How to file your taxes with Swiss and foreign securities in 2024

| Updated: |(Disclosure: Some of the links below may be affiliate links)

One question I often get is how to file taxes with stocks and dividends. This becomes especially popular when we add foreign stocks and dividends to the mix.

Many people are afraid of investing because they think it will make filing their taxes complicated. But in practice, it is not complicated to file taxes even with a large ETF portfolio.

In this article, we see how to file your taxes with Swiss Stocks and dividends, which is very simple. And with U.S. Stocks and dividends, which is slightly more complicated.

Filing taxes

In Switzerland, taxes are different for each canton. Each canton has its software and forms to complete your tax form. However, most of the forms are very similar and have similar names. So, if you can file your taxes in one canton, you should not have many issues filing them in another.

Since taxes differ in each canton in Switzerland, I need to take an example. So, I will take Fribourg as an example with the Fritax 2020 software. You can use this example to file your taxes for your canton. The concepts should be the same for each canton, but the software to fill them will differ slightly.

Some of the Swiss tax apps are better than others. I have not tested many of them, but from what I have seen, Fritax is probably average. It is not always intuitive, but it is relatively easy to use.

Unfortunately, Fritax is not available in English. So I will use the French version for my screenshots. The forms will be the same in German as well.

If you do not know why I am using U.S. ETFs, you may want to learn about the advantages of U.S. ETFs. They are related to how you will file your taxes with U.S. securities.

Swiss Securities

First, we start to see how to declare Swiss securities. These are the securities that are subject to the Swiss dividend withholding taxes. Indeed, the Swiss tax office will withhold 35% of the dividends. Your broker will do this directly.

