What should you do with a life insurance 3a?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Recently, I have talked about life insurance 3a policies and how bad they were. We have established that they have almost only disadvantages compared to an invested 3a.

So, people should not take new life insurance 3a. But what should you do if you already have one?

There are a few options about what to do with life insurance 3a. We will explore them all in this article and compare them. By the end of this article, you should know what to do about your life insurance 3a.

Life Insurance 3a

We have already established that life insurance 3a has significant disadvantages:

- Their returns are low.

- Their fees are high.

- They are very inflexible for deposits, locking you into this monthly expense.

- They are very inflexible for withdrawals, making you lose money in taxes.

- They are not transparent.

- They are heavily advertised.

The only advantage they have over an invested 3a (like finpension 3a) is that they have a guaranteed amount of money. However, life insurance 3a only guarantees a 0% interest rate, and the guaranteed amount is less than what you paid. If you want guaranteed 3a, you should take a bank 3a.

Life insurance 3a also has insurance in case of disability and death. This extra insurance may sound like a significant advantage. However, most people will not need insurance. On top of that, you can get pure risk life insurance for a fraction of the fees of life insurance 3a.

If you need more convincing, I have an entire article explaining why nobody should fall into the trap of life insurance 3a.

What to do with existing life insurance 3a?

It is essential to know that life insurance 3a is a terrible instrument. But what should you do if you already have one?

First, you should not feel bad about it. Many people in Switzerland are falling for life insurance 3a. I have a life insurance 3a. I am not proud of it, but I consider it a learning opportunity.

Why did I take life insurance 3a? An insurance advisor convinced me, and I did not know any better. Most people in Switzerland do not have the necessary financial education to understand how bad these products are. And most people in Switzerland trust advisors, banks, and insurance companies.

Banks, advisors, and insurance companies push these products because life insurance 3a is very lucrative. But life insurance 3a is not lucrative for its users.

We now go to the main question: What should we do with life insurance 3a?

There are three main ways to deal with life insurance 3a:

- Do nothing

- Reduce or stop the payments

- Cease the contract

We will see these three ways in detail in this article.

1. Do nothing

The first and simplest option is to do nothing. You continue contributing your monthly premiums, which stay in your life insurance 3a until your retirement age.

While this option is the simplest, it is also the most costly. Indeed, we have seen that life insurance 3a has abysmal returns and is very expensive. These low returns and high fees result in low performance for life insurance 3a in the long term.

