VIAC Vested Benefits Review 2024: Pros & Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

VIAC is an excellent company that provides a tremendous third pillar in Switzerland. They just entered the Vested Benefits market, which means they can also serve as the second pillar for some people. This is excellent news!

VIAC Vested Benefits account offers a significant allocation to stocks at a low price. On paper, it looks great. So, we will review this account in detail now!

This article is in my in-depth review of VIAC Vested Benefits accounts. It is an excellent account, but it has some shortcomings. I will review the investment models, the fees, and the customization you can do with your portfolio.

| Total Fee | 0.41% per year |

|---|---|

| Maximum portfolios | 1 |

| Stock allocation | Up to 99% |

| Maximum foreign exposure | 60% |

| Maximum investment in cash | 1% |

| Investment Strategy | Index funds |

| Fund providers | Credit Suisse and Swisscanto |

| Languages | English, French, German, and Italian |

| Sustainable option | Yes |

| Mobile Application | Yes |

| Web Application | Yes |

| Custodian Bank | WIR Bank |

| Established | 2017 |

| Foundation’s domicile | Basel |

VIAC Vested Benefits

In May 2020, VIAC announced they were starting to offer Vested Benefits accounts. Before that, VIAC was only offering third pillar accounts. There are offering a great third pillar account in Switzerland. Their second pillar is important to mention.

VIAC is relatively recent. It was founded in 2017. Since then, it has been growing very well. Only one and a half years after its creation, it managed more than 160 million CHF in assets.

VIAC vested benefits account follows the same philosophy as their third pillar offer. The idea is to provide high returns (with high equity allocation) with low-cost funds.

They are basing their accounts on passive funds. Since research has shown that active investing does not perform better in the long term, it is better to invest in the broad market instead of investing in stocks directly.

Another way they cut costs is by being a digital company. They do not have banking offices (but support is available by email and phone). You will access your vested benefits account from the web interface, and they will likely offer access to your account from your phone as well.

Interestingly, if you already have an account at VIAC for your third pillar, you do not have a new account! You can use the same account to manage both retirement accounts.

Remember, you can only use a vested benefits account if you are unemployed. These accounts are for people between jobs, having left Switzerland, retiring early, or in similar cases. Employed people cannot invest in these accounts.

If you can access vested benefits accounts, you can start investing directly with VIAC Vested Benefits accounts. This is the case for people who are unemployed or have left Switzerland.

If you want more information about VIAC, I have an entire review of their third pillar offering. And I have also interviewed VIAC’s CEO.

If you need a refresh, I have an article about the second pillar.

Investment strategy

VIAC’s strategy is based on low-cost index funds, which means they have great diversification and low fees. This investment model is the same that they apply to their third pillar, and it is the same philosophy I use for my investing.

