How to Open an Interactive Brokers Account in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Interactive Brokers is an excellent broker from the United States. It is known for its cheap fees and unique investment product range. It is being used by many personal finance bloggers, for instance.

It is currently the best broker that allows access to U.S. ETFs. And U.S. ETFs are the most efficient ETFs for Swiss investors.

In this guide, I review how to open an Interactive Brokers account. It is not very difficult, but there are a few things you need to know before you start your application. And I also teach you how to optimize your account to save money!

Interactive Brokers

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

So what is Interactive Brokers (IB)?

IB is a brokerage firm from the United States. It was created in 1978 in New York, more than 40 years ago! IB is the largest brokerage firm in the United States and the leading foreign exchange (forex) broker. Interactive Brokers offers access to many instruments, such as stocks, bonds, options, futures, and more.

Interactive Brokers is a very well-known broker with an excellent reputation. It is known to be cheap compared to its competitors. I have already compared IB and DEGIRO in the past. This comparison showed that it is even less expensive than DEGIRO, the broker I used before.

An essential thing with IB is that, by default, they do not lend your shares to other people, such as DEGIRO does by default. But you have the choice, which is good! Indeed, you also can lend shares, and you will get some of the money from the lending.

If you want more information on IB, read my review of Interactive Brokers.

Why open an IB account?

So, why did I open an IB account? It is currently the best broker available to Swiss investors.

There are many reasons to prefer Interactive Brokers over other brokers.

- IB offers access to U.S. ETFs to Swiss investors, while many brokers are not.

- IB has excellent prices.

- IB offers access to many investing instruments.

- IB offers foreign exchanges at an excellent price.

- IB has an excellent reputation.

- IB has good financial strength.

So, we will see how one can create an account on IB.

Create an Interactive Brokers account

First, prepare some time in front of you. The account creation process on Interactive Brokers is not difficult, but it will take some time. You will need to answer a few questions, and you will need to wait a day for your account to be funded.

Interactive Brokers has several entities in Europe. The primary entity is IB UK, but one is in Luxembourg, and one is in Ireland, for instance. For Swiss investors, the best entity is IB UK because they offer access to a Swiss IBAN and give you access to US ETFs. For European investors, it does not make much of a difference.

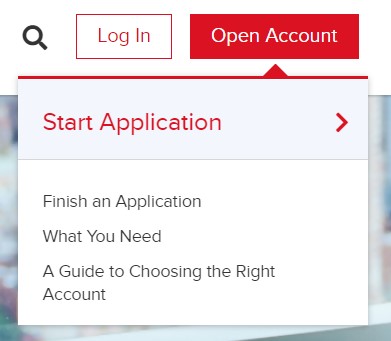

First, go to the account creation page and click “Open account”.

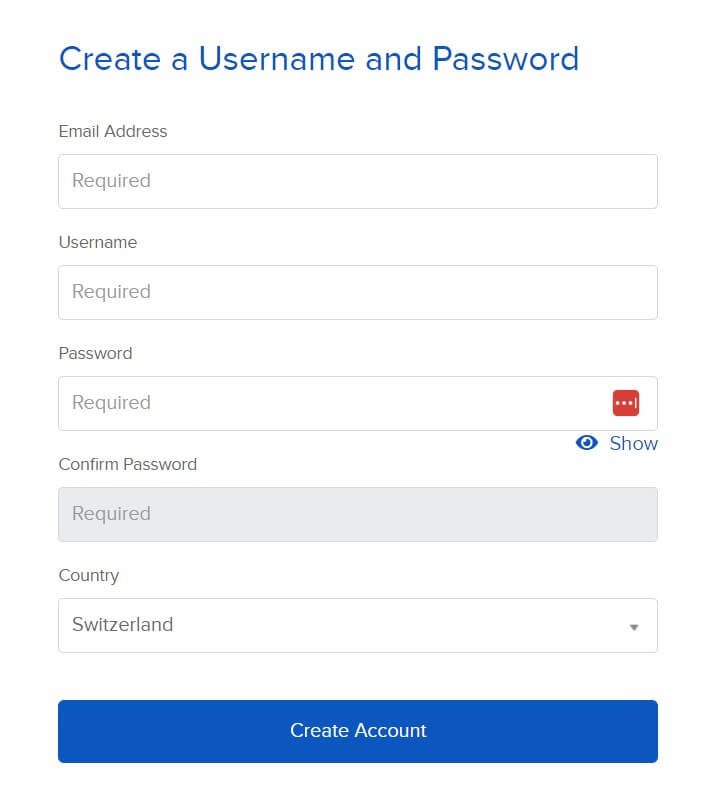

On the first page, you must enter your email, user name, and password for the account. Make sure to choose a good password and user name.

