What is the best third pillar in Switzerland for 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

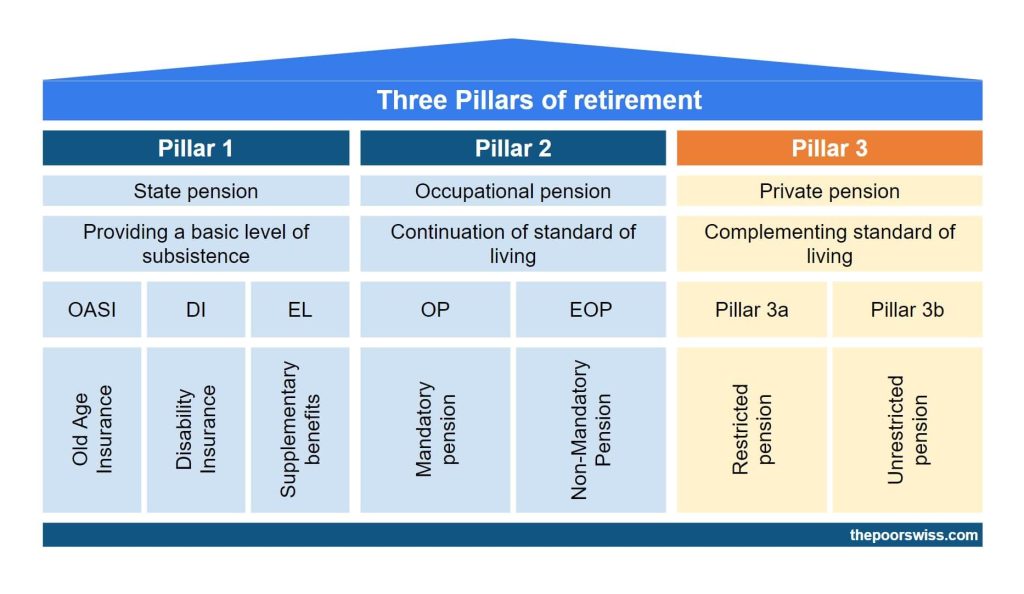

In Switzerland, contributing to your third pillar is one of the easiest ways to save on taxes. I recommend everybody to contribute to their third pillar.

But contributing to your third pillar is not enough. You should invest the money in your third pillar. That means you have to pick the best third pillar for your money. Since there are many options, choosing the best third pillar for your needs may be difficult.

So, this article is here to help you! We see how to choose the best third pillar!

What makes the best third pillar?

First, we must consider what makes the best third pillar. We must decide which factors will drive the choice.

I assume you already know about the third pillar and are contributing to it. If you do not, you should learn why you should contribute to the third pillar.

We only consider bank third pillars, not insurance third pillars. Indeed, in almost every case, a bank third pillar is much better than an insurance third pillar.

The goal of your third pillar is to provide you with enough money to retire comfortably. Therefore, you want your invested money to grow as much as possible while not taking too much risk. So, the best third pillar must support this goal!

There are three critical factors in choosing the best third pillar:

- A large allocation to stocks will increase your returns in the long term.

- A diversified stock allocation reduces the volatility of your portfolio.

- Low management fees to avoid wasting your returns in fees.

Since we are counting on the long term, there are also some things we can ignore:

- How good the app looks does not matter. You will spend less than an hour every year.

- The interest on the cash part is irrelevant unless you do not want to invest.

We will now delve more into the details of the three critical factors.

Allocation to stocks

The best third pillar has a significant allocation to stocks.

It will depend on your situation, of course. You need to choose yourself your asset allocation. Recently, Swiss bonds have had negative interest rates for about ten years. When this is the case, what is not in stocks should be invested in cash.

I want to allocate as much of my third pillar to stocks as possible. I already have bonds in my second pillar, and my current allocation to bonds is more than enough. Ideally, a third pillar will have a 100% allocation to stocks.

Diversification

The best third pillar has a diversified stock allocation.

Switzerland is too small of a country to only invest in its stocks. We need to have global stocks (stocks outside of Switzerland). Ideally, the allocation should be the same as a world stocks fund. Since the Swiss stock market represents about 3% of the entire stock market, we should avoid investing much more than that.

Unfortunately, this is not possible in Switzerland. The law states that the third pillar must have at least 40% allocated to Swiss stocks. So, an ideal third pillar should have 60% of international stocks and 40% of high-quality Swiss shares.

