Should You Contribute to Your Second Pillar in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

In Switzerland, you can make a voluntary contribution to your second pillar. These contributions come with tax advantages since you can deduct them from your income. Therefore, you have a return equal to your marginal tax rate. And this return is almost instant.

However, the money is then blocked into the second pillar. And the returns on that blocked money have been very low in recent years. Finally, you can only withdraw the money from your second pillar if you retire, buy a house, start a company, or leave the country.

Many ask whether they should contribute money to their second pillar or continue investing in stocks. In this article, I answer this important question.

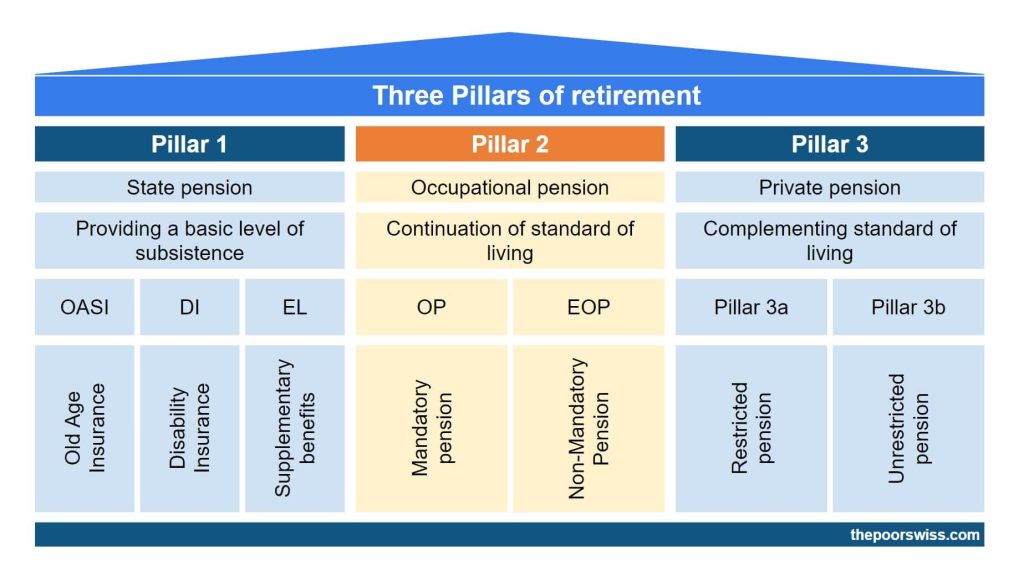

Second pillar contribution

So, how does a voluntary contribution to the second pillar work?

Usually, you pay each month some amount of your salary to the second pillar. And this is matched by your company. You do not have a say in this. So, there is no way to optimize that.

However, you can contribute some amount to cover the holes in your second pillar. If you had a low salary when you started, you will surely have holes in your contributions. When you contribute, you can deduct it from your taxes, just like the third pillar. The second and third pillars are among the best tax deductions.

How much of a reduction in taxes this will realize is challenging to calculate correctly. It depends on your marginal tax rate. The amount will depend on your income, your wealth, and where you pay your taxes. In most cases, this will be between 30% and 40%. That means that the immediate rate of return of this contribution will be 30% to 40%. We can view voluntary contributions as a form of investment.

Now, the invested money will be blocked until you can take it. In the second pillar article, we have seen only four cases when you can take this money out: building a house, starting a company, retiring, or leaving Switzerland. In those cases, you will lose out on the part of the second pillar as taxes. But this is not as much as your marginal tax rate.

Voluntary contributions are always blocked for three years (only the amount of the voluntary contribution is locked, not the entire second pillar).

As long as it is inside the second pillar, your money will get some interest rate. Unfortunately, the interest rate is currently low now. You can expect about a 1% interest rate in most pension funds in Switzerland. Nevertheless, it is a safe interest rate for now. It cannot go down. So, you can consider the second pillar as a place to allocate your bond.

However, if you are lucky, you will get a better pension fund. Some pension funds have average of up to 5% per year, but they are quite rare.

