Vested benefits accounts: All you need to know!

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Vested benefits accounts play an essential role in the retirement system of Switzerland. You can transfer your pension fund money to a vested benefits account when you are unemployed.

You then keep your vested benefits until your retirement or until you work again.

These accounts are not well known, and there are many interesting things to learn about them. So, this article will go in-depth into everything you should know about vested benefits.

What is a vested benefits account?

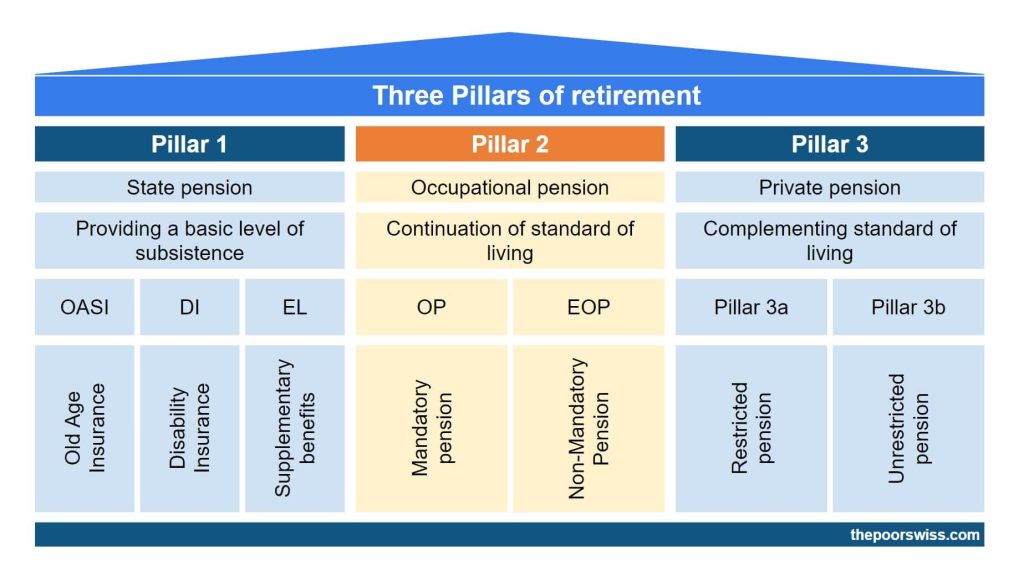

A vested benefits account is a particular account where you can keep your pension fund money when you are not working. It is part of the second pillar system.

When you are working, you are enrolled in a pension fund. But if you leave your company and do not join another, you will not be part of a pension fund. In that case, you must move your pension fund capital to a vested benefits account.

An exception to that is that if you are becoming unemployed, you could choose to still contribute yourself to the pension fund. In this case, you would generally go to the Substitute Occupational Benefit Institution. But this is a rare case.

This also applies if you move out of the pension fund system while still working, for instance, if you are moving abroad.

Just like a third pillar account must belong to a third pillar foundation, a vested benefits account belongs to a vested benefits foundation. These foundations are heavily regulated and must follow strict rules.

While not everybody can profit from vested benefits, they remain an important part of the retirement system. This article will cover everything there is to know about vested benefits.

Vested benefits and retirement

The usual way to use vested benefits is at retirement. It makes sense since it is part of the second pillar.

You can withdraw your vested benefits at retirement age or up to five years before normal retirement.

Also, it is currently possible to delay the withdrawal up to five years after retirement. However, this will not be possible after January 2024 unless you are still working.

Contrary to the second pillar in a pension fund, you cannot choose between a pension and a lump sum withdrawal. Indeed, you cannot draw a pension from a vested benefits account. You will need to withdraw the capital as a lump sum.

A few vested benefits foundations allow you to draw a pension, but this is extremely rare.

We must note that you cannot partially withdraw vested benefits accounts. At retirement, you have to withdraw it entirely.

Optimize for taxes

There is one thing very few people know: you can have two vested benefits accounts. Two accounts allow you to optimize your taxes when withdrawing from them.

You will pay a withdrawal tax when you withdraw your vested benefits. This tax is lower than the taxes you have saved using the second pillar, but it is not negligible either. Therefore, it is essential to try to optimize these taxes.