As we will see later, there is a way against this limit, making some third pillar providers significantly better than others.

Fees

And last but not least, the best third pillar has fees as low as possible.

I want my third pillar to have zero load fees. I do not want to pay to get money inside the fund. The absence of load fees is essential. You should never use any fund with load fees.

Moreover, the yearly fees must be low, and the TER must be as low as possible. Most third-pillar accounts in Switzerland have higher than 1% TER.

When you are investing for the long term, it is essential to minimize investing fees. The difference in returns in the long term is significant.

Third Pillar from a Bank

Most people in Switzerland will invest in a third pillar their banks provide. And they have a ton of options. Historically, they have been the only option available for third pillars.

I will not go over all the possible offers here. Indeed, there are too many of them. And most of them are terrible options. But I will go over some interesting options from some popular Swiss banks.

We will use the third pillar accounts from banks as examples. These are not the best third pillars.

Migros Bank Fund 85 V

My current bank is Migros, so I wanted to check their offer.

They have several retirement funds. The most interesting is Migros Bank Fund 85V. It has 85% in stocks and the rest in bonds and money market. The TER is 0.94% per year.

The allocation to stocks is slightly low but not too bad. The TER is not that bad for a Swiss bank. But I would not recommend this fund.

LUKB Expert Fund 75

Many people recommend the Luzerner Kantonal Bank’s LUKB funds. Let’s take a look at their LUKB Expert Fund 75.

This fund has 75% of stocks, which is alright but not great. 40% is invested in Swiss stocks, 35% in global stocks, 15% in Swiss bonds, 4% in international bonds, and the rest in liquidities and real estate. The diversification is not too bad when compared with other options.

It has a TER of 0.8%. For third pillar accounts in Switzerland, this is a good TER. However, it has a load fee of 0.4%. The TER is okay, but the load fee makes it highly undesirable.

PostFinance Pension 100

Many people are using retirement funds from PostFinance. So, we can take a look at the PostFinance Pension 100 fund.

This fund invests 100% in stocks. 72% is invested in Swiss companies, while 28% is invited globally. And the TER is 1.01% per year.

The allocation to stocks of this fund is quite reasonable. 100% allocated to stocks is the best you can do in your third pillar. However, more than a 1% yearly fee is already significant. And this fund is not well globally diversified since only 28% of the stocks are international. This is significantly lower than we would like.

Raiffeisen Pension Invest Futura Equity

Since many Raiffeisen banks have a good reputation, it is a good idea to look at their retirement funds, and more specifically, the Pension Invest Futura Equity fund, a mouthful.

This fund has between 80% and 100% in stocks. I do not know why it is not fixed. But the last invested value I saw was 95% in stocks, which is good. 47% is invested in Switzerland, which is not great but not the worst.

The TER of the fund is 1.42%, which is very bad. While it is not the most expensive fund in Switzerland, it is the most expensive that I will mention today. And it is way too expensive for people to consider.

Swisscanto Fund 95 Passiv VT

Swisscanto provides many Swiss funds, and many banks use them. We can examine the Swisscanto Fund 95 Passiv VT.

This fund invests 95% in stocks, which is excellent. The diversification is also good, with 65% invested in foreign equities. However, they hedge most of the equities, with 72% in CHF for the entire fund. This is not great for currency diversification.

On the fee side, this is an excellent example of how banks are trying to make it complicated for people to know how expensive it is. The flat fee for the fund is only 0.38% per year. At first sight, it sounds great. But if you look in detail, we can see that this is a fund of other funds, so there is an extra 0.33% in fees for the sub-funds. But they never show the full fee of 0.71%. On top of that, they are adding a 0.1% issuance fee and a 0.09% redemption.

It is the most complicated fee system I have seen during my research. They use several small fees not to scare customers away, but when you add up all the costs, this does not make them very attractive. And just because of this lack of transparency, I would not invest in their funds.

Independent providers

As we saw, offers from banks are not that great. Fortunately, recently, many independent providers have started in this market. And they are offering much better conditions than banks.

We have seen that banks have high fees, sub-par diversification, and not aggressive enough portfolios. Independent providers are fixing all these issues. So, to find the best third pillar, we need to look at these independent providers. Note that they are not all good. There are also some bad options.

There is no disadvantage to having your money in a third pillar from these companies instead of at a bank. They only have advantages.

There are many, but I will only mention two main providers in this article: Switzerland’s two best third pillar providers.