There is a second tax advantage to the second pillar. You do not have to pay taxes on the second pillar assets. So, if you have a large net worth, you will not have to pay wealth tax on your second pillar assets.

But this is a smaller advantage than the first one. It will still reduce your taxes a little further, but where the first tax advantage can be up to 40%, the second advantage is about 1% in the best case. Nevertheless, it is still important to know that you do not pay any wealth tax on your second pillar.

Scenarios

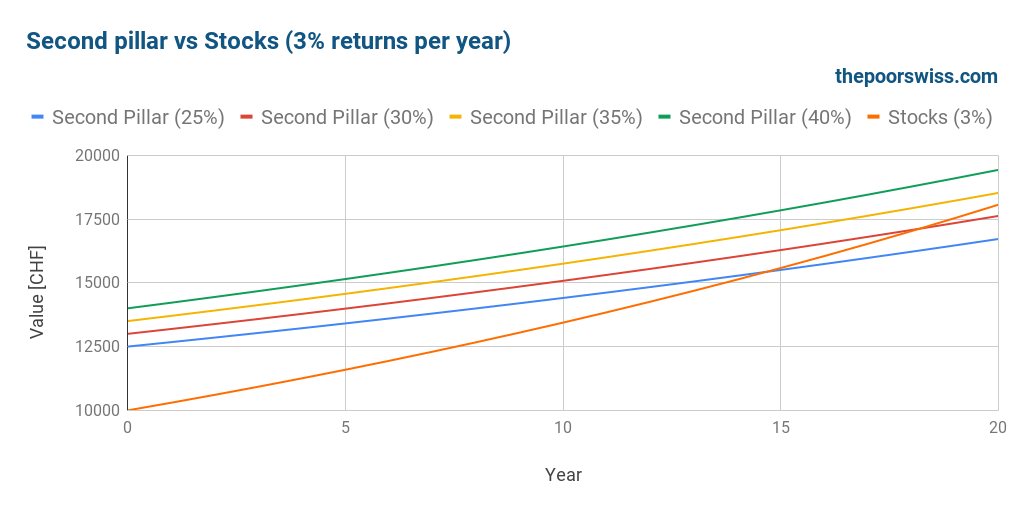

The obvious alternative is to invest in stocks. We can check how the same sum behaves if invested in stocks or contributed to the second pillar. First, we run some scenarios to see how that works. We will simulate a one-time investment of 10’000 CHF.

We start with a return per year of 3% for the stocks. This is a very conservative estimate. For the second pillar, we will consider 25%, 30%, 35%, and 40% marginal rates. The current interest rate on most second pillars is 1%. So we will take that as the reference.

The tax savings of the second pillar will be reinvested in stocks directly. So, if you have a marginal tax rate of 30%, 10’000 CHF invested in the second pillar will also result in 3000 CHF in stocks.

Here are the results for twenty years.

As you can see, it takes about 15 years for the stocks to catch with even the lowest marginal rate. And it would take more than 20 years for the stocks to catch up with the high marginal tax rates.

In that case, a 3% return per year on the stock market is slow to catch up with a substantial interest rate as a tax deduction. So, if you expect 3% from stocks, you should probably favor your second pillar.