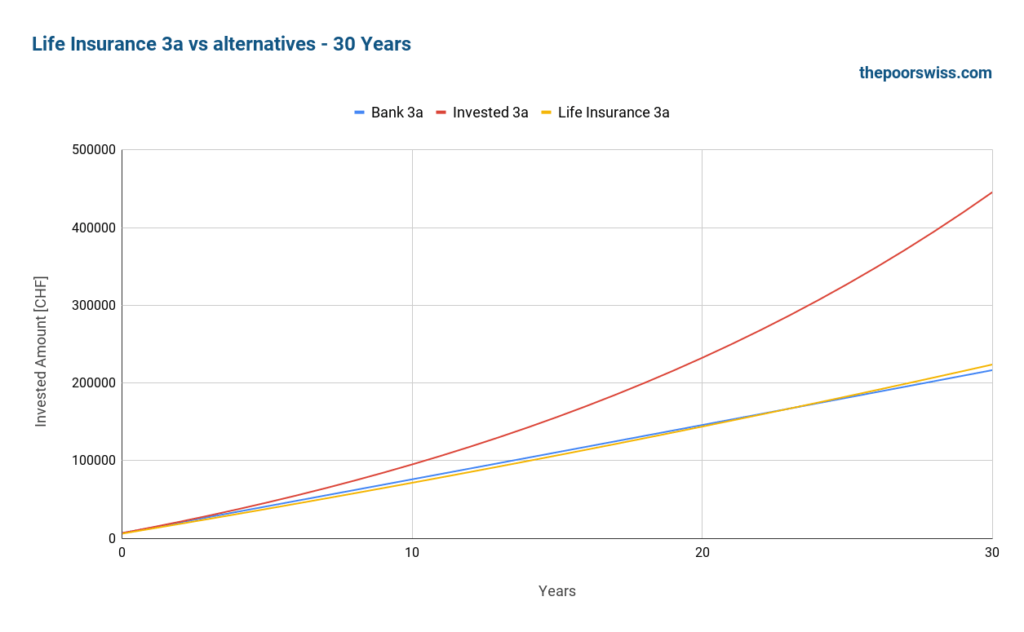

In the previous article, I ran a comparison and got these results after 30 years:

We can see that doing nothing can be extremely costly. Over 30 years, investing in a good 3a could easily yield twice more money by the time you retire.

Overall, I would strongly advise against doing nothing!

2. Release the premiums

The second option is to stop paying the premiums either fully or partially. Most life insurance 3a allows you to be released from the premiums. Once you release the premiums, you will not have to contribute anymore, and the money will stay with the life insurance until the original policy termination date.

From what I know, all life insurance 3a include such a clause in their conditions. So, it is generally not a huge deal to do that.

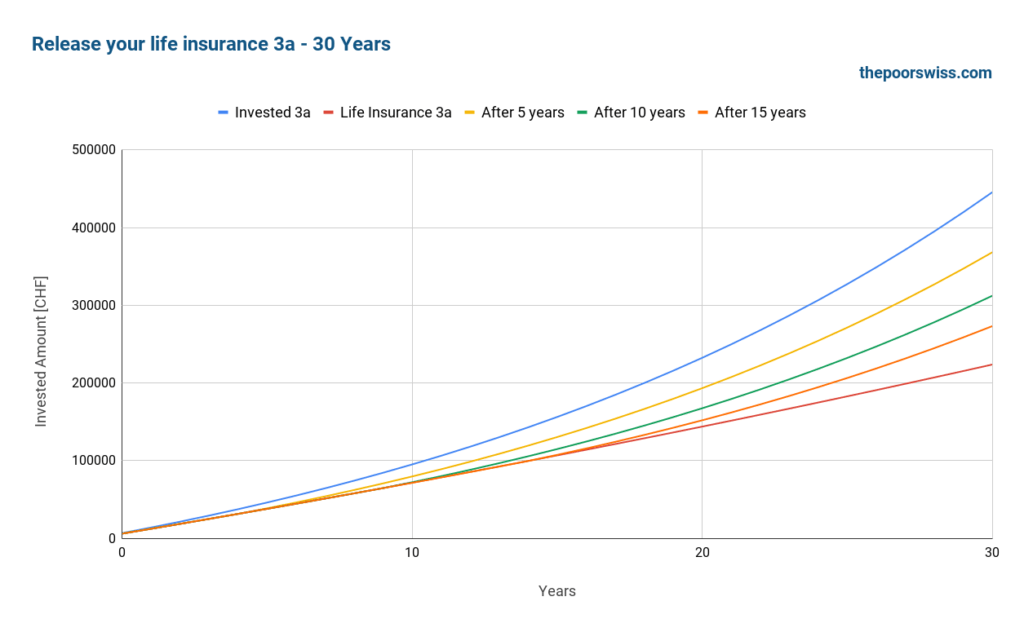

Here is what would happen to the money by stopping paying the premiums, simulated for 30 years.

We can see that the earlier we stop, the better results we get. It is logical since we get better compounding in the invested 3a, with much better returns. The part invested in the life insurance 3a will continue growing slowly over the years, but you could see it as bonds in your portfolio since this money (minus the fees) is guaranteed.

If you stop the premiums very early, in the first few years of the life insurance 3a, you may incur a penalty. Indeed, in the first few years, the life insurance company takes more in premiums for the risk premiums than in the following years. However, the earlier you stop, the better you will end up in retirement.

This strategy always makes sense unless you are extremely close to retirement. Even a few years without fees could help.

