VIAC 3a Review 2024 – Pros & Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

There are many third pillar providers in Switzerland. Some are good, but most are too expensive. You do not want to waste your retirement bank on fees. Therefore, you need to choose the best third pillar provider.

In 2018, VIAC started on the market of third pillars. VIAC is the first mobile third pillar. And they are really interesting! VIAC has very low fees and lets you invest up to 99% exposure in stocks. It is significantly better than what I have found before in other third-pillar providers.

In this article, I do an in-depth review of VIAC! Among other things, we will look at this service’s investing strategies and fees.

| Total Fee | 0.41% per year |

|---|---|

| Maximum portfolios | 5 |

| Stock allocation | Up to 99% |

| Maximum foreign exposure | 60% |

| Maximum investment in cash | 100% |

| Investment Strategy | Index funds |

| Fund providers | Credit Suisse and Swisscanto |

| Languages | English, French, German, and Italian |

| Sustainable option | Yes |

| Mobile Application | Yes |

| Web Application | Yes |

| Custodian Bank | WIR |

| Established | 2018 |

| Foundation’s domicile | Basel |

VIAC

VIAC is a recent actor in the third pillar area. It was launched in 2018 and is becoming increasingly popular.

It is pretty new compared to other big banks. It is essential to mention that VIAC is not a bank. The money you have with them is stored in the WIR bank. As such, you will have complete protection up to 100’000 CHF like the other banks. This protection is critical. Without that, I would not consider this provider at all. You want your money to have maximum protection.

VIAC is quite different from the other providers. You will only have access through a mobile application or web application. They do not have offices where you can do operations with them. This absence of bank offices is what makes them offer very low fees.

They started with only a mobile application. But since then, VIAC has added support for a web application. The web application is great for people like me who are not fond of mobile phones. Most people will probably like mobile applications since they are fond of phones.

To learn more about VIAC, you can read my Interview of Daniel Peter, CEO of VIAC.

So, we will see how good VIAC is as a third pillar in Switzerland.

Investing Strategies

For long-term investors, the investing strategy of a third pillar is essential.

VIAC offers three sets of strategies:

- Global – Investing in the entire world.

- Switzerland – Investing in Switzerland

- Global Sustainable – Investing in the whole world but omits some stocks such as tobacco or weapons stocks. This is called sustainable investing.

Each strategy has five variants: 20, 40, 60, 80, and 100. These variants specify the allocation to stocks.

You can also define your strategy by composing it with their different underlying funds. This customization is an excellent way to choose exactly what you want to invest in. But then, you need to have a good idea of how to create a custom portfolio. I would not recommend this to a starter investor.

The fact that we can go up to 100% invested is great! For a long-term aggressive investor, this is ideal. It is investing only 99% since they keep 1% in cash in each portfolio. But 99% is already a great amount invested in stocks.

Interestingly, they allow you to invest in either cash or bonds if you do not fully invest in stocks. This is great for people who do not think bonds will overperform cash.

You can also have several portfolios, up to five. Having five accounts is great for optimizing taxes by making staggered withdrawals.

VIAC Global 100 Fund

The most interesting strategy is the VIAC Global 100 strategy, which I chose for my VIAC account when I used it.

This fund invests 99% in stocks. Out of these stocks, 40% are Swiss stocks. Because of regulations, each portfolio is limited to 60% in foreign currency exposure. This is not a limitation on Swiss stocks since you could use CHF-hedged funds to get more foreign exposure while keeping under the limit. However, the default portfolio uses Swiss Stocks for 40%. The rest is invested in the entire world based on market-cap weight. The remaining 1% is allocated to cash.

This strategy’s TER is 0.45%, and there are no other fees, making it a very cheap solution for Switzerland!

