How to Open an Interactive Brokers Account in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Interactive Brokers is an excellent broker from the United States. It is known for its cheap fees and unique investment product range. It is being used by many personal finance bloggers, for instance.

It is currently the best broker that allows access to U.S. ETFs. And U.S. ETFs are the most efficient ETFs for Swiss investors.

In this guide, I review how to open an Interactive Brokers account. It is not very difficult, but there are a few things you need to know before you start your application. And I also teach you how to optimize your account to save money!

Interactive Brokers

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

So what is Interactive Brokers (IB)?

IB is a brokerage firm from the United States. It was created in 1978 in New York, more than 40 years ago! IB is the largest brokerage firm in the United States and the leading foreign exchange (forex) broker. Interactive Brokers offers access to many instruments, such as stocks, bonds, options, futures, and more.

Interactive Brokers is a very well-known broker with an excellent reputation. It is known to be cheap compared to its competitors. I have already compared IB and DEGIRO in the past. This comparison showed that it is even less expensive than DEGIRO, the broker I used before.

An essential thing with IB is that, by default, they do not lend your shares to other people, such as DEGIRO does by default. But you have the choice, which is good! Indeed, you also can lend shares, and you will get some of the money from the lending.

If you want more information on IB, read my review of Interactive Brokers.

Why open an IB account?

So, why did I open an IB account? It is currently the best broker available to Swiss investors.

There are many reasons to prefer Interactive Brokers over other brokers.

- IB offers access to U.S. ETFs to Swiss investors, while many brokers are not.

- IB has excellent prices.

- IB offers access to many investing instruments.

- IB offers foreign exchanges at an excellent price.

- IB has an excellent reputation.

- IB has good financial strength.

So, we will see how one can create an account on IB.

Create an Interactive Brokers account

First, prepare some time in front of you. The account creation process on Interactive Brokers is not difficult, but it will take some time. You will need to answer a few questions, and you will need to wait a day for your account to be funded.

Interactive Brokers has several entities in Europe. The primary entity is IB UK, but one is in Luxembourg, and one is in Ireland, for instance. For Swiss investors, the best entity is IB UK because they offer access to a Swiss IBAN and give you access to US ETFs. For European investors, it does not make much of a difference.

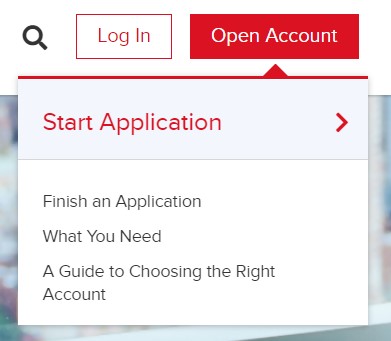

First, go to the account creation page and click “Open account”.

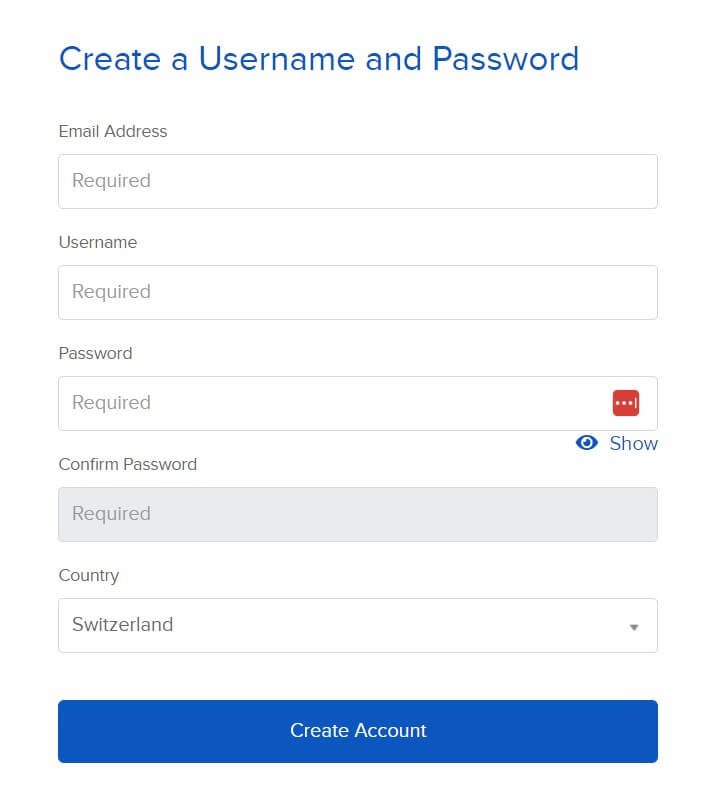

On the first page, you must enter your email, user name, and password for the account. Make sure to choose a good password and user name.

