How to Buy an ETF on Interactive Brokers the Easy Way

| Updated: |(Disclosure: Some of the links below may be affiliate links)

I have been using Interactive Brokers (IB) for several years. It took me a while to get used to this broker. However, I can now do all the operations I need easily. I will show you how to buy an ETF from start to finish on IB, the easy way!

Many readers were having a hard time starting with Interactive Brokers. It may be a little complicated initially, but it becomes straightforward once you do it. If you follow this guide, you will know how to buy ETFs from IB without issue!

This guide will show you how to buy an ETF directly from the account management interface. And we also see how to deposit money into your account from this interface and even how to convert currencies if necessary. So, we will cover all the steps to make your first investment with Interactive Brokers!

By the end of the guide, you will know exactly how to buy ETFs on IB!

Interactive Brokers Interfaces

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

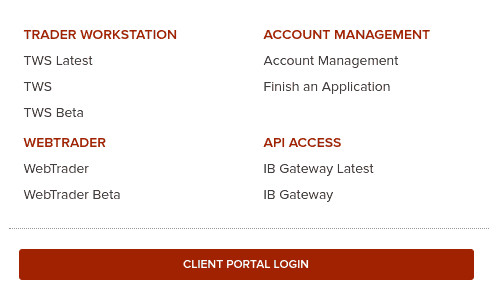

Interactive Brokers has several different user interfaces:

- Account Management

- Web Trader

- IBKR Mobile

- Trading Workstation (TWS)

This guide will show you how to buy an ETF from the Account Management interface. This interface is the simplest of all the interfaces. And this interface has all the features you need to buy your first ETF from Interactive Brokers. I have a guide on the different IB interfaces if you want to learn more. But do not worry, you only need one!

This guide will review how to buy the VOO (Vanguard S&P 500) ETF from the Account Management interface. Even though my example will focus on the VOO ETF, the process is the same for any ETF. For instance, I follow the same monthly steps to buy VT (my favorite ETF) and CHSPI (my Swiss ETF).

I will guide you through all the steps. The process starts with transferring the money to IB, converting it to USD, and finally buying the ETF. Of course, if your base currency is USD, you do not need step 2. And if your account is already funded, you do not need the first step either.

I assume that you already have an Interactive Brokers account. If you do not have one, you can read my guide on opening an Interactive Brokers account. And then, you can come back once you have created your account!

Usually, there should not be differences between the entities, but I recommend using the IB UK entity for Swiss investors.

The Best Interactive Brokers interface

The Account Management interface is the default interface of Interactive Brokers. This interface allows you to do everything you need:

- You can visualize your portfolio and see your investing performance.

- You can do basic trading. However, some of the advanced options for trading are not available from this interface (but we do not need them anyway).

- You can request a transfer of funds.

- You can generate reports of your activity or results.

This interface is excellent for most tasks. This interface is the only one I use for investing with Interactive Brokers. You should not fall into the trap of using a more complicated interface to do simple tasks.

To open this interface, you can go to the Interactive Brokers website. From there, you can click on the red Login button.

Go to the Client Portal Login or the Account Management link to access Account Management. They both do the same thing. You will need to enter your account name and password. And you will also need to use your phone for two-factor authentication.

Transferring money to Interactive Brokers

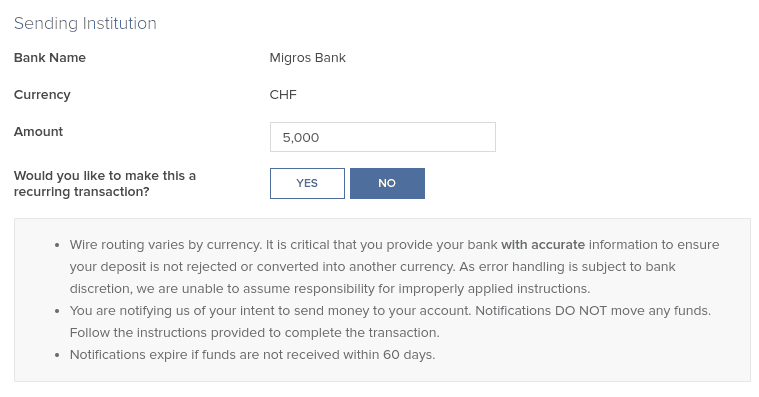

If you do not have enough money to make the trade you want, you must first fund your account. For example, you want to transfer 5000 CHF to your IB account.

