DEGIRO vs Interactive Brokers for European Portfolio: Who is cheaper in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

DEGIRO and Interactive Brokers are great brokers for European investors. But how do they compare exactly? Which one should you choose?

In this article, I compare DEGIRO vs Interactive Brokers in terms of price for a European ETF portfolio. I compare different scenarios that should cover the needs of most long-term investors.

We only compare the costs of both brokers, not the features and usability. If you are interested in the features, I have written reviews of both brokers.

And remember: Investing involves the risk of loss. Always do your research before you invest and know why you invest and what you invest in.

|

4.5

|

5.0

|

Our investment portfolios

For this comparison of brokers, we consider two different portfolios.

Since the fees do not change, we are not interested in the exact ETFs used. We are only interested in which exchange you purchase the ETFs.

For a choice of ETFs, I wrote about possible portfolios with European ETFs. To know why we must invest in European ETFs, you can read why we may lose access to superior U.S. ETFs. Swiss investors still have access to US ETFs, but European investors have already lost access.

The first portfolio is for a Swiss investor. This investor has 25% of his portfolio in a Swiss ETF (from the SIX stock exchange). The rest of the portfolio is from a European ETF (from the Euronext Paris stock exchange).

Our second portfolio, for a European investor, is even more straightforward. This investor has 100% of his portfolio in European ETFs (from the Euronext Paris Stock Exchange).

In both cases, each investor only invests once a month in one ETF. It is a perfect way to invest with low fees. Some people are investing every quarter. But it barely reduces fees, and it makes you keep more cash. Investing every month is also an excellent way to build an investment habit. So monthly investments make more sense.

For these two investors, we compare the prices of two brokers: DEGIRO vs Interactive Brokers. These two brokers are among the cheapest available in Europe. But which is more affordable for each scenario?

DEGIRO Fees

First, we study the fees for each service, starting with DEGIRO.

With DEGIRO, you pay a connectivity fee of 2.5 EUR (2.68 CHF) per year and per stock exchange on which you own shares. If you have an ETF on SIX and one on Euronext Paris, you pay 5 EUR per year. However, your local stock exchange is free. So, if you are a Swiss investor, you get SIX for free.

If you convert currency on your account, you pay a fee of 0.25%. It can quickly become expensive once you invest a large amount of money. A currency exchange happens if your base currency is CHF and you buy an ETF in EUR.

The fee system of DEGIRO is pretty simple. Unfortunately, it is slightly different for each country. I wish DEGIRO had the same prices regardless of which country you come from.

A collection of Core ETFs is also cheaper with DEGIRO. It used to be free, but the service fee still applies. You also still have to pay currency exchange fees if necessary, but the other expenses are waived. We do not use that for this comparison since that would significantly restrain our choice. But if you choose ETFs in the core selection, you can make it cheaper.

With DEGIRO, a Swiss investor pays 3 EUR (3 CHF) for each purchase of a Swiss ETF. The price is also the same (3 EUR (3 CHF)) for a European ETF. 2 EUR goes to DEGIRO while the other 1 EUR covers the third-party (the stock exchange) costs.

Now, for the European investor case, I take the example of DEGIRO France. The fees are a bit different from country to country. So, if you are not in France, you can check out the prices on your DEGIRO website.

Interestingly, this investor only pays 2 EUR (2 CHF) for each purchase of a European ETF. DEGIRO gets 1 EUR, and 1 EUR is for the third-party costs. It would be the same price for a Swiss ETF. However, European investors are unlikely to invest in Swiss ETFs. Interestingly, this is significantly cheaper than investing for a Swiss investor.

In the past, another account type was the DEGIRO custody account. But as of 2022, this account is not offered anymore to new customers.

Interactive Brokers Fees

Now, we also have to study the fees for Interactive Brokers. They do not have two account types but have two fee systems: Fixed and Tiered. So we compare these two. Other than the prices, there are no differences between the two pricing systems.

Regardless of where you live, you pay the same fees, which simplifies them a bit. In both cases, there are no custody or inactivity fees!

For both account types, you pay 2 USD (2 CHF) for currency exchange. The Swiss investor must exchange some CHF into EUR to buy European ETFs.

Fixed Pricing

The Interactive Brokers Fixed pricing is straightforward.

For buying an ETF on the Swiss Stock Exchange, you pay 0.10% of the total transaction. The minimum fee is 10 CHF, and there is no maximum fee.