Finpension 3a – Best Third Pillar

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

For most long-term investors, Finpension 3a will be the best third pillar available in Switzerland.

Indeed, they have some powerful advantages going for them:

- You can invest up to 99% in stocks

- The fees for an aggressive portfolio are extremely low, at 0.39% per year.

- They have a mobile application and a web application.

- You can make custom portfolios with a lot of liberty.

Finpension 3a is the best third pillar for long-term returns, with a high stock allocation and low fees. This is a great way to ensure your money is well invested until retirement.

Interestingly, Finpension also runs an excellent vested benefits account. They are experienced in the pension industry and provide great products.

Finpension 3a is the best third pillar available for aggressive long-term investors. So, in 2021, I started investing my third pillar in Finpension 3a. As for 2023, I am still using them and have five portfolios with them.

For more information, you can read my review of Finpension 3a.

VIAC – Good Conservative Third Pillar

In some cases, VIAC is an interesting alternative as well.

VIAC is a little more mature than Finpension 3a. They also offer an excellent third pillar. In general, they have several disadvantages over Finpension:

- Their custom strategies for investing are more limited.

- The fees are slightly higher.

- You are limited in your maximum foreign currency exposure.

However, they have some advantages for conservative investors who would not invest fully in stocks:

- They allow you to invest in cash or bonds.

- The fees are lower if you invest in stocks and cash. Indeed, you only pay fees on the invested part.

So, if you are a conservative investor (or a short-term investor) and do not want bonds, VIAC may be better.

But this is only true if you do not use bonds. If you use stocks and bonds, Finpension 3a is cheaper.

VIAC used to be the best third pillar until Finpension 3a came along. But it is only interesting in a few cases now.

For more information, you can read my complete review of VIAC.

Conclusion

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

Overall, the best third pillar available in Switzerland is Finpension 3a. They offer the highest allocation to stocks and the lowest fees. On top of that, you can create custom portfolios with a high degree of liberty. This makes them an excellent option!

For these reasons, in 2021, I invested in Finpension 3a instead of VIAC, and I recommend that all aggressive investors do the same. I have five portfolios with Finpension 3a.

If you open a Finpension 3a account, please use my code FEYKV5, this will help the blog and give you a 25 CHF fee credit (if you deposit 1000 CHF in the first 12 months).

If you need more information on these two third pillars, I have an article on VIAC vs Finpension. This article goes more in-depth into the comparison.

What about you? Which is your favorite third pillar?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best retirement accounts

- More articles about Retirement

- True Wealth 3a Review 2024: Pros & Cons

- Interview of Daniel Peter, CEO of VIAC

- Inyova 3a Review 2024 – Pros & Cons

Hello TPS,

Congratulations for the very useful and informative posts. Have learned a lot from them and the comment threads.

I have questions in two topics whose answers I haven’t managed to find:

1) I understand that there is a maximum tax-free amount that I can invest per year on the pillar 3a, but could I (and would it be advisable at all) invest more if I don’t claim the tax reduction for the excess money after the limit is reached? For example, if I open two pillar 3a accounts the same year and deposit in each the nominal maximum, but only register one in my tax declaration.

2) I was told once it is advisable to split the money in several pillar 3a accounts. How much per account would you advise to have, so that it is tax optimized?

Thank you soo much in advance for the time, and also once more for preparing your excellent posts :)

Hi Jose,

1) No you can’t. The third pillar is also exempt of net worth taxes, hence the limit would also apply to that. In fact, most third pillar providers will prevent you from depositing more than the limit. There is no advantage in depositing more than the limit.

2) That is correct. You should have 5 accounts, ideally each with more or less the same money inside. The reason is that you can start withdrawing your third pillar up to five years before retirement age. And doing that results in lower taxes.

Hi, about your answer to the point 2) above:

When you say “different accounts” that also means with different providers?

Or can you have 5 different 3a Pillar accounts with Finpension, for example?

Because as I understand, this is not the same as having 3 different portfolios within Finpension, right?

Thanks!

Hi mfb,

No, you can have 5 accounts with the same providers.

And yes, 5 different portfolios at Finpension count as 5 accounts. This is what I plan for my own retirement.

Hi!

Thanks for a great article! I have a couple of questions related to the case when people move out of Switzerland.

1. Is one able to still pay into a Finpension or VIAC account if living abroad? If I’m not mistaken, it is possible to continue paying in the SwissLife account, I don’t know if it is their own perk, or is this common across the board.

