By using the VIAC App, you enter into a contractual relationship with the Terzo Pension Foundation resp. the Vested Benefit Foundation of Bank WIR. Behind VIAC AG are the three initiators of VIAC’s pension solution, who developed the offer together with Bank WIR. This company has no relevance for you as a customer since the operation of the entire solution is ensured by Bank WIR.

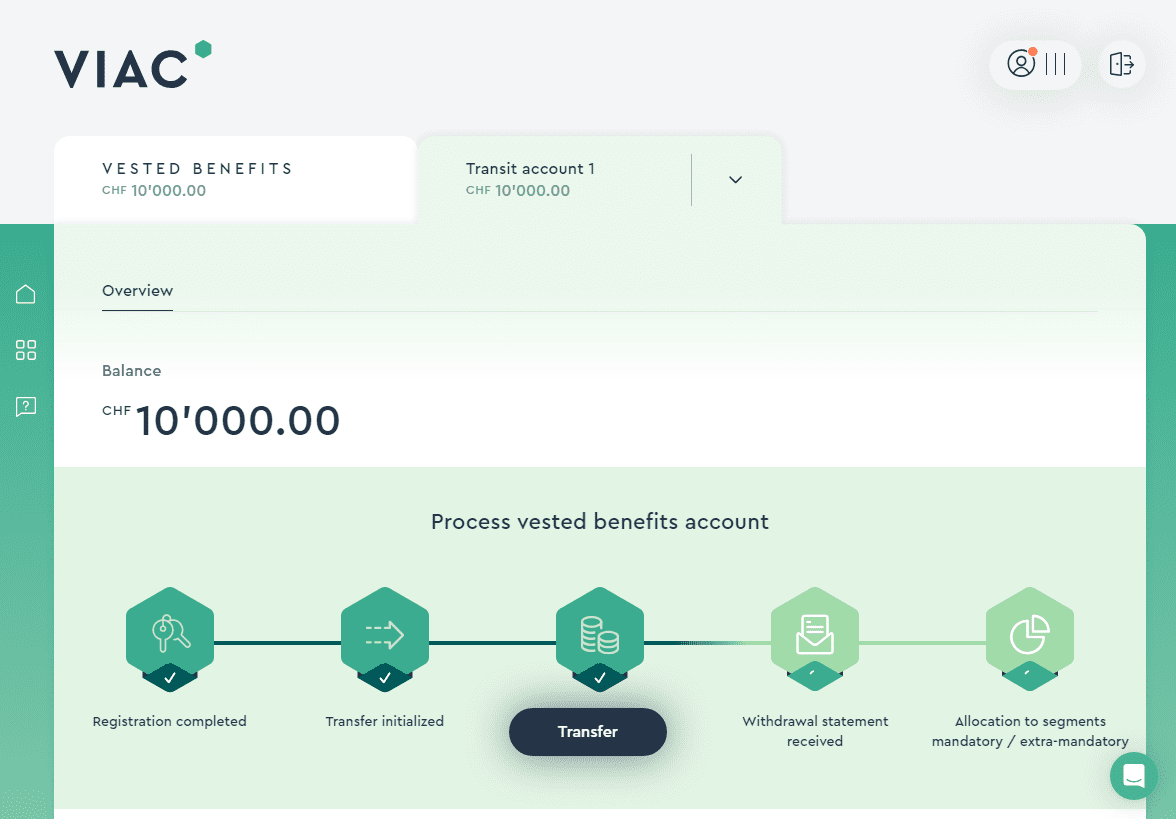

Manage your vested benefits money cost-effectively and efficiently.

