Neon vs Yuh: Best digital bank in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Neon and Yuh are both popular Swiss digital banks. Yuh started with banking and trading features, while Neon started with only banking features. But in 2023, Neon introduced an investing feature to its app.

Therefore, both digital banks now have a similar set of features! So, it is time to compare Neon vs Yuh in detail for banking and investing.

In this article, I compare Neon vs Yuh, their fees, features, and advantages and disadvantages. By the end of the article, you will know which you should use.

|

5.0

|

4.0

|

Neon

Neon is among the first digital banks in Switzerland. They have started a new trend of digital mobile banks.

Neon itself is not a licensed bank. The money is deposited in the Hypothekarbank Lenzburg (HBL), a licensed bank.

Neon has grown quickly since its creation in 2019. In 2022 alone, they already reached 100’000 users. Such growth is an excellent result for a Swiss digital bank.

In 2023, Neon started Neon Invest, its new feature for investing in the stock market. This new feature makes it a fully-fledged app for saving, paying, and investing.

Yuh

Yuh is a more recent digital bank, started in 2021. It was born from a collaboration between PostFinance and Swissquote, each owning 50% of Yuh.

Yuh is not a licensed bank, but they use the Swissquote banking license to provide banking services.

Since its inception, Yuh has offered banking and investing features. It was always meant to be an app for everything banking: pay, save, and invest.

Yuh has one extra feature Neon does not have: A third pillar. In this article, I focus on banking and investing features. But if you want to know more, you can read my article about Yuh 3a.

Yuh has grown very quickly since its creation. Indeed, in 2023, they already reached 160’000 customers!

Banking features

Both banks are mobile apps, so you must download them on your phone. Both apps are available in all major app stores, including Huawei (without Google Play Store).

Yuh and Neon are available in English, French, German, and Italian.

Both apps have all the basic banking features:

- Receive money

- Transfer money to another bank account

- Transfer money to other users

- Pay your QR Bills

- Electronic Bills (e-bills)

Both apps also let you use Google Pay, Apple Pay, Samsung Pay, and TWINT. It is worth mentioning that Yuh has its own TWINT app, while Neon relies on the UBS TWINT app. So, you can use your account entirely from the app without using the phone.

Both apps offer Mastercard cards to pay in shops or online. 3-D Secure is used for fraud protection in both cases.

They also both offer sub-accounts for savings. They are called Spaces with Neon, while Yuh calls them Saving Projects.

Yuh offers a feature that Neon does not have: a multi-currency account. Currently, you can hold 13 currencies in your Yuh account. However, they are under the same IBAN, so they do not offer you local IBAN like Wise would do. But that can still be useful if you receive some foreign currencies.

As of May 2024, you get a 1.0% interest rate on Yuh and 0.75% on Neon Spaces (up to 25’000 CHF, 0.50% after that). So, currently, you get a higher interest rate on Yuh, especially for large balances.

Overall, Neon and Yuh have all the features you need for banking and have a very similar offer. Yuh has a slight advantage over Neon if you need to hold multiple currencies.

It is worth mentioning that Neon is only open to Swiss residents with permits B or C. At the same time, Yuh allows more permits, such as L. Yuh also allows opening accounts from neighboring countries like France, Italy, and Germany. This makes Yuh more accessible to foreigners.

Investing features

We can now compare the investing features of both apps. Since I do not recommend investing in crypto, I will only focus on investing in stocks and ETFs. But I will quickly mention that Yuh offers some cryptocurrency features while Neon does not.

Both apps let you invest directly from the main app. It is not a separate app.

Currently, both apps let you buy and sell through market orders only. While limit orders could be useful in some cases, it is not a significant issue since market orders work great for liquid stocks and ETFs. Also, both services have announced they are planning to support limit orders in the future.

Both apps are designed to be made easy to invest with. After testing both, they are both comparably easy to use.

Neon and Yuh do not offer access to the entire stock exchange to make it easier for their users. Instead, they offer a selection of stocks and ETFs.

- Neon offers about 200 stocks, while Yuh offers about 250 stocks, a slight advantage for Yuh.

- Neon has more ETFs (about 70) than Yuh (about 40), a slight advantage for Neon.

Neither offer access to US ETFs (the best ETFs for Swiss investors).