I would recommend making your password at least 20 characters long. A long password is essential to secure your online accounts! Make sure to remember it correctly as well!

You also need to enter your country of residence. If your country of legal residence differs, you must also enter it. You can then confirm the first page.

At this point, they will email you to confirm your email address. Just check your mail and choose to continue the application.

Personal information

On the second page, you will have to set your account type. I put it to Individual for this example. You can check the kinds of accounts to ensure you choose the one according to your needs. But most people will want either an Individual or a Joint account.

Then, you will have to enter the general kind of personal information. Nothing is special here, only what you are used to entering on each website. You will have to set your addresses as well.

Since this will be related to your taxes, it is essential to enter them correctly. You will also need to enter a valid phone number. IB will use this phone number authentication, so once again, enter it correctly.

IB has several types of accounts. You will need to select the type you want. The primary type of account is a Cash account, which is the type you probably need. A cash account means you need to have the money before each trade.

There are also Margin accounts (IB has some good information about margin accounts). Margin means you can use leverage for investing with money you do not have. Unless you know what you are doing, I recommend a Cash account.

Another thing you need to configure when you create an IB account is the base currency. Since I make most of my payments in Swiss Francs (CHF) and live in Switzerland, I chose CHF as my base currency.

You can always convert money from your base currency to any other currency. The base currency only matters for the interface’s display. If you choose CHF, you can still transfer USD and buy shares in EUR, for instance.

Currently, the CHF balance has a positive interest rate. If it becomes negative again, you will see a warning about the negative interest rate on CHF balances. You can get the current negative interest rate and limit here.

Now, you will also have to set up three security questions. You will need these questions if you ever need to recover your account. Make sure you choose questions from which the answer is not ambiguous (but not easy to find)! This procedure is, once again, a standard procedure.

Investment Questions

After this, you need to answer questions about your finances.

You need to tell how much your net worth is and how much income you have. You also need to say what your objectives are for your investments. For instance, you may want to invest for capital appreciation or fixed income.

All this information is here for regulatory reasons. I would advise you to answer them with honesty.

You also need to set which instruments you need to invest in. For instance, if you want to invest in stocks and bonds, you must select these options. I only chose stocks.

Stocks, bonds, options, and futures are among many other choices. You must also select which country (stock market exchange) you want to invest in.

You also need to confirm your phone number with a code.

Confirmations

At this point, you must agree to all the rules IB has for trading. Ideally, you may want to read them. But you probably will not!

If you want, you can also join the Stock Yield Enhancement Program. This program will allow IB to lend your shares to other people. With that, you will receive half of the profits.

Of course, there is a slight risk to that, and you may also be unable to sell your shares when you want or need to. I am not using that feature now. But I have tested this feature recently, and it works well.

At this point, Interactive Brokers will want proof of your identification. For this, you can upload a driving license, an ID card, a passport, or an alien ID card for IB to confirm your identity. You will also have to enter information about your tax status on the same page.

You will also have to fill in information about your employer and job. Usually, you also need to submit something as proof of address.

Fund your IBKR account

IB will fully activate your account once they receive funding.

You need to deposit the first amount for IB to validate your account. First, you need to declare how much money you will deposit. Then, IB will give you all the information necessary for the payment.

Make sure you correctly copy the IBAN. With banking transactions, you should always double-check all banking information before transferring. The transfer will be free since they have a bank account in Switzerland!

And do not forget to include the “Further Benefit to XXX” line! Otherwise, the money will not go directly to your account, and you must contact them to fix the issue. You must do that for all future deposits to your Interactive Brokers account.

Finalize your account

After you have funded your account, you can still do a few more things.

First of all, you can configure the market data. You should set your market data status to non-professional. And you should check that you are not buying any market data. Unless you plan to day trade, you do not need this data. You do not want to pay for it.

One great thing is that you have to use two-factor authentication (2FA). You have no choice. You must configure your mobile phone to use it as 2FA.

2FA is an essential part of online security. First, you need to install IBRK Mobile on your phone. This application is available for Android and iOS.

