’830 CHF that is savings (invested in the third pillar and my broker account).

For the second pillar, it’s more complicated and you are right that my contributions to the second pillar are not counted. I do not consider this contribution as part of my income, it’s just a kind of taxes that is removed from me before I can touch it, so I do not want to take it into account.

Since I am counting on a 5% rate of return, these contributions to the second pillar will compensate for the fact that the second pillar is far from returning anything like 5%.

So, I still think the estimate is more or less accurate, but it remains an estimation, many things will change.

Does that make sense?

Thanks for stopping by!

It does :) But remember your employer should at least double your contribution. Mine tripples it which is very very nice so when I ran a simulation of my PF balance in 10 years that was some discovery ! So the delta coming from your employer should not be neglected when doing the forecast.

I get your 3a approach, I did not add it to my annual savings. Just a matter of individual approach to net worth components.

Coming back to the blog post idea, is that something you considered to explore ? If we can take out PF and 3a earlier as basis for self employment, that opens up many doors :)

Cheers

It’s true that you could count your employe contribution as well. You are quite lucky. We have a very bad second pillar here and my company is not doing anything special to improve that.

But even it makes sense to do that for future estimations, it do not make much sense to do that to compute your income and savings rate, which would be inflating it for no value.

Regarding taking it early, I am not sure that opens a lot of doors. You are still supposed to invest this money in the company. I do not know the exact limitations, but I am sure that there are some rules to avoid using it to actually live.

Now, you could do that if you intend to really live from your company as self-employed, this legal. But that will not speed up your path to FI a lot unless you get extreme returns from your company. No?

Cheers

Hello Sir,

thanks a lot for sharing your path to FI, very inspiring and informative :)

There’s just one think I wanted to clarify about what you wrote here:

“You now have your target net worth or your FI number. That is the net worth at which you will reach Financial Independence. As soon as your net worth is higher than this number, you are financially independent.”

So you seem to suggest that the FI number corresponds to the net worth, but I believe that’s not necessarily true. If part of my net worth is real estate or tangible assets, I won’t be able to “withdraw” them. As far as I know, also reading other resources (i.e Financial Freedom by Grant Sabatier), the FI number and the net worth are two related, but distinct, numbers.

The FI number should rather be the amount invested which generates returns. Am I missing or misunderstanding something?

Thanks from La Côte!!!

Hi Lucky Luke,

You make a great point and I completely agree with you.

First, I am not saying that the FI Number if your net worth, it’s just your target net worth. But it’s true that your house is “useless” in your FI Number.

I actually have an article about that: The FI Net Worth. I should mention this better in this article.

The FI Number is still the target, but you should indeed not count your entire net worth towards this target.

Let me know if this helps to clarify :)

Clear indeed :)

Thanks a lot for your response!

Hi Mr. Poor Swiss,

I started to follow ur blog some days ago, and went thru most of the articles already :)

Thanks for sharing.

Is it possible for you to make available the formulas for the calculation? Im quite new to the finance world, and i’m facing some issues on understanding the table.

How do you calculate the time to FI?

The actual formula for the Target Net Worth decreases with the Withdrawal rate in my calculations – hence, the formulas would be greatly appreciated.

Keep up the good work.

Cheers,

Ric

Hi Ric,

I will try to add more information to the article. But some of the formulas are not evident.

It’s actually not a formula, but an equation to solve for n (months): (NW + monthly_savings * n) * (monthly_ROI) ^ n = FI_Number

I simply solve it iteratively until the net worth is higher than the FI Number.

The target net worth must decrease if you increase the withdrawal rate indeed. A higher withdrawal rate means you can withdraw more from your capital. And this means you need to have less money.

I hope that helps a little.

hmmm. I am 65. I have $3,700,000. My annual expenses are about 100K per year. I use $70,000 since the rest comes from Social Security. I intend to only withdraw 2%. I have reverted to ultra conservative because of my age so I am only a bit over 30% invested in stocks. I will probably increase stock allocation as time marches on (gliding equity plan – increasing stock exposure as I increase with age). Now I estimate I – figure I have about 35 years left to live so if I take (70,000 x 35) I get that I need $2,450,000 (I use current dollars. I don’t count inflation because I figure my portfolio will be able to keep pace with inflation since most of the other 70% or so is invested in TIPS or other bonds). That leaves me with $1,250,000 I can invest in risk assets. According to your calculations I would need (100/2) * 70,000))a total of $3,500,000 which seems to be excessive since I calculate $2,450,000. Thoughts?

Hi Mark,

Wow, you are in a great spot!

These two calculations are different.

* The first one you did (70K*35) is exactly how much you need if your expenses don’t move and there is no inflation.

* The second one (70K * (100/2)) is using the 2%. If you want to live of 70K and only withdraw 2% of your portfolio each, you would need 3.5M indeed.

However, 2% withdrawal is extremely conservative. If you use a portfolio of 2.45M and used 70K per year, your withdrawal rate would be 2.85% which is still highly conservative! And when you consider that you still have 1.25M invested in more risky assets, your overall withdrawal rate would still be about 1.89%.

I think you are more than safe to have your portfolio outlive you! If I were you, I would do the same, keep 2.5M in safe investments and invest 1.2M in more risky investments. But I would probably not take too many risks either.

What do you plan for your 1.25M?

Thanks for stopping by and good retirement!

Thks Swiss for your reply. My actual plan for my 1.25M is most likely to leave as a legacy to my two children, haha luckily neither of them read financial blogs so they won’t be reading this 😂😂😂. I don’t want to tell them, although I am sure they are aware they will be getting something. Hehe I may use it as leverage if they throw us in an old folks home (joke) 😂😂

Hi Mark,

Yes, I think it is good not to tell them indeed. It’s always dangerous for them to give them too much money.