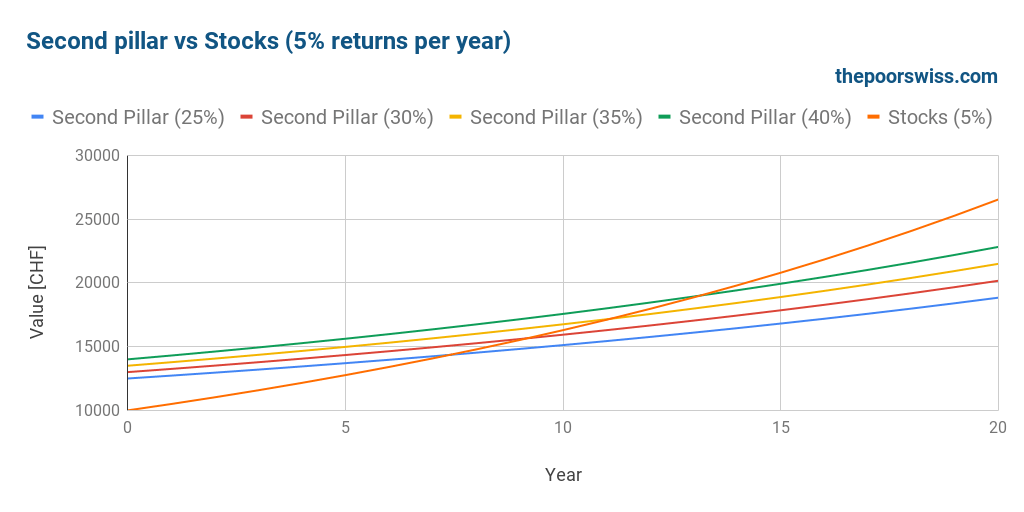

But generally, stocks are returning more than 3% per year. So, we will see what happens with a 5% return per year. This is what I expect on average from the stock market.

This time, it takes less than ten years for the stocks to increase as much as the second pillar, with the lowest marginal tax rate. But it almost takes 15 years to catch up with the highest marginal tax rates.

This exponential growth is the power of compounding. Even 5% per year can return a lot in the long term. 5% per year is what I expect from the stock market.

Obviously, in practice, you will not get 5% per year. You may get 10% one year and -20% the next year. But this is how the stock market works, and I am prepared for this. You can only expect average returns over the long term.

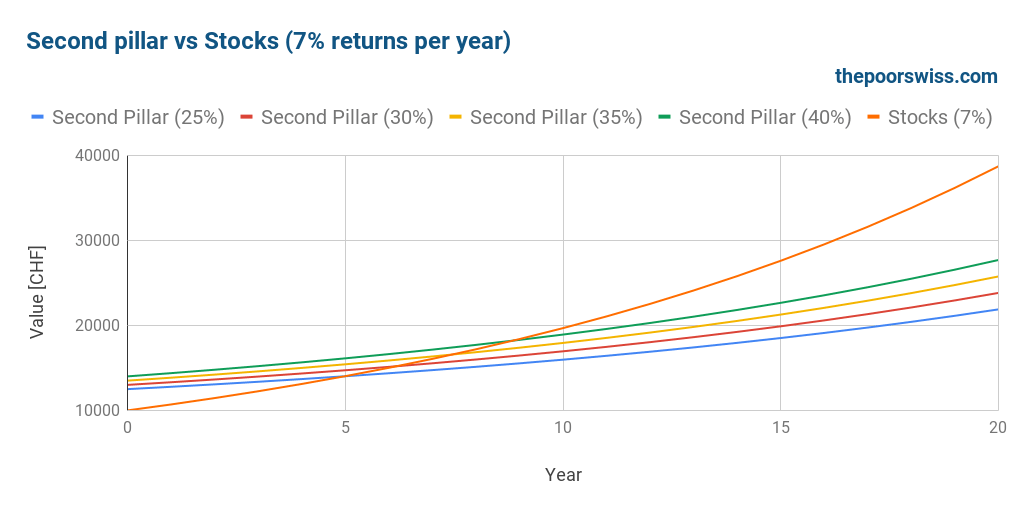

Now, some people are counting on about 7% of yearly returns. So, here is how that will go:

With 7% of stock returns per year, the return on the second pillar contributions is dwarfed. Even the highest marginal tax rates would be beaten after less than ten years. Compounding gets stronger and stronger as the returns increase.

So, we can draw a few conclusions from these results:

- The second pillar is interesting if you have a high income.

- The second pillar is interesting if you reinvest the tax savings in stocks

- If you expect very high returns from stocks, you should avoid the second pillar

- Over ten years, the second pillar is interesting

- Over more than 20 years, the second pillar is rarely interesting

However, there are other considerations. First of all, it will depend on the term of your investment. If you are investing long-term, it is probably better to stick with stocks. But if you are to get access to your second pillar soon, it may be a solid investment. It could be a good investment if you retire soon, build a house, or start a company in the medium term.