For purchasing an ETF on the European Stock Exchange, you pay 0.10% as well. But the minimum fee is only 4 EUR (4.28 CHF), and the maximum is 29 EUR (31.05 CHF).

In some cases, your order may use IB Smart Routing. In that case, the fees can be even lower. However, it is difficult to know which order uses which routing system. Therefore, I assume the higher fees. But it is good to know that fees can go even lower!

Tiered Pricing

The Interactive Brokers Tiered system is more complicated.

First, you must pay some transaction fees to IB for each region. Then, based on the stock exchange, you must pay some extra fees. And they are entirely different based on the exchange.

For buying an ETF on the Swiss Stock Exchange (I took EBS), you pay 0.05% in transaction fees to IB (with a minimum of 1.50 CHF and a maximum of 49 CHF). You then pay a flat fee of 1.5 CHF for the exchange and an exchange fee of 0.015%. On top of that, you pay a 0.38 CHF clearing fee and a 1 CHF trade reporting fee.

For buying an ETF on the European Stock Exchange (Euronext Paris), you pay 0.05% in IB transaction fees with a minimum of 1.25 EUR and a maximum of 29 EUR. You pay a 0.01% exchange fee (with a minimum of 0.8 EUR). And the clearing fee is 0.10 EUR.

We can observe that it is much cheaper to trade on Euronext than on SIX. Switzerland has a reputation for being expensive!

As you can see, this is much more complicated than the Fixed system. But you do not have to worry about this; I do all the math for you!

Swiss Investor

We can start with our Swiss portfolio, with 25% of a Swiss ETF and 75% of a European ETF.

In this case, our example investor invests once every four months in the Swiss ETF and the other months in the European ETF. The Swiss Investor has CHF as its base currency. It means that buying the European ETF incurs a currency conversion.

It is the kind of portfolio that most Swiss invest in. If you do not want a Swiss ETF, skip to the next section for a complete Europe ETF Portfolio. However, the following section uses EUR as a base currency.

We compare DEGIRO vs Interactive Brokers for this Swiss investor for several scenarios.

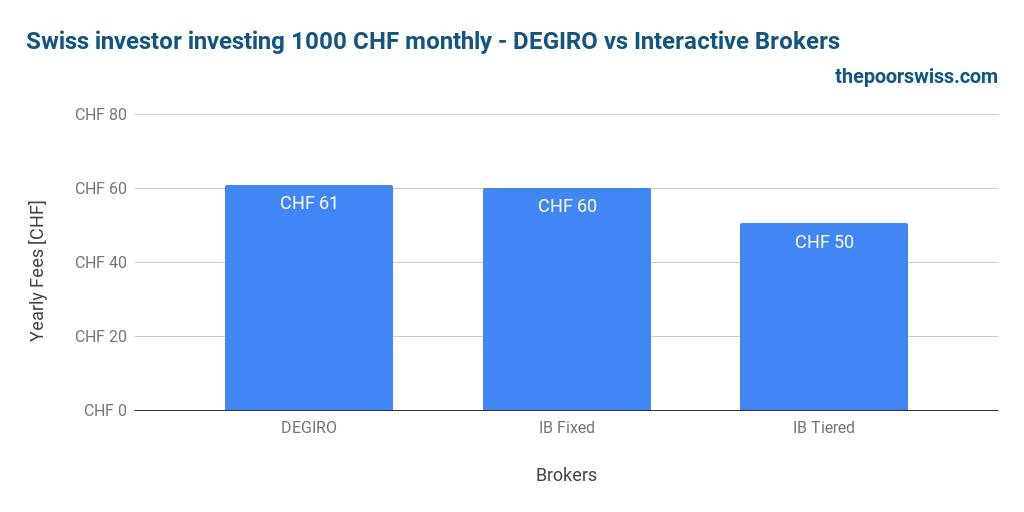

Starting investor

Our first scenario is with a person starting to invest.

The investor begins with 25’000 CHF and invests 1000 CHF every month. It is a typical scenario for someone just investing in the stock market. But this is only an example. There is no problem starting with zero CHF.

Here are the total fees for each broker account:

In this case, Interactive Brokers Tiered and Fixed are slightly cheaper than DEGIRO, but it is not significantly different. We can see that the Tiered pricing of IB is more affordable than Fixed for small investments.

So, in this particular case, Interactive Brokers Fixed and Tiered are the best choices.