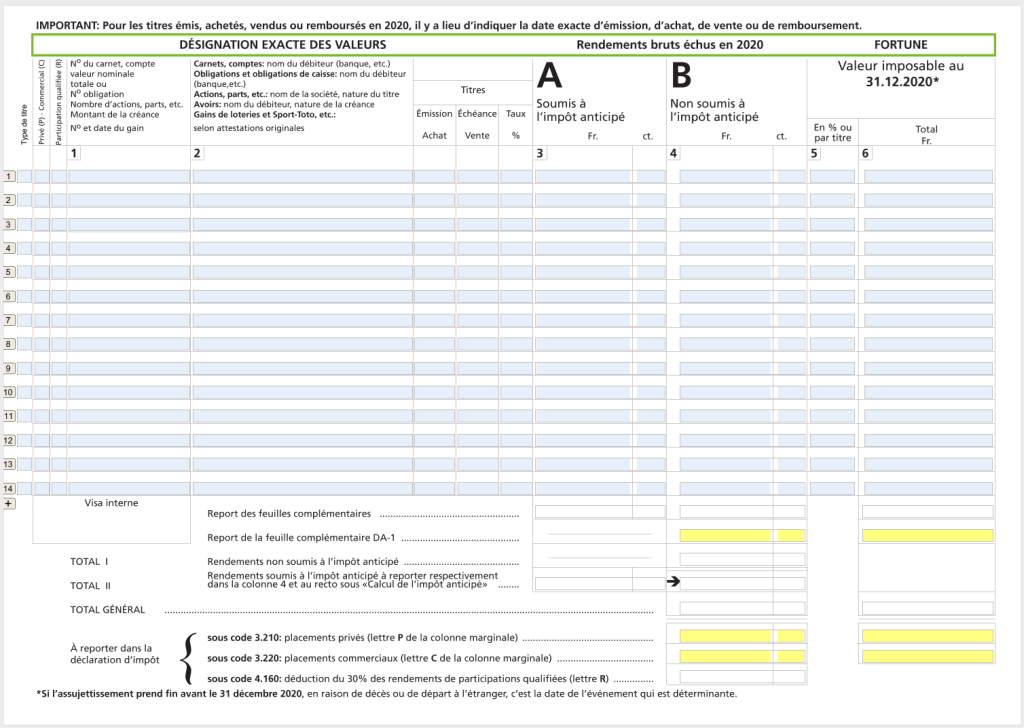

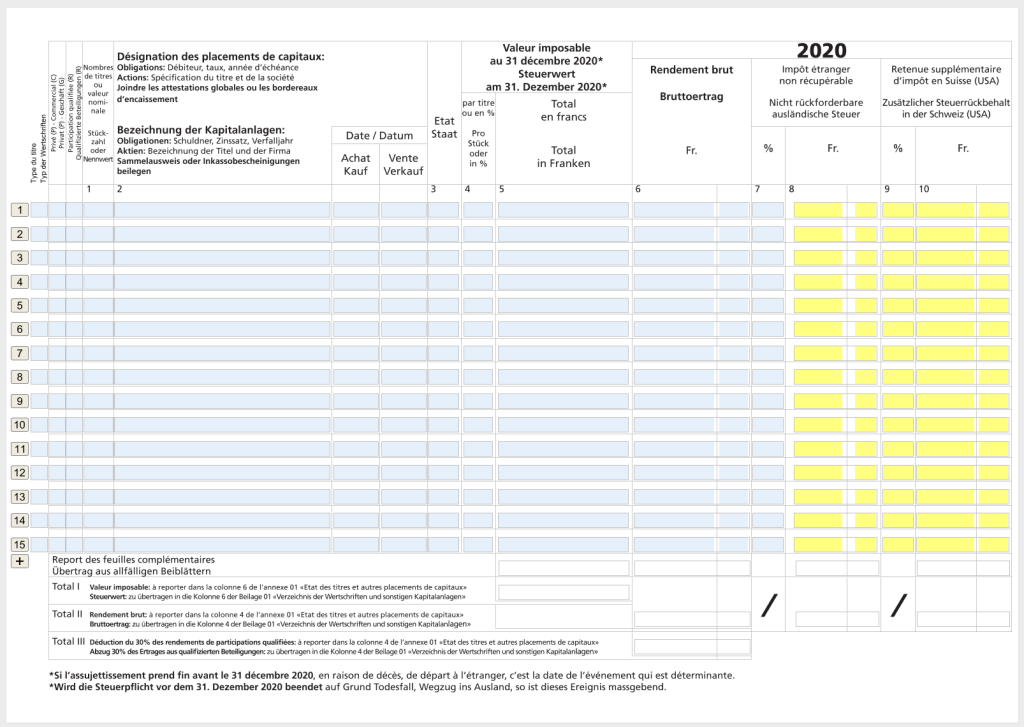

In your tax declaration, you will have a form to enter all your assets (bank accounts, bonds, stocks, and lottery gains). In my French software, this is called “Etat des titres”, which translates to “Status of the securities”.

Here is the form before filling it:

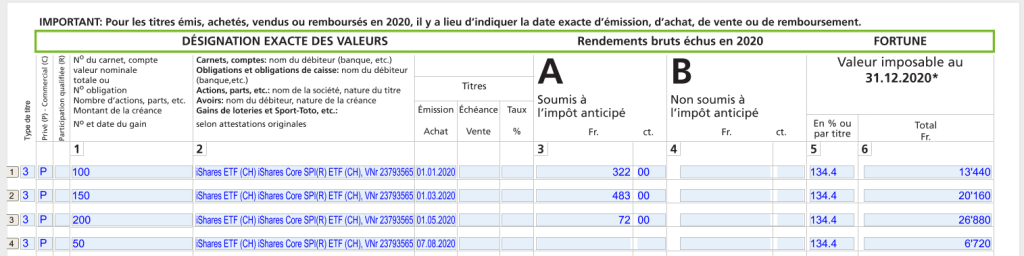

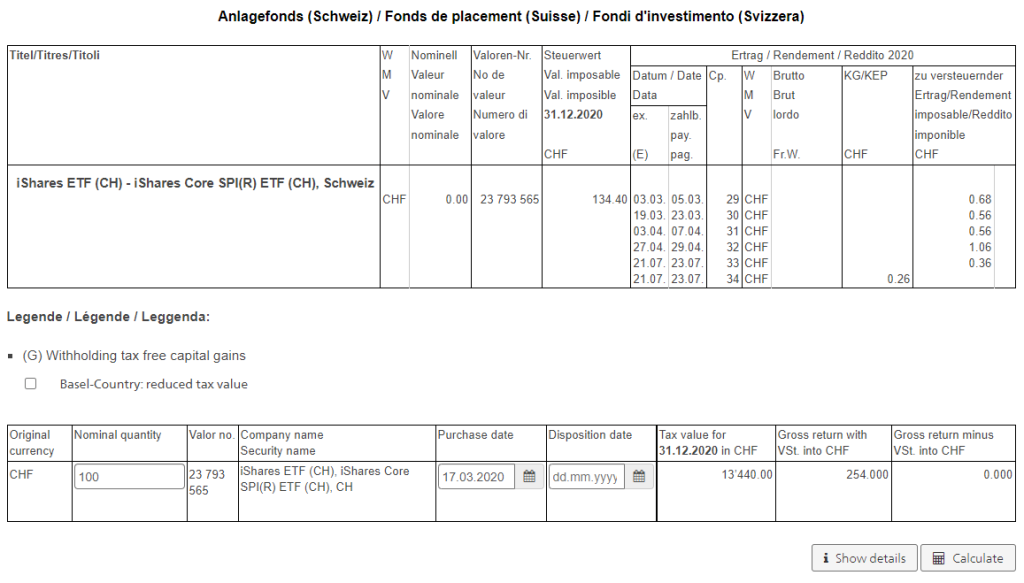

In this form, you must list all of your Swiss securities, whether stocks or ETFs. Since I am recommending investments in ETFs, I will take an ETF as an example. But you would do exactly the same with a stock. For example, I will use CHSPI, the Swiss ETF I use in my portfolio.

You must indicate this is a security (choice 3) in the first column on each line. You must then indicate that this is a private asset (choice P) in the second column.

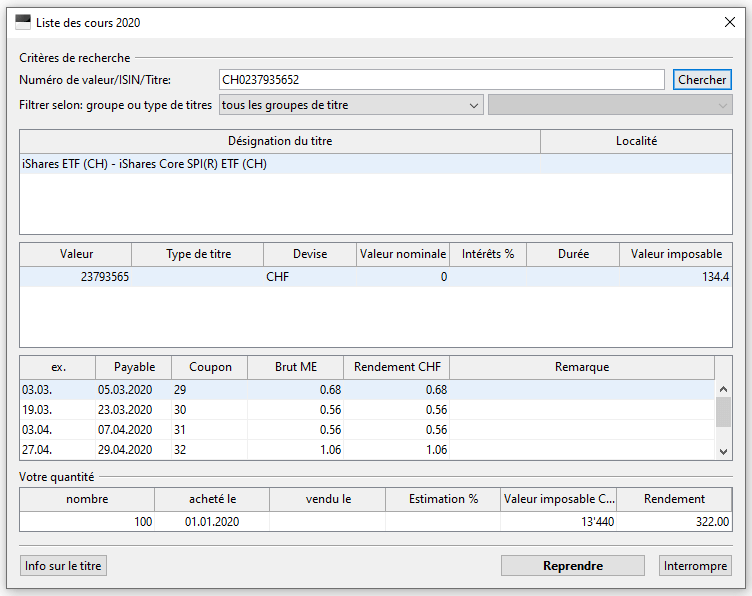

Then, you can press the “Listes des cours” (Lists of prices) to search for the prices of a security. This assistant will help you with your dividends and prices. You can enter the ISIN number of your ETF and press search (Chercher). For instance, the ISIN number of CHSPI is CH0237935652. You can find the ISIN number of each ETF on the website of the fund provider.

Then, you will see all the taxable income for this security. You can enter the number of shares, the buy date, and the taxable value, and the taxable dividend will be calculated for you. For instance:

The date will be considered to compute the dividends for this security. If you enter a date that is after some dividends have been issued, they will not be considered. And they will automatically compute the taxable wealth with the security value at the end of the year.