But do not forget that voluntary contributions are blocked for three years. So, if you intend to buy a house in the next three years, you should not invest in the second pillar (unless you already have enough in the second pillar without the voluntary contribution). If you plan to buy a house without the second pillar, you can continue your contributions if you have enough cash for the downpayment.

Another thing you need to take into account is whether you have a great second pillar account or not. If you have a good second pillar account invested in stocks, it will become more interesting to invest in it! But most people in Switzerland will not have access to a good second pillar.

The other consideration is whether you need bonds in your net worth.

Your bond allocation

Due to its safe nature and the guaranteed interest rate, I consider my second pillar bonds. I integrate my second pillar into my net worth as bonds.

So, another reason to buy into the second pillar depends on your allocation. If your bond allocation is too low for your current allocation, you can voluntarily contribute to increasing it. Given that it also has a nice tax advantage when you purchase, it is probably better than bonds.

When Swiss bonds are negative, the second pillar is also much more interest than Swiss bonds. If I need to increase my bond allocation, I will invest more in my second pillar instead of bonds.

At the start of 2021, we had 5.2% allocated bonds in our net worth. Since we aim for 10% bonds. So, it shows that we should contribute a little to our second pillar. Unfortunately, it is not a good time for us, as we will see in the next section.

Proper Timing

There are some cases where it becomes very interesting to make such contributions.

- When you know that you will retire or buy a house in the medium term (but further than three years). Since they are short-term investments, it is good to use them as such.

- When you know that you will leave your company and switch to vested benefits account. This could be the case when you are retiring early or leaving Switzerland. These accounts are often much better than second-pillar funds. So it could be interesting to max out your contributions to have them invested properly.

On the other hand, there is one case where you should not contribute to your second pillar: when you do not get any tax advantage. When you withdraw money early from the second pillar (for a house or business), you will not get any tax advantage until you have paid back the withdrawn money. So, as soon as you withdraw money from the second pillar, it becomes pretty much useless to put more money into it.

This is the case for us. We just withdrew money from our second pillar and cannot get any tax advantage until we contribute at least 50’000 CHF. So, without the tax advantages, it does not make sense for us to invest in the second pillar.

These examples show that timing is important for second pillar contributions.

Conclusion

From an investment point of view, contributions to the second pillar can be a good medium-term investment. However, you should only do them if you have a high income.

On top of that, if you expect very high returns from your stocks, the second pillar becomes less interesting. And you should try to reinvest your tax savings in stocks. Even though they have a substantial initial return on investment, they have very low returns per year after that.

On top of that, the money in a second pillar is an excellent alternative to bonds. They have a guaranteed (at least for now) interest and offer an excellent tax reduction. These tax reductions would be quite interesting as one is nearing retirement. But remember that you can only contribute to your second pillar if you have a salary or have your own company.

But it is not necessarily the best investment at all times. Like every other investment, it will depend on your context and your situation. You should consider every element before you decide on any investment. And never make any rash decisions!

Since our marginal tax rate is increasing, I wish I could contribute a little to the second pillar. Unfortunately, we just withdrew 50’000 CHF from it. So, we would need to contribute 50’000 CHF back without tax advantages before we could get tax advantages. So, we will first put that 50K CHF back into the pension fund before having benefits.

If you are interested in saving money from taxes, you can read my article about the best tax deductions in Switzerland.

What do you think about this? Are you contributing to your second pillar?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- What is a 1e pension plan (pillar 1e)?

- Third Pillar: All you need to know to retire in Switzerland

- The Three Pillars of Retirement in Switzerland

Hi Baptiste,

I have looked around but I did not manage to find an answer. If you contribute to the second pillar do you pay taxes as usual during the year and then expect to get the taxes back the next year after you do the tax declaration, or rather pay taxes as if you income is “income – 2nd pillar contribution” (which is possible for who is not taxed at source), which would be a more appealing option? The same would actually apply to the 3rd pillar and other costs that you know you will be deducting from your income.