It is also important to mention that Neon only offers trading on BX Swiss, while Yuh provides trading on multiple stock exchanges. However, it should not matter much to most investors, except for a slight difference in spread (see the fees comparison).

We should also mention that Yuh offers access to themes such as Metaverse or Recycling on top of stocks and ETFs. However, these themes are implemented as structured products. These are complex products that most people should avoid.

One extra feature that Yuh offers is fractional trading. Fractional trading means you can put a fraction of a share instead of buying a full share. This can help when purchasing costly shares. This is an advantage for Yuh if you want to use fractional trading.

Neon has another advantage in that you can transfer shares out to another broker. For me, this is a sign of professionalism. With Yuh, it is not possible to transfer your shares to another broker.

Finally, Yuh also has one final feature Neon does not have: savings plans. These plans allow you to automate your investments. Neon does not have such a feature.

Overall, Neon and Yuh have the basic investing features necessary for passive investors.

However, Yuh has some extra features Neon does not have, like fractional trading, savings plans, and cryptocurrencies. If these features matter to you, you may want to lean towards Yuh.

Banking fees

Neither bank account has any running fee, so the base account and the basic features are free. This is one of the significant advantages of digital banks.

With Neon, you can withdraw for free twice a month at any ATM. With Yuh, you get one free withdrawal per week. After that, withdrawals cost 1.90 CHF with Yuh and 2.00 CHF with Neon. This gives Yuh a slight advantage, but it is not a significant difference since it is generally easy to avoid withdrawing money.

The main difference between Neon vs Yuh comes when we do some foreign currency transactions. The fees will differ if you pay abroad or online in a foreign currency.

- With Neon, you will get the Mastercard rate with no extra surcharge. This rate is about 0.40% worse than the interbank rate.

- With Yuh, you will pay a 0.95% currency exchange fee for any of the 13 default currencies and 1.50% for any other currency.

So, Neon is significantly cheaper than Yuh when using your card in foreign currency or abroad.

The situation is a little different when you do transfers in foreign currencies. Neon uses Wise to transfer, with an extra convenience fee of 0.40%. For Yuh, you will pay the currency conversion fee of 0.95% for the main currencies and 1.50% for the others. So, some currencies will be cheaper with Yuh and others with Neon. Overall, they both have average fees for foreign transfers.

Overall, both have pretty similar fees except for foreign currency operations. So, when considering everything, Neon is significantly cheaper than Yuh unless you never use operations in foreign currencies.

Investing fees

You want to minimize your investment fees to invest in the stock market. So, we will compare Neon and Yuh’s investing fees.

Neither of these apps has a custody fee, which is great because it means you will pay nothing to keep your shares with them.