I would recommend making your password at least 20 characters long. A long password is essential to secure your online accounts! Make sure to remember it correctly as well!

You also need to enter your country of residence. If your country of legal residence differs, you must also enter it. You can then confirm the first page.

At this point, they will email you to confirm your email address. Just check your mail and choose to continue the application.

Personal information

On the second page, you will have to set your account type. I put it to Individual for this example. You can check the kinds of accounts to ensure you choose the one according to your needs. But most people will want either an Individual or a Joint account.

Then, you will have to enter the general kind of personal information. Nothing is special here, only what you are used to entering on each website. You will have to set your addresses as well.

Since this will be related to your taxes, it is essential to enter them correctly. You will also need to enter a valid phone number. IB will use this phone number authentication, so once again, enter it correctly.

IB has several types of accounts. You will need to select the type you want. The primary type of account is a Cash account, which is the type you probably need. A cash account means you need to have the money before each trade.

There are also Margin accounts (IB has some good information about margin accounts). Margin means you can use leverage for investing with money you do not have. Unless you know what you are doing, I recommend a Cash account.

Another thing you need to configure when you create an IB account is the base currency. Since I make most of my payments in Swiss Francs (CHF) and live in Switzerland, I chose CHF as my base currency.

You can always convert money from your base currency to any other currency. The base currency only matters for the interface’s display. If you choose CHF, you can still transfer USD and buy shares in EUR, for instance.

Currently, the CHF balance has a positive interest rate. If it becomes negative again, you will see a warning about the negative interest rate on CHF balances. You can get the current negative interest rate and limit here.

Now, you will also have to set up three security questions. You will need these questions if you ever need to recover your account. Make sure you choose questions from which the answer is not ambiguous (but not easy to find)! This procedure is, once again, a standard procedure.

Investment Questions

After this, you need to answer questions about your finances.

You need to tell how much your net worth is and how much income you have. You also need to say what your objectives are for your investments. For instance, you may want to invest for capital appreciation or fixed income.

All this information is here for regulatory reasons. I would advise you to answer them with honesty.

You also need to set which instruments you need to invest in. For instance, if you want to invest in stocks and bonds, you must select these options. I only chose stocks.

Stocks, bonds, options, and futures are among many other choices. You must also select which country (stock market exchange) you want to invest in.

You also need to confirm your phone number with a code.

Confirmations

At this point, you must agree to all the rules IB has for trading. Ideally, you may want to read them. But you probably will not!

If you want, you can also join the Stock Yield Enhancement Program. This program will allow IB to lend your shares to other people. With that, you will receive half of the profits.

Of course, there is a slight risk to that, and you may also be unable to sell your shares when you want or need to. I am not using that feature now. But I have tested this feature recently, and it works well.

At this point, Interactive Brokers will want proof of your identification. For this, you can upload a driving license, an ID card, a passport, or an alien ID card for IB to confirm your identity. You will also have to enter information about your tax status on the same page.

You will also have to fill in information about your employer and job. Usually, you also need to submit something as proof of address.

Fund your IBKR account

IB will fully activate your account once they receive funding.

You need to deposit the first amount for IB to validate your account. First, you need to declare how much money you will deposit. Then, IB will give you all the information necessary for the payment.

Make sure you correctly copy the IBAN. With banking transactions, you should always double-check all banking information before transferring. The transfer will be free since they have a bank account in Switzerland!

And do not forget to include the “Further Benefit to XXX” line! Otherwise, the money will not go directly to your account, and you must contact them to fix the issue. You must do that for all future deposits to your Interactive Brokers account.

Finalize your account

After you have funded your account, you can still do a few more things.

First of all, you can configure the market data. You should set your market data status to non-professional. And you should check that you are not buying any market data. Unless you plan to day trade, you do not need this data. You do not want to pay for it.

One great thing is that you have to use two-factor authentication (2FA). You have no choice. You must configure your mobile phone to use it as 2FA.

2FA is an essential part of online security. First, you need to install IBRK Mobile on your phone. This application is available for Android and iOS.

Once you have installed the application, you can register it as a two-factor authentication for your account. You will have to log in with your username and password, and you need to enter the code you received by SMS.

Finally, you can then choose a PIN for your future two-factor authentication. Remember that PIN since you must use it for each connection to Interactive Brokers.