Withdrawal taxes are using a progressive system. This means you will pay a different tax rate on each tranche of your withdrawal. For instance, a progressive tax system may look like this (entirely made up for the example):

- 2% on the first 10’000 CHF

- 3% on the next 20’000 CHF

- 4% on the next 20 ‘000 CHF

- 5% on the rest

So, if you withdraw 60’000 CHF, you will pay 2100 CHF in taxes. So, higher amounts are taxed at higher rates.

Imagine you can withdraw 30’000 CHF the first year and 30’000 CHF the second. In that case, you will pay 1600 CHF in taxes. You have saved 500 CHF on your taxes, more than 25%!

Therefore, you should always try to have two vested benefits accounts. When you leave a pension fund, you can tell them to split your second pillar and send it to two vested benefits accounts.

It is also important to note that you cannot have two accounts with the same foundation. You need to have accounts with different vested benefits foundations.

Vested benefits and employment

As discussed before, you use a vested benefits account when you are not part of a pension fund, namely unemployed.

But it is important to know that when you are employed again in Switzerland, you must transfer your vested benefits to a pension fund. This is a rule of the retirement system.

Many people will say it is a grey area because pension funds cannot verify your vested benefits assets. And indeed, many people do not transfer their retirement benefits when working again. But this is against the rules. Therefore I would not recommend doing it. I recommend following the rule and transferring your vested benefits to a pension fund.

Vested benefits and death

In the event of death, the vested benefits go to the beneficiaries. The foundation determines the beneficiaries based on four different groups.

In most cases, the vested benefits will go to the members of the first group: the surviving spouse or partner, the surviving divorced spouse of partner (under some conditions), and dependent children.

If there is nobody in the first group, this will go down to group 2, group 3, and then group 4. If all the groups are empty, the vested benefits will return to the state.

In most cases, you will not have to do anything, but if you are living with an unregistered life partner, you should declare it to the foundation to ensure they can inherit (if you wish to).

If you want to learn all the details, read my article about retirement benefits and death.

Vested benefits and divorce

Finally, we cover the event of divorce.

If you get divorced or your registered same-sex partnership is dissolved, each spouse or partner is entitled to half of the vested benefits of the other party earned during the period of marriage or partnership. This is done regardless of your marital property regime.

Only the part earned during the official relationship will be shared, not the entire sum. And both parties will see their earned vested benefits cut in half and transferred to the other person.

If only one person worked, this could significantly reduce their retirement benefits. This is one reason divorce makes couples much poorer.

Withdraw vested benefits without retiring

There are several other ways to withdraw your vested benefits without retiring.

The most used way is to use your vested benefits assets to finance a mortgage. You can use your retirement benefits to cover 10% of the property value.

You can also use your vested benefits to pay off an existing mortgage. This is not something really interesting, but that is an option nonetheless.

If you become self-employed, you can use your vested benefits to start your own company.

Finally, if you leave switzeralnd permanently, you can get some or all of your assets. If you leave for a country outside the EU/EFTA countries, you can withdraw the entire vested benefits. If you leave for a country part of the EU/EFTA, you will only be able to withdraw the extra-mandatory benefits.

The Substitute Occupational Benefit Institution

Many people have vested benefits assets in the Substitute Occupational Benefit Institution and may not even know it.

Indeed, many people forget to transfer their second pillar benefits when they switch employers or stop working. In that case, pension funds must transfer the assets automatically to the Substitute Occupational Benefit Institution.

How to choose vested benefits accounts?

When transferring your pension fund money to a vested benefits account, you must choose a vested benefits account. And as with every financial service, there are many options out there. And unfortunately, many of these options are pretty bad. So, how do we choose vested benefits accounts?

If you are close to withdrawing the money, your choice is simple. You only need to find a provider that allows you to keep the money in cash and charges as low fees (ideally zero) as possible.

However, if you are not close to retirement, you want to look for a provider that lets you invest your money.

There are several critical criteria for choosing a vested benefits provider.

First, you must look at the fees. You do not want to lose your hard-earned money in fees to a greedy banking institution. They usually charge a management fee in percent of your assets. This can eat your returns very quickly. And be careful that many companies are not transparent, and you have to look hard to find the total fees, not only the first fees they present.

Then, you need to look at the investment strategy of the company. You should prefer companies that offer passive funds. Ideally, you want to be able to invest as much as possible in stocks.

Finally, you should look at the domicile of the vested benefits foundation. This domicile is essential if you withdraw your vested benefits while abroad. Indeed, if you are abroad, the domicile of the foundation will determine which canton will tax you. And there are some major differences in withdrawal taxes between Swiss cantons.

