What is the best third pillar in Switzerland for 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

In Switzerland, contributing to your third pillar is one of the easiest ways to save on taxes. I recommend everybody to contribute to their third pillar.

But contributing to your third pillar is not enough. You should invest the money in your third pillar. That means you have to pick the best third pillar for your money. Since there are many options, choosing the best third pillar for your needs may be difficult.

So, this article is here to help you! We see how to choose the best third pillar!

What makes the best third pillar?

First, we must consider what makes the best third pillar. We must decide which factors will drive the choice.

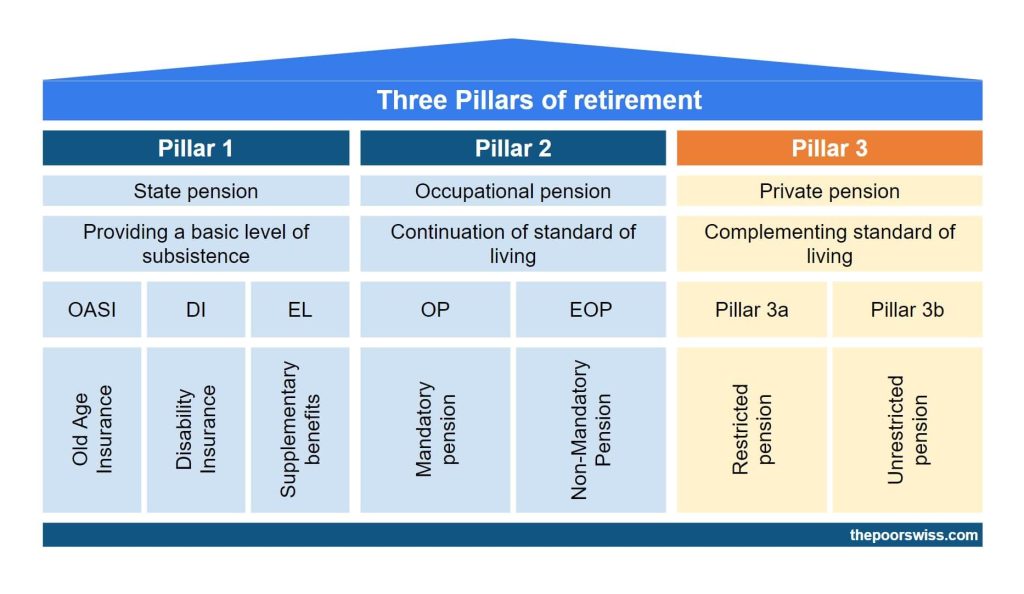

I assume you already know about the third pillar and are contributing to it. If you do not, you should learn why you should contribute to the third pillar.

We only consider bank third pillars, not insurance third pillars. Indeed, in almost every case, a bank third pillar is much better than an insurance third pillar.

The goal of your third pillar is to provide you with enough money to retire comfortably. Therefore, you want your invested money to grow as much as possible while not taking too much risk. So, the best third pillar must support this goal!

There are three critical factors in choosing the best third pillar:

- A large allocation to stocks will increase your returns in the long term.

- A diversified stock allocation reduces the volatility of your portfolio.

- Low management fees to avoid wasting your returns in fees.

Since we are counting on the long term, there are also some things we can ignore:

- How good the app looks does not matter. You will spend less than an hour every year.

- The interest on the cash part is irrelevant unless you do not want to invest.

We will now delve more into the details of the three critical factors.

Allocation to stocks

The best third pillar has a significant allocation to stocks.

It will depend on your situation, of course. You need to choose yourself your asset allocation. Recently, Swiss bonds have had negative interest rates for about ten years. When this is the case, what is not in stocks should be invested in cash.

I want to allocate as much of my third pillar to stocks as possible. I already have bonds in my second pillar, and my current allocation to bonds is more than enough. Ideally, a third pillar will have a 100% allocation to stocks.

Diversification

The best third pillar has a diversified stock allocation.

Switzerland is too small of a country to only invest in its stocks. We need to have global stocks (stocks outside of Switzerland). Ideally, the allocation should be the same as a world stocks fund. Since the Swiss stock market represents about 3% of the entire stock market, we should avoid investing much more than that.

Unfortunately, this is not possible in Switzerland. The law states that the third pillar must have at least 40% allocated to Swiss stocks. So, an ideal third pillar should have 60% of international stocks and 40% of high-quality Swiss shares.

As we will see later, there is a way against this limit, making some third pillar providers significantly better than others.

Fees

And last but not least, the best third pillar has fees as low as possible.