You must remember that the stock market returns are great in the long term but not necessarily in the short term. So, if you are close to retirement, below five years, you could stop the premiums and switch to a bank 3a instead. Or, you could be more conservative, depending on your asset allocation.

It is probably worth mentioning that doing that may prevent you from taking on another life insurance 3a. But that is probably a good thing.

3. Break the contract

The third option is to go a little further and entirely break the contract. With that, you stop paying, and you get back the money from the insurance company.

With this option, you will get back the buyback value. This value is based on the current value minus some cancelation fees. Usually, this value is zero in the first few years of the contract. You have no choice but to transfer this value to another 3a account.

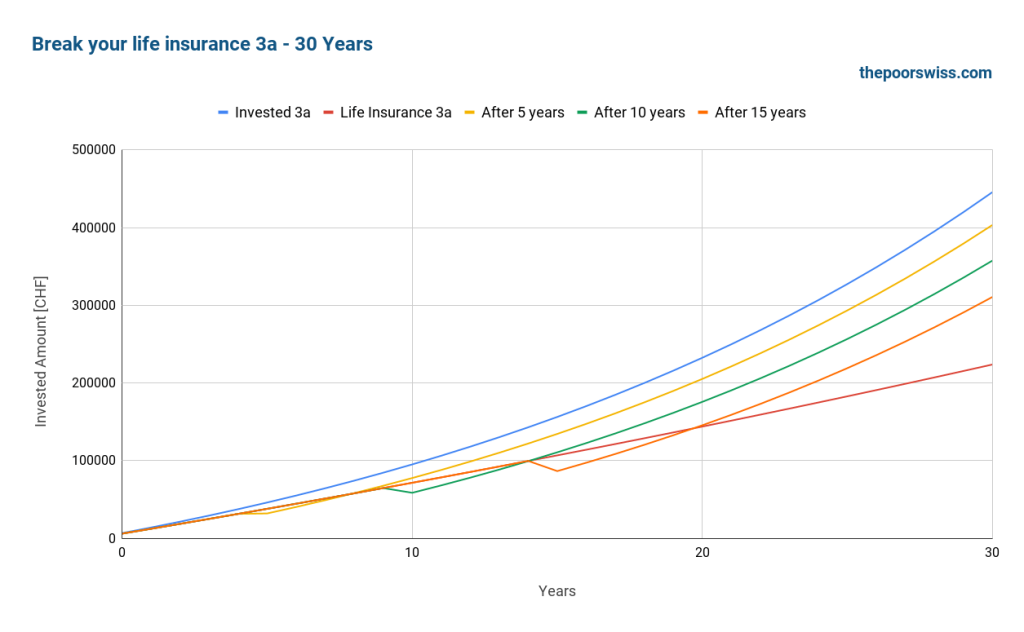

Once again, we can simulate this. I will assume that by canceling the contract, you will lose an extra 20% of the value compared to what you would have in life insurance 3a. This assumption is not precise since, in theory, you would lose more during the first few years and less during the following years. However, this allows us to make a simple simulation.

You may lose more than 20% or less than that based on your life insurance company. Unfortunately, they are not very transparent about these fees.

Here is what would happen if we were to break the contract after 5, 10, and 15 years.

We can see that the penalties can make a significant dent, but the returns of a good 3a easily recover this.

Again, the earlier you break the contract, the better the results will be in retirement. This effect is due to the compounding of the invested 3a.

I should repeat the disclaimer for the previous strategy: if you have only a few years, the stock market’s returns may not be great, depending on the timing. Therefore, breaking your contract a few years before retirement is not a great idea.