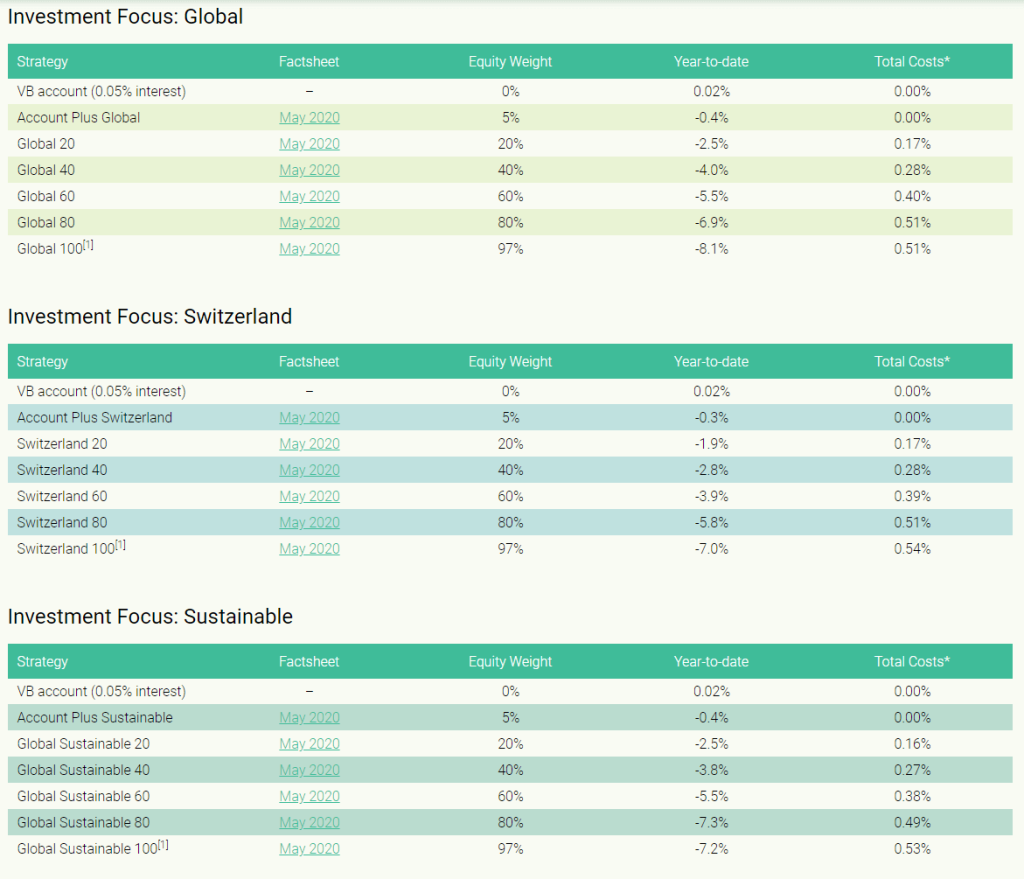

At VIAC, your vested benefits will be invested in index funds. There are several available strategies. They are grouped into three categories:

- Global: Stocks from the entire world with good diversification.

- Switzerland: Stocks from Switzerland.

- Global Sustainable: Stocks from the entire world focusing on sustainable factors.

And for each category, you can choose several allocation levels to stocks, from 0 to 99% (called 100). Here are all the strategies available:

These strategies should be enough for most people. I prefer the Global 100 strategy. It is the strategy that works best with my goals.

However, there is one significant limitation! The strategies with 99% invested in stocks are only available for the extra-mandatory part of your second pillar! The mandatory part can only be invested up to 80% in stocks, not more. For some people, it makes sense. But for people with a long investment horizon and a good risk capacity, this is a bit disappointing.

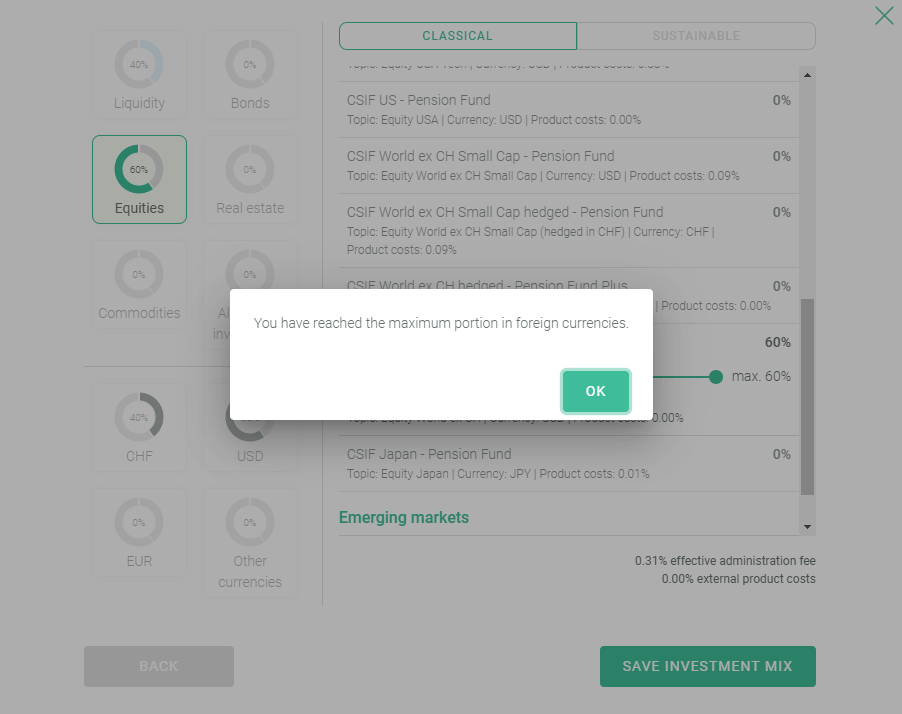

If you want more freedom, you can choose your individual strategy. This means you can choose directly from the list of index funds. You can make the portfolio that makes the most sense to you. However, there are also some limitations:

- You need a minimum of 40% invested in CHF.

- You cannot invest more than 80% in stocks for the mandatory part of your portfolio.

- Most funds have a maximum. For instance, you can only invest 20% in SMI and 17% in Real Estate. I don’t know exactly where these limits come from.