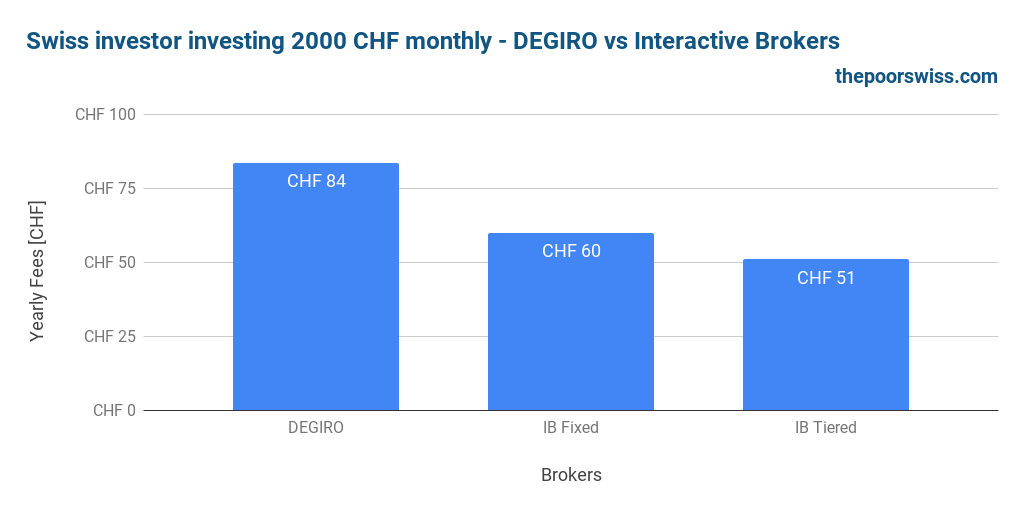

Standard Investor I

For the second scenario, we can take an investor who has 100’000 CHF and invests 2000 CHF monthly. After a few years of investing, this is the state that many investors can reach.

Here are again the total fees for each broker account:

Both Interactive Brokers Tiered accounts are now significantly cheaper than DEGIRO.

So, in this particular case, Interactive Brokers Tiered is the best choice. However, it is only marginally cheaper than Interactive Brokers Fixed. Both are excellent choices for this scenario.

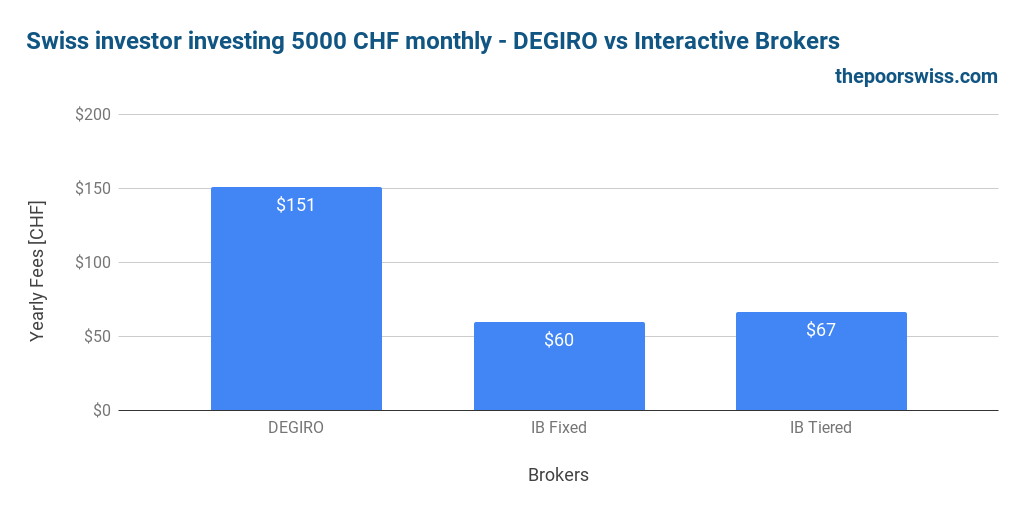

Standard Investor II

Here is what happens if we invest 5000 CHF monthly instead of 2000 CHF. It is still a typical investing case.

This scenario would give us the following totals:

We can see that Interactive Brokers Fixed is the best option here. Interestingly, Fixed is now cheaper than Tiered. And Interactive Brokers is now twice as cheap as DEGIRO.

Once again, in this particular case, Interactive Brokers Tiered would be the best choice.

