How to Open an Interactive Brokers Account in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Interactive Brokers is an excellent broker from the United States. It is known for its cheap fees and unique investment product range. It is being used by many personal finance bloggers, for instance.

It is currently the best broker that allows access to U.S. ETFs. And U.S. ETFs are the most efficient ETFs for Swiss investors.

In this guide, I review how to open an Interactive Brokers account. It is not very difficult, but there are a few things you need to know before you start your application. And I also teach you how to optimize your account to save money!

Interactive Brokers

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

So what is Interactive Brokers (IB)?

IB is a brokerage firm from the United States. It was created in 1978 in New York, more than 40 years ago! IB is the largest brokerage firm in the United States and the leading foreign exchange (forex) broker. Interactive Brokers offers access to many instruments, such as stocks, bonds, options, futures, and more.

Interactive Brokers is a very well-known broker with an excellent reputation. It is known to be cheap compared to its competitors. I have already compared IB and DEGIRO in the past. This comparison showed that it is even less expensive than DEGIRO, the broker I used before.

An essential thing with IB is that, by default, they do not lend your shares to other people, such as DEGIRO does by default. But you have the choice, which is good! Indeed, you also can lend shares, and you will get some of the money from the lending.

If you want more information on IB, read my review of Interactive Brokers.

Why open an IB account?

So, why did I open an IB account? It is currently the best broker available to Swiss investors.

There are many reasons to prefer Interactive Brokers over other brokers.

- IB offers access to U.S. ETFs to Swiss investors, while many brokers are not.

- IB has excellent prices.

- IB offers access to many investing instruments.

- IB offers foreign exchanges at an excellent price.

- IB has an excellent reputation.

- IB has good financial strength.

So, we will see how one can create an account on IB.

Create an Interactive Brokers account

First, prepare some time in front of you. The account creation process on Interactive Brokers is not difficult, but it will take some time. You will need to answer a few questions, and you will need to wait a day for your account to be funded.

Interactive Brokers has several entities in Europe. The primary entity is IB UK, but one is in Luxembourg, and one is in Ireland, for instance. For Swiss investors, the best entity is IB UK because they offer access to a Swiss IBAN and give you access to US ETFs. For European investors, it does not make much of a difference.

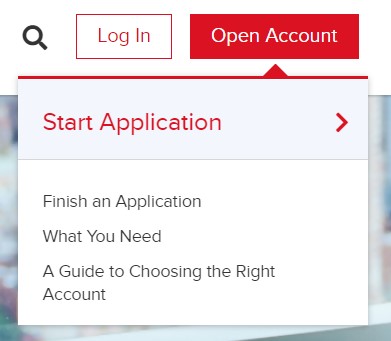

First, go to the account creation page and click “Open account”.

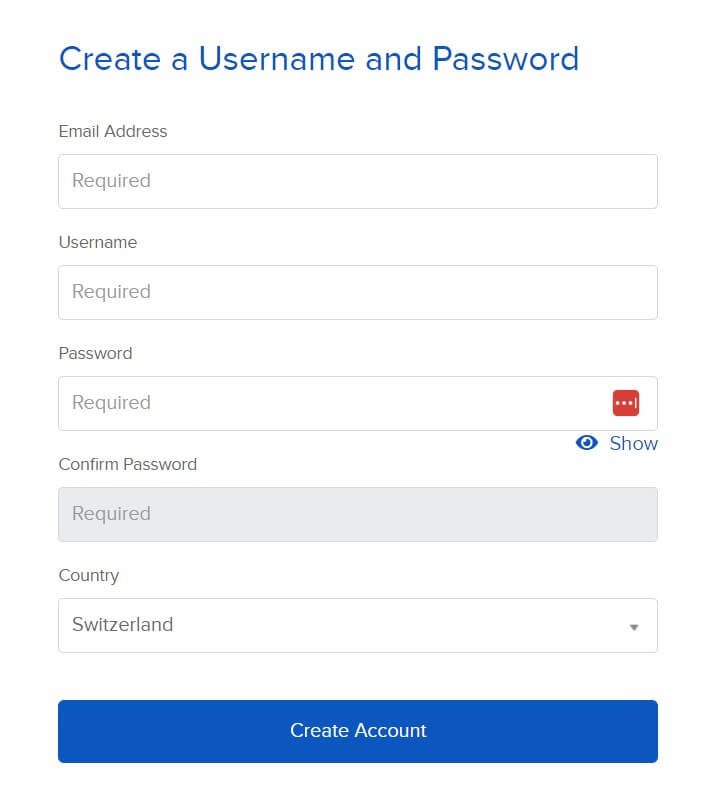

On the first page, you must enter your email, user name, and password for the account. Make sure to choose a good password and user name.