2. If not, is it mandatory to cash out immediately when moving?

3. Is there a chance to stretch the withdrawals while living abroad?

Thank you!

Hi,

1) No. You can only contribute to the third pillar if you have a salary in Switzerland.

2) No, it’s not mandatory. But it may depend on where you are going and whether this country has a social security treaty with Switzerland or not.

3) I don’t know. I would think no, but it may depend on each country. I would recommend contacting your third pillar provider or tax office for that kind of question.

Hey Migros have launched a new product (MiFuturo) https://www.migrosbank.ch/fr/personne-privee/prevoyance/prevoyance-enligne.html.

You could go up to 85% in actions. TER is not the lowest (0.9%)

That’s interesting, but as you pointed out, TER is not the lowest and it’s actually quite expensive, twice more than Finpension 3a. I would not recommend that.

Putting all of your 3rd pillar into stocks/etfs may be tax inefficient in terms of your overall portfolio allocation and total return in the long term.

See this article (DE only, easy to translate and graphs should work as non native speaker) for a breakdown of the reasoning: https://www.graffenried.ch/de/ueber-uns/publikationen/?oid=10225&lang=de&news_eintragId=20041

In summary their argument is the following:

1. You do get a yearly tax benefit from investing in the 3a pillar. This tax benefit cumulates over the years and is one contributor to your positive return in 3a pillars.

2. You can choose between different investment vehicles for your 3a pillar from cash accounts to etf/stock offerings like the ones discussed in your article.

3. When your funds from your 3a pillars are distributed/drawn during or shortly before retirement, you will have to pay full capital gains tax as they are counted as income on payout. This is often overlooked and means that also for etfs and stocks where you usually do not pay capital gains tax you will have to do so in your 3a pillar on payout. While this can be mitigated somewhat by streching the withdrawal over 5 years it still may be significant, especially with a 100% stock portfolio that did well in the market.

4. The capital gains tax on your stock/etf returns in your 3a pillar may lead to a situation where you pay so much taxes that the cumulative tax savings gained that I mentioned in 1. is entirely eliminated and you would have been better off to just invest your money without 3a in the same etfs (avoiding the capital gains tax on selling/drawing) in the free 3b pillar.

My general recommendation therefore is to view the 3a pillar as an overall part of your portfolio and asset allocation. If you save a lot besides your 3a it is imho generally more tax efficient to go with the higher risk/return assets outside of the 3a and do a more conservative cash or small stock allocation in the 3a, so that you take full advantage of your cummilative tax savings and do not wipe them out via capital gains taxes.

I was not aware of this for a long time and wanted it to bring to your and your readers attention.

Hi Stephan,

It’s true that you will pay taxes on the entire amount, including the capital gains. However, it’s not true that this is taxed as income. This is taxed at a special progressive rate based on the amount. So, you are not taxed as income. Otherwise, everything would be entirely negated and it would not make any point. But maybe that’s what you wanted to say.

We also have to keep in mind that (as they mention), the example they use is absolutely extreme. Almost nobody will ever reach those amounts.

Second, it ignores the fact that stretching the withdrawals over five years makes a very significant difference. You can easily divide your taxes by two. In their case, that would have made a significant difference.

Third, their example checks out but is contrived to a single example with a single marginal tax rate. For a higher marginal tax rate, the difference would be more interesting. And for a significantly lower marginal tax rate, the difference would be less interesting.

Finally, it ignores the fact that you can invest the tax savings bringing you even more capital gains on the 88K that are being saved.

Also it ignores the fact that most people don’t invest their money either in the third pillar or in their portfolio :(

So, yes, there are some cases where the the third pillar would not be very interesting. But using a single example is not very representative.

Hey TPS

Thanks for pointing out that it is indeed a special tax rate (in most cantons lower than income tax). The key point is that it is taxed, while it would be not taxed if invested in a 3b pillar (free investment).

I agree with all points you make – an individual assessment is necessary and investors should do a back of the napkin calculation for their individual situations (maybe something for a dedicated post @ TPS running some of your simulations).

You can find some more extensive examples at https://www.truewealth.ch/de/blog/saeule-3a-achtung-vor-der-steuerfalle but still not representative for most usecases. They link some useful calculators to get to your individual ‚break even‘ threshold.