Best Regards,

Niccolo

Hi Niccolo,

You pay less taxes. You will get a document proving your contribution, and you can deduct tax on your declaration. So, your taxable income will be lower the year you have done the contribution. It works the same as the 3a for that.

Thank you for the prompt answer.

By “you pay less taxes”, do you mean that I can avoid paying the taxes on these deductions in the first place? I am not sure if in all cantons it is the same. I recently moved to Zurich and here with a permit C you can practically decide how much tax to pay during the year. In particular, you simply fill your income in an online form and get an estimate of how many taxes you should pay that year together with a payslip. I am considering already deducting the voluntary contribution to the 2nd and 3rd pillars there, rather than waiting for the tax declaration, which would mean potentially waiting for more than an year to get those taxes back.

I believe most cantons work the same way. So, yes, you could pay less in advance.

Keep in mind that if you contribute 10’000 CHF, you cannot reduce your tax by 10’000 CHF, only by your marginal tax rate multipled by 10’000 CHF.

Hi,

Recently discovered your page and as a financial layman I find it extremely useful thank you!

I have a big gap in my 2nd pillar as I only started working here a few years ago. I have been paying max payments into a 3a with life insurance (which I understand is definitely not the best use of that money).

I am planning on doing this – and would love your feedback:

1. Keeping the 3a/life insurance policy but reducing the payment to the minimum amount

2. Opening a Viac account and depositing monthly, half the amount that I was putting into that 3a/life insurance policy

3. Buying back/ contributing to my 2nd pillar with the other half of the money that I was putting in the 3a/life insurance policy.

At a first glance, does this make sense and seem like a good first step as a beginner with no “assets” (home / businesses).

Hi Sarah,

1) Try to reduce it to zero, that would be ideal. But indeed reducing is a very good important first step.

For 2) and 3) I would first fill up the 3a and only then contribute to the second pillar. The 3a is more flexible for investing. When you are able to fill up the 3a each year, then you can think about contributing to your second pillar.

Yes, this makes sense :)

Dear Baptiste,

is there a limit amount to buyback 2nd Pillar per year for tax reductions? e.g. for 3rd Pillar is 7056 CHF per year.

thank you

There is a limit, but not a global limit. You can contribute as much as your pension fund will allow you, so as much as you are missing.

The second limit is that it does not make sense to contribute more than you would save in taxes. If you pay 0 CHF in taxes after contributing 100’000 CHF, it does not make sense to contribute more that year. In fact, we should stagger contributions.

Hi Baptiste,

There is another, albeit small additional benefit I think is missing here. If you contribute and save taxes, that saved money could be invested into stocks.

In my case, it’s a bit different. I am moving back to Switzerland starting again with zero in my 2nd pillar. It’s a bit more interesting to catch up now with the money I originally pulled out years ago.

Hi,

I was thinking the same, and it would make quite a difference reinvesting the tax savings every year. I run some simulation as the ones in this article and with:

– 10K CHF contribution per year in 2nd pillar.

– 30% tax saving reinvested every year in stocks

– 1% return per year on 2nd pillar.

– 5% return per year on stocks.

You would get a total asset value that for ~18 years would be higher with respect to investing 10k CHF per year only in stocks (with a peak of ~+16k CHF).

I hope I did not do any miscalculation, here is the short script for reference: https://paste.pics/ed2bd03401d8b247aaa3030d4857c73e8c178.

Hi Niccolo,

You are asbolutely right, I should add reinvesting properly in stocks, using the same average returns I comparing.

I don’t know I did not do it since I did it for the third pillar article.

Your math seems correct, but I did not run the entire simulations again.

I will update this article soon with reinvesting.

Ups, the link is broken, here is the updated link that shows my calulation: https://paste.pics/NTC0G.

Thanks, Niccolo. I have updated the article with results, including reinvesting in stocks. As expected, the results are better than before for the second pillar. And up to 5% returns per year on stocks, the second pillar performs nicely.