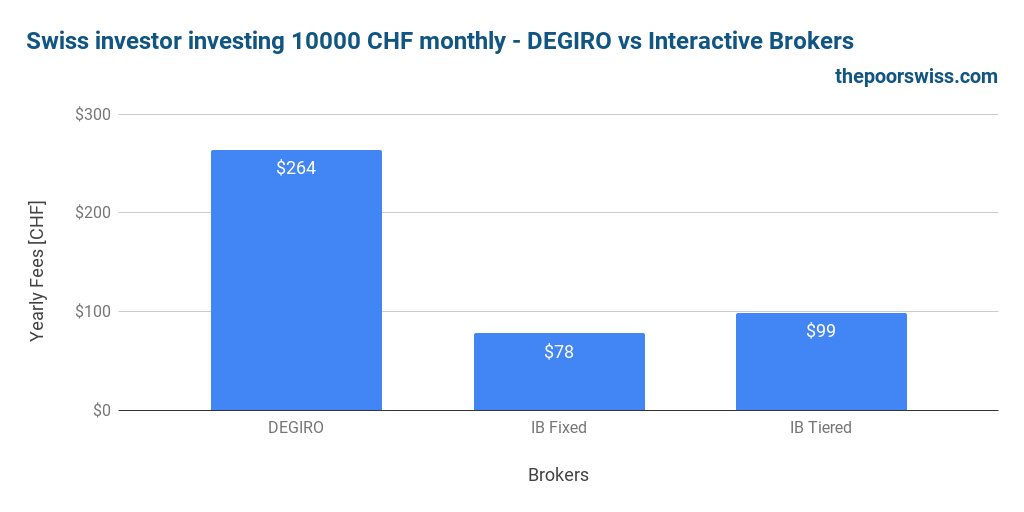

Advanced Investor

We should check the last scenario for our Swiss investor. This time, our investor has 500’000 CHF and is investing 10’000 CHF every month. This scenario is not typical since this is a lot of money. But this is still possible.

We get the following totals from this case:

Not a lot of things have changed in this scenario. We can note that the gaps between the different options are increasing. The Fixed account is still the best option. Tiered is still relatively cheap as well. However, Interactive Brokers is now more than three times cheaper than DEGIRO!

In this case, Interactive Brokers Tiered is the cheapest option.

Conclusion Swiss Investor

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

We can draw several conclusions for Swiss investors:

- Interactive Brokers Tiered is the cheapest account for small investors

- Interactive Brokers Fixed becomes cheaper for the higher amount invested per month.

- The difference between Interactive Brokers Tiered and Interactive Brokers Fixed is relatively small.

- DEGIRO can become several times more expensive than Interactive Brokers

- Most of the fees of DEGIRO come from currency exchanges.

For Swiss investors, I recommend using Interactive Brokers.

It does not mean that DEGIRO is a bad broker for Swiss investors. In the worst scenario, you would pay 264 CHF more per year. This is not a considerable amount. DEGIRO is still a great broker, not just as cheap as IB. If you do not want a broker from the United States, go with DEGIRO!

European Investor

If you live in Europe, you likely have a portfolio with only European ETFs.

In this case, the example investor invests monthly in a European ETF. It is a simple scenario. Since a European investor has euros, there will be no currency conversion in this scenario. It makes a significant difference!

This should be the case for most European Investors except for Swiss investors. It could also be different for people from the United Kingdom since they do not have euros.

Some of the prices from DEGIRO vary from country to country. For this example, I took the prices from France. Interactive Brokers has no difference based on where you come from.

We compare DEGIRO vs Interactive Brokers for the same scenarios for this European investor.