Comparing the three strategy

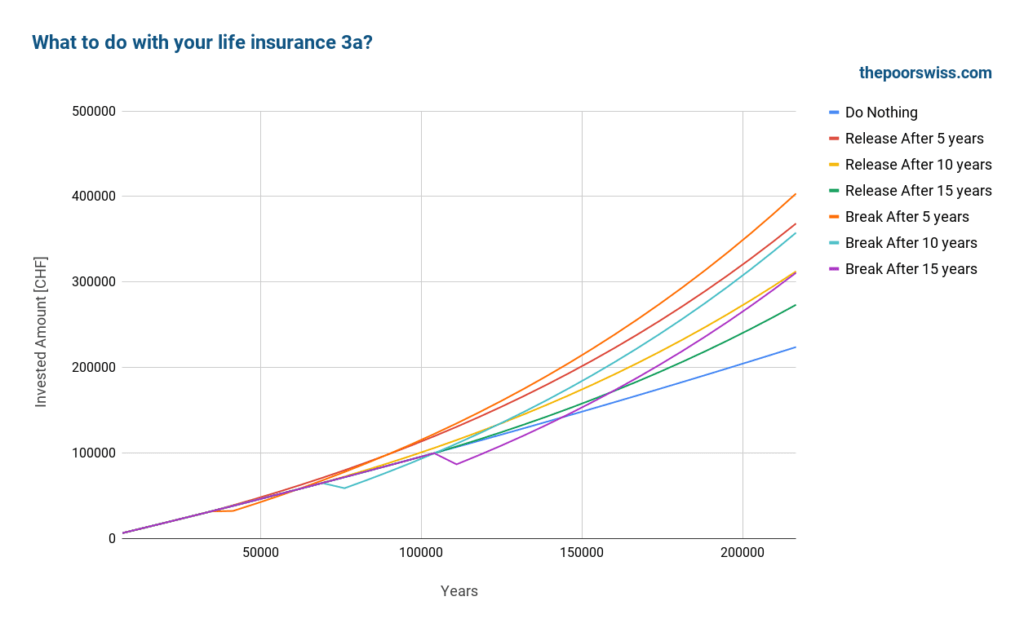

Here are all three strategies together on our graph to summarize them.

The difference between the worst and best strategies is almost 200’000 CHF! Such an amount of money can make a very significant difference in your life in retirement.

Unless you are very close to retirement, you should do something about your life insurance 3a. And doing something means either releasing your premiums or entirely breaking the contract.

The earlier you can do something, the better your returns will be in the long term. And generally, it should only take a few years to recover the loss from breaking the contract.

So, what makes the most sense is to break the contract and move the little money you get back into a good 3a and then invest regularly into that 3a. Releasing the premiums is also an excellent strategy that can make a lot of difference.

Life insurance 3a and mortgage

If you have tied your life insurance 3a with a mortgage for indirect optimization, you may be unable to change your life insurance.

Indeed, if you are using it for indirect amortization, your life insurance 3a policy belongs to the bank. Therefore, you will not be able to make any changes to the contract without changing the mortgage contract.

In these cases, the best option is to wait until the next contractual deadline for your mortgage. Then, you can either switch to direct amortization or use another third pillar for indirect amortization.

Of course, you can also ask your bank to see if there is a quicker way out.

What will I do with our life insurance 3a?

By now, you may know that I also have a life insurance 3a. And if you have read my previous article on life insurance third pillar, you will know that my life insurance policy is really bad.

Before writing these two articles, I thought I would keep them as a reminder of my error. Then, I was thinking of lowering the premium from 300 CHF per month to 100 CHF since it seemed possible. Since I had to wait a few more years because of my mortgage, I wrote these articles to support my evidence.

At this point, I have realized that my life insurance 3a needs to stop. Before, I did not know it was possible to stop paying the premiums completely.

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

So, I plan to break the contract in 2024, when I can renegotiate my mortgage. At this point, I will remove the life insurance 3a from my mortgage, switch to direct amortization, and start to invest in finpension 3a fully.

I will then move the leftover money from the contract into Finpension 3a. At first, I was thinking of keeping it and considering it a bond. However, life insurance 3a is much more than a bond. Therefore, it does not make sense to keep some money with these people.

Conclusion

If you are trapped with a bad life insurance 3a, I strongly encourage you to do something about it. At least you should learn more about how they deliver very poor returns, have high fees, and are not transparent.