You can also at other small things like:

- Customization of portfolio

- Foreign exposure limits

- Sustainability options

The best vested benefits account

Finpension Vested Benefits is the best account in Switzerland.

Use the FEYKV5 code to get 25 CHF in your account!

- Invest 99% in stocks

Currently, the best vested benefits provider is Finpension. This service has many advantages:

- You can invest up to 99% in stocks

- You only pay a 0.49% yearly fee (the lowest available!)

- Finpension is only using passive funds

- You can customize your portfolio in detail

- You can heavily invest in foreign currency instruments (without hedging)

- Excellent tax domicile for withdrawing abroad

- They have two foundations, ideal for splitting your assets

Finpension is significantly better than other alternatives if you want to invest aggressively. If I had to use a vested benefits account, I would use finpension.

You can read my review of Finpension vested benefits if you want more information.

However, keep in mind that if you look for a short term vested benefits account, Finpension may not be the best. Indeed, for the long-term, you want to invest it aggressively. But in the short term, you want to be more careful. In general, for the short term, you will want a good interest rate on cash and avoid exit fees.

Conclusion

There are many important notions regarding vested benefits. If you are serious about the retirement system of Switzerland, you should learn about this important subject too.

Choosing a good account is essential if you use vested benefits. Currently, finpension is the best option for aggressive investors.

If you want to learn more about the retirement subject, I encourage you to read my article about the Substitute Occupational Benefit Institution, another little-known part of the retirement system.

What about you? Are you using a vested benefits account? Did I miss anything about these accounts?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- How Much Will You Spend in Retirement?

- Should you contribute to your third pillar in 2024?

- What Would I Do If I Retired?

Hey Baptiste!

Interesting article! I have a question where I would ask for your opinion.

I used to work in CH for 10+ years and left the country 2 years ago, I have transferred my pension fund sum to a vested benefits account. I would like to amortize the money to cover my mortgage in my EU domicile. I was told the full amount is possible but if I do decide to sell the property then I will have to repay the full amount again to the vested benefits. Is this correct? Do you have any knowledge in why this would be the case? Appreciate any help you can give!

Hi Robs,

Yes, that is correct. If you use the money for a property before retirement, you will then have to pay it back if you sell the property. This is to avoid a loophole where people would be able to empty their accounts by buying and selling.

Hi Robs. I am not sure if this is correct. There are 2 situations here, a) you stay in Swizerland b) you left Switzerland for good. This repayment is needed when you stay in Switzerland and/or add more to 2nd pilar (rachat de cotisations). This is to prevent people from paying in during their employment and getting tax benefits (while working), then taking the money out without paying full tax. The tax at withdrawal is reduced, so without such protection, you could use such tax-benefits all the time. However, if you left Switzerland (and NEVER return!), that doesnt apply, as I believe. Plus, no-one will ever be able to control if you sold your property or not. Why would you repay this when living abroad, where the whole purpose of this repayment is to prevent you from further tax gains IN Switzerland? But if you decide to return to Switzerland, then it;’s probably another story. Not a tax advisor, but this is my understanding.

Thanks for the reminders. Seems I tend to forget some of the basics like “Past performance is not indicative of future results”.

Finpension has a couple of model portfolios and while I like the ability to customize the portfolio I wonder if there is any guidance how to select one of the 3 fond issuers finpension currently offers after having chosen an “Investment strategy” (i.e. Global 60)

Hi marcello,

:)

I think the fund issue comes down to preference. CS is the optimal one because they have the cheapest fonds, followed by UBS and Swisscanto.

If you do not trust CS at all and do not even want your money to touch them, then you should ditch them, otherwise stick with the default option.

Interesting Post as always! I’m about to stop working while staying in CH and need to invest my 2nd pillar for the next 10 years or so. I started to compare different solutions and completely understand the importance of fees. However benchmarking the different model portfolios of finpension from 2019-2022 I got a broad variety of different performances vs. market but also comparing the different portfolios. Additionally I compared a “full service provider” (Vermögenszentrum) with approx. 0.5% higher yearly fees (which is a lot). However this provider produced in some years a performance that was beating the finpension model portfolios by 1.5% to 2% resulting in “net performance” after fees that was outperforming finpension. I would be interested in your view fees vs. investment performance and 2nd since finpension offers a wide range of portfolios you can customize yourself what would be a good approach to select the potentially best performing portfolio. I’m really a bit lost here and would appreciate some thoughts.