Starting investor

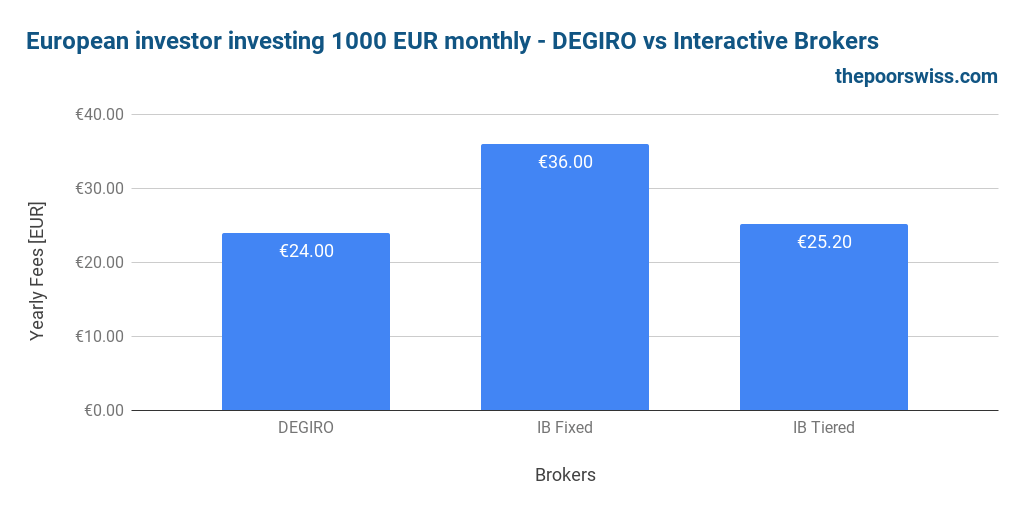

Our first scenario is for a person that is starting to invest. The investor begins with 25’000 EUR and invests 1000 EUR every month. This scenario is typical for a European investor just starting to invest in the stock market.

Here are the total fees for each broker account:

In this case, DEGIRO is very slightly cheaper than Interactive Brokers. But both are affordable in this case. Interactive Brokers Tiered is better than Interactive Brokers Fixed.

So, in this case, DEGIRO is the best option. But IB is also very cheap.

Standard investor I

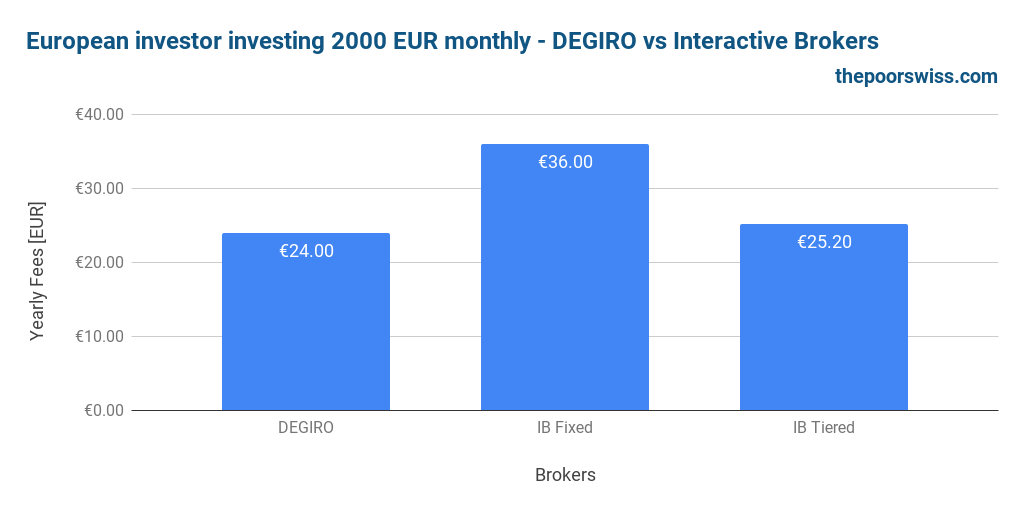

Our second scenario is with a person in the second stage of investing. The investor already has a portfolio of 100’000 EUR. This standard investor invests 2000 EUR each month.

Here are the total fees for each broker account:

Nothing changed in this scenario. So, in this case, DEGIRO remains the cheapest option by a small margin. But IB is also very cheap.