The results of this article show that doing nothing may cost you a lot of money in retirement. Before doing this analysis, I considered doing nothing. However, I now realize it does not make sense.

Once I can renegotiate my mortgage, I will free my life insurance 3a from the bank. Then, I will break the contract and invest everything in finpension 3a.

If you need to find a good 3a after reading this article, you should read about the best third pillars in Switzerland.

What about you? What will you do with your life insurance 3a?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- The Three Pillars of Retirement in Switzerland

- How Much Will You Spend in Retirement?

- Third Pillar: All you need to know to retire in Switzerland

Hi Baptiste,

Thank you for the informative article, wish I came across your work a few years earlier.

I was sold 3a with life insurance by a broker with no detailed information, me being new in Switzerland thought it was important and went ahead.

So I am having 3a with SwissLife. I have paid from Jan 2021 until august 2023. I am self employed and haven’t had any income for this year due to no contracts, just home with baby. And I discussed with SVA to deregister my self entrepreneur retroactively form end of December 2022, meaning I am unemployed for this year.

I asked my broker few times what to do if I can’t pay my premium(automated deductions from bank account) due to no income, he only suggested me lowering the premium to minimum which wasn’t helping me much.

With some readings on internet, I learnt that unemployed with no benefits can stop paying premiums, this was never told by broker, is this correct?

I broke my contract with broker to move my contract directly with SwissLife now.

I didn’t pay for September and October, I have received legal reminder but I don’t have income to pay anymore, 575 chf per month.

I have few questions please.

– Is it only possible to transfer 3a to another bank? No possibility to cash out in private bank account?

-SwissLife said I can get my money (ofcourse after penalty) into a business account if I start a new self employment. What if the new self employment didn’t go well and I decide to cancel it in few months, what happens to the balance amount?

– Do you see any other solution for me? My financial or investment knowledge is almost nil so please help. Would gladly read any articles of you suggest me to.

Thank you once again.

Hi Pema,

Normally, you can ask to release the premiums. You should not simply not pay but do it officially. Since the 3a is not compulsory, they generally have to let you reduce the premiums or cut them entirely, but you have to go through official ways with them with that.

*) Yes, you can only transfer to another 3a, not a standard bank account.

*) You can indeed use the 3a money to start a new business. If the new business odes not work, I would expect that thismoney is simply considered lost for the system but I am not sure.

*) You should insist to release the premiums, that seems to be the most reasonable option in your case. You may have to pay for the two months you are late (not sure, again) but then your premiums would be waived for the future.

Please help me understand what does releasing the premium means?

Regarding the missing premiums for last two months, I have communicated my situation with the SwissLife and they told me to deactivate my automated deduction from bank account.

Thank you for the quick response, it helps a lot.

Releasing the premiums means getting a waiver for payment. Basically, you are telling me the contract is not broken but you will not pay anymore. Since this insurance is compulsory, it shoudl always work.

Basically, they should know you are not paying as not think you are missing payments. If they told you to deactivate it, you should not receive legal reminds. Have you told them about the reminders?

Hello !

I just came through this article thanks to a Reddit post, and I was wondering: my boyfriend and I both subscribed 3A and 3B pillars with AXA, with the Smart Flex option.

(I didn’t know better and and everybody around me seems to have suscribed one with AXA aswell) what would be your advice then?

We have paid 300.- since April so a total of 2700.- each one of us.

Hi Paulo,

Sorry to hear about that, it’s unfortuantely a trap many people fall into.

My advice is the same for every one. At the very least, release the premiums. And if you have the stomach for it, cancel the contracts altogether and start investing in a proper 3a like finpension or VIAC. If you are young, you should be able to take that as a learning experinece.

Hi Baptiste,

Thanks a lot for your interesting articles. At the moment I have 2 life insurance 3a with Generali, called Scala Profit, which follow a multi index called “Multi Index 100”. 100% is invested, of this 70% outside Switzerland.