3 years is a negligible window of time to compare performance, it’s irrelevant.

If one account could show they were 1% better on average over 30 years at least, I may be willing to pay an extra 0.5%, but definitely not for shorter periods of time.

I would personally be very surprised if VZ did better than Finpension over 30 years.

Finally, keep in mind that past performance is no indication of future returns and that over 10 years, there have been many periods where the stock market was down.

FWIW,

Here is my understanding of what one can do if they have a Swiss vested benefits account and move to or live in France. For example a Frontalier that retires early or leaves their Swiss employment.

The French government allows a one-time low tax lump sum withdrawal from Swiss vested benefits account taxed at 6.7%.

When the funds are withdrawn, the Swiss canton where the account is located will take a withholding tax amount. Let’s say 10% for VIAC.ch in Basel. But, once the French resident has payed the 6.7% tax in France, they can fill out certain Swiss forms and receive a full refund of the Swiss/Basel 10% withholding tax.

This works in all cantons due to the double taxation treaty between France and Switzerland.

That’s really interesting, thanks for the details!

Hi,

Thank-you your Vested Benefits articles have been very helpful. You mention that Finpension being located ub Schwyz is a good if you are making a withdrawal as moving abroad as the WH Tax is low. But I “think” this is only true on smaller amounts. See this chart in link below for Canton Tax rates and withdrawal amounts:

Am I understanding this correctly? Viac is in Basel and a lump sum withdrawal > 1 Million chf would have a lower tax than finpension in Schwyz? And regatrdless, the withhoding tax is recoverable if the foreign country has a double taxation treaty with Switzerland?

THANK-YOU for your great website and regards

https://moncourtierfrontalier.com/quitter-la-suisse-2eme-pilier-frontalier/#Comment_retirer_la_part_surobligatoire_de_la_LPP%E2%80%89

Hi Le,

That’s correct. Schwyz is great, below 1 million but not the cheapest after that. On the other hand, extremely few people will have such an amount in their second pillar.

I don’t know if the withholding tax is recoverable. I have never heard anything like that.

Hey, thanks for that link. Can I ask about this – as per Finpension page, the Maximum withholding tax rate (federal, cantonal and municipal combined) is 4.8 % ion Schwyz. So I do not understand – 4.8 % no matter what, what amount etc? Which info is true? https://finpension.ch/en/withholding-taxes-pensions/

I would personally rather trust finpension over the other website, but I have no proof that any of them are wrong. The max by finpension is likely the max over all possible amounts. But the disparities between both articles are weird.

Hmm, would be great to know for sure. As per this link above provided by Le, Schwyz is competitive up to 500k or max 1 MIllion. Then the % is ridiculously high, and many cantons have better %, Zug, wow. Not urgent and long time before I cash anything in but any idea where this can be verified for sure?

It’s weird, they have another tax page with different numbers: https://finpension.ch/en/capital-withdrawal-tax-compared/

I will ask them what is the difference between these two.

But most people will never go above 500K (most will be lower or much lower).

Hmm, many people will go above 500k. But it is not even the case. It seems that Schwyz is comletely not competitive above certain level, Uri, Zug, all are better. And I see there are various systems, some cantons combine it with income tax, some don’t. Wow, I have seen that before, years ago, but never gave deeper thought for this. Would be great to understand how this mechanism works for each canton.

2nd – I understand, that if you live abroad at the time of withdrawal and for example, transfer your vested benefits account assets from a foundation located in a high tax rate to a foundation in a lower tax rate- you then pay these lower % then? And transfer between foundations IS possible, isnt it?

For your second point, yes, transfers between foundations are possible. And yes, if you withdraw while abroad, the domicile of the foundation is what matters.

Hi Baptiste, firstly, many thanks for this article – it is extremely helpful!

I am planning to leave Switzerland sometime this year to move to a non EU/EFTA country, and I’d like to check whether it’s possible to 1) transfer my pillar 2a to a vested benefit account and then 2) withdraw the amount a year or so later while I am already living abroad?

The rationale for doing so is that our pension fund provider is domiciled in a canton with a high tax rate (and if the capital withdrawal tax rate applied is based on MY canton of residence, then it’s even worse as I live in Vaud), so I’m thinking of transferring the amount to Finpension first so that Schwyz capital withdrawal tax rates would be applied when I withdraw the amount while already living abroad.