Standard Investor II

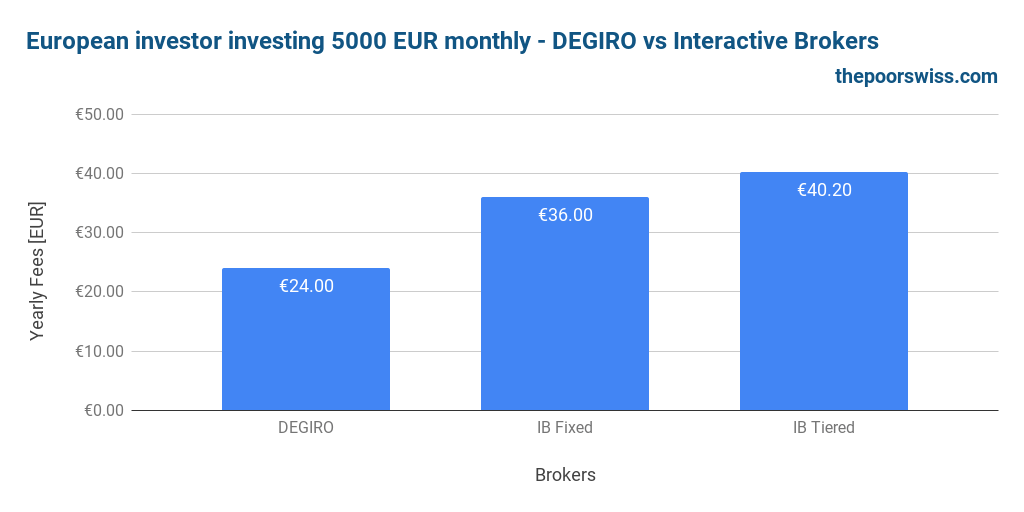

Here is what would happen if this standard investor invested 5000 EUR per month instead of 1000 EUR.

This scenario would give us the following fees per broker account:

Now that the investments increase, IB becomes more expensive while the prices for DEGIRO do not change. The gap is starting to be more significant here. Interactive Brokers Fixed is now cheaper than Interactive Brokers Tiered.

For this particular case, DEGIRO is the best option.

Advanced Investor

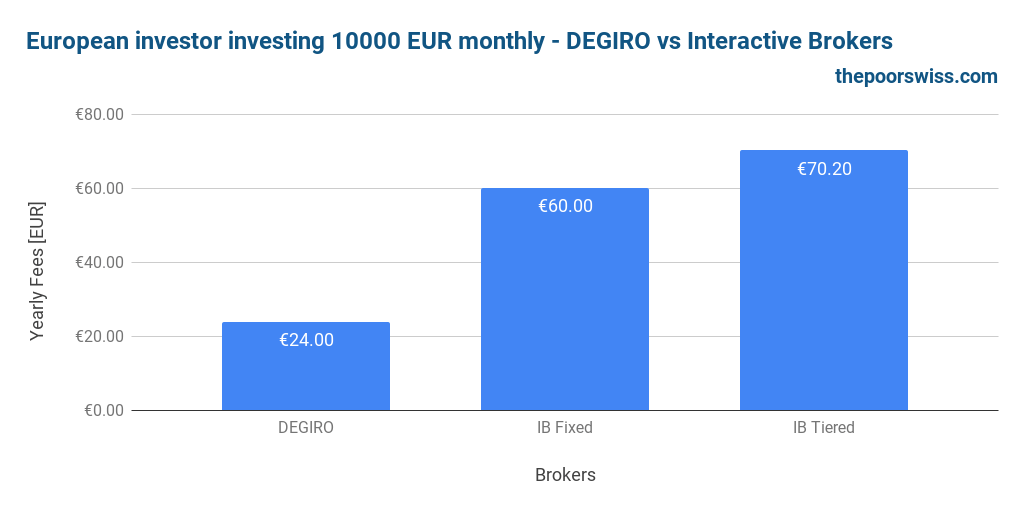

Finally, we also check the final scenario for our European investor. Our last investor has 500’000 EUR and is investing 10’000 EUR every month. It is not a typical scenario since this is a lot of money. However, this is still possible for dedicated investors or high-income earners.

Here are the prices for each broker account:

Once again, DEGIRO is the best option, twice cheaper than Interactive Brokers Fixed.

Conclusion European Investor

We can draw several conclusions for European investors:

- DEGIRO is the cheapest account

- Interactive Brokers Tiered is a good option for small investors

- Interactive Brokers Fixed is a good option for investors with more money

- Investing without currency exchanges can save a lot of money.

Most European Investors should go with DEGIRO.

One advantage of IB is that you can move from country to country without changing your account to a new entity. With DEGIRO, the entity you use depends on where you live. So, if you move abroad, you may have to switch your account, which is not free. So, if you plan to move abroad or be a nomad, I recommend Interactive Brokers.

Conclusion – DEGIRO vs Interactive Brokers

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

There you have it! We now know the cheaper option between DEGIRO vs Interactive Brokers for several scenarios. Interestingly, both broker accounts are competitive. There is no bad option between these two brokers.

We can draw some conclusions from this comparison:

- For a Swiss Investor, Interactive Brokers Tiered should be the most affordable broker unless you invest a lot, in which Interactive Brokers Fixed becomes interesting.

- DEGIRO should be the most affordable broker option for a European investor.

- There is very little difference in prices between DEGIRO and Interactive Brokers. Both brokers are very affordable.