Here is an example of what this could look like.

The totals are automatically done at the end of the form. And these values are propagated into the rest of the forms.

If you already have securities before the beginning of the year, you have two options. If you file your taxes right after the year without losing your tax declaration, you can keep all the buy operations from the previous year. Or you can use the total number of shares at the beginning of the year with a single entry and a date like the last year of the previous year. I have already done that in the past, and I have never had any issues.

If you have sold securities during the year, you must also declare them. You can use a purchase date and sold date to let the software compute how many dividends you received before selling the shares. In that case, the software will automatically set the taxable value to zero.

Using ICTax

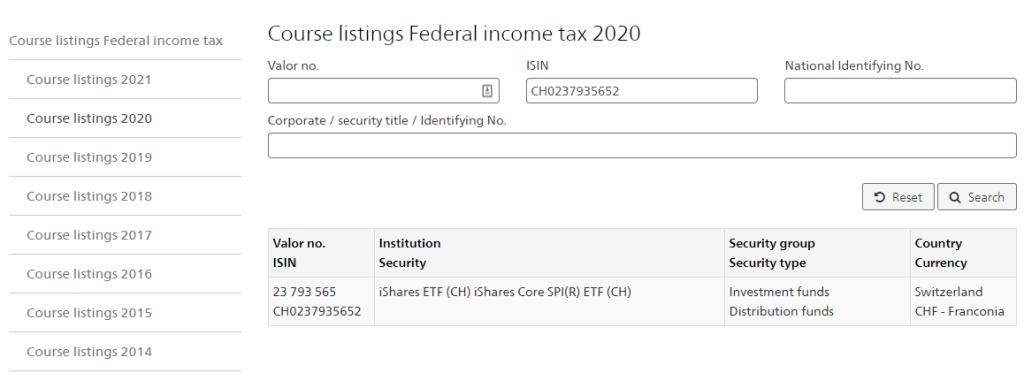

Unfortunately, not every Swiss taxes software allows you to get all these numbers inside the app. So, in this case, you will have to use the ICTax website. This is the reference for all the official end-of-year prices and currency conversions to file your taxes. One good thing is that this website is available in English, contrary to the tax software.

You can go to the website and search for the ISIN again:

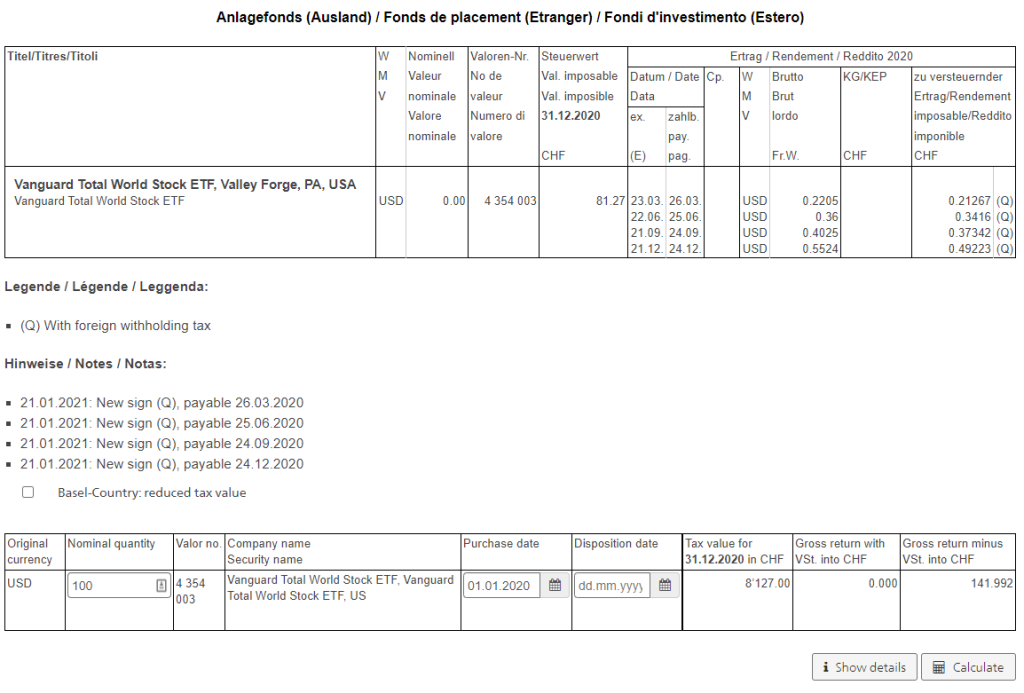

And then, you can click on the ETF of your choosing. After that, you must do the same as before with the tax software. You will be able to enter the number of shares and purchase date. The website will automatically compute the tax value and the gross return. You can then copy these values directly into your tax declaration.

It is much less practical to file taxes like this than having the software do it for you. But in any case, it should not take you long to complete your Swiss securities.

It is also a good reason to keep your trading limited to a few ETFs. If you are buying many securities during the entire year, you will have to enter many lines. But it is not as complicated as many people believe.

If your ETF is not on ICTax, you can ask them to add it to the system. But most well-known ETFs should already be there. I have never had an issue so far.

U.S. ETFs / Securities

For U.S. ETFs and securities, it can get a little more complicated because there are a few possible cases.

First, it will depend on which broker you are using. If you are using a Swiss broker, you will pay two deductions:

- 15% withheld by the Swiss broker

- 15% directly withheld at source by the Internal Revenue Service (IRS)

If you are using a broker like Interactive Brokers, you will only see the IRS’s direct deduction. This is a foreign tax.

You need to use the DA-1 form to claim back foreign tax. You need to use the R-US 164 form to claim back Swiss withholding if you use a Swiss broker.

These forms are attachments to the form we covered in the previous section. And they are extremely similar. The difference will be in setting the percentages that you can claim back.

If you use other foreign securities, the idea remains the same, except that the percentages will differ. You will have to find the percentages for both columns for your situation.

In this case, Fritax did an excellent job since they put DA-1 and R-US 164 together. Therefore, there is only a single form to fill for foreign securities. This is a great idea!

Here is the empty combined DA-1 / R-US 164 form:

As we can see, it is extremely similar to the previous form. And it works exactly the same way. You must still select that this is an action and part of your private net worth. Then, you can use the same assistant to get all the tax information by pressing the “Liste de cours” button on top of the form.

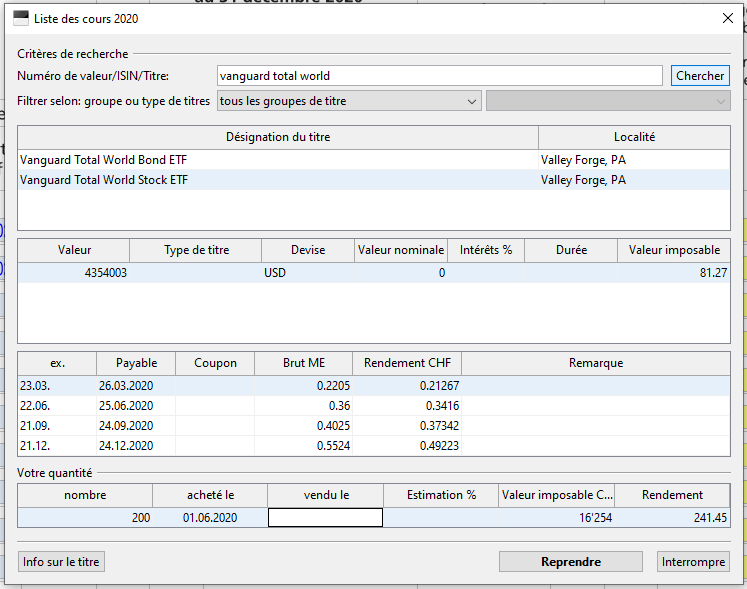

They have all the information, even for U.S. ETFs, such as Vanguard Total World (VT). Here is an example of how to fill it with VT:

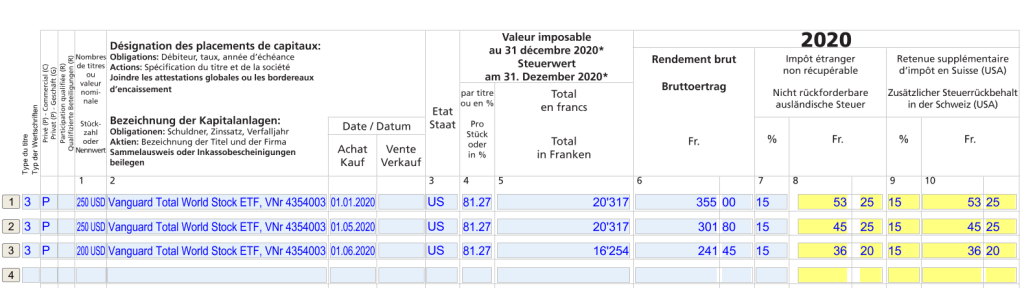

Once you have filled a line, you still need to select the country in column 3. This will be the US in our case.

Then, you need to update columns 7 and 9 with the percentages for your case. If you only fill the DA-1 form (with Interactive Brokers), you must set column 7 to the value 15. If you are filling the R-US 164 form (with a Swiss broker, for instance), you must set column 9 to the value 15.

Then, the tool will automatically compute how much taxes were withheld in both cases. And Fritax will automatically fill in the total.

Here is a filled DA-1 form with both sides filled:

If you use Interactive Brokers and only pay 15% of dividends withholding, you can change column 9 to the value 0.

All the other details are the same as for the Swiss securities, so you can look at the previous sections to get all the information. But with the Fritax software, it is not that bad to file your taxes with foreign securities. As you can see, the DA-1 and R-US 164 forms are almost the same as the standard securities form.

It is important to note that the DA-1 deduction is generally only applied if you have more than 100 CHF in foreign withholding. It does not change how you file your taxes, but knowing this may avoid a surprise when receiving your tax decision.

Using ICTax

If your tax software does not support getting the values directly from it, you can use the ICTax website for foreign securities too. It will give you all the dividends in CHF and the tax value of your securities at the end of the fiscal year.

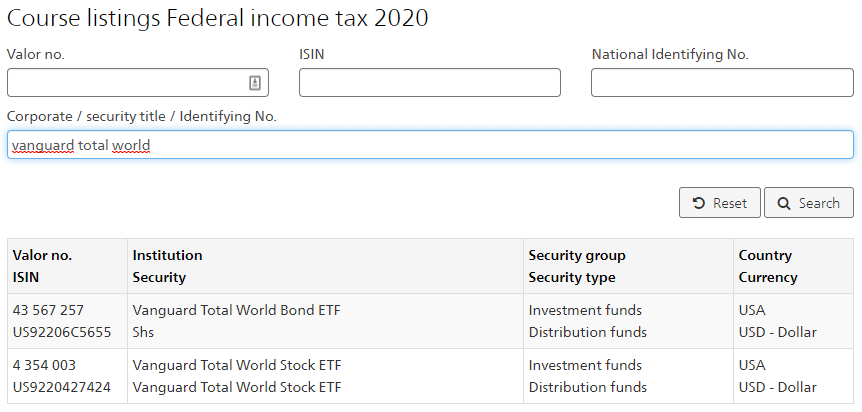

This will be done exactly like we did for Swiss securities. For instance, you can search for Vanguard Total World on the website:

Make sure you choose the Stock version and not the bond version (unless you have both, of course). And then, you can fill it up like before. For instance:

Then, you will only have to copy these values into the DA-1 or R-US 164 form and select the correct withholding percentages. It is not more complicated than for Swiss securities.

Attachments

The tax office will request documents attesting to your dividends, capital gains, and net worth.

Some Swiss brokers will propose some special documents for taxes. And some people believe that only these reports are valid. But that is not correct. Even foreign brokers have documents that Swiss tax offices accept.