I want my third pillar to have zero load fees. I do not want to pay to get money inside the fund. The absence of load fees is essential. You should never use any fund with load fees.

Moreover, the yearly fees must be low, and the TER must be as low as possible. Most third-pillar accounts in Switzerland have higher than 1% TER.

When you are investing for the long term, it is essential to minimize investing fees. The difference in returns in the long term is significant.

Third Pillar from a Bank

Most people in Switzerland will invest in a third pillar their banks provide. And they have a ton of options. Historically, they have been the only option available for third pillars.

I will not go over all the possible offers here. Indeed, there are too many of them. And most of them are terrible options. But I will go over some interesting options from some popular Swiss banks.

We will use the third pillar accounts from banks as examples. These are not the best third pillars.

Migros Bank Fund 85 V

My current bank is Migros, so I wanted to check their offer.

They have several retirement funds. The most interesting is Migros Bank Fund 85V. It has 85% in stocks and the rest in bonds and money market. The TER is 0.94% per year.

The allocation to stocks is slightly low but not too bad. The TER is not that bad for a Swiss bank. But I would not recommend this fund.

LUKB Expert Fund 75

Many people recommend the Luzerner Kantonal Bank’s LUKB funds. Let’s take a look at their LUKB Expert Fund 75.

This fund has 75% of stocks, which is alright but not great. 40% is invested in Swiss stocks, 35% in global stocks, 15% in Swiss bonds, 4% in international bonds, and the rest in liquidities and real estate. The diversification is not too bad when compared with other options.

It has a TER of 0.8%. For third pillar accounts in Switzerland, this is a good TER. However, it has a load fee of 0.4%. The TER is okay, but the load fee makes it highly undesirable.

PostFinance Pension 100

Many people are using retirement funds from PostFinance. So, we can take a look at the PostFinance Pension 100 fund.

This fund invests 100% in stocks. 72% is invested in Swiss companies, while 28% is invited globally. And the TER is 1.01% per year.

The allocation to stocks of this fund is quite reasonable. 100% allocated to stocks is the best you can do in your third pillar. However, more than a 1% yearly fee is already significant. And this fund is not well globally diversified since only 28% of the stocks are international. This is significantly lower than we would like.

Raiffeisen Pension Invest Futura Equity

Since many Raiffeisen banks have a good reputation, it is a good idea to look at their retirement funds, and more specifically, the Pension Invest Futura Equity fund, a mouthful.

This fund has between 80% and 100% in stocks. I do not know why it is not fixed. But the last invested value I saw was 95% in stocks, which is good. 47% is invested in Switzerland, which is not great but not the worst.

The TER of the fund is 1.42%, which is very bad. While it is not the most expensive fund in Switzerland, it is the most expensive that I will mention today. And it is way too expensive for people to consider.

Swisscanto Fund 95 Passiv VT

Swisscanto provides many Swiss funds, and many banks use them. We can examine the Swisscanto Fund 95 Passiv VT.

This fund invests 95% in stocks, which is excellent. The diversification is also good, with 65% invested in foreign equities. However, they hedge most of the equities, with 72% in CHF for the entire fund. This is not great for currency diversification.

On the fee side, this is an excellent example of how banks are trying to make it complicated for people to know how expensive it is. The flat fee for the fund is only 0.38% per year. At first sight, it sounds great. But if you look in detail, we can see that this is a fund of other funds, so there is an extra 0.33% in fees for the sub-funds. But they never show the full fee of 0.71%. On top of that, they are adding a 0.1% issuance fee and a 0.09% redemption.

It is the most complicated fee system I have seen during my research. They use several small fees not to scare customers away, but when you add up all the costs, this does not make them very attractive. And just because of this lack of transparency, I would not invest in their funds.

Independent providers

As we saw, offers from banks are not that great. Fortunately, recently, many independent providers have started in this market. And they are offering much better conditions than banks.

We have seen that banks have high fees, sub-par diversification, and not aggressive enough portfolios. Independent providers are fixing all these issues. So, to find the best third pillar, we need to look at these independent providers. Note that they are not all good. There are also some bad options.

There is no disadvantage to having your money in a third pillar from these companies instead of at a bank. They only have advantages.

There are many, but I will only mention two main providers in this article: Switzerland’s two best third pillar providers.

Finpension 3a – Best Third Pillar

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

For most long-term investors, Finpension 3a will be the best third pillar available in Switzerland.

Indeed, they have some powerful advantages going for them:

- You can invest up to 99% in stocks

- The fees for an aggressive portfolio are extremely low, at 0.39% per year.

- They have a mobile application and a web application.

- You can make custom portfolios with a lot of liberty.