There are two steps in this process:

- First, create a new deposit method.

- Then, declare an incoming transfer from a deposit method.

The first step is only necessary if you have never made a transfer from this source. If you already did it, you can skip it. We should see how to do both of the steps.

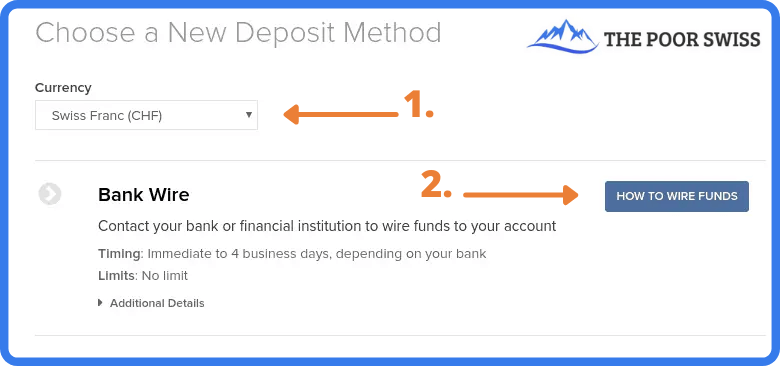

1. Create a new deposit method

On Interactive Brokers, you must first declare the transfer’s source.

It is only necessary to do this once for each source. You can have many sources in many different currencies. However, the source of the deposit must be an account in your name. But it does not have to be in the same currency as your account currency. This is highly convenient to fund your account from different sources.

To access this view, go to Menu > Transfer & Pay > Transfer Funds. If you want to declare a new source, click on How to wire Funds. Then, you must fill in some information about this deposit method.

Make sure to double-check all the information. IB will use this information to associate the incoming funds to your account. If something does not match, the fund transfer may be delayed.

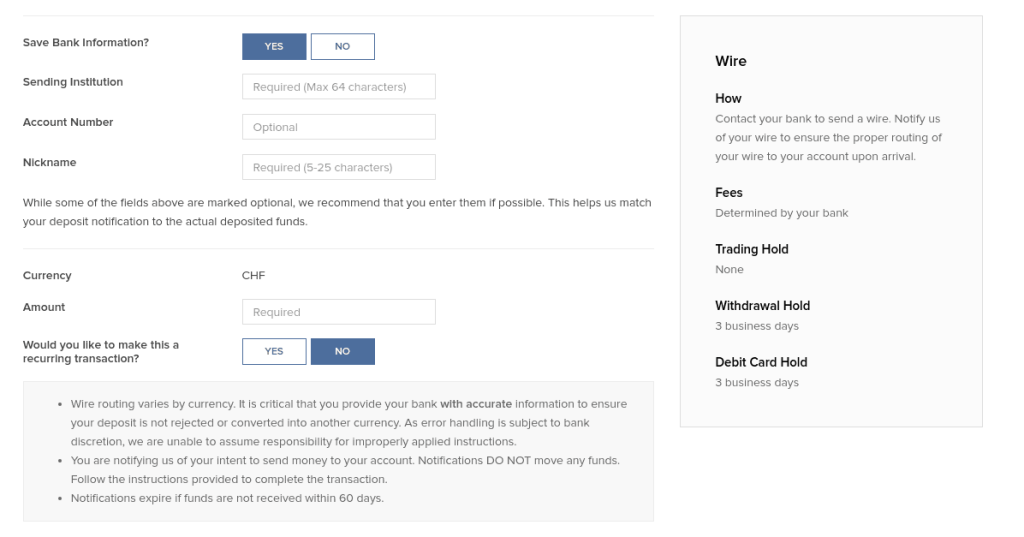

2. Declare a new wire transfer

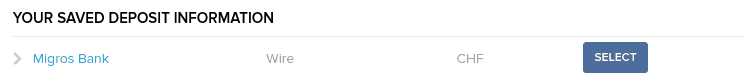

Once you have created your deposit method, you must declare a new transfer from this method. You will have to do that every time you do a transfer.