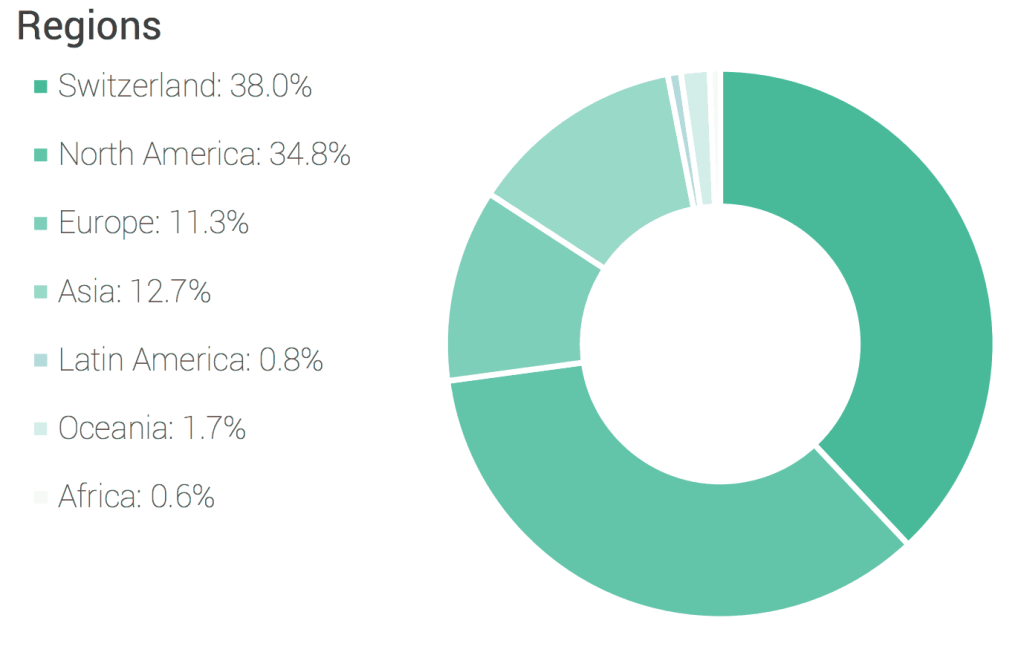

Here is the allocation by region of the Global 100 fund:

And there is the exact allocation of each sub-fund (as of September 2018):

- SMI (Swiss): 27.75%

- SPI Extra (Swiss): 9.25%

- Europe ex-CH: 10.60%

- S&P 500: 31.51%

- Canada: 1.93%

- Pacific ex-Japan: 2.54%

- Japan: 4.46%

- Emerging Markets: 8.96

- Cash: 3.00%

This offer is great. It is better than most other candidates:

- The allocation to stocks is high

- The allocation to international stocks is the maximum permitted by their regulations.

In the long term, this nice allocation to stocks and the relatively low fees will result in significantly more returns.

VIAC Fees

When investing long-term, it is important to look at the fees.

The base fee of VIAC is 0.52% per year. But you only pay this fee on the invested part (the stocks). So, if you have more cash, you get fewer fees.

In 2021, VIAC introduced a fee cap on its administration fee. So, you cannot end up with more than a 0.40% administration fee. If your strategy has a higher fee, it is reduced to 0.40%.

Now, some of the strategies also have product costs. These products can make the strategy more expensive than 0.40%; only VIAC’s administration fee is capped.

The fees at VIAC are different for each universe and strategy. For instance, here are the fees for the global strategies:

- Global 20: 0.17% per year

- Global 40: 0.28% per year

- Global 60: 0.39% per year

- Global 80: 0.41% per year

- Global 100: 0.41% per year

Fees for Switzerland strategies are slightly higher:

- Switzerland 20: 0.17% per year

- Switzerland 40: 0.28% per year

- Switzerland 60: 0.39% per year

- Switzerland 80: 0.42% per year

- Switzerland 100: 0.43% per year

And the sustainable strategies are the most expensive:

- Global Sustainable 20: 0.16% per year

- Global Sustainable 40: 0.28% per year

- Global Sustainable 60: 0.39% per year

- Global Sustainable 80: 0.43% per year

- Global Sustainable 100: 0.44% per year

Overall, these are excellent fees! Compared to most offers in Switzerland, this is better!

Life and disability insurance

VIAC has something special that differentiates it from other third-pillar providers.

Indeed, with VIAC, you can get life or disability insurance. With each 10’000 CHF invested in your account (only the invested part counts), you get 2’500 CHF insurance.

You have to choose in your account whether you want disability (in case of at least 70% disability) insurance or life insurance. In the case of life insurance, this will be paid to your beneficiaries with the money of your third pillar. In case of disability, you will get the insurance payment directly from yourself.

It is a nice bonus, but this is not life-changing. This will only be useful if you die or get disabled (and you have to choose) before your retirement age. And the amount is still quite limited, so, for many people, this will not replace proper life or disability insurance. But this could still be very useful. And since it is free, it is not a bad deal for VIAC users.

Sustainability of VIAC

More and more people are interested in investing sustainably. They want their money to work for a better future and not invest in companies that are not sustainable for our world. But does VIAC offer a sustainable option?

When you choose the sustainable option, VIAC will invest in different funds. It will invest in two different types of funds:

- Socially Responsible Investing (SRI) funds.