Finpension 3a is the best third pillar for long-term returns, with a high stock allocation and low fees. This is a great way to ensure your money is well invested until retirement.

Interestingly, Finpension also runs an excellent vested benefits account. They are experienced in the pension industry and provide great products.

Finpension 3a is the best third pillar available for aggressive long-term investors. So, in 2021, I started investing my third pillar in Finpension 3a. As for 2023, I am still using them and have five portfolios with them.

For more information, you can read my review of Finpension 3a.

VIAC – Good Conservative Third Pillar

In some cases, VIAC is an interesting alternative as well.

VIAC is a little more mature than Finpension 3a. They also offer an excellent third pillar. In general, they have several disadvantages over Finpension:

- Their custom strategies for investing are more limited.

- The fees are slightly higher.

- You are limited in your maximum foreign currency exposure.

However, they have some advantages for conservative investors who would not invest fully in stocks:

- They allow you to invest in cash or bonds.

- The fees are lower if you invest in stocks and cash. Indeed, you only pay fees on the invested part.

So, if you are a conservative investor (or a short-term investor) and do not want bonds, VIAC may be better.

But this is only true if you do not use bonds. If you use stocks and bonds, Finpension 3a is cheaper.

VIAC used to be the best third pillar until Finpension 3a came along. But it is only interesting in a few cases now.

For more information, you can read my complete review of VIAC.

Conclusion

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

Overall, the best third pillar available in Switzerland is Finpension 3a. They offer the highest allocation to stocks and the lowest fees. On top of that, you can create custom portfolios with a high degree of liberty. This makes them an excellent option!

For these reasons, in 2021, I invested in Finpension 3a instead of VIAC, and I recommend that all aggressive investors do the same. I have five portfolios with Finpension 3a.

If you open a Finpension 3a account, please use my code FEYKV5, this will help the blog and give you a 25 CHF fee credit (if you deposit 1000 CHF in the first 12 months).

If you need more information on these two third pillars, I have an article on VIAC vs Finpension. This article goes more in-depth into the comparison.

What about you? Which is your favorite third pillar?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best retirement accounts

- More articles about Retirement

- Interview of Beat Bühlmann – CEO of finpension

- Finpension Vested Benefits Review 2024 – Pros & Cons

- Interview of Daniel Peter, CEO of VIAC

Hi, happen to come across this artical. Unfortunately I have to say your comment on Swisscanto (CH) Vorsorge Fonds 95 Passiv VT CHF is not correct. The class has TER (total expense ratio) of 0.4%, and there is no further hidden cost in this fund of fund construction. All the subfunds used to construct this strategy are implemented with a 0 load fee class of various Swisscanto index funds, there is no ETF or fee load class of other funds in this strategy. Hence the TER 0.4% is the real TER of this 3rd pillar fund. The subscription and redemption spread is needed when the new investment comes in in order to protect the existing investors’ intrestes, i.e. if you are already invested in a fund, you don’t want the new investment coming in to dilute your perfomamce. I hope this makes sense to you. Finpension 3rd pillar fund charges of 0.4% TER, actually there are two fee load share class on Credit Suisse emerging market funds. in this case, Swisscanto funds even for emerging market funds has 0 fee load.

The sub-funds may have no load fees, but I would be really surprised if there were no ETF fees.

If you are working for Swisscanto, please send me a document attesting of zero TER on the sub-funds.

is it possible split pillar 3a into two different funds (2 different banks)?

i mean if i wanna invest the max amount 6800.-, splitting it into two different accounts. Can I still have the fiscal advantage?

Hi Leonardo,

Yes, you can have several accounts and invest 6883 total (like 3000 and 3883 for instance).

In fact, it’s better to have several accounts so that you can spread the withdrawals over several years.

Your article is a great help. I choose Finpension with your code, but was shocked when I was notified by public and unencrypted email how much money I have transferred. In the last 20 years I have not seen this unprofessional notification. Not even credit card companies send their statements by email. All privacy measures become obsolete if Finpension is emailing the amounts. You may want to include it in your review. I immediately have transferred back to my VIAC third pillar.

Hi Eon,

I don’t really see the problem. Emails are not public, they are sent to your email address and most emails will go through secure channels. The email themselves are indeed not encrypted, but most emails are not.

It’s up to you to secure your email account.

I would actually much prefer my credit card companies to send me their statements by email.

Hi,

awesome article, thanks for writing all this down! Please, could you expand (or point to sources) on the 40% rule? Does that mean that I must have 40% exposure to swiss funds in order to be eligible for the tax benefit?

I am using finpension 3a and you can clearly create your own portfolio which could consist of only world equity. Would that render me ineligible for the taxes benefit? Thanks!