Return to the Transfer Funds view and select one of the deposit methods. You should have one for each bank account from which you plan to send money to IB.

Once you have set the correct amount you intend to transfer (5’000 CHF in my example), you can continue, and Interactive Brokers will give you all the information for the bank transfer.

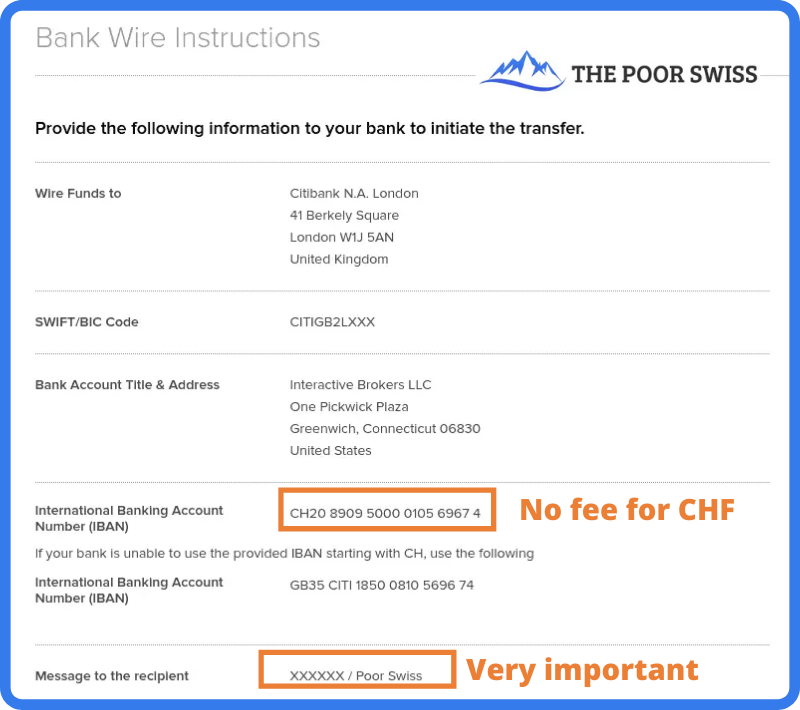

This view should give you all the necessary information to perform the wire transfer from your bank. Be careful about setting the correct message to the recipient. This message should contain your account number and your name.

This information is what Interactive Brokers will use to identify the transfer. If you do not use the correct information, the transfer may take a while to be processed and returned to your bank account.

You can then initiate the transfer from your bank. If you transfer CHF, use the CH IBAN (IB should present it by default). That way, the transfer will be entirely free. Once you initiate the transfer, reaching IB may take a few days. But, generally, it is pretty fast. When my bank executes the transfer, I usually see the money in my IB account the same day.

You may be assigned another IBAN (from Credit Suisse) to wire money to your account, depending on when you created your account. This other IBAN is also a CH IBAN you can transfer to without fees. In this case, follow the instructions given to you by IB.

Convert currency from Account Management

Since April 2024, you do not have to convert currency directly. Indeed, if you have a cash account, IB will automatically buy the currency you need from your base currency. If you want a little more control, you can do the conversion yourself.

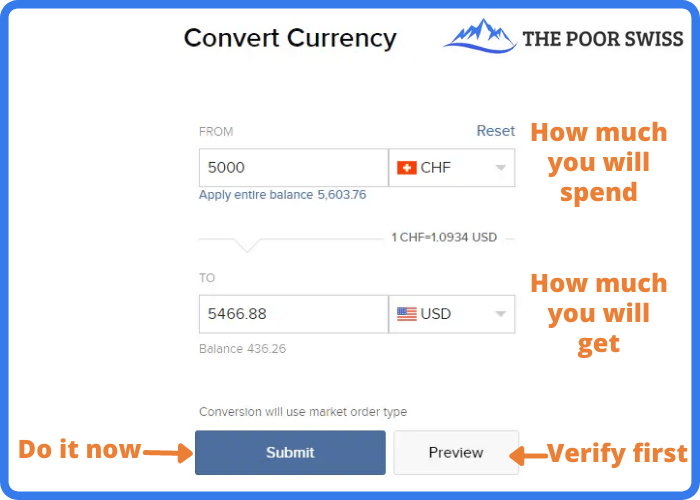

If you plan to buy an ETF in another currency, you will first have to buy this currency. It is straightforward to do so from the account management interface.