The TER is 0.20% and “other expenses” is 0.75%.

The guaranteed amount will always be 0 and there is not the feature that they pay your premium if you lose your job, in fact I have a separate insurance for that.

I’ve already given one of them my money for 3 years, the other for 1 year, for a total of around 15000 CHF. I think that, if I’m lucky, I can get around 4700 CHF in total.

Is your suggestion to stop it and start with Finpension?

Hi Walter,

This is not the worst 3a life insurance but it is still way inferior to a good 3a like Finpension or VIAC.

If I were in your shoes, I would stop both indeed and start over with Finpension. Or, I would at least release the premiums if possible so as to stop paying.

Even if they say 100% is invested, this is likely not counting the risk premium which is lost. And then having 0.95% on the investment is also expensive.

So, it really depends if you believe in this product or not. Do you think continuing to to invest it will yield more than if you were to use Finpension instead? If that’s not the case, you should stop.

I think that the amount of expenses I would save in 25 years (I’m 40) with Finpension is more than the amount of money I have accumulated so far in my current 3rd pillar, so I think it’s worth for me to change.

One point is crucial: if, say, in 10 years a 3rd pillar better than Finpension comes out, can I move my money from Finpension to the new 3rd pillar without losing money? In fact, the most annoying part of the insurance 3rd pillar is that if you want to change you lose part or all of the money you have paid so far…

Hi Walter,

By switching away from Finpension in 10 years, you would not pay fees. However, you would be forced to sell your investments. And then, you would have to buy again on the other hand. This means that you would pay load and redemption fees on both ends. And this could also mean that you could lose (or win) by being out of the market for a few weeks.

Hi,

Thanks a lot for this valuable information.

I have a SwissLife policy that has a 5% “collateral element” and 95% “return element”. Is the “return element” more or less equivalent to an invested 3a?

Hi,

Without seeing more, I would guess that it’s more or less equivalenet to an invested 3a with high fees (Swiss Life ain’t cheap).

What does the 5% collateral means? Does that mean you lose 5% to life insurance?

So apparently they call it “Dynamic Elements Duo” and I’m having a really difficult time understanding if I got screwed or not.

https://www.swisslife.ch/en/individuals/products/pension-and-asset-accumulation/save/dynamic-elements-duo.html

It’s not a very bad solution, but it’s not a good product. It’s still a life insurance with some investment part. But it will still be inferior to a pure 3a.

Hello Baptiste,

Actually I have a life insurance but invested in found, is that bad as a normal life insurance?

Thanks

Gio

Most life insurance 3a are invested in funds. So, it’s likely that your life insurance is also bad :)

Hi,

Thank you for the post.

I am in a similar problem. I think I made a mistake. I created a 3a insurance with Liechtenstein Assurance.

I paid only 4 months, around 2320chf already. I can see my account with only 650chf invested… that is disappointing. So between the 3rd and 4th payment I told them this makes no sense because I plan to stay in Switzerland only about 10 years and what I would pay in premiums would be too much. better to put money in Neon savings with 0.6% interest… Anyway. I didnt notice a difference in this 4th month maybe because the paperwork didnt get processed quickly enough. But I am strongly considering cancelling it immediately OR to change the monthly payments to the minimum possible (which I have asked them what that could be – in the contract it mentions that I can change it once per year).

I could loose almost 3000chf… but maybe better than in several years… What do you think/recommend?

Hi Ricardo

Especially since you don’t plan to stay in Switzerland until retirement, you should cancel entirely as soon as possible. It’s not great to lose that money, but you would lose much more over 10+ years.

Hello,

Can I transfer my 3rd pilar from the bank to a finpension account without being penalized?

Thank you very much and thank you for the quality of the content provided in your blog.

Best regards

Hi Matraca,

Normally, yes. But the conditions may be different for each bank. Some banks may have closing fees.

Hello,

Thank you.

Not affraid of a market collapse exactly when you are retiring ?

Yes, this is an important risk to consider. I am thinking of adding margin of safety to my plan to increase the security.