For instance, I use an annual activity statement report with Interactive Brokers. This contains all operations, all dividends, and the status of my shares at the end of the year. I have never had any issue with that. You can get this from the Reports tab. In there, you can generate an activity statement for the entire year.

Conclusion

There you have it! Following these simple steps, you can file taxes with Swiss and foreign securities! It is not as complicated as many people believe.

Even for U.S. Securities, it is not complicated. You must fill out an extra form (DA-1) in the best case and two in the worst case (DA-1 and R-US 164), but these forms are almost the same as for Swiss securities. So, I do not think this is a big deal.

If you are wondering why we need to fill all these lines, it is for the system to compute exactly how much you got from dividends. Since dividends are taxed as income, this must be precise. And only by indicating each buy and sell date will you get a precise amount.

Hopefully, this will help you file your taxes with securities.

If you want more tax information, I have an in-depth guide about Swiss taxes.

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- Financial advisors – Do not get ripped off

- What is Compound Interest? Is it Magic?

- The Complete Guide to Asset Allocation

Hi Baptiste,

thanks for the great article! I have a financial product with my bank that every 3 months automatically sells from one SICAV fund and invests in another. I am not actively doing that, but the bank has some sort of mandate from me to run these operations. Do I need to declare all these transactions that the bank does in my tax declaration? thanks a lot for your answer.

Hi Andreas

I don’t know for sure, I never was involved with any kind of thing like that, it even sounds weird.

But in my opinion, if the bank invests on your behalf directly, not in a fund, these transactions should figure in your tax declaration. But you should ask the bank.

Dear Baptiste,

I am working in Geneva and started investing in US stocks via Interactive Broker in year 2022.

So far I have not received any dividend and got a profit of approx $1500 during trade in a year. Have not received any tax statement from Interactive Broker yet (scheduled after march 2023). My questions are:

1. Do I still need to fill DA1 form during swiss tax declaration this year?

2. Do I need to enter all my transactions even if I have done multiple transactions e.g. 1-5 shares per transaction?

Thank you for your guidance.

Rajan

Hi Rajan,

IBKR will not give you a tax report for Switzerland, only for the US.

In Switzerland, you can simply use an annual activity statement.

1) If you bought stocks in 2022, yes.

2) Yes, you are supposed to enter all the transactions. What matters to the tax office is mostly the dividends since this is where you are going to be taxed. So you could group transactions together I guess as long as the dividends is correct and the end-of-year total is correct as well.

Hi Baptiste

Firstly, can I say that I’m a big fan of your site. On this topic, though, I’m a bit confused.

In the tax form the column mentions “Impôt étranger non récuperable”. This would suggest to me that in the case of a foreign broker, the 15% IRS tax (assuming W8-BEN has been done) cannot be further reclaimed. In the case of a Swiss broker, only 15% of the additional tax in the final column can be reclaimed. Therefore, even in the best case, 15% is lost to the IRS, isn’t it?

Thanks, John

Hi John,

It cannot be reclaimed in the foreign country. But since we have an income tax treaty, we can mention it as already paid taxes. They won’t give it back, but it’s like a discount on your taxes.

Does that make sense?

Great guide, a couple of questions:

1. The answer might be in the article itself but somehow it was not 100% clear to me. For US ETFs, we have 15% withheld by the Swiss broker + 15% by IRS. If you use a Swiss broker you can claim back the former and if you use IBKR you can claim back the latter? Or you can claim back both?

2. R-US 164 when using a Swiss broker and Da-1 from when using IBKR, what’s the W8-BEN, and in what cases do we use it?

3. I’m taxed at source but need to still declare taxes when income is +120K, do you think I am eligible to get taxes back?

Appreciate your support.

Have a great day!

Bapt

Hi Bapt,

1) If you use US ETFs, 30% are withheld at source by IRS. If you take advantage of the income tax treaty between Switzerland and the US (by filling the W8-BEN form), this is reduced to 15%, and you can then claim it back.

Most US brokers will allow you to fill this W8-BEN. But I’m pretty sure that many Swiss brokers won’t allow you that.