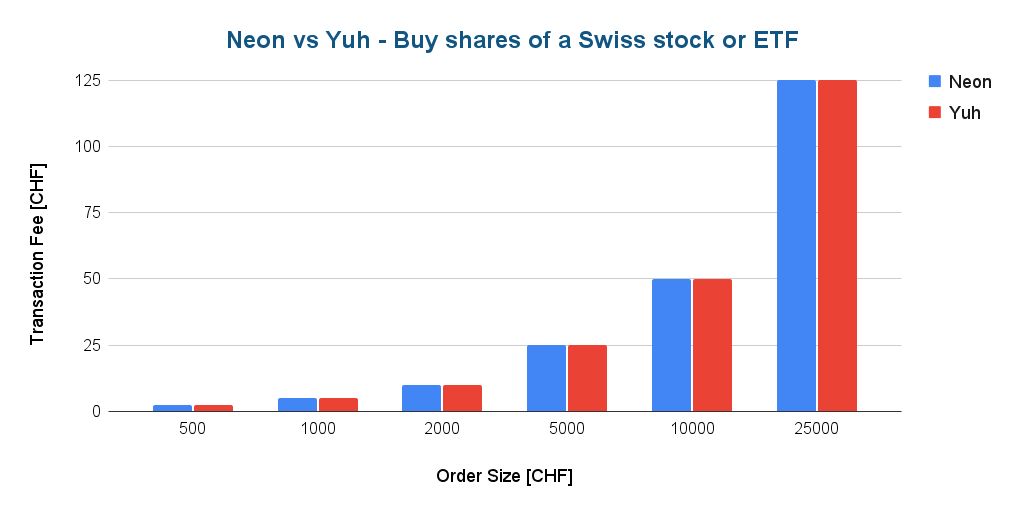

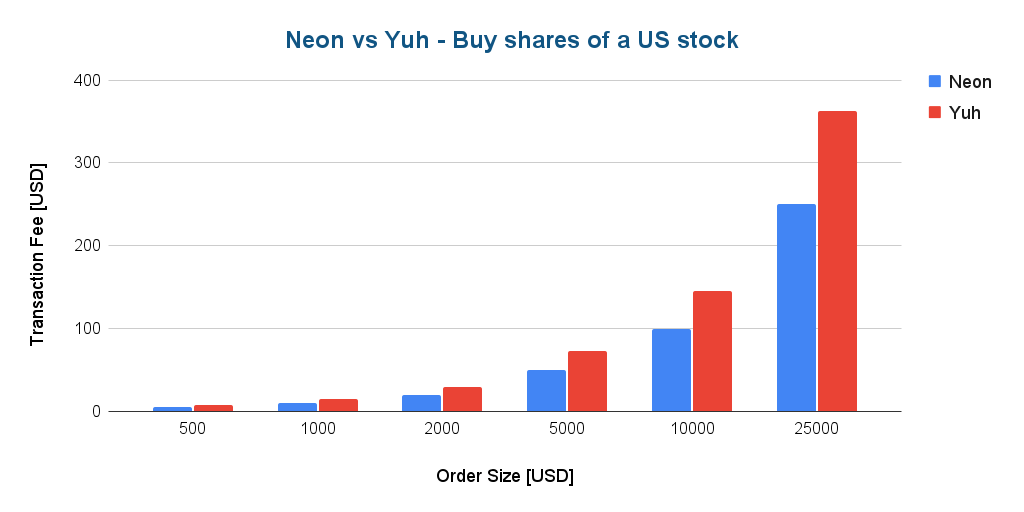

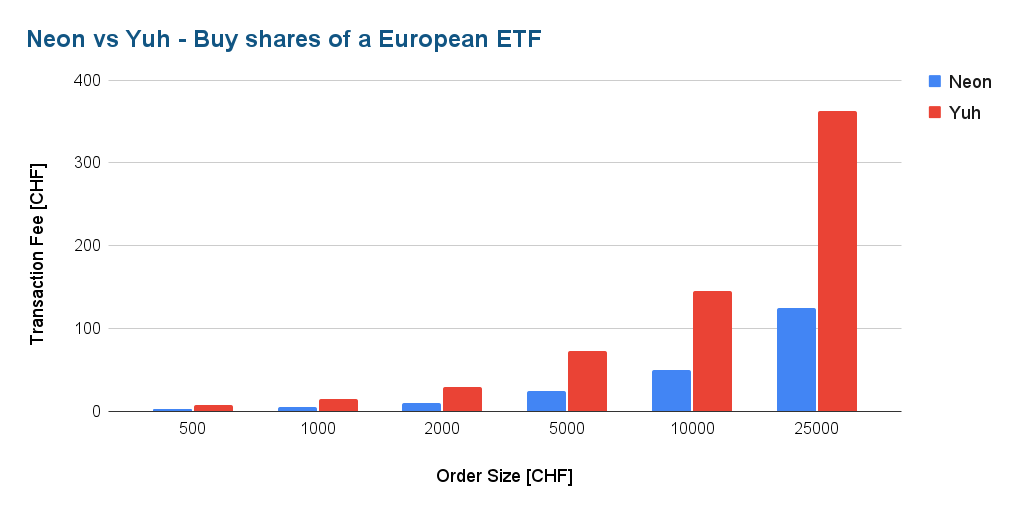

With Yuh, you will pay 0.50% to buy a stock or an ETF, with a minimum of 1 CHF. With Neon, you will pay 0.50% for a Swiss stock or an ETF and 1.0% for a foreign stock.

So, for Swiss stocks and Swiss ETFs, both will have the same fee.

For foreign stocks and ETFs, we must consider foreign currency exchange fees. With Yuh, you will pay 0.95% for currency conversion. With Neon, you will pay no currency conversion fee. They achieve this by trading everything in CHF on the BX Swiss stock exchange. And the stock exchange itself will convert currencies at the interbank rate without markup.