You can go into the menu and click on Convert Currency.

In this view, you can choose which currency you want to convert and into which currency. Next, enter the amount you want to convert and click Submit. Interactive Brokers will then generate an order for you on the forex market. And once this order is executed (generally instantly), you will get your USD.

If you want more control, there is another way to convert currency. You can buy currency like you buy shares (see next section). For instance, you can purchase shares in USD.CHF, which means buying some USD with some CHF. If you want to buy USD with EUR, you can look for USD.EUR. If you want to buy EUR with USD, you can trade for EUR.USD. You get the idea!

This method will give you more options. But in most cases, the simple conversion will work nicely. I only use the default currency conversion method since it is simpler and saves time.

Buy an ETF on Interactive Brokers

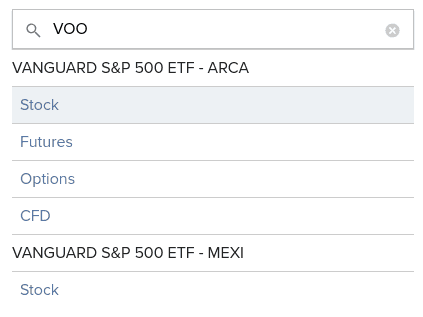

Once you have enough cash in the correct currency, you can buy some VOO ETF shares (or any other ETF). You can use the search function from the top right of the interface.

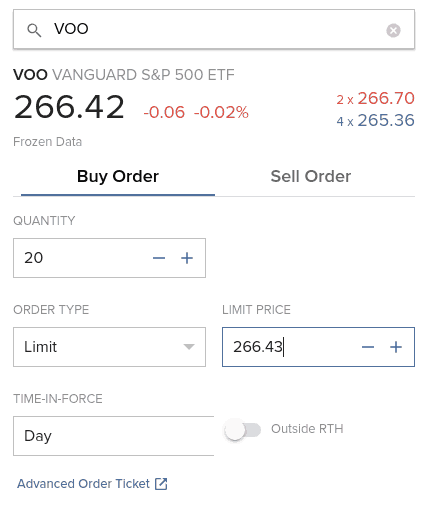

You can type VOO or the name of any other ETF you wish to buy shares from and type Enter. Interactive Brokers will propose several options (Stock, Futures, Options, and Contracts For Difference (CFD)). ETFs are listed as Stock. And sometimes, you will also see several exchanges. Here, we want the Stock on the ARCA exchange.

If all these values confuse you, do not worry! Here is what they mean:

- 266.42 is the current market price.

- -0.06 is the last change of the market price in absolute value.

- -0.02% is the last change of the market price in percent.

- In red, you will find the ask volume and the ask price (266.70)

- In blue, you will find the bid volume and the bid price (265.36)

And the fact that it is written Frozen Data is because I did not pay to get real-time data for this particular market. Or it could also mean that I am trading out of hours. If you are a passive investor like me, you only need to worry about the current price. You can ignore all the other information.

Then, you can set the amount you want and the Limit price. Since it is a trade, you can use several order types: Market, Limit, Stop, and Stop Limit. If you are trading with a popular ETF, you can use a Market order.

The execution on IB is good enough that you will not have issues with market orders. Otherwise, you can use Limit Orders. You can set the Limit price based on the current data. But be careful about not trying to optimize too much.

I only use Market Orders. They are simple and not nearly as inefficient as some people think.

You can also set the duration of the order. Either the order is valid only today or Good Till Cancel (GTC). If you want to learn more about these options, I wrote an entire article about stock market order types.

I would advise using the Preview option to ensure you want this operation.

This view will give you all the information you want about the order. You need to pay special attention to the amount and the commission.

For instance, I would have paid 5328.60 USD for the purchase of 20 shares, and I would have only paid fees between 0.31 and 0.41 USD (yes, IB is that cheap!). Once satisfied with your order, click Submit to validate it and wait for it to be executed.

If you use a market order and the stock exchange is open, IB will instantly execute. IB will execute a limit order based on the price you set. If you set a price higher than the current price, it will also be executed instantly.