Once you have installed the application, you can register it as a two-factor authentication for your account. You will have to log in with your username and password, and you need to enter the code you received by SMS.

Finally, you can then choose a PIN for your future two-factor authentication. Remember that PIN since you must use it for each connection to Interactive Brokers.

If you do not know about 2FA and why it is necessary, read my article about online personal finance and security.

Wait for your account

At this point, you only need to wait for IB to create and fund your account.

It should not take too long. It only took one day for my account to be created and funded. It is pretty fast. The next day, I could directly make my first trade.

Optimize your IBKR account

Now that you have access to your account, there are two more things to finalize in your account.

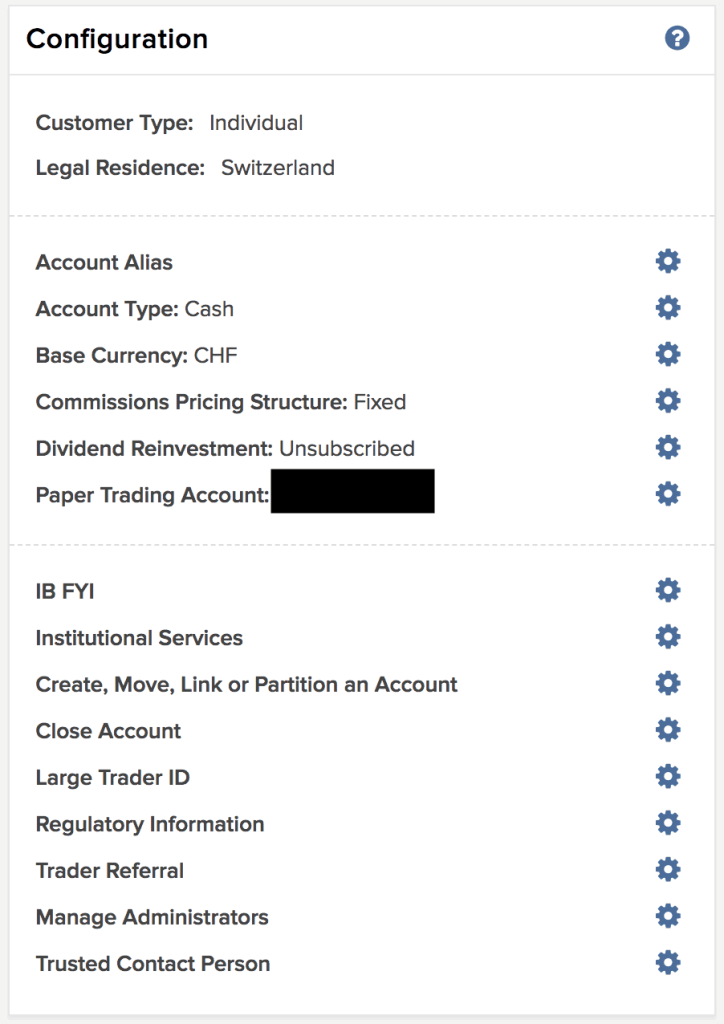

The first thing remaining at this point is configuring the Pricing System. I recommend you use the Tiered Pricing system. IB is cheaper than DEGIRO when you use the Tiered Pricing system.

You can make the change in your Account Settings. If you prefer the more predictable Fixed Pricing, you can also opt for it. There are some cases where fixed pricing is cheaper than tiered pricing.

Here are my settings just before I made the change to Tiered pricing:

The second thing applies if you are a Swiss investor and will invest in U.S. ETFs. In that case, you need to fill out the W-8BEN form. That is pretty simple. You can go into your Account Settings. Then, you must click the (i) blue button next to your name below Profiles. Then, you can click on “Update Tax Forms”.

They will then take you through the process, and you can fill out the W-8BEN tax form. This form will halve the dividend withholding from your American stocks and ETFs. This step is essential if you want to profit from the great tax efficiency of U.S. ETFs.

Some people have told me that it sometimes takes about one day for the account currency to be changed on the interface. You have to wait one day, and the issue should disappear. In the meantime, you may see some numbers in other currencies (likely GBP).

Another thing you can choose to do is to allow IB to lend your shares. By doing so, you will get 50% of the profits. This feature is called the Stock Yield Enhancement Program. However, there are some risks. I have tried it on and off over the last few years, but whether you think it is worth it is up to you.