Here is an example of such a limitation:

I think customization is a bit too limited. I know most of these limits are there by law, but I wish we could go more in-depth in the customization. But, it is already great that we can customize it ourselves.

So, if you invest with a VIAC Vested Benefits account, you will get a high allocation to stocks and a nice allocation to foreign shares.

Fees

Now that we have examined their strategy, we should look at the fees in detail.

The fees vary based on the allocation to stocks in your portfolio. The more stocks you have, the higher the fee. If you do not invest in stocks, you will pay zero fees with VIAC!

The administration fee of VIAC is 0.52% on your invested assets, with a fee cap of 0.40%. On top of that, you will also pay some external costs for the funds themselves.

However, we are more interested in strategies with very high stock allocations. VIAC’s highest allocation to stocks is 99%. Here are the fees for the three strategies with their maximum stock allocation:

- Global 100: 0.41% TER

- Switzerland 100: 0.43% TER

- Global Sustainable 100: 0.43% TER

So, the fees are really low! With a significant stock allocation, you will pay between 0.41% and 0.43%.

The fees can go down to zero if you do not want to invest your assets.l But this is probably not what you are looking for.

On top of that, there is an extra foreign currency exchange fee. VIAC will pay 0.75% for currency exchange. This fee does not mean you have an additional charge of this magnitude. In practice, their algorithm reduces this by reusing sale and buy operations. VIAC estimates this fee to be about 0.05% extra on average.

If you use your vested benefits account to buy a house, you must pay a 300 CHF fee. But this is the only extra fee that you will see with VIAC.

So, we need to account for a price between 0.46% and 0.48% per year for managing the second pillar assets. The great thing is that there is no extra fee, for instance, for transferring your portfolio to another provider or leaving Switzerland.

So, overall, the fees for the VIAC vested benefits account are excellent!

Opening a VIAC vested benefits account

We now examine how one can open a vested benefits account with VIAC.

The great thing is that you can do almost everything online directly from the VIAC Vested Benefits Website. From there, you can register an account. And then, they will walk through the registration. It is straightforward. If you have ever opened an online account before, you will be able to do that effortlessly. You just need to have a copy of your ID ready to go. They will also confirm your identity with your phone.

If you already have an account with VIAC for your third pillar, you can log in to your account. From there, you can directly register for the vested benefits solution. Less information will be necessary.

In both cases, once you complete all the information, you will get a template of a letter you can send to your current vested benefits account (if any). That way, you can transfer your existing vested benefits funds if you desire to do so. Otherwise, you can give the displayed information to your current pension fund to transfer your assets if you leave the company.

Overall, it is very easy to open a VIAC vested benefits account. Anybody can do it, which will take you less than 10 minutes.

The security of your money is paramount. So, we must look at the security of VIAC’s vested benefits accounts.

VIAC is an official vested benefits provider, so it is very well regulated. Swiss Law regulates all Swiss vested benefits accounts. Your money is segregated from VIAC itself. WIR Bank holds all your assets. So, even if VIAC goes bankrupt, your assets are safe in a reputable big bank.

In this case, online security needs are a bit special. From the web interface, you cannot order a transfer of money. The only thing you can do is change your portfolio. So the worst thing hackers can do to your account is to reduce your equities allocation and learn some personal information. It is still essential that they have good technical security. But it is not as critical as a bank account.

The connection to the web application is encrypted. You will need a password to access your VIAC vested benefits account. You must confirm your identity with an SMS code when performing a special operation. While this is enough security, I wish second-factor authentication would always be used to connect. Doing so would protect your personal information better.

For me, the security of VIAC is sufficient for a vested benefits account. I wish a second factor was mandatory to connect to the web application.

Alternatives

It is always important to compare a service with its alternatives. There are not many outstanding vested benefits accounts in Switzerland. We should compare with Finpension Vested Benefits accounts.

VIAC vs Finpension Vested Benefits

Finpension Vested Benefits is the best account in Switzerland.

Use the FEYKV5 code to get 25 CHF in your account!

- Invest 99% in stocks

Recently, I have done a review of the finpension vested benefits account. Finpension vested benefits is a solid contender to VIAC vested benefits account. So, it is interesting to make a small comparison between the two products. I will make a full comparison of the two products later on.

A few things are different between the two vested benefits accounts.

- Finpension lets you have more exposure to foreign currencies. This extra exposure means more capacity for diversification.

- VIAC charges between 0.46% and 0.48%, while Finpension charges 0.49% (it could be higher with some funds). So, VIAC is slightly cheaper than Fipension.

- Finpension has fixed fees regardless of the amount of stock you invest in. VIAC has lower prices if you do not invest everything into stocks.