Thank you.

I can’t reply to your last comment.

What your plan in order to increase security?

More bonds?

Hi Matraca,

I plan to use a slightly more conservative withdrawal rate than my current target. For instance, using 3.7% instead of 3.8%.

I also plan to not retire before I reach something like 110% FI to be safe.

How this will protect you from a market drop in your retirement?

If you start with 110%, you are much safer from a drop in the early years, no?

Hi there

Thank you so much for your help on this subject. I have two questions:

1. I’m with an AXA life insurance and stopped paying into after reading this – now what to do? I have switched to neon and see they support inyova and frankly – do you have any experience with this?

2. do you know annoying who could have a look over the documents I have with AXA and advise the best time to do the switch? As i think one is limited in time.

Thank you!

Zoe

Hi Zoe,

1) I dont’ think you can simply stop paying. I think you have to tell them to release the premiums, probably by letter.

I have reviewed both of these services:

*) Inyova 3a Review 2023 – Pros & Cons

*) Finpension 3a Review 2023: Pros & Cons

2) I have no idea.

True. What is your bond allocation?

Currently, 0% in the accumulation. I have not yet decided what it will be in retirement, but possibly 0%-20%.

I recently came across a product from axa. Smart flex. The Global fund is 100% global stocks (over 60% in the US market and only 2.68% in Switzerland) it’s possible to invest 90% of the monthly payments to this fund). Finpension total equity 100 and other funds invest 40% in the Swiss market and 30% in the US.

Factsheet link: https://www.axa.ch/doc/afon9

Would you consider switching to this product and removing the insurance options a good/better alternative to canceling the insurance within the first 5 years and investing what you can get out in a finnpension fund? Or would managing fees from an insurance company still be too high, even without the life insurance..

Hi,

No, I would most definitely not switch to this product. The fees are higher than Finpension for a good fund. This fund is also hedged which is not great for most people. I also would not trust Axa that there is only 0.47% fee.

With Finpension, you can choose your own portfolio and do 99% US if you want.

thanks for all the great insights

i was recently recommended Axa smartflex pension plan and the product is Investment theme : Global which is managed passively by Black Rock investment.

the price including TER is 0.5%

any thoughts on that

My thoughts are always the same: a life insurance 3a will never be better than a good 3a like finpension.

Hey, thanks a lot for your reply. I already canceled it before I wrote the comment, but this was still eating me a little :)

Hi Baptiste,

They said if I stop paying at all it will also be considered contract brake and I will only get 17k.

The only way to keep the 25k would be to keep deposit the minimum which is 100chf/mo.

They would invest 60% in AXA Strategy Fund Global Equity CHF (ISIN CH0457194931) with a management fee of 0.5%

But then they also said that in case of death of the contract owner, the heirs will get just 36k.

So even if I die one year before the end of the contract which according to their forecast the account should have around 110k by then, they will only give back 36k!

I struggle to see how is this type of contract legal, isn’t there any consumer association or something?

Hi Lucas

Interesting, I thought most companies accepted the release of the premiums, at least for the 3a product since 3a is optional.

I think the problem is that most people don’t realize how bad these products are so people do not really complain.

Hi Baptiste,

Thanks a lot for your blog, I started recently studying how to invest in Switzerland even though I’m living here since 10 years.

For the past 5 years I had the 3a Pillar with life insurance AXA, I paid in total 30k.

In my account there are now 25k as I didn’t realize they took 800 chf/year for the premium of the life insurance.

If I break the contract I would get only 17k.

So my options are:

1. Move 25k within AXA to a different product with only saving and no premiums and need to deposit 100chf/mo to keep it active.

2. Break the contract and move 17k to Finpension.

What would you do?

Hi Lucas,

You have yet another option which would be to stop paying the premiums. This means the money is kept inside the acocunt and will keep “growing”, but you will not contribute more.

Personally, I would take the loss and move the 17k to Finpension, but of course this is only based on my situation, yours may be different.