So which should you choose? Swiss investors should probably go with Interactive Brokers Account. If they do not want a US broker, they should go with DEGIRO.

European investors, on the other hand, should probably go with DEGIRO. It is significantly cheaper for beginner investors.

If you need more information on these brokers, you can read my reviews:

What about you? Which broker do you use?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Brokers

- More articles about Investing

- How do commission-free brokers make money?

- Charles Schwab International Review 2024 – Pros & Cons

- The best broker for Swiss investors in 2024

I tried to rebuild your example but I got not the same results for the dividents. Arent you using 1.8% as divident yield of the already investet money each three month?

Hi Manu,

No, I am using 1.8% per year, this 1.8/4 each three months.

I hope that helps*

Is DeGiro any good since we are forced to pay the 0.1% currency exchange fee as swiss? It’s hard for me to estimate the total cost of this on for example a 100k EUR S&P500 ETF.

I initially planned to do currency conversion myself with Revolute(free for 5000€) (and when more than 5000€ than transferwise). In that case i now realize I would need to use IB since DeGiro only takes CHF. But than I can just buy currency at market-rate with IB. So would this make any sense?

#1 What currency strategy would you recommend on for example a 100k EUR S&P as a Swiss. Is there anything significant to save with IB vs Degiro?

In your fee chart above the 0.1% exchange fee does not seem to have a major impact on the total fees.

So in the end i assume DeGiro would be cheaper if i today add 100k to an account.

#2 Regarding Basic vs Custody account. Is the increased rist of the Basic only covering 20k worth worrying about?

Hi Tim,

In this comparison, I already took the currency exchange fee into account. This is what makes DEGIRO slightly more expensive than IB. But the DEGIRO is not huge.

If you plan to use IB for currency conversion, then, you should simply use only IB and not IB and DEGIRO.

#1 If you have to pay currency exchange fess, IB will be slightly cheaper for 100K EUR. If you do not pay them, DEGIRO will be cheaper (if you have EUR).

#2 I do not think it is worth worry about no. But that is a decision that everybody has to take for himself.

Thanks for stopping by!

Hi,

Thanks for the great article!

Would you mind sharing your thoughts on the two brokerages in terms of counter party risk and risks associated with insolvency etc.? IB seems more reliable due to being a public company and having a higher $ amount of protected capital, what are your thoughts on that?

On another note, you did not have such scenario in your article, however, it seems to me that Degiro custody account would be a great option for someone that is invested in accumulating ETFs because you would be able to avoid the huge dividend fee.

Hi Dovy,

I would think indeed that the risk of losing money with Interactive Brokers is lower than with DEGIRO. It has been active for longer and seems to generate more revenue. I am not saying that DEGIRO is unsafe, it’s probably only a small difference. But it could be an argument for some people.

Yes, you are entirely right. If you invest only in accumulating funds or stocks without dividends, it is perfectly fine to use DEGIRO Custody. You get the protection of DEGIRO Custody and the low fees of DEGIRO Basic.

Thanks for stopping by!

There are http://www.interactivebrokers.co.uk based in UK, http://www.interactivebrokers.com in US and http://www.interactivebrokers.eu in Luxembourg. What made you choose UK based version instead of other two?

Hi Domas,

For the U.S., it’s easy, you cannot invest if you are not a U.S. Citizen (or maybe a U.S. resident at least).

For EU, I actually did not know it existed. I am trying to find differences, but it’s really not clear what changes between EU and UK.

Hopefully, EU and UK are almost the same things.

Thanks for stopping by!

Hi Mr the poor swiss,

I am thinking in changing my broker like you did, from degiro to interactive brokers. Could you help me with 1 question about IB?

If the base currency of the account is CHF and I hold multiple currencies (like EUR) with the manual convertion, is it possible to deposit/withdraw EUR from/to my european bank account? Can I have multiple bank accounts linked to the IB account?

This is not possible with Degiro because I can only withdraw funds in the base currency of the account, CHF in my case.

Thanks a lot!

Hi Alex,

I have never tried EUR. But I did several transfers in USD although my base currency is CHF.

According to the documentation, it seems possible to make a transfer in EUR with a SEPA transfer. So I would think it should not be an issue. But if you want to be sure, you can contact their support.

You can have many bank accounts linked to your IB account. You just have to declare them before the deposit. This is much more flexible than DEGIRO.

Thanks for stopping by!

Hi mate, great comparison. How about IBKR LITE – this is some no-fees variant for IB account, but with less features available – can you comment on this, please?