If you do not know about 2FA and why it is necessary, read my article about online personal finance and security.

Wait for your account

At this point, you only need to wait for IB to create and fund your account.

It should not take too long. It only took one day for my account to be created and funded. It is pretty fast. The next day, I could directly make my first trade.

Optimize your IBKR account

Now that you have access to your account, there are two more things to finalize in your account.

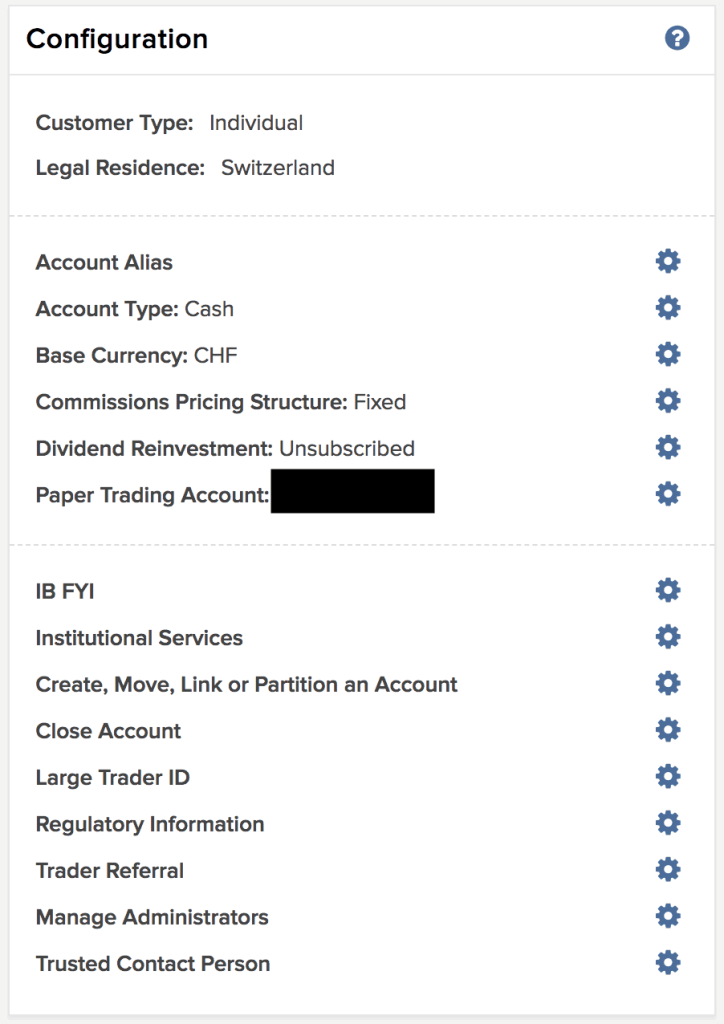

The first thing remaining at this point is configuring the Pricing System. I recommend you use the Tiered Pricing system. IB is cheaper than DEGIRO when you use the Tiered Pricing system.

You can make the change in your Account Settings. If you prefer the more predictable Fixed Pricing, you can also opt for it. There are some cases where fixed pricing is cheaper than tiered pricing.

Here are my settings just before I made the change to Tiered pricing:

The second thing applies if you are a Swiss investor and will invest in U.S. ETFs. In that case, you need to fill out the W-8BEN form. That is pretty simple. You can go into your Account Settings. Then, you must click the (i) blue button next to your name below Profiles. Then, you can click on “Update Tax Forms”.

They will then take you through the process, and you can fill out the W-8BEN tax form. This form will halve the dividend withholding from your American stocks and ETFs. This step is essential if you want to profit from the great tax efficiency of U.S. ETFs.

Some people have told me that it sometimes takes about one day for the account currency to be changed on the interface. You have to wait one day, and the issue should disappear. In the meantime, you may see some numbers in other currencies (likely GBP).

Another thing you can choose to do is to allow IB to lend your shares. By doing so, you will get 50% of the profits. This feature is called the Stock Yield Enhancement Program. However, there are some risks. I have tried it on and off over the last few years, but whether you think it is worth it is up to you.

Conclusion

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

The procedure is now complete! If you followed this guide, you now have an Interactive Brokers account.

With this great broker, we have access to U.S. Exchange Traded Funds such as VT, which makes the most significant part of my portfolio.

I have now been using IB for more than two years. And I am delighted with IB. Interactive Brokers is the best broker available to Swiss investors.

The next step is now to buy an ETF from Interactive Brokers. It is also relatively simple and only takes a little time.