You will pay 0.5% with Neon for a foreign ETF and 1.0% for a foreign stock. And you will pay 1.45% for a foreign ETF or stock with Yuh. This means Neon is significantly cheaper than Yuh for foreign operations!

I must mention that using BX Swiss has one slight disadvantage for Neon. On a small stock exchange, the spread of each operation will be slightly higher. This should not matter if you invest only once a month like me. But if you invest frequently, this could be an issue.

There is one extra difference for foreign dividends (not in CHF). With Yuh, you will receive the dividends directly into your account if they are in one of the 13 default currencies (which is very likely). However, Neon will convert them back to CHF with a 1.50% conversion fee.

With a portfolio with a standard dividend yield of about 2%, this extra fee is like a 0.03% custody fee (on foreign shares). This makes it more interesting to use accumulating ETFs with Neon.

With a very large portfolio (in the six figures), this can become a significant fee. So, you need to be careful and think about where you want to take your portfolio.

Overall, Neon will be cheaper than Yuh. This is especially true for operations in foreign currencies. It is also true for very small operations, but the differences are less important. But you may have to be careful about your foreign dividends if you have an extensive portfolio.

Safety

You must invest your money in a safe company. So, we must compare the safety of Neon vs Yuh.

Since neither company is a bank, they use another custody bank to store assets from their customers. Yuh uses Swissquote as their custody bank. Neon uses Hypothekarbank Lenzburg (HBL) for custody of assets.

These two banks have a good reputation for safety. Since they are Swiss banks, your assets with them will be insured for up to 100’000 CHF in case of bankruptcy.

The custodian bank also holds your shares in a different custodian account. In theory, everything should be fine in case of bankruptcy by the custodian bank.

If either Neon or Yuh goes bankrupt, your money will be safe with the custody bank. Regaining access to your money and assets will likely take time, but you should be fine.

So, when comparing the safety of Neon vs Yuh, both appear equally safe. Yuh has a slight advantage since it is backed by two large financial institutions, bringing more financial safety.

Reputation

We should also compare the reputation of Neon vs Yuh.

My primary source of data is Trustpilot for user reviews. We can look at the Trustpilot profile for Neon and the Trustpilot profile for Yuh.

Neon gets a 3.2 score out of 5 only. Interestingly, most of the reviews are either five stars or one star. The bad reviews are about technical issues of the app, mostly the app being down for maintenance (which happens regularly). Some people also complain about onboarding, which asks many questions (like all banks).

The positive reviews are mostly about people’s savings when using Neon abroad and the overall prices.

Yuh gets a 2.5 score out of 5 only. The complaints are about two different areas. First, people complain about technical issues blocking their money and poor execution of trades and transfers. Then, people complain about poor customer service, where it is impossible to get somebody to help. These reviews are interesting because I got similar comments on my blog about Yuh.

On the plus side, Yuh users like the simplicity of the platform and the low fees.

We must be careful and take these reviews with a grain of salt. First, there are not many reviews for these two companies. Then, Trustpilot is not always very representative of real users.

Nevertheless, these reviews still show some technical problems on both sides. It also shows some execution issues and possible money blocked for Yuh users. Since I have also received several reports about that, I tend to give some value to these reports.

Overall, it seems that Neon has a better reputation than Yuh. But Neon’s issues on salary day are hurting its reputation as well.

Neon vs Yuh Summary

We can summarize our Neon vs Yuh comparison with a short table:

|

5.0

|

4.0

|

|

No custody fees

|

No custody fees

|

|

|

|

|

- Swiss broker

- Very easy to use

- Excellent fees abroad

- Excellent fees for all operations

- Expensive for large operations

- No fractional trading

- Technical issues on salary day

- Swiss broker

- Very easy to use

- Fractional trading in stocks

- Good fees for most operations

- Hold multiple currencies in your account

- Foreign transactions could be cheaper

- Expensive for large operations

- Cannot transfer shares to another broker

We can draw a few conclusions for Neon vs Yuh:

- Neon is cheaper than Yuh when used abroad or in foreign currency.

- Neon is cheaper than Yuh when investing in foreign stocks and ETFs.

- Yuh allows you to hold multiple currencies in your account.

- Yuh allows fractional trading, while Neon does not.

- Neon has a slightly better reputation.

- Dividends in foreign currencies are not free with Neon.

- Yuh lets you automate your finances with savings plans.