By the way, I am a little (or rather completely) lost how it is with dividends if you are Swiss resident. I am not planning to invest mainly for dividend income as some people do, but this is big part of investing when you select stocks individually. Do you possibly know what will I have to do in scenario, when I buy 10-20 stocks out of which 15 pays dividend, at various times, different amounts etc. I understand I must present that info to Swiss tax authorities but how will this be treated, tax wise? There is couple of possible scenarios – US stocks paying out the dividends, Swiss stocks paying out the dividend, plus any other country paying dividend in different currency etc. What if I receive dividend from 10 US companies and from 5 Swiss companies. In Geneva tax form guidance I see this –

Rendements bruts soumis et non soumis à l’impôt anticipé. Les rendements de titres étrangers ne sont pas soumis à l’impôt anticipé suisse et doivent être indiqués dans la colonne 14b. S’agissant des rendements de placement suisse, ces derniers sont en principe soumis à l’impôt anticipé et doivent

figurer sous la colonne 14a.

Does it means that Swiss tax authorities will NOT want any monnies from me on non-Swiss dividends? And will tax me 30 % on Swiss dividends?

Also, I have read somewhere on your blog that you can claim from US tax authorities 15 % of original 30 % tax on dividends – is this complicated process?

Hi Hubs,

IBKR Lite is a good option. But it is not available for European customers, only for U.S. customers. So, for now, we do not have a choice.

If you have individual stocks, it can become difficult to fill your tax declaration. You will have to list all your purchases and sales. For the dividends, it will depend on the software. In my state, they can compute the dividends based on the rest of the information. For each, you will have to indicate how much has been withheld.

They will tax you on both, but different percentages. And you will be able to reclaim some of that withholding.

No, it’s not a complicated process. If you use interactive brokers, you will have access to the W8-BEN form directly from the web interface. you just have to fill a few things and IB will automatically stop the withholding. It takes less than 5 minutes.

Thanks for stopping by!

Thanks for the comparison, super interesting! I am a small EU investor using DEGIRO Basic. Did you consider that some ETFs have no purchase fee?

https://www.degiro.ie/data/pdf/ie/commission-free-etfs-list.pdf

I assume that makes it even a cheaper option. Or does IB also have that?

Thank you!

Hi Daniel,

Yes, I considered that, but since that would restrict the choices, it would not be a good comparison.

But it’s a good point. I added a note to it in the Degiro Fees section. This is an important point.

Thansk for pointing that out!

Hi,

Thank you so much for your articles. They are really good and help a lot to take decisions.

I would like to point that even if there is really small difference and I know is very difficult to calculate because is not a constant incoming; we should include what IB pays you if you lend the stocks. In DeGiro they don’t pay anything for this concept but IB yes.

Also, sometimes I have some cash in the IB account before buying something… There are also interest paid daily ! I know that is not a lot, but some months I have 1 or 2 dollar extra.

Good job!

Regards.

Hi Tuno,

These are very good points!

Indeed, IB has also a program where they can lend your shares. When they do, they share half the profits with you. It’s nearly impossible to estimate how much it is. But it is worth mentioning in the article.

And yes, IB will give you some interest on your USD cash. But it will also make you pay some negative interest rate on CHF cash (DEGIRO does it too). I will mention that as well in the article when I update it.

Thanks for stopping by!

IB is available world wide.

DeGiro is available just for 18 EU states.

Europe and even EU has more than 18 states!

Hi poorswiss,

Nice post, thank you for sharing all this info with us. It must take you considerable time.

Just a small correction on your text, you only pay the connectivity fee with DEGIRO for exchanges outside your home market. If a swiss investor buys etfs from SIX and Euronext Paris, he will pay 2.5 EUR per year and not 5. I find this connectivity fee very strange, but they also have to make money ahah

Cheers! =)

Hi Alex,

You are entirely right! Thanks for pointing that out! I will fix that and update the numbers this weekend.

This should not make any difference in the results, but it’s better to be precise!

Thanks for stopping by!

Interesting article, thank you!.

As in some of the examples, the costs are close, I would be interested to an opinion on the best for other factors, website functionality, customer service, tax reporting.

This could be a deciding factor I suppose if costs are similar.

Hi Gavin,

This is a good point. I plan to write a comparison of DEGIRO and Interactive Brokers with all the other factors.

I do not know when it will come, probably in February. I am a bit late on my writing these days.

I completely agree that price is not the only factor!

Thanks for stopping by!