I would recommend making your password at least 20 characters long. A long password is essential to secure your online accounts! Make sure to remember it correctly as well!

You also need to enter your country of residence. If your country of legal residence differs, you must also enter it. You can then confirm the first page.

At this point, they will email you to confirm your email address. Just check your mail and choose to continue the application.

Personal information

On the second page, you will have to set your account type. I put it to Individual for this example. You can check the kinds of accounts to ensure you choose the one according to your needs. But most people will want either an Individual or a Joint account.

Then, you will have to enter the general kind of personal information. Nothing is special here, only what you are used to entering on each website. You will have to set your addresses as well.

Since this will be related to your taxes, it is essential to enter them correctly. You will also need to enter a valid phone number. IB will use this phone number authentication, so once again, enter it correctly.

IB has several types of accounts. You will need to select the type you want. The primary type of account is a Cash account, which is the type you probably need. A cash account means you need to have the money before each trade.

There are also Margin accounts (IB has some good information about margin accounts). Margin means you can use leverage for investing with money you do not have. Unless you know what you are doing, I recommend a Cash account.

Another thing you need to configure when you create an IB account is the base currency. Since I make most of my payments in Swiss Francs (CHF) and live in Switzerland, I chose CHF as my base currency.

You can always convert money from your base currency to any other currency. The base currency only matters for the interface’s display. If you choose CHF, you can still transfer USD and buy shares in EUR, for instance.

Currently, the CHF balance has a positive interest rate. If it becomes negative again, you will see a warning about the negative interest rate on CHF balances. You can get the current negative interest rate and limit here.

Now, you will also have to set up three security questions. You will need these questions if you ever need to recover your account. Make sure you choose questions from which the answer is not ambiguous (but not easy to find)! This procedure is, once again, a standard procedure.

Investment Questions

After this, you need to answer questions about your finances.

You need to tell how much your net worth is and how much income you have. You also need to say what your objectives are for your investments. For instance, you may want to invest for capital appreciation or fixed income.

All this information is here for regulatory reasons. I would advise you to answer them with honesty.

You also need to set which instruments you need to invest in. For instance, if you want to invest in stocks and bonds, you must select these options. I only chose stocks.

Stocks, bonds, options, and futures are among many other choices. You must also select which country (stock market exchange) you want to invest in.

You also need to confirm your phone number with a code.

Confirmations

At this point, you must agree to all the rules IB has for trading. Ideally, you may want to read them. But you probably will not!

If you want, you can also join the Stock Yield Enhancement Program. This program will allow IB to lend your shares to other people. With that, you will receive half of the profits.

Of course, there is a slight risk to that, and you may also be unable to sell your shares when you want or need to. I am not using that feature now. But I have tested this feature recently, and it works well.

At this point, Interactive Brokers will want proof of your identification. For this, you can upload a driving license, an ID card, a passport, or an alien ID card for IB to confirm your identity. You will also have to enter information about your tax status on the same page.

You will also have to fill in information about your employer and job. Usually, you also need to submit something as proof of address.

Fund your IBKR account

IB will fully activate your account once they receive funding.

You need to deposit the first amount for IB to validate your account. First, you need to declare how much money you will deposit. Then, IB will give you all the information necessary for the payment.

Make sure you correctly copy the IBAN. With banking transactions, you should always double-check all banking information before transferring. The transfer will be free since they have a bank account in Switzerland!

And do not forget to include the “Further Benefit to XXX” line! Otherwise, the money will not go directly to your account, and you must contact them to fix the issue. You must do that for all future deposits to your Interactive Brokers account.

Finalize your account

After you have funded your account, you can still do a few more things.

First of all, you can configure the market data. You should set your market data status to non-professional. And you should check that you are not buying any market data. Unless you plan to day trade, you do not need this data. You do not want to pay for it.