- VIAC gives you interest in your cash allocation. On the other hand, Finpension has zero interest on your cash.

- Finpension is domiciled in Schwyz. This means that the withholding taxes for people leaving Switzerland and withdrawing their vested benefits account will be lower with Finpension than with VIAC. Schwyz is the canton with the lowest withholding taxes.

Overall, they are both great vested benefits accounts. However, Finpension offers a better vested benefits account than VIAC.

If you want more details, you can read my full comparison of VIAC vs Finpension vested benefits accounts.

Finpension also has the best third pillar in Switzerland.

FAQ

Can I open several VIAC Vested Benefits accounts?

No, VIAC has only one vested benefits foundation and you cannot create more than one account with the same foundation.

How much can I invest in stocks with VIAC Vested Benefits?

Up to 97% can be invested in stocks.

Who is VIAC Vested Benefits good for?

VIAC Vested Benefits is good if you want a good vested benefits and only plan on needing one.

Who is VIAC Vested Benefits not good for?

VIAC Vested Benefits is not great if you want two vested benefits accounts. It is also not great if you want a high foreign currency exposure.

VIAC Vested Benefits Summary

VIAC Vested Benefits is a good vested benefits account offered by VIAC. They offer good prices and nice investments in stocks.

Product Brand: VIAC

4

VIAC Vested Benefits Pros

Let's summarize the main advantages of VIAC Vested Benefits:

- Very low fees

- Can invest up to 97% in stocks

- Interest on the 3% in cash

VIAC Vested Benefits Cons

Let's summarize the main disadvantages of VIAC Vested Benefits:

- Limited exposure to foreign exposure

- Domiciled in an expensive state for withdrawals for people leaving Switzerland

- Fees for foreign currency exchanges

Conclusion

It is excellent that VIAC started its VIAC Vested Benefits account. We need more good retirement accounts in Switzerland.

The VIAC Vested Benefits account is a great offer. You can invest heavily in stocks for a very low fee. These two things are what matters most with retirement accounts for long-term investors.

While it is excellent, the VIAC Vested Benefits account is not perfect. You can only invest up to 80% in stocks for the mandatory part of your second pillar. Also, the maximum exposure to foreign currencies is 60%. These limits reduce the diversification that we can reach with this account.

For these reasons, the Finpension vested benefits account is superior to the VIAC Vested Benefits account. If you want more details, I have a full comparison of VIAC and Finpension for vested benefits.

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best retirement accounts

- More articles about Retirement

- Interview of Daniel Peter, CEO of VIAC

- Selma 3a Review 2024 – Pros & Cons

- VIAC 3a Review 2024 – Pros & Cons

Hello Babtiste, thanks for the great summary! Quick question: one of the advantages of Finpension vs. VIAC you mention in your article is that Finpension is domiciled in Schwyz (thus when you eventually withdraw the funds the taxation is the lowest in Switzerland); what I did not understand is that in the summary table for VIAC (right at the beginning of the article) it seems that VIAC is also domiciled in Schwyz? If so, same taxation rates should apply for VIAC as well, correct?

Hi Kasia,

Thanks for pointing that out. It’s a mistake, VIAC’s foundation is in Basel. I have updated the article!

Also, keep in mind that this only applies when you withdraw from abroad. If you withdraw from Switzerland, you will pay the withdrawal taxes based on your residency canton.

Hi Baptiste,

Do you have any experience or comparison with liberty

https://liberty.ch/fr. They seem to be a big player in the vested benefits market and established since 2005. They also have an emigration service for people that are about to (early-) retire and want to cash out their 2nd pillar when they relocate abroad.

Thanks for your insights

OD

Hi OD,

I have no experience with them. But looking at them, it does not look very interesting compared to Finpension and VIAC.

They have a 0.40% base fee on which the TER of the funds is added up and shown to be about 0.28%, which puts them at 0.68% TER at first sight. It’s not terrible, but it’s also not great. They also seem to have expensive fees for early withdrawals.

Thank you for the overview, TPs!

Can anyone migrate from the pension fund used by their employer? Do you know if the pension fund used by my employer would redirect the money to VIAC (or valuepension) automatically every month? Or would I need to notify my employer to directly deposit the money on my pension fund of choice?

Thank you!

Hi V,

Unfortunately no. A vested benefits account is only for people that do not have an employer. For instance, if you are between jobs, if you switched from employee to self-employed, if you retired early, if you left Switzerland, …

If you are employed by a company, like me, you have no choice but to use your company’s pension fund (which will very likely suck).

I will try to make this clearer in the article.

Thanks for stopping by!