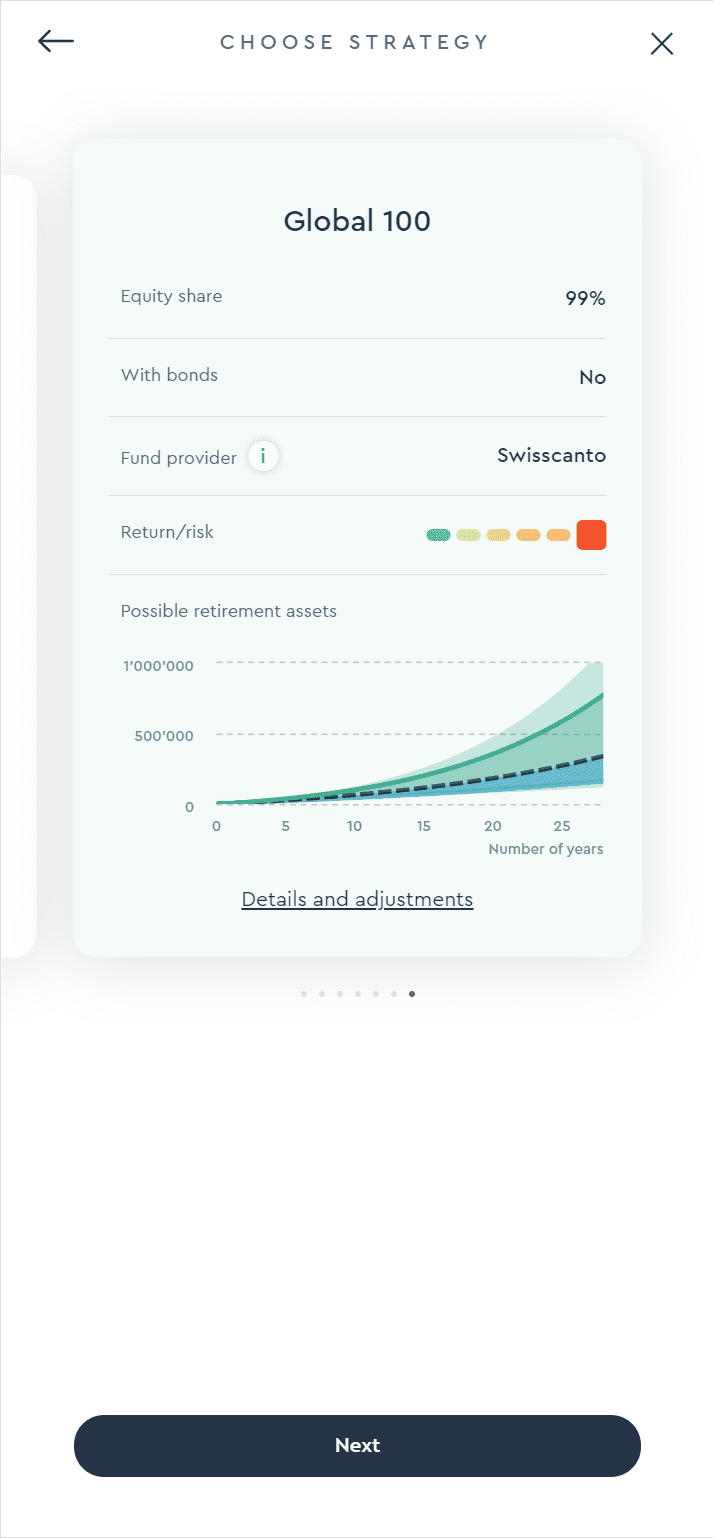

Pension calculator

Performance:

- good

- medium

- poor

Note

This overview is based on historical and representative index data of the last 15 years. The values shown represent the displayed strategy after deducting our administration fee and the corresponding product costs.

The three lines show poor (5%-quantile/yellow), medium (50%-quantile/black) and good (95%-quantile/green) performance. There is a low probability of performance lying outside these lines - these cases are represented by the lighter areas (1% and 99%-quantiles).

Past performance is no guarantee of future performance. Actual returns can deviate significantly from estimates

Your advantages

Innovative technologies and cost-effective investments for optimal pension provision in vested benefits.