Conclusion

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

The procedure is now complete! If you followed this guide, you now have an Interactive Brokers account.

With this great broker, we have access to U.S. Exchange Traded Funds such as VT, which makes the most significant part of my portfolio.

I have now been using IB for more than two years. And I am delighted with IB. Interactive Brokers is the best broker available to Swiss investors.

The next step is now to buy an ETF from Interactive Brokers. It is also relatively simple and only takes a little time.

What do you think about Interactive Brokers? Do you already have an account? If not, which broker are you using?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Brokers

- More articles about Investing

- What is the best Swiss broker in 2024?

- TradeDirect Review 2024 – Pros & Cons

- Swissquote vs Interactive Brokers 2024

Hi Poor Swiss,

your content is great! thank you so much for teaching the newbies in this world!

I have a question regarding the account settings, I see that under Pricing plan I have a IB account “Pro”, but I cannot change this, neither I see this description on your settings.

I did some reading and it seems all non US residents/citicens have this account, could you please confirm I am not going to be considered by IB as a pro trader (I am far from a beginner) and also not incur in some extra “Pro trading costs”?

thank you so much!

Hi Blanca,

In Switzerland, we can only access the Pro account, I have the same. In the US, they also have the Lite account, but we can’t use it in Switzerland.

So, this has nothing to do with professional investor status :)

Hi Poor Swiss,

So I am in the process of opening my account with IB when it comes to funding the account when I add the IBAN they provide and the address, the address is either a uk on or US one which means my bank will charge me an international fee for any Swiss francs that I send over to IB because it’s now recognising it as an international transfer because of the address provided by IB

I also notice that form that IB provides it gives two IBANS on Swiss the other GB but don’t provide a Swiss address to use along the Swiss IBAN. Did you face the same and how do you go about it to make sure you have free Swiss francs transfer?thanks

Hi Jay,

Are you sure about that? What is your bank?

I have tried from Neon and Migros and they both were entirely free transfers to the CH IBAN even on UK address.

They do not have a swiss address, only a Swiss IBAN (CH).

They indeed have two CH IBAN, both should be working fine. Just use the one they give you.

hi Poor Swiss, Thank you so much for checking I will give it a shot with my UBS I was initially using my revolt account and it immediately flagged it as an international transfer when I added the address. In amidst of trying to sort this out I called IB and while I had them on the phone I enquired on Vanguard all World (VT) ETF,the lady explicitly told me I wont be able to invest in any US ETFS because the account they have created for me is called “Retail” and they can only change it to “professional” if I meet 3 requirements; if I worked or working in the financial sector of 5 years plus, my entire portfolio being minimum 500K… and I have none of these requirements and the main reason I was moving over to IB from Degiro where I recently created account was to take advantage of the US ETFs as encouraged from one of your articles

Hi Jay

Yes, no reason to go through Revolut for IB.

If you are in the EU, she is correct. If you are in Switzerland, she’s wrong. You don’t need to be a professional investor to buy US ETFs on IB UK as a Swiss investor.

hi Mr Poor Swiss,

yes i am a swiss investor. Thanks for that clarification once i am settled in into the account and i cant buy US ETFs I will follow up with a call to make sure I am given that right access at least whilst we still can. Because I tried to explain to her i was investing from CH but she was adamant. I will double check once I can start trading on the platform.

Good luck!

It helps to insist in these cases.

Hi upon the very First Verification and account type selection, it asks if i want to invest in Cryptocurrency, if i say yes, they create my account in the US , if i say no, it is created in the UK affiliate, any chance you know where is your account? Basically can you invest in crypto? If yes i would say US account, if not UK account.

Hi TN,

My account is in the UK. Currently, Swiss investors are not allowed to invest in cryptos with IB.

If you find a way to invest in cryptos with IB as a Swiss investor, let me know!

Hello Mr the Poor Swiss,

Love your content, Thank you so much for helping us out.

I have a question, I’m trying to open an IBKR account, but when I honestly answer the Income and Worth part it doesn’t let me. My Liquid Net Worth in CHF is not 100,000. But they tell me that to trade options it much be, Should I lie? Otherwise, I will never be able to open an account. But at the same time, it doesn’t feel right to lie about that… also my annual income isn’t superior to 40.000 CHF. Everyone keeps telling me because time in the market beats timing the market, but I think I don’t have the means to actually invest, If I’ honest in my application.