I still would recommend using the 3rd pillar as a cash/bond part of your overall asset allocation and keeping your stock/etf portfolio seperate in 3b (free investment), especially for larger portfolios that everyone striving for FI is acummulating along the way. A middle of the road approach is to choose a reduced stock-% in the 3a pillar to stay below the individual threshold that negates your tax efficiency (including all the factors mentioned in our previous posts the individual thresholds may vary heavily).

In any case I think swiss FI investors should be made aware of this potential tax-trap of 100% stock/etf 3a pillars and check their individual situation to make an informed decision on how to allocate their assets.

Hi Stephan,

After thinking for a while about this problem, I realized that if you are in the situation where you, in the end, have a loss in your overall taxes, it means that your overall gain is so big that it doesn’t really matter :)

In this example from the article – who cares that you paid 200k in taxes, if you won 2.3 million?…. In order to save on taxes (i.e., have a smaller amount paid on the withdrawal day as compared to taxes you accumulated over the years), you also have to have a smaller absolute profit. In the end, it pays off to lose in taxes, because you win much more money anyway!

I agree that you would have won more money if you put this money somewhere else where you don’t pay taxes on your gains at all. But if you are to put the max amount in the 3rd pillar anyway (which most do), I think it is more profitable to put that money in stocks, as you will likely maximize your final profit, despite the loss in taxes.

Dumb question – what do you think about the UBS 3rd pillar options. I thought UBS don’t charge fee’s on their 3rd pillar accounts (or at least that’s what I thought), and they also offer a different mixes of stocks.

They may not charge direct fees, but I am pretty sure that the fees of the funds themselves are not waived and these fees are high. I would be extremely surprised if UBS did not charge anything on their retirement funds. That is just not how they work.

Hi!

Thanks for this great post! Why do you think the insurance do not make sense? Some also offer 100% fund investment with similar performance and fees (ex: 0.48% for SwissLife).

Best

MW

Hi MrWave,

The problem of third pillar insurance is that you will lose some part of your investments for the life insurance premiums. And these costs are quite significantl. So, if you do not need a life insurance, you will lose money for nothing.

Also, if you need life insurance, you would be better off with proper life insurance and a separated third pillar because life insurances outside of third pillar have better conditions than those linked to third pillar.

What about swiss life as 3rd Pillars?

Hi Fra,

Generally, Swiss Life third pillar are extremely expensive. But they have many products and I do not know them all.

If you are interested in one in particular, let me know and I’ll check it out.

Hi,

They boast 0.48% in fees for their Swiss Life Dynamic Elements Portfolio Global Equity offer. What do you think about that?

The fund itself looks good and indeed comparable to VIAC and Finpension when we only consider the fund.

The problem is that some part of your money will not be invested in the fund. In most cases, 10% to 20% of your contribution to the third pillar insurance will go into the insurance to pay the premiums and not into the funds. So, this is a direct loss of 10% to 20%. This is the main problem with life insurance third pillar, not the choice of funds.

Hi,

i am deciding also where to put my money for Pillar 3a but i have not understood this part of your reply:

“The problem is that some part of your money will not be invested in the fund. In most cases, 10% to 20% of your contribution to the second pillar insurance will go into the insurance to pay the premiums and not into the funds. So, this is a direct loss of 10% to 20%. This is the main problem with life insurance third pillar, not the choice of funds.”

What do you mean that money we give for Pillar 3a is a direct loss?

Thanks

Just for completeness, there was a typo in my comment, I meant the third pillar and not the second pillar.

To answer your question, this is only for a third pillar insurance, not an account like VIAC or Finpension 3a.

With a 3a life insurance, some part of your money goes to cover the risk part of the insurance. This money is entirely lost. The other part goes to invested funds and you have to pay the fees again on that part, but they can be more reasonable.

Got it.

One question come up in my mind. Sorry maybe a noob and silly question but how do i understand if the fund i invest for my Pilla 3a is on life insurance rather than just an account? i was checking for Swiss Life Dynamic Element and i do not see that 10% refers to life insurance. How do i check it?

thanks

Hi,

The main difference is whether you have a contract or not I would say. With a life insurance, you have likely talked to an advisor that recommended this product and made you sign a contract. That contract will say how much you must contribute per month. And you have a certain value at death.

From what I have seen so far, Swiss Life Dynamic Elements is a life insurance.

Thanks for clarification.

Also, as i understood Finpension and similar are more for investing in Pillar 3a right? Those are still good if i just want to put money there without concern about change investment and others, basically just idle. Or for this purpose are better other provider? hence like SwissLife and others.