One great thing is that you have to use two-factor authentication (2FA). You have no choice. You must configure your mobile phone to use it as 2FA.

2FA is an essential part of online security. First, you need to install IBRK Mobile on your phone. This application is available for Android and iOS.

Once you have installed the application, you can register it as a two-factor authentication for your account. You will have to log in with your username and password, and you need to enter the code you received by SMS.

Finally, you can then choose a PIN for your future two-factor authentication. Remember that PIN since you must use it for each connection to Interactive Brokers.

If you do not know about 2FA and why it is necessary, read my article about online personal finance and security.

Wait for your account

At this point, you only need to wait for IB to create and fund your account.

It should not take too long. It only took one day for my account to be created and funded. It is pretty fast. The next day, I could directly make my first trade.

Optimize your IBKR account

Now that you have access to your account, there are two more things to finalize in your account.

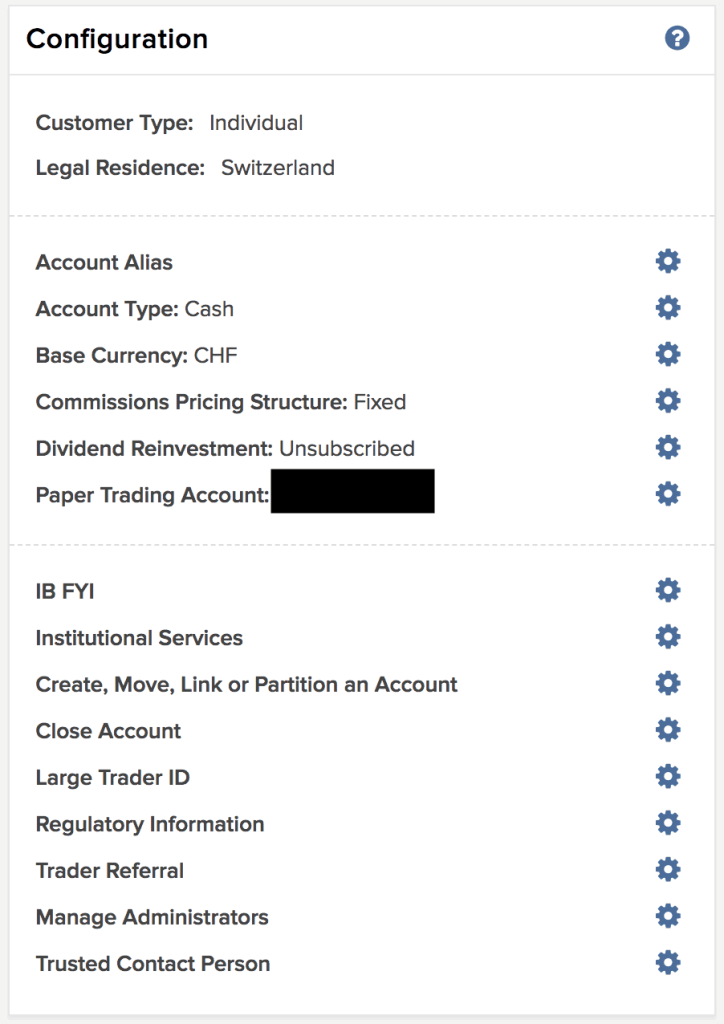

The first thing remaining at this point is configuring the Pricing System. I recommend you use the Tiered Pricing system. IB is cheaper than DEGIRO when you use the Tiered Pricing system.

You can make the change in your Account Settings. If you prefer the more predictable Fixed Pricing, you can also opt for it. There are some cases where fixed pricing is cheaper than tiered pricing.

Here are my settings just before I made the change to Tiered pricing:

The second thing applies if you are a Swiss investor and will invest in U.S. ETFs. In that case, you need to fill out the W-8BEN form. That is pretty simple. You can go into your Account Settings. Then, you must click the (i) blue button next to your name below Profiles. Then, you can click on “Update Tax Forms”.

They will then take you through the process, and you can fill out the W-8BEN tax form. This form will halve the dividend withholding from your American stocks and ETFs. This step is essential if you want to profit from the great tax efficiency of U.S. ETFs.

Some people have told me that it sometimes takes about one day for the account currency to be changed on the interface. You have to wait one day, and the issue should disappear. In the meantime, you may see some numbers in other currencies (likely GBP).

