The 13 Steps of My Monthly Personal Finance Routine

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Having a personal finance routine can help save time and money! For many people, having a strict routine will help them remember essential things. It is the case for me. Each month, I follow the same personal finance routine for my budget. In this article, I describe the steps I am doing every month.

It is great to have a routine. It helps you get more efficient, and like this, you do not forget to do anything. And once you start doing it routinely, it becomes automatic, and you will save time. And time is your most important resource. And following a personal finance routine will help you avoid mistakes and save money in the process!

Of course, you do not need to follow the same steps as me. You should probably not have the same steps. Every people can have different things to do based on the way they are investing or based on their situation.

But I would encourage you to define at least a monthly routine clearly. You can use mine as a base template if you want. And why not even a weekly routine?

So, here are the 13 steps of my monthly personal finance routine.

1. Pay my monthly bills (after salary)

All the services you need to pay, save and invest, in a neat package, with extremely good prices!

Use the poorswiss code to receive 10CHF!

- Pay abroad for free

- Invest with great fees

Once I receive my salary, the first of my personal finance routine steps is to pay my monthly bills for the next month. I do this with the Neon mobile app.

These bills are my mortgage interests, taxes, insurance, credit card bills, and sometimes exceptional bills like Billag or some bi-annual bills. My salary goes into my checking account. I also receive some bills in my mailbox that I pay at the end of the month.

Why am I doing this first?

For the simple reason that I want to know how much I have left for next month. And I want to know how much money I can invest this month. I do not believe in the “Pay Yourself First” philosophy. It does not make any sense. If you save as much as you can, there will be something left to pay yourself. Pay yourself first makes you complacent, thinking you cannot save more.

2. Check my emergency fund

I always keep about two months of monthly expenses in my emergency fund. My emergency fund holds about 10’000 CHF.

I directly keep my emergency fund in my checking account. If you have access to high-interest savings accounts, you should use them instead. But in Switzerland, we do not get any interest in bank accounts.

So, once I have paid my monthly bills, I check how much I can move to my broker. I always keep about 10’000 CHF in my checking account. I invest everything higher than that. So, if I have 16’700 CHF left, I will invest 6’700 CHF this month. It cannot get simpler than that!

3. Invest my extra savings

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

Once I know how much I can invest, I transfer this money to my broker account. It generally takes one working day for the money to arrive at Interactive Brokers. After I receive the money in my broker account, I directly invest it. For instance, I can invest all the money in my VT ETF.

I am using the new amount to rebalance my portfolio. I am investing in the fund that is the most below its allocation. It is how I am balancing month by month. I never rebalance my portfolio. It is in check with my overall investment strategy.

Currently, the stock market is my only investment. But if I were to make other investments, I would split the money between the stock market and the alternatives.

4. Check my spending and budget

At the beginning of each month, I look back at the budget of the past month. I try to do this as early as possible, ideally on the first day of the month. I check every expense and earning for mistakes. Once I am sure of my expenses, I take note of my savings rate (which can still change with the next two steps).

I am doing my budget in a straightforward way with multiple categories and an amount per category. What matters to me is that I have an accurate view of all our expenses.

And most importantly, I take a look at how much we spend on every category. I try to understand what went well and what did not go well. It will help me improve month after month.

If you aim to improve your budget a little each month, your budget will be much better after a year!

5. Check my credit cards

I am also checking that all the expenses from my credit cards are in my budget. I also check every credit card expense for possible mistakes. Several times I forgot to add small expenses to my budget from my credit card. The biggest benefit is making sure that there are no errors or frauds on my credit card statements.

It is also an excellent time to check if I can buy more things with my credit card. Now that I have several credit cards, it is good to check if some expenses are not using the correct credit card. I want to minimize my fees as much as possible. And maximize the small bonus I get for spending with my credit card.

But if you want to keep it simple, you can also not bother with credit cards and use your bank cards! It will not make a huge difference.

6. Check all my accounts

After my credit cards, I check all my accounts. My goal is to get the current value of each of them.

Fortunately, I do not have many accounts. I have a checking account, one at Migros Bank and another one at Neon Bank. For each of my checking accounts, I verify all the transactions. I also make sure I have put each of these transactions in my budget. It is generally the only account that is moving significantly.

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

I also check my third pillar accounts at Finpension 3a. I check the value of each of my investments. Once I have all these values, I can carry on to my next step.