Thank you so much.

Hi Joan,

I don’t understand the question about options? Are you trying to trade options? If you are starting out in your investing, you should not trade options.

In any case, I would not recommend lying, no.

Yes, I’m trying to buy options. I would like to start investing in the S&P500. So that’s why I’m trying to trade options, to give access to ETFs and Index Funds.

Thank you so much for your reply.

Hello,

great blog with lots of tips. I just opened an account but I realized that I opened a margin account instead of cash. Now I tried to edit under the configuration but don’t let me do it, he tells me:

“Negative Excess Cash: Settle positions or deposit with more cash.

Position Violations: Close prohibited positions in a liquidity account (example: stocks in short positions).

Negative Currency Violations: Buy the currency in the FOREX markets or liquidate the positions you have in that currency. ”

Do you know why and how I can solve the problem by switching to a cash account?

Thank you very much.

Greetings.

Hi Gabriele,

You can’t change back to a cash account if you are using margin. So, first, you need to get rid of the margin.

My guess is that you bought shares in foreign currencies without converting first. For instance, you deposited CHF and bought in USD. In that case, you will need to convert some CHF into USD to compensate.

The other thing possible is that you sold more shares than you have. In that case, you will have to buy bak the shares.

This is why I don’t recommend margin accounts since you have to be careful about what you are doing.

Hi, thanks for the reply. I solved the problem I changed the mode on the mobile app I was able to switch to liquidity, however I have not invested anything yet I uploaded 50 fr. on the account to open the account. I have another question when you say, “And don’t forget to include the line” Additional benefits for XXX “! Otherwise, the money will not go directly to your account and you will have to contact them to resolve the problem. You will have to do this for all your deposits to your Interactive Brokers account. ” What do you mean? Can you check it even when I have already registered? Thank you!

Hello,

another thing, in your explanation at the point to change the “commissions pricing Structure” under configurations they do not appear to me. I’m not there, maybe I missed something? Thanks for your great explanations

In your account settings, there is a list of rights on the right of the screen. In there, you have one that says Pricing Structure. Next to that is a small wheel you can click and this will let you choose between Fixed and Tiered.

It’s nothing you have to check. It’s something you have to add in your bank transfer. When you do a transfer, you have usually a “message” field where you can add a message to the recipient. This is where you should add at least your account name (UA-something).

Thank you very much for the information you have given me. I have read most of your reviews on your blog and also living in Switzerland (Ticino, Lugano) and I am taking a lot of ideas from you. Now I am trying to make my wallet with IB and I would like to change bank and switch to a Neon digital bank I will try to do thanks to your explanations. I subscribed to your blog so as not to lose any information I keep myself updated. Thanks Again Baptiste

Thanks for your kind words! I am glad you found all this helpful :)

Dear Baptiste

I really enjoy your blog, great infos everywhere. Now I came into the unpleasant situation that my Swiss broker told me to close my HK-listed ETFs by mid-January 2022 since they do not have a KID available and thus do not comply with the painful MiFID regulations (I read your other article that treated this topic in view of US-domiciled ETF’s). I am in the process of opening an IB account (in any case because seems generally the best option for Swiss investors) but maybe you would know the answer to two of my overarching questions:

– does IB allow retail investors to keep their uncompliant assets?

and

– what is it worth to keep them if one cannot trade (i.e. sell) them anymore? Why having an asset if there is no market for it?

Looking forward to hear your thoughts and thanks,

Daniel

Hi Daniel,

Sorry to hear about that. These stupid regulations are really painful for investors.

To my knowledge, they do allow it. They won’t allow you to buy things you are not allowed to buy, but once new regulations kick in, they should let you hold the non-compliant assets, just not buy more.

If you are allowed to keep them, you should be allowed to sell them. The market does not disappear, there are just fewer participants in it.

Hi Baptiste,

Thank you so much for all the useful information you are providing.

I have one question, which is not directly related with the opening of the account, but the transfer of funds to it.

As a test I tried to transfer 100 usd (Shared costs) from a Swiss Bank Account in chf to the IB Account, and in the end I got only 88 usd at the target. It seems a lot of 3rd parties have taken a good toll from those 100 usd. On top of those 12 usd lost somewhere in the transfer, the Swiss Bank will charge me 5 chf for the international transfer.

My question is:

Is there any cheap way to get the funds from a Swiss Bank Account into IB Account without much loss?