Conclusion

All the services you need to pay, save and invest, in a neat package, with extremely good prices!

Use the poorswiss code to receive 10CHF!

- Pay abroad for free

- Invest with great fees

With their excellent handling of foreign currency conversion and all-around good fees, Neon is better than Yuh for banking and trading! If you trade in anything other than a Swiss stock or ETF, the difference in fees will be significant. And if you pay abroad or in foreign currencies, your fees will also be lower with Neon than with Yuh.

With the new invest feature, Neon is now a great mobile app to do it all: pay, save, and invest!

Neon and Yuh have all the necessary features to start trading in the stock market. They are both making it easy to start investing.

On the other hand, Yuh has some features that Neon does not have. Yuh allows fractional trading, savings plans, and basic cryptocurrency features and lets you hold multiple currencies in the app. This may be an advantage for Yuh if you strongly need these features.

One may argue that having a 3a benefits Yuh, but I disagree. People should not necessarily use one bank to do it all. No bank in Switzerland does everything perfectly. You should use the best service available (banking, investing, retirement) regardless of whether they are in a single bank or multiple banks.

If you want more information on these two digital bank accounts, you can read my reviews:

What about you? Which do you prefer, Neon or Yuh?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Brokers

- More articles about Investing

- eToro Review for Swiss investors in 2024

- Cornèrtrader Review 2024 – Cheapest Swiss broker

- Yuh vs Swissquote 2024 – Best Broker in 2024

One thing I’m not seeing here: Witholding tax for foreign investment. A regular broker has this thing where they subtract 15% witholding tax from your US dividends, plus there’s an additional 15% ‘zusätzlicher Steuerrückbehalt USA’ that’s also taken off. If you then fill out the A1 form with your tax statement, you can claim the entire 15+15% back. Yuh subtracts 30% witholding tax, and no ‘zusätzlicher Steuerrückbehalt USA’. So, at tax time, you can only claim the 15% back, and you effectively lose the other 15% witholding tax. I had to find this out the hard way as the tax man slashed the amount they paid back with the A1 :(

Haven’t tried Neon for US investments so I don’t know how they’re doing that.

Hi Stephan,

Neither Neon nor Yuh are doing W8_BEN and allow you to reduce your withdrawal rate. Since they dont’ offer US ETFs either, I think it’s reasonable.

But I will mention that because compared to a broker like IB, it will make a significant difference.

Actually, Yuh has a small number of US domiciled ETFs like SPY or VT, most are Europe based though. I guess it’s time I take the IBRK plunge. Do you know if I can transfer USD from a CH based USD Account (like Yuh, but I have a couple others), to IBRK without currency conversion? I buy USD denominated BRCs often so that gets me new USDs regularly that I transfer out (did it to yuh until I was aware of the issue I mentioned)

Are you sure Yuh as access to US ETFS? Is see none in their list (https://links.imagerelay.com/cdn/2958/ql/yuh-investment-universe-product-list-en).

I think you can transfer USD from a CH based account, but I have never tried it. I have sent USD from the US, but never from Switzerland.

I 100% think that IBKR is the world’s best broker. You have access to almost every ETF in every major market as well as currency conversion at the best rates available online.

I agree :)

yuh changed us etf to europe etf a while ago because of legal marketing regulation… if you still have VT you can buy more but for new customers they changed to VWRD.

Thanks, that’s more in line with that I thought!

Unfortunately, Yuh now asks for a 1 % fee when trading an amount below 500 Franken…

I have to correct the statement, it is CHF 1 minimum. So it is basically more than 0.5 % if you invest below CHF 200. That makes it now less attractive for smaller recurring investments…

You are right. It’s not a new fee, but I forgot to mention it in this article. I will update it! Thanks!

Hello Baptiste,

Silly question. Does it have an advantage to but Stock from InteractiveBrokers instead of Yuh, other than the currency converted that you mentioned before?

Cheers!

B

Hi Bruno,

With IBKR, you will be much lower transaction fees as well. So, lower transaction fees and much lower currency conversion fees (unless you trade very small amounts), makes a significant difference.

Thanks for your article, as always.

I have tried both Neon and Yuh and ended up keeping an account with both :-)

Nowadays, Yuh is my main account, and I use Neon mainly when on vacation abroad to take advantage of their excellent fees. I have also kept my original account with Migros Bank but have switched receiving my salary at Yuh instead of MigrosBank.