Thank you!

Hi Mei,

That should be possible indeed. However, I would not recommend Finpension for that since you would be forced to invest that money and a few years in the stock market is a bad idea. You should find a vested benefits account in Schwyz that allows you to keep the money in cash.

Liberty pension offers that option (also based in canton SZ). An inclusion of Liberty pension in your Vested benefits accounts provider comparison would be very useful. Thanks

Thanks for the suggestion, I will consider Liberty Pension in my next updates.

Good Morning

I have a question regarding my vested benefits account. After I worked in Switzerland for seven years, I left the country for 2.5 years and deregistered in Switzerland. The latter might allow me some freedom to deal with the money accumulated in these seven years in my pillar 2. However, I moved my pillar 2 to the vested benefits account with my Swiss bank. Can you advise if I am obliged to transfer the money from my vested benefits account to the pillar 2 fund partnering with my employer? Or would I have the option to transfer the money to another pillar 2 provider, e.g., finpension? The reason for considering finpension is that they would potentially provide higher returns with a very high proportion of stock investment. If allowed, would you recommend transferring the vested benefits account to finpension? I appreciate any help you can provide.

Best, N

Hi Nick

Are you back in Switzerland and working here? If you are, yes, you need to transfer your vested benefits to your new employer. When you start working again, vested benefits must be transferred to your new employer’s pension fund.

Thank you!

“If you leave for a country part of the EU/EFTA, you will only be able to withdraw the extra-mandatory benefits”

>> Unless you start working as a self-employed, and you do not contribute to any pension fund in that country.

This is an info that many do not know and are “forced” to leave a good amount of their 2nd pillar in Switzerland.

A question from my side if I may…

What if 2 months before I leave Switzerland I quit my job, then am I allowed to move my pillar 2 into a vested account(being unemployed)? If so then once I move back to my EU country, will I be allowed to close that vested account and wire the funds to my bank account?

Asking this question because I really do not want to go through the hassle of having to temporarily move to Dubai or whatever similar place, just to get my full pillar 2 back.

Thanks so much for your feedback

Hi Horia,

I am not sure I follow you.

Are you saying that if you move to the EU but are not an employee, you will be able to withdraw the entire vested benefits amount?

Yes, you got it right

Interesting, I will have to research this.

As for your second question, if that is true, then yes, it should work. You can quit your job, transfer your money to a vested benefits account and then get it in full while leaving Switzerland. Keep in mind that if you come back, you will have to reimburse that money.

Thank you Baptiste,

Another interesting article.

I did this operation in November. Taking advantage of my change of status from employee to LLC.

I transferred my funds to Finpension (thanks to your good recommendation) with the advantage of being able to create two accounts as you mention in the article.

This operation allows me to push my investment strategy via passive funds and improve my FIRE situation.

Thanks

Dror

Hi Dror,

Thanks for sharing! And congratulations to the move to finpension vested benefits!

P.S. I will likely have questions for you regarding the LLC

With pleasure Baptiste. Do not hesitate to contact me.

Hi Baptiste,

great article, always useful and informative.

Just wanted to confirm my understanding is correct, if you reach retirement age and your money are in a vested benefits account, and you want to have a pension, the only option is to use the Substitute Occupational Benefit Institution, with the main drawback that the pension you get is lower than what you would get with pension funds.

Thanks,

Stefano

Hi Stefano

Very few vested benefits offer a pension. Looking at the website of the Substitute Occupational Benefit Institution, it does not look like they offer pension for vested benefits.

Most people with vested benefits take them as lump sum. Don’t you want to do that?

I think it makes sense. In general I would not risk that in case of death, the money are lost.

No, this money is not lost if you are getting a lump sum. It’s in your bank account and follows standard inheritance rules. If you get a pension, on the other hand, this may get lost if you are not married.

Sorry I was not clear. I meant if you get a pension, same as regular pension fund.

Then, yeah, in the case of a pension, you may have to think about what happens in case of death! Good point.

My understanding is that Substitute Occupational Benefit Institution offer the pension option, and the current rate is 4.2% on the whole amount deposited, so indeed not very high, and it may be better to get the capital and invest it directly.

thank you

I will try to look again. But 4.2% is surprising because it’s below the legal minimum of 6.80 on the mandatory portion.