Thanks in advance for your reply.

Hi Pedro,

I don’t understand why you would send 100 USD from a CHF bank account? Why don’t you send CHF directly, it’s free.

And if you have USD in an international account, you can transfer directly to the USD account of IB, it’s also free.

Hi Baptiste,

Maybe my question was not so well formulated. I have an account at Credit Suisse (in CHF only), which will always charge 5 CHF on any international transfer.

I don’t have any account in US, only created the Interactive Brokers account. Consequently would like to know from you what would be the best way (less charges) to transfer money to the IB Account from the Swiss bank.

The transfer of 100 usd was just an initial test to see if the transfer would work fine.

Thanks in advance for your reply.

Just some additional information…

I have setup the currency at IB Account as USD. If you tell me that CHF is better for making the transfers, I guess it is still possible to change.

When I did my first transfer (yes, I just opened the IB Account 2 days ago based on your reviews) I had like 4 options to transfer, maybe here you also have a recommendation.

I believe the 5chf at Credit Suisse will always be charged, which is ok when I decide to transfer a bigger amount of money.

Cheers,

Pedro

The configured currency in your account will only change the display. If your base currency is CHF, you can still receive CHF AND USD. And if your base currency is USD, you can still receive USD AND CHF.

Normally, you want a wire transfer to the CH IBAN of IB.

Hi Pedro,

You should transfer directly CHF to the CH IBAN of IB. This will be free since it won’t be an international transfer.

Hi Baptiste

Thank you so much for all this precious information.

Now that you mention CH IBAN of IB, I wonder where can I find it. I only know the Account Id, which is not an IBAN. Can you please tell me where I can find it?

Another question, and that is related with the fixed/tiered pricing. Is this something you specify when executing an order or a global setting which you indicate? If global setting, can you please also tell me where can I check it?

I have been in the Account Settings trying to find both but so far no success.

Thank you once again and Happy New Year.

Cheers!

Hello again,

No need to answer. Already found the Tiered Price option and while digging the Transfer Funds section I found the IBAN.

Thank you so much for all the info.

Cheers

Well done :)

Good luck with your investing!

Great job! Thanks for the fantastic info!

One Question about the base currency at IB. You mentioned that it is mandatory to select a base currency. I could go with CHF for that matter since I live in Switzerland. But if I transfer EUR, what happens?

Do those get automatically converted? Does the system track how much of which currency I have or does it always convert everything to CHF? With convert I mean virtually do the conversion. I assume that it wont actually buy CHF with my EUR, right?

Is there a way to have subaccounts in different currencies than the base currency (or an equivalent system) so that I can buy Asset A (which is in EUR) with my EUR and Asset B (which is in CHF) with my CHF? Bottom line is, since I actually do have money in different currencies, I want to benefit from the fact that I can buy at least those assets that are in EUR with EUR and those assets that are in CHF with CHF without having to do any exchange whatsoever. Thank you and sorry for the long question.

Thank you very much.

Hi,

The base curency is really only for the display. If you have a CHF base currency, you can still deposit EUR and USD. And you can hold as many currencies as you want in your account.

IB never converts anything automatically. You need to do the conversion on IB and you will see how much of each currency you have.

Regarding the subaccount, given what I said about base currency, there is no need to have multiple subaccounts.

Hi!

What a great blog you have!

Thank you so much for your effort!

I have a question about funding my account. If I have ba in UBS, why do I need additionally contact them to make a fund? I have stopped on a step to add Assets : “Please add multiple entries by repeating the Add Asset function, or uploading a CSV.” Could you please suggest what kind of info IB requires?

Thank you in advance!

Kind regards,

Julija

Hi Julija,

I am afraid I don’t understand. What do you mean by “Add Assets”. And are you doing something on the UBS side or the IB side? I have never seen that message or “Add Assets” in IB.

Hello Mr the Poor Swiss,

Fantastic blog. I became addict to it.

When I want to set my account, they asked me if I want to trade crypto. If I answer yes I will be under ITBK US, if no I will be under ITBK UK.

What do you think?

Note : I am using already Binance for trading crypto.

Best regards,

Assane

Hi Assane,

Crypto is only available in IB US. I don’t think Swiss customers can use IB US at all. So, currently, IB does not offer crypto to Swiss customers.

And it’s also not a bad idea to separate your crypto investments (which should be in a cold wallet) from your stocks.