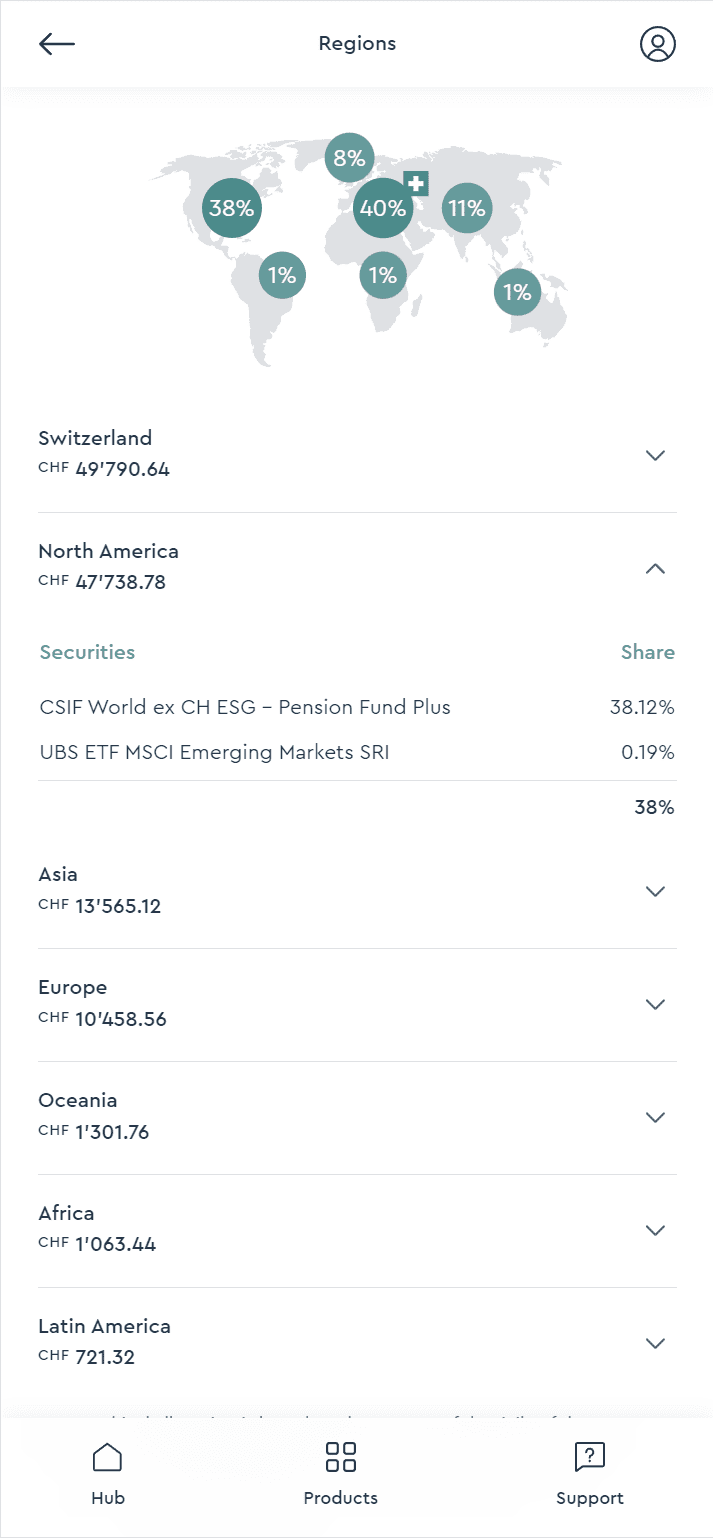

More flexibility

Thanks to the segmentation (no splitting, only 1 vested benefit relationship is created) of your vested benefit assets into mandatory and extra-mandatory, you can define a different strategy for each segment if required. This allows you to invest your vested benefits assets even more flexibly.

Broad selection

From an interest-bearing VB account to a vested benefits portfolio with a pure equity strategy (only available in the extra-mandatory segment) – VIAC offers the right strategy for every risk type. If required, you can adjust your investment strategy on a weekly basis.

More efficiency

Wherever possible, we use institutional fund tranches. This means that you often benefit from TER 0% funds, which are also exempt from withholding tax in some countries.

Unrivaled low cost

The administration fee covers all brokerage fees for the purchase and sale of the funds as well as custody account management. Foundation administration and management are also included.

When do I need a vested benefits account?

In certain cases, you must park your pension fund assets in a vested benefits account.

Vested benefits cash or securities account?

The most important thing first: Upon taking up a new job, you must transfer your vested benefits assets into the new pension fund. A vested benefits account is thus usually the best choice for short-term parking of money.

Unless you have to transfer your pension fund assets back into a pension fund, vested benefits serve the same purpose as pension funds. The investment horizon is therefore very long, making it suitable for investing in securities. This is also because vested benefits can only be withdrawn early in a few exceptional cases regulated by law.

Yet not everyone is equally relaxed about fluctuations in pension assets. VIAC therefore offers a wide range of options: from classic vested benefits cash accounts to strategies with almost 100% equities (only selectable in the extra-mandatory segment). We offer the right strategy for every need. You can also define a different strategy for your mandatory and extra-mandatory segments and thus, for example, choose a lower risk level for the mandatory segment.

The best pension without obstacles

Top security

Your pension assets are managed by the vested benefits foundation of WIR Bank. WIR Bank is a purely Swiss, cooperative bank.

Digital vested benefits

Whether on PC or smartphone: Your vested benefits account is opened 100% digitally within minutes.

Automatic rebalancing

If you decide to invest your vested benefits, our system will constantly monitor your vested benefits portfolio. Any shifts in asset allocation – triggered by market fluctuations – are thus corrected.

Experts help

If you have any questions or uncertainties, our pension experts will help. Whether by Chat, email or under 0800 80 40 40. We are here for you.

We take good care of your money.

VIAC is a product of the Vested benefits foundation of WIR Bank.

WIR Bank’s vested benefits foundation offers vested benefits accounts since 2003 and already manages more than CHF 800 million.

All money that is not invested is held by WIR Bank. Thanks to the bankruptcy privilege up to CHF 100’000, it is well protected and receives preferential treatment if WIR Bank goes bankrupt.

Interest

0.65%

If you choose the fund provider Credit Suisse, your securities units will be traded and held in custody at Credit Suisse. In the event of bankruptcy, they are considered special assets and do not fall into the bankruptcy estate.

If you choose the fund provider Swisscanto, your securities units will be traded and held in custody at Zurich Cantonal Bank (ZKB). In the event of bankruptcy, they are considered special assets and do not fall into the bankruptcy estate.