What do you think about Interactive Brokers? Do you already have an account? If not, which broker are you using?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Brokers

- More articles about Investing

- What is the best Swiss broker in 2024?

- Yuh Review 2024: One app to pay, save and invest

- Cornèrtrader Review 2024 – Cheapest Swiss broker

Hello!

Really interesting blog.

Can I ask you: do you have any experiences with registering Swiss equities through IB? I know most traders do not care and/or do not want their names to be known by the companies they own shares of. But I really would like to attend selected shareholder assembly meetings (when again possible!) and get occasional info directly from the companies when I am a shareholder. Thank you!

Hi Peter,

I believe this is not possible with IB. They do no have the feature to register any share.

Hi Mr Poor Swiss,

I opened the account on Sunday, it was finally approved today all good. But my funds are still not there. I guess its because of this:

And do not forget to include the “Further Benefit to XXX” line! Otherwise, the money will not directly go to your account, and you will have to contact them to fix the issue. You will need to do that for all your future deposits to your Interactive Brokers account.

Where should I include this? As a comment during the ebanking payment?

I sent them now a message through the enquiry option but let’s see when they will reply. I can’t understand why my deposit did not reach them in the first place.

Many regards

Christos

Hi Christos,

The IBAN from IB is not your personal IBAN, it’s shared among every user. So, without the information, it’s more difficult for them to identify your deposit.

This information is in “message to destination” in your banking application.

Now, if they do not identity the source of a deposit, they will simply return the money, but this could take a while indeed.

For me all this is not so smooth. I sent all documents 5 weeks ago but account is still in “pending” status. First I didn’t fund account, this was maybe reason. But now is 10 days gone after I transferred real money. Clear is that 1-2 business days waiting time can’t be true. Anyway I’m not sure what to expect.

Sorry to hear bout your experience Toomas!

Did you contact them to ask the status of your account?

Hey Mr. Poor Swiss! I would like to start day trading with us Stocks on IB. Is that possible at all, because I’ve heard about the day pattern rule and I’m not sure if it’s also in Switzerland valid? Thank you for your answer in advance!

Hi Dorothy,

I am really not an expert on day trading. I have no idea what is the day pattern rule.

I would think that IB is a good broker for day trading, but again, I have never done it.

Hi. Fabulous website – bravo and thanks for the great work!

I am about to open an IB account. Though I live in Switzerland, I will at first use my USD funds to invest. I assume I will have to send the funds to an IBAN specifically for USD. Is that provided by IB on sign-up? Or will they assume I will use CHF (my base currency) and provide only the IBAN for CHF? Thanks!

Hi David,

With an account from Switzerland, you can send money to a CHF IBAN but you can also send money to their USD account. However, they do not have a USD IBAN account to my knowledge. They have an actual USD account in the U.S. that I have been using but depending on where your funds are, it may not work for you.

Thank you! It turns out they have multiple options for transferring USD – via wire (but typically costs money), using your bank’s ‘bill pay’ function (usually free but can be slow), or via ACH (which I have found to be the cheapest, i.e. free, and fastest once set up). In all cases I tried there is still a hold of a few days for accessing the funds once IB receives them. Something to be aware of.

Just sharing the knowledge for those with the same question I had!

Thanks a lot for sharing, David! This is very interesting :)

Hi there

Thanks for the cool articles. I plan on opening an IB account for some day/short term trading.

– do you have any experience with day/short term trading on IB? or do you know of others who use it for this? because the fees are quite low.

– if I put 10-20k CHF in the account, do I have to convert it to USD or do you recommend it? Most of the stocks I trade are in USD. Not sure about the advantages if I convert the CHF

Thx and wish you a great day!

Hi Robert,

1) Never did, never will

2) You do not have to convert it. But if you want to trade in USD, you have to convert CHF to USD. Since a conversion at IB is basically a flat fee, it’s better to convert once a large amount than several times smaller amounts.

For day trading you might be better upgrading to the next level up in IB. I haven’t tried day trading as I understand the odds are really not in your favour. That being said I do actively allocate & trade around long term stock positions.

If you want to buy US stocks you will need to convert your CHF to USD first on the platform. Very easy.

The one thing to note for day traders is that there’s a 2 day settlement period. So if you sell a stock you don’t have the cash immediately ready to buy another stock.

IB offers cheap margin loans. Be careful. As Charlie Munger once said “there are 3 ways for a man to go broke: ladies, liquor, & leverage.”

ib is very good but very complex(all imaginable functionality)

swissquote and saxo are also very good, saxo being the easiest to use if that is what you look for, but limited on eg warrants.

all have 2nd f authentication via phone.