My experience has been good so far with both banks. The reasons which have led me to choose Yuh as my main bank are:

– offers the full set of features I need since they added eBill and Twint

– most reactive of the 3 banks mentioned in increasing the interest rate paid on deposits when the central bank raised their rates

– pays interest on deposits in EUR

– pays interest on the full account balance. You don’t need to pay attention to transferring funds to a space or explicit deposit account to receive interest. This is a big plus for me.

– allows fractional trading (I have a small investment in CHSPI for my home country bias while keeping my main US ETFs with IB. For my particular setup and level of deposit, it is efficient and cost effective)

– multi-currency account works very well (used with transfers between Swiss EUR accounts, SEPA transfers with a French bank, EUR payments with debit card,etc.). No bad surprise with any unexpected fee.

Concerning currency conversion fees, I strongly recommend that people take advantage of the dedicated services available online instead of converting currencies with the bank directly. I am personally using a Geneva based service called Telexoo, and have had no problem with them. Their conversion rates are usually more favorable. I simply wire my CHF amount to them, and receive back the converted EUR amount without incurring any fee with Yuh. The amount simply gets credited on the EUR balance of the multi-currency account.

Thanks for sharing your experience T!

Interesting, I did not know about Telexoo. It looks like indeed like their CHF / EUR fees are quite fair!

I didn’t know about Telexoo. Did you try Wise before? Curious how it compares in your experience.

I just did a quick simulation to convert 2000 CHF to EUR. Telexoo estimates that I will receive 2074.90 EUR (not guaranteed), and Wise shows 2074.17 EUR (guaranteed). Telexoo seems to be 0.035% better there, but at the expense of predictability.

What I don’t like is that Telexoo displays “0 CHF wire fees” but actually tweaks the exchange rate with a fake one to include their fees. Wise on the other hand is much more transparent, they use the real exchange rates (with a small spread for the 48 hours exchange rate guarantee) and then shows you separately the fees that they take on top. Much more honest and transparent imho.

From the look of it they seem to be roughly equivalent except that Wise is more international, more established in B2C, and more transparent. Since they almost have the same fees Wise looks like a better option to me.

Hi Paul. Thanks for your feedback.

No I haven’t tried Wise, and simply did a few simulations as you did, before to go forward with Telexoo.

I have a different reading than you. For me:

– the difference in the credited amount is to me negligible. Where each company extracts their fee from is of no concern. I prefer to compare the credited amount and am comfortable with this approach.

– Telexoo seems to be quite clear about their policy, if you look at both their FAQ and page on fees. But I understand that you may feel more comfortable with the Wise approach

– being a Swiss citizen/resident, I prefer to do business with a company based in the same country rather than a big international firm. If a problem arise, we are in the same jurisdiction. From what I understand, Swiss customers are handled by Wise UK.

I must also mention that I only use the service infrequently (4 times in 2 and a half years), so my concerns are probably different from those of a cross border worker having to convert his salary each month, or a company conducting n7merous transactions.

Yuh has a public roadmap. Among other things, virtual cards and pillar 3a are planned: https://portal.productboard.com/yuh/5-to-the-yuhniverse/tabs/17-planned

Yuh has the massive advantage that you can open an account even with a temporary Swiss residence permit such as the permit L. Actually they don’t even require you to live in Switzerland at all, you can also be based in France and some other countries (can’t remember which).

In comparison Neon requires you to have a B or C permit. Very annoying when you urgently need a bank account but the Migrationsamt is taking their time to process and send you the permit (and maybe even ask you for more documents which delays the process further).

I haven’t tried Neon but I haven’t had any problems with Yuh so far. Everything works, transfers go through, and I always can connect without any issues on salary day (wtf Neon?!)

Main downside for me is that the transaction history is cluttered with their stupid 2 SWQ bonus whenever you pay by card. The only way to get rid of those is to go to your account settings and entirely disable receiving the bonuses. Can’t receive bonuses without massively cluttering your transaction history.

But why? To be honest I think it’s just an honest UX overlook, their designers and product managers probably don’t use the app at all.

Hi Paul,

Excellent point, Paul! I forgot to mention that. I have updated the article to add a mention of that.

Interesting, I never heard anyone mention the clutter of SWQ transactions. This kind of makes sense since this will likely double each transaction.