- Environmental Social Governance (ESG) funds.

These two kinds of funds are very similar. They select companies based on sustainable factors. For instance, they will not invest in companies that make weapons or in companies that exploit children.

While this sounds good in theory, there are many issues with these funds. For instance, it was shown that about 80% of sustainable funds had exposure to fossil fuel companies. These companies are the antithesis of sustainable investing.

Also, the criteria for selecting companies in these funds are not very transparent or even agreed upon between different funds.

Finally, these funds are not very selective. Indeed, it was shown that nearly 90% of the companies in the S&P500 are present in ESG funds. So, very few companies are excluded.

Regarding VIAC, these options are likely more sustainable than the default options. However, this sustainable option is not very sustainable. I would not call this greenwashing, but this is level zero of sustainable investing. The only advantage is that this is simple and cheap.

So, I would not say sustainable investing is very sustainable, but it is better than nothing.

Security

We can also look at the security of the VIAC third pillar.

The applications’ technical security (web and mobile) is pretty good. All communications are encrypted between the application and the server. And since you cannot do anything with your third pillar until you retire (or in a few other special cases), the apps are well protected.

The only thing I would like is a proper second factor of authentication on the web application. But again, since you cannot do much, it is unimportant.

If you hold cash, it will be held by WIR Bank, the custodian bank of VIAC. This cash will be privileged in case of bankruptcy up to 100’000 CHF. This protection is the same as the bankruptcy protection of other Swiss banks. If you are an aggressive investor, this should not matter much since you should have very little cash.

The securities themselves are invested in institutional funds. These funds are very stable and are held in your name. The funds are not directly on the balance sheet of VIAC but on the balance sheet of the foundation. So, if VIAC goes bankrupt, these funds are safe in the foundation. It will be up to the foundation to find a new manager for these funds and to get you access to this money again.

Finally, I have never heard of any data leak that would have occurred at VIAC. This is always a good sign, even for recent companies.

Overall, I think that VIAC’s security is quite good and well-regulated. The applications are well-made, and the foundation is organized, so your assets are well-protected.

Alternatives

In Switzerland, there are many alternatives.

Compared to third pillar accounts from banks, VIAC is a great third pillar, much better than anything a bank proposes.

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

However, compared to other independent third pillar providers, VIAC is not the best available. Finpension 3a is currently the best third pillar available. Finpension 3a has several advantages over VIAC:

- The fees are slightly lower.

- You have more freedom in designing your portfolio.

- You can avoid all currency hedging.

However, Finpension 3a has one slight disadvantage over VIAC. With VIAC, you could invest in stocks and cash and save a little on fees compared to investing in stocks and bonds.

To learn more, read my detailed comparison of VIAC and Finpension 3a.

VIAC FAQ

Is VIAC regulated?

Yes, VIAC is regulated in Switzerland as a third pillar foundation.

Is VIAC safe?

VIAC is well regulated and assets of the investors are fully segregated from the main entity. In case of bankruptcy, the foundation would have to find an alternative manager but investor funds would be safe.

How much fees will I pay with VIAC?

VIAC has an administration fee of 0.52% per year (currently capped at 0.44%). On top of that, you also currency exchange fees, at around 0.05%.

Who is VIAC 3a good for?

The VIAC third pillar is a good third pillar for conservative people or people that do not have a very long term horizon.

Who is VIAC 3a not good for?

VIAC 3a is not the best for aggressive investors, with a long term horizon. Indeed, you can invest more aggressively with some alternatives.

VIAC Summary

VIAC is a good third pillar, with good fees. It is a great third pillar for conservative investors.

Product Brand: VIAC

4

VIAC Pros

Let's summarize the main advantages of VIAC:

- You can allocate up to 97% in Stocks

- Very low fees

- VIAC is very transparent

- A small interest rate on the cash part

- Strategies with low allocation to stocks are cheaper

- Mobile and web applications

VIAC Cons

Let's summarize the main disadvantages of VIAC:

- You need a minimum of 40% in Swiss Francs (CHF)

- You need to keep 3% in cash

- Not the cheapest third pillar

Conclusion

The conclusion is pretty simple! VIAC is an excellent third pillar provider in Switzerland. The fees are very low, and VIAC offers a high stock allocation. These facts are great for long-term investors. And since most third pillar investors are in for the long-term, this is excellent.

I also like VIAC’s transparency. They communicate well and share as much information as possible. VIAC is the best third-pillar provider for this information. It is also very clean and modern. They do not try to hide fees, and they have been quite helpful in answering my questions for this article.