Good luck your money!

3.5% is better than zero or negative :)

Looking forward to seeing you in the double digit!

Totally agree, we all have to start somewhere :)

I’m also looking forward to this second digit.

Thanks for stopping by

Thanks for the article!

Frankly speaking, I am amazed by the math you put together…it sounds pretty sophisticated what you are calculating. On the other hand, your FI ratio, is just telling you how far you are away from having saved up the amount of money needed to reach full retirement.

I am well on my way towards financial independence, but have never calculated my FI ratio, oops! Why not? Because I count more on covering ongoing cost from passive revenue streams. As soon as I can see that my monthly expenses are covered from the cash flows generated, I would feel comfortable of calling me FI. Makes sense?

You’re welcome :)

Yes, the FI ratio is a pretty simple thing, just the fraction of the target net worth.

It makes total sense! If you are able to cover all your expenses with passive income, you’ll also have reached Financial Independence :) By the way, some bloggers compute a FI ratio as Passive Income over Expenses. This is just a different approach to FIRE that works pretty good as well. There is no one single solution to FIRE.

Good luck on your way towards FI ;)

First of all, I love the name of your blog, I once had a Swiss guy tell me that I’m the poorest person he’s ever met. He wasn’t kidding!

I’ve never computed this calculation before but I’m going to give a try. Thanks for sharing.

Hi Janet. Thanks :) Swiss people are not as rich as the world thinks :P Good luck with your own personal finance goals :)

Isn’t 71k yearly a low salary for Switzerland or that is after the taxes?

Hello

It’s net salary, what I receive in my bank account, it’s after deductions (such as retirement). But before taxes. It’s not too bad, even for Switzerland, but it’s low for Computer Science. Not everybody in Switzerland have big salaries. I know a lot of people who have less than 5K monthly salary. The media do so much in showing that Switzerland is so rich that everybody think that every Swiss is rich, but this is far from true.

P.S. Sorry for the delay, it seems WordPress didn’t like your username :s

Solid assessment I would say! Best of luck with this financial marathon!

Hi,

Thanks for dropping by.

Thank you :) Best of luck to you too.

Hello Swiss! I wish I could change your domain name to “therichswiss” because I don’t like calling you “poor” lol!

Based on your net worth, you are in great and healthy shape! And honestly, anything in life can happen. Nothing is certain!

Like you, my fiance and I are focusing on savings rate, decreasing expenses, and increasing income. I think as long as you keep your mind focused on those areas, the net worth will gradually build over the years without you noticing. After all, this is a marathon and not a race! Not to mention, that number can drastically fall at any time especially when markets head south.

Overall, this is a great post about what the FI ratio is. I personally didn’t look at my FI ratio because it feels like there’s still a long way to go to reach freedom haha! But still, doing whatever we can to sustain current lifestyle without going broke or eroding the nest egg!

Hello panda,

Do not hesitate to call me poor :P

It’s part of my strategy to make me believe that I’m poor in order to have healthier budget ;) Moreover, if you consider the *rich* in Switzerland, I’m more than poor, but that ‘s another story.

As you say, the net worth number can significantly fall. I totally agree with you! Savings Rate, Expenses and Income are the most important numbers to focus on. Once these numbers are good, the rest will follow: The net worth will increase, the FI ratio will increase and the years to FI will decrease.

The only number I really follow each month is my savings rate. I computed my FI ratio for fun. It is too early for me too to see the possible early retirement.

P.S. Maybe I should already buy the therichswiss.com domain for when I’m satisfied enough of my results!

ahhaha~~~ i am waiting to hear you from the therichswiss.com domain one day . I believe time can tranform you from thepoorswiss to therichswiss .

Haha :)

Thanks.

Let’s hope it goes that way ;)

This is really a great site. Thank you very much Sir, so helpful.

I do Corporate Valuation and Capex assessment as a manager in Corp Strategy in an big MNC, but ironically have never really looked at my personal finance. I bumped into your site as I am now planning to retire early and spend time with my family (tired of office politics, hypocratic and incompetent bosses). I really found this so useful !!!

I am more confident now. I am 56 and as of today I have 2.5 MCHF networth (cash, stocks and including pillar 2 and 3). I have no liability and own a house (70% on mortgage). I didn’t include my 30% downpayment in my networth calculation. I have grown up children who are independent. I and my wife spend 7k per month including mortgage interest. We live a simple but happy life, go to Aldi, Denner and don’t eat out very often. I wear Casio watch, and buy stuff from Factory outlet (Landquart and Foxtown). But I drive BMW X5 and want to maintain similar car.

I guess, seriously, am I financially independent? I mean if I can’t stand my boss anymore, I could technically resign and focus on managing my networth? How much return I would need to target to keep up with inflation, if I expect to live 30 more years until the age of 85?

If I resign today (age 56), how would I be entitled to my pillar 2? When can I cash in the fund?

Thank you very much Mr. The Poor Swiss

Thank you so much.

Hi Ricky,

Just seeing this, it’s difficult to say if you are financially independent, this is a complex subject. It would depend on your withdrawal rate and your expected expenses in retirement (lower taxes probably?).

The calculations imply that the net worth is fully invested in a diversified portfolio of stocks and bonds. So, your portfolio will play a role as well. Most people are counting on 7% yearly returns after inflation.

You can start cashing in your second pillar at 58 normally, but that depends on your second pillar company. Your third pillar will have to wait until you are sixty. And some second pillar plans have an early retirement bridge solution where they get you better conditions when retiring at 58.

If you want to discuss this further, you can contact me directly, but again, this is a complex question that cannot be answered easily :)