Congratulations, you now have shares of your ETF! You can follow this simple every month and be on your way to using the stock market for great returns!

Warnings from Interactive Brokers

When you trade with IB from the Account Management interface, you may encounter several warning popups on your screen. You will get used to it. But when you are starting to invest, it can be overwhelming. So, here is what the biggest warnings mean.

And do not forget to click the check box to avoid seeing them again!

Warning about small currency transactions

The first warning is when you do a small currency transaction below 25’000 CHF.

In that case, IB will tell you that the order is too small to use IDEALPRO and FXCONV instead. You do not need to worry about that! They are just two different routing systems.

For orders below 25’000 CHF, IB will not guarantee interbank exchange rates. So, you may be getting a slightly worse deal. But the difference is negligible enough that you do not have to worry about it. I have converted many times small amounts with IB without any issues.

Warning about lack of real-time data

The second warning that could pop up is when you buy an ETF without real-time data.

If you are like me, you will not have paid the monthly fee to get real-time prices. Passive investors do not need real-time pricing! The prices you see in the interface are delayed by 15 minutes. If you need real-time data, you can always look at Google Finance to see them.

So once again, do not worry about this warning.

Warning about price caps

The third warning is about mandatory price caps. This warning is probably the least obvious of the three.

In 2016, Interactive Brokers started implementing price caps for market orders. It means that a limit order with a price significantly different from the market price cannot be executed even though it would be valid otherwise. IB uses its way of setting price caps to decide what is fair and what is not.

For instance, if a stock trades at a market price of 100 USD and you open a buy limit order at 50 USD, IB will not take this limit order into account to execute against other market orders.

Thus, using price caps on market orders is simply a protection for investors using market orders. This protection is good for honest investors like you and me.

Once again, you can safely ignore this warning.

FAQ

How much does it cost to convert currency on IB?

Converting currency on IB will cost you 2 USD, regardless of the amount. For medium to considerable amounts, this is very cheap. But you should avoid converting tiny amounts.

Conclusion

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

Now, you are already done! You will now have more shares of the VOO ETF (or any other ETF you want to buy). The entire process is the same for any other ETF. You have to change the name you are searching for, and if it is available in Interactive Brokers, you can buy it.

It is straightforward to trade from the Account Management interface. You can do all the basic investing tasks from this interface. Likely, most simple investors will never need any other interface.

As you can see, you can do much from the Account Management interface. Even though its name talks only about managing your account, it can do much more than that! You can do most things on this interface.

Of course, there are a few limitations. For instance, some Interactive Brokers order types are not available. But that is not an issue for simple passive investors. The account management interface is the only one I use, and I never found anything missing. I invest every month using this interface.

For beginners with Interactive Brokers, I recommend using the Account Management interface. Once you are more familiar with it, and if you are interested, you can start exploring the other interfaces. But you can go your whole investing life only using this single interface.

To streamline your investing, you may consider automating your investments with Interactive Brokers. With that technique, you will have almost nothing to do to invest each month.

If you prefer trading from your mobile, you can buy ETFs from the IBKR Mobile Application. Or, if you need additional information on this broker, read my review of Interactive Brokers.

Do you have any questions on how to use IB? Do you have any tips for the Account Management interface?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Brokers

- More articles about Investing

- Swissquote Review 2024 – A great Swiss Broker

- How do commission-free brokers make money?

- Yuh Review 2024: One app to pay, save and invest

Hi Poor Swiss. Do you know if fractional buying of ETFs is available via IB and how does it work? For example, I don’t want to buy 20 shares of a fund, but rather buy USD 1000-worth of shares? I’m seeing this video on the IB site on the topic https://www.youtube.com/embed/STS54N8DPvs?rel=0

Hi Drago,

Yes, you can trade in fractional shares in IB. By default, this is not enabled. But you can enable it in your account settings. However, this is only available for U.S. stocks. So if you invest in European stocks or Swiss stocks, you won’t be able to do it.

Now, I have never done that. I have not even enabled the option. But I would think that ETFs should work exactly in the same way as stocks since they are basically the same thing.