When VIAC was introduced, they were the best third pillar available. Now, there are other competitors. If you want to keep up to date, I have an article about the best third pillars in Switzerland. I moved my third pillar from VIAC to Finpension 3a, but both are great options.

If you like VIAC, you may like VIAC’s vested benefits.

Which third pillar do you use? What do you think of VIAC?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

With Viac, do you pay the fees, TER expenses of underlying funds on top of their fees?

If so, isn’t it better to get the underlying funds directly from CS? Most of their funds are offered by Credit Suisse – and have considerable and TER/fees

Hi Kilari,

The 0.51% is including all the fees of the underlying funds. And these are institutional funds that we cannot access as simple investors, they are extremely cheap.

Thanks ThePoorSwiss

Great intelligible blog with useful information!

One question: You write “The law states that the third pillar must have at least 40% allocated to Swiss stocks.”

Could you give the source of that information? I did not find it anywhere and it seems to me that there are ways to get around it technically.

Hi Lou,

That’s a great question. I can’t seem to find an internet source from this.

It came from my discussion with the CEO of VIAC. This is a regulation from the supervisory authorities. It’s actually not Swiss stocks, but rather a limit in domestic currency.

I do not know exactly why Finpension allows more than 40% while VIAC does not. It could come from different supervisory authorities or different interpretations of the same rule.

Thanks for stopping by!

I had very good experiences with VIAC. The opening and transfer processes work very well. The chat support is provided by very experienced people sometimes the by the VIAC founders itself.

You have to be careful with transfers at the end of the month. To ensure your money is invested at the beginnig of the next month, do the transfer at best 3 working days before month end.

Cheers,

Andreas

Hello ThePoorSwiss

Thanks for this article.

I too opened a 3rd pillar with VIAC on Monday. The 300 CHF exit fee is a bit annoying but ok.

Cheers

Dear Mr. The Poor Swiss,

May I know the solvability and rating of the WIR Bank? I read that a few years ago they had troubles so that if you have more than 100k CHF invested in their third pillar, customers should be sure they will have their money at the age of retirement.

Thank you.

BR

Ivan

Hi Infor,

Indeed, about 5-6 years ago, they had issues. I do not see that as huge issue for VIAC for several reasons:

* Major reason: most of your money should be invested and not in cash

* Minor: VIAC is working with Terzo Foundation, from WIR, not directly with WIR

* Minor: There have not been any recent issues with the WIR bank.

If you are worried, you can always split your third pillars between several providers.

I hope that helps.

Thanks for an insightful article Mr Poor Swiss,

Are you aware of any Third Pillar providers that would allow one to invest directly into single-line stocks (Nestle etc.) instead of having to take the equity exposure via ETFs and funds?

Hi Mike,

No, I am not aware of any such providers.

It’s unlikely to happen because there are rules against having too much exposure to a single company for a pension provider.

Thanks for stopping by!

Hi Mr. The Poor Swiss,

Thank you for putting in that much effort in sharing all these life changing tips.

Did you consider comparing the option to invest the 3A in a Life Insurance such as the swiss life flexsave duo which I believe is an index 100% stocks with a life/death insurance for the partner/kids?

Just wondering where these kind of products lie compared to VIAC.

Many thanks in advance for your reply

Hi Alex,

Thanks for your kind words :) I am glad this helps!

In general, life insurance 3a is just strictly worse than a banking third pillar.

Even if this one does not look too bad, you will still have fees on investing that will very likely be much higher than VIAC and you will pay a premium for the life insurance part. It means that not all your money is going to be invested into the stocks.

If you really need life insurance, there are some great life insurance policies available. So you should take a good third pillar (finpension 3a or VIAC) and a good life insurance.

And be careful that many states have no tax-advantages for 3b life insurance.

Thanks for stopping by!

Dear Mr. The Poor Swiss, do you have some indication for a life insurance policies?

Many thanks in advance for your reply

I have never looked into pure life insurance policies, no.

Hi Poor Swiss,

Thank you for a great website, I have been trying to soak up as much info as possible and its been a great education.

I have a question:

You suggest to have majority of stocks in the 3rd pillar. I understand that this is sensible as your investment horizon is long since these are retirement funds. However if you are moving from one fund to another (e.g. Postfinance to Viac) then aren’t you breaking the long-term aspect. If 5 years later there is a better option/provider than Viac, and I want to move, shouldn’t I NOT be maxing out on stocks as my horizon is until the next time I switch a provider/funds?

Many thanks,

Hi YamS,

Yes, the majority of stocks I suggest is well-suited to my personal situation and time horizon.