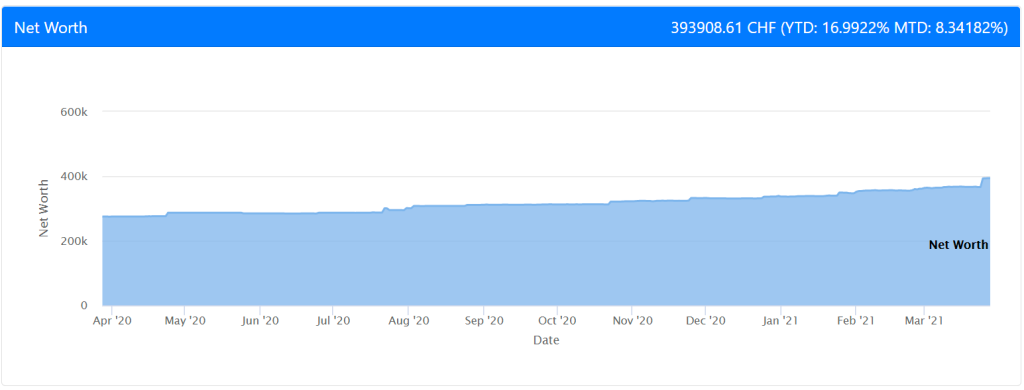

7. Update my net worth

Now, I got the values of all my accounts and all my investments. It is time to put them together in my net worth tracking application. Once it is done, I get my new net worth!

I can see how much the net worth increased (or decreased) compared to last month. I also track how much my net worth grew from the beginning of the year.

For me, these are important personal finance metrics to keep in mind.

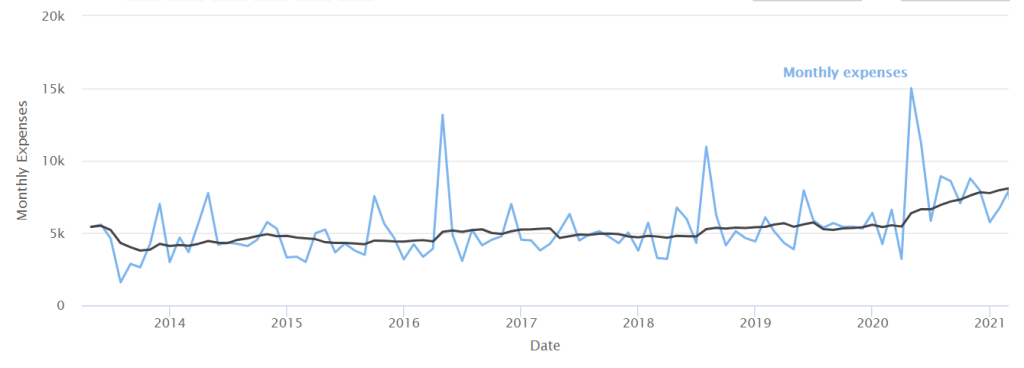

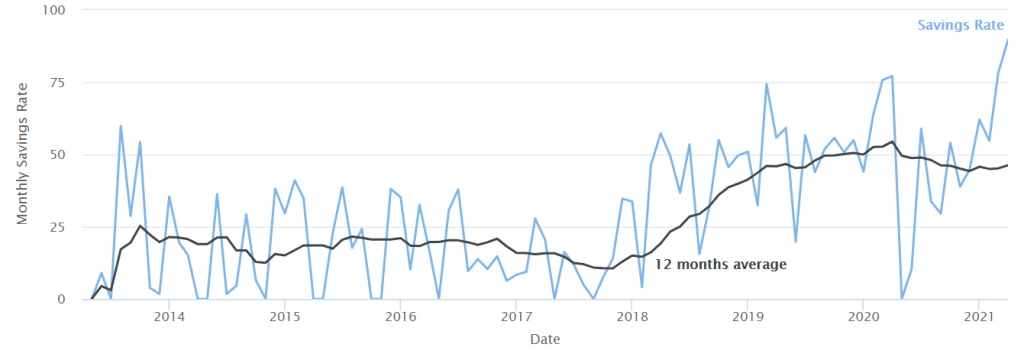

8. Keep track of the trends

One thing I also like is to compare the trend of several things. In the previous step, I can compare the direction of my net worth. It should, of course, go up. But it should ideally accelerate its ascent.

I also check the trend of my expenses. For instance, I keep track of the pattern of my expenses over time. One thing that is very important for me is the 12-month average. For example, for my expenses (in black):

Ideally, I would like the average to go down to 4500 CHF. But these days it is not great. I cannot even keep it below 5000 CHF. The average is more important than the value of each month. Because you may have some lousy and perfect months, but the average should stabilize. I am also checking the trend of my income. And very importantly, I am reviewing the trend of my savings rate. It is the most important trend for me.

Since I started to improve my finances in 2017, my average savings rate has been consistently going up. It is an excellent sign.

I also check the rate of my income and earnings. Most of my income is very regular since it is my salary. But I also get a little income from this blog. And I like to check how earnings are going.