Hi Jan,

This limitation is for pension providers like finpension 3a and VIAC, not directly for you.

What you have in your third pillar does not make a difference for the tax benefits.

Finpension 3a still has to obey that rule globally, but not for every portfolio.

Hello,

I read your article about Finpension with interest. I just think you should add the ethical/ecological aspects (ESG) in your criteria to choose between different options. It is a very important aspect to take into account as well.

Hi Coralie,

I have mentioned that you can invest in a sustainable strategy, that then uses ESG funds. It is up to every investor to choose.

Thank you for this great article. On custom strategy on viac you can go around the 40% swiss allocation by holding CSIF World ex CH hedged – Pension Fund. How is FinPension going around this chf limitation ?

Also Viac is backed up by Wir Bank a co-operative swiss bank already managing 1 billion assets of 3rd pillar.

How is founded FP ?

Hi Josh,

that’s correct, VIAC limitation is about 40% in Swiss francs, not about Swiss stocks, I should make this clearer in the article.

With Finpension, you can go 99% in foreign currency. They are saying that the 40% limit applies to the entire foundation assets, not to every investor.

Finpension assets are deposited at Credit Suisse, a bank with much more than 1B in third pillar assets.

As for funding, I do not know. But they are running a successful 1e, vested benefits and third pillar and they seem successful and gaining traction.

Hi,

I don’t think VIAC is worse than Finpension.

First fee in 97% stock account on VIAC is also 0.44% since beginning of 2021.

Second, it’s not really 3% that they keep in cache but more between 2.5 and 2.75%, and you get 0.1% intrest on it (which is very small but safe).

Third, custom portfolio is now maybe even better on VIAC.

Fourth and most important (but also most difficult to check since it depends heavily on time window) VIAC offers marginally better performance with their Global 100 strategy compared to Finpension Global Equity 100 strategy.

Hi,

1) Yes and no, you also need to take the foreign currency exchange fees that are higher on VIAC. And Finpension has 99% in stocks, over 30 years this makes a difference.

2) That probably not significant in the long term

3) I strongly doubt it. Finpension allows you to go 99% in foreign currency, VIAC forces you into 40% Swiss francs.

4) Indeed, very difficult.

Now, Finpension 3a is only slightly better than VIAC, not much.

Hello!

What would be your preferred option considering that we will move abroad (to the EU) in 1-2 years? If I understood correctly, there is a 250 CHF fee (750 CHF if within the first year) when withdrawing the funds from Finpension

Hi Victor,

It depends if you intend to withdraw it directly or not.

1) If you intend to withdraw directly when you leave the country. I would recommend a cash third pillar in any bank that has no withdrawal fees abroad

2) If you would like to keep the money until retirement age and then withdraw the money, then I would recommend Finpension 3a and in the end pay the 250 CHF fee.

Hi!

I’m in a similar situation. I just moved to Switzerland and I’m planning on staying here for 3 to 5 years, not more than that.

I still want to maximize the pillar 3a contribution and invest it aggressively.

I was thinking that I could withdraw the funds at any time once I leave Switzerland (not necessarily the moment I leave Switzerland), but it seems I’m wrong. If I leave Switzerland and want to withdraw those funds, I need to do it immediately before or after I leave Switzerland.

So should I not invest it aggressively? I also read in a comment below something that I agree with. Even if the markets are down once I leave, if I withdraw the funds and immediately reinvest them, there should be no big issue in terms of profitability, so I guess I should still use the pillar 3a strategy. Would you agree?

Hi,

If it’s only 3-5 without flexibility, I would not invest it aggressively indeed.

If you sell and buy back again latter without delays, there is indeed no big issue. The problem is in the delays. It could take a while before you get your fund after they have been sold. Depending on the state of the market, this could be poor.

Apparently, I can withdraw the funds anytime after leaving Switzerland, not necessarily the moment I leave Switzerland (I asked Finpension about this). So there’s no issue in investing aggressively because I can wait out bad market times.

On a different note, given I’ll only stay here for a few years, I think it’s best to minimize my contributions to Pillar 2. My employer contributes the same no matter how much I contribute myself, and I can lower or raise my contribution. Since the contributed funds for a few years will make the pension amount irrelevant, I think it makes sense to minimize my contribution to Pillar 2.

In that case, that would work indeed, as long as you can keep the money invested.

And yes, it should make sense to reduce your second pillar if you are not planning to rely on it.

Well done on your blog, it’s incredibly helpful.