Great, thanks for the fast update!

Do you have a link to your calculation? My estimation is a bit off and I am curious to know if there there is something i am not taking into account.

Sorry, I don’t have them public. It’s too much effort to keep them public and then answer all the questions I would get. And I also find the sharing on Google Sheets to be bad for public sharing.

Keep in mind we are not doing the same since I am doing a single investment and you are doing yearly investment.

Hi, do you get taxed when you do an early withdrawal of the Pilar 2 say, o buy a house? At which rate are the withdrawals taxed? Same as normal income?

Thank you!

Hi Nicolas

Yes, you get taxed, but at a significantly lower rate than income tax rate. This rate is different for each canton. And this rate is generally progressive by tier.

Hello,

I asked my second pillar provider and they confirmed that although you cannot withdraw the 22nd pillar contribution for three years to buy a home, you can still pledge it to buy a home. So I think that having the intention to buy a home in the next three years should not be a reason not to contribute to your 2nd pillar.

Am I missing something here you think?

Thanks a lot for your blog

Hi Justin,

You are correct. If you plan to pledge the money, you should be fine since pledging is long-term and you have no 3 years limit. In that specific case, it’s not a reason not to contribute.

I think this article is missing an important point: The returns on the 2nd pillar during retirement.

On the mandatory part of the pension, it’s 6.8% and on the extra mandatory (if that’s where you contribution lands), it depends, but it’s common to get over 5%.

So when you combine the tax advantages with the returns which are higher than an often targeted 4% during retirement, then it looks like an attractive proposition, except for the fact that the money is more difficult to get to prior to retirement.

That article assumes you are getting a lump sum for your second pillar.

Contributions all lands in the extra mandatory part. So, you usually get about 5% pension.

4% is not target return, but withdrawal rate, which are different. I expect at least 5% annually returns, so 5% on the second pillar is in check with what I expect from my own portfolio.

Hi IB, I have been lurking around your blog with so many questions. Sorry and thank you. You are so great!!! As I’m leaving Switzerland and about to transfer my Pillar 2 into finpension vested benefits account, I’m considering making the buy back contribution of around 30K to get more benefits from tax deduction. Is this falling into the scenario “When you know you will leave your company and switch to a vested benefits account. This could be the case when you are retiring early or leaving Switzerland. These accounts are often much better than second pillar funds. So it could be interesting to max out your contributions to have them invested properly”

I’m quite unsure about the locking 3 years rule for the buy back. I’m leaving in a next few months and will make the buy back now. Is the transfer from Pension Fund to finpension considered an early withdrawal that violates this 3 years rule.

I found this on finpension website,

“The blocking period is three years. It begins on the day of purchase and ends three years later to the day. Both the advance withdrawals (WEF, self-employment, emigration) and the lump-sum withdrawal on retirement are affected by the blocking period.”

Normally, buyins should be locked for withdrawals, not for transfer. You should be able to do contributions and move all the money to another pension fund or vested benefits accounts without issue.

You can ask finpension to be sure, but I am pretty sure it would not cause an issue.

Hi, since my one year employment contract ends in August i was wondering if i am allowed to contribute to second pillar too? The idea would be to transfer the money after the contract end to a vested benefit account like finpension or viac (99% stock allocation possible). So i would benefit from tax savings and still be invested in stocks until my retirement. i am currently 37.

Dear Baptiste,

I like your blog a lot (i sometimes disagree with some things, while at the same time agree with many other things); i think that your blog stimulates us a lot to think about how exactly we provide for own future – and this is very important. Thank you so much indeed for sharing so much with us. I think that yours: “So, you can consider the second pillar as a place to have your bond allocation.” (i.e. to use pillar 2 instead of bonds, as swiss bonds yield negatvely) – is a terrific thought! i honestly never thought of the 2nd pillar this way; it is very wise and gives plenty of food for thought.

Hi,

Don’t hesitate to let me know in the comments when you disagree :)

I am glad some of my articles are stimulating people to think more about their future!

And the second pillar is a good way to balance an asset allocation!