Now that I reread this, I will have to check again what would happen with a Swiss broker (I have never used one).

2) I covered the W8-BEN above.

3) I would say that as long as you fill a tax declaration, you should be go to get these taxes back.

Hello Mr. The Poor Swiss,

Thank you for the great article. I would like to ask one question about the US taxes: could you clarify the role of the W-8BEN form (I see it mentioned in the context of non-US citizens investing in US securities)?

Or to put it more generally, do non-US citizens (residents in Switzerland) have to “establish a relationship” with the US IRS if they invest and/or claim back the withholding taxes?

Best Regards,

Stefan

Hi Stefan,

You don’t have to establish a relationship with the IRS. Filling out the W8-BEN is simply a way to indicate that you are eligible to tax advantages due to the US-CH tax treaty. This will allow you to reduce your tax withholding.

Hello,

Thanks for your informative and very interesting blog. My question concerns myself as an amateur investor . I recently started investing, in 2022, by using IBKR as a platform (btw I am a Swiss fiscal resident with a C permit). I mainly invest in US securities (mostly individual stocks and the VUG ETF at the moment, I am at a net loss of apr. 15% at the end of 2022), and here are my questions:

-Do I have to specifically file the IRS ”form 1042-s” aside from my habitual Swiss tax declaration? Or is it somehow automatically done by IBRK?

-Do I have to do something (taxwise) about the (minimal) dividends that I have received from some of my stocks? (I mean besides my classic swiss tax declaration which is done by my accountant).

Thank you,

Mike S.

Hi Mike,

You don’t have to file anything from the IRS if you are not fiscally linked to the US.

You don’t have to do anything else than what is listed in the article.

Really informative article!

1) If you are a somewhat active trader, with perhaps hundreds of buy/sell positions, it would seem cumbersome to fill in the form manually. Do you know if there is any way to automatize this? Would a high frequency trader have to input millions of positions manually?

2) If you are not an active trader, but prefer to have a stock portfolio rather than an ETF, with perhaps 300-1000 dividend paying stocks. Is there a non-manual way to input the data in the software?

Thanks!

Hi Corinne,

1) I have no idea if you can automate it and I would expect that even active traders have to list all operations

2) I don’t think so

Keep in mind that I have never traded actively, so never had any of these issues.

Hi Baptiste

Just to make sure: When you’re using a foreign broker such as Interactive Broker you don’t have to pay any taxes in that country? Only in the country of your residence (Switzerland, in your and my case)?

Thanks, Marco

Hi marco,

That’s correct. Using a foreign broker does not make you eligible to foreign taxes. On the other hands, owning some foreign stocks may make you eligible to some taxes. For instance, US stocks make you eligible to the US estate tax (but the US estate tax is not a big deal).

Hi there! Thanks so much for this article. I just opened an account with IB. However, I am taxed at source (i.e. I do not declare anything myself). Do you have any idea how it works in this case?

Hi Yana,

I don’t have experience with tax at source, but I would think that since you are taxed at source and don’t make a declaration, you don’t have anything to do that in that case.

That also means that you can’t get back dividends withholding on US ETFs, but the difference is not significant enough that it should matter in your case.

Hi Baptiste,

Thanks so much for the information. I had a personal question and was wondering if you could help with it? I am student who has lived in the UK for the last 3 years studying. My nationalities are both British and Swiss (have lived in Switzerland for over 14 years). My family live in Switzerland and my Brokerage account is currently under my Swiss address (although my parents denounced my residence 3 years ago when i moved to the UK). Am I still liable to Swiss capital gains tax exemption if I am a Swiss citizen but no longer a resident? I am currently with IB for shares and plan on investing in UCITS ETF’s. Thanks again.

Hi Jake

I would say that you are now liable under UK tax, no? Only Swiss residents and taxpayers are exempted from capital gains. If you pay taxes in another country, you must abide by their tax laws. So, it will all depend on UK taxes.

There is no general exemptions for capital gains tax for Swiss citizens.