Another thing you can choose to do is to allow IB to lend your shares. By doing so, you will get 50% of the profits. This feature is called the Stock Yield Enhancement Program. However, there are some risks. I have tried it on and off over the last few years, but whether you think it is worth it is up to you.

Conclusion

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

The procedure is now complete! If you followed this guide, you now have an Interactive Brokers account.

With this great broker, we have access to U.S. Exchange Traded Funds such as VT, which makes the most significant part of my portfolio.

I have now been using IB for more than two years. And I am delighted with IB. Interactive Brokers is the best broker available to Swiss investors.

The next step is now to buy an ETF from Interactive Brokers. It is also relatively simple and only takes a little time.

What do you think about Interactive Brokers? Do you already have an account? If not, which broker are you using?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hi Baptiste,

I see that you have opened an Individual account. Would you please clarify why it is better than joint account for a married couple? I mean is it better to open 2 individual accounts than one joint account for a married couple? Due to maybe having a higher protections?

Thanks!

Zuzana

Hi Zuzana

Originally, I had an individual account, because I started my account before getting married. However, I have since switched to a joint account, I think it makes more sense for practical reasons.

I have updated the article accordingly.

WOuld you know if Interactive UK the account holders are subject to inheritance tax from USA? I am sure that in Interactive LLC (US) you should be liable and when you pass away, the other account holder or the Heirs will receive about 40% less. In switzerland this does not happen. Do you know the case of Interactive UK or other office of Interactive?

Hi Lenadro

The broker does not matter, what matters is the origin of the shares. Even with a Swiss broker, you are liable for this estate tax.

You can read my article about it: Should Swiss investors worry about the U.S. Estate Tax in 2024?

Dear Baptiste,

Thank you for your article, it is certainly helping me in my navigation of ETF investments in Switzerland. I am currently trying to navigate the best way to set up an IB account as a US citizen living and working Switzerland. Which IB platform is best to open an account with given my situation (IB UK or IB US)? My primary bank account is in Switzerland, but I still maintained a US bank account as well (in case that matters).

Thank you again!

Best,

Scott

Hi Scott

I think it will make very little difference. IB US sounds good as a US citizen, but you would do well with IB UK as well. IB US would let you trade cryptos while IB UK would let you trade CFDs (bad idea).

The only thing I am not sure is whether you can transfer CHF without fees to the IB US account, but I would believe it’s doable.

Thanks for the input. Quick question on top of this, with PRIIPs Regulation, would it be safer to open a IB US account for the guarantee of US ETF access? Not sure if that regulation will ever affect access with the IB UK, but figured I would ask.

Best regards,

Scott

I don’t think it would matter. Since the UK is not part of the European Union anymore, it should make no difference for a Swiss investor if they deal with a UK entity or a US entity.

Hi, I have opened a IB UK account. Then I got interested in boing some Bitcoin ETF but IB told me that for this I need to have the LLC (Luxembourg) account – I can open LLC and transfer my stocks. But from reading this poor Swiss post, I understand that with LLC I will not be able to trade US ETFs and have a Swiss IBAN- right? If so, I will not change as my primary goal is buying stuff like VT.

Hi Miro

I am not sure this is correct. IB LLC usually refers to the US entity, not the Luxembourg entity. I have heard of Swiss investors switching to the US entity to buy crypto, but never to the Lux entity.

And indeed, if you move to Lux, you may not be able to trade US ETFs. I don’t know about the CH IBAN, it may be available.

hello, yes I think was mistaken – I mean the Us entity, not Lux. Are there any cons for using the US entity?

As far as I know, no. But I have not looked into details yet since I do not plan on moving to the US entity.

Maybe there is a different tax implication if using the US vs the UK account? One should not mess with USA…. so I remain hesitant to change to USA… bye bye crypto

In theory, no. In the end, the UK entity is still related to the US entity, so I don’t think there are more dealings with Uncle Sam if you use the US account or the the UK account. But of course, that’s only the theory, there may be some slight changes in practice.

Hey Baptiste,

Thanks a lot for all the information, I finally created the IBKR account.

Could you please clarify something, to make sure everything is set-up correctly (probably the app has changed a bit over the years):

It’s about the W-8BEN form that you mention we should fill out.