Regarding opening 4-5 separate 3a accounts. What is your optimal strategy for contributions? For example: Year 1 open an account and contribute max (6883chf), year 2 open a new account and contribute max to new account, etc. After 4 years, start with the first account again and contribute the max.

Or do you open 4 accounts straight away and split 6883chf over each account each year?

Thanks for all your insight.

Hi Nic,

Keep in mind that the number of accounts that is optimal may differ from canton to canton. However, more than 5 never makes sense. So, you can use 5 in any cantons, but then, you will have to spread them over a number of years, as defined by you canton taxes.

The optimal way would be to open 5 accounts directly and spread the maximum/5 each year. However, that’s painful to do. I think that opening the first in year 1, then the second in year 2, and so until you have 5 makes more sense. And then, you contribute to 1 again on year 6, then 2, then 3, …

That’s so much simpler and that’s what I am doing myself.

Hi! Thank you very much for all your content! Super helpful, especially for a beginner.

I do have a couple of questions regarding splitting the 3rd pillar.

1. From what i understood, if i open an account and in the first year i put the max amount of money, next year i am not obliged to continue putting money in that account and I can open a new one?

2. I didn’t fully get what are the benefits of splitting the 3rd pillar into multiple accounts. Could you please help me with that?

3. my taxes are deducted at source. If I open the 3rd pillar account and start investing, how can i deduct from my taxes? Do i need to go and let them know that i need to change my tax filling system?

Thank you very much and I hope my questions are not silly.

Have a nice day!

Hi Raluca,

Thanks for your kind words

1) That’s correct!

2) Basically, cantons are using a stepped tax system. For instance, from 1K to 10K, it’s taxed 5%, but from 10K to 20K, it’s taxed 10%. But this is reset each year. So, if you have 20K and withdraw in one year, you will pay 5% on 10K and 10% on the next 10K, so a total of 1500 CHF taxes. But if you withdraw in two years, you will only pay 5% of each 10K, wich is a total of 1000 CHF, so you saved 500 CHF.

3) Be careful. As long as you are taxed at source, you can’t get benefits of the third pillar. You will have to ask for a full tax declaration and it may be more expensive that what you are paying now. I can’t tell you if you are going to save money by doing so.

Hey, thanks for your awesome articles!

One question, as I wanted to start with something after moving to Switzerland, I decided to go with UBS (yes, I know it is expensive, but I just wanted to start and mark that tick and then consider how to exactly deal with that).

One thing no ones mentions anywhere (probably because I am wrong), is that with UBS for example, if at the time of retirement, your funds in 3a performs really bad (shit happens, we know bad years from the history), then e.g. with UBS it is possible to not convert to cash but rather just continue keeping in funds (in Custody Account) and take them out whenever the market restores.

With VIAC and any other non-bank solutions, you simply must (if I am wrong please correct me and I would be really happy about it) to take your money out, so there is possibility of great loss. Of course we are talking about long-term and therefore with low fees it might be still better than more expensive bank solutions. But still, you never know..

Could you elaborate on that? Probably I am reading something incorrectly or simply from statistics I will always win with something like VIAC.

Thanks.

Hi ruuk,

That’s an excellent point!

You are not wrong. It’s true that with both Finpension and VIAC, you will have to sell the shares to get the money out. And this may come at a bad time in the stock market. However, there is one thing you can do to reduce the risks. Once you receive the money, you can reinvest it directly. Then, it does not matter if it’s high or low on the stock market. You will still have a few days not-invested, but then you have great fees before, a few days not invested and great fees after. So, I would think that as long as you reinvest yourself the money once your receive it, this will still beats something like UBS and their higher fees.

Interestingly, Selma allows you to keep the shares in your 3a and move them to the standard robo-advisor account after retirement.

Oh, I see the point.

Then I need to consider moving away from UBS and try to transfer to VIAC/Frankly/FP/etc. Also need to read your article on Selma option.

Thanks! 🙂

Hi, maybe I follow up on this question and answer thread with another question ?

Say market was at a low when you had to sell your portfolio but you could reinvest – would you then have to through a platform like interactive brokers ? And try to replicate what was original portfolio that you just sold off ?

Also, just to clarify, when you reach retirement age viac just automatically sells your portfolio off? Or how does it work as opposed to UBS ?

As you may have guessed I am considering a similar switch but trying to understand all the implications that come with this.. Thanks for your answer !

I am not sure I understand the question.

In almost all cases when you reach retirement age, all the 3a portfolio is entirely liquidated and you receive cash. I don’t think UBS is an exception to this? If you plan to retire on this money, you could either use it as cash or reinvest it.

There may be a few exceptions where you could transfer your shares at retirement age directly into your investment account if you have both at the same bank.