Hi Alessandro

Yes, I am assuming that people want to invest :)

If you don’t want to invest at all, VIAC is still good, but Finpension is not great.

SwissLife I would not recommend, but for cash 3a, there are indeed many options.

Hi!

First of all, I want to say a huge thank you for all the info you keep providing!

I have started investing using Selma (thanks to you) and now I am thinking of opening 2 new 3a pillar accounts (I already have one in a regular bank and an insurance one).

Based on your articles, Finpension and VIAC seem to be the obvious choices (the idea is to open both accounts at the same time and see how they perform – I like the idea of an experiment!).

I read your article about Selma and it seems more expensive than both Finpension and VIAC … Would you suggest opening a 3a with Selma instead? Are fees still double compared to Finpension and VIAC? I wonder if Selma will decrease its fees at some point as well …

PS: I have about 20 years to go before retirement.

Thank you!

Hi Cris,

Selma 3a is indeed more expensive than Finpension 3a and VIAC. Currently, I think it’s too expensive, even if you already have a Selma account. It’s good that everything is integrated, but it could become cheaper.

I would suggest going with Finpension or VIAC for now. If Selma 3a decreases its fees in the future, you are always free to switch.

Hi!

Great content as usual.

I’ve just found out that as stated here:

https://www.ubs.com/ch/en/help/pension/pillar3a-withholding-tax.html?fbclid=IwAR0qjw5s_9-drzuQptNEAFUtD_FeNZ5ccBt5Ec_qVGnMvPAni1gNM8T09XU

Beginning in 2021, it will no longer be possible to file requests for withholding tax adjustments on account of additional deductions (e.g. pillar 2 buy-ins, pillar 3a contributions or debt interest). 2020 is the last tax year for which a withholding tax adjustment can be requested. For this reason, you should check with your tax advisor whether it still makes financial sense to pay into a pillar 3a account starting in 2021.

Do you think it still makes sense to open a 3a account?

Hi manuel,

This change is only for people that pay tax at source (foreigners). If you cannot get a tax deduction, the third pillar does not make sense now.

Now, you can actually ask your state to do an ordinary tax declaration. But in that case, you will have to file a full tax declaration instead and your taxes may change (for better or worse). I am not sure it makes sense.

For most tax at source people that do not fill an ordinary tax declaration (people with less than 120’000 income), then I would think it does not make sense anymore to invest in the third pillar.

Thank you for you reply Mr. The Poor Swiss.

If I understand correctly also for people that earns more than 120000 CHF that pays tax at source it doesn’t make sense anymore cause it would not be possible to file requests for withholding tax adjustments regarding pillar 3a contributions

In most cantons, if you pay more than 120K, you should switch to a full tax declaration. Hence the number. I think Geneva and maybe Zurich have a higher limit.

Basically, the third pillar only makes sense if you can claim the deduction.

Trank You for your Reply

If I understand it correctly, you will just have to request to fill out a proper tax declaration. You can still enter all the adjustments (including Pillar 3a) there.

That is also my understanding :)

Hi! regrding the integration to the retirement, do you think is more convenient to contribute to a 3rd pillar or to invest in etf with my own accumulation plan? becouse i saw that there are some tax benefits with the 3rd pillar, but i saw also that in the most of the cases the interests are very low.

thank yoy very much

Hi Febs,

I would recommend contributing to the third pillar and investing the money in your third pillar. With Finpension 3a and VIAC, your money will be invested in a lot of stocks (or fewer stocks depending on your choice) and you will get very good returns.

I have an article about whether you should contribute to your third pillar.

hi! thank you for your suggestion…but do you think it would be a good idea contributing to the third pillar instead of an indipendend investiment in etf even if im not sure i will stay in Switzerland until retirement age?

thank you very much

It depends on many factors. If you know you are going to leave soon, then, it does not make sense.

But if you leave in the distant future and you have a large income, then it could still make sense yes.

Keep in mind that if you want to cash in your third pillar you will have to sell the stocks, which may happen at a bad time, so once again, time horizon matters.

hi! thak you very much for your help, i’m still not sure what is best for my situation. I would like to ask you if the figure of an independent financial advisor exists here in Switzerland and if maybe you can recommend one to me. Thank you very much anyway

Hi,

There are probably some independent financial advisors in Switzerland, but I do not know any.