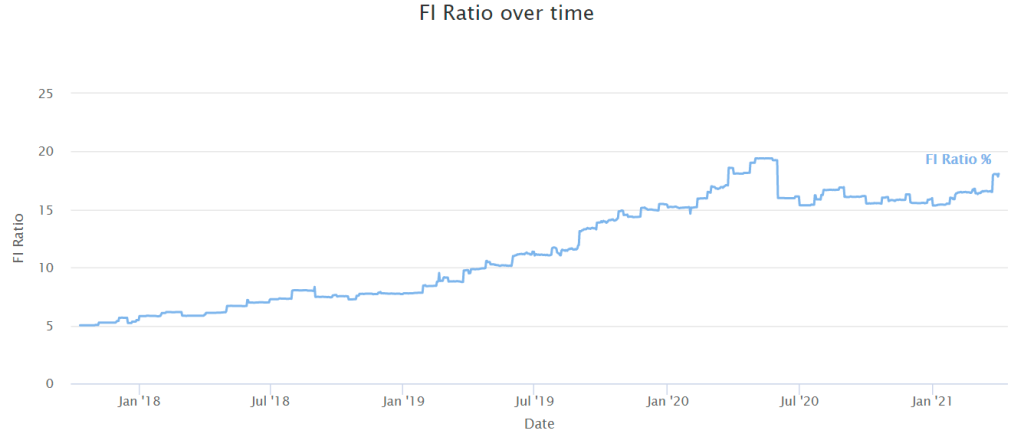

9. Check my Financial Independence (FI) Ratio

After I finish all the data, I will get the final numbers out. I can check my savings rate, of course. And its trend is seen in the previous section. But the last value I am checking is my Financial Independence (FI) Ratio. This metric tells me how far away I am from being Financially Independent. I can also check the trend:

My FI ratio should always go up. For now, it is increasing quite slowly. I am working on making it grow faster. But I am not stressed as to when I will be able to retire.

Currently, our expenses are not yet very stable, so this causes our FI ratio to jump all over the place.

10. Update our goals

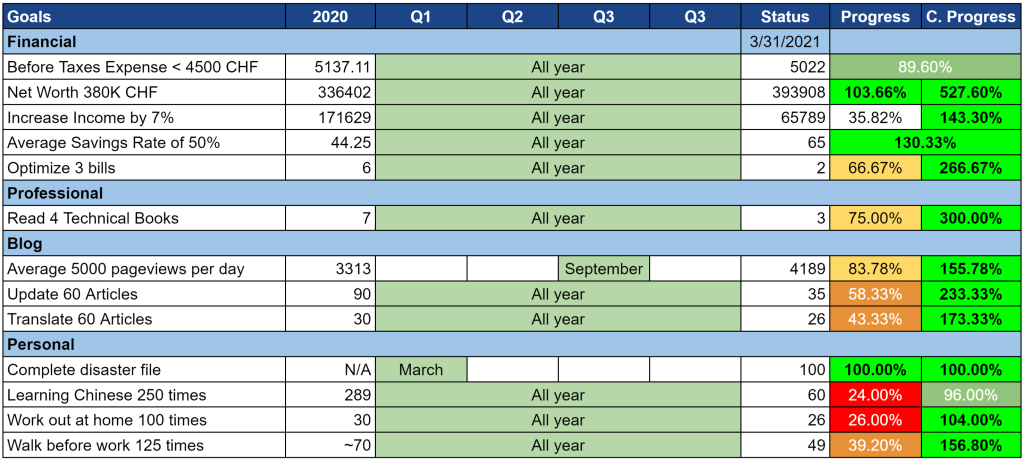

Finally, I now have all my numbers. It is time for me to check the current status of my goals. Every year, I try to set a few goals for the entire year. And every month, I check how the goals are going.

For instance, here is one recent update on my goals.

It helps me to have a good idea of where I am. It also helps me see what to do better to reach my goals.

11. Set next month’s goals

Once I have finished inspecting my yearly goals, I set a few goals for the next month. For instance, if I have spent too much in one month, I set a very strict limit on spending in the following. I am also setting soft goals such as:

- Research credit cards to find a better one

- Research bank accounts to find a better one

And so on. I try to put 4-5 goals for each month. I do not always report them on the blog. Generally, I write them down on a piece of paper.

And once I have my goals completed, I try to make a small plan of what I can do to improve my goals.

12. Study the analytics of the blog

This blog is my only side hustle. So, I am incorporating it into my monthly personal finance routine. If you have other side hustles, it would be good to check them every month as well.

I am checking how much traffic this blog got and comparing this to the previous month. I am using Google Analytics for this. If some pages get more traffic than usual, I am trying to understand why. And if the traffic is going down, I am also trying to understand why.

I am also checking if my blog consumes too much power on my hosting plan. I am using SiteGround to host this blog. Since I use one of their cheap plans, I must ensure I do not use too much. If I use too much, the decreased performance will impact the readers’ experience negatively. If it is too high, it is time to go to a higher hosting plan.