You are kind of breaking the long-term aspect yes. There is an opportunity cost in that you are going to have to stay out of the market. And your funds will need to be sold on one side, then transferred, then bought again on the other side. Now, depending on how the market is doing, it may not be that bad.

If you can switch to a much better provider like VIAC compared to Postfinance, it is worth moving even if you have to stay out of the market for a while.

If you are trying to switch for a minimum advantage, you may have to weigh the advantages of the new solution compared to the opportunity cost of switching over.

Now, this does not mean you need less stocks in your portfolio. But it means that you may not be able to sell. If you have to sell in a down market, you may lose several % between the time you sell and the time you buy back. So, you may need to wait and it’s difficult because it’s market timing. So I consider this as an opportunity cost.

Does that make sense?

Thanks for stopping by!

Thanks for the reply Mr. Poor Swiss, I really appreciate it. Though, I’m probably not following this well.

My starting assumption here is that a stock-heavy portfolio is better in the long run and a bond-heavy one better for short term horizons.

If I decide to change providers (e.g. Postfinance to VIAC) then it technically ceases to be a long-term retirement investment. And having to terminate /change providers in the short-term, it is more likely that a stock-heavy portfolio (with greater volatility) could be at a lower value than a bond-heavy portfolio (lesser returns, but relatively more stable).

Is the above correct? Or maybe I’m missing something?

I guess, in any case, the timing of the switch is important such that we have a personally acceptable return from the fund we are terminating before switching to a new one. Thus if the market is down, it is probably not a good time to terminate the fund and better to wait until a favorable time.

Thanks again for your time.

Hi YamS,

You are correct regarding long-term.

But even if you sell to rebuy, the term is not really changed. You are still in for the long-term, but you are rebalancing into a better fund. Just because you change does not mean your term is changed.

Of course, there is more risk in doing that if you have stocks than if you have bonds. And it will depend on the transaction date on both sides. In the worst case, you are looking at two months out of the market, which can make a significant difference.

If you are planning to move now, you should move now, not in the future. And you can’t plan to move in the future since you do not know whether there will be a better provider in the future.

Thanks for stopping by!

I just found that with Individual strategy – you dont have to have the minimum of 40% in swiss stocks.

The requirement is restricted to 60% foreign currency. So if you use hedged World funds you can all all your equity outside Switzerland. This could be a game changer as to why you should select Individual Strategy.

Hi Legin,

You are right, I made a mistake in my article. The limit is not 40% of Swiss Stocks, but 40% in CHF. So you could use 60% World and 37% World Hedge and 3% cash and you would be fully diversified. Now, it remains to see if you want Swiss Stocks as your home bias, but that’s another story.

Thanks for sharing, I’ll update the article.

Hi Mr Poor Swiss

I am considering switching my 3rd pillar from UBS, where I have it in a cash 3rd pillar account (not invested). The high fees of UBS scare me off, so I am looking for alternatives. Also, a crucial point for me is the following: I am not Swiss. I do not know if I´ll be living in Switzerland until retirement. So what happens, if I invest my third pillar with VIAC but I leave Switzerland in 5 yrs e.g.? Will I have to liquidate my third pillar fund and realize potential losses due to market environment? Or will I be able to leave the money in the fund until my retirement, altough I am not living/working in CH anymore? UBS does not offer the latter option. But which institution does and combines it with the lowest fees?

Thanks for your feedback.

Regards

Pablo

Hi Pablo,

If you are leaving Switzerland, there are several cases. You have the option to cash it out if you are leaving definitely. But I think that some companies offer the option of keeping it as you mentioned. But I think that most companies will not want to keep the third pillar since this makes it difficult for them tax-wise.

I honestly do not know if VIAC will accept this. You should try to ask them.

It’s not a great situation. If you know you are going to leave in the next 5 years, you may still invest but with a lower stock allocation. If you have a longer time in front of you, it would be easier. There are not great solutions in this case.

Thanks for stopping by!

Thanks for the reply. I asked viac about the possibilities (via chat, which responded swiftly): Apparently, if I left Switzerland, the money I had invested so far would remain invested until retirement if I do not opt to cash it out. Only exception: If I moved to the US, then I would be obliged to cash out the 3rd pillar account. For me this is great news and makes me seriously consider moving my 3rd pillar.

Hi Pablo,

Thanks for sharing the information with us!

It’s good to know that you could keep it invested until retirement.

So, now, if you know you are not going to move to the U.S., you should be more than fine to start investing your third pillar with VIAC.

Thanks for stopping by!