I personally would not want to trade in fractional shares. The problem is that the share is not really yours. It is held by IB and then shared between different investors. In case a problem arises, it may be difficult to claim the share.

I’d rather keep until the next month and then buy the rest of the shares rather than buy 19.4 shares for instance.

Just know that it won’t make a big difference in the long-term whether you invest 19.5 instead of 19 shares (and then buy a next extra one after two months).

Thanks for stopping by!

Hi! Thanks for the feedback! Up to now I was playing around with stocks and ETFs on a small scale to get some experience of the stock market and was mostly trying to buy during dips. But like you said, opportunities are missed that way and funds are left unused. So I might just follow your example and just increase my ETF portfolio whenever I get paid once a month with a view of the long term.

Hi Mr. The Poor Swiss (and everyone else!),

I plan to increase my World UCITS ETFs portfolio (also have IBKR, EUR as base currency), and wonder if there is a timing method for when to buy them. I have read in another blog about someone who buys them seasonally every quarter to compensate for fluctuations. Another one just advises to buy during dips. Do you have any specific strategy/approach in regards to when to buy your stocks/ETFs or do you consider that it will gain value in the long term and hence it doesn’t really matter?

Thanks!

Hi Conman,

I do not have any approach to this.

As long as I am investing for the long-term, I am investing whenever I have money, generally once a month. Once a quarter makes sense in order to save on some trading fees (but does not make sense if you use a cheap broker like IBKR).

I do not have any expense investing for the short and medium-term.

Buying the dips is easy to say but complicated to do. If you wait too long, you are going to miss on opportunities. If you do not wait enough, it’s the same thing. Therefore, it’s better to not wait at all :)

What is your current strategy?

Thanks for stopping by!

Guys..if you are from EU, you can invest in UCITS ETFs. Vanguard and many others offer them

Sorry this was the actual notification ” No Trading Permission, Customer Ineligible; Ineligibility reasons: This product is currently unavailable to clients classified as retail clients. Note: Individual clients and entities that are not large institutions generally are classified as retail clients. There may be other products with similar economic characteristics that are available for you to trade”

Hi David,

That sucks! Which country are you from?

People from the European Union are not allowed anymore to trade in U.S. ETFs since they passed a stupid law to force people to invest in subpar financial products.

Thanks for stopping by!

Hi Mr. The Poor Swiss,

How did you get around the EU laws for US based ETFs? Do you have american citizenship?

Thanks!

Hi Gigiduru,

I am Swiss :) Currently, the EU laws do not apply to Swiss investors.

However, by 2020, there will be a new set of Swiss laws that are mostly mirroring the EU laws. They are slightly different, so it’s not clear if they will block us from investing into U.S. ETF, but it’s probable.

Thanks for stopping by!

Hi

I will start buying ETFs on IB beginning of 2020.

Do you think it makes sense to still buy US ETFs?

I thought of buying the Ireland based ones like the iShares SP500 UCITS or the Vanguard SP500 UCITS.

Another question I d have is:

On which exchange would you buy them? For example, the Vanguard can be bought at SIX in CHF, or LSE in USD and I am trying to figure out where to buy it and in which currency?

Regarding liquidity, it would make sense to buy at LSE no?

Is it also possible to automate purchasing etfs on IB ? Something like a savings plan?

Best,

Reto

Hi Reto,

Yes, I think it still makes sense as long as you can. If you are planning to start next year, you should definitely wait until next year to decide. Maybe we will know on January 1st if something changes or not.

Funds should always be bought in their original currency and in their biggest exchanges. Like this, you won’t pay any fees for currency exchange. And you will have better liquidity (lower spread).

For VUSA, I would buy either on Euronext or on LSE.

I do not know if it’s possible to automate, probably. I do not like automation for my money ;)

Thanks for stopping by!

Hi,

I cannot buy ETFS such as VWO or GLD… It says that it is only for institutional investors. Anyone with the same problem?

Thanks for the article!

An useful article thank you. When I bought my VOO a lot of pop up warning showed up. I click ok on all and it worked well, was a bit confused through by all the warning :)

Hi Maxine,

Yeah, the first time I bought something, I was also confused by the warnings. I remember that one of them was because I did not have real-time quotes for United States. Once you get used to it, it’s fine, they just want to protect themselves!