I also checked the income I got during the month. But this is currently not my focus on the blog.

13. Post on the blog

Finally, my personal finance routine’s last item is to post my monthly report on this blog. If you do not have a blog, you may write a small report on your computer. Or you could keep track of the numbers for the next month.

For instance, you can check out the most recent monthly report. This post has the details of my expenses and income. It also contains the current status of my goals. And, of course, some information about things that happened during the month. And my expectations for next month.

Why am I doing this?

I am mostly doing this for myself. I want to keep track of my financial status. I also believe it makes me more accountable. And it helps to keep me motivated. And since I like reading monthly reports, maybe some people will enjoy mine!

What I do not do

You may have seen that there are also some things I do not do.

First, even though I check the value of my funds, I do not plan any action for them. I do not want to sell or buy based on the price of the funds. I buy as soon as the money reaches my broker account. And I do not sell as long as I do not need the money. It is essential for long-term passive investing.

You have also seen that my personal finance routine is entirely manual. I do not automate any of my money things. I think that automating your personal finances is a mistake. I much prefer to be in control.

Conclusion

Here you have it! My 13-step monthly personal finance routine system!

Following this system helps me be very aware of what is going on with my finances. What is good and what is bad? I want to have as much information as possible with my budget. And I want to avoid missing a step. I very rarely make a money mistake with my personal finance routine. And since I do the same steps every month, I save time.

These steps are personal. Of course, not everybody will have the same. However, I believe everyone should have a bit of a personal finance routine. Even with you have only a few steps, it helps to do them regularly and each month.

Enough about me! What about you? Do you have a personal finance routine? How many financial steps do you do each month?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Manage your money

- More articles about Save

- What’s the Time Value of Money?

- Depreciating assets will hurt your wealth

- Working may cost you more than you think!

So at the end of the month after paying your bills you only leave your emergency fund in cash? Does that mean you live off your emergency fund every month until your next salary? And then you top it up again?

Excellent question!

No, I do not touch my emergency fund. We pay everything by credit card. So, we will pay the credit card bill at the end of the month as well and this is counted in what I pay on salary day.

When do you pay into your third pillar? Does it go along with paying bills?

I always pay for our 3a accounts in January/February, before sending money to my IB account.

How many hours do you invest in these 13 steps each month?

Hi Pinu

I would say about 2 hours.

Hi Baptiste, do you pursue financial independence of the whole family or yourself only? This question is based on the account checking and investments. I hope it’s not too personal. Feel free not to answer if it is.

Hi michal,

I pursue financial independence for the whole family. The idea is that I could stop working without impacting at all the family.

Our main accounts (bank and broker) are joint accounts.

Thanks for the answer. It actually brings me to yet another question: is it possible to have a joint account at IB formally? (I’ve never tried.)

Yes, you can have joint accounts. In fact, they have many kinds of accounts such family accounts, friends accounts, advisors accounts and such.

Baptiste, I follow most of your newsletters. Really, this way of sharing info and your approach is way better than I have aeen anywhere including banks, IFAs etc. You are too organised for me but I do track regularly. As most of your money (I assume after maximising your pillar 2) goes into funds with your broker, have you ever considered an offshore wrapper where for tax purposes it counts towards your NW but the income is not taxed as such? Very valuable blog.

Hi François,

Thanks for your kind words!

No, I have not considered such. An offshore wrapper sounds like tax evasion to me and I don’t want to touch that.

There is very good content on your blog, I was truly delighted with this information.

Wow, that is quite commitment. I do No. 1, 3, 4, 7(no so offen). What I should do more are 5, 6 and 9. For the goals I use the apps called ‘Strides” keep tracking them. It costs 30CHF annually I used it for 2 years. Thanks for sharing this, I think we have something quite in common but of course there are difference according to personal situation.

P.S. Thinking about having a block as well, now I am using Onenote from microsoft.

Haha, I do my best :)

I did not know Strides, it looks quite interesting.

I completely agree that this routine is very personal. Some people will have more steps, some will have less. My routine is mostly here as an example :)

What do you mean by a block? To take notes? I have a small notepad in most places that I can quickly jot down thoughts. But I wish I could find a nice one integrated in a wallet, but I have not found a good one so far. Too bad the GTD Wallet was discontinued :(

I guess he meant blog, in order to publically keep tracks of the budget.

I wanted to ask, for your NW, do youtake in consideration and calculate the USD/CHF exchange, and how much you lose/gain due to the currency exchange and perhaps evaluate if it’s beter to invest in CHF or Euro instead?

I take the exchange rate into consideration yes, everything is converted to CHF.

I currently do not calculate how much was gained or lost due to currency exchange, I just estimate it based on the performance of my portfolio and the performance of the US/CHF.