I don’t think IB is complex. It has a ton of features, true, but they are well organized so that you do no have to think about them if you do not use them.

Thanks for your feedback on SQ and Saxo, I have never used them!

Good evening,

Does anyone know if you need to pay 30% tax on the sale of US shares? As a swiss resident I understood I need to submit the form W-8BEN. With TD-Ameritrade for example they give you the form when you are opening an account. Does IB do the same thing? Do they fill out the form for me, or do I need to do it myself?

I tried to contact the live chat support of IB but for multiple times I wait over an hour and they never answer.

Other thing, I tried IB’s demo account (paper account) and the execution time is just awful, sometimes a couple of minutes (for the purchase and sale of US shares with excellent liquidity like Amazon). Does that happen in the live account?

Thank you!

Hi Andreas,

There is no such thing as a 30% tax on the sale of U.S. shares. The W8-BEN is related to dividends, not capital gains. And yes, IB will let you fill the form, you have to do it yourself from within IB.

The live account has no such issues. All my ETFs are purchased instantly.

Thanks for stopping by!

Hello,

I just set up my account, waiting for the approval. I had already a Degiro account (never used) but I think I prefer IB also because it allows transfers from Transferwise.

I just did wrong when choosing the account type (I set ‘margin’ instead of ‘cash’, can it be changed after the account is active?).

I have another question: I live in CH and my main personal expenses and income (salary, rent, insurance etc.) are obviously in CHF, my business however is working in EUR and USD. I applied for EUR as main currency, but maybe it’s better to switch to CHF as my salary is in CHF, what do you think? (also same question as before: this can be changed after the account is set?)

Thanks!

Hi Mich,

The base currency is only for display. You can still deposit money in currencies other than your base currency.

Both the account type and the base currency can be changed later on.

I just tried to open an account with them and after 20 minutes of entering forms I was unable to proceed, as they asked for a signature in a box that took only keyboard inputs and didn’t accept anything I wrote. Any idea how to get past that? I wrote their live support but didn’t get a response for 45 minutes at which point they logged me out and terminated the whole process :(

Hi

Have you tried another browser?

I don’t remember having issues with the signature, but I can’t remember if I typed it or drew it.

Hi Robin,

If you go to FAQ, and search for ‘signature’, you will find the following:

Why am I receiving an error message about my electronic signature?

Please try to type your electronic signature exactly as it is written next to the signature box. The electronic signature is case sensitive.

Regards

Markus

I would just like to say that I’m very happy with IB & am consolidating a lot of investments there. In fact I had a lot of shares transfer in yesterday.

I had no problem signing up.

Indeed they have a CH IBAN so you can transfer from your CH account quickly & cheaply.

The best thing about IB is the range of products they offer. You can keep it simple (probably best) & just buy broad index ETFs & keep costs low. However, if you have an interest in actively investing you have access to all the US sector ETFs e.g TAN if you think Biden’s infrastructure Bill will drive the renewable energy sector.

Thanks a lot for sharing your experience!

It’s great indeed to have all this choice in investment. It’s better to have all this choice and not need it that need it and not have it :)

Hello,

Great blog!

I started the open account process as per your instructions, and everything very smoothly.

The only thing was that when I gave instructions to fund the account from my UBS account, the destination account is City bank in UK. Do you know if this is the right way and they will charge me fees? It was today 14.02.2021.

I only found options to open IB account from their UK web address for resident in Switzerland.

https://www.interactivebrokers.co.uk/

Thanks for your support

Pedro

Hi Pedro,

Normally, when you declare a deposit from IB in CHF, you will have access to a CH IBAN as well. They are offering several options, but the one that you want to use is the CH IBAN. If you use this one, you won’t pay fees. But if you use another IBAN, you will indeed pay fees.

I have screenshots of this process on this article: https://thepoorswiss.com/buy-etf-interactive-brokers-account-management/

Hi Pedro, I have the same issue. I’ve opened my IB account in Feb and made 3 transfers since then. I have been charged more than Fr.25 per transfer by UBS and BCV, as IB gave me an account in Germany (in CHF, but with ” DE ” IBAN) to fund my IB account. After reading this article (thanks Mr. Poor ;)) I wrote to IB requesting a CH IBAN so I can fund my account without paying this gigantic bank fee for international transfer.

Sorry to hear about that! You have to be careful indeed about the account that they’re proposing. I do not know why they do not always propose the CH IBAN for CHF transfers.