Thanks for sharing :)

Hi Mr. The Poor Swiss,

Thank you for sharing your knowledge. It’s greatly appreciated. I am taking my first steps towards ETF investment using IB, so this post is just a godsend for me.

Let me ask you several questions:

1)”Contrary to other brokers, you do not have an option to simply convert the currency. … On the other hand, it is very cheap to convert currencies on Interactive Brokers.”

How can I caclulate the exact fees for the conversion? Is there any formula? When I tried to buy USD I was given some diapason, for example: commission 2.01 … 2.52 CHF. I find it very weird. Can you imagin the situation when you come to Migros to buy a bottle of orange juce and you see the price: 1.0 – 1.55 CHF. Only at the time when you pay, the cashier decides how much exactly she/he wants to charge you :) Would you like it?

2)”Once you are sure of what you want, you can either click on Preview to view how much you are going to pay or directly click on Submit Buy Order to send the order to IB”.

Looking at the screenshot you provided I can’t find any of the buttons you mentioned:) But it is not a problem. What is real issue for me is all these numbers shown on the picture. I believe that the most important number here is 1.00265 which is what? Is it Bid or Ask? (In WebTrader you can see both: Bid and Ask and easily calculate the spread.) What do all other numbers mean? What is 500K x 1.00321, 1M x 1.00208? What is 0.01% frozen data? I also see +0.00015 in green. Initially I thought that the current exchange rate was recently increased by this amount of money, in other words it was 1.00250 a second ago, but then I realized that it’s not true. So, I am still puzzled what it means. The only thing I am more or less sure about is that the value will be red if it is negative :(

I also noticed that your limit price for the buy order is a little bit lower then the current exchange rate, which means that you want to buy USD for maximum 1.002 CHF while it is currently sold for 1.00265. In this case, I am afraid you might never buy USD if I understand this correctly. If I am not mistaken, it is better to set the limit for a buy order a little bit higher than the current price, i.e. 1.003 in your case, isn’t it?

I also noticed that when an order is created in Account management, the price limit is filled correctly. Several seconds later the exchange rate changes, but the limit stays the same. In WebTrader for example, you’ll see the Limit Price changing while you fill other fields of the order. This is good because it sticks with the current exchange rate.

3) I tried my first conversion from CHF to USD. I transfered 100 CHF to my IB account to test the system. I decided to buy 96 USD. The exchange rate was: 1,00769, so I spent 96,73824 CHF. When I was previewing my order I saw several popups. The first one was very confusing:

“Important Note: Your order size is below the USD 25000 IdealPro minimum. You may cancel and increase the order size if you wish to route to IdealPro or select the Transmit button to route as an odd lot order. Note that odd lot orders are not guaranteed executions at the IdealPro displayed quotes.”

What does all this mean? What is IdealPro in particular and why do I need it? Do you usually have your order size above the 25000 USD?Several other pop-ups warned me about risks and other issues.

Now we are coming to the most interesting part. In my portfolio I see the following:

Cash

CHF: 1.24

USD: 96

Total Cash (in CHF): 98.16

This raises so many questions, so I even don’t know where to begin.

As I mentioned already, I had to spend 96,73824 CHF. This means that remaining amount should be 100 – 96,73824 = 3,26176 CHF. Why do I see only 1.24CHF? Does it mean that IB took 2,02176 CHF as a comission for conversion?

How do they calculate the Total cash? If I calculate it, I get a different value: 96 * 1,00769 + 1.24 = 97,97824 CHF.

4) A day after the conversion I received an email from donotreply@interactivebrokers.com :

Dear IBKR Client,

Your Daily Activity Statement and Official Trade Confirmation for May 13, 2019 are now available for account U***XXXX.

Interactive Brokers

The email does not have any attachments. It does not tell where this statement is available. What a useless message! Could you please tell me where I can find this “Daily Activity Statement”?Thank you in advance and I apologize for so many questions.

Hi Aleksei,

1) I think the reason they are displaying it like that is because, before the order is executed they do not know the final value that is converted. However, it is easy to know how you convert.

The fees for converting currencies are 0.20 * 0.0001 * ConvertedValue, with a minimum of 2 USD. So you will basically pay 2 USD unless you convert an immense amount of money at once. If you convert more than one billion USD in a month, you will get better rates, but I guess you are not there yet!