When I follow the steps and click on my name, there is:

“Tax Forms: Combined CRS/IRS Tax Form”

When I click on that and the dialog opens, there the title says:

“Self Certification of Tax Residencies

Substitute Form W-8BEN”

Is that it? Just want to make sure that I understand that correctly, and there is no separate form that I should submit somewhere else.

Thanks again!

Hi,

Well done for creating an account!

Yes, that should be all you need. They have updated this part of the UI. Normally, this form should be filled during onboarding, so in theory, there is nothing to do, but for some people, they had to fill it up later.

Once you receive your first dividends, you should make sure that only 15% was deducted and if not, contact the support to get this fixed.

Hey Baptiste

And the other 15% you can claim back from the Swiss Tax Authorities, right?

Cheers

Yes :)

How to file your taxes with Swiss and foreign securities in 2024

Thanks a lot!

Thanks a lot for this article.

Can you transfer existing stocks in UBS to IB UK? Or do I need to liquidate all and then transfer the money and then buy everything again in IB UK? Thanks

Hi Phil

You can usually transfer shares from brokers to brokers. I have never tried it from UBS, but I cannot imagine why it would not work. If you have a significant portfolio, it’s better to transfer it by the automated transfer system.

Hello Baptiste,

Thank you for the post, very informative as usual.

I am ready to open an IBKR account but ai have a question before doing it. Do you have any referral code or link providing some benefits for both of us that I could use in the opening process?

Hi James,

Unfortunately, I don’t have any benefits for your for IBKR.

Hello Baptiste,

Do you know if there are any differences regarding taxes between an individual or joint account?

I want to open an account and I would like to create a joint account for me and my wife.

Thank you so much for your blog, your content and work is amazing.

Regards,

Jeremy

Hi Jeremy,

No, there should be no difference. If you are married, you will pay your taxes together anyway.

There may be exceptions if you are not subject to the same taxes for instance if you don’t have the same citizenship, but I would think that in this case, opening the account would be difficult already.

Hi, thank you for your answer.

We are both Portuguese with Permis B. In this case, we should open an account on IB Uk right?

Yes, most Swiss residents should use an IB UK account. The only exception is probably US citizens.

Thank you so much for your help :)

Hi Baptiste, many thanks for your answer. What about linking my Wise account with my IB account and making the conversion through Wise such that I receive USD directly in my IB account? Do you happen to know how the fees of Wise compare to the fees of IB as a function of the amount to be converted? Thanks in advance.

Hi willy,

* IB is 2 USD per conversion

* Wise is about 0.49% per conversion (can be variable)

This means that IB is cheaper starting at about 410 CHF conversion.

Hi Baptiste,

I’ve opened an IBRK account and want to do my first deposit. I already have an USD account in a Swiss bank. I’ve chosen ‘Bank Wire’ as a a method to fund the account. In the Bank Wire instructions it is stated to provide my Swiss bank the instructions to initiate the transfer: shouldn’t I just make the deposit to IBRK via my home banking instead? Do you think fees will apply, since the beneficiary is a US bank?

Thanks

Hi Paolo

I am not sure I understand your question.

In any case, you should initiate the transfer from your home banking system. If you do a CHF transfer from a CH account, it will be free of charges. If you do a USD transfer from a US, it will also be free.

Now, if you are doing a USD transfer from a CH account, I think you should do it to the CH IBAN of IB if possible. But in that case, there may be fees anyway because of using USD. I have never done that.

Dear Baptiste,

Many thanks for this very valuable article and all the information of your blog. Now, before looking for other sources of information, I always Google first “poor Swiss” and my question… 😊 Thanks for sharing all your knowledge.

I have a question related to the Margin Accounts of IB. When making a currency conversion in my cash account, settlement takes 2 business days. Margin accounts, on the other hand, do not have to wait for settlement to use funds. Hence the question: is there any disadvantage or anything else to consider when upgrading from Cash Account to Margin Account?

Many thanks in advance!

Kind regards,

Willy

Hi Willy,

Thanks for your confidence!

The disadvantage of a margin account is that you may be in debt without realizing it if you do not know what you are doing. If you are careful and do things well, margin accounts have no disadvantages. I would only recommend if you know what you are doing.

And indeed, one of the advantage is that we don’t have to wait for transactions to settle.