Thanks for sharing!

Can confirm that this doubles all card transactions. You can actually hide them by unticking the “Investment transactions” category in the filters. But in addition to hiding investment transactions (that you may not want to hide!), it just resets every time you open the app which is super annoying. They should add a category “SWQ bonuses” in the filters and allow you to make this setting permanent.

Thanks for sharing the details!

You missed the intrests. 0.9% interst on on Neon Spaces is a game changer for me.

Good point, I should mention interest rate. However, since Yuh is at 1.0%, I don’t think it makes that much of a difference between both.

I use NEON and am mostly happy with it. The sole issue I have with NEON is that they do not fully support TWINT. While you can login your NEON account to the UBS TWINT app, NEON does not have their own TWINT app. The result is that there is a 300.- monthly limit on P2P transfers. I’m curious if this is different for YUH.

Interesting, I was not aware the differences where that large. It this limit for any use of TWINT?

No, I’m not aware of any TWINT limits for banks that have their own TWINT app. Although probably there is a limit of 5000.- or some similar amount. However, 300.- limit is ridiculous. I maintain my account at my Cantonal bank for one reason only: they have their own TWINT app.

But, after reading all the comments posted about Yuh, I’m now thinking of switching to them!

@Joel Did you consider using the official Prepaid TWINT app instead of UBS TWINT?

https://play.google.com/store/apps/details?id=ch.twint.payment

Limit for sending money to TWINT users is 1000 CHF per month for a total of 5000 CHF per year. Likewise, receiving money from TWINT users has the same limits (but they are distinct).

You can top up your prepaid TWINT account with direct debit, QR-bill, and TWINT voucher codes (you can buy those at stores such as Migros).

Source: https://www.twint.ch/en/faq/what-are-the-top-up-and-purchase-limits-for-twint/

Or yeah you can just open a Yuh account instead. It’s probably the same level of effort as opening a TWINT prepaid account but it’s more convenient.

How can you stand behind a fintec company and even call it a bank which it isn’t and suggest it for general finances and savings which is not guaranteed by the government regulated institution (you can check it here: https://www.esisuisse.ch/en)? I know what they are stating, but the fact that they have their bank account managed in a German bank makes me worry even more about its safety. Someone suggested me this blog for financial advises, but this is just purely risky living. Something similar than if I would hold all my money on my Wise account… I don’t mean these companies are not good for a student or someone for travelling, but as a main financial Bank account, no way.

You are wrong on two points:

* They are not using a German bank but a Swiss bank: Hypothekarbank Lenzburg

* This is guaranteed by Esissuise since the money is deposited on a Swiss bank

Now, if only I could login into my Neon account instead of being locked out by outages and bad app updates…

Even knowing that Yuh is more expensive (I will just use alternatives like Revolut when necessary), I moved away from Neon because I couldn’t rely on it (and the response I got from their support was dismal).

Hi Marcos,

That’s a good point. They are having increasing issues with conecting to the app. I will mention that on the comparison.

Have you ever had such issues with Yuh?

I’ve only recently moved away from UBS (sunsetting the budgeting feature was the last straw).

It might have been extremely bad luck, but Neon just completely failed me on my first month (besides the 2 day outage, it would regularly fail to create a payment, load future activity, create a “space”, etc). But it was their incredible tone deaf response that drove me away.

So far, I haven’t had such issues with Yuh; fingers crossed. On the other hand, I received that dreadful notification asking for more info (the one that people overlook/ignore and end up locked out), but I was able to resolve it within the app.

This “staged” onboarding is quite strange, indeed; I understand why people is puzzle by it. Funnily enough, people complain that Neon onboarding is too long…

As for customer support, I did had an interaction with Yuh’s. It did take several minutes to someone to pick up the call, but it was resolved satisfactorily.

Yuh lacks in regards to reporting and some things are non-intuitive For example, about the latter, the only way to access eBill is from payments; even though I want to check on a credit notice. As for the former, there are no export option (not even CSV; by the way, that is a complaint for Swisscard too).

Thanks for sharing.

In my case, I only got technical issues on salary days, but I may not use the app much.

Good to know about the staged onboarding. It’s interesting that I never saw any complaint about that on neon, but many on Yuh.

On the other hand, I agree that the current state of logins at Neon is not acceptable and I really hope they work it out.