2) Frozen Data means I am not seeing real time prices. This is because I did the screenshot outside of trading hours.

The 0.01% is the last change and the number in green next to the price is also the last change in value.

The number in red on the right is the Ask price and volume

The number in blue on the right is the Bid price and volume

You’re right, in Account Management, the Limit price is set once and not adapted, you have to adapt it yourself.

However, if the Limit price is lower than the market price, it will wait until the limit is reached. If the market only goes up, then it is possible that it will never be filled. However, my Limit was really possible. I was trying to get a little sale on the price of the USD. USD/CHF prices are relatively stable and I did not need the money directly anyway.

3) They have two different ways of doing currency conversion. IDEALPRO and FXCONV (the default). It is possible that you get a slightly better price on IDEALPRO, however this is so small that it should not matter for people like us who are converting small amount of currency (<100'000). If you convert more than 25K, I believe it's automatically using IDEALPRO. But I am really not sure.

Another difference is that FXCONV will create virtual positions in your portfolio. These positions will be visible in the WebTrader for instance. They do not make any difference and generally disappear after some time. You should really not worry about that.

For your math, it seems to make sense. The minimum fee is 2 USD, therefore you should avoid converting very small amounts. As for how they calculate total cash, I do not know, but they probably use real time data and they probably use the market price.

4) Unfortunately, IB will not send you reports by mail. They will only tell you that it is available. I agree that it's pretty useless!

To generate it, you can go to Account Management, click Reports on the left menu and then Statements. And from here you can generate a shitload of different statements.

I realize that there are some things missing from this article, I will improve it when I get the time, it's in my TODO list now :)

Thanks for stopping by!

Actually it’s possible to get HTML reports by email, I don’t remember where it is but somewhere in acct mgmt you can enable it.

Thanks for the tip Maci :)

I will have to check this out, I would like to get a report directly by mail without having to log in.

Hi, I’ve looked at your article and their pricing scheme and I have a hard time to find case when it’s more expensive with tiered pricing, even on lowest tier. Do you have an example maybe?

Hi Maci,

It’s indeed difficult to find good examples of when it would be more expensive. On their website examples, there is one example that is slightly more expensive with Tiered. There are also some examples for other Exchanges (European / Hong Kong), where it is often better to use Fixed. However, for U.S. funds, Tiered seems to be always better for my way of investing.

Thanks for stopping by :)

Hi there. Nice of you to share your experiences for all of us. Much appreciated.

As you must be aware, since December 2019 IB included Fractional Trading on stocks. Do you happen to know if it is available also in Europe on EUR ETFs?

I can’t seem to make it work…

I’m diversifying my portfolio monthly with IWDA + EMIM + IUSN + AGGH and it doesn’t work on either of them…

Thank you for your time!

Hi Marian,

Did you enable the fractional shares option in the configuration in IB? I only remember seeing the option for U.S. shares on my end.

It’s quite possible that they only allow this for the U.S.

But do you really need that?

Thanks for stopping by!

Hi you poor swiss :)

Actually I had a chat with them and it turns out it’s only available for US stocks/etfs.

I did need that because it would make my monthly allocation easier as i could purchase an ETF for a fixed amount of Euro. Given that the stocks differ very much in value i’ll need to kinda rebalance every month.

Anyway, I’ll figure it out somehow! Thanks for the response.

Hi Marian,

What I do to avoid this issue is simply to buy only one ETF each month. I always buy the ETF that needs the most shares to be balanced.

When you have a small portfolio, you will be unbalanced for a while, but it will stabilize a bit more each month.

Thanks for sharing what they said!

I guess you’re using tiered pricing? Are there any downsides vs fixed? Doesn’t seem like a much difference though, with fixed you’d pay 1 USD.

Hi Maci,

Yes, I am using the Tiered Pricing. There is no downside for my personal investment situation. However, you need to check for your own investment.

It’s not much indeed, but I am doing about 2 trades a month, that’s about 18 USD saved per year. Not a huge difference, but every little bit helps ;)

I wrote an article about the Tiered Pricing of Interactive Brokers, this may help you!

Thanks for stopping by and welcome!